Here’s something nobody tells you at dinner parties: inheritance tax in England has undergone the most dramatic transformation in decades, and if you’re still operating under the old domicile rules, you’re planning with yesterday’s map.

I’ve spent the better part of twenty years explaining tax to people who’d rather discuss root canals. But this? This is different. The shift from domicile to residence-based taxation that took effect on 6 April 2025 isn’t just another regulatory tweak—it’s a seismic recalibration of who pays what, when, and why.

Let me be blunt: the inheritance tax England system is no longer something you can afford to understand “sort of”. Between frozen thresholds, pension reforms landing in 2027, and the new long-term residence rules, there are more tripwires in estate planning than ever before.

The Fundamentals Haven’t Changed (But Everything Else Has)

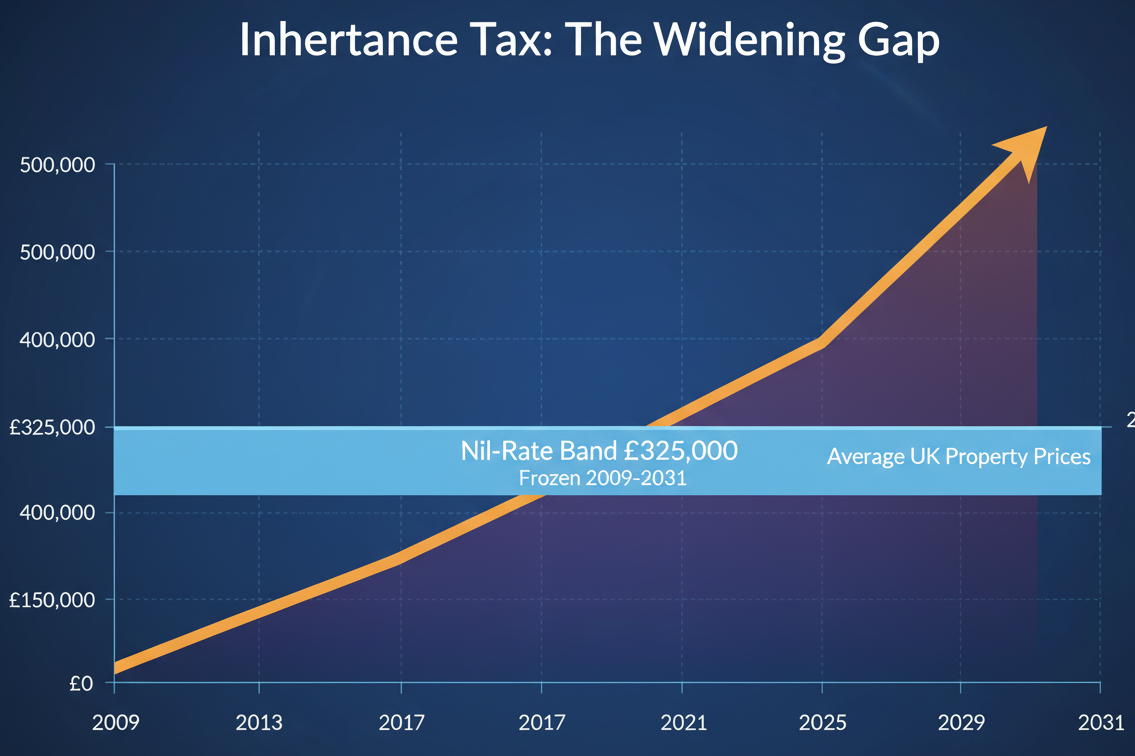

Right, so let’s start with what you probably already know. Inheritance tax in England kicks in when your estate exceeds £325,000. That’s the nil-rate band, and it’s been stubbornly parked at that figure since 2009. Fifteen years. No movement. Meanwhile, property values have done what property values do—climbed relentlessly upward, dragging more and more estates into the taxable zone.

If you own a home and leave it to direct descendants (children, grandchildren, even adopted or step-children), you might also get the residence nil-rate band of £175,000. Combine these, and a married couple can potentially shield £1 million from the taxman.

