Let me guess: you’ve got a business plan gathering dust somewhere (probably in Google Drive with “FINAL_v3_ACTUAL_FINAL” in the filename). Meanwhile, your actual financial planning consists of checking your bank balance before making decisions and hoping HMRC doesn’t notice that thing you’re not entirely sure about.

Sound familiar?

Here’s the uncomfortable truth—most London businesses treat financial planning like they treat going to the dentist. They know they should do it. They’ll definitely do it next month. Then suddenly it’s three years later and there’s a problem that could’ve been spotted ages ago.

Financial planning in London isn’t just about spreadsheets and forecasts (though yes, those matter). It’s about building a business that doesn’t keep you awake at 3am wondering if you can make payroll. And in a city where operating costs can devour profit margins faster than you can say “business rates,” getting this right isn’t optional anymore.

Why Your Accountant Probably Isn’t Planning Anything

Most accountants—and I’m going to catch heat for this—are historians. Brilliant historians, mind you. They’ll tell you exactly what happened last quarter, file your returns impeccably, and keep you compliant. But planning? That requires a different beast entirely.

See, there’s traditional accounting (looking backwards) and then there’s financial planning (actually helping you figure out what’s coming). The problem is many London business owners don’t realise their accountant is only doing half the job.

Real financial planning London services dig into things like:

- What happens if your biggest client leaves?

- Can you actually afford that hire you’re planning?

- Should you be structuring your business differently for tax purposes?

- Where’s your money actually going? (The answer surprises people.)

Ask Accountant in Merton specialises in the forward-looking stuff—the proactive tax advisory solutions and business growth planning that prevent those 3am panic sessions. They’re located at 178 Merton High St (SW19 1AY) if you fancy talking to humans who think about what’s ahead rather than just tidying up what’s behind. Ring them on +44(0)20 8543 1991.

But let’s get into what proper business financial planning London actually involves.

Cash Flow: The Thing Everyone Ignores Until It’s Too Late

You can be profitable and still go bust. Let that sink in.

I’ve watched businesses with healthy order books collapse because they didn’t understand one simple thing: profit isn’t cash. You might have £50k in invoices outstanding, but if you need to pay wages on Friday and those invoices won’t clear until next month, you’ve got a problem.

London makes this worse. Everything costs more here—rent, wages, even your bloody coffee. Your cash flow needs to be tighter than a drum, and most business owners are running theirs like a leaky bucket.

The Cash Flow Mistakes I See Repeatedly:

- Mistake #1: Extended Payment Terms That Seem Harmless Giving clients 60-day terms feels generous until you realise you’re essentially running a free financing operation. Your suppliers still want paying in 30 days.

- Mistake #2: Seasonal Blindness Every December, the same businesses are shocked—SHOCKED—that cash flow gets tight around Christmas. It happens every year. Plan for it.

- Mistake #3: The “We’ll Just Use the Overdraft” Mentality Overdrafts are expensive emergency funds, not business planning tools. If you’re constantly in your overdraft, that’s not a cash flow issue—that’s a business model issue.

Here’s a cash flow planning framework that actually works:

| Timeframe | What to Track | Action Required |

| Weekly | Actual cash position vs forecast | Chase late payments, delay non-essential spending |

| Monthly | Payment patterns, seasonal trends | Adjust forecast, renegotiate terms |

| Quarterly | Overall cash runway | Strategic decisions about growth or cost-cutting |

| Annually | Long-term cash requirements, major investments | Capital planning, financing arrangements |

(Note: adjust these timeframes based on your business cycle—some businesses need daily tracking during busy periods.)

The Tax Planning Nobody Taught You

Right, tax. Everyone’s favourite subject.

Most businesses approach tax planning like this: earn money, get tax bill, have minor heart attack, pay tax bill, repeat. There’s a better way, but it requires thinking about tax throughout the year rather than in January when the bill arrives.

The fundamental principle is simple—legal tax planning isn’t about dodging your obligations; it’s about not paying more than you actually owe. And trust me, without proper financial planning London expertise, you’re probably overpaying.

Consider Corporation Tax. You’re paying 25% on profits over £250k (as of recent changes), but there are legitimate ways to reduce your taxable profit:

- Pension contributions (you get tax relief, your future self gets a retirement)

- Capital allowances on equipment (buying that computer? Claim it)

- R&D tax credits (if you’re doing anything remotely innovative, look into this)

Then there’s the ownership structure question. Should you be a limited company? A sole trader? Partnership? The answer affects everything from how much tax you pay to how easily you can extract money from the business. I’ve seen people lose thousands simply because they set up in the wrong structure from day one.

