Running a small business in 2026 feels a bit like trying to assemble IKEA furniture during an earthquake. Everything’s shifting—regulations, technology, customer expectations—and you’re just trying to keep the bloody screws from rolling under the sofa.

But here’s the thing: whilst 84% of UK small businesses are apparently charging into this year with grand growth plans (according to recent Novuna Business Finance research), many are doing so without addressing some genuinely critical gaps in their approach. I’ve watched enough businesses stumble—not because they lacked ambition, but because they missed the fundamentals hiding in plain sight.

So let’s talk about the business advice that actually matters in 2026. Not the fluff you’d find on a motivational poster, but the practical, occasionally uncomfortable truths that separate thriving enterprises from those perpetually firefighting.

The Cash Flow Conversation Nobody Wants to Have (But Everyone Should)

You know what kills more businesses than bad products? Poor cash flow management. It’s unglamorous, unsexy, and absolutely vital.

Here’s a statistic that should make you sit up: 82% of small business failures can be traced back to cash flow problems or misunderstanding how cash flow actually works. Not market competition. Not lack of innovation. Just money—or rather, the lack of it when you need it most.

The problem? Revenue and cash aren’t the same thing. You can be “profitable” on paper whilst simultaneously unable to pay the heating bill. I’ve seen it happen. One tech startup I know doubled their sales in a single year and nearly went bankrupt because they were building inventory two months early and collecting payment six months late. Growth became a Trojan horse.

In 2026, with Making Tax Digital looming for those earning over £50,000 (more on that nightmare later), your cash flow visibility needs to be sharper than ever. Proper bookkeeping isn’t optional anymore—it’s your early warning system.

What Actually Works for Cash Flow in 2026:

Build a 12-month rolling forecast—Update it monthly. Yes, monthly. Include scenarios for best case, worst case, and “this is probably what’ll happen” case. If your quarterly MTD submissions drop bookings below your trigger point for two consecutive quarters, you’ll know to pause discretionary spending before you’re in trouble.

Track your Days Sales Outstanding (DSO) religiously. If customers are taking longer to pay, that’s a red flag waving frantically at you. Many businesses in 2026 are using AI-powered tools to spot likely late payers before they become actual late payers—and it’s making a tangible difference to cash reserves.

Categorise every expense. Not just for HMRC’s benefit, but so you actually understand where money’s going. Split it into: General & Admin, R&D, Sales & Marketing, Operations, and Cost of Goods Sold. Look at the percentages. Does spending 40% on marketing make sense when you can’t fulfil orders fast enough? Probably not.

Companies like Ask Accountant in South West London have noticed a sharp uptick in clients requesting cash flow forecasting services specifically because of these new digital reporting requirements. Smart move, frankly.

| Cash Flow Strategy | Implementation Difficulty | Impact on Business |

|---|---|---|

| 12-month rolling forecast | Medium | High – Prevents nasty surprises |

| Quarterly digital submissions (MTD) | High initially, easier once established | High – Mandatory compliance |

| AI-powered late payment prediction | Low (if using right tools) | Medium to High |

| Early payment discounts for customers | Low | Medium – Improves DSO |

| 3-6 month cash reserve | High (requires discipline) | Very High – Business survival buffer |

| Negotiated supplier payment terms | Medium | Medium |

Making Tax Digital: The April 2026 Reckoning

Right, let’s address the elephant wearing a HMRC badge in the room.

From 6 April 2026, if you’re self-employed or a landlord earning over £50,000, you’re entering the brave new world of Making Tax Digital for Income Tax Self Assessment. This is, according to the government, the most significant change to self-assessment since 1997. Which is either impressive or terrifying, depending on your perspective.

What does this actually mean? Instead of submitting one annual return (which you could cobble together from shoeboxes of receipts and a prayer), you’ll now need to:

- Maintain digital records

- Use HMRC-approved software

- Submit quarterly updates

- Complete a final end-of-period statement

And if you’re thinking “I’ll just wing it,” consider this: whilst HMRC has mercifully announced they won’t apply penalties for late quarterly submissions during the 2026-27 tax year, that grace period won’t last forever. Also, Corporation Tax filing penalties are doubling from 1 April 2026—missing a filing will now cost you £200 instead of £100. Miss it by three months? That’s £400. Three successive late filings? £2,000.

