There’s a particular knot that forms in your stomach when you open that brown envelope with the HMRC logo. You know the one. It sits on your kitchen counter for a full twenty minutes before you work up the nerve to rip it open, and suddenly you’re Googling “HMRC tax investigations” at 11 PM with a cold cup of tea beside you.

Here’s the thing nobody tells you until it’s too late: HMRC opened over 30,000 tax investigations last year, and most of them weren’t targeting millionaire tax dodgers or elaborate offshore schemes. They were looking at ordinary people. Small business owners who miscategorised a few expenses. Freelancers who genuinely didn’t know they needed to declare that side income. People like you, probably.

I’ve watched clients go from confident to completely panicked when faced with an HMRC tax investigation. The process feels deliberately opaque—like they designed it to make you sweat. But once you understand how these investigations actually work (and why they happen), they become significantly less terrifying. Not pleasant, exactly. But manageable.

Why HMRC Decides to Investigate You Specifically

HMRC doesn’t just throw darts at a board with taxpayer names on it. Well, sometimes they do—there’s genuinely a random selection element called “aspect enquiries” where they pick returns at random to keep everyone honest. But most investigations start because something tripped their internal alarm system.

Their software is looking for patterns. Anomalies. Numbers that don’t quite add up when compared against industry benchmarks or your own historical data.

Common triggers include:

- Lifestyle doesn’t match declared income – You’re reporting £25,000 annual profit but posting Instagram stories from a Maldives resort every other month. HMRC notices these things, especially since they’ve enhanced their social media monitoring capabilities.

- Claiming business expenses that seem disproportionately high for your turnover

- Sudden, unexplained drops in profit margins year-on-year

- Working in a high-risk sector (construction, hospitality, and cash-heavy businesses get extra scrutiny)

- Tips from the public or disgruntled ex-business partners – yes, people absolutely do snitch

- Transactions involving offshore accounts or property deals that flag in their Connect system

The Connect system deserves its own mention because it’s genuinely impressive in a Big Brother sort of way. HMRC pulls data from dozens of sources: Land Registry, banks, PayPal, eBay, Companies House, credit reference agencies, even foreign tax authorities. They’re building a digital jigsaw puzzle of your financial life, and when a piece doesn’t fit, an investigation starts.

The Different Flavours of HMRC Tax Investigations

Not all investigations are created equal. Some are quick temperature checks; others are full financial colonoscopies.

Aspect Enquiries (The Gentle Prod)

This is HMRC asking about one specific thing on your return. Maybe your motor expenses jumped 200% this year, or you claimed a home office deduction that seems generous. They’ll write asking for clarification on that single aspect. These usually resolve quickly if you’ve got proper records.

Full Enquiries (The Proper Investigation)

This is where they examine your entire tax return with a fine-tooth comb. Everything’s fair game: income, expenses, capital gains, the lot. These investigations can stretch for months—sometimes over a year—and require mountains of documentation. They’re exhausting.

Code of Practice 9 (The Serious Fraud Stuff)

If HMRC suspects deliberate tax fraud, they’ll issue a Code of Practice 9 (COP9) investigation. This is the nuclear option. You’re essentially being offered the chance to confess everything in exchange for immunity from criminal prosecution. If you receive one of these, stop reading this article immediately and call a specialist tax advisor. Today. Now, actually.

Reality Check: If HMRC discovers significant undisclosed income during an investigation, they can go back up to 20 years. That’s not a typo. Twenty years. They rarely do, but in cases of deliberate fraud, they absolutely will—and the penalties become eye-watering when you add two decades of interest and fines.