Ask Accountant handles this kind of tax advisory work—the strategic stuff that saves money rather than just filing returns. They also deal with specific nightmares like CIS claims and refunds for construction businesses, which is its own special circle of bureaucratic hell.

Growth Planning (Or: When “Getting Bigger” Goes Horribly Wrong)

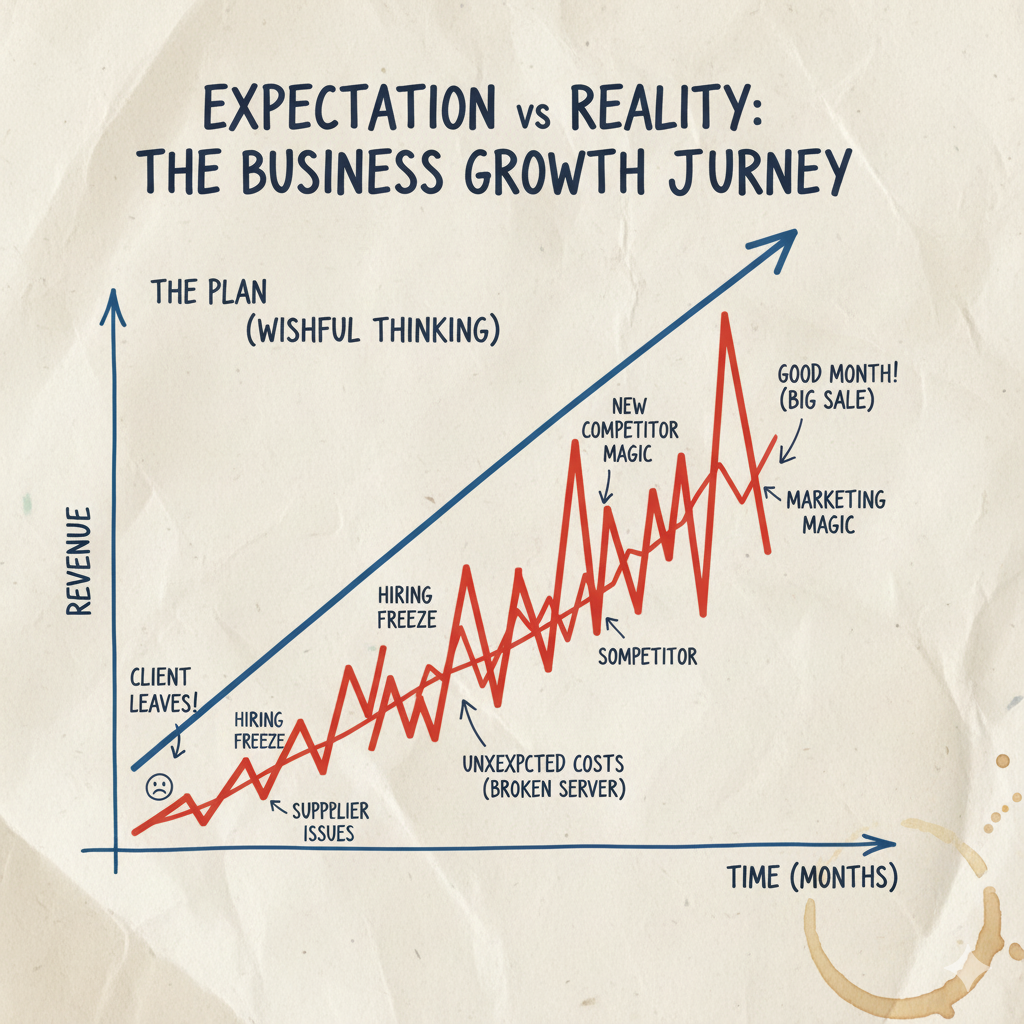

Everyone wants to grow. Bigger revenue, more clients, expansion, that sort of thing. But growth without planning is just expensive chaos.

I’ll give you an example. Small marketing agency in Shoreditch. Lands a massive client (think major retail brand). Revenue instantly doubles. The founder thinks he’s made it. Eighteen months later, the business nearly collapses.

What happened? They hired too fast, took on office space they couldn’t really afford, and when that big client left (as clients do), they had costs built for a business twice their actual size. The growth nearly killed them.

This is why business growth planning matters:

- Capacity Analysis – Can you actually deliver if you get what you’re chasing? Or will quality collapse?

- Infrastructure Timing – When do you hire? When do you invest in systems? Too early and you’re burning cash. Too late and you’re drowning.

- Funding Strategy – Growth needs fuel. Where’s the money coming from? Retained earnings? Loans? Investors? Each has implications.

- Exit Planning (Yes, Already) – Even if selling is decades away, understanding what makes your business valuable shapes every decision you make.

