Right, let’s address the elephant in the room straightaway: there’s technically no such thing as “succession tax” in the UK. Not officially, anyway. What we’re actually talking about when someone mentions succession tax is Inheritance Tax (IHT) – though you’ll occasionally hear old-timers refer to it as “death duty,” which sounds properly Victorian but hasn’t been the legal term since 1986.

Why does this matter? Because if you’ve been googling “succession tax” frantically after hearing about it down the pub or reading something vague on social media, you need to know you’re looking at the same beast that takes a 40% bite out of estates worth more than £325,000. And that bite just got sharper with the massive changes rolling out from April 2025 and 2026.

The terminology confusion isn’t entirely random. In some countries, succession tax refers to what heirs pay when they inherit (like France’s droits de succession), whilst others use estate tax to describe what’s levied on the deceased’s assets. The UK’s system is technically an estate tax masquerading under the “inheritance tax” label – but honestly, most people just want to know how much HMRC will claim when someone dies.

What Actually Happens When Someone Dies (The Tax Bit Nobody Wants to Think About)

Here’s the reality check: when you die, your “estate” – everything you own, from your house to that collection of rare vinyl you’ve been accumulating – gets valued. If it’s worth more than £325,000 (the nil-rate band), everything above that threshold gets taxed at 40%.

Unless.

And there are quite a few “unlesses” that we’ll get to. But first, let me paint you a scenario I see repeatedly at Ask Accountant. A client comes in, genuinely shocked that their modest three-bedroom semi in South London has pushed their estate over the threshold. “I’m not wealthy,” they’ll say. No – but you’re property-rich, and HMRC doesn’t distinguish.

Critical point: The £325,000 threshold has been frozen until 2030. With property prices climbing and inflation doing its thing, thousands more families are being dragged into paying succession tax who never thought they’d be affected. This is called fiscal drag, and it’s sneaky.

The Residence Nil-Rate Band (Your Property Lifeline)

There’s an additional allowance worth £175,000 if you’re passing your home to direct descendants – children, grandchildren, or even step-children count. This residence nil-rate band (RNRB) brings your total tax-free allowance to £500,000. For married couples or civil partners, you can combine these allowances, potentially protecting up to £1 million.

But (there’s always a “but”) this starts tapering away if your estate exceeds £2 million. For every £2 over that threshold, you lose £1 of your RNRB. Annoying? Absolutely.

The Seismic Changes Coming in 2025 and 2026

If you thought you’d got your head around succession tax, I’ve got news. The rules are changing dramatically, and some of these shifts will fundamentally alter how wealth passes between generations in the UK.

April 2025: The End of Domicile (Sort Of)

The UK has ditched the domicile-based system for succession tax and replaced it with a residence-based one. What does this mean? Previously, non-UK domiciled individuals (non-doms) only paid succession tax on UK assets. Now, if you’ve been UK resident for 10 out of the past 20 years, your worldwide assets fall into HMRC’s net.

The “tail provision” is particularly vicious: even after leaving the UK, you’ll remain liable for succession tax on worldwide assets for up to 10 years, provided you hit that 10-year residency threshold whilst here.

| Years of UK Residence | Tax Scope | Post-Departure Tail |

|---|---|---|

| Less than 10 in past 20 years | UK assets only | None |

| 10+ years in past 20 years | Worldwide assets | 10 years after leaving UK |

| Previously deemed-domiciled (left before April 2025) | Subject to old 3-year tail | 3 years (transitional rule) |

April 2026: The £1 Million Relief Cap That’s Caused Uproar

Business Property Relief (BPR) and Agricultural Property Relief (APR) have long been succession tax’s safety valves. They’ve allowed family businesses and farms to pass between generations without being destroyed by tax bills.

From 6 April 2026, that changes. The 100% relief will be capped at £1 million of combined business and agricultural assets. Anything above gets only 50% relief, meaning an effective succession tax rate of 20% on the excess.

I won’t sugarcoat this: it’s catastrophic for some families. A £3 million farm that would have previously passed tax-free? Now faces a £400,000 tax bill. Where’s that money supposed to come from? Many farms are asset-rich but cash-poor.

Planning opportunity: If you have qualifying business or agricultural assets worth over £1 million, you’ve got a shrinking window to consider lifetime gifting strategies. But be warned – if you die within seven years of making the gift, it can still be caught. And there’s Capital Gains Tax to consider too. This isn’t DIY territory.

How Succession Tax Actually Gets Calculated (With Real Numbers)

Let’s work through an example because abstract numbers are useless.