The tax itself? A flat 40% on everything above your threshold. No sliding scale. No gentle easing in. Just 40%.

Quick Reality Check: Most estates in England still don’t pay inheritance tax. But “most” is doing a lot of heavy lifting here. With thresholds frozen until at least 2031 and property prices rising, that “most” is shrinking every year.

What Actually Changed in April 2025 (And Why It Matters)

For over a century, inheritance tax in England hinged on domicile—a slippery concept involving your “permanent home” and intentions. Non-domiciled individuals (non-doms) only paid inheritance tax on UK assets, keeping their overseas wealth out of reach.

That’s finished.

From 6 April 2025, the UK switched to a residence-based system. Now, if you’ve been UK tax-resident for 10 out of the previous 20 tax years, you become a “long-term UK resident”. And once you hit that threshold? Your worldwide assets fall within the scope of inheritance tax England charges.

The Inheritance Tax Tail That Won’t Let Go

Here’s where it gets genuinely nasty. Leave the UK thinking you’ve escaped? Not so fast. The new rules include what’s called an “IHT tail”—a period after you leave during which you remain liable for UK inheritance tax on your worldwide estate.

| Years Resident in UK (of last 20) | IHT Tail After Leaving |

|---|---|

| 10-13 years | 3 years |

| 14 years | 4 years |

| 15 years | 5 years |

| 16 years | 6 years |

| 17 years | 7 years |

| 18 years | 8 years |

| 19 years | 9 years |

| 20 years | 10 years |

The minimum tail is three years. The maximum? A full decade. That’s ten years of remaining in the UK’s inheritance tax crosshairs even after you’ve physically left.

Gifting Your Way Out? Not So Simple

People love the idea of giving away assets during their lifetime to reduce their estate. And yes, gifts can work—if you survive seven years after making them. That’s the famous seven-year rule, and it applies to what HMRC calls “potentially exempt transfers” (PETs).

But there are exemptions you can use immediately, no seven-year wait required:

- £3,000 annual exemption – You can give away up to £3,000 each tax year, and if you didn’t use last year’s allowance, you can carry it forward (making it £6,000 in total, but only for one year)

- £250 small gifts – Give as many people as you want up to £250 each, provided you haven’t used another allowance on them

- Wedding gifts – £5,000 to your child, £2,500 to a grandchild, or £1,000 to anyone else

- Regular gifts from income – If you can afford to maintain your standard of living whilst making regular payments (like paying into a grandchild’s savings account), these can be exempt

What catches people out is gifts with reservation. If you give away your house but continue living in it rent-free, HMRC treats it as if you still own it for inheritance tax England purposes. The gift has to be genuine—you can’t have your cake and eat it.

Don’t Get Clever Without Help: I’ve seen families try to navigate gifts with reservation on their own, only to discover years later that their “planning” achieved precisely nothing. The rules are byzantine. Get proper advice before you move assets around.

The Pension Bombshell Landing in April 2027

If you thought pensions were a neat way to pass wealth down without inheritance tax, I have news. From 6 April 2027, unused pension funds and death benefits will be dragged into your estate for inheritance tax in England calculations.

Currently, defined contribution pensions typically sit outside your estate. Die before 75, and your beneficiaries usually receive the pot tax-free. Die after 75, and they pay income tax at their marginal rate. But no inheritance tax.

That’s ending. From 2027, your pension becomes part of your taxable estate. Personal representatives (executors) will be responsible for reporting and paying any IHT due on pension assets.

Who Gets Hit Hardest?

The government estimates around 10,500 estates will pay inheritance tax for the first time because of these changes. Another 38,500 will pay more than they would have under the old rules. The average increase? About £34,000.

Here’s a worked example:

Sarah and Tom own a £400,000 home, have £100,000 in ISAs, and Tom has a pension worth £650,000. Before April 2027, their estate (excluding pensions) is £500,000—safely under their combined £1 million threshold. No inheritance tax.

