Picture this: You’ve spent decades building your pension pot, watching those monthly contributions slowly transform into what should be your golden ticket to retirement freedom. Then the taxman shows up at the party.

Here’s what nobody tells you about retirement planning – that lovely tax on pension lump sum you’re entitled to withdraw can trigger a tax bill that makes your monthly council tax look like pocket change. But here’s the twist: it doesn’t have to.

I’ve watched too many people hand over thousands in unnecessary tax simply because they didn’t know the rules of the game. The truth? Reducing tax on pension lump sums isn’t about clever accounting tricks or offshore shenanigans. It’s about understanding a system that’s actually designed to reward careful planning.

The Great Pension Tax Myth That’s Costing You Money

Let’s demolish the biggest misconception floating around: that all pension withdrawals are taxed equally.

Wrong. Spectacularly wrong.

The reality involves something called the 25% tax-free allowance – your statutory right to withdraw a quarter of your pension pot without HMRC taking a penny. For a £200,000 pension, that’s £50,000 landing in your account tax-free. Not bad for understanding one simple rule.

But here’s where it gets interesting (and where most people trip up): what you do with the remaining 75% determines whether you pay tax like a financial amateur or like someone who actually understands the system.

Why Your Withdrawal Strategy Matters More Than Your Investment Returns

I’ll be blunt about this – your investment returns over the last decade probably pale in comparison to what you could save through smart withdrawal planning.

Consider these two scenarios:

