Right. Let’s get this out of the way: if you’re a contractor in construction and you think CIS compliance is just about ticking boxes once a month, you’re in for a rude awakening. And probably a penalty notice. Most contractors don’t realise they need specialist CIS accountants until something goes catastrophically wrong.

I’ve watched perfectly competent builders—people who can manage multi-million-pound projects without breaking a sweat—completely fall apart when it comes to the Construction Industry Scheme. It’s bizarre, really. You’d think that someone capable of coordinating twenty subcontractors on a complex site would be able to file a monthly return on time. But here’s the thing: construction management and tax compliance require entirely different mental muscles, and HMRC doesn’t care how brilliant you are at one if you’re cocking up the other.

The Construction Industry Scheme isn’t new. It’s been around in various forms for decades, originally designed to stop tax evasion in an industry where cash payments and disappearing subcontractors were, shall we say, not uncommon. What is new is how aggressively HMRC is enforcing it in 2025, and how much the penalties have increased for those who get it wrong.

Why CIS Accountants Are Suddenly Essential (Not Optional)

In the past year alone, HMRC has rolled out targeted audits, real-time data cross-checking, and what they’re calling “one-to-many” letter campaigns. Translation? They’re sending thousands of letters to contractors whose records look dodgy, giving them 45 days to sort themselves out before a proper investigation begins.

The stakes have changed dramatically. Contractors are now facing:

- Loss of gross payment status mid-year (not just at annual reviews)

- Personal liability for directors in cases of fraudulent supply chain activity

- Penalties up to 30% of evaded tax amounts

- Automatic five-year bans on gross payment status for businesses connected to fraud

And this is where CIS accountants become less of a luxury and more of a necessity. Because the margins for error? They’re shrinking faster than your profit margin when you underquote a job. Professional CIS accountants understand these evolving enforcement tactics and build defences before HMRC comes knocking.

