5 Stages of a Tax Investigation and What to Do at Each One

There’s a particular kind of dread that comes with a letter from HMRC. You know the one — stiff envelope, official font, the word “investigation” sitting there on the page like a small explosion. Most people’s first instinct is to either phone someone in a panic or shove the letter in a drawer and pretend […]

Help Filling In Inheritance Tax Forms 2026

Nobody tells you about the forms. You lose someone. There’s grief, there’s funeral arrangements, there’s the slow and slightly surreal business of sorting through a life. And then — usually when you’re least equipped for it — HMRC hands you a document that looks like it was designed by a committee who genuinely enjoy making […]

IHT 400 Notes Explained: What Each Section Actually Means

Nobody sits down on a Tuesday morning and thinks, “Right, today I fancy working through 24 pages of HMRC inheritance tax guidance.” And yet, here you are. Probably because someone you cared about has died, and now there’s a form between you and settling their estate properly. The IHT 400 Notes — officially titled “How […]

how long does hmrc take to process inheritance tax?

There’s a particular kind of stress that comes with being an executor. You’re grieving, you’re managing paperwork that could fill a filing cabinet, and somewhere in the middle of it all, HMRC is sitting on a form you posted weeks ago — and you have absolutely no idea what’s happening. If you’ve found yourself refreshing […]

Can You Submit IHT400 Online in 2026?

There’s a particular type of grief-tinged admin that nobody prepares you for. You’ve just lost someone — a parent, a spouse, a sibling — and within weeks you’re expected to navigate one of HMRC’s most demanding tax forms. The IHT400. Forty pages of questions about assets, debts, gifts made seven years ago, jointly owned property, […]

Complete IHT400 Guidance for UK Inheritance Tax Returns

There’s a particular dread that descends when someone hands you the IHT400 guidance notes for the first time. You’re grieving. You’re exhausted. And now HMRC wants a 16-page inheritance tax return, plus potentially a dozen supplementary schedules, all within a strict deadline. Welcome to being an executor. The IHT400 is the main form executors use […]

Do I Need to Complete IHT400 Before Applying for Probate?

Nobody warns you about the paperwork. You hear about the grief, the funeral arrangements, and the difficult family conversations. But the administrative maze that follows death? That blindsides most people completely. One of the most common questions professionals encounter when handling estates is: do I need to complete IHT400 before applying for probate? The answer […]

How to Choose the Right Tax Specialist Near Me 2026

Most people only start thinking seriously about finding a tax specialist near me when something goes wrong. An unexpected HMRC letter. A looming self-assessment deadline. A business growing faster than anyone anticipated. By then, the pressure is already on — which is precisely the worst time to be making important decisions about who handles your […]

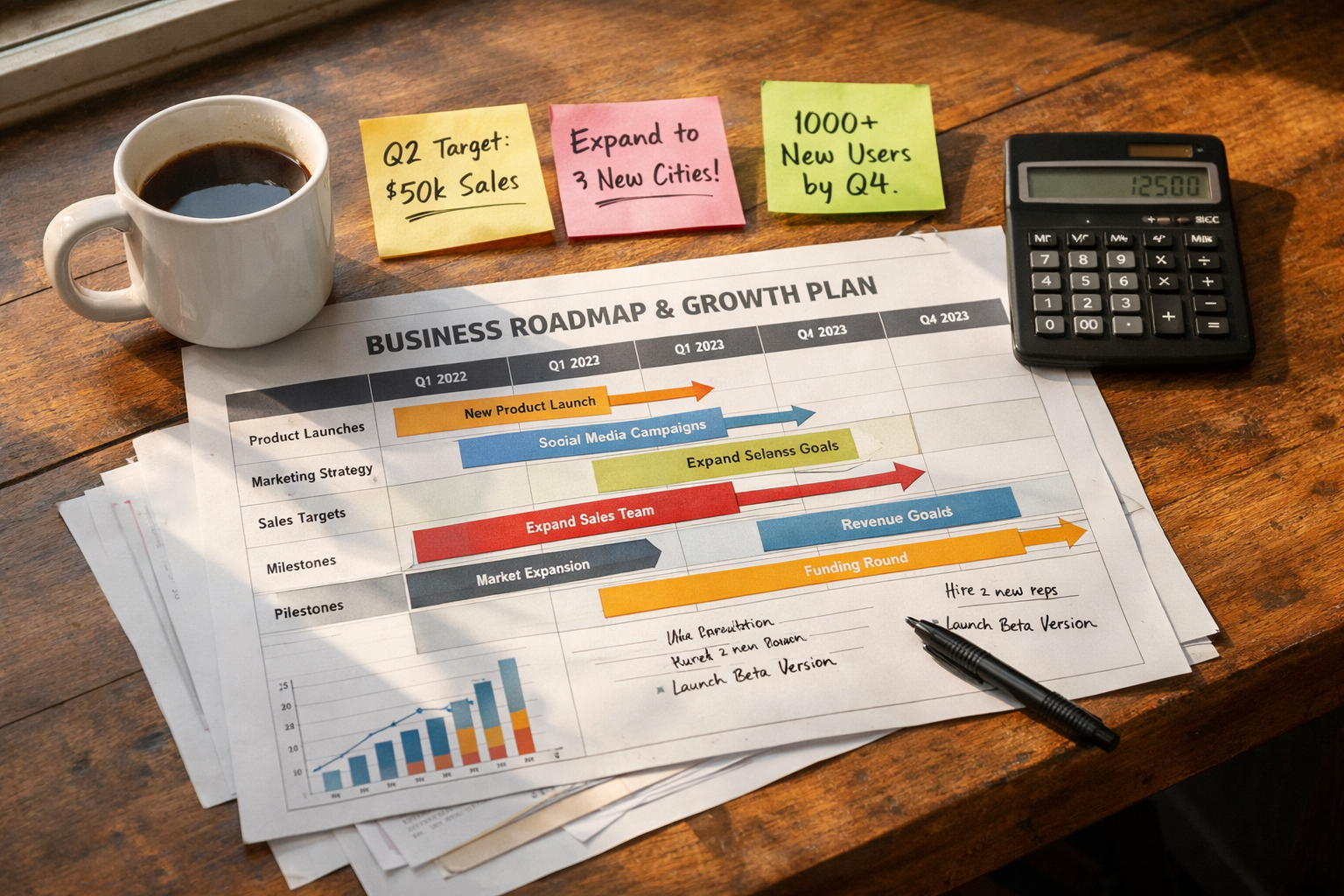

Business Growth Planning Strategies That Work

There’s a version of business growth planning that looks great in a presentation slide and does absolutely nothing in the real world. You’ve seen it — the five-year plan with optimistic revenue curves and aspirational market share figures, printed nicely, filed somewhere, and never looked at again until someone finds it during an office clear-out […]