Imagine this: It’s Friday afternoon, and while your competitors are celebrating the end of the week with a celebratory cup of coffee, you’re still buried under spreadsheets that look like they’ve been run through a blender. Sound familiar?

Here’s the uncomfortable truth – lease accounting isn’t just another box to tick on your compliance checklist. It’s become the silent assassin of productivity in countless businesses across the UK, stealing hours from your week and introducing errors that can cascade through your entire financial reporting system.

But what if I told you that the right lease accounting solutions could transform this weekly nightmare into a streamlined process that practically runs itself? That’s not wishful thinking – it’s what happens when businesses finally embrace modern approaches to managing their lease portfolios.

When Spreadsheets Attack: The Real Cost of Manual Lease Management

I’ve seen seasoned accountants reduced to tears by lease calculations. Not because they lack skill, but because manual lease accounting is fundamentally broken in today’s complex business environment.

Consider Sarah, a finance manager at a growing retail chain. She spends roughly 15 hours each month wrestling with lease data across 47 locations. That is almost two working days that modern software could accomplish in minutes. Multiply that by her hourly rate, add the cost of the strategy work that won’t get done, and you’re talking thousands of pounds of hidden costs each and every month.

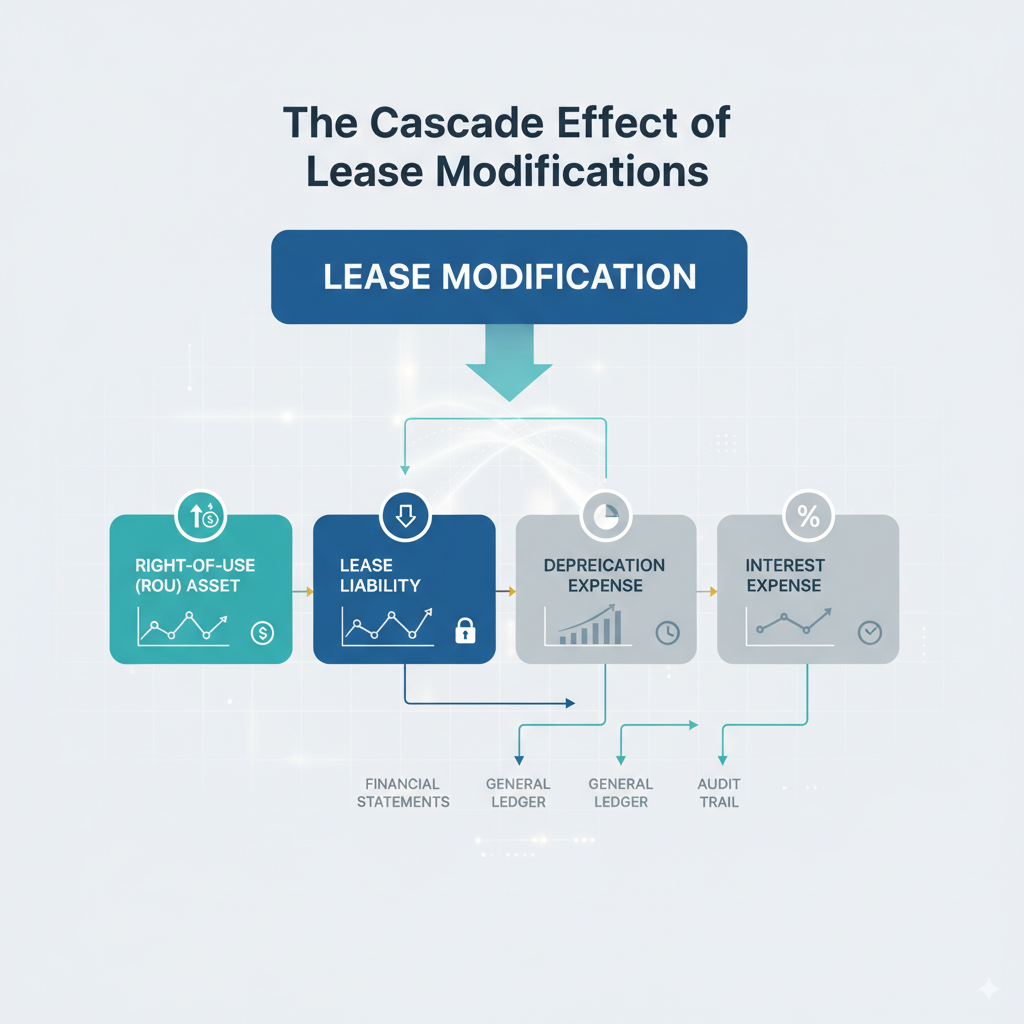

The introduction of IFRS 16 and FRS 102 didn’t help this situation either. These standards have altered how we think about lease obligations, transforming what was once a simple entry in operating expenses into a complex right-of-use asset calculation that demands precision and meticulous documentation.

The Ripple Effects Nobody Talks About

Manual lease accounting creates problems that extend far beyond the finance department:

- Audit anxiety: When your lease data lives across multiple spreadsheets, audit season becomes a treasure hunt where X never marks the spot.

- Decision-making delays: Without real-time lease information, strategic decisions about space utilisation get postponed indefinitely.

- Compliance gaps: Missing renewal dates or miscalculating lease modifications can trigger costly penalties.

- Team burnout: Repetitive manual processes drain motivation from even the most dedicated staff members.

The Evolution of Smart Lease Management

Modern lease accounting solutions have evolved far beyond simple calculation tools. Today’s platforms combine automation with intelligence, creating systems that don’t just process data – they actively prevent problems before they occur.

