I’ll be honest—there’s something slightly absurd about the way modern business owners treat payroll and tax management. We’ll happily delegate our marketing to specialists, outsource our IT to experts, even hire someone to manage our social media presence. But when it comes to the financial backbone of our business? Suddenly we’re all convinced we can muddle through with a few YouTube tutorials and a prayer.

Here’s the thing, though: accounting payroll business and tax isn’t just complicated—it’s actively trying to catch you out. HMRC doesn’t care that you were busy growing your business when that deadline passed. Your employees don’t care that calculating pension contributions made your brain hurt. And that fine you just received? It definitely doesn’t care about your good intentions.

Ask Accountant has been watching businesses in London make the same mistakes for years now, and the pattern’s pretty clear. The companies thriving aren’t necessarily the ones with the best products or the flashiest websites. They’re the ones who figured out early on that trying to be their own accountant, HR department, and tax specialist simultaneously is a recipe for expensive chaos.

The Real Cost of DIY Financial Management (Spoiler: It’s Not What You Think)

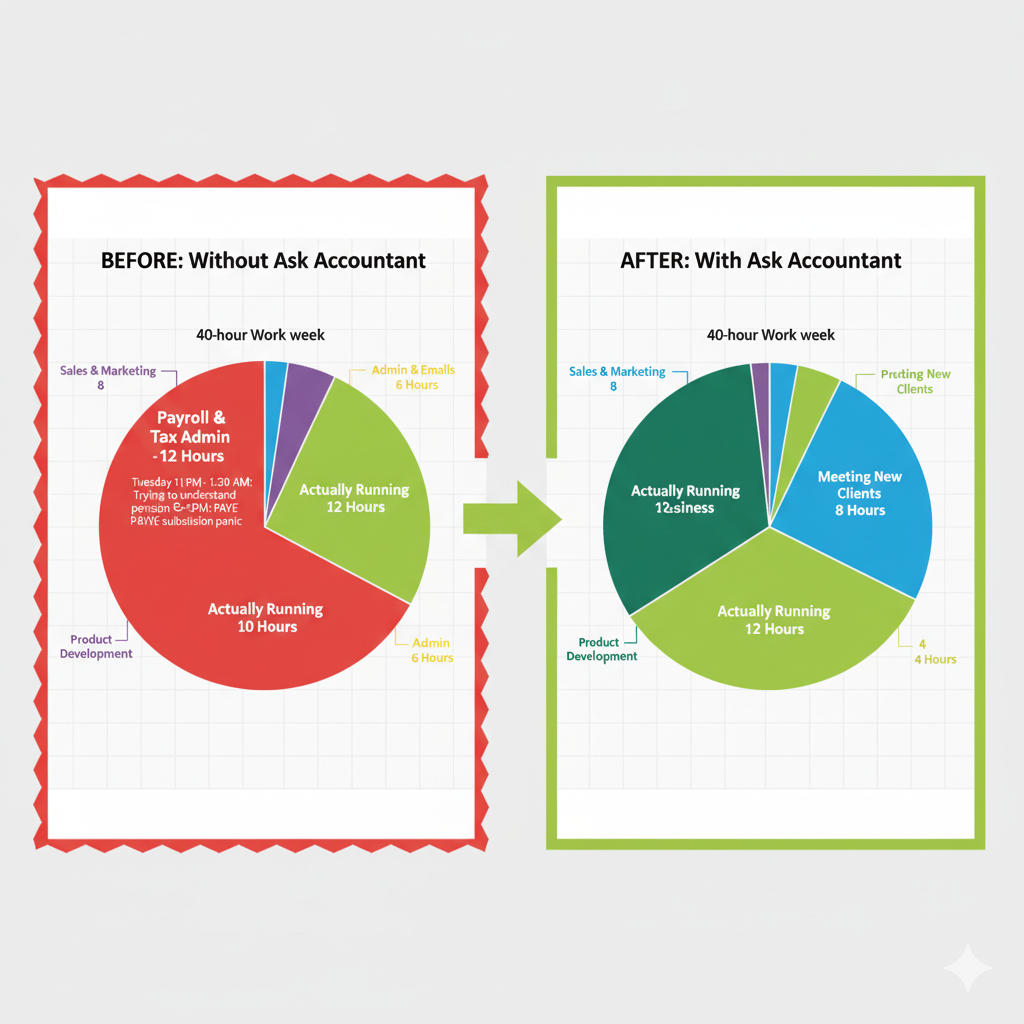

Everyone focuses on the obvious expenses—accountant fees, service charges, professional subscriptions. Fair enough. But what about the invoice you forgot to send because you were wrestling with payroll software? Or the tax relief you didn’t even know existed? What about the three hours you spent last Tuesday trying to figure out auto-enrolment contributions when you could have been, I don’t know, running your actual business?

Time has this annoying habit of being finite. Every hour you spend deciphering PAYE regulations is an hour you’re not:

- Meeting potential clients

- Developing new products

- Training your team

- Actually making money