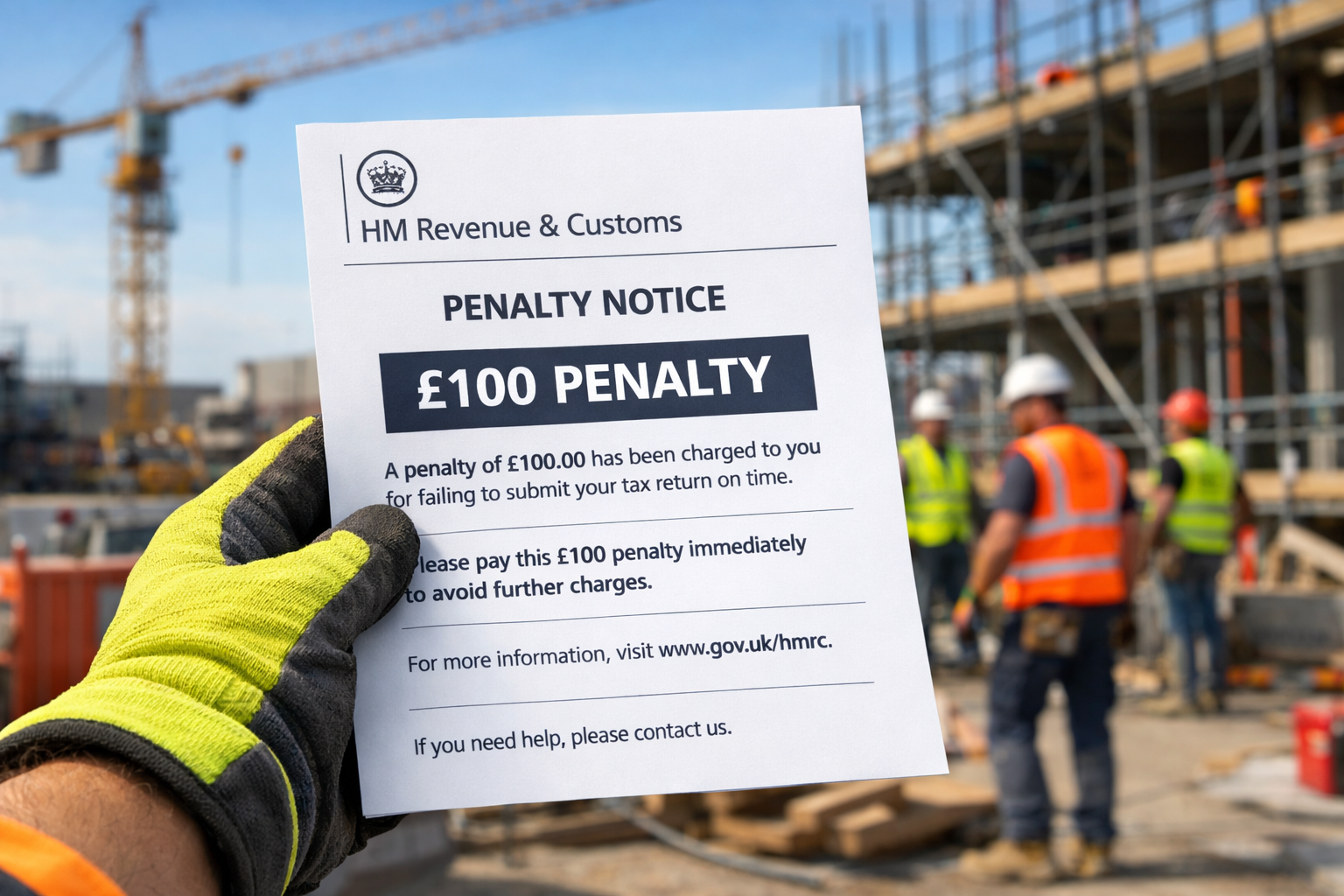

The Monthly Return Disaster: How a Single Day Costs £100

Let me paint you a picture. It’s the 20th of the month. You’ve been on site since six, there’s a problem with the scaffold delivery, and one of your best subcontractors has just called in sick. The last thing on your mind is the CIS monthly return that was due yesterday—the 19th.

Congratulations. You’ve just earned yourself a £100 penalty.

“But I forgot!” you might say. HMRC’s response? “Not our problem.”

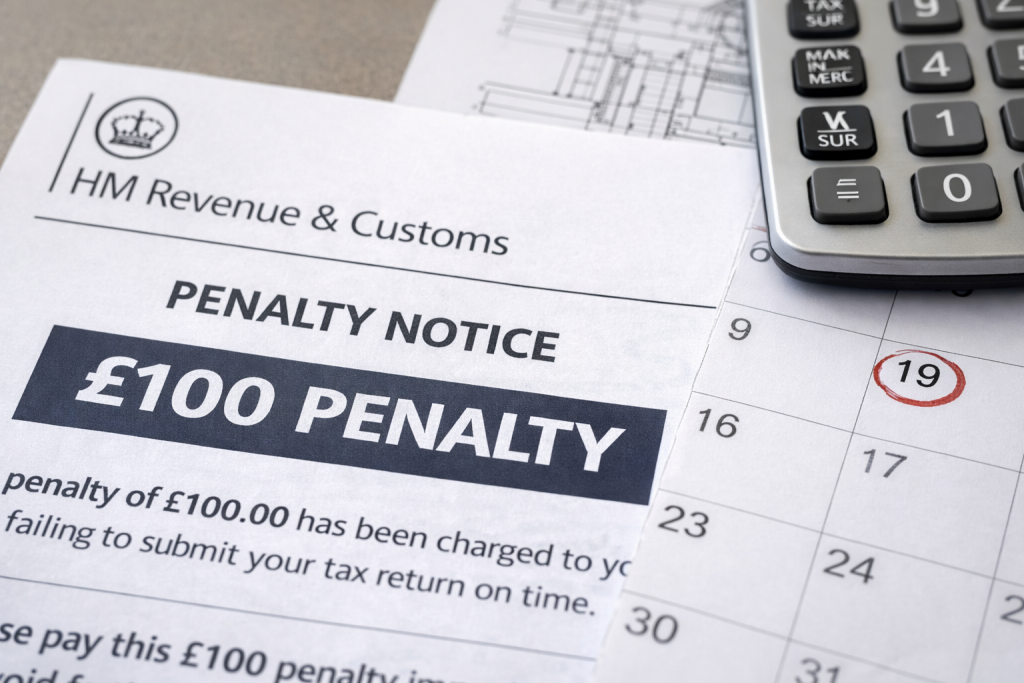

The deadline for filing CIS returns is brutally simple: the 19th of every month following the tax month (which runs from the 6th of one month to the 5th of the next). Miss it by even one day, and the penalties start stacking up like this:

| How Late | Penalty Amount | Cumulative Total |

|---|---|---|

| 1 day late | £100 | £100 |

| 2 months late | Additional £200 | £300 |

| 6 months late | £300 or 5% of deductions (whichever is higher) | £600+ |

| 12 months late | Another £300 or 5% | £900+ |

| Beyond 12 months | Up to £3,000 or 100% of CIS deductions | Potentially thousands |