Think of it as having a vigilant assistant who never sleeps, never forgets renewal dates, and certainly never makes arithmetic errors after a long day. These solutions integrate seamlessly with existing ERP systems, pulling property data, calculating complex amortisation schedules, and generating reports that would take human accountants days to compile.

Key capabilities that separate modern solutions from legacy approaches:

- Automated lease classification: The system determines whether each lease qualifies as finance or operating under current standards.

- Dynamic recalculation: Modifications trigger instant updates across all affected periods.

- Multi-currency handling: Essential for businesses with international operations.

- Scenario modelling: Test different lease terms before committing to agreements.

Time Savings: Manual vs. Automated

This table illustrates the time efficiency gained by switching from manual processes to an automated lease accounting solution.

| Feature | Manual Process | Automated Solution |

| Lease Classification | 2-3 hours per lease | Instant analysis |

| Monthly Journal Entries | 4-6 hours | 15 minutes |

| Compliance Reporting | 8-12 hours | 2 hours |

| Lease Modifications | Half day per change | 20 minutes |

| Error Rate | 5-8% typical | <0.1% |

Beyond Software: Building a Bulletproof Process

The most sophisticated lease accounting software in the world won’t save you if your underlying processes are fundamentally flawed. I’ve watched businesses invest heavily in technology only to recreate the same inefficiencies in digital form.

The foundation starts with data integrity. Your lease agreements need to be centralised, standardised, and accessible. This means creating a single source of truth for all lease information – not scattered across email threads, filing cabinets, and various team members’ personal folders.

Document management becomes crucial here. Every lease modification, renewal notice, and correspondence should flow through your system automatically. Some businesses I work with have transformed their approach by implementing workflow automation that routes lease documents for approval, captures key terms electronically, and triggers reminders months before critical dates.

The Integration Challenge (And How to Solve It)

Most finance teams fear that implementing new lease accounting solutions will create more work, not less. This concern isn’t unfounded – poorly planned integrations can temporarily disrupt operations and create duplicate data entry requirements.

However, modern platforms are designed with integration in mind. They connect directly to your existing accounting software, property management systems, and document repositories. The key is selecting solutions that complement your current technology stack rather than forcing you to rebuild everything from scratch.

Ask Accountant frequently helps businesses navigate these integration challenges. Our business advisory approach focuses on creating seamless workflows that enhance existing processes rather than replacing them wholesale.

