Picture this: It’s 3 AM, you’re surrounded by receipts that smell faintly of last year’s coffee spills, and you’re staring at a tax form that might as well be written in ancient Sumerian. Your laptop screen glows accusingly as HM Revenue & Customs’ website times out for the third time. Sound familiar?

Here’s the thing nobody talks about—whilst everyone bangs on about how “easy” it is to file your own taxes these days, the reality is messier than a toddler’s finger painting session. Professional tax preparation services aren’t just for the wealthy or the hopelessly confused. They’re for anyone who values their sanity, accuracy, and frankly, their money.

When Simple Becomes Complicated (And It Always Does)

Tax codes change faster than London weather. What worked last year might cost you hundreds this year. Self-employed? You’re practically navigating a minefield blindfolded. Got rental income? Welcome to a whole new level of complexity that makes quantum physics look straightforward.

I’ve watched perfectly intelligent people—doctors, engineers, business owners—reduce themselves to tears over Capital Gains Tax calculations. These aren’t dim bulbs we’re talking about. They’re sharp cookies who’ve simply hit the wall where expertise matters more than intelligence.

The mathematics are brutal: HMRC processed over 12 million Self Assessment returns last year, with error rates averaging 15-20% for self-prepared returns. Professional tax preparation services typically see error rates below 3%.

The True Price of Getting It Wrong

Let’s talk numbers, shall we? Because this isn’t just about convenience—it’s about cold, hard cash.

HMRC Penalties: The Gift That Keeps on Taking

| Mistake Type | DIY Average Cost | Professional Service Risk |

| Late filing penalty | £100-£1,600 annually | Virtually eliminated |

| Incorrect calculations | £300-£3,000+ per error | Covered by professional indemnity |

| Missed deductions | £500-£2,500 lost savings | Systematic claim optimization |

| Interest on unpaid tax | 7.75% annually | Accurate payment calculations |

Note: Figures based on HMRC penalty notices 2023-2024

Here’s what really gets my goat: people spend more on their annual coffee habit than they’d invest in professional tax preparation services, then lose thousands to avoidable mistakes. It’s like refusing to pay for a map whilst hiking in the Lake District, then acting surprised when you end up in Scotland.

Beyond the Basics: What Professional Tax Preparation Services Actually Do

Forget everything you think you know about accountants. Modern professional tax preparation services are part detective, part fortune teller, and part financial therapist.

The Detective Work Nobody Sees

A proper tax professional doesn’t just fill in forms—they hunt for money you didn’t know existed. Business expenses you forgot about. Allowable deductions hiding in your utility bills. Capital allowances on that laptop you bought for work.

Take Sarah, a freelance graphic designer from Wimbledon. She’d been filing her own returns for three years, thinking she was being clever and saving money. When she finally sought professional tax preparation services, they found £2,400 in missed deductions from just the previous year alone. Her home office expenses, professional development courses, even the portion of her mobile phone bill used for client calls—all legitimate business expenses she’d never claimed.

Future-Proofing Your Finances

Here’s where it gets interesting. Professional tax preparation services don’t just look backwards—they plan forwards. They’ll spot when you’re approaching thresholds that trigger different tax rates. They’ll suggest timing strategies for major purchases or investments. They become your early warning system for financial decisions.

The Compliance Minefield: Staying on HMRC’s Good Side

Compliance isn’t just about avoiding penalties—it’s about maintaining your reputation and peace of mind. Professional tax compliance services understand the intricate dance between maximising your tax efficiency whilst staying firmly within legal boundaries.

The Documentation Dance

Ever tried explaining to HMRC why you can’t find receipts from 18 months ago? Professional tax preparation services typically include record-keeping systems that would make a Swiss banker weep with joy. They know exactly what documentation HMRC expects, in what format, and how long you need to keep it.

Real talk: HMRC can investigate your tax affairs up to 20 years retroactively if they suspect deliberate evasion. With professional tax preparation services, you’re not just getting current year compliance—you’re building a defensible audit trail for decades.

The Technology Factor: Software vs. Expertise

Yes, tax software exists. Yes, it’s improved dramatically. No, it’s not equivalent to professional expertise.

Tax software follows rules. Professional tax preparation services understand principles. There’s a world of difference.

Consider this scenario: You’ve had a complex year involving freelance work, rental income, and significant medical expenses. Tax software will process what you input, but it won’t question whether you’ve categorised everything optimally. It won’t suggest restructuring your affairs for next year’s benefit. It certainly won’t catch that subtle interaction between different types of income that could save you hundreds.

