You know what’s weird? Construction companies can build entire skyscrapers, engineer complex drainage systems, and orchestrate dozens of subcontractors across multiple sites—but ask them about their cash flow forecast, and suddenly everyone’s staring at their boots.

I’ve watched this happen more times than I care to admit. A thriving construction firm with a packed project pipeline can collapse faster than a poorly mixed concrete foundation, not because they couldn’t build, but because nobody was properly watching the numbers. The irony? Construction accounting isn’t actually more difficult than construction itself—it’s just different. And that difference matters enormously.

Here’s the thing: every blueprint tells a story about what will be built. Balance sheets? They tell you whether you’ll survive long enough to build it.

Why Construction Companies Bleed Money (Even When They’re “Profitable”)

Let me paint you a picture. You’ve just landed a £500,000 contract. Celebrations all around, right? Except you need to order materials worth £150,000 today, pay your crew weekly, wait 30-60 days for client payments, and somehow cover CIS deductions that you won’t reclaim for months.

This isn’t theoretical—this is Tuesday afternoon for most construction firms.

The problem with accounting for construction companies isn’t complexity for complexity’s sake. It’s that everything happens backwards. You spend before you earn. You commit before you collect. You’re liable for work that subcontractors haven’t even completed yet. Traditional accounting methods—the kind that work perfectly fine for, say, a coffee shop or a consulting firm—simply don’t capture this reality.

And that’s before we even touch on:

- Job costing that actually reflects site conditions (not just estimates)

- CIS compliance that doesn’t give you a headache

- VAT schemes that might save you thousands

- Retention money sitting in limbo

- WIP (Work in Progress) valuations that your bank actually believes

The Real Cost of DIY Accounting

I met a builder once who kept his accounts in three different notebooks. One for suppliers, one for clients, one for “other stuff” (his words, not mine). He was brilliant at his trade—his plastering work was genuinely art—but his business lasted eighteen months. Not because he couldn’t find work. Because he had no idea whether the work he was doing actually made money.

That’s not a cautionary tale about disorganisation, though. I know construction directors with sophisticated Excel spreadsheets who’ve made the same mistake. The issue isn’t the tool—it’s understanding what construction accounting needs to do.

What “Accounting for Construction Companies” Actually Means

Right, let’s get specific. Because “accounting for construction companies” sounds like corporate jargon, but it’s actually shorthand for about fifteen different financial disciplines that all need to work simultaneously.

Job Costing: Where Profit Lives or Dies

Every construction project is essentially a mini-business. It has its own revenue, its own costs, its own timeline, its own risks. Which means you can’t just look at your overall bank balance and call it a day. You need to know—project by project, phase by phase—whether you’re making money or subsidising someone else’s bad planning.

Proper job costing tracks:

- Direct costs (the obvious stuff):

- Materials purchased for that specific job

- Labour hours allocated to that site

- Equipment rental or depreciation

- Subcontractor invoices

- Site-specific insurance or permits

- Indirect costs (the stuff people forget):

- Administrative overhead apportioned to the project

- Vehicle expenses for site visits

- Storage or wastage

- Warranty provisions

- That inevitable extra skip you needed

Here’s what gets interesting: most construction firms I’ve worked with think they know their job costs. They’ve got estimates. They’ve even got actuals… sometimes. But ask them about the variance between the two? The reasons why a job came in at 112% of budget? Whether those overruns are a pattern or an anomaly?

Silence.

An accounting company experienced in construction doesn’t just record these numbers. They help you interpret them. They’ll spot that you consistently underestimate electrical work. They’ll notice that projects with Architect X always run over. They’ll identify which types of contracts actually make you money versus which ones just keep people busy.

Cash Flow: The Construction Killer You Can Predict

Look, I’m going to say something controversial: most construction companies that fail don’t fail because of bad work. They fail because of bad timing.