Here’s what makes this particularly nasty: even if you didn’t pay any subcontractors that month, HMRC doesn’t automatically know that. They’ll still issue the penalty unless you proactively file a nil return or notify them. This catches out so many contractors it’s almost comical. Almost.

A proper CIS accountant sets up systems that make missing deadlines virtually impossible. Automated reminders, pre-populated data, verification that happens automatically rather than at the last minute. It’s not rocket science, but it requires someone who actually understands the scheme and isn’t simultaneously trying to manage a building site. The best CIS accountants treat your compliance like you treat your site management—with systems, processes, and fail-safes.

The Subcontractor Verification Trap (Or: How to Accidentally Become Liable for Someone Else’s Tax)

This one’s my favourite mistake to watch contractors make. Well, “favourite” in the sense that it’s utterly predictable and entirely avoidable, yet happens constantly.

Before you pay a subcontractor—before, not after, not “when you get around to it”—you must verify their status with HMRC. This tells you whether to deduct at 0% (gross payment status), 20% (registered), or 30% (unregistered). Get this wrong, and guess who HMRC comes after for the missing tax?

Not the subcontractor. You.

The contractor is legally liable for CIS tax that should have been deducted but wasn’t. If you pay someone £10,000 and later discover they should have had £2,000 deducted at 20%, that £2,000 comes out of your pocket—not theirs. And if HMRC decides you didn’t exercise “reasonable care” in verifying their status, they can go back six years and charge you penalties and interest on top.

Think about that for a second. Six years of potential liability, plus interest, plus penalties. Over verification that takes about three minutes online.

Common verification cock-ups include:

- Verifying too late (after payment has already been made)

- Not re-verifying when a subcontractor’s status changes

- Assuming someone has gross payment status because they had it last year

- Trusting what the subcontractor tells you instead of checking with HMRC

- Failing to keep records proving verification was done

Since April 2024, VAT compliance has been added to the tests for maintaining gross payment status. This means subcontractors who mess up their VAT can lose their gross status—and if you don’t catch that change and update your records, you’re the one who ends up paying.

CIS accountants who know what they’re doing build robust verification processes into your workflow. At Ask Accountant, we’ve seen contractors save tens of thousands simply by having proper verification systems in place before problems arise.

