Here’s something that keeps tax advisors up at night: watching ordinary families hand over 40% of everything they’ve built to HMRC. Not because they haven’t worked hard. Not because they haven’t saved. But because they didn’t know the rules of a game nobody really explains properly.

I’m talking about Inheritance Tax – or IHT, as we call it in the trade. That quiet wealth-eater lurking in Britain’s tax code.

The odd thing? Most people (around 94%) won’t ever pay a penny. Yet for the remaining 6%, we’re looking at bills that can hit six figures. And here’s what really gets me: with a bit of forward thinking and some proper IHT tax planning, a huge chunk of that bill simply evaporates.

Let me walk you through this properly.

What Actually Happens When Someone Dies (The Tax Bit Nobody Talks About)

When someone passes away, there’s a peculiar dance that takes place. The executors tally up everything – the house, savings, that collection of first editions nobody knew about, the lot. Then they subtract the debts. What’s left is the “estate.”

Right now, if that estate exceeds £325,000, HMRC wants 40% of everything above that threshold. Forty percent! That’s not a rounding error; that’s a generational wealth transfer… to the Treasury.

But here’s where it gets interesting (and slightly bonkers): a married couple can effectively protect up to £1 million if they play their cards right. The standard £325,000 nil-rate band plus an additional £175,000 residence nil-rate band – if you’re leaving your home to direct descendants – doubles up between spouses.

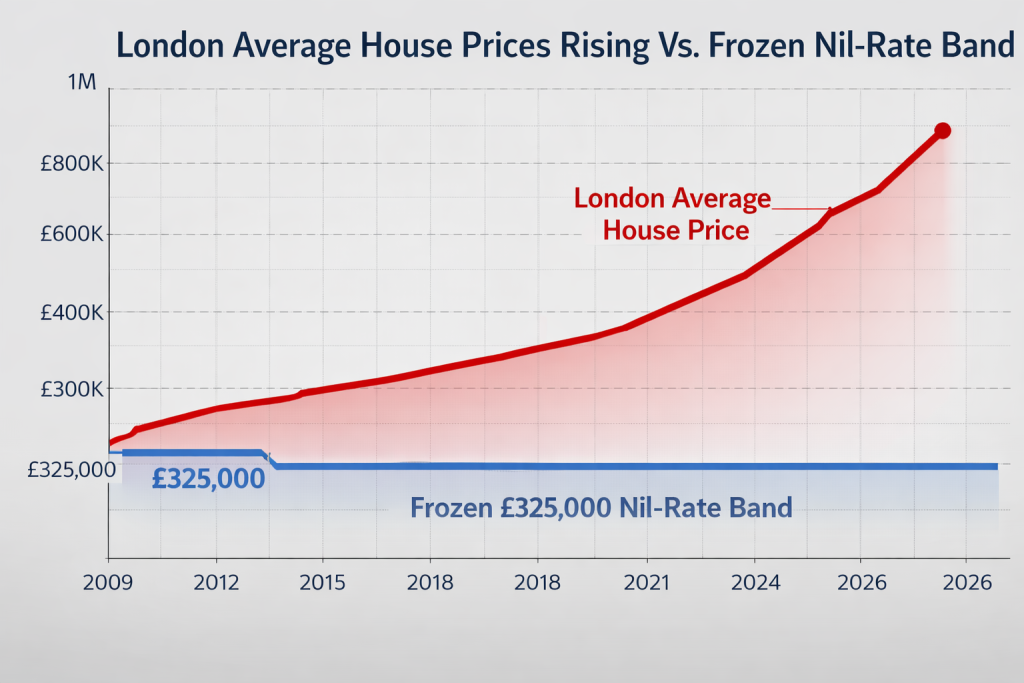

The problem? House prices in London and the South East have been climbing steadily whilst the nil-rate band has been frozen solid since 2009. It’s staying frozen until at least 2030. So every year, more families drift into IHT territory without doing anything except… existing.

