Here’s something nobody tells you at dinner parties: roughly one in twenty estates in Britain gets walloped by inheritance tax. That’s it. Just 5% or so. Yet somehow, the panic around British inheritance tax creates more anxiety than a root canal appointment.

I’ve watched people lose sleep over tax bills that’ll never materialise, whilst others stumble into six-figure liabilities because they assumed “the family home is safe.” (Spoiler: it isn’t always.)

So let’s talk about how this thing actually works—without the jargon that makes your eyes glaze over, and definitely without pretending it’s simpler than it is.

The Brutal Basics Nobody Warned You About

British inheritance tax hits estates valued above £325,000 at a flat 40% rate. Yes, you read that correctly. Forty percent.

Die with an estate worth £425,000? The taxman claims £40,000 before your beneficiaries see a penny. Own a London flat and some savings? You’re potentially in the danger zone already.

But—and this is where it gets interesting—most people won’t pay a single pound. The thresholds, exemptions, and reliefs stack up like a game of Jenga played by accountants who’ve had too much coffee.

What Actually Counts as Your “Estate”?

Everything you own minus everything you owe. Sounds straightforward until you start listing it:

- Property (your home, buy-to-let flats, that caravan in Cornwall)

- Savings and investments

- Life insurance payouts if they don’t go into trust

- Personal possessions (jewellery, art, the vintage motorcycle gathering dust)

- Your share of jointly owned assets

What doesn’t count? Pensions, typically. At least until April 2027, when the government’s changing that rule. More on that particular headache later.

The Nil-Rate Band: Your £325,000 Get-Out-of-Jail Card

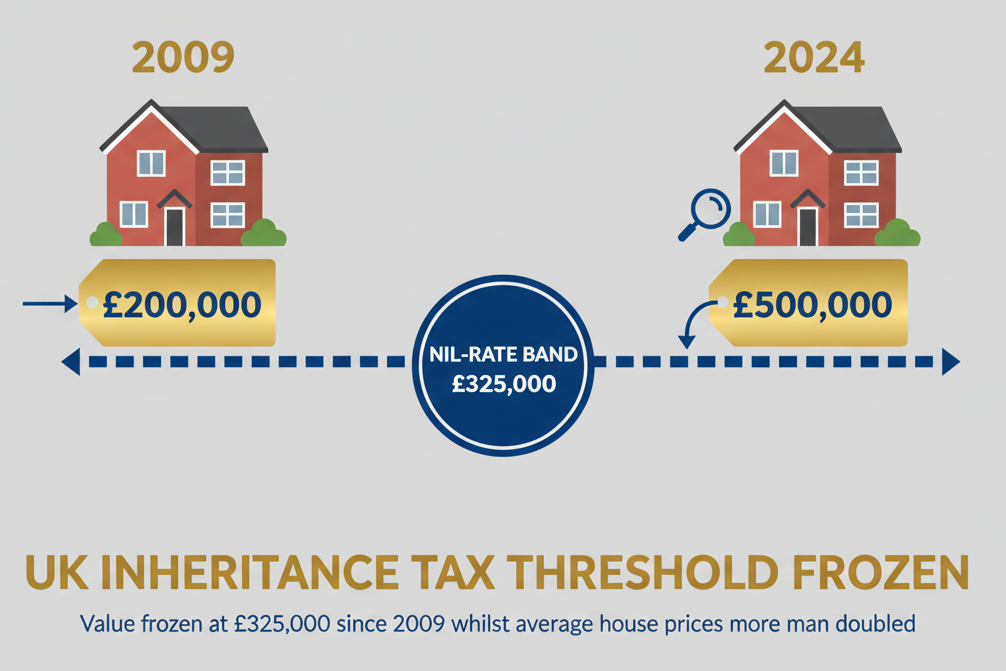

This threshold—£325,000—has been frozen since 2009. Think about that. House prices have doubled or tripled in parts of the UK, yet this figure hasn’t budged. It’s like playing Monopoly where everyone’s salaries increased except yours.

But here’s where British inheritance tax gets clever (or devious, depending on your perspective):

Married couples and civil partners can combine their nil-rate bands. Die without using yours? It transfers to your surviving spouse. They inherit your £325,000 allowance plus their own, creating a £650,000 threshold.