And let’s not even start on the stress factor. I’ve met business owners who can pitch their services brilliantly, negotiate complex deals, manage difficult clients—but mention pension scheme administration and they visibly deflate.

The maths is grimmer than you’d expect. A mid-level employee in London costs roughly £35-50 per hour when you factor in overheads. If you’re spending 10 hours a month on accounting payroll business and tax admin (and most people spend more), that’s £350-500 of your productive time vanished. Every month. That’s £4,200-6,000 annually, not counting the mistakes, missed opportunities, or the sheer mental exhaustion.

What Actually Happens When You Partner with the Right Firm

Right, so you’ve decided to stop pretending you enjoy processing payslips at midnight. What changes?

First off: your Friday afternoons come back. Revolutionary concept, I know. But seriously, when someone else handles your payroll, you’re not spending the end of every week triple-checking calculations and hoping the bank transfer goes through properly. Ask Accountant’s clients often mention this first—the sudden absence of that weekly dread.

Then there’s the proactive stuff. A decent chartered accountant firm doesn’t just process numbers; they actually think about your business. They spot patterns. “Hey, you’ve taken on three new employees this quarter—have you considered how that affects your Employment Allowance?” or “Your CIS claims and refunds could be optimised if we restructured this bit here.”

See, that’s the difference between doing accounting payroll business and tax yourself versus having professionals handle it. You know your business intimately, obviously. But you might not know that changing your payment structure slightly could save you thousands in tax. Or that you’re eligible for reliefs you’ve never heard of. Or that your current bookkeeping method is creating completely unnecessary complications.