When Artificial Intelligence Meets Real Intelligence

| Aspect | Tax Software | Professional Tax Preparation Services |

| Rule application | Excellent | Excellent + strategic interpretation |

| Error detection | Basic | Comprehensive review process |

| Planning advice | Limited templates | Personalised strategy |

| Audit support | None | Full representation |

| Updates | Automatic | Interpreted and explained |

Choosing Your Champion: What Makes Professional Tax Preparation Services Worth It

Not all tax professionals are created equal. Here’s what separates the wheat from the chaff:

Qualifications That Matter

- ACA, ACCA, or CTA qualifications

- Current practice certificate

- Professional indemnity insurance

- Continuing professional development records

The Service Spectrum

- Basic compliance: Forms completed accurately and on time.

- Strategic planning: Year-round advice on tax-efficient decisions.

- Crisis management: HMRC investigation support and representation.

At Ask Accountant, we’ve seen businesses transform their entire financial outlook through strategic tax planning. Our services span everything from inheritance tax planning to comprehensive business advisory work, because effective tax preparation doesn’t exist in isolation—it’s part of your broader financial ecosystem.

Questions That Reveal Expertise

A competent professional tax preparation service should be able to explain:

- How recent legislative changes affect your specific situation

- Alternative approaches to structuring your affairs

- The reasoning behind their recommendations

- Potential risks and mitigation strategies

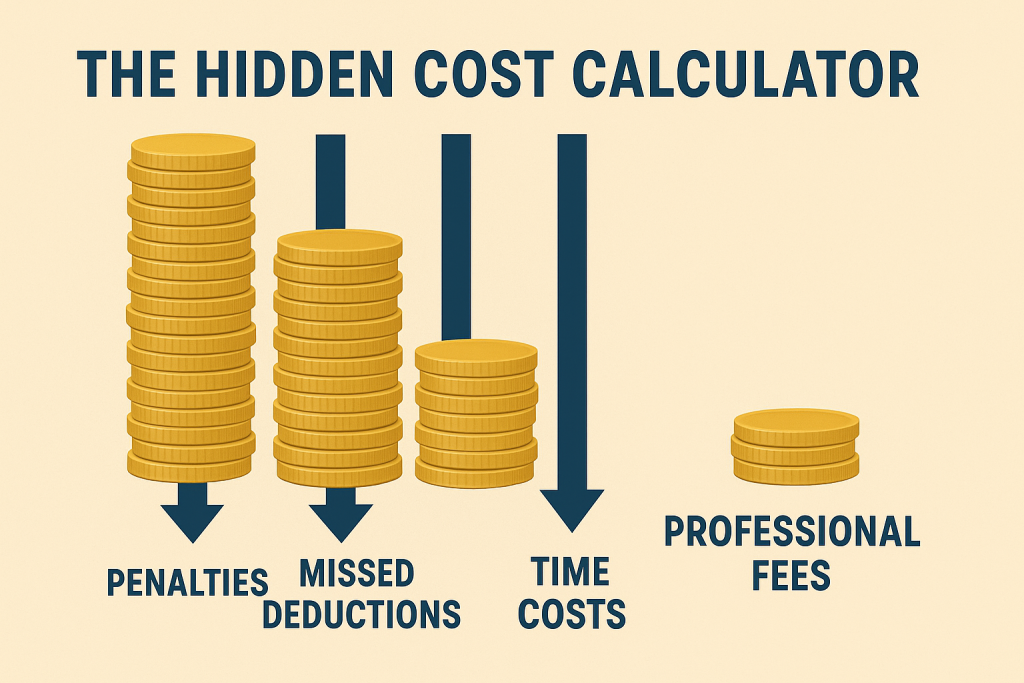

The Hidden Costs of “Saving Money”

Let me share something that might sting a bit: choosing amateur tax preparation (including doing it yourself) often costs more than hiring professionals. Here’s why:

- Time opportunity cost: If you’re earning £25/hour and spend 20 hours on tax preparation, that’s £500 of your time. Add the stress, potential errors, and missed opportunities, and suddenly professional fees look rather reasonable.

- Audit anxiety: Self-prepared returns are statistically more likely to trigger HMRC reviews. Professional tax preparation services significantly reduce this risk through systematic accuracy and appropriate documentation.

- Missed optimisation: DIY preparers typically claim fewer legitimate deductions than they’re entitled to. Professional services often pay for themselves through improved tax efficiency alone.

Making the Investment Decision

Here’s my completely unbiased opinion (and by unbiased, I mean thoroughly researched but admittedly passionate): if your tax situation involves any complexity beyond basic employment income, professional tax preparation services are cost-effective. Period.

Green Light Indicators:

- Self-employment or freelance income

- Property rental income

- Investment portfolios

- Business ownership

- Significant life changes (marriage, divorce, inheritance)

- Previous HMRC enquiries

The Sweet Spot

Most individuals and small businesses find the sweet spot in comprehensive professional tax preparation services that include:

- Annual return preparation

- Quarterly check-ins for planning

- HMRC correspondence handling

- Basic business advisory services

At Ask Accountant (located at 178 Merton High St, London SW19 1AY), we’ve structured our services around this comprehensive approach because piecemeal tax advice often creates more problems than it solves.