Smart business growth planning involves stress-testing your plans. What if growth is slower than expected? Also, what if it’s faster? What if your key person leaves? What if your main supplier goes bust?

These aren’t fun questions. But asking them before crisis hits is what separates sustainable businesses from expensive learning experiences.

The Bookkeeping Foundation (Unsexy But Critical)

Nobody starts a business dreaming about bookkeeping. But here’s the thing—financial planning built on rubbish data is worthless. It’s like building a house on sand.

Your bookkeeping needs to be:

- Timely (not six months behind)

- Accurate (categorised properly, not just dumped into random accounts)

- Detailed enough (so you can actually see what’s happening)

The biggest bookkeeping mistake London businesses make? Treating it as a compliance chore rather than a management tool. Your bookkeeping should tell you stories about your business. Which products make money? Which clients are profitable after you account for all the time they consume? Where are you haemorrhaging money?

If your current bookkeeping can’t answer these questions, it’s not fit for purpose.

| Business Size | Recommended Bookkeeping Setup | Monthly Cost Range |

| Sole trader, simple income | DIY with software (Xero, QuickBooks) | £10-30 (software only) |

| Small Ltd company, <£100k turnover | Part-time bookkeeper + software | £100-250 |

| Growing business, £100k-£500k | Dedicated bookkeeper or service | £300-600 |

| Established business, £500k+ | In-house part-time or full accounting service | £600-1500+ |

| Complex business (multi-entity, international) | Full accounting team or comprehensive outsourced solution | £1500+ |

These are rough guides—your actual needs vary based on transaction volume and complexity. A retail business with 1000 small transactions needs different support than a consultancy with 10 large invoices.

Services like accounting and bookkeeping from specialists (Ask Accountant offers this) make sense when your time is worth more than the cost of outsourcing. If spending four hours monthly on bookkeeping costs you £200 in lost business opportunities, paying someone £150 to do it better is a bargain.

When Financial Planning Gets Complicated: Special Cases

Some situations need more than basic planning:

- Construction and CIS The Construction Industry Scheme is designed to make everyone’s life difficult. CIS claims and refunds can be complex, especially if you’re subcontracting. Getting these wrong costs money—both in overpaid tax and potential penalties.

- Inheritance Tax Planning If your business is part of your estate (and it probably is), inheritance tax planning matters more than you think. Business Property Relief can help, but it’s not automatic and has rules.

- Auto-Enrolment Pensions You need this sorted. It’s law. But beyond compliance, think strategically—employer pension contributions are a tax-deductible way to reward staff. Use it.

- Multiple Income Streams Rental property plus business income? Investments? Each adds complexity to your tax position and planning needs.

The “Should I Do This Myself?” Question

Can you handle your own financial planning? Maybe. Should you? Different question entirely.

Here’s my honest assessment: if your business turns over less than £50k and has simple finances, you can probably manage with good software and occasional professional advice. You’ll need to educate yourself properly though—no cutting corners.

Between £50k and £250k? You need professional input, but how much depends on complexity. At minimum, get quarterly reviews with someone who knows what they’re doing.

Over £250k? If you’re not working with proper financial advisors and accountants, you’re leaving money on the table. The tax implications alone justify the cost.

But here’s what you absolutely cannot outsource: understanding your own numbers. Even with the best accountant in London, you need to know what your cash flow looks like, what your margins are, and where you’re heading. Delegating the work is smart. Delegating the understanding is dangerous.

What Good Financial Planning Actually Looks Like

Let me paint you a picture of a business doing this right:

- They have a 12-month rolling cash flow forecast updated monthly. Not a complex model—just clear visibility of what’s coming in and going out. They can tell you within a few thousand pounds what their cash position will be in three months.

- Their bookkeeping is current within a week. They can run a P&L anytime and trust the numbers. They understand what is and is not profitable in their business.

- They also conduct quarterly planning meetings during which they revise their performance performance against plan, their forecasts and make strategic decisions using data as opposed to gut feeling.

- They do not only consider tax in January but all year long. They are buying and timing their purchases and tax-decisions.

- They are quite familiar with their numbers and when they present an opportunity they can easily determine in a short period of time whether it is an opportunity or a costly diversion.

That’s what we’re aiming for. Not perfection–just good enough so that you are in control of the ship instead of desperately bailing out water.

Building Your Financial Planning System

Start simple. Seriously, don’t try to build a comprehensive financial planning system overnight. Here’s a realistic roadmap:

- Month 1: Get your bookkeeping sorted. Current, accurate, trustworthy.

- Month 2: Build a basic cash flow forecast. Just three months ahead is fine to start.

- Month 3: Start tracking actuals vs forecast. Understand where you’re off and why.

