Here’s a confession: if you’ve been Googling “inherent tax” in a panic at 2am because someone mentioned it at a dinner party and you nodded along knowingly—you’re not alone. Plot twist? There’s no such thing as inherent tax. But there’s absolutely such a thing as inheritance tax, and that’s what people actually mean when they fumble the terminology.

So let’s clear this up straightaway. The term “inherent tax” doesn’t exist in UK tax law. What does exist (and what might cost your loved ones up to 40% of your estate) is inheritance tax. Think of it as the government’s way of taking a slice before your beneficiaries get their hands on what you’ve left behind.

Why does this confusion happen? Probably because “inherent” sounds official and tax-y, and let’s face it, most of us would rather watch paint dry than read HMRC guidance. But understanding inheritance tax isn’t optional if you want to protect your family’s financial future. Let me walk you through what actually matters.

What Actually Is Inheritance Tax?

Picture this: your aunt Beryl passes away, leaving behind a house in Surrey worth £450,000 and some savings. Her estate gets valued, debts get deducted, and then—boom—HMRC wants 40% of everything above £325,000. That’s inheritance tax in action.

Inheritance tax (often shortened to IHT) is a levy on your estate when you die. Your “estate” means everything you own: property, savings, investments, even that vintage record collection gathering dust. The UK government taxes estates valued above the nil-rate band threshold of £325,000 at a whopping 40%. Ouch.

But here’s where it gets messier than a toddler’s birthday party: the term “inheritance tax” is technically a misnomer. In most countries, an inheritance tax is paid by the person receiving the inheritance. An estate tax, by contrast, is paid by the deceased’s estate before distribution. The UK calls its system “inheritance tax,” but it actually functions as an estate tax. Confusing? Absolutely. Welcome to British tax policy.

Important distinction: In the UK, the estate pays the tax before beneficiaries receive anything. You don’t personally write a cheque to HMRC for your inheritance (unless it’s from certain lifetime gifts). The executor sorts it out using estate funds.

The “Inherent” Confusion: Why This Mistake Matters

When people search for “inherent tax,” they’re usually panicking about the wrong thing. The word “inherent” means something that’s a natural or permanent characteristic—like the inherent risk of investing in cryptocurrency, or the inherent chaos of assembling IKEA furniture.

In tax conversations, you might hear phrases like “the inherent power of taxation” (meaning the government’s fundamental right to collect taxes) but that’s constitutional waffle, not a specific tax you’ll ever pay. What you will encounter is inheritance tax, which has nothing inherent about it—it’s entirely legislated, threshold-dependent, and frankly, quite avoidable with proper planning.

So if someone mentions “inherent tax” in relation to estates or wills, politely redirect them. Or don’t—let them continue sounding confused whilst you quietly sort out your own affairs properly.

How Does Inheritance Tax Work in Practice?