The business advice here is brutally simple: sort your digital infrastructure now, not in March 2026 when everyone else panics simultaneously and accountants’ phones melt from the call volume.

Research shows that 10% of small business owners don’t even know about MTD yet, and 21% don’t fully understand the digital record-keeping requirements. Don’t be in either category.

If you need guidance on tax compliance or help selecting appropriate software, get professional advice early. Waiting until April is like starting your Christmas shopping on December 24th—technically possible, but needlessly stressful.

Technology: Stop Treating AI Like It’s Optional

Look, I get it. Another year, another technological “revolution” we’re supposed to embrace. But 2026 is different because AI has shifted from “interesting future possibility” to “practical daily tool.”

The statistics are compelling: 35% of UK SMEs are actively using AI, and that figure’s climbing rapidly. But here’s what caught my attention—88% of firms have adopted AI in some form, yet only 5% report seeing meaningful value from it.

That gap? That’s the difference between using AI and integrating it properly.

Small businesses in 2026 need to think about AI in three buckets:

1. Administrative Automation (the low-hanging fruit)

This is AI handling the tedious stuff: invoice processing, email triage, calendar management, basic customer queries. One virtual assistant business I know uses AI to handle 3x as many client tasks as traditional VAs could manage, which fundamentally changes their economics.

2. Financial Intelligence (the cash flow connection)

AI-powered tools can now analyse your transaction patterns, seasonal trends, and even macroeconomic signals to forecast liquidity needs. They’ll recommend actions—like adjusting payment terms or accessing short-term credit—before problems arise. This isn’t science fiction; it’s available software.

3. Customer Engagement (the competitive edge)

Agentic shopping through platforms like ChatGPT is coming to the UK soon. If your products show up in AI-powered searches and consumers can buy without leaving the app, you’ve just opened a new marketing channel. Businesses on Shopify and Etsy are already seeing this in the US.

The business advice isn’t to use AI everywhere immediately. It’s to identify your three most time-consuming processes and ask: “Could AI handle 60-80% of this?” For many businesses, that’s payroll management, customer support, and content creation.

The Employment Rights Minefield

If you employ people (or plan to), 2026 brings a fresh batch of legislative headaches disguised as “improvements.”

The Employment Rights Bill is rolling out throughout 2026, and whilst the British Chambers of Commerce and various business leaders have raised concerns about whether these rules work in practice rather than just theory, they’re coming regardless.

Key changes you need to understand:

Day-one unfair dismissal rights: New employees can challenge termination from day one. Your probation periods haven’t disappeared, but they’re now riskier. This means better hiring processes, clearer documentation, and—here’s the uncomfortable bit—more careful consideration before you hire someone you’re not sure about.

Guaranteed hours and shift predictability: If your business relies on variable rotas or calling people in when it gets busy, you need a bulletproof system to justify those decisions. Hospitality and retail feel this most acutely. The advice? Treat rotas as commitments rather than suggestions. Publish schedules earlier. Track changes. Explain them clearly.

Sick pay reforms: The government’s reviewing who qualifies for statutory sick pay and how quickly they receive it. Changes take effect in April 2026. If eligibility widens or waiting periods shorten, wage bills increase. In small teams where one absence can derail a week’s work, better absence tracking becomes critical.

Combined with April’s National Living Wage increase (£12.71 for over-21s) and frozen employer National Insurance thresholds, labour costs are climbing. The business advice that works? Build these increased costs into your financial forecasts now, and consider whether some roles might be better filled by outsourcing or automation.

For businesses needing strategic guidance on navigating these changes, professional business advice services can provide tailored solutions that actually fit your circumstances.

When Sustainability Stops Being Optional

Environmental, Social, and Governance (ESG) requirements are tightening. Stricter UK and EU sustainability disclosure rules are planned for 2026 and beyond, and this isn’t just for multinational corporations anymore.