You already know this, probably. But here’s what an accounting company brings to the table (and why it matters for construction growth):

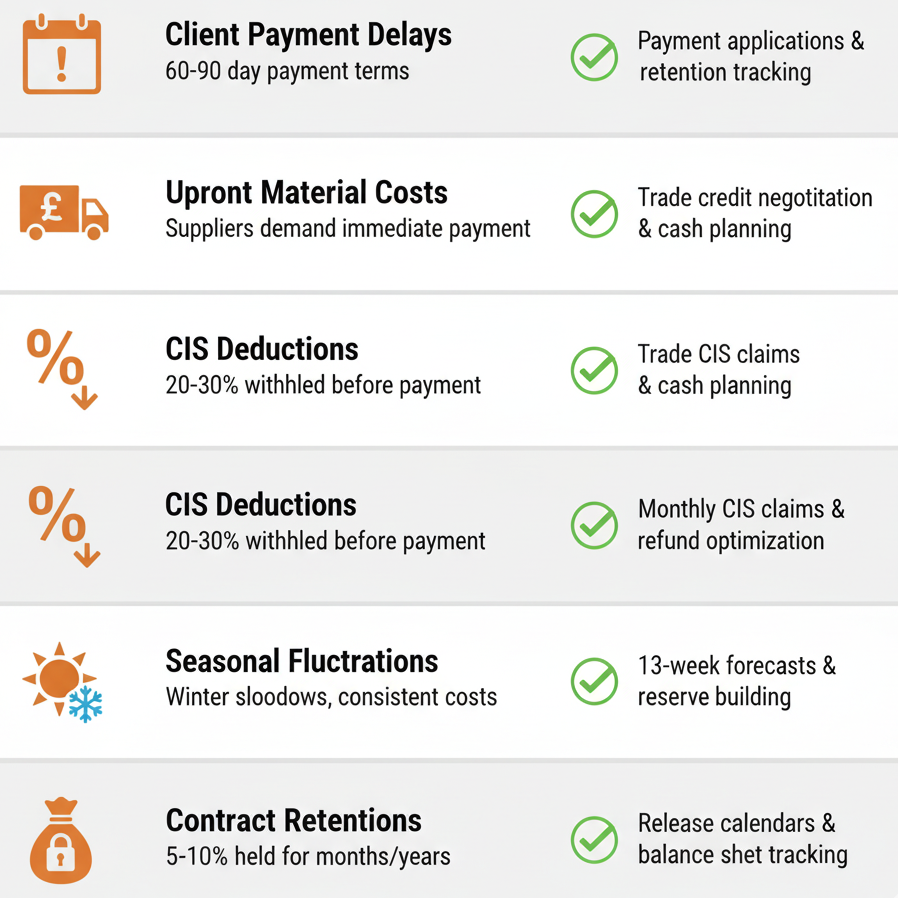

| Cash Flow Challenge | What It Really Means | How Accountants Help |

| Client payment delays | You’re essentially providing free credit to clients—sometimes for 60-90 days | Application for payment templates, retention tracking, debt recovery procedures |

| Upfront material costs | Suppliers want money NOW but clients pay later | Trade credit negotiation, supplier payment scheduling, working capital planning |

| CIS deductions | 20-30% of your invoice disappears before you see it | Monthly CIS claims, refund maximisation, verification management |

| Seasonal fluctuations | Work slows in winter but costs don’t | 13-week cash flow forecasts, reserve planning, seasonal cost management |

| Contract retentions | 5-10% of contract value held for months/years | Retention release calendars, balance sheet tracking (so it doesn’t get “forgotten”) |

The difference between generic accounting and accounting for construction companies is that construction accountants have seen these patterns hundreds of times. They know that a healthy-looking order book in May can still mean a cash crisis in September if nobody’s managing the payment cycles.

Ask Accountant, for instance, specialises in exactly this kind of forward-looking analysis for construction businesses. Not just recording what happened, but projecting what will happen—and more importantly, what you should do about it. Their approach to business accounting services isn’t about compliance theatre; it’s about giving construction firms the visibility to make decisions before problems become crises.

The CIS Maze (And Why It’s Worth Getting Right)

The Construction Industry Scheme. Three words that make grown contractors wince.

But here’s what nobody tells you: CIS isn’t just a tax thing—it’s a cash flow opportunity.

Yes, really. When you’re working as a subcontractor, you’re dealing with those painful 20% or 30% deductions. But handled properly (and this is where accounting for construction companies gets technical), you can:

- Claim overpaid deductions back monthly instead of waiting until year-end

- Reduce your deduction rate from 30% to 20% with proper verification

- Offset deductions against your corporation tax liability immediately

- Structure your business to minimise CIS impact altogether

I’ve seen construction companies sitting on £15,000-£40,000 in CIS refunds they didn’t realise they were entitled to. That’s not small change—that’s the difference between taking on another project or turning it down because you can’t cover the initial costs.