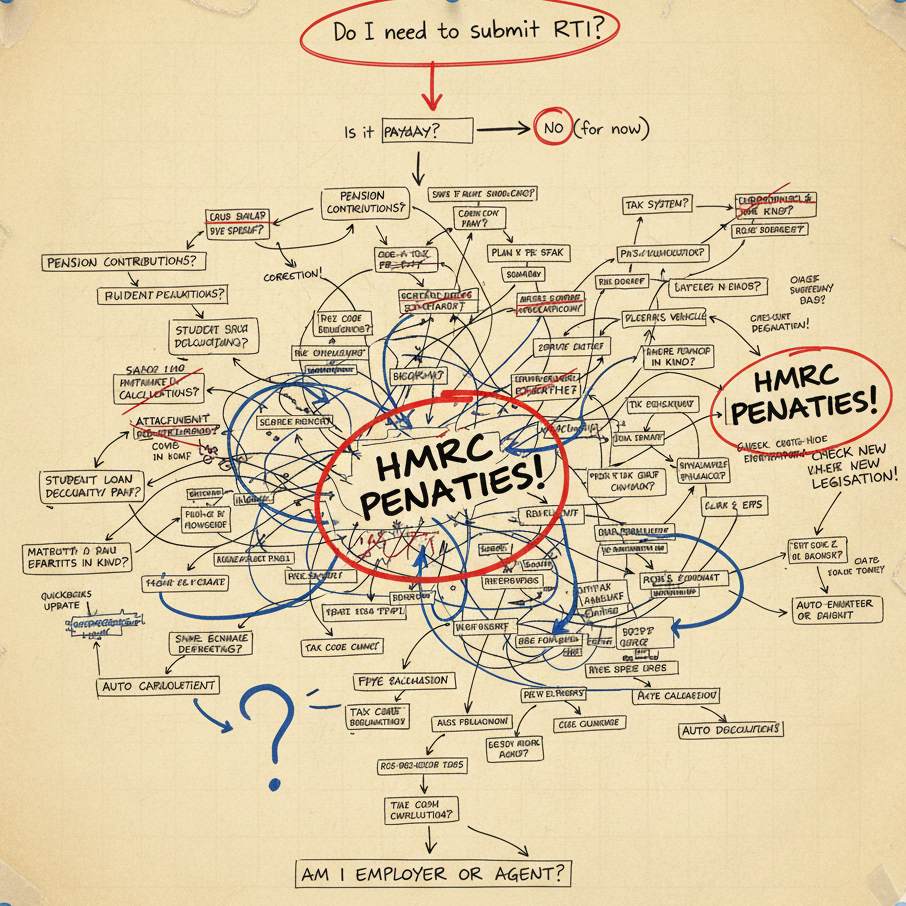

The Compliance Safety Net (Because HMRC Loves Surprises)

| Common Payroll Mistake | Potential Fine | Likelihood (DIY) |

| Late PAYE payment | £100-£400+ per occurrence | Moderate-High |

| Incorrect RTI submission | £100-£400 monthly | High |

| Auto-enrolment non-compliance | £400-£10,000 | Very High |

| Missing tax deadline | 5-100% of tax owed | Moderate |

| Incorrect expense claims | Varies wildly (sometimes penalties + back-taxes) | Moderate |

That table’s deliberately simplified, by the way—the actual penalty structure is even more Byzantine. But notice anything? Every single one of those mistakes happens constantly when businesses self-manage. With professional support? They basically don’t happen. Because that’s literally what you’re paying for: someone whose entire job is knowing that the RTI deadline is different from the payment deadline, and that auto-enrolment regulations changed again last month.

The Services That Actually Matter (And Some That Might Surprise You)

When you’re evaluating chartered accountant firms, the service list can feel overwhelming. Let me break down what actually moves the needle:

Business accounting services sounds vague, right? What it really means is having someone who understands the full picture. Not just “here’s your profit figure” but “here’s your profit, here’s what’s driving it, here’s where you’re losing money without realising, and here’s what we should do about it.”

Tax advisory solutions—this is where most businesses leave serious money on the table. Not sexy, I’ll grant you. But the difference between basic tax compliance and proactive tax advisory solutions can literally be tens of thousands of pounds annually. We’re talking proper business growth planning that factors in tax efficiency from the ground up.

Then there’s the specialist stuff. CIS claims and refunds if you’re in construction (an absolute maze, honestly). Inheritance tax planning if you’re thinking about succession. Business advice that’s actually tactical rather than generic motivational platitudes.

What matters most? Honestly, it depends on your business stage. A startup needs different support than an established company considering expansion. This is why Ask Accountant’s approach focuses on understanding where you are and where you’re trying to go, rather than selling everyone the same package.

Small Business Accounting Services: The Goldilocks Problem

Too much accounting support and you’re paying for services you don’t need. Too little and you’re back to DIY chaos. Small business accounting services need to hit that “just right” zone.

Here’s what that actually looks like in practice:

- Bookkeeping that makes sense. Not bookkeeping that follows some theoretical perfect system, but bookkeeping that works for how your business actually operates. If you’re receipt-phobic, the system needs to account for that (pun absolutely intended). If you’re drowning in invoices, different approach entirely.

- Some businesses need weekly check-ins. Others are fine with monthly reviews. The firms that get this right ask about your rhythm rather than imposing theirs.

- Real-time access to your numbers. Remember when getting financial information meant waiting for your accountant to “run the reports”? Yeah, that’s over. Modern small business accounting services should give you dashboard access to your key numbers whenever you want them. Not because you’ll check constantly (you won’t), but because occasionally you need to know where you stand right now.

The Technology Question (AKA: Why Your Accountant Should Be Slightly Nerdy)

Let’s talk software for a moment, because it matters more than people realise.