Here’s what’s happening: larger businesses are being forced to report on their supply chains’ environmental impact. Which means they’re going to start asking you for data about your carbon footprint, waste management, and sustainability practices. Even if you’re small, if you’re in anyone’s supply chain, these questions are coming.

This creates both obligation and opportunity. Businesses that can clearly demonstrate their environmental credentials—using data-driven tools to measure and communicate impact—will have a competitive advantage when bidding for contracts.

The business advice? Don’t wait for customers to demand sustainability reporting. Start measuring now. Track energy usage, waste, transportation emissions. Even basic data puts you ahead of competitors who haven’t started.

And yes, there’s a growing market for ESG consultancy. If you’ve got expertise in sustainability compliance, 2026 might be your moment.

| 2026 Priority | Why It Matters | Quick Win Action |

|---|---|---|

| Digital tax compliance | MTD mandatory from April; penalties doubling | Choose approved software this month |

| Cash flow forecasting | Economic uncertainty requires better visibility | Create 12-month rolling projection |

| AI integration | Competitors are gaining efficiency advantages | Identify 3 time-consuming processes to automate |

| Employment law updates | Day-one rights and sick pay changes | Review hiring processes & documentation |

| Sustainability tracking | Supply chain data requests incoming | Begin measuring carbon footprint & waste |

| Cost control discipline | Rising wages & overhead squeezing margins | Assign “owners” to major spending categories |

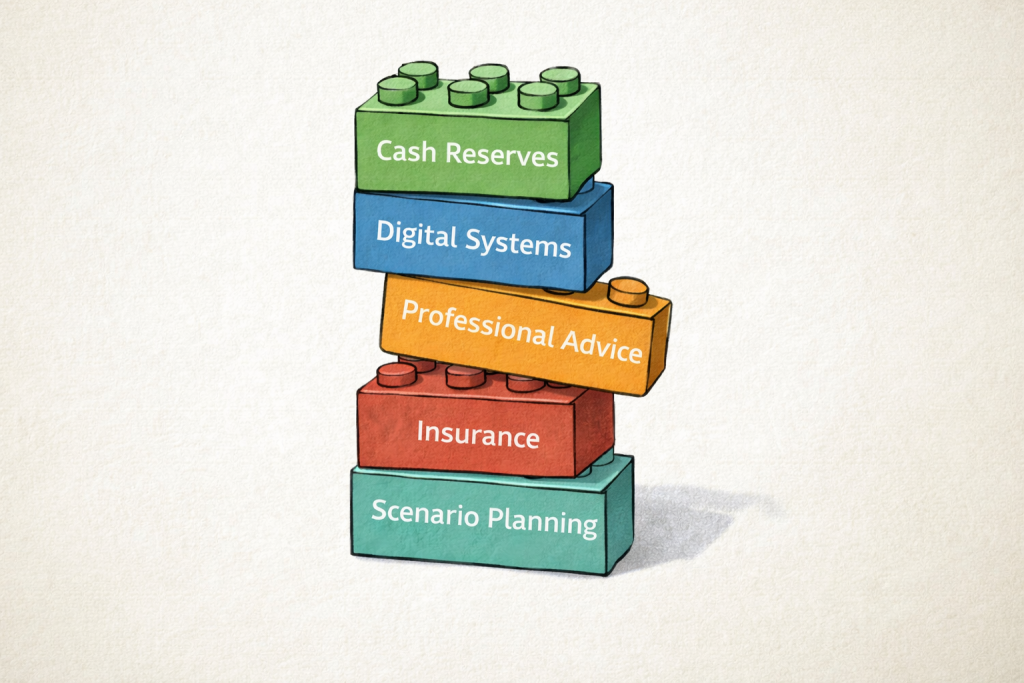

Building Actual Resilience (Not Just Talking About It)

Financial resilience keeps getting mentioned in every bloody business survey, but what does it actually mean beyond having money set aside?