Looking Forward: Tax Planning vs. Tax Preparation

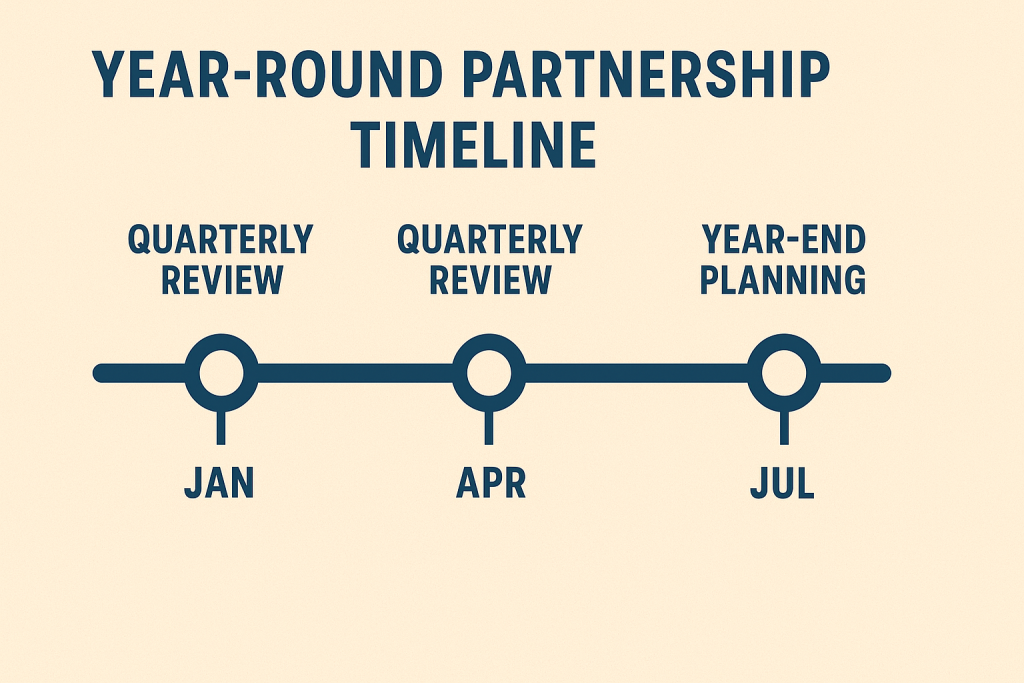

Here’s where most people get it backwards: they think about taxes once a year, usually under deadline pressure. Professional tax preparation services should be working with you year-round, positioning you for success rather than just recording historical events.

The Strategic Advantage

Proper professional tax preparation services include:

- Quarterly business reviews to optimise ongoing decisions

- Legislative update briefings when changes affect you

- Year-end planning sessions to maximise current year efficiency

- Multi-year strategic planning for major financial goals

Think of it as the difference between having a personal trainer who sees you once a year versus one who guides your fitness journey continuously. The results speak for themselves.

Frequently Asked Questions

Q: What is the average amount that professional tax preparation services would cost?

A: The charges depend on the complexity, and majority of the people spend between £300-£800 per annum on full-time services. Business returns will tend to be between £600-£2000 plus. The investment is normally self paying with better accuracy and tax efficiency.

Q: Are there circumstances in which I can change to professional tax preparation services whilst I have been prepared to do my own returns?

A: Absolutely. Actually, a high number of professionals can examine your previous returns and determine the past opportunities to claim into amendments, which might reclaim overpaid taxes.

Q: What is the right time to seek professional services on the preparation of taxation matters?

A: Stephens, preferably long before the year is over. Year-long strategic planning is usually better than last-minute preparation of returns.

Q: What are the documents that I should present?

A: This will depend on the circumstance, but will include: P60s, P45s, bank statements, business records, investment statements, property documentation, and receipts of claimable expenses.

Q: Do tax preparation companies provide their guarantee?

A: Professional indemnity insurance is bound on reputable services and tends to assure them to pay off the fines they get due to their mistakes. This coverage should always be checked before starting to engage.

Q: What do I do to check the credentials of a tax professional?

A: Verify their membership to a professional body (ICAEW, ACCA, CIOT), practicing certificate status and cover of professional indemnity insurance.

The Bottom Line

Professional tax services preparation is not a cost, but an investment in accuracy, compliance and peace of mind. It is not whether you can afford professional help or not, it is whether you can afford not to.

When you are willing to stop making tax time the annual emergency event it is and to treat it as a strategic financial planning opportunity it ought to be, it may be time to have a chat. To find out how professional tax preparation services can change your attitude towards tax compliance and planning you can contact Ask Accountant at +44(0)20 8543 1991.

Due to the fact that frankly speaking life is too short to waste on arguing with HMRC forms at 3 AM.