This isn’t automatic, though. Executors must claim it. I’ve seen families miss this because nobody knew to ask.

| Your Estate Value | Nil-Rate Band | Taxable Amount | IHT Due (40%) |

|---|---|---|---|

| £300,000 | £325,000 | £0 | £0 |

| £500,000 | £325,000 | £175,000 | £70,000 |

| £800,000 | £650,000 (couple) | £150,000 | £60,000 |

| £1,000,000 | £650,000 (couple) | £350,000 | £140,000 |

Notice how that last row stings? A million-pound estate—which in London might be a modest three-bed semi and some savings—triggers a £140,000 tax bill for a couple who’ve used their combined allowances.

The Residence Nil-Rate Band: When Your Home Gets Special Treatment

In 2017, the government introduced an additional threshold specifically for your main residence. It’s called the residence nil-rate band (RNRB), and it’s worth up to £175,000 per person.

Sounds brilliant, right? An extra £175,000 of tax-free allowance?

Hold on. The rules are pickier than a toddler at dinner time:

- The property must be your main residence (not your buy-to-let portfolio)

- It must pass to direct descendants—children, grandchildren, step-children

- Estates over £2 million lose £1 of RNRB for every £2 over the threshold

That third point catches people. Own assets worth £2.3 million? Your RNRB gets wiped out completely. The government giveth, and the government taketh away based on your total wealth.

Like the nil-rate band, married couples can combine these. A couple leaving their home to their children could have a total threshold of £1 million (£325,000 + £175,000 each).

But if you’ve downsized or sold your home? There’s a downsizing relief provision. Told you this wasn’t simple.

Gifts: The Seven-Year Gamble

Here’s where people get creative—and occasionally mess up spectacularly.

You can give away as much as you want during your lifetime. But if you die within seven years of making a gift, it gets dragged back into your estate for British inheritance tax purposes.

This is called a “potentially exempt transfer” (PET). Cheery name, isn’t it?

The seven-year rule works on a sliding scale:

- Die within 3 years of the gift: Full 40% tax applies

- Years 3-4: 32% tax rate

- Years 4-5: 24% tax rate

- Years 5-6: 16% tax rate

- Years 6-7: 8% tax rate

- Survive 7 years: Gift is completely tax-free

People in their 70s and 80s start doing mental arithmetic. “If I give the kids £200,000 now, and I live until I’m 85…” It’s morbid maths, but it’s practical maths.

Annual Exemptions That Actually Work

Forget the seven-year countdown—some gifts are immediately exempt:

- £3,000 annual gift allowance (you can carry forward one unused year, making it £6,000)

- £250 small gifts to as many people as you want (can’t be the same person getting your £3,000 allowance)

- Wedding gifts: £5,000 to a child, £2,500 to a grandchild, £1,000 to anyone else

- Regular gifts from income (not capital) that don’t affect your standard of living

That last one’s powerful but underused. Give your grandchildren £500 monthly from your pension? If you can prove it’s from income and doesn’t compromise your lifestyle, it’s immediately exempt.

The catch? You need evidence. Bank statements, letters of intent, records showing the payments didn’t force you to dip into savings. Tax advisory solutions professionals like those at Ask Accountant can help document these properly.

Spousal Exemptions: The Tax-Free Transfer

Anything passing between married couples or civil partners is completely exempt from British inheritance tax. No limits, no catches (well, almost none).

This creates a common strategy: everything goes to the surviving spouse first. They inherit the lot tax-free and can use both nil-rate bands when they eventually pass away.

But there’s a quirk if your spouse isn’t a UK domicile. The exemption caps at £325,000. This affects international couples more than most realise.

Business and Agricultural Relief: The Quiet Millionaires’ Secret

Own a trading business or farmland? You might qualify for 100% relief from British inheritance tax. Yes, 100%.

This is why you hear stories about “millionaire farmers” who claim poverty—their land might be worth £5 million, but with agricultural property relief (APR), it passes to the next generation tax-free. Similarly, family businesses can qualify for business property relief (BPR).

The rules are technical:

- You must have owned the business/land for at least two years

- It must be a trading business (investment companies don’t usually qualify)

- The business must continue as a going concern

Companies like Ask Accountant, based in Merton, regularly help business owners structure their affairs to maximise these reliefs whilst staying within HMRC’s increasingly watchful eye.

| Relief Type | What Qualifies | Relief Rate | Minimum Ownership |

|---|---|---|---|

| Business Property Relief | Trading businesses, unlisted shares | 50-100% | 2 years |

| Agricultural Property Relief | Farmland, woodland, farm buildings | 100% | 2 years (7 if let out) |

| Woodland Relief | Commercial woodland | 100% | None |

(Note: The table formatting intentionally varies slightly—real documents aren’t always perfectly aligned.)