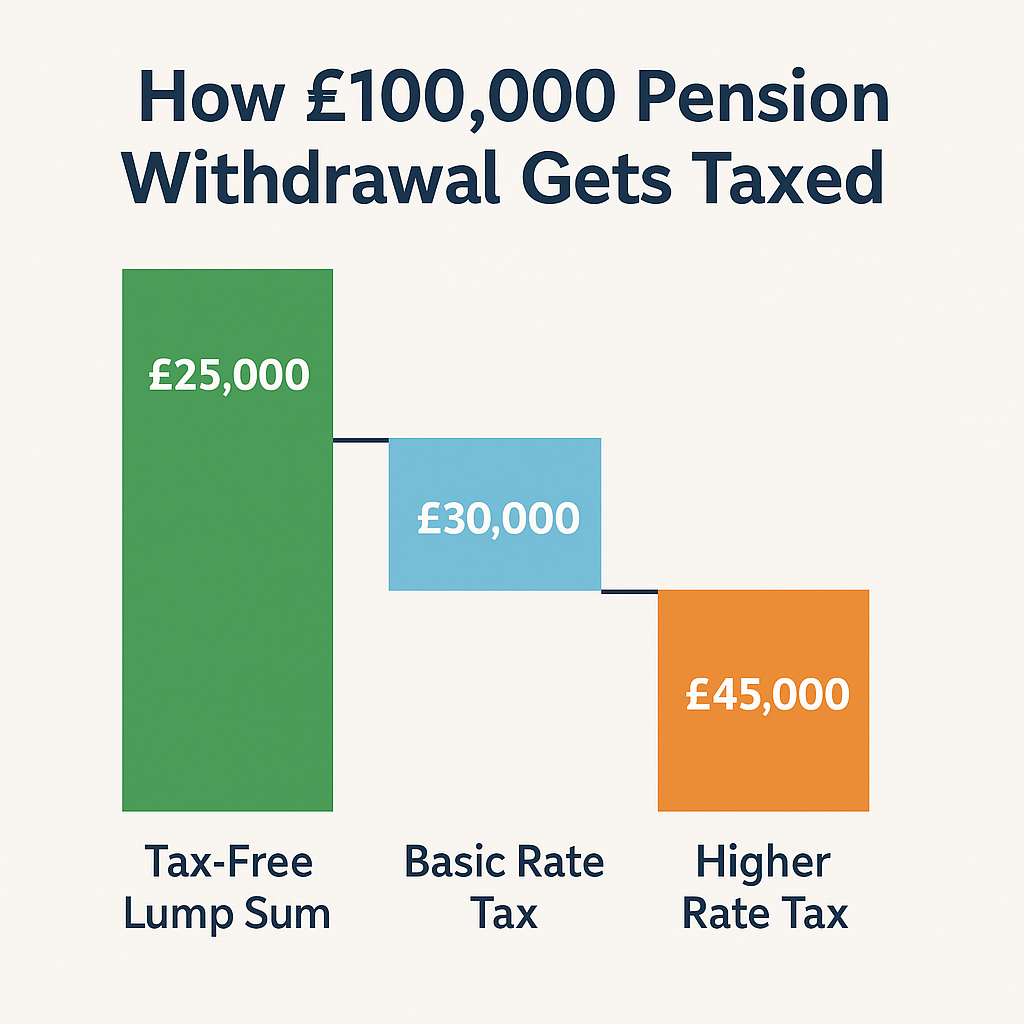

The Impatient Approach: Withdraw £100,000 in one go

- £25,000 tax-free

- £75,000 added to your annual income

- Likely pushes you into higher tax bands

- Potential tax bill: £15,000-30,000 depending on your other income

The Patient Approach: Spread withdrawals across multiple tax years

- Same £25,000 tax-free

- £75,000 spread over 3-4 years

- Keeps you in lower tax bands

- Potential tax saving: £8,000-15,000

The difference? Just timing. Same money, wildly different tax outcomes.

The Pension Commencement Lump Sum: Your First Line of Defence

Every defined contribution pension scheme must offer you the option to take 25% as a tax on pension lump sum. This isn’t negotiable – it’s written into pension law.

But the devil, as always, lives in the details.

The Lump Sum Allowance: Your New Reality

The current lump sum allowance (LSA) is £268,275, which represents the maximum tax-free cash you can take across all your pensions combined (Royal London). This replaced the old lifetime allowance system in April 2024.

Here’s what you need to know:

| Allowance Type | Current Limit | What It Covers |

| Lump Sum Allowance (LSA) | £268,275 | Tax-free cash from pensions |

| Lump Sum and Death Benefit Allowance (LSDBA) | £1,073,100 | LSA plus death benefits |

| Note: These figures apply for 2025-26 tax year | ||

Exceed the LSA, and the excess gets taxed at your marginal rate Tax on your private pension contributions: Lump sum allowance – GOV.UK. For someone in the higher rate band, that’s a brutal 40% tax on what should have been tax-free money.

Income Tax Bands: The Hidden Pension Killer

Here’s something that’ll make you rethink that large pension withdrawal: income tax bands don’t care where your money comes from.

Withdraw £50,000 from your pension in one tax year, and it’s treated exactly like earning £50,000 from employment. If you’re already earning £30,000 from other sources, congratulations – you’ve just pushed yourself firmly into the higher rate tax band.

The Current Tax Landscape (2025-26)

The standard Personal Allowance remains £12,570 Income Tax rates and Personal Allowances : Current rates and allowances – GOV.UK for the 2025-26 tax year. Here are the current rates:

- Personal Allowance: £12,570 (tax-free)

- Basic Rate: 20% on income between £12,571-£50,270

- Higher Rate: 40% on income between £50,271-£125,140

- Additional Rate: 45% on income above £125,140

The brutal reality? Take a £60,000 pension withdrawal when you’re already earning £35,000, and £15,000 of that withdrawal gets hammered with 40% tax. That’s £6,000 straight to HMRC that could have stayed in your pocket with better planning.

The Art of Pension Phasing: Spread the Load

Smart pension withdrawal isn’t about taking everything at once – it’s about controlled, strategic phasing that keeps you in lower tax bands.

Option 1: Uncrystallised Funds Pension Lump Sum (UFPLS)

This allows you to take small chunks from your uncrystallised pension pot – 25% tax-free, 75% taxable. Perfect for managing your annual income and staying within favourable tax bands.

Example Strategy:

- Annual withdrawal: £20,000

- Tax-free portion: £5,000

- Taxable portion: £15,000

- If your other income is £25,000, total taxable income becomes £40,000 – safely within basic rate territory

Option 2: Flexi-Access Drawdown

Crystallise part of your pension to access the tax-free lump sum, then draw income as needed from the remainder.

The flexibility here is remarkable. Need more income one year for home improvements? Take it. Expect lower expenses next year? Reduce withdrawals and let your pension pot continue growing.

However, there’s a crucial catch: once you trigger flexible access, the Money Purchase Annual Allowance (MPAA) reduces the amount you can pay into a defined contribution pension to £10,000 a year Tax and your pension | MoneyHelper. This includes both your contributions and employer contributions.