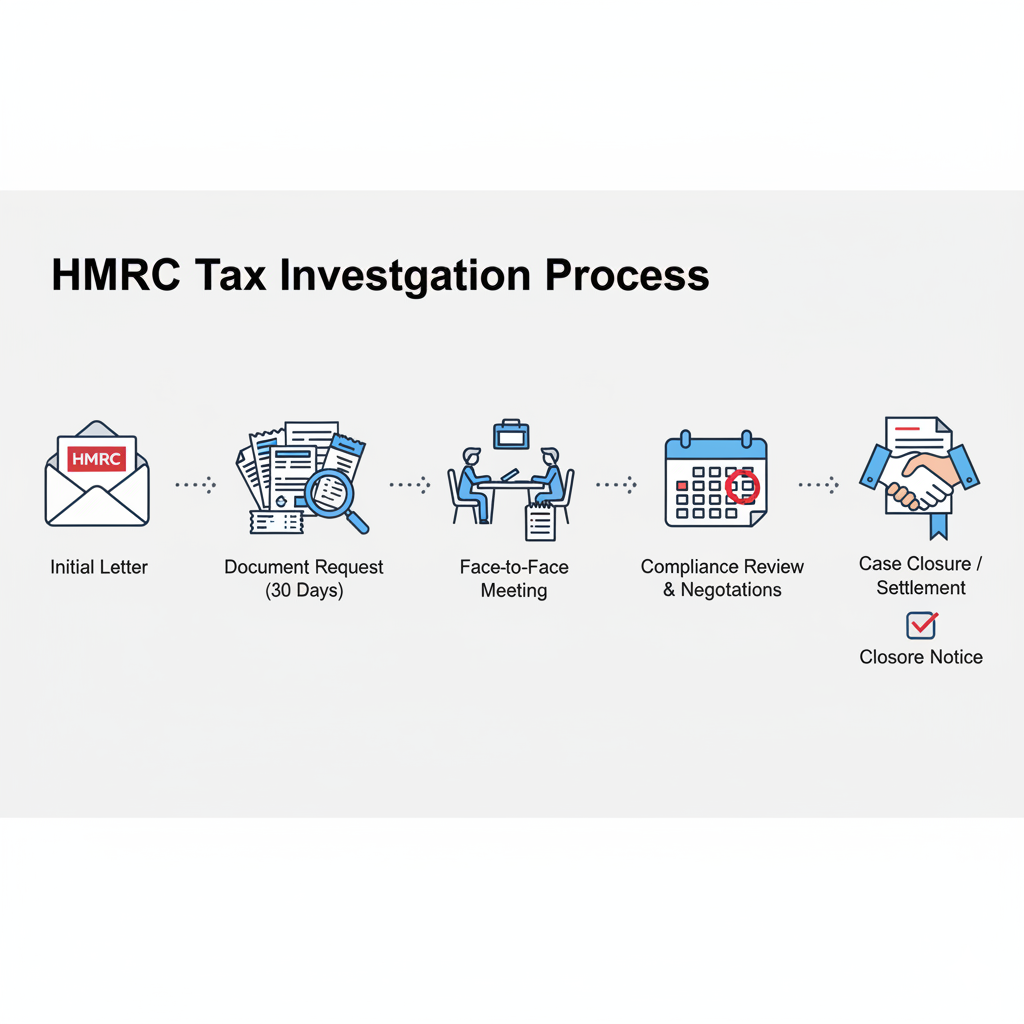

What Actually Happens During an HMRC Tax Investigation

The investigation typically starts with a letter. Not a phone call, not an email—a proper letter that arrives by post and makes your heart sink.

The letter will specify what they’re investigating and request specific documents. This might include:

- Bank statements (personal and business) for the relevant tax years

- Sales invoices and purchase receipts

- Contracts with clients or suppliers

- Accountancy records and working papers

- Correspondence with your accountant

- Evidence supporting any specific claims or deductions

You’ll have 30 days to respond. That deadline is firmer than you’d think.

Sometimes HMRC will request a face-to-face meeting. These meetings happen at their office, your accountant’s office, or occasionally your business premises. They’re interviewing you, basically—gathering information while watching how you respond to questions. It’s not adversarial (usually), but it’s definitely not casual either.