The Pension Bombshell Nobody Saw Coming

For years, savvy planners used pensions as an IHT tax planning masterstroke. Pensions sat outside your estate. Completely. You could leave hundreds of thousands to your kids, tax-free, whilst HMRC couldn’t touch it.

That party’s ending in April 2027.

From that date, defined contribution pensions will be counted as part of your estate for IHT purposes. If you die before 75, your pension won’t automatically be tax-free anymore – it’ll be subject to the full 40% rate if it pushes you over the nil-rate band. Die after 75? You’re looking at both IHT and income tax on those pension funds.

This changes everything. The combination of IHT at 40% plus income tax could mean beneficiaries see less than half of what you’ve saved. Not exactly the legacy most people have in mind.

If you’ve got a substantial pension pot, this is your wake-up call. The strategies that worked brilliantly until yesterday might leave your family with a nasty surprise in 2027.

The Seven-Year Rule (And Why It’s More Complicated Than You Think)

Ask anyone about IHT tax planning and they’ll mention the seven-year rule. “Just give it away and live for seven years!” they’ll say cheerfully, as if longevity were simply a matter of diary management.

The rule itself is straightforward: gifts to individuals become completely exempt from IHT if you survive seven years after making them. These are called Potentially Exempt Transfers, or PETs in tax speak.

But die within those seven years? The gift gets added back to your estate for tax purposes.

Here’s the bit most people miss: if you die between three and seven years after making the gift, something called taper relief kicks in. The tax bill gradually reduces:

| Years Between Gift and Death | Tax Rate on Gift |

|---|---|

| Less than 3 years | 40% |

| 3–4 years | 32% |

| 4–5 years | 24% |

| 5–6 years | 16% |

| 6–7 years | 8% |

| 7+ years | 0% |

Important caveat: taper relief only applies to the tax on the value above the nil-rate band. And the gift recipient is the one who has to pay this tax, not the estate. Worth remembering before you gift your grandson £500,000 and then, well, life happens.

Also – and this catches people out regularly – you can’t give away your house, continue living in it rent-free, and call it a gift. That’s a “gift with reservation” and the seven-year rule doesn’t apply. If you want to gift your property and keep living there, you’ll need to pay proper market rent to the new owners.

The Annual Exemptions Everyone Forgets About

Whilst everyone obsesses over the seven-year rule, there are immediate, no-waiting-required exemptions that most people ignore:

£3,000 annual exemption: You can give away £3,000 per tax year, completely IHT-free. Don’t use it? You can carry forward one year’s unused allowance, letting you gift £6,000 in a single year. Both spouses can do this, so a couple could potentially gift £12,000 in one go.

£250 small gifts: You can give £250 to as many people as you like, every year. Can’t be the same person receiving the £3,000, mind you – HMRC isn’t that generous.

Wedding gifts: Getting married opens up a one-time window. Parents can gift £5,000 to their child, grandparents can give £2,500 to a grandchild, and anyone else can give £1,000 – all tax-free.

Normal expenditure out of income: This is the hidden gem. If you make regular gifts from your income (not your capital), and they don’t affect your standard of living, they’re immediately exempt. In theory, unlimited. But you’ll need to keep meticulous records to prove the pattern to HMRC.

Trusts: Not Just for the Ultra-Wealthy Anymore

The word “trust” makes people think of Downton Abbey and family estates spanning generations. But trusts are actually brilliant IHT tax planning tools for ordinary families.

Put assets into a trust, and after seven years, they’re typically out of your estate for IHT purposes. The trustees manage the assets for whoever you’ve named as beneficiaries. Your grandchildren could benefit from the trust without the assets counting towards your estate.

The catch? Trusts come with their own tax regime. There are periodic charges every 10 years (the anniversary charge) and exit charges when assets leave the trust. Plus, setting them up properly requires professional advice – mess it up and you could create more problems than you solve.