Margaret dies in 2026. She’s widowed, so she inherited her late husband’s unused nil-rate band. Her estate:

- Family home: £650,000 (passing to her daughter)

- Savings and investments: £200,000

- Personal possessions: £50,000

- Total estate: £900,000

Here’s the calculation:

- Combined nil-rate band (Margaret + late husband’s): £650,000

- Combined residence nil-rate band: £350,000

- Total tax-free: £1,000,000

Margaret’s £900,000 estate? Entirely tax-free. Her daughter inherits everything without paying a penny in succession tax.

Now let’s tweak it. Same scenario, but Margaret’s house is worth £850,000 (not unrealistic in parts of London). Total estate: £1,100,000.

Taxable amount: £1,100,000 – £1,000,000 = £100,000

Succession tax due: £40,000

That £40,000 has to be paid before the estate can be distributed. Usually within six months of death, or HMRC starts charging interest.

Gifting Your Way Out of Succession Tax (The Seven-Year Itch)

One of the most powerful succession tax planning tools? Give it away before you die.

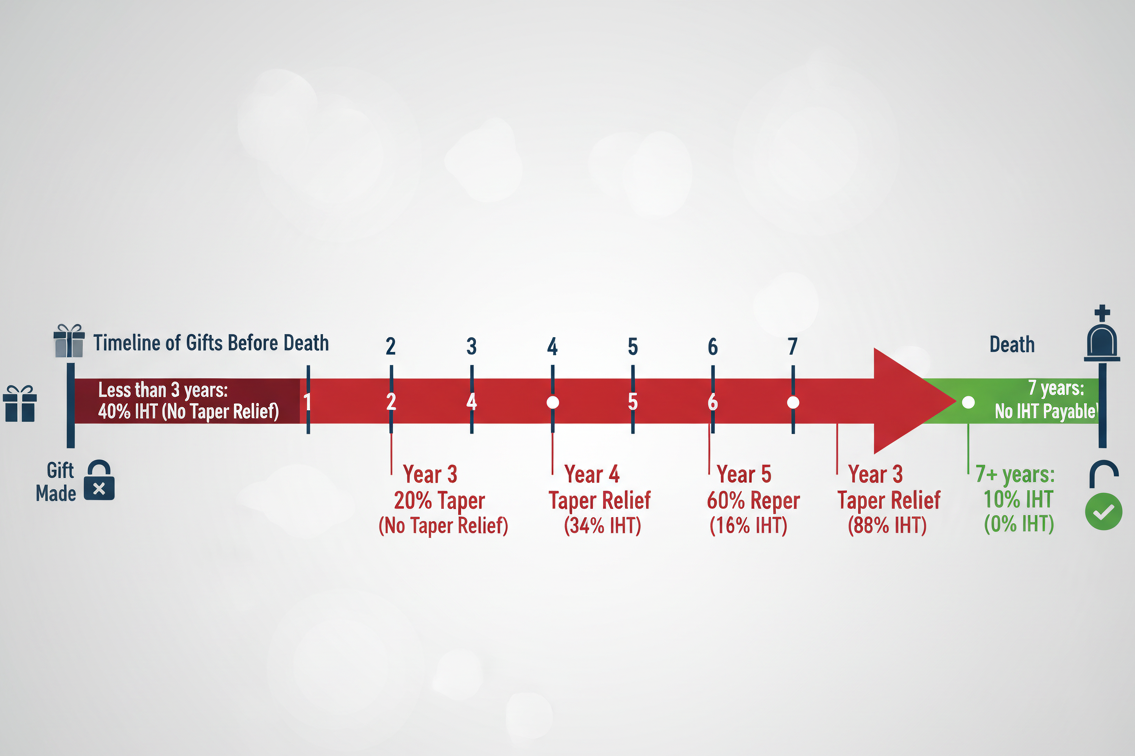

Gifts to individuals are “potentially exempt transfers” (PETs). If you survive seven years after making the gift, it escapes succession tax entirely. Die within those seven years, and it gets dragged back into your estate – though there’s taper relief if you make it past year three:

| Years Between Gift and Death | Tax Rate on Gift |

|---|---|

| Less than 3 years | 40% |

| 3-4 years | 32% |

| 4-5 years | 24% |

| 5-6 years | 16% |

| 6-7 years | 8% |

| 7+ years | 0% |

But here’s where people trip up: gifts with reservation. You can’t give away your house but continue living in it rent-free. That’s a gift with reservation, and it doesn’t work for succession tax purposes. HMRC isn’t unaware.

You can give away £3,000 each tax year (your annual exemption), plus unlimited amounts from surplus income, plus £250 to as many people as you fancy, plus wedding gifts up to certain limits. These are immediately exempt.

What About Trusts? (They’re Not Dead Yet)

Trusts have been succession tax planning’s Swiss Army knife for decades. But the changes from April 2025 have complicated matters for those with international assets.