Real resilience in 2026 means:

Diversification that makes sense. Twenty-five percent of businesses are prioritising the need to diversify products and services this year—up from 20% last year. But diversification done badly (chasing every shiny opportunity) is worse than staying focused. The question isn’t “What else could we sell?” but “What adjacent problems do our existing customers have that we could solve profitably?”

Cost discipline without penny-pinching stupidity. There’s cutting unnecessary expenses, and then there’s slashing things that generate revenue. Know the difference. When Deloitte surveyed finance leaders, they found that successful cost management requires ownership—someone responsible for each major spending bucket who can explain what drives that spend, not just sign invoices.

Scenario planning as a habit. Build three versions of your future: baseline (probably), downside (if things go sideways), and upside (if opportunities materialise). Keep them to one page each. Focus on your four main drivers: revenue, gross margin, payroll, and cash. Set clear triggers for action. If bookings drop below X for two months running, pause discretionary spend. Simple.

Access to capital before you’re desperate. Arrange a business line of credit or alternative funding options whilst you don’t urgently need them. When you’re scrambling for cash is exactly when lenders become suspicious and terms deteriorate.

Professional services like business planning can help structure these resilience strategies properly, particularly around financial forecasting and growth planning.

The Bit About Tax Changes That’ll Actually Affect You

Beyond Making Tax Digital (which we’ve covered), 2026 brings other tax shifts worth understanding:

Dividend tax increase: Standard rate jumps from 8.75% to 10.75% from April 2026. Upper rate climbs from 33.75% to 35.75%. If you’re a company director paying yourself in dividends, this directly impacts your take-home. Time to review your remuneration strategy with an accountant.

Capital gains on business disposals: The rate for business asset disposal relief increases to 18% from 14% on 6 April 2026. Selling business assets—shares, buildings, equipment—just got more expensive.

Business rates changes: Retail, hospitality, and leisure properties get a new lower rate (5p reduction on multipliers). Good news for some. But larger properties above £500,000 rateable value likely face increased bills. Meanwhile, business rates are devolved to Scotland and Wales, where different regimes apply entirely.

Capital allowances adjustments: Writing down allowance for plant and machinery drops from 18% to 14% from April 2026. However, there’s a new 40% first-year allowance for certain expenditure from January 2026, including assets for leasing. The timing of capital investments suddenly matters more.

None of these changes are catastrophic individually, but together they nibble away at margins. The business advice? Factor them into your 2026 planning now. Corporate tax planning becomes less optional and more strategic.

Why “Digital-First” Isn’t Negotiable Anymore

I’m slightly tired of hearing “digital transformation” as if it’s still a choice. In 2026, it’s just… how business works.

This doesn’t mean you need a Silicon Valley-style tech stack. It means:

- Cloud accounting so you can see your financial position in real-time, from anywhere, and share access with your accountant without printing a single spreadsheet. (Cloud accounting solutions have become significantly more user-friendly.)

- Digital payment options that customers actually use—contactless, mobile payments, online invoicing with embedded payment links.

- Automated backups because ransomware attacks targeting small businesses increased again in 2025 and show no signs of slowing. Around 85% of UK companies plan to increase cybersecurity budgets in 2026. Should you be one of them? Probably.

- Basic CRM functionality so you’re not managing customer relationships through memory and scattered emails.

The businesses struggling in 2026 aren’t those with smaller marketing budgets or less fancy offices. They’re the ones still operating like it’s 2015—paper-based, reactive, disconnected from the data showing them where they’re actually making or losing money.

Talent Strategies That Acknowledge Reality

Hiring in 2026 is… complicated. The unemployment rate’s sitting around 5.1%, creating a candidate-led market where good people have options.

Simultaneously, employees expect:

- Flexible working arrangements (hybrid at minimum, often remote options)

- Genuine work-life balance (not just lip service)

- Benefits beyond statutory minimums—mental health support, wellness programmes, tailored packages

- Professional development opportunities

Small businesses can’t always match corporate salaries, but they can offer things large organisations struggle with: autonomy, direct impact, faster decision-making, closer relationships with leadership.

