Here’s the thing nobody tells you when you start a business: accounting and bookkeeping will haunt you at 2 AM.

Not in some dramatic, existential way. More like that niggling sensation that you’ve forgotten something crucial whilst lying in bed—except what you’ve forgotten is three months of receipts shoved into a carrier bag under your desk.

I’ve watched business owners juggle client meetings, staff issues, marketing campaigns, and supply chain nightmares—all whilst their financial records slowly descend into chaos. The spreadsheet that “worked fine at the start” now resembles a game of Tetris played by someone having a panic attack. And that shoebox of receipts? Let’s not even go there.

The reality is that roughly half of small business owners find bookkeeping painfully time-consuming, stealing hours from what they actually built their business to do. Meanwhile, cash flow problems account for the downfall of 82% of small businesses. That’s not a typo. Eighty-two percent.

So why do savvy entrepreneurs—people brilliant at what they do—end up in financial muddles that could’ve been avoided? And more importantly, what separates those who stay afloat from those who drown in invoices and HMRC penalties?

When You’re Wearing Too Many Hats (And One’s a Bookkeeper’s Visor)

Most small business owners become accidental accountants. One day you’re passionate about your craft—whether that’s designing websites, fixing boilers, or crafting artisan cheese—and the next you’re googling “double-entry bookkeeping” at midnight.

The average SME owner spends over 80 hours yearly managing finances. That’s two full working weeks. Imagine what you could do with that time: land new clients, develop products, or—radical thought—take a proper holiday.

But here’s where it gets sticky. About 60% of small businesses struggle with organising their financial documents, leading to missed tax deadlines and penalties that make your eyes water. The Construction Industry Scheme alone trips up countless contractors who should be focusing on, you know, actual construction.

The Knowledge Gap Nobody Admits To

Let’s be honest: most business owners have zero formal accounting training. Why would they? You started your company because you’re brilliant at your thing, not because you dreamt of reconciling bank statements.

This knowledge gap creates a domino effect. You’re not sure which expenses are deductible. You mix personal and business transactions (a cardinal sin, by the way). You select the wrong accounting method—cash basis versus accrual—and suddenly your financial statements are about as accurate as a weather forecast for next Christmas.

And tax compliance? With regulations shifting faster than a politician’s promises, keeping current feels like chasing your own tail whilst riding a unicycle. Blindfolded.

The Real Cost of DIY Accounting and Bookkeeping

“I’ll save money doing it myself!”

Famous last words.

Between 30% and 50% of small businesses fork out anywhere from £1,000 to £20,000 annually fixing accounting mistakes. That’s not a cost—that’s a financial haemorrhage.

The most insidious problems aren’t even obvious:

Delayed accounts receivable. Clients take ages to pay, but you’re too busy (and possibly too British) to chase them properly. Meanwhile, your cash flow looks like a sad puddle.

Inconsistent record-keeping. One month you’re diligent with receipts. The next, you’re estimating expenses based on vague memories and credit card statements that might as well be hieroglyphics.

The reconciliation disaster. You know you should match your bank statements to your records monthly. But life happens, and suddenly you’re trying to untangle six months of transactions the week before your tax return is due.

Sales tax nightmares. With Making Tax Digital in full swing and e-commerce complicating VAT collection, getting this wrong can trigger HMRC investigations that make root canal treatment look appealing.

Here’s a fun scenario: A customer pays by cheque but the deposit’s delayed by postal mishaps. Without regular reconciliation, that discrepancy snowballs into incorrect reports and potentially overdrawn accounts. Ask me how I know. (Actually, don’t.)

Cloud-Based Solutions: Not Just Trendy Buzzwords

Remember when “the cloud” sounded like something from a science fiction film? Now it’s transformed how businesses handle accounting and bookkeeping.

Modern cloud accounting software—platforms like Xero, QuickBooks, Sage Business Cloud, and FreeAgent—have democratised access to enterprise-level tools. What massive corporations paid fortunes for is now available to sole traders for roughly the cost of a few fancy coffees monthly.