Real-World Implementation: What Actually Works

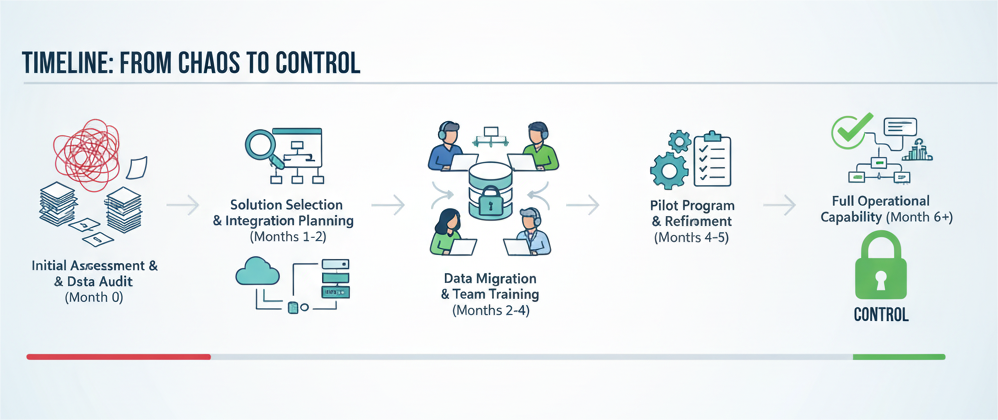

Let me share what I’ve learned from watching dozens of businesses transform their lease accounting operations. The most successful implementations share three common characteristics:

- They start small and scale systematically. Rather than attempting to digitise every lease simultaneously, effective rollouts begin with a pilot group of 10-20 leases. This approach allows teams to identify potential issues and refine processes before expanding system-wide.

- They prioritise training over technology. The fanciest software becomes useless if your team doesn’t understand its capabilities. Successful businesses invest significant time in comprehensive training programmes, often designating “super users” who become internal experts and troubleshooters.

- They have realistic timelines. Implementation is seldom as fast as vendors claim or as slow as pessimists predict. Under normal circumstances, most businesses become fully operational in 3-6 months, provided there is proper preparation and allocation of resources.

The Accuracy Imperative: The More Precise the Better

Although lease accounting solutions can definitely save time, their true value lies in eliminating the errors that torment manual processes. One inaccurate calculation can be carried forward through multiple reporting periods, creating compliance issues that may only be discovered months later.

Take into account the intricacy of a standard lease modification. When a tenant exercises an expansion option or negotiates alternative payment terms, it impacts right-of-use asset balances, liability calculations, and depreciation schedules. These interdependencies are difficult to manage manually and often lead to inconsistencies that are a nightmare to audit.

Modern systems handle these complexities automatically, recalculating all values in real-time and maintaining audit trails that record every change. This level of accuracy is not just a convenience; it’s becoming a necessity as regulatory oversight increases and compliance standards rise.

The Hidden Benefits of Accurate Data

Precise lease accounting creates opportunities that extend far beyond regulatory compliance. When your lease data is clean and current, you can:

- Negotiate more effectively with landlords using historical cost analysis.

- Identify optimisation opportunities across your property portfolio.

- Make informed expansion decisions based on comprehensive lease burden analysis.

- Streamline budgeting processes with accurate forward-looking projections.

| Business Size | Typical Annual Savings | Implementation Cost | ROI Timeline |

| Small (1-10 leases) | £8,000 – £15,000 | £3,000 – £5,000 | 6-9 months |

| Medium (11-50 leases) | £25,000 – £45,000 | £8,000 – £15,000 | 4-6 months |

| Large (50+ leases) | £60,000 – £150,000 | £20,000 – £40,000 | 3-5 months |

Note: Figures include staff time savings, reduced error correction costs, and improved decision-making value.

Choosing Your Path Forward

The lease accounting solutions market ranges from simple calculators to enterprise-grade platforms pricier than some houses. To navigate these choices, you must understand not only your current needs but also where your business is headed in the next few years.

For Small Businesses (<20 leases)

Cloud-based solutions often provide the best balance of functionality and cost. These platforms are typically subscription-based, allowing you to get started without a significant upfront investment.

For Mid-Size Businesses

Look for solutions that integrate fully with your existing ERP systems. The goal is to create seamless workflows that eliminate duplicate data entry and provide advanced reporting capabilities.