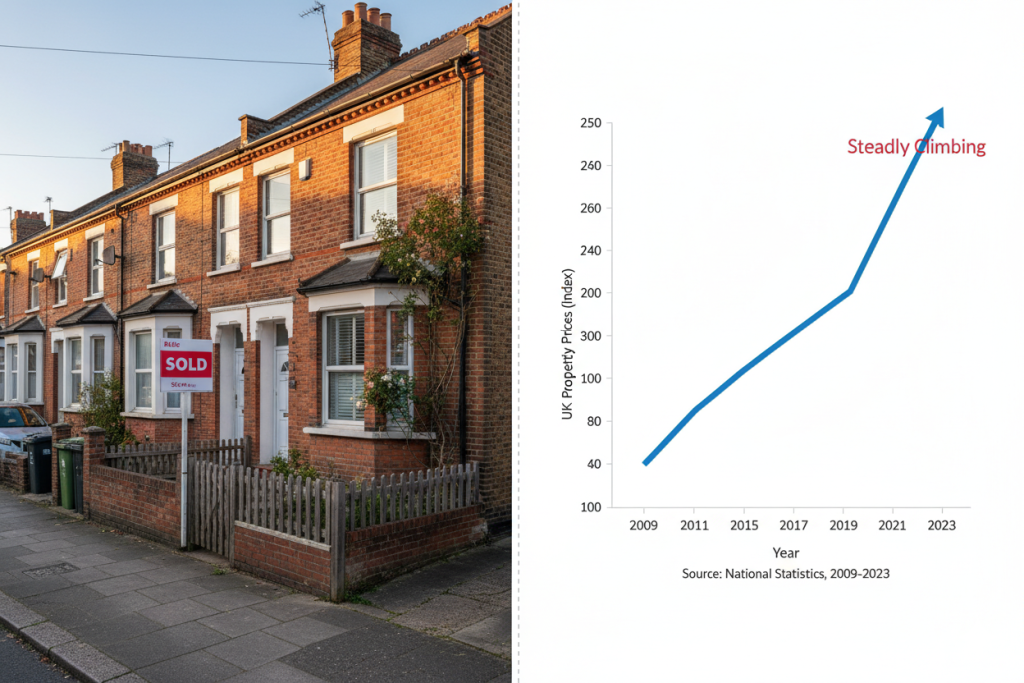

Right, let’s get tactical. Inheritance tax kicks in when your estate exceeds £325,000 (the nil-rate band). That threshold hasn’t budged since 2009—frozen tighter than a Londoner’s response to small talk on the Tube—and it’s staying frozen until at least 2027/28.

The Basic Calculation

Here’s a stripped-down example:

- Estate value: £500,000

- Nil-rate band: £325,000

- Taxable amount: £175,000

- Tax at 40%: £70,000

Your beneficiaries receive £430,000 after tax. HMRC gets £70,000. That’s enough to make anyone’s stomach churn, but wait—there are ways around this.

The Residence Nil-Rate Band

If you’re passing your home to direct descendants (children, grandchildren—not your mate Steve), you might qualify for an additional £175,000 allowance called the residence nil-rate band. This potentially takes your total threshold to £500,000. For married couples who can combine allowances? That’s a cool £1 million before inheritance tax bites.

But here’s the catch (there’s always a catch): this extra allowance tapers away if your estate exceeds £2 million. For every £2 over that threshold, you lose £1 of the residence allowance. The super-wealthy get penalised—whether that’s fair depends on your political leanings and probably how many properties you own.

| Scenario | Nil-Rate Band | Residence NRB | Total Tax-Free |

|---|---|---|---|

| Single person, no property | £325,000 | £0 | £325,000 |

| Single person, home to children | £325,000 | £175,000 | £500,000 |

| Married couple, no property | £650,000 | £0 | £650,000 |

| Married couple, home to children | £650,000 | £350,000 | £1,000,000 |

| Estate over £2m (single) | £325,000 | Reduced/£0 | Variable |

The Seven-Year Rule and Lifetime Gifts

Think you can dodge inheritance tax by giving everything away before you die? Not so fast. HMRC thought of that decades ago.

Gifts made within seven years of death may still be taxed. These are called “potentially exempt transfers” (PETs)—which sounds like something from a vet’s office but is actually quite serious. If you gift £400,000 to your daughter and then unfortunately pass away four years later, that gift could be taxed.

There’s a sliding scale though (taper relief):

| Years Before Death | Tax Rate on Gift |

|---|---|

| 0-3 years | 40% |

| 3-4 years | 32% |

| 4-5 years | 24% |

| 5-6 years | 16% |

| 6-7 years | 8% |

| 7+ years | 0% |

Survive seven years after making the gift, and it’s completely inheritance tax-free. Morbid? Perhaps. Effective? Absolutely.

Small Gifts That Don’t Count

HMRC isn’t entirely heartless. You can give away:

- £3,000 per year (the annual exemption—you can roll one unused year forward)

- £250 to as many people as you want (as long as you haven’t used another exemption for them)

- Wedding gifts up to £5,000 to children, £2,500 to grandchildren, £1,000 to anyone else

- Regular gifts from income (not capital) that don’t affect your standard of living

These exemptions mean you can start planning early without triggering the seven-year countdown. Smart estate planning isn’t just for the wealthy—it’s for anyone who’d rather not hand 40% to the taxman unnecessarily.

Pro tip: Keep meticulous records of all gifts. If you’re giving regular payments from income (rent, dividends, pension), document that it’s truly surplus to your needs. HMRC will scrutinise this if challenged.

Who Actually Pays Inheritance Tax?

Short answer: the estate. Specifically, the executor or administrator handles it.