The administrative burden is real, though. Every subcontractor needs verifying. Every payment needs the right documentation. Miss a filing deadline, and you’re looking at penalties. Get your gross payment status revoked, and suddenly your cash flow takes a 20% hit overnight.

This is precisely the kind of thing where specialised help pays for itself. CIS claims and refunds aren’t sexy, but they’re one of the fastest ways to inject cash back into a construction business without borrowing a penny.

Project Accounting: The Spreadsheet That Tells The Truth

Let me show you something. Here’s a simplified version of what project-level accounting should actually look like:

| Project Element | Budget (£) | Actual Cost (£) | Variance | % Complete | Forecast Final Cost |

| Materials | 45,000 | 38,200 | -6,800 | 75% | 50,933 |

| Labour (Direct) | 32,000 | 28,800 | -3,200 | 75% | 38,400 |

| Subcontractors | 18,500 | 22,100 | +3,600 | 80% | 27,625 |

| Plant/Equipment | 8,200 | 7,950 | -250 | 75% | 10,600 |

| Site Overheads | 6,500 | 5,200 | -1,300 | 70% | 7,428 |

| TOTALS | 110,200 | 102,250 | -7,950 | 75% | 134,986 |

See that? At first glance, this project looks great. You’re £7,950 under budget! Pop the champagne!

Except… look at the final column. Based on the rate of spend at 75% completion, this job is actually heading for a £24,786 overrun. The subcontractor costs are running hot, and materials aren’t as under budget as they appear—you’ve just been lucky with timing so far.

This is why accounting for construction companies requires more than bookkeeping. It requires analysis, forecasting, and the uncomfortable conversations that save businesses. A good construction accountant will spot this trend at 40% completion and help you course-correct. A great one will have warned you during the tender stage that this job was priced too tight.

VAT: The Hidden Complexity (That Might Save You Money)

VAT in construction is… special. And by special, I mean “has more exemptions, reverse charges, and edge cases than any reasonable person should have to deal with.”

But getting it right matters. A lot.