Previously, non-UK domiciled individuals could settle non-UK assets into “excluded property trusts” (EPTs) that sat outside the succession tax net. From April 2025, if the settlor is a long-term UK resident (that 10-year test again), those assets become liable.

For UK-based assets and UK-domiciled settlors, trusts still work – but they come with their own succession tax charges. When you put assets into most trusts, there’s an immediate 20% charge if you exceed your nil-rate band. Then there are 10-yearly “anniversary charges” and exit charges when assets leave the trust.

Sounds complicated? It is. Which is why trust planning needs professional advice, not internet guides.

Business Owners: Your Succession Tax Survival Guide

If you own a trading business or shares in one, Business Property Relief has historically been your get-out-of-jail card. That £1 million cap from April 2026 changes everything.

Let’s say you’ve built a manufacturing business now worth £3 million. Under the old rules, 100% BPR meant zero succession tax on that business passing to your children. Under the new rules:

- First £1 million: 100% relief (£0 tax)

- Remaining £2 million: 50% relief (£1 million taxable)

- Succession tax bill: £400,000

Unless your business has £400,000 in readily available cash, that means either borrowing or selling assets to pay HMRC. Some businesses won’t survive it.

Harsh reality: We’re already seeing business owners accelerating succession plans, gifting shares to the next generation now to start that seven-year clock. But that triggers its own issues around control, Capital Gains Tax (though holdover relief can help), and whether the next generation is actually ready. Family governance matters have never been more important.

Planning Steps for Business Owners

- Value your business accurately. Don’t guess. Professional valuation matters because it affects every subsequent decision.

- Consider lifetime gifting of shares above the £1 million threshold that’ll receive relief. But involve lawyers for proper shareholder agreements.

- Review life insurance. A whole-of-life policy written in trust can provide liquidity to pay succession tax without selling business assets. The premiums might hurt, but they’re cheaper than losing the business.

- Don’t forget EMI schemes. Enterprise Management Incentives can be succession tax-efficient ways to transfer value to key employees.

- Shareholder agreements need reviewing. Especially clauses around pre-emption rights and what happens on death.

Pensions: The Succession Tax Bombshell Arriving in 2027

Currently, undrawn pension funds sit outside your estate for succession tax. It’s one of the most tax-efficient places to stash wealth for passing to the next generation.

From April 2027, that ends. Undrawn pensions and death benefits will be pulled into your estate for succession tax calculations.

This changes everything about pension planning. Drawing down vs leaving untouched, who to nominate as beneficiaries, whether to crystallise – all these decisions now need rethinking through a succession tax lens.

Common Succession Tax Mistakes (That Cost Thousands)

1. Assuming “it won’t apply to me”

With house prices where they are, ordinary families are hitting succession tax thresholds. Check. Don’t assume.

2. DIY gifting without advice

Especially with property or business assets. The Capital Gains Tax implications alone can be brutal. And if you structure it wrong, you might not even achieve succession tax savings.

3. Forgetting about joint assets

Only the deceased’s share of jointly owned assets gets included in their estate. But the way joint ownership is structured (joint tenants vs tenants in common) massively affects succession tax planning.

4. Leaving everything to your spouse

The spouse exemption means no succession tax on death one. Great! But it can mean losing the first person’s nil-rate band if not properly structured.

5. Not updating your will

That will you made in 1995? Probably doesn’t reflect current succession tax rules, let alone the incoming changes.

How to Report and Pay Succession Tax

When someone dies, the executor (or administrator if there’s no will) needs to:

- Value the entire estate within six months

- Complete the relevant HMRC forms – usually IHT400 for taxable estates

- Pay any succession tax due before probate is granted

- Submit forms electronically from April 2025 (using advanced electronic signatures)

That third point is the killer. You often can’t access the estate’s money until you’ve got probate. But you can’t get probate until you’ve paid the succession tax. It’s a Catch-22 that forces many executors to take out loans or negotiate payment by instalments for certain assets like property.

The IHT400 form is 17 pages of joy, plus supplementary schedules depending on the estate’s complexity. It asks for valuations of everything: houses, cars, jewellery, bank accounts, debts, funeral costs, gifts made in the past seven years… Get it wrong and HMRC will investigate. Get it very wrong and there are penalties.

Professional support matters here. At Ask Accountant, our team handles succession tax planning as part of our broader inheritance tax advisory services. We’re based at 178 Merton High St, London SW19 1AY, and we work with families and business owners to structure estates efficiently within the ever-changing rules. Whether it’s calculating liabilities, structuring lifetime gifts, or dealing with HMRC investigations, we’ve navigated these waters hundreds of times. Ring us on +44(0)20 8543 1991 to discuss your situation – because with succession tax, getting it wrong isn’t just expensive; it can tear families apart.