Multiple Pension Pots: Your Secret Weapon

Here’s where things get really interesting. If you have multiple pension pots (workplace schemes, personal pensions, SIPPs), you’re sitting on a tax-planning goldmine.

Each pension can be accessed independently, meaning you can:

- Take 25% tax-free from one pot

- Leave others untouched and growing

- Access different pots in different tax years

- Optimise withdrawals based on your changing circumstances

But remember: your LSA applies across all pensions, so if you had two pots worth £400,000 and £800,000, you could take 25% tax-free from the first pot (£100,000) and only 21% from the second (£168,275) to stay within the £268,275 limit Tax-free pension lump sum allowances | MoneyHelper.

A Real-World Example

Sarah has three pension pots:

- Pot 1: £80,000 (former employer)

- Pot 2: £120,000 (current employer)

- Pot 3: £60,000 (personal pension)

- Year 1: Access Pot 3 – £15,000 tax-free, manageable taxable income

- Year 2: Access Pot 1 – £20,000 tax-free, stay within basic rate

- Year 3: Begin drawdown from Pot 2 – major tax-free lump sum when other income drops

Total tax-free cash: £55,000 (well within the £268,275 LSA)

The State Pension Timing Game

Here’s something most financial advisers won’t tell you: your state pension timing can dramatically affect your overall tax strategy.

You can defer your state pension and earn increments of approximately 5.8% for each year of deferral. But more importantly for tax planning, you can time its commencement to coincide with reduced private pension withdrawals.

Strategic Approach:

- Ages 60-66: Higher private pension withdrawals while no state pension

- Age 67+: Reduced private pension withdrawals, commence state pension

Result: More even income distribution, lower overall tax burden

Marriage and Civil Partnership: The Overlooked Tax Advantage

If you’re married or in a civil partnership, you’re sitting on one of the most underutilised tax-saving strategies available.

Pension Sharing Opportunities

While you can’t directly transfer crystallised pension benefits, strategic planning can help:

- Different retirement ages: Partner with lower income takes pension benefits first

- Income splitting: Balance withdrawals between partners to optimise tax bands

- Spousal transfers: Use annual exemptions for non-pension assets to balance overall wealth

Consider this scenario:

- Partner A: High earner, large pension pot

- Partner B: Lower earner, smaller pension pot

Smart Strategy: Partner B takes pension benefits earlier while Partner A continues working. When Partner A retires, they can take benefits while Partner B reduces withdrawals.

The Employer Final Salary Anomaly

If you’re fortunate enough to have a final salary (defined benefit) pension, the tax rules work slightly differently – and potentially in your favour.

Commutation Factors: Your Hidden Advantage

Most final salary schemes allow you to exchange annual pension for a tax-free lump sum. The exchange rates (commutation factors) are often generous, particularly in low interest rate environments.

Typical Exchange: £1 of annual pension = £15-20 lump sum

For someone entitled to £10,000 annual pension, exchanging £2,000 of income could generate a £30,000-40,000 tax-free lump sum. The math often works in your favour, especially if you’re concerned about scheme longevity or prefer immediate access to capital.

The Inheritance Tax Connection Nobody Mentions

Here’s a curve ball: your pension withdrawal strategy affects not just income tax, but potentially inheritance tax (IHT) too.

Pensions vs. Other Assets for IHT

- Uncrystallised pensions: Generally outside your estate for IHT

- Drawdown pensions: Can be outside your estate if you retain discretionary benefits

- Withdrawn pension funds: Become part of your taxable estate

Strategic Implication: If you’re worried about IHT, leaving money in pension could be more tax-efficient than withdrawing it, even if you don’t need the income immediately.

