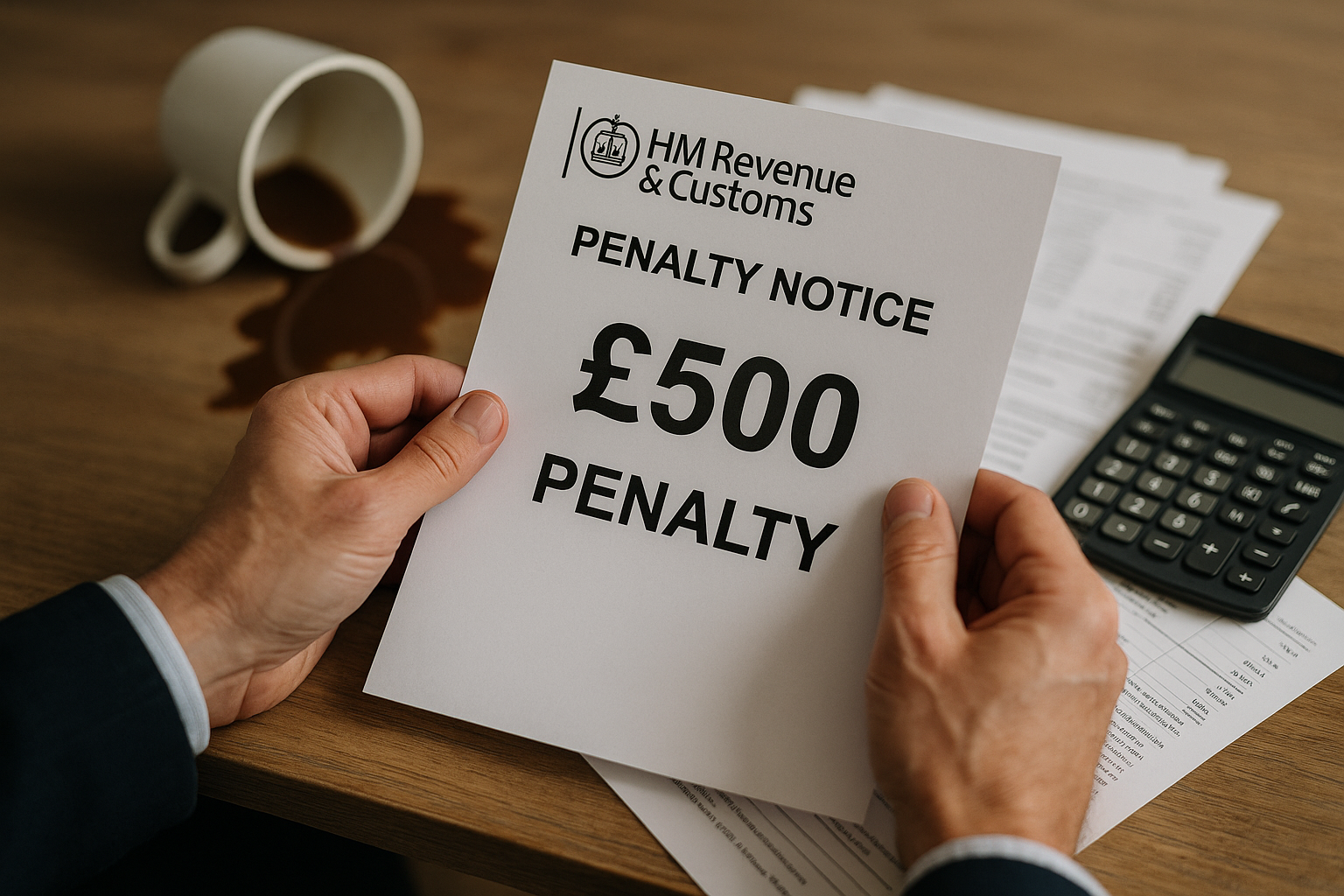

Here’s something that’ll make your Monday morning coffee taste bitter: you’ve just discovered a corporate tax return penalty lurking in your company’s correspondence. That familiar HMRC letterhead never brings good news, does it? But before you start calculating how many biscuits you’ll need to stress-eat through this crisis, let me share something rather encouraging—most penalties aren’t set in stone.

I’ve watched countless business owners assume these penalties are non-negotiable. They’re not. In fact, HMRC processes thousands of successful penalty appeals each year, and yours could be next.