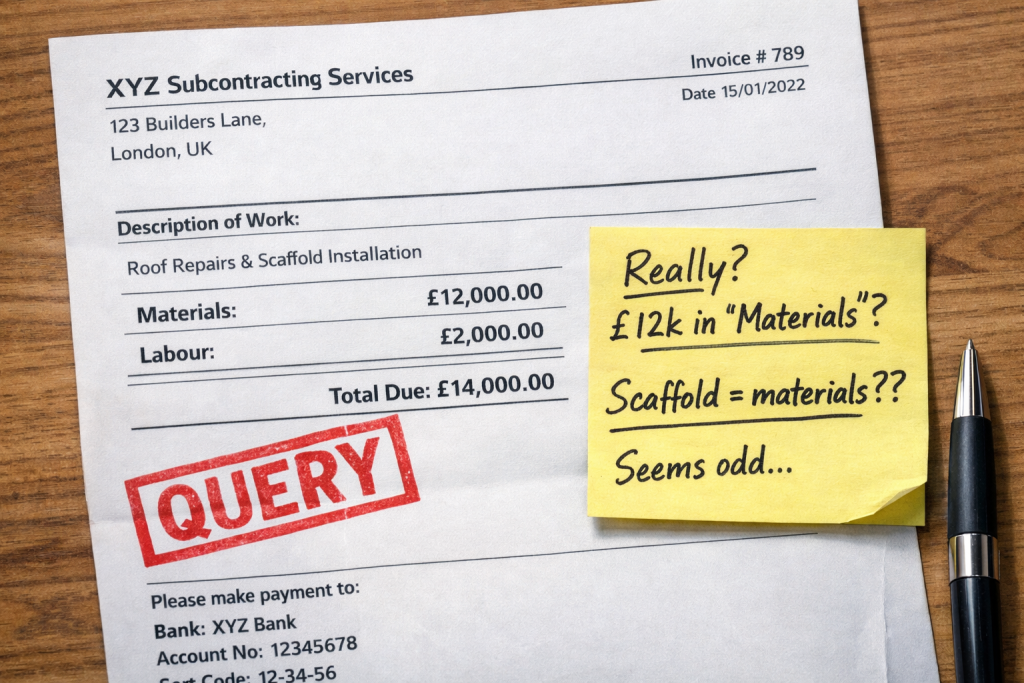

The Materials vs Labour Split: Where Good Intentions Meet Bad Outcomes

Here’s a mistake that seems innocent but can trigger an HMRC investigation faster than you can say “mixed contract.”

When you pay subcontractors, you only deduct CIS tax from the labour element—not from materials. Sounds straightforward, right? Here’s where it gets sticky: what counts as “materials”?

HMRC has very specific rules about this, and contractors constantly get it wrong. The basic principle is that materials must be genuinely materials—actual physical items that become part of the construction. They can’t be:

- Plant hire (that’s subject to CIS)

- Equipment rental (subject to CIS)

- Scaffold hire (you guessed it—subject to CIS)

- Skip hire (also subject to CIS)

I’ve seen contractors accept invoices where subcontractors have helpfully allocated 60% of the cost to “materials” to reduce the CIS deduction. Sounds great until HMRC audits you and decides that 60% figure is completely unjustifiable, and you owe the difference plus penalties.

The problem is that many subcontractors don’t understand the rules either (or worse, they understand them perfectly well and are hoping you don’t). They’ll submit invoices with materials claims that don’t stack up, and when HMRC reviews your records, it’s you who has to justify them.

A competent CIS accountant reviews these splits before returns are filed, flags suspicious claims, and helps you maintain defensible records. Because “my subbie told me it was materials” isn’t going to cut it as a defence. Experienced CIS accountants have seen every dodgy materials claim imaginable and can spot problematic invoices instantly.

The Employment Status Nightmare Nobody Wants to Talk About

Right, this one’s complicated, and it’s getting contractors into serious trouble.

Just because you’re paying someone under CIS doesn’t automatically mean they’re self-employed. HMRC is increasingly scrutinising arrangements where “subcontractors” look suspiciously like employees. If they determine someone should have been on your payroll, you could owe:

- All the income tax and National Insurance that should have been deducted via PAYE

- Employer’s National Insurance contributions

- Penalties for failure to operate PAYE

- Interest on all of the above

The factors HMRC considers include whether the worker:

- Uses their own tools and equipment (or yours)

- Has control over when and how they work

- Can send a substitute to do the work

- Works exclusively for you for extended periods

- Is integrated into your business structure

- Bears financial risk if things go wrong

The IR35 rules add another layer of complexity for limited company subcontractors. Get this wrong, and you’re looking at assessments that can genuinely destroy a small contracting business.

This isn’t something you want to guess at. Experienced CIS accountants assess employment status properly, document the reasoning, and help you structure arrangements that reflect the genuine relationship rather than wishful thinking about tax efficiency.

Record-Keeping: The Boring Bit That Becomes Critical When HMRC Comes Calling

Nobody gets into construction because they love paperwork. I understand that. But here’s the reality: poor record-keeping is the single biggest reason contractors end up in serious trouble with HMRC.

The minimum records you must keep include:

| What You Need to Keep | How Long | Why It Matters |

|---|---|---|

| Verification confirmations from HMRC | Minimum 3 years, ideally 6 | Proof you verified before paying |

| Monthly deduction statements issued to each subcontractor | 3 years minimum | Legal requirement under CIS |

| Copies of all CIS returns submitted | 6 years | Evidence of compliance |

| Payment records showing gross, materials, and net amounts | 6 years | Support your deduction calculations |

| Subcontractor invoices | 6 years | Justify materials claims |

| Evidence of payment to HMRC | 6 years | Prove deductions were actually paid over |

When HMRC audits you (not if, but when), they’ll expect you to produce all of this instantly. Can you? Most contractors can’t, which is why audits that should take a few hours end up taking months and resulting in significant penalties.