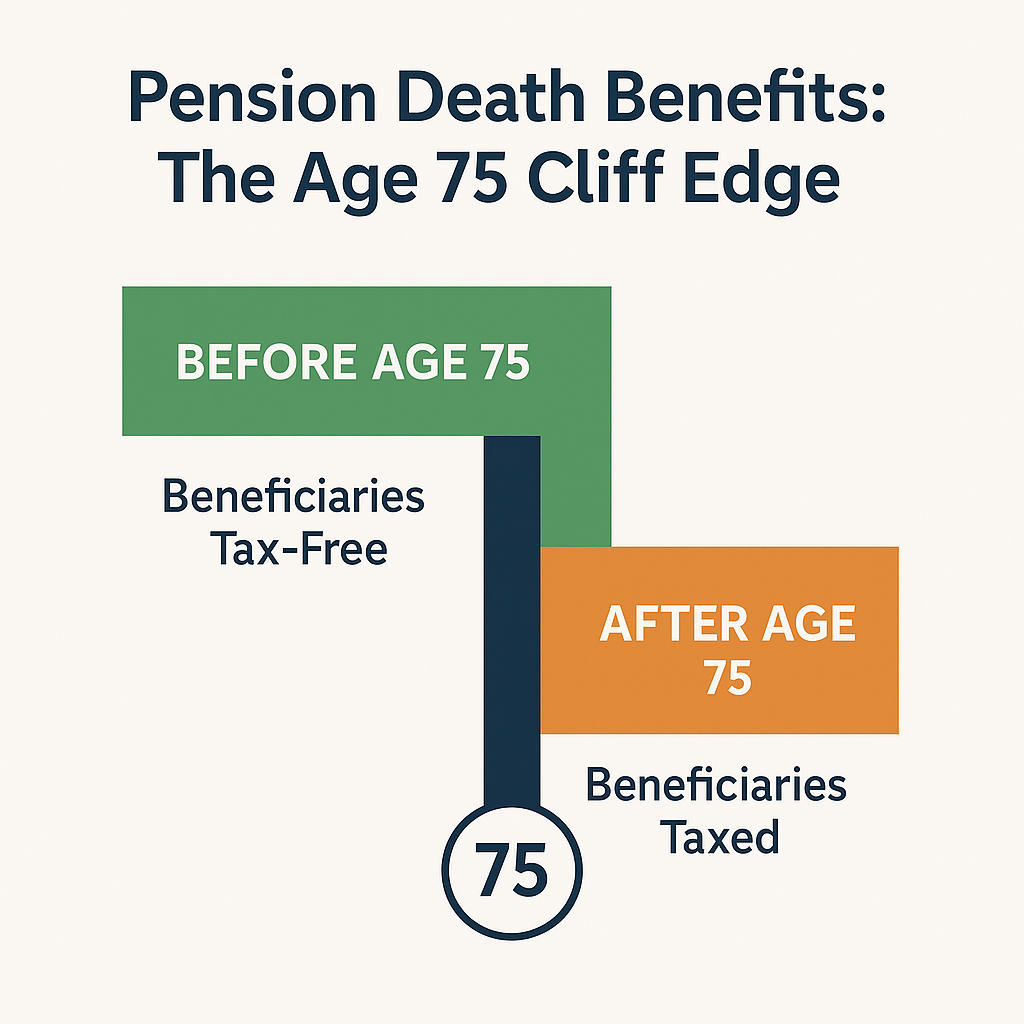

| Asset Type | IHT Treatment | Income Tax on Death |

| Uncrystallised Pension | Outside estate | Potentially tax-free to beneficiaries under 75 |

| Drawdown Pension | Potentially outside estate | Beneficiaries pay their marginal rate |

| Withdrawn Funds | Part of taxable estate | N/A (already taxed) |

Emergency Fund Strategy: The Pension Safety Net

Most financial advice suggests keeping emergency funds in ISAs or savings accounts. But here’s an alternative perspective: your pension can serve as the ultimate emergency fund.

The 25% Emergency Access

Because you can take 25% tax-free from any pension pot, crystallising small amounts provides immediate access to tax-free cash without the ongoing drag of low savings account interest rates.

Example Emergency Strategy:

- Keep £10,000 in instant access savings for immediate needs

- Identify which pension pot you’d crystallise for larger emergencies

- Understand the process and timing for emergency pension access

- Know your tax position for the emergency withdrawal year

This isn’t suitable for everyone, but it’s worth understanding as an option.

The Business Owner’s Pension Tax Advantage

If you’re a business owner or have been, your pension tax planning options multiply significantly.

Small Self-Administered Schemes (SSAS)

These offer remarkable flexibility:

- Ability to lend money back to your business

- Property investment within the scheme

- Greater control over investment timing and withdrawals

- Potential for more sophisticated tax planning

Self-Invested Personal Pensions (SIPP)

Similar flexibility to SSAS but available to anyone:

- Direct property investment

- Individual share selection

- Flexible withdrawal timing

- Sophisticated estate planning opportunities

Warning Alert: Both SSAS and SIPP options require careful professional guidance. The flexibility comes with complexity and potential pitfalls that can be expensive if mismanaged.

