Here’s something nobody tells you about running a small business in the UK: your accounting software choice can make or break your sanity. I’ve watched brilliant entrepreneurs turn into stress-eating zombies because their bookkeeping system felt like wrestling with a particularly vindictive octopus.

The thing is, most business owners stumble into accounting software the same way they choose a Netflix series – they pick whatever looks decent and hope for the best. But switching to QuickBooks UK isn’t just about prettier dashboards or trendy features. It’s about reclaiming those weekend hours you’ve been sacrificing to spreadsheet hell.

The Great British Accounting Software Dilemma

Let’s be brutally honest here. The UK market is drowning in accounting solutions, each promising to be the “perfect fit” for your business. Sage, Xero, FreeAgent – they’re all fighting for your attention like eager puppies in a pet shop window.

But here’s what I’ve noticed after years of helping businesses untangle their financial messes: QuickBooks UK consistently delivers something most competitors struggle with – genuine simplicity without sacrificing power. It’s like having a Swiss Army knife that actually makes sense.

What Makes QuickBooks UK Different? (Spoiler: It’s Not What You Think)

Most people assume QuickBooks UK is just the American version with a Union Jack slapped on top. Wrong. Intuit rebuilt this thing from the ground up for British businesses, and frankly, it shows in ways that’ll surprise you.