The inspector assigned to your case becomes your main point of contact. Some are reasonable; some seem to have taken a personal vow to extract maximum tax from every investigation. You don’t get to choose, unfortunately.

How Long These Things Actually Take

Ask HMRC and they’ll say most investigations conclude within 16 months. Ask anyone who’s actually been through one and they’ll laugh bitterly into their wine.

| Investigation Type | Typical Duration | What Affects Timeline |

|---|---|---|

| Aspect Enquiry | 3-6 months | How quickly you provide requested documents |

| Full Enquiry (straightforward) | 12-18 months | Complexity of your affairs, quality of your records |

| Full Enquiry (complex) | 18-36 months | Multiple income sources, property portfolios, offshore elements |

| COP9 Investigation | 18-48 months | Scale of suspected fraud, willingness to cooperate |

The timeline stretches longer when you’re slow to respond, your records are chaotic, or disagreements arise about specific items. HMRC can also pause investigations if they’re waiting on third-party information or dealing with backlogs (which they frequently are).

The Money Part (Yes, This Gets Expensive)

Even if you’ve done nothing deliberately wrong, investigations cost money. Professional representation isn’t cheap, but trying to handle a full enquiry yourself is like performing your own dental surgery—technically possible, but inadvisable.

If HMRC finds underpaid tax, you’ll face:

- The tax you should have paid originally (obviously)

- Interest calculated from when the tax was due—see the current HMRC interest rates

- Penalties ranging from 0% to 100% of the tax owed, depending on HMRC’s view of your behaviour

The penalty percentage depends on whether HMRC thinks you made an innocent mistake (0-30%), were careless (15-30%), or deliberately messed about (20-70% for hiding things, up to 100% for outright fraud). These categories involve some interpretation, which is where having professional representation becomes valuable—someone who can argue your corner and negotiate the penalty percentage downward.

Lesser-Known Fact: You can actually appeal against HMRC’s penalty determination if you think it’s unfair. Many people don’t realise this option exists and just accept whatever penalty HMRC imposes. Don’t be those people.

Your Rights (Which Nobody Tells You About)

HMRC has substantial powers, but you’re not helpless. You have specific rights that investigators must respect:

- You can request extensions to submission deadlines if you need more time to gather documents (within reason)

- You’re entitled to know what they’re investigating – they can’t go on endless fishing expeditions without focus

- You can insist on professional representation being present at all meetings

- You can challenge information notices if you think they’re requesting unreasonable amounts of data

- You have appeal rights if you disagree with their final determination

Here’s something that surprises people: you can actually close down an investigation yourself by applying for a closure notice if HMRC is dragging things out unreasonably. The tax tribunal will then decide whether the investigation should end or continue.

Record-Keeping That Actually Protects You

The best defence against HMRC tax investigations is records so comprehensive they’re boring. I mean properly tedious, organised-to-the-point-of-obsession records.

What you need depends on your circumstances, but generally:

For self-employed individuals:

- All invoices issued to clients (keep them for at least 5-6 years, preferably digitally and with a backup)

- Receipts for every business expense, categorised properly

- Mileage logs if you’re claiming vehicle expenses—with dates, destinations, and business purposes

- Bank statements showing business transactions

For small limited companies:

- VAT records if registered

- PAYE documentation if you employ people

- Proof of any loans to/from the company

- Board meeting minutes (yes, even if you’re the only director)

- Contracts with major clients or suppliers

The records need to be contemporaneous. You can’t reconstruct a year’s worth of mileage logs from memory when HMRC comes knocking—they can spot fabricated records surprisingly easily. Your claimed journey from London to Manchester on a Tuesday matches up with… a social media post from your Ibiza holiday that same week? Not ideal.