Different trusts suit different situations:

- Bare trusts give beneficiaries an absolute right to assets at 18

- Discretionary trusts let trustees decide who benefits and when

- Life interest trusts give someone the right to income or use during their lifetime, with the capital passing on later

Is it worth it? Depends entirely on your circumstances. But for estates likely to face a significant IHT bill, trusts often make sense.

The Life Insurance Shortcut

Here’s a thought that stops some people in their tracks: you can’t actually predict when you’ll die. (Shocking, I know.)

Which means all this careful IHT tax planning around seven-year rules and gift timing might not work out. So what do you do?

Life insurance written in trust. It’s beautifully simple: you take out a whole-of-life policy for roughly the amount of IHT your estate will face. When you die, the policy pays out – but because it’s written in trust, the payout doesn’t form part of your estate. Your beneficiaries get a lump sum that covers the tax bill.

The premiums need to be kept up-to-date (obviously), and you’ll want to review the sum assured periodically as your estate value changes. But it essentially buys peace of mind. Your family won’t need to scramble for cash or sell the house at a fire-sale price just to pay HMRC.

Business Property Relief and Agricultural Property Relief (While They Last)

If you own a business or farmland, you might qualify for some serious IHT tax relief. Business Property Relief (BPR) and Agricultural Property Relief (APR) can reduce IHT to zero on qualifying assets.

But – and there’s always a but – the rules changed from April 2026.

The first £1 million of qualifying business or agricultural property still gets 100% relief. Anything above that? You’ll only get 50% relief, meaning an effective IHT rate of 20% instead of 40%. Still better than nothing, but a significant change if you’re sitting on valuable farmland or a family business worth several million.

AIM shares used to be a clever way to get BPR, but relief on those is also dropping to 50% from April 2026. Given the volatility of smaller companies on the Alternative Investment Market, this route requires proper financial advice to weigh the investment risk against the potential tax saving.

The Charitable Giving Discount

Leave 10% or more of your net estate to charity in your will, and the IHT rate on the rest drops from 40% to 36%.

Does the maths work out in your family’s favour? Sometimes, yes. Let’s say you’ve got an estate of £1 million. Under normal circumstances, after deducting the £325,000 nil-rate band, you’re paying 40% on £675,000 – that’s £270,000 in tax, leaving £730,000 for your family.

Now leave 10% to charity (£67,500). Your taxable estate drops to £607,500, and you pay 36% on that – £218,700 in tax. Your family receives £713,800, plus charity gets £67,500. You’ve given away £67,500 but only reduced the family inheritance by about £16,000 whilst supporting causes you care about.

Not everyone’s cup of tea, but for those already planning charitable bequests, it’s worth understanding the mechanics.

What About the Residence Nil-Rate Band?

The residence nil-rate band (RNRB) adds up to £175,000 to your IHT-free allowance – but only if you’re leaving your home to direct descendants (children, grandchildren, step-children, adopted children).

Combined with the standard £325,000 nil-rate band, that’s potentially £500,000 per person, or £1 million for a married couple.

There’s a taper, though. If your estate exceeds £2 million, the RNRB reduces by £1 for every £2 over that threshold. By the time you hit £2.35 million, it’s gone completely.

And “downsizing relief” exists for those who’ve already sold a larger home. If you moved to something smaller or into care, you might still qualify for some RNRB. The rules are… let’s call them “intricate.”

The 2025 Domicile Changes (For Non-Doms)

If you’ve lived abroad or recently moved to the UK, pay attention. From April 2025, IHT liability shifted from being domicile-based to residence-based.

Live in the UK for 10 out of the last 20 years? You’re now a “long-term resident” and subject to IHT on your worldwide assets. Leave the UK? You’ll remain in the IHT net for up to 10 years after departure, depending on how long you were resident.

This massively affects anyone who previously claimed non-domiciled status to shelter overseas assets. If this is you, professional cross-border tax advice isn’t optional anymore.