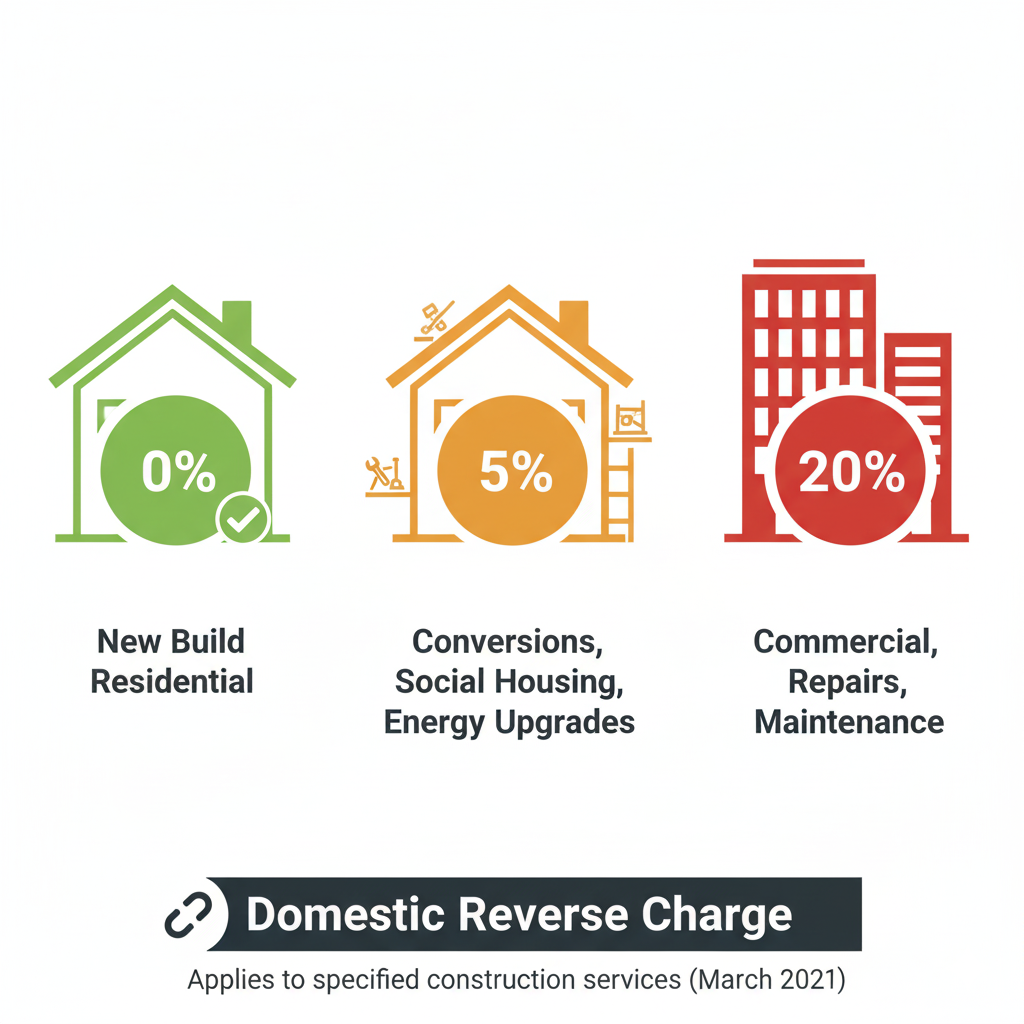

The standard rate is 20%, but depending on what you’re building, it might be:

- 0% (new build residential)

- 5% (residential conversions, social housing, renovations, energy-saving installations)

- 20% (commercial, repairs, maintenance)

- Subject to the Domestic Reverse Charge for specified services

Mess this up, and you’re either:

- Overcharging clients (making you uncompetitive)

- Undercharging HMRC (hello, penalties)

- Claiming input VAT you’re not entitled to (see option 2)

The Construction Domestic Reverse Charge, which came into effect in March 2021, completely changed how VAT works for certain construction services. Now, instead of the subcontractor charging VAT to the contractor, the contractor accounts for both the output and input VAT.

Sounds simple. It isn’t. The practical implications for cash flow, accounting systems, and compliance are significant—and frankly, this is where having proper tax advisory solutions becomes less of a luxury and more of a necessity.

Growth Planning: Because Busy Doesn’t Mean Profitable

Here’s a truth that makes people uncomfortable: you can grow yourself into bankruptcy.

I’ve watched construction companies double their turnover and halve their profit margin in the same year. They took on bigger projects, hired more people, bought more equipment… and discovered too late that their systems, their cash reserves, and their accounting practices couldn’t scale.

Growth in construction requires:

Financial infrastructure that can handle complexity:

- Multi-project tracking that actually works

- Real-time visibility into profitability (not “we’ll know next quarter”)

- Cash flow forecasting that accounts for payment terms, retention, and seasonal patterns

- Automated invoicing and payment collection

- Management accounts that inform decisions, not just record history

Tax efficiency as you scale:

- Corporation tax planning (because surprises are expensive)

- Capital allowances on equipment and vehicles

- R&D tax credits (yes, construction can qualify)

- Succession planning and asset protection

- Structure optimisation (sole trader vs. limited company vs. group structure)

Business intelligence that goes beyond the numbers:

- Which project types deliver the best margins?

- Which clients pay on time vs. which ones don’t?

- What’s your true capacity with current resources?

- Where are the bottlenecks in your operations?

- When should you stop chasing volume and start chasing value?

This is where the conversation shifts from “accounting for construction companies” to genuine business growth planning. Because accounting, done properly, isn’t just historical record-keeping. It’s strategic intelligence.

The firms that work with accountants who understand construction—who’ve been through multiple growth cycles with multiple clients—gain something invaluable: pattern recognition. They’ve seen what works. They’ve seen what fails. They can tell you that expanding into groundworks before you’ve sorted your civil engineering margin probably isn’t wise. Or that taking on commercial contracts when you’re set up for residential will strain your working capital in ways you haven’t anticipated.

The Technology Question (Or: Why Your Accounting Software Matters)

Let’s talk tools for a second, because this genuinely impacts how well accounting for construction companies can function.