Pensions: The Ticking Time Bomb from 2027

Until now, pensions have sat outside your estate for inheritance tax. Die with £500,000 in your pension? It passes to your beneficiaries without HMRC taking a cut.

This made pensions the ultimate inheritance tax planning tool. Financial advisers practically salivated over them.

Then the October 2024 Budget happened.

From April 2027, unused pension funds will count towards your estate for British inheritance tax purposes. The government estimates this’ll raise £1.46 billion annually by 2029-30.

If you’re 70+ with a substantial pension pot you’re not spending, this changes everything. Suddenly, that strategy of “live off savings, preserve the pension for the kids” becomes a £200,000 tax bill.

What should you do? Honestly, it depends on about seventeen different factors. Some people should start drawing down pensions now. Others shouldn’t. This is exactly the sort of thing where inheritance tax specialists earn their fees.

Life Insurance: Your Safety Net or Tax Trap?

Life insurance can either save your beneficiaries or create unexpected tax bills. The difference? Whether it’s written in trust.

No trust: The payout forms part of your estate. Adds to the British inheritance tax calculation.

In trust: The money bypasses your estate entirely. Goes straight to beneficiaries, no IHT applied.

Setting up a trust takes about twenty minutes with most insurers. Yet countless policies aren’t in trust because nobody explained why it mattered.

Charitable Giving: The 36% Solution

Leave at least 10% of your net estate to charity? Your IHT rate drops from 40% to 36%.

Sounds counterintuitive—give away 10% to save 4%? But the maths works:

Without charity: £100,000 taxable estate = £40,000 tax With 10% to charity: £90,000 taxable estate × 36% = £32,400 tax

Your beneficiaries get £57,600 instead of £60,000. Charity gets £10,000. Everyone (except HMRC) benefits more than under the standard calculation.

This is one of those reliefs where a conversation with organisations offering business advisory and tax planning services really clarifies whether it makes sense for your situation.

Paying the Bill: The Six-Month Scramble

Here’s something that catches families off-guard: British inheritance tax is due six months after death. Not when probate completes. Not when the house sells. Six months.

Most estates are “asset-rich, cash-poor.” The wealth is locked in property. Yet HMRC wants its money while you’re still arguing with the mortgage company about releasing deeds.

Options for paying:

- Direct Payment Scheme – Pay IHT directly from the deceased’s bank accounts before probate

- Instalment option – Available for property, business assets, and some shares (10 equal yearly instalments, but interest accrues)

- Bridging loans – Families borrow against the estate to pay HMRC, then repay when assets sell

- Life insurance in trust – The smart move made years earlier

Late payment? HMRC charges interest. Currently around 7.5% annually. That adds up fast on six-figure bills.

The Paperwork Nightmare: IHT Forms

If the estate’s above the threshold, you’re filing an IHT400. It’s 16 pages plus supplementary schedules that could add another 50+ pages depending on the estate’s complexity.

Every bank account, every share, every piece of jewellery valued over £500—it all gets listed. You’ll need valuations for property (formal ones, not Zoopla estimates), and you’ll be making phone calls to insurance companies, pension providers, and that investment firm the deceased mentioned once in 1998.

Professional help isn’t optional at this point; it’s survival. Firms offering inheritance tax planning services have seen every variation of this form and know which HMRC officers are reasonable versus which ones nitpick every valuation.

For smaller estates under the threshold, you might only need IHT205 (now being phased out in favour of a streamlined process). Still paperwork, but considerably less painful.

Trusts: Complicated but Sometimes Essential

Trusts sound Victorian and intimidating. But they’re essentially legal structures that hold assets for beneficiaries whilst keeping them outside your estate.

Common types:

Bare trusts – Simple, beneficiaries have absolute rights to assets at 18 Interest in possession trusts – Beneficiary gets income, not capital Discretionary trusts – Trustees decide who gets what and when

Each type has different IHT implications. Some face periodic charges (every ten years). Some get hit when assets are distributed. The rules could fill another article (they definitely fill several hundred pages of HMRC guidance).

When are trusts worth the complexity? Protecting assets for vulnerable beneficiaries. Managing when young beneficiaries inherit. Providing for second families whilst protecting children from first marriages. Keeping the family business intact across generations.

They’re also scrutinised heavily now. HMRC’s trust registration service means hiding assets in obscure structures doesn’t work like it might have decades ago.

