Right. Let’s talk about the IHT400—that intimidating bundle of pages that lands on executors’ desks when someone dies and there’s inheritance tax to sort out.

I’ve watched countless families struggle through this form (sometimes at 2am, surrounded by bank statements and half-empty coffee mugs), and honestly? It doesn’t have to be the nightmare everyone claims it is. But you do need to know what you’re dealing with before you start ticking boxes.

The IHT400 form is HMRC’s way of calculating exactly how much inheritance tax the estate owes. Unlike its simpler cousin—the PA1P form that sufficed for straightforward estates—the IHT400 requires forensic detail about everything the deceased owned, owed, and gave away in their final years.

Decoding the IHT400: What Actually Is This Thing?

Think of the IHT400 as the exhaustive financial biography of someone’s death. It’s the form HMRC uses when an estate either owes inheritance tax or doesn’t qualify as an “excepted estate” (we’ll get to that).

The form itself? Fourteen pages. But here’s the catch—you’ll almost certainly need supplementary schedules too. These are separate forms (numbered IHT401 through IHT436) that dive deeper into specific assets: property, shares, business interests, gifts, trusts. An estate with a house, some shares, and a gift history could easily require the main IHT400 plus four or five schedules.

And no, you cannot save your progress halfway through. The interactive PDF demands completion in one sitting, so gather everything first. Coffee optional; patience essential.

When the IHT400 Becomes Your Problem

Not every estate needs the full IHT400 treatment. Some lucky executors get away with simpler forms. Whether you’re stuck with the IHT400 depends on a few specific triggers:

The estate exceeds £325,000 (or £650,000 if claiming a transferable nil-rate band from a deceased spouse). That’s your threshold. Cross it, and you’re filling out this form.

Foreign assets over £100,000? You need the IHT400 even if the total estate sits comfortably under £325,000. HMRC wants details on that Spanish villa or French apartment.

Trust assets exceeding £250,000 trigger the requirement too. Same goes for gifts made within seven years of death totalling more than £250,000.

Here’s what catches people out: Even if no inheritance tax is actually due—because everything passes to a spouse, for instance—you might still need the IHT400 if the estate’s total value exceeds £3 million. HMRC wants visibility on large estates regardless of tax liability.

Let me give you a real scenario. Thomas died leaving a UK estate worth £290,000. Seems straightforward—under the threshold, right? Except he also owned an £80,000 apartment in Spain. Total foreign assets: £80,000. Under the limit, so no IHT400 needed? Wrong. The rules state foreign assets must be under £100,000 and the total estate under the threshold. His executors needed the full IHT400 despite no tax being due.

The Cast of Characters Who Might Fill This Out

The responsibility for completing the IHT400 typically falls on:

- Executors named in the will – You’re first in line. The deceased trusted you with this job (whether you wanted it or not).

- Administrators – When there’s no will, the court appoints administrators who inherit this delightful task.

- Solicitors or professional executors – Many people wisely delegate this to professionals who’ve done it hundreds of times.

- Accountants specialising in inheritance tax – Particularly for complex estates involving businesses or multiple properties.

Can you do it yourself? Absolutely. Should you? Depends on the estate’s complexity. A straightforward estate with one property, some savings, and no gifts? Manageable with careful attention. An estate with business interests, offshore accounts, agricultural property, and a complex gift history? You’d be brave—or foolish—to tackle that without professional help.

Timing Is Everything (And HMRC Means It)