When someone dies, their executor (named in the will) or administrator (if there’s no will) must:

- Value the entire estate

- Calculate whether inheritance tax is due

- Submit the relevant forms to HMRC

- Pay the tax (usually within six months of death)

- Then distribute what’s left to beneficiaries

The tax comes out of the estate’s funds before anyone inherits a penny. If there’s not enough liquid cash (common when estates are property-heavy), executors might need to sell assets or arrange payment by instalments for property.

Beneficiaries generally don’t pay inheritance tax directly, but they might face it indirectly if they’ve received lifetime gifts within the seven-year window. In those cases, they become responsible for the tax on the gift. Fun times.

Common Exemptions and Reliefs

Not everything in your estate gets taxed. Some assets benefit from exemptions or reliefs that can dramatically reduce the bill.

Spousal Exemption

Transfers between UK-domiciled spouses or civil partners are completely exempt from inheritance tax. Unlimited. Pass your entire £50 million estate to your spouse, and there’s zero tax. (Though the tax just gets deferred until they die, unless they spend it all on cruises and Fortnum & Mason hampers.)

Charitable Donations

Leave at least 10% of your net estate to charity, and the inheritance tax rate on the rest drops from 40% to 36%. It’s one of the few instances where giving money away actually saves money.

Business Relief

Own a trading business or shares in an unlisted company? Business Property Relief (BPR) can reduce the taxable value by 50% or even 100%, depending on the asset type. This is massive for family businesses—you can potentially pass on a £2 million company inheritance tax-free.

Agricultural Property Relief (APR) works similarly for farmland and related property. Farmers have been particularly vocal about recent proposed changes to these reliefs, and rightly so—without APR, family farms could be carved up to pay tax bills.

Warning: Business and agricultural reliefs have strict qualifying conditions. Don’t assume your Ltd company or smallholding automatically qualifies. Get professional advice, or risk an unpleasant surprise.

Inheritance Tax Planning: Strategies That Work

Planning isn’t about cheating the system; it’s about legally minimising a tax that can otherwise decimate family wealth. Here are tactics that actually work (not the dodgy offshore schemes your cousin’s friend mentioned at Christmas).

Start Gifting Early

The seven-year rule means time is your friend. Gift property, cash, or investments to your children in your 60s rather than your 80s, and you’re more likely to outlive the seven-year window. Morbid mathematics, but effective.

Use Trusts Wisely

Trusts can remove assets from your estate whilst retaining some control. Bare trusts, interest in possession trusts, discretionary trusts—each has different inheritance tax implications. They’re complex, often expensive to set up, but potentially worth it for larger estates.

Life Insurance in Trust

A whole-of-life policy written in trust can provide a lump sum to beneficiaries that sits outside your estate. This can give your family the liquidity to pay inheritance tax bills without having to sell the family home. It’s not glamorous, but it works.

Pensions: The Overlooked Tool

Most pension schemes sit outside your estate for inheritance tax purposes. Defined contribution pensions can typically be passed on tax-free if you die before 75 (though beneficiaries pay income tax if you’re over 75). This makes pensions a surprisingly powerful inheritance planning vehicle.

Rather than drawing down your pension in retirement, consider living off other assets and leaving the pension to grow tax-efficiently for your beneficiaries. Counterintuitive but potentially brilliant.

The Inheritance Tax Debate: Should It Exist?

Here’s where I get slightly philosophical (bear with me). Inheritance tax is wildly unpopular. Polling consistently shows it’s Britain’s most hated tax, despite affecting less than 5% of estates. Why?

Critics call it “double taxation”—you earned money, paid income tax, saved it, and now the government wants another bite. They argue it’s unfair, hits the middle class hardest (the wealthy have accountants and trusts), and punishes thrift.

Defenders counter that inheritance tax promotes meritocracy. Without it, wealth concentrates in dynasties, and children of the rich start life on third base whilst everyone else scrambles for a chance to bat. It’s about levelling—or at least slightly tilting—the playing field.

The truth? Both sides have points. What’s undeniable is that the current system is riddled with loopholes, reliefs that mainly benefit the ultra-wealthy, and freezing thresholds that drag more “ordinary” families into the net each year. Reform is overdue, but whether that means abolition or overhaul depends on who you ask.

For now, it exists. You need to deal with it.

Mistakes People Make (And How to Avoid Them)

Let me save you from the howlers I’ve seen over the years:

Assuming you’re below the threshold. With UK house prices, especially in the South East, middle-income families can easily breach £325,000. Add a pension, some savings, and that vintage car collection, and suddenly you’re in taxable territory. Get your estate valued properly.