When Professional Help Pays for Itself

I’ll be honest – there comes a point where DIY pension planning becomes penny-wise but pound-foolish.

Professional advice becomes essential when you’re dealing with:

- Multiple pension schemes with different rules

- Guaranteed annuity rates or protected tax-free cash amounts

- Significant assets where IHT planning matters

- Business ownership with multiple pension arrangements

- Complex family situations requiring sophisticated planning

At Ask Accountant, we regularly see clients save thousands through strategic pension withdrawal planning. The consultation fee often pays for itself within the first year through tax savings alone.

Recent client example: A 62-year-old with £400,000 across three pension pots was planning to take £100,000 immediately. Through strategic phasing across four tax years and coordinating with his wife’s pension access, we identified potential tax savings of over £12,000.

The expertise covered inheritance tax, business advice, and proactive tax advisory solutions – exactly the kind of holistic approach that turns pension planning from a tax nightmare into a strategic advantage.

The Pension Flexibility Timeline: When to Act

Understanding timing is crucial for pension tax planning:

- Age 55 (57 from 2028)

- Minimum pension access age

- Access to tax-free lump sums begins

- Flexible drawdown becomes available

- Strategic planning window opens

- Age 60-65

- Prime tax planning years

- Often reduced employment income

- Maximum flexibility for withdrawal timing

- State pension not yet commenced

- Age 66-67

- State pension commencement

- Need to rebalance withdrawal strategy

- Consider pension deferral options

- Review overall income levels

- Age 75

- Significant milestone for beneficiaries

- Death benefits become taxable for beneficiaries

- Consider accelerated withdrawals if health concerns

- Review estate planning implications

Common Mistakes That Cost Thousands

Let me share the pension withdrawal errors I see repeatedly:

- The “Take It All” Mistake: Withdrawing large amounts in single tax years, creating unnecessary higher-rate tax bills.

- The “Ignore Other Income” Mistake: Forgetting about employment income, rental income, or investment returns when planning pension withdrawals.

- The “Same Every Year” Mistake: Taking identical amounts annually instead of varying withdrawals based on changing circumstances.

- The “Emergency Panic” Mistake: Making hasty pension decisions during financial stress without considering tax implications.

- The “Ignore Death Benefits” Mistake: Not considering how pension withdrawal strategies affect what beneficiaries receive.

- The “LSA Overspend” Mistake: Exceeding the £268,275 lump sum allowance and paying unnecessary tax on what should be tax-free money.

Your Next Steps: Making It Happen

Right, enough theory. Here’s your practical action plan:

- Audit Your Position: List all pension pots, current values, and scheme rules

- Calculate Your Allowances: Understand your remaining LSA and how much tax-free cash you can access

- Map Your Income: Project your income from all sources for the next 5-10 years

- Model Different Scenarios: Calculate tax implications of various withdrawal strategies

- Consider Professional Review: For complex situations or significant pension values

Here is the truth of the matter: cutting the tax on lump sum withdrawals on pensions is not about loopholes and edges. It is about applying knowledge about rules, which are already at your advantage and turning it into smarts.

Your pension is not an ordinary retirement fund, but it is a clever tax planning device with its divider being the people who know how to use it.

Looking to get tax planning advice on personalised pension? Ask Accountant offers expert advice on a range of inheritance tax, business advice as well as tax advisory services. Based at 178 Merton High St, London SW19 1AY, you may call +44(0)20 8543 1991 to address your case.

Frequently Asked Questions

Q: Is it possible to withdraw more than 25 percent pensions tax-free?

A: As a rule not, but there are older schemes with rights to higher tax-free percentages. Look up with your scheme administrator.

Q: What would result when I take more than the lump sum allowance?

A: Any amount in addition to the threshold of 268,275 pounds is subject to an income tax at the rate you pay on your marginal income.

Q: Are there any provisions of recovering cash payments into my pension?

A: Yes, however, the Money Purchase Annual Allowance will limit your annual contributions to £10,000, in the event that you use flexible benefits.

Q: How do the state benefits respond to a pension withdrawal?

A: They may influence benefits that are tested. In determining the entitlement to benefits, there is an inclusion of pension income.

Q: Do student loans requirements count pension earnings?

A: Yes, pension withdrawals are included in a calculation of the income to pay student loans.