Common IHT Planning Mistakes (That Cost Families Thousands)

After years helping clients with IHT tax planning, I’ve seen the same mistakes repeatedly:

1. Waiting too long to start planning The seven-year rule means you need time for gifts to become exempt. Starting in your 80s is risky. Starting in your 60s gives you options.

2. Not keeping records of gifts HMRC will want to see evidence of when gifts were made and to whom. Without records, proving exemptions becomes impossible.

3. Gifting away assets you’ll need Giving your house to your kids might seem clever until you need to fund care in later life. Never gift what you might need to live on.

4. Assuming everything transfers to your spouse tax-free It does – if they’re UK-domiciled. Non-UK domiciled spouses face a limit (currently £325,000). International families need specialist advice.

5. Forgetting to write a will Die without a will (intestate), and your assets are distributed by government rules, not your wishes. This can create unnecessary IHT liabilities and family disputes.

6. Holding life insurance policies personally A life insurance payout forms part of your estate unless it’s written in trust. Simple fix, massive difference.

How Much IHT Might You Actually Pay? (Quick Calculator)

Let me walk through a real example. Sarah’s estate comprises:

- House worth £600,000

- Savings and investments £250,000

- Personal possessions £50,000

- Total estate: £900,000

She’s a widow, so she’s inherited her late husband’s unused nil-rate band. Her total allowances:

- Standard nil-rate band: £325,000 (hers) + £325,000 (husband’s) = £650,000

- Residence nil-rate band: £175,000 (she’s leaving the house to her daughter)

- Total allowances: £825,000

Estate £900,000 minus allowances £825,000 = £75,000 taxable at 40%

IHT bill: £30,000

Not ruinous, but still thirty grand that could’ve gone to her daughter. With proper IHT tax planning – perhaps gifting some savings early, using her annual exemptions, or setting up a life insurance policy in trust – that bill could be reduced or eliminated entirely.

What Changes Might Be Coming?

The seven-year rule itself is under scrutiny. Treasury officials have floated ideas about immediate taxation on gifts above a certain annual allowance. Business and agricultural reliefs have already been capped. The nil-rate bands are frozen until 2030, meaning inflation and house price growth will drag more families into the IHT net each year.

Will the rules change further? Probably. IHT generates over £7 billion annually for the Exchequer now, heading toward £10 billion by 2030. That’s serious money. With public finances under pressure, governments look at existing reliefs and think, “Could we tighten those?”

Which means if you’re considering significant gifts or restructuring your estate, waiting might cost you. The current rules – even with recent changes – still offer substantial opportunities for effective IHT tax planning.

Getting Professional Help (When DIY Won’t Cut It)

Look, I’ll be straight with you: simple estates with modest values often don’t need expensive professional advice. Use your annual exemptions, make some gifts, write a will. Job done.

But if your estate’s heading north of £500,000, involves business assets, foreign property, trusts, or complex family arrangements, you need proper advice. The costs of getting it wrong dwarf the cost of getting it right.

| Your Situation | DIY or Professional? |

|---|---|

| Estate under £325,000, simple assets | DIY (write a will, use annual exemptions) |

| Estate £325,000–£500,000 | Professional will-writing, basic IHT planning |

| Estate £500,000–£1 million | Definitely professional advice (gifting strategies, trusts, life insurance) |

| Estate over £1 million or complex assets | Specialist IHT tax planning essential |

| Business owners / farmers | Specialist advice on BPR/APR reliefs |

| International assets / non-UK domicile | Cross-border tax specialists only |

Here at Ask Accountant, we work with families across London and beyond on exactly these issues. IHT tax planning, estate structuring, business succession – it’s what we do day in, day out. Not because we love forms and tax codes (though some of us genuinely do), but because getting this right means families keep more of what they’ve built.

Sometimes that means creative solutions. Sometimes it means simply explaining the rules properly so you can make informed decisions. Either way, the conversation starts with understanding where you are and where you want to be.