The genuine advantages go beyond “access your data anywhere” (though that’s brilliant when you’re meeting clients or, let’s be real, avoiding the office entirely):

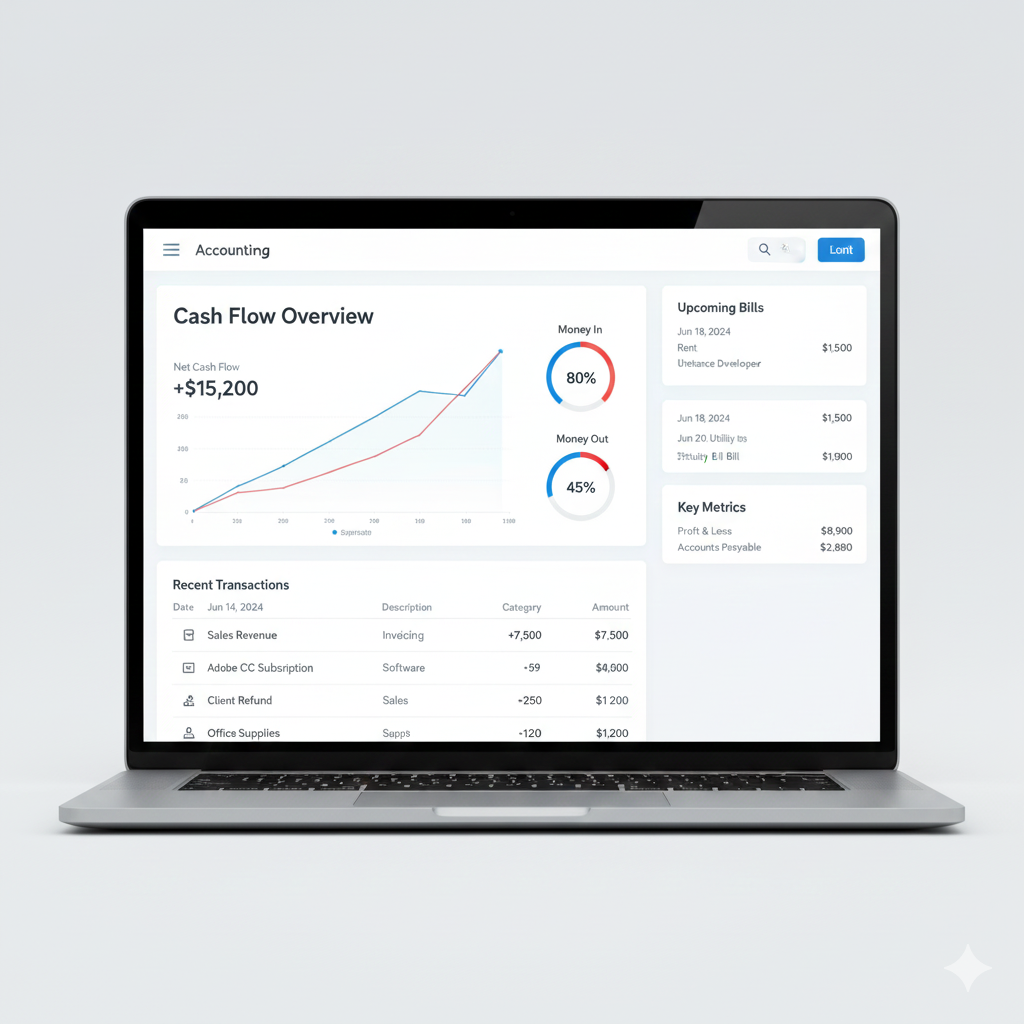

Real-time visibility. No more waiting until month-end to discover you’re skint. Cash flow and expenses update live, so you can make decisions before problems become disasters.

Automation that actually works. Bank feeds automatically import transactions. Invoices generate themselves. VAT returns practically complete themselves. The software handles tedious reconciliations whilst you do literally anything else.

Fewer cock-ups. Manual entry = human error = financial penalties and lost revenue. Automation dramatically cuts mistakes by eliminating repetitive data entry. Your tired brain at 11 PM is not a reliable accountant.

Making Tax Digital compliance. HMRC requires digital records for VAT reporting. MTD-compliant software handles this seamlessly—no more panicking about whether you’ve submitted correctly.

Collaboration without the awkwardness. Your bookkeeper, accountant, and business partner can all access the same current data simultaneously. No more emailing spreadsheets back and forth like some bizarre corporate ping-pong match.

Choosing the Right Platform (Because They’re Not All Created Equal)

The cloud accounting market is crowded. Here’s the honest breakdown:

| Software | Best For | Starting Price | Key Features |

|---|---|---|---|

| Xero | Growing businesses needing scalability | £15/month | Unlimited users, 1000+ app integrations, bank reconciliation |

| QuickBooks Online | Sole traders & very small businesses | £12/month | Receipt capture, mileage tracking, mobile app excellence |

| Sage Business Cloud | Businesses needing payroll integration | £14/month | Built-in payroll, cash flow forecasting, comprehensive reporting |

| FreeAgent | Freelancers & contractors | Varies (often free with certain banks) | AI transaction suggestions, MTD-compliant VAT, project tracking |

Don’t obsess over features you’ll never use. Start simple. A sole trader doesn’t need inventory management for seventeen warehouses.