When You Should Definitely Get Professional Help

Some situations scream “hire a specialist immediately”:

- Any investigation involving suspected fraud or deliberate wrongdoing

- Undisclosed offshore income or assets

- Large sums of money involved (if the disputed tax exceeds £10,000, get help)

- You’ve received a Code of Practice 9 letter

- Complex business structures or multiple income sources

- You genuinely don’t understand what HMRC is asking for

The cost of professional representation feels steep until you calculate what it costs to handle things badly. A skilled tax advisor or accountant who specialises in HMRC investigations knows exactly which hills to die on and which concessions to make. They understand the system, they speak the language, and—crucially—they don’t panic when HMRC pushes back aggressively.

At Ask Accountant, we’ve guided numerous individuals and small businesses through HMRC tax investigations from start to finish. Our team understands the investigation process inside-out, and we’ve successfully negotiated with HMRC to reduce penalties and minimise stress for our clients. Whether you need help with business accounting services, tax advisory solutions, or representation during an active investigation, we’re based at 178 Merton High St, London SW19 1AY. You can reach us on +44(0)20 8543 1991—and no, that first conversation to discuss whether you actually need our help isn’t going to cost you anything.

The Voluntary Disclosure Route (Getting Ahead of Trouble)

Sometimes you discover a mistake before HMRC does. Maybe you’re reviewing old returns and realise you forgot to declare some freelance income. Or your bookkeeper miscategorised something significant and you’ve underpaid tax for three years.

Here’s where voluntary disclosure becomes your friend.

If you proactively tell HMRC about unpaid tax before they contact you, the penalties drop significantly. Instead of facing 30-100% penalties for concealed errors, you’re looking at 0-30% for unprompted disclosures. HMRC genuinely does reward honesty—or punish it less severely, which amounts to the same thing.

The Digital Disclosure Service makes this process relatively straightforward now. You can notify HMRC of errors, calculate the additional tax owed, and arrange payment plans if needed. The psychological relief of getting ahead of potential problems is substantial, never mind the financial savings.

Common Mistakes That Escalate HMRC Tax Investigations

People sabotage themselves during investigations in predictable ways:

- Missing deadlines. HMRC interprets this as uncooperative behaviour, which colours their entire approach to your case. Miss enough deadlines and they’ll apply for penalties and potentially escalate the investigation.

- Providing incomplete information. Sending some bank statements but not others raises immediate suspicions. They’ll assume the missing ones contain problematic transactions.

- Being obviously evasive in meetings. You don’t need to volunteer information unnecessarily, but giving vague, defensive answers to straightforward questions makes investigators dig deeper.

- Submitting obviously reconstructed records. If your mileage log is written in the same pen with identical handwriting throughout 12 months, they’ll know you created it last Tuesday.

- Getting aggressive or confrontational. Some people think they can intimidate HMRC inspectors into backing off. Those people are wrong, and they end up with higher penalty determinations as a result.

What Happens When It’s Finally Over

Investigations end in one of several ways:

- No changes required – HMRC accepts your return as submitted. This happens more often than you’d think, especially with aspect enquiries where you’ve got proper documentation.

- Agreed adjustments – You and HMRC reach agreement on what tax is actually owed, along with penalties and interest. You sign a settlement document, pay up, and move on with your life.

- Disputed determination – HMRC issues a decision you disagree with, triggering the appeals process. This can drag on for ages and potentially end up in tribunal, but sometimes it’s worth fighting.

Once settled, HMRC typically won’t investigate the same tax years again unless new information emerges. You’ll receive a closure notice confirming the investigation is finished. Frame it if you want—you’ve earned it.

Practical Steps to Take Right Now

Even if you’re not currently under investigation, you can prepare:

- Audit your own records – Pretend you’re HMRC reviewing your returns. What looks questionable? What documentation is missing?

- Fix your record-keeping system – Get proper accounting software like Cloud Accounting if you’re still using spreadsheets and shoeboxes. The investment pays for itself during the first investigation you avoid.

- Review your past returns for errors – If you find something significant, consider voluntary disclosure before HMRC finds it.

- Understand your specific risk factors – Cash business? High expense claims? Multiple income sources? Know what makes you a target and address those areas preemptively.