Standard accounting packages like Sage or Xero? They’re fine for general business. But construction needs:

- Job costing modules

- Application for payment workflows

- Retention management

- CIS integration

- Equipment asset tracking

- Multi-site visibility

- Subcontractor management

Some firms use specialised construction software (Coins, Jonas, BuildSoft). Others cobble together Xero plus job management tools plus spreadsheets. The best solution depends on your size, complexity, and how your team actually works.

But here’s the critical bit: the software is only as good as the person interpreting the data. I’ve seen companies with £100k/year construction ERP systems producing less useful insights than firms with a £50/month Xero subscription and a switched-on accountant. The rise of cloud accounting has made powerful tools more accessible than ever.

The accountant who understands your business—who knows that the Lancaster Road project is running over because the architect keeps changing specs, not because your site manager is inefficient—adds context that no software can replicate.

When to Get Professional Help (Hint: Earlier Than You Think)

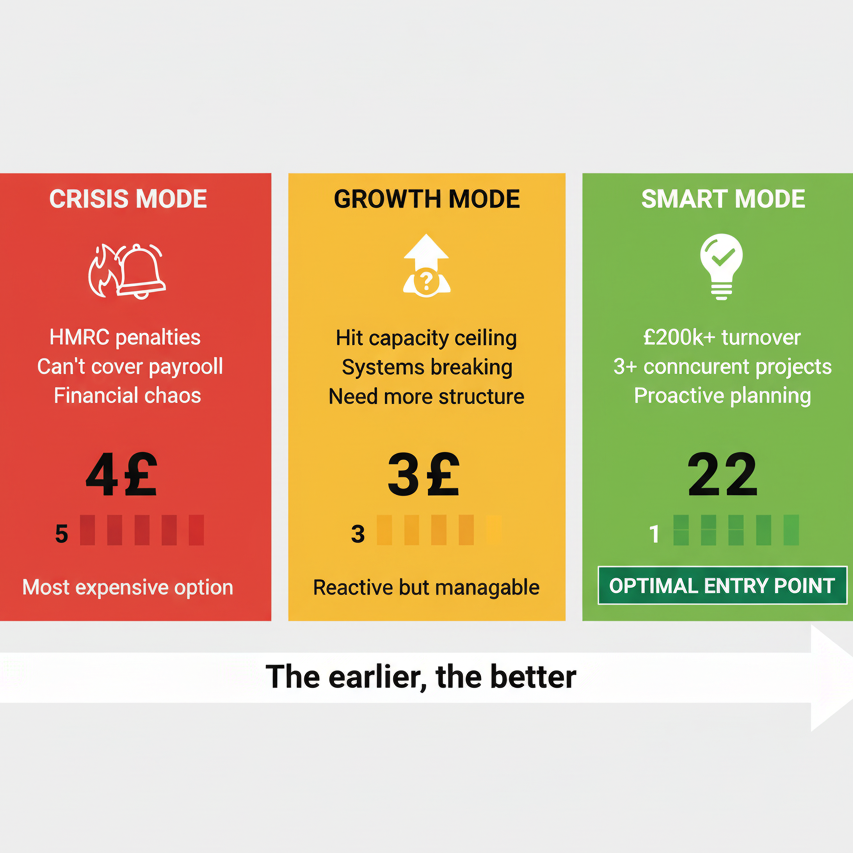

Most construction businesses bring in professional accounting help at one of three points:

- Crisis mode — Something’s gone badly wrong, HMRC is asking questions, or they’ve just realised they can’t cover next week’s payroll

- Growth mode — They’ve hit a ceiling and need systems that can handle more complexity

- Smart mode — They recognised early that their expertise is building things, not managing the financial machinery

Guess which one tends to be most expensive and stressful?

If you’re doing more than £200k in annual turnover, or managing more than three concurrent projects, or employing subcontractors, or dealing with retention money… you’ve already reached the point where professional business accounting services stop being optional and start being essential.

The cost isn’t trivial—good construction accounting runs anywhere from £200-£1,000+ per month depending on complexity. But consider what you’re getting:

- CIS compliance (avoiding penalties)

- Cash flow management (avoiding crises)

- Tax efficiency (reducing liability)

- Business intelligence (improving decisions)

- Time back (stop doing bookkeeping at 11pm)

That last one alone might be worth it. How much is your evening with your family worth? How much revenue could you generate if you spent your administrative time actually running your business instead?