After April 2027? That pension gets added. Total estate: £1,150,000. After deducting their £1 million allowance, £150,000 is taxable at 40%. Inheritance tax bill: £60,000.

That’s sixty thousand pounds that could have been avoided with some forward planning.

Business and Agricultural Relief: The £1 Million Cap

For decades, Business Property Relief (BPR) and Agricultural Property Relief (APR) have allowed qualifying business and farm assets to pass on with 100% relief from inheritance tax England charges. A £10 million family business? Tax-free. A £50 million farm? Also tax-free.

From 6 April 2026, that’s changing. Only the first £1 million of combined BPR and APR assets will receive 100% relief. Anything above that drops to 50% relief.

| Asset Value | Relief Before April 2026 | Relief After April 2026 | IHT Due (at 40%) |

|---|---|---|---|

| £1 million | 100% (£0 tax) | 100% (£0 tax) | £0 |

| £5 million | 100% (£0 tax) | £1m at 100%, £4m at 50% | £800,000 |

| £10 million | 100% (£0 tax) | £1m at 100%, £9m at 50% | £1,800,000 |

For farming families who assumed their land would pass down intact, this is devastating. An £8 million farm that currently attracts no inheritance tax will face a £1.4 million bill from April 2026.

Trust Structures Under the New Rules

Trusts used to be a favourite tool for non-doms protecting overseas assets from UK inheritance tax. Under the old domicile rules, if you settled foreign assets into trust whilst non-UK domiciled, those assets remained excluded property indefinitely.

No longer. From 6 April 2025, the IHT status of trust assets depends on whether the settlor is a long-term UK resident at the time of a chargeable event. Assets can now move in and out of the inheritance tax net based on the settlor’s residence status.

If you’re a long-term resident, non-UK assets in trust will face:

- Ten-year anniversary charges (up to 6% every decade)

- Exit charges when capital is distributed

- Potential inclusion in your estate at death if you’re also a beneficiary

And if you leave the UK as a long-term resident? Expect an exit charge of up to 6% on non-UK trust assets that transition to excluded property status.

What You Can Actually Do About This

Right. Enough doom. What are your options?

1. Review your will and estate plan. When did you last look at it? If it was before April 2025, it’s out of date. The new residence rules, incoming pension changes, and trust implications mean your existing arrangements might no longer work as intended.

2. Reassess your residence history. If you’ve spent significant time in the UK, work out whether you’re already a long-term resident or approaching that threshold. It matters enormously for your worldwide estate exposure.

3. Consider drawing down pensions before 2027. If you have substantial pension wealth and don’t need it for retirement income, you might want to extract and spend or gift it before it gets pulled into your estate. But—massive caveat—this has income tax implications. Don’t do this without proper advice.

4. Make use of annual exemptions. That £3,000 allowance? Use it. Every year. If you’re married, that’s £6,000 between you that can leave your estate immediately with no seven-year wait.

5. Keep impeccable records. HMRC will want evidence of gifts, their dates, and values. If you’re claiming regular gifts from surplus income, document everything. Bank statements, spreadsheets, contemporaneous notes—all of it.

Need Expert Guidance on Inheritance Tax in England?

At Ask Accountant, we specialise in inheritance tax planning, business advice, and proactive tax advisory solutions. Whether you’re navigating the new residence rules, planning for the 2027 pension changes, or restructuring business assets ahead of the £1 million cap, we can help.

Our team in London offers comprehensive accounting and bookkeeping services alongside strategic estate planning. We understand that inheritance tax England rules are complex, and one-size-fits-all advice doesn’t cut it.

Contact Ask Accountant:

📍 178 Merton High St, London SW19 1AY

☎️ +44(0)20 8543 1991

The Frozen Threshold Problem (And Why It’s Getting Worse)

That £325,000 nil-rate band? It’s now frozen until April 2031. The residence nil-rate band of £175,000? Also frozen. The combined £1 million BPR/APR allowance? Frozen.