Start Now (Even If You Think You’ve Got Time)

The biggest advantage in IHT tax planning is time. The seven-year rule rewards early movers. Regular gifting builds up over years. Trusts need time to work their magic. Life insurance premiums are cheaper when you’re younger.

I’ve lost count of the families who come to us in their late 70s or 80s, suddenly realising their estate faces a massive IHT bill, and the window for effective planning has largely closed. It’s not impossible to help, but the options are far more limited.

Start the conversation in your 60s (or earlier), and you’ve got options. Lots of them. Wait until your 80s, and you’re mostly hoping to survive seven years whilst wrapping up loose ends.

Final Thoughts

IHT tax planning isn’t about dodging your responsibilities or finding dodgy loopholes. It’s about understanding the rules Parliament has created and using them intelligently to protect what you’ve spent a lifetime building.

The rules exist because Parliament wants to encourage certain behaviours – supporting charities, passing on family businesses, planning ahead. So use them. That’s not evasion; it’s common sense.

And if you’re sitting there thinking, “I really should sort this out but I’ll do it next year,” remember: next year, your estate might be worth more, the rules might be tighter, and you’ve lost 12 months of the seven-year clock.

The best time to start IHT tax planning was ten years ago. The second-best time is today.

If you’d like to discuss your specific situation, the team at Ask Accountant in Wimbledon (we’re at 178 Merton High St, London SW19 1AY, or you can ring us on 020 8543 1991) can walk you through what makes sense for your circumstances. We work with individuals and families on inheritance tax planning, estate structuring, and making sure more of your hard-earned wealth stays in the family.

Because, at the end of the day, that’s what this is really about: looking after the people you love, even after you’re gone.

Frequently Asked Questions

Q: Do I need to pay IHT if I inherit from my spouse? A: No. Assets left to your UK-domiciled spouse or civil partner are completely exempt from IHT. Plus, any unused nil-rate band transfers to the surviving spouse, effectively doubling their allowance to £650,000 (or £1 million including residence nil-rate bands).

Q: Can I avoid IHT by putting everything in my children’s names? A: Technically possible, but risky. You lose control of the assets, your children’s creditors could claim them, and if they divorce, the assets might be split. Plus, if you die within seven years, the gifts are still caught by IHT. Better to explore trusts, life insurance, and structured gifting.

Q: What happens to my pension after the 2027 changes? A: From April 2027, unused defined contribution pensions will be included in your estate for IHT purposes. This means a pension worth £500,000 could face a £200,000 tax bill (40%) if it pushes you over the nil-rate band. Planning is essential.

Q: Is it too late to do IHT tax planning if I’m already 75? A: Not at all. Whilst time is more limited, there are still valuable strategies: maximise annual exemptions, set up life insurance in trust, make gifts (even if within seven years, taper relief helps), review your will, and consider whether trusts make sense. Start now rather than putting it off further.

Q: How much does IHT tax planning cost? A: Depends entirely on complexity. Simple will-writing might cost £200-£500. Comprehensive IHT planning with trusts and restructuring could run £2,000-£5,000+. But if it saves your family £50,000, £100,000, or more in IHT, that’s money well spent.

Q: Can I gift my house to my children and still live in it? A: Only if you pay market-rate rent to them. Otherwise, it’s a “gift with reservation” and remains in your estate for IHT purposes. The rules are strict on this – HMRC knows it’s a common attempted workaround.

Q: What’s the difference between domicile and residence for IHT? A: Until April 2025, IHT was based on domicile (essentially, where you consider your permanent home). From April 2025, it’s based on residence – if you’ve been UK resident for 10 of the last 20 years, you’re subject to IHT on worldwide assets. This mainly affects former non-doms and international families.

Q: Do I need a solicitor or an accountant for IHT planning? A: Often both. Solicitors handle wills, trusts, and legal structures. Accountants specialise in tax planning, calculations, and financial strategies. For complex estates, a coordinated approach between legal and tax professionals delivers the best results. Here at Ask Accountant, we work alongside trusted legal professionals to provide comprehensive planning.