- Build a relationship with a qualified accountant – Having someone on speed dial when trouble hits is invaluable. Services like business advisory, bookkeeping, and proactive tax advisory solutions aren’t just about compliance—they’re about having an expert in your corner when it matters.

| Record Type | Minimum Retention Period | Best Practice |

|---|---|---|

| Business expense receipts | 5+ years | Keep digitally with backups; 7+ years is safer |

| VAT records | 6 years | 6 years minimum (legally required) |

| PAYE records | 3 years | Keep for 6 years to match tax investigation window |

| Company accounts | 6 years | Permanently—they’re useful for historical comparison |

| Personal tax returns | 22 months after tax year ends | Keep indefinitely with supporting documents |

| Contracts, agreements | 6 years after contract ends | Keep permanently for major agreements |

The Psychological Toll Nobody Mentions

Here’s what the official guidance doesn’t tell you: HMRC tax investigations are genuinely stressful. They affect your sleep. They dominate your thoughts. They strain relationships because you’re distracted and worried about money.

This is normal. You’re not overreacting.

The uncertainty is often worse than the eventual outcome. Most investigations end with relatively modest settlements—a few thousand pounds in extra tax and penalties. Painful, but not life-destroying. The months of stress beforehand, though? That’s the real cost.

Which is why having someone competent managing the process matters so much. Yes, it costs money to hire a tax advisor specialising in investigations. But the mental health benefits of handing the stress to a professional who deals with this stuff daily? Priceless. (Literally—you can’t really put a price on sleeping through the night again.)

Frequently Asked Questions About HMRC Investigations

Can HMRC just turn up at my business without warning? Generally, no. They need to give you advance notice for a compliance visit. However, if they suspect you might destroy evidence, they can apply for an inspection warrant and show up unannounced with police officers. This is rare but not impossible.

What happens if I can’t afford to pay the tax HMRC says I owe? They’re surprisingly flexible about payment plans. Time to Pay arrangements let you spread payments over months or even years in some cases. They’d rather get the money gradually than bankrupt you trying to collect it all at once.

Will an investigation affect my credit rating? Not directly. However, if HMRC obtains a county court judgement against you for unpaid tax, that will appear on your credit file and hammer your rating for six years.

Can I refuse to provide information HMRC requests? You can challenge information notices through the tribunal system if you think they’re unreasonable. But flat-out refusing without legal grounds will result in penalties and potentially criminal charges for obstruction.

How do I know if my accountant is good enough to handle an investigation? Ask directly about their experience with HMRC investigations. How many have they handled? What were the outcomes? If they seem uncertain or suggest it’s no big deal, find someone else.

Final Thoughts (And Why You Shouldn’t Panic)

HMRC tax investigations feel like the financial equivalent of being called to the headmaster’s office. Even when you’ve done nothing wrong, there’s that automatic guilt response.

But here’s the reality: most people survive investigations just fine. You provide your records, answer their questions, maybe pay a bit of extra tax if there’s been a genuine mistake, and life continues. The horror stories you hear—the ones involving massive penalties and criminal prosecution—typically involve deliberate, sustained fraud. If you’ve been making honest mistakes or dealing with complex tax situations in good faith, you’re not going to prison.

The key is responding properly from the start. Don’t ignore the letters. Don’t try to handle serious investigations alone. Don’t panic-delete records or suddenly claim your laptop fell in a lake (yes, people actually try this).

Get organised, get professional help if needed, and remember that HMRC investigators are just civil servants doing their jobs. They’re not personally invested in destroying you—they’re working through a checklist to verify your tax position.

That brown envelope might still make your stomach drop. But now at least you know what comes next, how to handle it, and—most importantly—that you’ll probably be absolutely fine.

Cheapest Backlinks

November 17, 2025Hey very cool blog!! Man .. Excellent .. Amazing .. I’ll bookmark your site and take the feeds also…I’m happy to find numerous useful information here in the post, we need work out more techniques in this regard, thanks for sharing. . . . . .