Meanwhile, property values continue rising. The Office for National Statistics reports average UK house prices increased by over 70% between 2009 and 2024. The nil-rate band? Zero percent increase over the same period.

This is what economists call “fiscal drag”—inflation and asset growth quietly hauling more people into higher tax brackets without any legislative changes. It’s stealth taxation, and it’s remarkably effective.

Between April and July 2025 alone, IHT receipts hit £3.1 billion—up £200 million year-on-year. Forecasts suggest revenues could exceed £14 billion by 2029-30 if no further reforms are made.

Common Mistakes That Cost Families Thousands

Leaving everything to your spouse without planning beyond that. Yes, spouse exemption means no inheritance tax on the first death. But when the surviving spouse dies, their estate (now doubled in size) can face a massive bill. Better to use both nil-rate bands strategically.

Ignoring gifts with reservation rules. Giving away your house but continuing to live there? That doesn’t work. Either pay market rent, or accept it’ll still count as part of your estate.

Failing to update pension nominations. If your expression of wishes form still names beneficiaries from before the 2025 changes, you might be creating unintended tax consequences. Review these regularly, especially with the 2027 pension reforms approaching.

Assuming life insurance is automatically exempt. It is—but only if it’s written in trust. Otherwise, the payout forms part of your estate and gets taxed at 40%.

Not keeping gift records. Made a £20,000 gift to your daughter five years ago? If you can’t prove it, HMRC might disallow it. Keep dated records of everything.

What’s Next for Inheritance Tax England?

The residence-based system is bedding in. The pension changes are coming in 2027. The BPR/APR cap lands in 2026. But will there be more reforms?

Possibly. There’s ongoing debate about abolishing or reducing the nil-rate band for high-value estates, similar to how the personal allowance tapers for high earners. Some commentators suggest a wealth tax might emerge as an alternative.

What’s certain is that inheritance tax in England generates significant revenue for the Treasury, and with public finances under pressure, it’s unlikely to become more generous anytime soon.

Final Thought: Estate planning isn’t a one-time exercise. It’s an ongoing process that needs regular review—especially now, with legislative changes arriving in waves. What worked in 2020 might not work in 2025, and certainly won’t work in 2027.

Frequently Asked Questions

What is the current inheritance tax threshold in England?

The nil-rate band is £325,000, with an additional residence nil-rate band of £175,000 if you leave your home to direct descendants. This gives a maximum threshold of £500,000 for individuals or £1 million for married couples who plan properly. These thresholds are frozen until April 2031.

How does the seven-year rule work for gifts?

If you give away assets and survive seven years, the gift becomes exempt from inheritance tax England charges. Die within seven years, and it may be taxable. Gifts made in the first three years before death are taxed at 40%; gifts made between three and seven years benefit from taper relief, reducing the rate gradually to zero.

Will my pension be subject to inheritance tax?

Not yet, but from 6 April 2027, most unused pension funds and death benefits will be included in your estate for inheritance tax purposes. This represents a major change from current rules where pensions typically pass outside your estate.

What happens if I’m a long-term UK resident and move abroad?

You’ll remain liable for UK inheritance tax on your worldwide assets for a period after leaving—the “IHT tail”. The minimum tail is three years (if you were resident for 10-13 of the last 20 years), rising to a maximum of ten years (if you were resident for all 20 years).

Can I give unlimited gifts to my spouse?

Yes, provided both of you live permanently in the UK. Gifts between UK-resident spouses or civil partners are exempt from inheritance tax with no limit. This exemption also applies on death—you can leave your entire estate to your spouse tax-free.

What’s the difference between nil-rate band and residence nil-rate band?

The nil-rate band (£325,000) applies to all estates. The residence nil-rate band (£175,000) is an additional allowance, but only if you own a home and leave it to your children, grandchildren, or other direct descendants. Not everyone qualifies for both.

This article reflects the position of inheritance tax England law as at December 2025. Tax legislation changes regularly, and individual circumstances vary. Always seek professional advice before making estate planning decisions.