Digital record-keeping is no longer optional—it’s the only sensible approach. Cloud-based systems mean records can’t be “lost,” can be accessed from anywhere, and can be backed up automatically. If you’re still using Excel spreadsheets stored on a laptop that could die at any moment, you’re playing Russian roulette with your business.

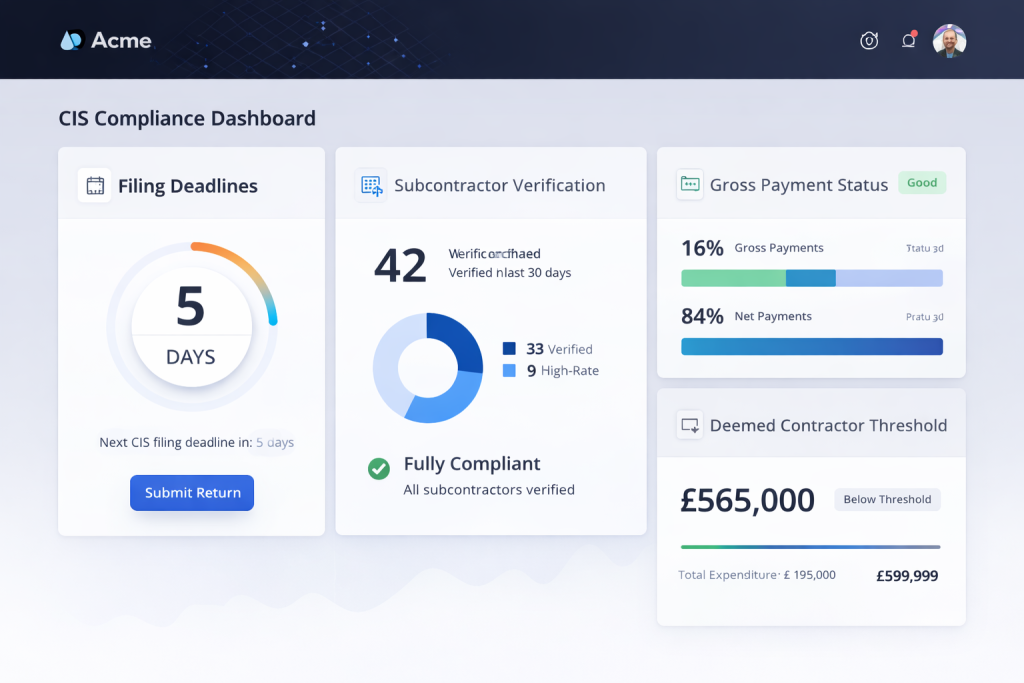

The Deemed Contractor Threshold: The £3 Million Surprise

Here’s a mistake that catches out businesses that aren’t even primarily in construction.

If your company spends more than £3 million on construction work in a rolling 12-month period, you become a “deemed contractor” and must operate CIS—even if construction isn’t your main business. This applies to:

- Property developers

- Large retail chains doing fit-outs

- Manufacturers expanding facilities

- Any business undertaking significant construction work

The nasty surprise? You can cross this threshold mid-month and be required to operate CIS immediately on the next payment. Miss that, and you’re looking at penalties for failure to register, failure to deduct, and failure to file returns—potentially dating back months before you even realised you were a deemed contractor.

Continuous monitoring is essential. You need to track construction expenditure on a rolling 12-month basis, anticipate when you might hit the threshold, and register proactively. This is exactly the kind of forward-thinking that CIS accountants provide as standard but that busy business owners almost never do themselves. Smart CIS accountants set up alerts well before you hit the £3 million mark.

The Gross Payment Status Illusion (And Why Losing It Destroys Cash Flow)

Subcontractors with gross payment status receive payments in full, without 20% being deducted. It’s a massive cash flow advantage, which is why losing it is so devastating.