Strategic Outsourcing: When to Wave the White Flag

There’s no shame in admitting accounting and bookkeeping aren’t your forte. In fact, recognising your limitations is possibly the most entrepreneurial thing you can do.

Professional bookkeepers and accountants bring more than technical knowledge—they offer perspective. A fresh set of eyes spots cost-saving opportunities, identifies dodgy patterns, and prevents expensive mistakes before they happen.

What Professional Help Actually Looks Like

The spectrum ranges from “occasional advice” to “please handle everything whilst I focus on running my actual business”:

Bookkeeping services handle day-to-day transaction recording, bank reconciliations, and keeping your records current. Think of them as your financial maintenance crew, preventing small issues from becoming catastrophes.

Management accounting takes raw data and transforms it into insights. What’s your most profitable product line? Which clients are costing you money? Where’s the cash actually going?

Tax advisory keeps you compliant whilst minimising your tax burden legally. The right accountant doesn’t just fill in forms—they strategise. Capital allowances, R&D credits, pension contributions… there’s a shocking amount of legitimate tax planning most businesses miss.

Business advisory for growth planning. When you’re ready to expand, hire, invest, or even sell, you need someone who understands the financial implications beyond basic bookkeeping.

At Ask Accountant, we’ve seen everything from “help, HMRC is investigating me” panic to strategic growth planning for businesses ready to scale. Our team in Merton handles business accounting services, bookkeeping, CIS claims and refunds, auto-enrolment, and proactive tax advisory solutions that actually prevent problems rather than just reacting to them.

Common Bookkeeping Disasters (And How to Dodge Them)

Let’s talk about the mistakes that keep accountants employed:

The Personal-Business Money Mixer

Using your business account for personal expenses (or vice versa) is like making a smoothie in a cement mixer—messy, confusing, and ultimately disastrous.

Separate accounts aren’t just good practice; they’re essential for:

- Accurate financial reporting

- Legitimate tax deductions

- Protecting yourself during audits

- Maintaining limited company status (mixing funds can pierce the corporate veil)

The “I’ll Remember That” Receipt System

No, you won’t remember. That crucial expense from three months ago? Gone. Lost. Vanished into the ether along with your car keys and that brilliant business idea you had in the shower.