The business advice that’s working? “Strategic flexibility”—a mix of permanent staff, contractors, and outsourced functions. Maybe your IT doesn’t need to be in-house. Perhaps HR can be outsourced to specialists. Could that finance role be a fractional CFO rather than a full-time hire?

Also, train your team to use AI tools effectively. The “augmented worker” or “SuperWorker” concept—employees leveraging AI to boost productivity—is shifting from buzzword to practical advantage. Businesses whose teams can use AI responsibly see faster decision-making and more consistent workflow execution.

For specific employment challenges like auto-enrolment compliance or payroll management, outsourcing to specialists often makes more sense than struggling through it yourself.

Where the Opportunities Actually Are

Amidst all these challenges (and let’s be honest, it’s been a bit of a litany of problems), 2026 also presents genuine opportunities:

AI consulting and implementation is exploding because most businesses have adopted AI but few are extracting real value. If you understand how to bridge that gap, clients will pay you.

ESG compliance consultancy will grow as regulations tighten and supply chain data requests increase. Specialists in carbon disclosure, ethical supply chains, or sustainability reporting are in demand.

Cybersecurity services for SMEs are thriving as threats escalate. Most small businesses lack in-house expertise but desperately need protection. Managed detection, vulnerability assessments, 24/7 monitoring—there’s real money in keeping businesses safe.

Subscription and D2C models continue strong performance. Curated experiences sold direct-to-consumer create predictable revenue through customer loyalty. From eco-conscious hobby boxes to local food subscriptions, the model works if you understand your audience.

Specialist recruitment in tight labour markets benefits businesses who truly understand specific sectors rather than generalist recruiters.

Virtual assistance with AI integration allows VAs to handle 3x traditional capacity, fundamentally changing the economics whilst meeting growing demand for flexible support.

Notice a pattern? The opportunities exist at intersections—where new technology meets traditional problems, where regulation creates compliance needs, where changing customer behaviour demands new solutions.

What Good Business Advice Actually Looks Like in 2026

After this tour through tax changes, employment law, technology shifts, and economic uncertainty, what’s the business advice that actually matters?

Here’s my attempt at distillation:

1. Get your financial foundations sorted. Cash flow visibility, proper bookkeeping, realistic forecasting, appropriate software. Not sexy, absolutely essential. If your accounting is a mess, everything else is harder. Period.

2. Embrace mandatory changes early. Making Tax Digital isn’t going away. Employment law changes are happening. Corporation tax penalties are doubling. Fighting reality is expensive and exhausting. Get ahead of these changes whilst you have time to implement properly rather than panic-scrambling in March.

3. Use technology intentionally. AI, automation, cloud systems—these aren’t buzzwords anymore. But using them just because everyone else is using them is wasteful. Identify specific problems, find technological solutions, measure results. Rinse and repeat.

4. Protect what you’ve built. Cybersecurity, proper insurance, cash reserves, documented processes. Resilience isn’t hoping nothing goes wrong; it’s preparing for when something inevitably does.

5. Invest in expertise where it matters. You can’t be an expert in tax law, employment regulations, digital security, AI implementation, and running your actual business. Professional advisors who understand your specific circumstances aren’t an expense—they’re risk mitigation and growth enablers.

6. Stay focused on what actually drives revenue. It’s easy to get distracted by compliance requirements, new technologies, and industry trends. But at the end of the day, businesses survive by solving customer problems better than alternatives. Don’t lose sight of that whilst juggling everything else.

The Uncomfortable Truth About 2026

Running a small business in 2026 requires juggling more complexity than ever before. Digital tax reporting. Evolving employment rights. Rising costs. Technological disruption. Sustainability requirements. Cybersecurity threats.

The businesses that’ll thrive aren’t necessarily those with the biggest budgets or fanciest technology. They’re the ones that:

- Maintain clear visibility into their cash position

- Adapt to regulatory changes proactively rather than reactively

- Use technology to amplify their strengths rather than paper over weaknesses

- Invest in expertise where needed instead of DIY-ing everything

- Keep their focus on customer value whilst managing operational complexity

Is this harder than running a business was ten years ago? Absolutely. But the tools available to manage that complexity are also better than they’ve ever been.