Not telling anyone about gifts. You gave your son £50,000 five years ago? Great, but did you document it? If you die tomorrow, HMRC will want records. Keep a gift log. Boring, essential.

Thinking your will reduces inheritance tax. Your will determines who gets what, not how much tax is paid. You need lifetime planning, not just a well-drafted will.

Ignoring spouse allowances. If your spouse dies without using their full nil-rate band, you can claim it. But you need to apply for it—it’s not automatic. Executors: don’t miss this.

Giving away your home then living in it rent-free. HMRC’s “gift with reservation of benefit” rules will catch this. If you gift your house to your kids but continue living there without paying market rent, it stays in your estate. Nice try though.

When to Get Professional Help

DIY inheritance tax planning is possible for simple estates. HMRC provides forms, guidance, and helplines. But if your estate includes business assets, multiple properties, overseas assets, or complex family structures (second marriages, stepchildren, estranged relatives), you need professional advice.

An accountant or tax adviser can help you legitimately reduce your inheritance tax liability through trusts, lifetime gifts, business relief planning, and more. The cost of advice is almost always less than the tax you’ll save.

Need Help with Inheritance Tax Planning?

At Ask Accountant, we’ve helped countless families in London navigate the complexities of inheritance tax. Whether you’re planning your own estate or dealing with a loved one’s affairs, our experienced team can provide the tax advisory solutions you need.

We offer comprehensive services including inheritance tax planning, business advice, and proactive tax advisory solutions tailored to your situation. Based in Merton, we serve clients across South West London and beyond.

📍 178 Merton High St, London SW19 1AY

📞 +44(0)20 8543 1991

Don’t let 40% of your estate vanish unnecessarily. Get in touch for a no-obligation chat about your options.

Frequently Asked Questions

What’s the difference between inherent tax and inheritance tax?

There is no such thing as “inherent tax” in UK tax law. The correct term is inheritance tax, which is a 40% levy on estates valued above £325,000. The confusion likely stems from the similar-sounding words, but inheritance tax is the only relevant tax when it comes to estates and bequests.

Do I have to pay inheritance tax if I inherit a house?

Not directly—inheritance tax is paid by the estate before distribution. However, if the total estate (including the house) exceeds the nil-rate band, tax will be deducted from the estate’s value before you receive anything. If the house is passed to children or grandchildren, the residence nil-rate band might increase the tax-free threshold to £500,000 (or £1 million for married couples).

Can I avoid inheritance tax by giving everything away?

Partially. Gifts made more than seven years before death are typically inheritance tax-free. However, gifts within the seven-year window may still be taxed on a sliding scale. You can also use annual exemptions (£3,000 per year) and make small gifts (£250 per person) without triggering the seven-year rule.

Is inheritance tax the same as estate tax?

Technically, no—though the UK confusingly calls its system inheritance tax when it actually functions as an estate tax. In tax terminology, an estate tax is paid by the deceased’s estate before distribution, whilst an inheritance tax is paid by the recipient. The UK’s “inheritance tax” is paid by the estate, making it technically an estate tax by international standards.

How long does it take to sort out inheritance tax?

Inheritance tax must typically be paid within six months of death, though the estate administration process can take 9-12 months or longer for complex estates. Executors usually need to pay the tax before probate is granted, which can create cash flow challenges if the estate is property-heavy.

Does everyone have to pay inheritance tax?

No. Currently, fewer than 5% of UK estates pay inheritance tax, though this proportion is rising due to frozen thresholds and increasing property values. If your estate is below £325,000 (or up to £1 million for married couples with property passed to children), no inheritance tax is due.

Final Thoughts: Plan Now, Save Later

Look, inheritance tax isn’t going anywhere. The government needs the revenue (currently around £7 billion annually), and despite its unpopularity, there’s no political consensus on scrapping it.

What you can control is how much of your estate actually gets taxed. Start planning early, use available exemptions, consider lifetime gifting, and for anything remotely complex, get professional advice. Your beneficiaries will thank you—probably whilst on a nice holiday funded by the tax you saved them.

And next time someone mentions “inherent tax” at a dinner party? You can now politely correct them whilst simultaneously sounding unbearably smug. You’re welcome.