Your accounting payroll business and tax management runs on technology now. All of it. Cloud accounting platforms, payroll systems, Making Tax Digital compliance, automatic bank feeds—it’s unavoidable. The question isn’t whether to use technology, it’s whether you understand it well enough to use it properly.

This is where professional support becomes genuinely valuable beyond just “doing the numbers.” A good firm doesn’t just process your information; they help you set up systems that work for you rather than against you.

Take auto-enrolment pension schemes. Theoretically straightforward: you enrol eligible staff, calculate contributions, submit information. In practice? Different software platforms handle it differently. Some integrate beautifully with payroll. Others require manual intervention every single month. Getting this wrong doesn’t just waste time—it can trigger compliance issues.

When Software Isn’t Enough

Here’s something nobody tells you: automation is brilliant until it isn’t. Software can process standard payroll flawlessly. It falls over completely when:

- Someone takes shared parental leave

- You have employees in multiple countries

- There’s a complicated director’s loan situation

- Staff have multiple roles with different pay structures

- Someone’s on long-term sick leave with statutory pay complications

These situations need human expertise. Not just any human—someone who’s seen the scenario before and knows the correct treatment. This is where the “chartered accountant” part of “chartered accountant firm” earns its keep.

What to Actually Ask When You’re Choosing a Firm

Right, practical stuff. You’re convinced you need professional support. How do you avoid picking badly?

- Don’t ask: “What are your fees?” (At least not first.)

- Do ask: “How do you handle clients like me?” Specificity matters here. If you’re a limited company with three employees, you want to hear about their experience with similar businesses. If you’re a sole trader considering incorporation, different conversation entirely.

- Don’t ask: “Do you offer bookkeeping?” (Obviously they do.)

- Do ask: “How does your bookkeeping service integrate with your tax advisory solutions?” Because integrated service beats disconnected specialists every time. Your bookkeeper spotting tax planning opportunities in real-time? That’s valuable. Your bookkeeper and tax adviser operating in silos? Not so much.

- Ask about response times. Not “How quickly do you respond?” but “What happens if I have an urgent payroll question at 4 PM on a Friday?” The answer tells you a lot about whether they treat you as a person or a file number.

| What They Say | What It Might Mean |

| “We offer comprehensive services” | Could mean anything—ask for specifics |

| “We specialise in small businesses” | Good sign if you’re small, but verify their definition of “small” |

| “We use [specific software]” | Great—but ask if they’re flexible if you prefer something else |

| “Fixed monthly fees” | Predictable costs, but understand what’s included and what costs extra |

| “We’re proactive, not reactive” | Everyone says this. Ask for examples of what that means practically |

| “Personal service” | Will you have a dedicated contact or whoever’s available? |

The London Factor (Because Location Still Matters)

Operating in London creates specific challenges around accounting payroll business and tax. The living wage is higher. Employee expectations differ. The cost of mistakes is steeper because everything’s more expensive, including putting problems right.

Ask Accountant operates from 178 Merton High St, London SW19 1AY, which matters for more than geographical convenience. It means they understand London employment costs, London business rates, London-specific compliance issues. They’ve dealt with the quirks of HMRC’s London offices. They know which local regulations affect your accounting payroll business and tax obligations.

This isn’t parochialism—it’s practical. A firm that primarily works with businesses in, say, rural Scotland might be technically excellent but unfamiliar with considerations specific to London operations. Commercial rent calculations differ. Employment patterns differ. Even the bloody business rates are calculated differently in some cases.

Making the Switch (It’s Less Painful Than You Think)

So you’re convinced. Now what?

The transition is the bit everyone worries about. Understandably—you’re handing over something fairly crucial to outsiders. What if information goes missing? What if there’s a gap in coverage? What if they don’t understand your special circumstances?

Professional firms have done this hundreds of times. They have processes. Here’s roughly what happens:

- First, they’ll want access to your current systems—whatever disaster you’ve created. Don’t be embarrassed. Accountants have seen worse. Trust me, whatever mess you think you’ve made, they’ve seen messier.

- They’ll audit where you are currently. Not in a judgmental way (mostly), but to understand what needs fixing immediately versus what can wait. Maybe your payroll’s actually fine but your tax position needs urgent attention. Or vice versa.