If you’re feeling overwhelmed by the changes ahead—particularly around tax compliance, financial planning, or business growth strategies—professional guidance can cut through the noise. Ask Accountant, based at 178 Merton High St, London SW19 1AY, specialises in helping small businesses navigate exactly these challenges. Whether you need support with accounts and tax, VAT compliance, or comprehensive tax advisory solutions, having someone in your corner who understands both the regulations and your business makes the difference between thriving and merely surviving.

You can reach them at +44(0)20 8543 1991 to discuss how proper accounting and bookkeeping support might help your business approach 2026 with confidence rather than dread.

Because at the end of the day, the best business advice for 2026 isn’t a magic formula or secret strategy. It’s maintaining solid fundamentals whilst adapting intelligently to what’s changed. Get the basics right—cash flow, compliance, technology, people—and you’ll have the foundation to actually capitalise on opportunities when they appear.

Which they will. Even in 2026.

Frequently Asked Questions

What is the most important business advice for small businesses in 2026?

The most critical business advice for 2026 focuses on mastering cash flow management whilst adapting to mandatory digital tax reporting. With Making Tax Digital coming into force in April 2026 for businesses earning over £50,000, combined with doubled Corporation Tax filing penalties, proper financial visibility and digital infrastructure aren’t optional anymore. Businesses that maintain clear cash forecasts, embrace appropriate technology, and invest in professional support will significantly outperform those trying to muddle through with outdated systems.

How will Making Tax Digital affect my small business in 2026?

Making Tax Digital (MTD) for Income Tax Self Assessment becomes mandatory from 6 April 2026 for self-employed individuals and landlords with qualifying income over £50,000. You’ll need to maintain digital records, use HMRC-approved software, submit quarterly updates, and complete a final end-of-period statement. Whilst HMRC won’t apply late submission penalties for quarterly updates during 2026-27, this grace period is temporary. The threshold drops to £30,000 from April 2027 and £20,000 from 2028, so early adoption and proper systems implementation are essential.

What technology should small businesses prioritise in 2026?

Small businesses should prioritise three technology areas in 2026: MTD-compliant accounting software (mandatory for tax reporting), AI-powered tools for administrative automation and cash flow forecasting, and robust cybersecurity measures. Rather than adopting technology indiscriminately, identify your three most time-consuming processes and implement targeted solutions there. Cloud accounting platforms, automated invoicing systems, and basic AI integration for customer service or financial forecasting deliver measurable returns whilst keeping complexity manageable.

How can small businesses manage rising employment costs in 2026?

With the National Living Wage increasing to £12.71 for over-21s, frozen employer NI thresholds, and new Employment Rights Bill provisions, labour costs are rising. Successful strategies include: building these increases into financial forecasts immediately, considering strategic flexibility through a mix of permanent staff, contractors, and outsourced functions, implementing AI tools to boost employee productivity, and reviewing remuneration structures to balance statutory costs with retention needs. Professional business advice around workforce planning can help identify optimal staffing models for your specific circumstances.

What business opportunities exist in 2026 despite economic uncertainty?

Despite challenges, significant opportunities exist in: AI implementation consulting (helping businesses extract actual value from AI adoption), ESG compliance services (as sustainability reporting requirements tighten), cybersecurity for SMEs (with 85% of UK companies increasing security budgets), subscription and direct-to-consumer models, specialist sector recruitment, and AI-augmented virtual assistance. The common thread is solving genuine problems at the intersection of regulatory change, technological advancement, and evolving customer needs.

Should small businesses invest in professional accounting and advisory services?

In 2026’s complex regulatory environment, professional accounting and business advice shifts from optional luxury to strategic necessity. Qualified advisors provide: MTD compliance support, tax planning to minimise legitimate liabilities, cash flow forecasting and financial modelling, strategic business planning, and risk management. The cost of professional services is typically far less than the penalties for non-compliance, missed tax relief opportunities, or poor financial decisions. Services like bookkeeping, payroll management, and tax advisory from firms like Ask Accountant in London deliver measurable ROI through both compliance and strategic value.