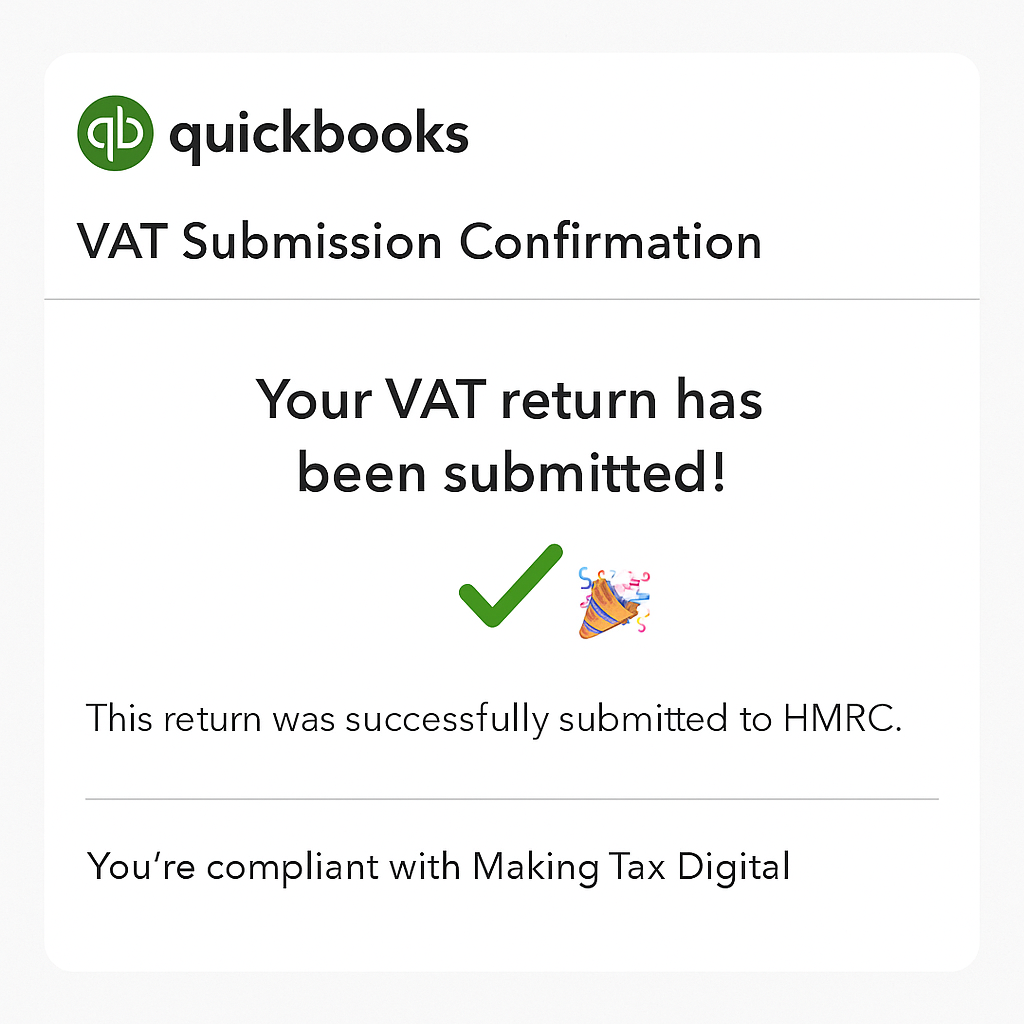

The VAT handling alone is worth the price of admission. Instead of making you feel like you need a mathematics degree to submit your returns, QuickBooks UK treats VAT like the routine business necessity it should be. Making Tax Digital compliance? Sorted. Real-time submissions? Done without drama.

But the real game-changer is how it handles multiple currencies. If you’re doing any international business (and let’s face it, most of us are these days), you’ll appreciate not having to perform mental gymnastics every time a client pays you in euros.

The Setup Process That Actually Makes Sense

Setting up QuickBooks UK feels refreshingly different from other platforms. Where most accounting software dumps you into a configuration maze that would challenge a NASA engineer, QuickBooks UK asks you simple questions about your business and builds your system around your answers.

The import process deserves special mention. I’ve seen businesses postpone switching accounting software for years because they were terrified of losing historical data. QuickBooks UK’s migration tools handle this with surprising grace – though I’d still recommend backing everything up twice. Because paranoia in accounting is just good sense.

| Setup Stage | Time Required | Difficulty Level | Common Pitfalls |

| Initial account creation | 10-15 minutes | Easy | Using wrong email address |

| Company information setup | 20-30 minutes | Moderate | Incorrect VAT registration details |

| Chart of accounts configuration | 45-90 minutes | Moderate-Hard | Over-complicating account structure |

| Bank connections | 15-25 minutes | Easy | Security settings blocking access |

| Historical data import | 2-6 hours | Hard | Data formatting inconsistencies |

The Bank Feed Revolution (Or: How I Learned to Stop Worrying and Love Automation)

One feature that consistently impresses new users is the bank feed integration. QuickBooks UK connects directly to most major UK banks, automatically importing transactions and suggesting categorisations based on your historical patterns.

This isn’t just convenient – it’s revolutionary for small business owners who’ve been manually entering every Costa Coffee receipt. The machine learning gets smarter over time, eventually recognising that your Tuesday morning Pret purchase is probably a business meal, not office supplies.

Pro tip: Spend the first month being pedantic about categorising everything correctly. Your future self will thank you when the system starts predicting with uncanny accuracy.

When Things Go Sideways (And How to Fix Them Without Losing Your Mind)

Let’s address the elephant in the room – no software is perfect, and QuickBooks UK occasionally throws curveballs that’ll test your patience. The most common complaint I hear? The mobile app sometimes feels like it was designed by someone who’s never actually used a smartphone for business.

But here’s where QuickBooks UK redeems itself: their support system. Whereas some of the competitors view customer support as their second priority and form support teams in countries where they understand those countries business practices, Intuit spends a lot of money on customer support teams in the UK who actively know how UK businesses operate.

The Costs No One Talks About

Most of the pieces discussing the cost of QuickBooks in the UK dwell on the subscription fee per month, the truth is that there are other costs hidden in the fine print. Its current pricing is between 10 and 115 pounds per month and it does offer heavy promotion discounts to first-time users in most cases. Pre-built app integrations can be costly, they can be easy to collect, and that seemingly inoffensive inventory management integration add-on could end up much more expensive than your base subscription.

| Cost Category | Monthly Range | Annual Impact |

| Base subscription | £10-£115 | £120-£1,380 |

| Payroll add-on | £4 + £1.30 per employee | Variable |

| Third-party integrations | £10-£50+ | £120-£600+ |

| Professional setup | One-time: £200-£800 | Amortised cost |

Professional setup deserves special consideration. While QuickBooks UK markets itself as “easy to set up yourself,” complex businesses often benefit from expert guidance. The plans now include Simple Start (£10/month), Essentials, Plus, and Advanced (£115/month), each targeting different business sizes and needs. Companies like Ask Accountant (based at 178 Merton High St, London) specialise in QuickBooks UK implementations, handling everything from data migration to staff training.