The Anatomy of Corporate Tax Return Deadlines (And Why They Matter More Than You Think)

Companies House and HMRC operate on different planets when it comes to deadlines. Your corporate tax return is due 12 months after your accounting period ends—not to be confused with your Companies House filing deadline, which catches people out regularly.

Miss this deadline by even a day? The penalties start rolling in like clockwork:

- 3 months late: £100 fixed penalty

- 6 months late: Additional £200 penalty

- 12 months late: Another £200 penalty (plus potential tax-geared penalties)

What’s particularly infuriating is how these penalties compound. A company that’s 13 months late faces £500 in fixed penalties before we even consider the tax-geared penalties that can reach 20% of unpaid tax.

Here’s where it gets interesting though—HMRC’s own statistics show that reasonable excuse appeals succeed in roughly 40% of cases.

When Life Happens: Valid Excuses That Actually Work

The phrase “reasonable excuse” sounds woolly, doesn’t it? Like something a teenager might mumble when they’ve missed curfew. But HMRC’s interpretation is surprisingly specific.

Technical failures top the list of successful appeals. If your accounting software crashed during filing season, or HMRC’s own online service was down (happens more often than they’d like to admit – check HMRC service availability), you’ve got solid ground to stand on.

Serious illness works, but it needs to be properly documented. A week-long flu won’t cut it, but a hospital stay that prevented you from managing company affairs? That’s different entirely.

Death or serious illness of someone crucial to your filing process—your accountant, company secretary, or spouse who handles the books—these are circumstances HMRC regularly accepts.

Here’s one that surprises people: postal delays. If you posted your return in time but Royal Mail let you down, HMRC will often waive penalties. You’ll need proof of posting, obviously.

The Digital Age Complications

Modern business throws up new challenges. Cyber attacks, data breaches, or ransomware incidents that prevent access to financial records—these are increasingly recognised as reasonable excuses. One client of ours faced a sophisticated phishing attack that locked them out of their systems for six weeks. HMRC accepted this as a reasonable excuse without hesitation.

The Appeal Process: Less Terrifying Than It Sounds

Don’t let the word “appeal” intimidate you. We’re not talking about wigs and gavels here—it’s largely a paper exercise that you can handle yourself (though professional help never hurts).

Step One: Write to HMRC within 30 days of receiving the penalty notice. This deadline is crucial—miss it, and you’ll need to explain why your appeal is late as well as why you filed late. (See HMRC guidance on appealing penalties).

Step Two: Explain your circumstances clearly. Skip the dramatic language and stick to facts. HMRC officers appreciate brevity and clarity over emotional appeals.

Step Three: Provide evidence. Photos, medical certificates, emails showing system failures—whatever supports your case.

| Appeal Timeframe | Action Required | Success Rate |

|---|---|---|

| Within 30 days | Standard appeal process | ~40% |

| 30-90 days | Explain late appeal + original excuse | ~25% |

| After 90 days | Tribunal application required | ~15% |

Prevention: The Unglamorous but Effective Approach

I know, I know—prevention advice feels like being told to eat your vegetables when you’re asking about hangover cures. But hear me out.

Calendar alerts should ping multiple times. Set them for three months before, one month before, two weeks before, and one week before your corporate tax return deadline. Redundancy is your friend here.

Delegate, but verify. If your accountant handles filing, brilliant—but check in regularly. Even the best professionals occasionally juggle too many balls.

Digital filing beats paper every time. Not just for speed, but for the automatic confirmation receipts that serve as appeal evidence if something goes wrong.

The Role of Professional Support

This brings me to something worth considering—professional tax advisory solutions can transform your relationship with HMRC deadlines entirely. At Ask Accountant, we see businesses breathe easier once they’ve got proper systems in place. It’s not just about filing returns; it’s about building processes that prevent these panic moments altogether.

Our approach involves proactive tax advisory solutions that flag potential issues months before they become problems. Located at 178 Merton High St in London, we’ve helped countless companies navigate penalty recovery while building robust compliance systems for the future.

The Hidden Costs Nobody Mentions

Late filing penalties are just the tip of the iceberg. Corporate tax return delays can trigger:

- Interest charges on unpaid tax (currently 7.75% annually – check current rates)

- Potential investigation triggers

- Credit rating implications

- Additional penalties if payments are also late

But here’s what really stings—the opportunity cost. Time spent dealing with penalties is time not spent growing your business. I’ve seen directors lose weeks of productivity over penalties that could have been resolved quickly with the right approach.