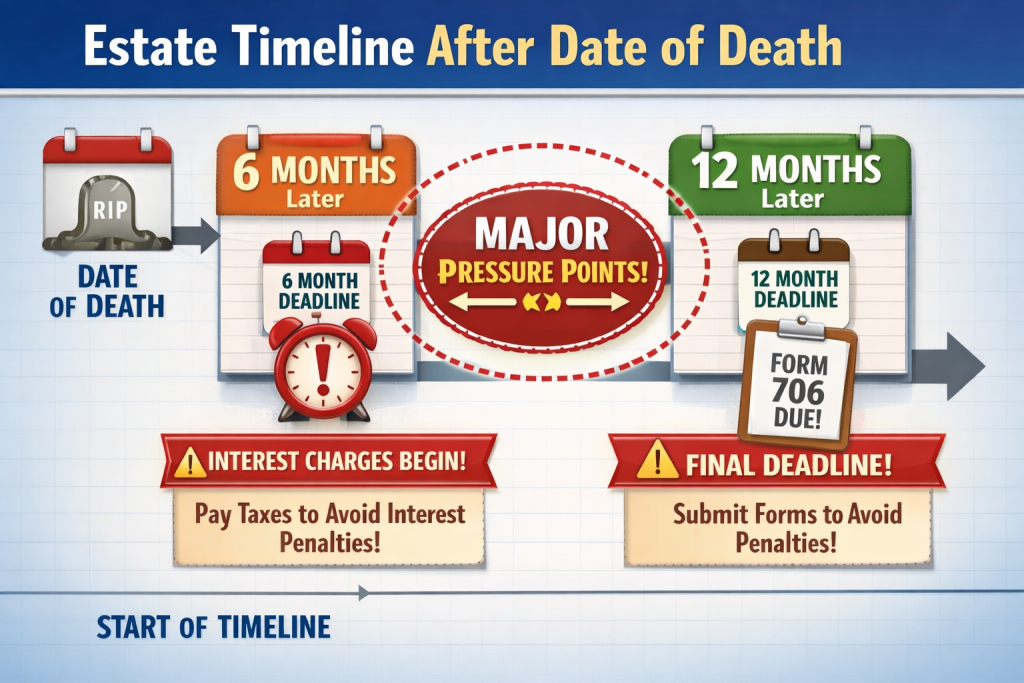

The deadline for submitting your IHT400: 12 months from the end of the month in which death occurred.

Someone died on 15th March 2025? Your IHT400 is due by 31st March 2026.

But—and this is crucial—the tax itself is due much earlier. You’ve got six months from the date of death to pay any inheritance tax owed. Miss that deadline and HMRC starts charging interest at 7.75% (as of April 2025). That interest compounds, turning a manageable bill into something considerably less manageable.

Here’s the pressure point executors face: you need to value everything, calculate the tax, and arrange payment within six months. But most assets remain locked until you get probate. And you can’t get probate without submitting the IHT400 and paying the tax. See the circular problem?

| Timeframe | Action Required | Consequence of Missing It |

|---|---|---|

| 6 months from death | Pay inheritance tax | Interest charges at 7.75% on outstanding tax |

| 12 months from end of death month | Submit IHT400 | £100 initial penalty; £200 at 6 months late; up to £3,000 at 12+ months |

| 20 working days before probate application | Allow HMRC processing time | Delays in matching IHT421 to probate application |

The Document Mountain You’ll Need to Climb

Before you even think about opening the IHT400, gather these documents. And I mean all of them:

Property valuations – Get three estate agent valuations (they should be within 10% of each other) or commission a RICS surveyor. Don’t rely on Zoopla or Rightmove estimates. HMRC’s district valuers will challenge anything that looks suspiciously low, and they’re annoyingly good at their jobs.

Bank statements showing balances on the exact date of death – Not the online banking balance you saw that morning. Contact each institution for official date-of-death valuations. They matter.

Investment portfolios – Share valuations, ISAs, bonds, premium bonds. Everything.

Pension details – Though from April 2027, unused pension funds will be brought into the estate for IHT purposes following the Autumn Budget 2024 announcement.

Details of gifts made in the seven years before death – This is where it gets tricky. That £15,000 wedding gift everyone remembers? Easy. The regular £200 monthly payments to grandchildren that nobody mentioned? Less easy. Check bank statements meticulously.

Business asset details if the deceased owned a company or partnership share. Trust documentation if trusts are involved. Debts and liabilities—mortgages, loans, credit cards, even unpaid utility bills count.

Critical point: You cannot save a partially completed IHT400. The form must be finished in one session. Attempting to fill it out piecemeal, waiting for valuations to arrive, or spreading it over several days won’t work. Get everything ready first, set aside several hours, then complete the entire form.

Where Executors Trip Up (And How to Avoid Joining Them)

After years of watching this process, certain mistakes appear with depressing regularity:

Undervaluing Assets

Might seem tempting to shave a few thousand off that property value. HMRC has surprisingly good intelligence about property values and market rates. They will notice if your valuation seems suspiciously low. Emma valued her mother’s house at £320,000 based on a Zoopla estimate. HMRC’s district valuer assessed it at £365,000. Result? £18,000 additional tax, a six-month delay, and interest charges.

Forgetting About Gifts

The deceased might have mentioned that £15,000 they gave their daughter for her wedding. But did they tell you about the regular payments to grandchildren? Probably not. Check the seven-year rule carefully. All gifts within seven years of death need reporting, regardless of size.

Missing Supplementary Schedules

Forgetting to include IHT405 for property or IHT403 for gifts? That’ll delay your probate by weeks or months while HMRC sends it back requesting the missing paperwork.

Not Obtaining an Inheritance Tax Reference Number First

When tax is payable, you need an IHT reference number before submitting the IHT400. Sending it without one? HMRC rejects it. Several weeks lost.