Looking Ahead: What Might Change Further

Succession tax has been political football for years. Labour has traditionally talked about reforming or increasing it. The Conservatives periodically promise to reduce or abolish it. What actually happens? Usually not much, though the current changes are the biggest shake-up in decades.

Speculation is rife about further reforms:

- Removing or reducing the spouse exemption

- Cutting the seven-year gift rule to five or even three years

- Abolishing the CGT uplift on death (currently, inherited assets get rebased to market value, wiping out capital gains)

- Tightening holdover relief for business assets

None of this is confirmed. But it illustrates why succession tax planning can’t be a “set and forget” exercise. The landscape shifts.

Practical Steps You Can Take Today

Calculate your exposure. List everything you own, add it up, compare it to your available allowances. Be realistic about property values.

Review who owns what. Assets held as joint tenants automatically pass to the survivor. Tenants in common allows you to leave your share through your will, which can be more tax-efficient.

Start gifting (wisely). Even small regular gifts out of surplus income can mount up over time and escape succession tax entirely.

Consider life insurance. If you can’t reduce your succession tax liability, at least ensure there’s cash to pay it.

Update your will. Especially if it predates recent rule changes or your circumstances have changed.

Talk to your family. The biggest succession failures I’ve seen haven’t been tax failures – they’ve been communication failures. When the next generation doesn’t understand the plan (or worse, actively disagrees with it), that’s when estates get torn apart in disputes.

Final Thoughts (Because Death and Taxes Are Inevitable)

Succession tax isn’t going anywhere. If anything, with government finances where they are and an ageing population, it’s more likely to tighten than loosen.

The good news? Unlike death itself, succession tax is mostly manageable with proper planning. The £325,000 threshold feels increasingly inadequate, and the new reliefs cap has legitimately angry business owners and farmers contemplating their futures. But within those constraints, there are still planning opportunities.

The bad news? Those opportunities are narrowing. The window for using BPR and APR at 100% above £1 million closes in April 2026. Lifetime gifting takes seven years to work. Pension planning needs completing before April 2027’s changes bite.

Time, in other words, matters.

Don’t put this off until it’s too late. Don’t leave it to your executors to figure out whilst they’re grieving. And for heaven’s sake, don’t think you can DIY complex succession tax planning because you read an article online (including this one – I’ve given you the framework, but your specific circumstances need specific advice).

Death is certain. Succession tax is probable. But with planning, the amount you pay is negotiable.

Frequently Asked Questions

Is succession tax the same as inheritance tax in the UK?

Yes. Succession tax is an informal term for what’s legally called Inheritance Tax (IHT) in the UK. Both terms refer to the 40% tax charged on estates exceeding £325,000.

How much can I inherit tax-free in the UK?

The basic threshold is £325,000 (nil-rate band), plus potentially £175,000 if you inherit a property from a direct ancestor (residence nil-rate band). Married couples can combine allowances, protecting up to £1 million.

Do I pay succession tax if I inherit from my parents?

Only if the estate exceeds available allowances. The tax is paid by the estate before distribution, not by beneficiaries. However, gifts received within seven years of death might create a tax liability for the recipient.

Can I avoid succession tax by gifting money before I die?

Potentially, yes. Gifts made more than seven years before death are exempt from succession tax. Gifts within seven years may be taxable depending on timing (with taper relief available after year three).

What happens if there isn’t enough money to pay succession tax?

HMRC may allow payment by instalments for certain assets like property or business interests. Alternatively, executors might need to sell assets, take out loans, or negotiate payment arrangements.

Are pensions included in succession tax calculations?

Currently, no – undrawn pensions sit outside your estate for succession tax purposes. However, from April 2027, this changes and pensions will be included in estate valuations.

How does succession tax work for business owners?

Trading businesses can qualify for Business Property Relief (BPR). From April 2026, 100% relief applies to the first £1 million of qualifying business assets, with 50% relief on amounts above that (meaning an effective 20% succession tax rate on the excess).

Do I need to report gifts to HMRC?

Most lifetime gifts don’t need reporting immediately. However, executors must disclose all gifts made in the seven years before death when completing succession tax forms (IHT400).

Can I live in a house I’ve gifted to my children?

Not without paying market rent, or it becomes a “gift with reservation” which doesn’t work for succession tax planning. HMRC will treat it as still part of your estate.

What’s changing with succession tax in 2025 and 2026?

From April 2025, succession tax moves from a domicile-based to residence-based system, affecting non-UK domiciled individuals. From April 2026, Business Property Relief and Agricultural Property Relief get capped at £1 million per person. From April 2027, pensions are pulled into estate calculations.