The Integration Ecosystem That Actually Works

Here’s where QuickBooks UK genuinely shines – its app marketplace feels less like a money grab and more like a curated selection of tools that actually solve real problems. The Shopify integration handles e-commerce seamlessly, while apps like Receipt Bank (now Dext) transform expense management from tedious to tolerable.

What impressed me most? The way these integrations communicate with each other. Information flows between connected apps without the usual data inconsistencies that plague multi-platform setups.

Industry-Specific Features That Matter

QuickBooks UK doesn’t try to be everything to everyone, but it handles common UK business scenarios with surprising sophistication. Construction Industry Scheme (CIS) compliance, for instance, feels like it was designed by someone who actually understands subcontractor relationships.

The project tracking functionality serves creative agencies and consultancies particularly well. You can track time, expenses, and profitability by project without needing separate project management software – though you’ll probably want one anyway if you’re managing complex client relationships.

Making the Switch: A Week-by-Week Breakdown

Week 1: The Setup Phase

Don’t try to migrate everything at once. Start with basic company information and current-month transactions. Get comfortable with the interface before adding complexity.

Week 2: Historical Data and Testing

Import the previous year’s data and run parallel systems. Yes, it’s extra work, but catching discrepancies now saves headaches later.

Week 3: Team Training and Workflow Integration

Get everyone comfortable with the new processes. The learning curve isn’t steep, but rushing this step creates resistance.

Week 4: Full Migration and Old System Shutdown

Only switch completely once you’re confident everything works correctly. Keep your old system accessible for a few months – just in case.

The Verdict: Is QuickBooks UK Worth the Hassle?

After working with dozens of businesses through their QuickBooks UK transitions, I’ve noticed a pattern. The companies that struggle are usually those trying to replicate their old processes exactly, rather than adapting to QuickBooks UK’s natural workflow.

The software works best when you let it guide your processes rather than forcing it into your existing habits. This requires some mental flexibility, but the payoff – in terms of time saved and stress reduced – is substantial.

When QuickBooks UK Isn’t the Answer

Let’s be realistic – QuickBooks UK isn’t perfect for everyone. Manufacturing businesses with complex inventory requirements might find it limiting. Firms that require a lot of customisation may want something less restrictive (but more complex).

However, QuickBooks UK is just right in terms of amenities and ease of use in most small to medium UK firms particularly the ones in service sectors, retail, or the professional services.

When To Seek Professional Advice (Since Doing Things Your Own Way Sucks)

Somewhere between this marketing strategy of the QuickBooks UK as being user friendly and the reality lies. Small and at its simplest, business can definitely go ahead and carry out self-setup, however, in case of having more than one source of revenue, complex inventory management, international transactions, professional advice will prove to be worth to break into quickly.

Ask Accountant is based in London and provides all-round QuickBooks UK set up and support. Their offering is not just simple installation but also covers business accounting services, tax advisory services, business strengthening planning and in general, anything you require that will not only help you implement QuickBooks UK, but to optimise your entire financial process.

In case you would like to concentrate on the running of your business and want a technical heavy-lifting job to be performed, contact them on +44(0)20 8543 1991.

FAQs Frequently Asked Questions

What is the time frame of converting completely to QuickBooks UK?

The bulk of businesses can move it in 2-4 weeks mainly depending on the complexity of data, size of the team. Standard service enterprises may conclude at the end of the week whereas retail trade with large stock can take the whole month.

Can I import data from Sage or Xero?

Yes, though the process varies by source system. Sage migrations tend to be more straightforward, while Xero imports sometimes require data cleaning. Always backup everything first.

Is QuickBooks UK genuinely Making Tax Digital compliant?

Absolutely. It handles VAT submissions directly to HMRC and maintains all required digital records. The integration is seamless enough that you might forget MTD exists.

What will occur in case of default cancellation of the subscription?

Exporting your data is possible in several formats; however, you will be deprived of the online interface. It is expensive and disruptive to change to a new accounting system again and again. Therefore, make an adequate consideration of what the long-term implications are before engagement.

How does customer support actually work?

Phone, chat, and email support are included with all plans. You can track your VAT then prepare and submit your return to HMRC using any one of the QuickBooks Online plans: Simple Start, Essential, Plus and Advanced. Response times are generally good, though complex technical issues sometimes require escalation. The UK support team understands local business requirements better than their international counterparts.

Muhammad

October 18, 2025Hurrah, that’s what I was seeking for, what a stuff!

present here at this webpage, thanks admin of this website.