Claiming Reliefs Incorrectly

Business property relief has strict qualifying conditions. Owning shares in your local pub doesn’t automatically qualify if you weren’t involved in running the business. Agricultural property relief? Even more complex. Get professional advice for these.

| Common Mistake | Why It Happens | How to Avoid It |

|---|---|---|

| Using property website estimates | Seems easier than formal valuations | Get 3 agent valuations or RICS survey |

| Omitting small regular gifts | Family doesn’t mention them | Review 7 years of bank statements thoroughly |

| Incomplete schedules | Confusion about which forms needed | Read IHT400 Notes carefully; list all asset types first |

| Submitting before getting IHT reference | Misunderstanding the sequence | Get reference number first when tax is due |

| Misunderstanding domicile | Assuming UK residence = UK domicile | Check domicile status carefully; seek advice if unclear |

What Happens When You Get It Wrong

Let’s be honest: you might make mistakes. Most people do. The question is what HMRC does about it.

Late submission penalties start at £100 if you’re late. After six months, add another £200. After twelve months? Up to £3,000 total, depending on how much tax is owed and whether you submitted voluntarily or only after HMRC inquiries.

However—and this is important—HMRC will waive penalties if you have a “reasonable excuse.” That means you took steps to prepare the IHT400, but something beyond your control prevented timely submission. COVID delays were accepted. So are deaths of other family members, serious illness, or problems obtaining foreign asset valuations.

Inaccurate valuations trigger different consequences. If you discover errors after submission, use Form C4 (Corrective Account) immediately. Voluntary corrections receive more favourable treatment than errors HMRC discovers during compliance checks.

Deliberate concealment? That’s prosecution territory. Don’t go there.

Feeling overwhelmed by the IHT400? You’re not alone. At Ask Accountant, we’ve guided countless executors through this process, ensuring accurate valuations, complete documentation, and timely submission. Based in London at 178 Merton High St, our team specialises in inheritance tax advisory and can handle the entire IHT400 process while you focus on what matters. Call us on +44(0)20 8543 1991 for a straightforward conversation about your situation.

Frequently Asked Questions About the IHT400

Can I submit the IHT400 online?

You can complete the interactive PDF form on your computer, but submission is typically by post to HMRC. Some professional software allows electronic submission, but DIY executors usually print and post the completed IHT400 with supporting schedules.

What’s the difference between IHT400 and IHT205?

The IHT205 was the short-form return for non-taxable estates. It was discontinued for deaths after 1st January 2022. Now, excepted estates use form PA1P, while taxable or complex estates require the full IHT400.

Do I need a solicitor to complete the IHT400?

No legal requirement for professional help exists. Many executors successfully complete straightforward IHT400 forms themselves using the detailed guidance notes. However, estates involving businesses, agricultural property, complex trust arrangements, or substantial foreign assets typically benefit from professional assistance. The cost of getting it wrong often exceeds professional fees.

How long does HMRC take to process the IHT400?

HMRC aims to process IHT400 forms within 15 working days of receipt and issue form IHT421 within 15 working days of processing. However, incomplete submissions, missing schedules, or queries about valuations extend this considerably. Allow 20 working days from submission before applying for probate to ensure the IHT421 reaches the probate office in time.

Can I claim a refund if I overpaid inheritance tax?

Yes. Common scenarios include properties selling for less than the probate valuation or discovering previously unknown debts. Use Form C4 to notify HMRC of changes and claim refunds. Keep all documentation proving the revised valuations.

What if I discover unreported gifts after submitting?

Use Form C4 to amend your IHT400 immediately. Voluntary disclosure receives better treatment than HMRC discovering the omission during a compliance check. Don’t wait—penalties increase with delay.

Final Thoughts: It’s Manageable (Really)

The IHT400 form intimidates people. Fourteen pages, multiple schedules, complex calculations, tight deadlines, and penalties for errors? No wonder executors panic.

But here’s what I’ve learned watching families navigate this: preparation beats panic every time. Get your documents together before you start. Read the IHT400 Notes (yes, all of them—they’re tedious but invaluable). Work methodically through each section. And don’t be afraid to ask for help when you need it.

Whether you tackle the IHT400 yourself or work with professionals like the team at Ask Accountant, the key is understanding what you’re dealing with and why it matters. HMRC needs accurate information to calculate inheritance tax fairly. You need to provide it correctly to avoid delays, penalties, and years of correspondence.

Do it properly the first time, and you’ll get through probate smoothly. Mess it up, and you’re looking at months of corrections, queries, and frustration.

Your choice.