To get and keep gross payment status, you must pass three tests:

- Business test: You must be genuinely carrying on business in the UK with a proper business bank account

- Turnover test: Your business must meet minimum turnover thresholds

- Compliance test: You must be up to date with tax returns and payments for PAYE, VAT, Corporation Tax, and Self Assessment

That compliance test is where people trip up. Miss one VAT return? Fail to file your Self Assessment on time? Pay your Corporation Tax late? Any of these can result in losing gross payment status.

And here’s the kicker: HMRC now reviews gross payment status more frequently, not just annually. They can revoke it mid-year if compliance issues arise. For a subcontractor operating on tight margins, suddenly having 20% withheld from every payment can literally put them out of business.

If you’re a subcontractor relying on gross payment status, you need absolute certainty that every filing and payment across your entire tax affairs is perfect and on time. That’s not something to leave to chance or “deal with later.”

When Things Go Wrong: Appeals, Penalties, and Damage Limitation

So you’ve cocked it up. The penalty notice arrives. What now?

First: don’t ignore it. Seriously. I cannot emphasise this enough. Penalty notices have appeal deadlines (usually 30 days), and missing those deadlines means you lose the right to challenge the penalty.

You can appeal if you have a “reasonable excuse.” What counts as reasonable?

- Serious illness or bereavement

- Unexpected technology failures (if you can prove it)

- Postal delays (again, need proof)

- Fire, flood, or other disasters

What doesn’t count as reasonable:

- “I forgot”

- “I was busy”

- “I didn’t understand the rules”

- “My accountant was supposed to do it”

Appeals can be made online through HMRC’s portal or in writing. If HMRC rejects your appeal, you can escalate to a tax tribunal—but you’ll need professional representation at that point, and it’s time-consuming and expensive.

Better approach? Don’t end up there in the first place. Prevention is infinitely cheaper than cure.

Why “I’ll Just Do It Myself” Usually Ends Badly

Look, I get it. You’re a competent person running a successful business. How hard can CIS compliance be?

Harder than you think. Not because the individual tasks are complex, but because getting everything right, all the time, every month, while also running an actual construction business is genuinely difficult.

The things that go wrong when contractors try to manage CIS themselves:

- Missed deadlines because site emergencies take priority (they always do)

- Verification done late or not at all

- Poor understanding of materials vs labour splits

- Inadequate record-keeping systems

- Failure to spot when subcontractors lose gross payment status

- No monitoring of the deemed contractor threshold

- Confusion about employment status

Each of these mistakes, individually, can cost thousands in penalties. Combined? They can genuinely threaten your business.

Professional CIS accountants don’t just file your returns—they build systems that prevent problems before they occur. Monthly CIS checks, automated verification, proper record-keeping, proactive monitoring of compliance across all your tax obligations. It’s not glamorous, but it works.

The cost of getting professional help is almost always less than the cost of a single penalty for late filing, let alone the more serious mistakes around verification and deductions. Working with qualified CIS accountants is an investment that pays for itself the first time it prevents a penalty.

What Actually Good CIS Accountants Provide (Beyond Basic Filing)

Not all CIS accountants are created equal. Some will just file your returns and call it a day. That’s not enough.

Proper CIS support includes:

- Proactive deadline management: You should never have to remember when returns are due

- Automated verification systems: Every subcontractor verified before payment, every time

- Real-time gross payment status monitoring: Immediate alerts if a subbie loses their status

- Proper materials review: Invoices checked for dodgy claims before returns are filed

- Employment status assessments: Clear documentation of why each worker is genuinely self-employed

- Deemed contractor threshold monitoring: Tracking expenditure before you accidentally trigger CIS obligations

- Audit-ready records: Everything organised and accessible if HMRC comes calling

- Integration with payroll and VAT: Ensuring compliance across all schemes, not just CIS

At Ask Accountant, our approach to CIS claims and refunds goes beyond basic compliance. We treat CIS as part of your overall tax strategy, ensuring everything works together rather than creating problems in one area while solving them in another.

The 2025 Enforcement Landscape (And Why You Should Care)

HMRC’s approach to CIS enforcement has fundamentally changed. The days of “hope for the best and sort it at year-end” are gone.

Current enforcement focuses on:

- Real-time data matching: HMRC cross-references CIS returns with VAT returns, PAYE submissions, and Corporation Tax filings. Discrepancies trigger automated flags.