- Month 4: Add tax planning into your regular reviews. What’s your expected liability? Any planning opportunities?

- Month 5: Begin scenario planning. What if revenue drops 20%? What if it grows 50%?

- Month 6: Review and refine. What’s working? What isn’t? Adjust your system.

Don’t try to do everything at once. That’s how New Year’s resolutions fail. Small, consistent improvements beat ambitious plans that collapse under their own weight.

The Professional Help Question

At some point, you’ll need expert guidance. The question is when and from whom.

Look for advisors who:

- Ask questions about your business goals, not just your numbers

- Explain things in English, not accountant-speak

- Proactively suggest improvements rather than just responding to questions

- Have experience with businesses like yours

Ask Accountant provides small business accounting services alongside business advisory—the kind where they actually care about where you’re heading. They offer comprehensive business advice and handle everything from bookkeeping to strategic financial planning London businesses need. They’re at 178 Merton High St if you want to chat with someone who does proactive work rather than just filing returns. Call +44(0)20 8543 1991 to see if they’re a good fit.

But whether you work with them or someone else, find people who view their role as helping you succeed, not just keeping you compliant. There’s a difference.

Common Financial Planning Mistakes in London Businesses

Let me save you some pain by listing mistakes I see repeatedly:

- Underestimating London Operating Costs Everything costs more here. Your financial plan needs bigger buffers than it would elsewhere.

- Ignoring Personal Finance Integration Your business finances and personal finances are connected. Especially in smaller companies. Plan holistically.

- Planning in Isolation Your financial plan should connect to your business strategy. If your plan says “grow 30%” but your finances say “we can afford 10%,” something’s wrong.

- Treating Plans as Sacred Plans are guides, not commandments. When reality changes, adapt. Stubbornly following a plan that no longer makes sense is madness.

- Focusing Only on Revenue Revenue is vanity, profit is sanity, cash is reality. Plan for all three.

The Practical Reality Check

Here’s what I want you to do after reading this. Not some huge transformation—just three practical things:

- Check your current cash position and forecast the next 90 days. Can be rough. Just do it.

- List three financial questions you can’t answer about your business. Find someone who can help answer them.

- Schedule a quarterly financial review in your calendar. Doesn’t matter what it covers yet—just block the time.

That’s it. Three things. Do them this week, not “when things calm down” (spoiler: things never calm down).

Financial planning in London isn’t about creating the perfect system. It’s about building something practical that actually helps you run a better business. Something you’ll actually use rather than a beautiful plan that sits ignored in a drawer.

Start somewhere. Start small if you must. But start.

Frequently Asked Questions About Financial Planning for London Businesses

How much should I budget for professional financial planning services in London?

Depends entirely on your business size and complexity. Simple sole traders might spend £500-1500 annually. Small limited companies typically run £1500-4000. More complex businesses can easily spend £5000+ but should see returns exceeding the cost through better tax planning and decision-making. Obtain quotations from several companies and make sure you know exactly what each one includes.

What distinguishes a financial planner from an accountant?

Compliance, including tax reports, annual accounts, and maintaining your legal status, is usually handled by an accountant. A financial planner (or strategic accountant) helps you make decisions about the future—growth strategies, tax efficiency, business structure. Many accounting firms now offer both, but traditionally they’re different skill sets. Make sure whoever you hire does what you actually need.

How often should I review my business financial plan?

Monthly for cash flow (minimum). Quarterly for overall financial performance and planning adjustments. Annually for comprehensive reviews and long-term strategy. More frequently during rapid growth or difficult periods. The key is consistency—better to do lighter monthly reviews than skip them and do one massive annual session.

Does starting a business require different financial preparation than an established one?

Of course. Startups prioritize surviving, creating a financially viable product-market fit, and runway (the amount of time until you run out of money). Well-established companies prioritize long-term value generation, tax efficiency, sustainable growth management, and margin optimization. Although the fundamental ideas are a”re the same, the priorities are very different.

Do I need expert assistance with financial planning, or can I do it on my own?

Honest answer: you can handle basics yourself with good software and education. Whether you should depends on your business complexity, your financial literacy, and the opportunity cost of your time. Most businesses benefit from professional help once they’re turning over £75k+. Consider it like legal advice—you can learn enough to handle simple stuff, but complex situations need experts.

What financial planning software works best for London businesses?

Xero and QuickBooks are the dominant players, both solid choices. Xero tends to be more popular with UK accountants. FreeAgent is good for smaller businesses and freelancers. Sage is still around but feels dated. Whatever you choose, make sure your accountant can work with it—switching later is painful. Most modern cloud accounting software does the job; the differences are mostly about interface preferences.