- Then there’s a handover period. Usually a month or two where they’re handling things but checking more frequently than they will eventually. This overlap is deliberate—it catches any quirks in your business that didn’t come up in initial discussions.

The Ongoing Relationship (Not Just a Transaction)

Here’s what separates adequate accounting support from genuinely useful business growth planning partnerships:

- They remember your context. You’re not explaining your business structure every conversation. They know your goals, your concerns, your industry challenges. When they make suggestions, they’re relevant rather than generic.

- They anticipate issues. You don’t just hear from them when something’s wrong. They’re flagging potential problems before they become actual problems. “You’re approaching the VAT threshold—let’s discuss options” type conversations.

- They connect the dots between different services. Your bookkeeping informs your tax planning informs your business advice. It’s holistic rather than compartmentalised. This is where having integrated business accounting services rather than separate specialists really pays off.

Consider this scenario: Your bookkeeper notices you’re consistently profitable in quarters one and three but barely breaking even in quarters two and four. They mention it to whoever handles your tax advisory solutions. Together, they suggest restructuring how you take income to smooth tax payments and improve cashflow. That’s collaboration that saves you actual money.

When Things Go Wrong (Because They Sometimes Do)

Let’s be realistic. Even with professional support, issues arise. HMRC queries appear. Pension schemes have glitches. Someone’s payslip gets miscalculated.

The difference is: you’re not handling it alone at 11 PM while googling frantically.

A decent firm has:

- Insurance (professional indemnity—not exciting but important if they make a costly mistake)

- Experience with HMRC (they know how to navigate disputes and queries efficiently)

- Protocols for fixing problems (because reactive panic helps nobody)

I’ve seen businesses liquidated by HMRC investigations that could have been resolved in weeks with proper professional support. I’ve also seen minor payroll errors snowball into major compliance issues because nobody caught them early.

Professional support isn’t about preventing every possible problem (impossible). It’s about having someone who knows how to fix problems efficiently when they inevitably appear.

The Business Advice You Didn’t Know You Needed

Right, confession time: most people partner with accountancy firms for the obvious stuff—payroll, tax returns, compliance. The real value often comes from the less obvious stuff.

- Strategic business advice that’s grounded in financial reality rather than motivational fluff. “Here’s what the numbers say about your business direction” is infinitely more useful than “have you considered diversifying?”

- Growth planning that accounts for tax implications. Structuring advice before you make major decisions, not after. Conversations about whether hiring another employee or outsourcing makes more financial sense. Whether incorporating would benefit you. How to handle a sudden influx of revenue without triggering tax issues.

This is the stuff that doesn’t appear on service lists but happens in regular check-ins. It’s why the relationship matters more than the transaction list.

Practical Warning: The Race to the Bottom

Here’s something important: the cheapest option is rarely the best option in accounting payroll business and tax management.

I’m not saying overpay. I’m saying that firms offering suspiciously low rates are cutting corners somewhere. Maybe they’re overloaded and can’t give proper attention to each client. Maybe they’re inexperienced and pricing aggressively to build a client base. Maybe they’re fine with basic compliance but hopeless at strategic advice.

Value isn’t the same as cost. An accountant charging £200 monthly who saves you £5,000 in tax annually is cheaper than an accountant charging £100 monthly who doesn’t. Simple maths, but people forget it constantly when comparing prices.

Look for transparent pricing. Fixed fees are brilliant for budgeting, but make sure you understand what’s included. “We charge £150 monthly” sounds great until you discover that’s just bookkeeping and everything else costs extra.

Ask Accountant’s approach involves actual conversation about needs before pricing, which should be standard but often isn’t. If a firm quotes you instantly without understanding your situation, they’re guessing. And guessing rarely ends well.

The Flexibility Question

Your business changes. Your accounting support should change with it.

Maybe you start as a sole trader needing basic bookkeeping. Then you incorporate. Then you hire staff. Then you’re looking at acquisition opportunities. Each stage needs different support.

Good firms scale with you. They’re not trying to sell startup services to established companies or vice versa. They’re adjusting their support to match where you actually are.