- Supply chain fraud detection: From April 2026, businesses connected to fraudulent labour suppliers face automatic liability and personal penalties for directors.

- Targeted campaigns: “One-to-many” letters going to thousands of contractors, with 45-day deadlines to prove compliance.

- Mid-year gross payment status reviews: Not waiting until annual renewal to identify and act on compliance failures.

The penalties are harsher, the scrutiny is tighter, and the tolerance for mistakes is lower than ever.

If your CIS compliance isn’t rock-solid, 2025 is the year to fix it—before HMRC fixes it for you.

Your Next Steps

If you’re reading this and recognising mistakes you’ve been making (or are currently making), don’t panic. But do act.

Start with a CIS health check. Review your systems, your records, and your processes against the requirements outlined here. Where are the gaps? What’s relying on someone remembering rather than on proper systems? What could go catastrophically wrong if that one person who “handles the CIS stuff” got hit by a bus?

If you’re not confident that every aspect of your CIS compliance would survive an HMRC audit tomorrow, that’s a problem worth fixing today.

The construction industry has enough genuine challenges without adding self-inflicted tax penalties to the mix. The difference between contractors who thrive and those who struggle often isn’t their technical competence or their project management skills—it’s whether they’ve sorted out the boring administrative stuff that HMRC actually cares about.

Get the compliance right, and you can focus on what you’re actually good at: building things. Get it wrong, and you’ll be spending your time fighting fires with HMRC instead of winning new work.

Which would you rather be doing?

Frequently Asked Questions About CIS Compliance

What happens if I miss the CIS monthly return deadline by one day?

You’ll receive an automatic £100 penalty from HMRC. There’s no grace period—even one day late triggers the penalty. The only way to avoid it is to appeal with a reasonable excuse (and “I forgot” doesn’t count). This is why automated systems and reminders are so critical for contractors.

Do I need to file a CIS return if I didn’t pay any subcontractors that month?

Technically, no return is required for a nil month. However, HMRC won’t automatically know you made no payments and may issue a penalty notice anyway. It’s safer to either file a nil return or proactively notify HMRC that no payments were made. Many contractors file nil returns just to avoid the hassle of explaining it later.

Can I verify a subcontractor after I’ve already paid them?

Legally, you must verify before making payment. If you verify afterwards and discover you should have deducted CIS tax but didn’t, you become liable for that tax—not the subcontractor. HMRC can pursue you for the missing deductions, plus penalties and interest if they determine you failed to exercise reasonable care.

What’s the difference between being a contractor and a deemed contractor?

Mainstream contractors are primarily construction businesses. Deemed contractors are businesses in other sectors that happen to spend more than £3 million on construction in a rolling 12-month period. Both have identical CIS obligations once registered, but deemed contractors often don’t realise they’ve crossed the threshold until it’s too late.

How do CIS accountants actually save contractors money?

By preventing penalties (which can reach thousands of pounds), ensuring proper verification (so you don’t become liable for subcontractors’ tax), maintaining gross payment status (worth 20% cash flow advantage for subbies), optimising materials vs labour splits within HMRC rules, and catching errors before they become compliance issues. The cost of proper CIS support is almost always less than the cost of one significant mistake. Quality CIS accountants typically save contractors 5-10 times their fee value in avoided penalties and tax liabilities.

What should I do if I receive a letter from HMRC about CIS compliance?

Don’t ignore it. These letters typically give you 45 days to review and correct your records. Use that time to verify all subcontractors properly, check your deduction calculations, and ensure your records are complete. If you find errors, disclose them proactively rather than waiting for HMRC to discover them during an audit. Consider getting professional help immediately—it’s much cheaper to fix issues before an investigation starts.

Need Expert CIS Support?

At Ask Accountant, we specialise in keeping construction contractors compliant while minimising their administrative burden. Our comprehensive services cover everything from monthly CIS returns to tax compliance across your entire business.

We’re based in London at 178 Merton High St, London SW19 1AY, but we work with contractors across the UK. Whether you need a complete CIS overhaul or just want peace of mind that your existing systems are sound, we can help.

Call us on +44(0)20 8543 1991 or visit our website to discuss your specific situation. Because sorting out CIS compliance properly is infinitely cheaper than dealing with HMRC penalties.