For Enterprise Organisations

You’ll need the ability to manage complex lease portfolios across multiple jurisdictions, currencies, and accounting standards. These solutions often include advanced features like lease optimisation algorithms and predictive analytics.

The Human Factor: Technology is Not All You Need

The best lease accounting software still relies on human expertise to provide valuable output. Technology handles calculations and report generation, but strategic decision-making requires professionals who understand both the technical requirements and the business implications.

This is where professional business advisory services become invaluable. Seasoned consultants not only help companies adopt new systems but also streamline their entire lease management strategy. They identify process improvements, help you stay ahead of changing standards, and provide ongoing support as your business needs evolve.

At Ask Accountant, our business accounting services don’t stop at number-crunching. We partner with businesses in London and beyond to develop lease accounting processes that support strategic growth and regulatory compliance. Whether it’s the implications of inheritance tax on property holdings or the need for detailed tax advice on your leasehold portfolio, expert advice is the difference between bare compliance and sound financial management.

Looking into the Future: The Next Wave of Lease Management

Artificial intelligence and machine learning are beginning to transform lease accounting solutions. These technologies can identify trends in lease terms, predict optimal renewal strategies, and even flag potential compliance violations before they occur.

Some advanced platforms now offer predictive analytics that help businesses model different scenarios and their financial consequences. Imagine instantly seeing how a change in market conditions could impact your lease portfolio or receiving automated suggestions for lease adjustments that could save you thousands of pounds a year.

Another emerging trend is the integration of Internet of Things (IoT) sensors into lease management systems. These sensors can monitor real-time space utilisation, providing data that can inform decisions about renewing, modifying, or terminating lease agreements based on actual usage patterns rather than assumptions.

What to Do Next to Make the Change

Transforming your lease accounting processes doesn’t happen overnight, but it doesn’t have to be daunting. The key is to start with a clear understanding of your current pain points and realistic expectations about what technology can and cannot do.

- Start by conducting a health check on your current processes. Document the time your team spends on lease-related activities, identify the most frequent sources of errors, and clarify your compliance requirements.

- Research suitable solutions. Don’t be swayed by features you won’t use. Instead, focus on finding a platform that can scale with your business.

- Plan for proper implementation support. Whether through vendor training programs or external advisors, ensure your team has the resources needed to succeed with new systems.

The goal isn’t just to save time or reduce errors – though modern lease accounting solutions certainly deliver both benefits. The real opportunity lies in transforming lease management from a reactive compliance exercise into a strategic business capability that supports informed decision-making and sustainable growth.

Your competitors are already making this transition. The question isn’t whether your business needs better lease accounting processes – it’s how quickly you can implement solutions that give you a competitive advantage.

Transform your approach to lease management today. Businesses across London and throughout the UK trust Ask Accountant for comprehensive accounting and bookkeeping services that extend far beyond basic compliance. Our business growth planning expertise, combined with auto-enrolment support and specialised CIS claims and refunds assistance, creates integrated solutions that drive real business value.

Contact us at +44(0)20 8543 1991 or visit 178 Merton High St, London SW19 1AY to discuss how our lease accounting expertise can save your business time while ensuring complete accuracy and compliance.

Frequently Asked Questions

Q: How long does it typically take to implement a lease accounting solution? A: Most businesses become fully operational in 3-6 months, depending on the complexity of the portfolio and the resources dedicated to data migration and training.

Q: Does lease accounting software support both IFRS 16 and UK GAAP? A: Yes, modern platforms are designed to support multiple accounting standards simultaneously and can automatically generate compliant reports for different regulatory frameworks.

Q: What happens to our existing lease data during implementation? A: A professional implementation includes data migration services to transfer your current lease information, often involving data cleansing and standardisation to ensure optimal system performance.

Q: Do we need to replace our entire accounting system to use a lease accounting solution? A: Not necessarily. Most modern lease accounting platforms are designed to integrate with existing ERP systems, enhancing rather than replacing your current infrastructure.

Q: How do lease accounting solutions handle lease modifications and renewals? A: Advanced platforms automatically recalculate all affected values when lease terms change, maintaining a full audit trail and ensuring compliance with accounting standards throughout the lease lifecycle.