Fighting Back: Real Appeal Examples

Case Study One:

A Manchester-based engineering firm missed their deadline after their accountant suffered a heart attack. They provided medical evidence and a timeline showing the accountant’s unavailability coincided exactly with their filing period. Result? Full penalty waiver.

Case Study Two:

A tech startup’s cloud-based accounting system was hacked three weeks before their filing deadline. They documented the incident with police reports and IT security firm correspondence. HMRC accepted this as a reasonable excuse and waived £300 in penalties.

Case Study Three:

This one’s trickier—a family business claimed their older director’s confusion led to missed deadlines. Without medical documentation of diagnosed cognitive issues, HMRC rejected the appeal. The lesson? General claims need specific evidence.

When Professional Help Makes Sense

Sometimes you need reinforcements. If your penalties exceed £1,000, if you’re facing tax-geared penalties, or if HMRC has rejected your initial appeal, professional representation often pays for itself.

We regularly handle penalty appeals as part of our comprehensive business accounting services. The key is acting quickly—every day counts when dealing with HMRC deadlines.

| Penalty Amount | DIY Appeal | Professional Help |

|---|---|---|

| Under £500 | Often worthwhile to try yourself | May not be cost-effective |

| £500-£2,000 | Consider professional advice | Usually beneficial |

| Over £2,000 | High risk without expertise | Strongly recommended |

The Tribunal Route: Last Resort or Strategic Choice?

If HMRC rejects your appeal, you can escalate to the First-tier Tribunal. This sounds daunting, but it’s actually quite accessible. Many cases are decided on paper without a hearing—you simply submit your evidence and arguments in writing.

Tribunal fees were abolished in 2017, making this route more accessible. (For information on current tribunal processes, refer to the official tribunal website). Success rates vary wildly depending on circumstances, but well-prepared cases with solid evidence fare much better than rushed applications.

Key insight: Tribunals often look more favourably on cases where the taxpayer made genuine efforts to comply but faced genuine obstacles. Simply forgetting or being too busy rarely succeeds at this level.

Building Penalty-Proof Systems

Once you’ve dealt with your immediate penalty situation, it’s time to build defences against future problems. This isn’t just about setting calendar reminders—though they help.

- Document everything. Email confirmations, postal receipts, system screenshots—they all become evidence if things go wrong again.

- Build redundancy into your filing process. Multiple people should know when deadlines approach, not just one overwhelmed director or accountant.

- Regular compliance reviews catch problems early. We recommend quarterly check-ins to ensure all obligations are on track.

The Bottom Line on Recovery

Here’s what I want you to remember from all this: corporate tax return penalties aren’t inevitable life sentences. HMRC processes thousands of successful appeals annually, and with the right approach, yours could join them.

The key is acting promptly, presenting facts clearly, and providing supporting evidence. Whether you handle the appeal yourself or seek professional support, the important thing is to start the process quickly.

If you’re struggling with penalty recovery or want to build systems that prevent these issues entirely, professional support can make all the difference. Our team at Ask Accountant combines penalty recovery expertise with proactive business advisory services. You can reach us at +44(0)20 8543 1991 or visit us at 178 Merton High St, London SW19 1AY.

Don’t let penalty fears paralyse your business operations. With the right knowledge and approach, you can turn this setback into an opportunity to build stronger compliance systems for the future.

Frequently Asked Questions

Q: Can I appeal a corporate tax return penalty after paying it?

A: Absolutely. Paying a penalty doesn’t prevent you from appealing it. If successful, HMRC will refund the amount with interest.

Q: How long does the penalty appeal process typically take?

A: Most appeals are resolved within 8-12 weeks, though complex cases involving multiple penalties can take longer.

Q: What happens if HMRC rejects my initial appeal?

A: You can escalate to the First-tier Tribunal within 30 days of receiving HMRC’s rejection decision.

Q: Are there any penalties for filing your corporate tax return early?

A: No penalties exist for early filing. In fact, submitting early can prevent many compliance headaches down the road.

Q: Can I get professional help with the penalty appeal process?

A: Yes, experienced tax advisors and accountants regularly handle penalty appeals as part of their comprehensive business services.