Making It Work: What Good Accounting Partnership Looks Like

Not all accounting firms understand construction. Some will happily take your money and treat you like every other client, completely missing the nuances that matter to your industry.

What should you actually expect from an accounting company that supports construction growth?

- Proactive communication, not reactive compliance:

- They reach out before deadlines, not after

- They flag issues early (“your materials costs on the Riverside job look high”)

- They provide forward-looking advice, not just historical reports

- Construction-specific expertise:

- Understanding of CIS inside and out

- Knowledge of construction VAT rules

- Experience with retention accounting

- Familiarity with different contract types (JCT, NEC, etc.)

- Connection to construction-specific challenges

- Technology that integrates with how you work:

- Cloud-based access (because you’re not in an office all day)

- Mobile-friendly (because site visits happen)

- Integration with your existing tools

- Regular backups (because data loss is catastrophic)

- Business advisory, not just number-crunching:

- Understanding your goals (not just recording your transactions)

- Challenging assumptions (in a helpful way)

- Benchmarking against industry norms

- Connecting you with other resources (bankers, insurance, legal)

Take Ask Accountant, based in London. Their approach to working with construction businesses combines traditional accounting rigour with modern business advice. They handle everything from routine bookkeeping and auto-enrolment compliance through to sophisticated inheritance tax planning for construction business owners looking at succession. More importantly, they offer proactive tax advisory solutions rather than reactive firefighting—the kind of approach that lets construction companies focus on what they do best whilst knowing the financial foundation is solid.

You can reach them at 178 Merton High St, London SW19 1AY, or call +44(0)20 8543 1991. But honestly, whether it’s them or another firm, the key is finding accountants who get construction. Who don’t look confused when you mention interim valuations or practical completion certificates.

The Bigger Picture: From Survival to Strategy

Here’s where we pull it all together.

Accounting for construction companies isn’t fundamentally about compliance or tax returns or even accurate bookkeeping (though those matter). It has to do with being able to make the financial visibility and strategic capability that allows construction businesses to shift out of survival mode and into growth mode.

When you truly know your numbers, when you have a sense of which jobs are profitable, which clients suck out the resources, which growth prospects do and can work, and which businesses only seem good in theory, then you are able to make decisions not out of hope but at least out of strength.

That might mean:

- Turning down work that doesn’t fit your sweet spot

- Investing in equipment because the numbers support it

- Hiring that project manager you’ve been afraid to commit to

- Expanding into a new service line with confidence

- Finally taking that holiday you’ve been postponing for three years

The construction industry is challenging enough without flying blind financially. Weather delays, material price volatility, labour shortages, client demands, regulatory changes—you’re dealing with enough variables outside your control.

Your finances? Those should be the thing you do control. Everything is based on this.

Since at the bottom of the day, blue prints to balance sheets, it is all one project, which is to create a business that stands.

Frequently Asked Questions

How is accounting of construction companies different with the normal business accounting?

Construction accounting is associated with such specific issues as job costing on a project basis, CIS tax reductions, retention funds, protracted payment schedules, and work carried forward values. In contrast to retail or service companies that can operate with very simple transactions, construction companies must be able to keep track of costs and revenues on a project level, and they have to deal with a complicated cash flow schedule.

How often should I review my construction accounts?

Monthly at minimum for basic financial health. But for active projects, you need weekly or even daily visibility into job costs and cash position. Many construction businesses fail not because they’re unprofitable overall, but because they didn’t spot a problem project early enough.

Can I handle construction accounting myself with software?

You can, but it’s rarely the best use of a construction business owner’s time. It is a matter of whether your time is better used doing site management and working on expanding the business or going through invoices at midnight. The construction companies most often hit a kind of limit (typically about 200-300k turnover) at which it tends to be more economical in terms of professional assistance than the home engineering methods.

What is the largest accounting error that construction companies commit?

Confusing turnover with profit, and cash in the bank with actual financial health. A full order book means nothing if your jobs aren’t priced properly or your clients don’t pay on time. Close second: not tracking project costs accurately enough to know which types of work actually make money.

Seo Backlinks

October 18, 2025You made some respectable points there. I looked on the web for the issue and found most individuals will go along with together with your website.

check backlinks for website

October 21, 2025I as well conceive thus, perfectly pent post! .