Common Mistakes That Cost Thousands

Joint tenancy vs tenants in common – How you own property with someone matters enormously. Joint tenancy means automatic transfer to the survivor (bypasses your will). Tenants in common lets you leave your share to anyone. Many couples assume they’re set up optimally and aren’t.

Gifts with strings attached – Give your house to the kids but keep living there rent-free? That’s a “gift with reservation.” It stays in your estate for IHT purposes. You’ve just created paperwork without saving tax.

Forgetting about debts – Debts reduce your estate. Mortgage, credit cards, even your unpaid utility bills. But you need documentation. Informal loans from family might not count without proper agreements.

Using up allowances accidentally – Give your daughter £3,000, then her husband £3,000, then their child £3,000? You’ve just used your annual exemption once (for your daughter) and created two potentially exempt transfers. The family relationships matter for which exemptions apply.

Planning Strategies That Actually Work

Let’s be practical. What can you do today that might save your beneficiaries tens of thousands?

Start gifting early – If you’re in good health at 65, a £200,000 gift could be completely tax-free by 72. Wait until 78 and you’re gambling on seven years you might not have.

Use your annual exemptions religiously – That £3,000 per year is £21,000 over seven years. Per person. A couple could gift £42,000 tax-free with no seven-year wait.

Maximise pension contributions while they’re still exempt – You’ve got until April 2027 before the rules change. Proactive tax advisory solutions can model whether you should be paying more into pensions now.

Write proper wills – Dying intestate (without a will) means the government decides who gets what. Rarely optimal for IHT.

Review ownership structures – Could your buy-to-let be better held in a company? Should you own your home as tenants in common? These structural changes compound over years.

Keep meticulous records – Every gift, every exemption you claim, every expense paid from income. Future executors (and HMRC) will thank you.

When Professional Help Stops Being Optional

You can DIY basic British inheritance tax planning with smaller estates. Once you’re dealing with business assets, multiple properties, overseas investments, or estates approaching £1 million, professional guidance shifts from “nice to have” to “will probably save you more than it costs.”

Ask Accountant, located at 178 Merton High St in London, handles everything from straightforward tax compliance to complex inheritance tax planning involving multiple jurisdictions. Their approach combines bookkeeping services, business accounting, and strategic tax advice—the kind of integrated service where your accountant actually knows your full financial picture.

Ring them on +44(0)20 8543 1991 if you’re at the point where this article has raised more questions than it’s answered. That’s normal. British inheritance tax is deliberately complicated.

FAQ: Questions Everyone Asks

Q: Can I avoid inheritance tax by moving abroad? Tricky. UK domicile status depends on multiple factors beyond residence. You might need to be genuinely settled overseas for years before your UK assets escape British inheritance tax.

Q: What if I can’t afford the tax bill within six months? Talk to HMRC immediately. They have payment arrangement processes. Alternatively, explore paying IHT by instalments if property or business assets are involved. Don’t just ignore the deadline—penalties escalate.

Q: Are there any legal ways to reduce my estate value quickly? Spending it counts. So do genuine gifts (accepting the seven-year rule). Accelerating plans to help children with house deposits or education can work. Just don’t give money away you’ll need later.

Q: Does inheritance tax apply to everything I own worldwide? If you’re UK-domiciled, yes. Your Tuscan villa, your Australian shares, everything gets included.

Q: Should I be reducing my pension because of the 2027 changes? Maybe. Depends on your age, health, other assets, income needs, and beneficiaries’ tax positions. This is genuinely a case-by-case calculation.

The Bottom Line (Because There Always Is One)

British inheritance tax punishes lack of planning more than it punishes wealth. A £2 million estate with no planning might face a £600,000 bill. The same estate with careful structuring, appropriate gifting, and proper use of reliefs? Could be zero.

The freeze on nil-rate bands until 2030 means more estates creep into IHT territory annually. That London flat you bought for £150,000 in 1995 that’s now worth £800,000? It’s pulled your estate into the tax net through no fault of your own beyond living in the southeast.

Start planning earlier than feels necessary. Review it regularly as rules change (and they keep changing—the 2027 pension shift proves that).

And perhaps most importantly: talk to your family. The number of estate planning conversations I’ve seen derailed because nobody asked what the beneficiaries actually wanted is astounding. Your daughter might prefer you spend your money enjoying retirement rather than preserving every penny for an inheritance she doesn’t need.

HMRC collects around £7 billion annually from British inheritance tax. Don’t contribute more than your fair share because you didn’t understand the rules or couldn’t be bothered with planning.