This flexibility extends to communication too. Some business owners want detailed monthly meetings. Others prefer quarterly check-ins plus access when needed. Neither’s wrong—it’s about matching service delivery to how you actually work.

The “Why Now?” Question

If you’re still doing your own accounting payroll business and tax management and it’s working… well, when exactly does “working” become “barely managing”?

The honest answer is: most businesses wait too long to get professional support. They wait until there’s a crisis—missed deadline, HMRC investigation, massive fine, or just complete overwhelm. Then they’re implementing solutions in panic mode rather than making considered choices.

The best time to sort your financial management is before you desperately need to. Controversial opinion, I know.

Consider what “working” actually means. Are you:

- Spending reasonable time on admin? (Less than 5 hours monthly?)

- Confident you’re not missing tax reliefs or optimisations?

- Actually certain your payroll calculations are correct?

- Comfortable with your compliance position?

- Able to make business decisions based on current financial data?

If you hesitated on any of those, “working” might be overselling it slightly.

Making Contact (The Bit Where I’m Supposed to Sell You)

Look, here’s the reality: you’re either convinced this makes sense for your business or you’re not.

If you are, the next step is pretty straightforward. Have a conversation with someone who understands accounting payroll business and tax management professionally. Not a sales pitch—an actual discussion about your specific situation.

Ask Accountant offers exactly that. No stress, no commitment, simply a realistic discussion as to whether professional support would help your specific business. They are available at +44(0)20 8543 1991 or an in-person visit to their office in London.

They do all of the items listed here; inheritance tax, CIS claims and refunds, comprehensive tax advisory, business accounting services, ongoing bookkeeping, auto-enrolment compliance, focused small business accounting, proactive tax advisory, business growth planning and general business advisory work.

But honestly, the services list matters less than whether they understand your business and can actually help. That only comes from conversation.

The Bottom Line (Literally)

Running a business is complicated enough without trying to be your own accountant, payroll specialist, and tax expert simultaneously.

Professional support costs money. But so does your time. And so do mistakes. And missed opportunities. And stress-induced insomnia.

The calculation isn’t “can I afford an accountant?” It’s “can I afford not to have one?”

For most businesses past the earliest startup phase, the answer’s pretty clear. The ones thriving aren’t doing so because they’re brilliant at accounting payroll business and tax administration. They’re thriving because they focused on what they’re actually good at and delegated the rest to people who are good at that.

Revolutionary concept: do what you do well. Let others do what they do well. Turns out this specialisation thing might actually work.

Frequently Asked Questions

How much does partnering with a chartered accountant firm typically cost?

Depends entirely on complexity. Basic bookkeeping and payroll for a small business might run £150-300 monthly. Add comprehensive tax advisory and strategic business advice and you’re looking at £300-600+ monthly. Fixed fees offer predictability; hourly rates offer flexibility. The key is understanding exactly what’s included before committing.

When should a business consider getting professional accounting help?

Honestly? Earlier than most people think. If you’re spending more than a few hours monthly on financial admin, you’re probably past the point where DIY makes sense. Definitely get help before hiring your first employee (payroll’s complicated), before hitting VAT threshold, or when considering major business changes like incorporation.

What’s the difference between a bookkeeper and a chartered accountant?

Bookkeepers handle day-to-day financial recording—transactions, invoices, reconciliations. Chartered accountants are qualified professionals who can provide strategic tax advice, audit financial statements, and offer comprehensive business advisory services. Many firms (like Ask Accountant) offer both, which is ideal because your bookkeeping then informs your strategic planning.

Can I switch accountants mid-year?

Yes, absolutely. There’s no requirement to wait until year-end. Professional firms handle transitions regularly and have processes for taking over mid-period. You might have some overlap costs during transition, but you’re not locked in with an accountant who isn’t meeting your needs.

What information do I need to provide to get started?

Typically: previous tax returns, recent financial statements or bank statements, details of any current employees (for payroll), information about your business structure, and access to whatever bookkeeping system you currently use (even if it’s chaotic). Don’t stress about perfect organisation—fixing organisational chaos is literally part of what you’re hiring them to do.