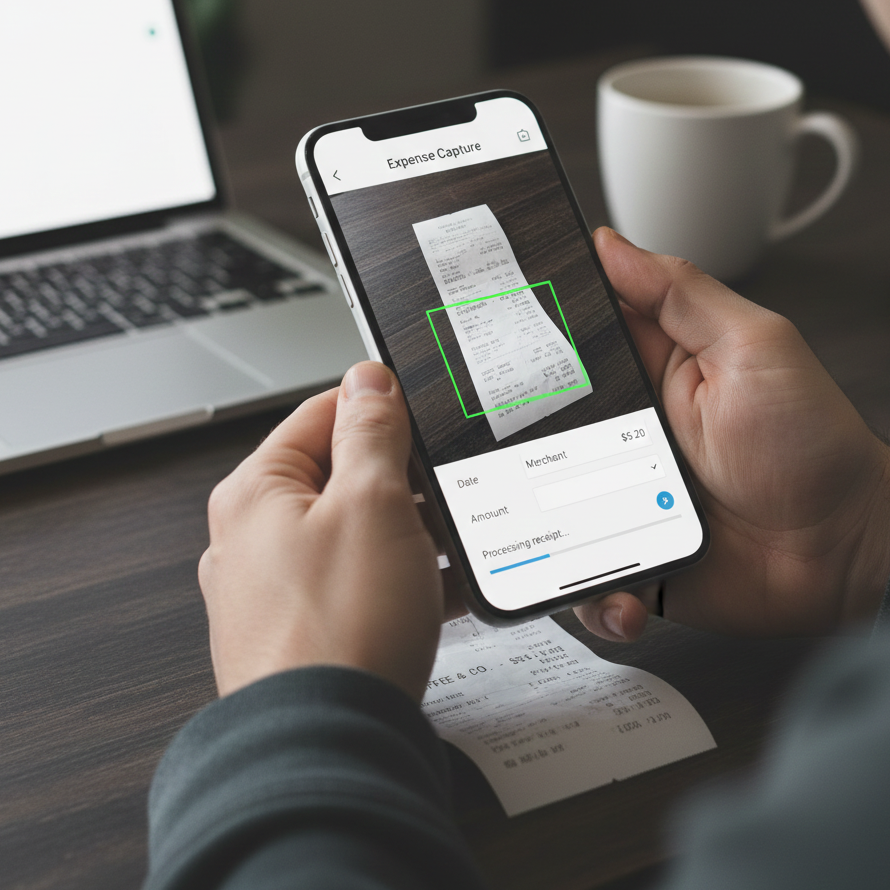

Modern receipt management shouldn’t involve shoeboxes:

- Photograph receipts immediately with your accounting app

- Use automated expense tracking tools

- Implement a consistent filing system (digital or physical—just pick one and stick with it)

- Schedule weekly reviews rather than annual panic sessions

The Delayed Invoicing Death Spiral

“I’ll send the invoice next week” becomes next month, and suddenly you’re chasing payment for work done in the Mesozoic era.

Quick invoicing isn’t pushy—it’s professional:

- Invoice immediately upon completion (or according to contract terms)

- Set up automated payment reminders

- Offer multiple payment methods (bank transfer, card, direct debit)

- Establish clear payment terms upfront

Ignoring Cash Flow Until It’s Too Late

Profitability ≠ cash flow. You can be technically profitable whilst simultaneously unable to pay your rent. Fun times.

Cash flow problems affect 82% of small business failures, yet most owners only check their bank balance reactively—usually when something bounces.

Cash flow management essentials:

- Weekly cash position reviews (not monthly—weekly)

- Maintain a cash reserve for dry spells (aim for 3-6 months of expenses)

- Invoice promptly and chase overdue payments aggressively

- Negotiate supplier terms that align with customer payment cycles

- Consider invoice financing or business lines of credit for smoother operation

Accounting and Bookkeeping Hygiene: Your Maintenance Checklist

Financial management isn’t a once-yearly panic fest. It’s ongoing maintenance—like brushing your teeth, but with more spreadsheets.

Daily (or at least weekly):

- Record transactions whilst you remember the details

- Photograph and file receipts

- Review bank feeds in your accounting software

- Process new invoices and bills

Monthly:

- Reconcile all bank and credit card accounts

- Review profit and loss statements

- Check aged receivables and chase overdue payments

- Analyse cash flow trends

- Set aside money for tax obligations

Quarterly:

- Submit VAT returns (if applicable)

- Review quarterly management accounts

- Assess budget performance and adjust forecasts

- Meet with your accountant for strategic review

Annually:

- Prepare and file tax returns

- Complete year-end accounts

- Conduct full financial review and planning session

- Update business plans based on actual performance

The Tax Compliance Minefield

HMRC doesn’t care that you were busy. Deadlines are deadlines, and penalties are… well, penalising.

Making Tax Digital has transformed UK tax reporting. Digital record-keeping is now mandatory for VAT-registered businesses, with income tax requirements expanding. Using MTD-compliant software isn’t optional anymore—it’s the law.

Common tax pitfalls:

- Missing quarterly VAT submission deadlines

- Incorrectly categorising expenses (entertainment versus business meetings, anyone?)

- Forgetting about Corporation Tax payment dates

- Not registering for VAT when you cross the threshold

- Claiming personal expenses as business deductions (HMRC will notice)

When HMRC Comes Knocking

Tax investigations are stressful. Even when you’ve done nothing wrong, an HMRC inquiry feels like being called to the headmaster’s office.

Having a skilled accountant ensures your books are accurate and provides professional representation during investigations. They know the regulations, speak HMRC’s language, and can often resolve issues that would send DIY accountants into meltdown.

If you’re facing an investigation or simply want peace of mind, specialist services like HMRC investigation support can be invaluable. Better yet, proper tax compliance prevents investigations in the first place.

Automation: Your Secret Weapon

Here’s the beautiful truth about modern accounting and bookkeeping: software can automate roughly 50% of standard accounting processes. That’s half your workload potentially eliminated.

Processes ripe for automation:

- Bank transaction imports and categorisation

- Invoice generation and distribution

- Payment reminders and debt collection

- Expense tracking and approval workflows

- Payroll processing

- VAT calculations and submissions

- Financial report generation

The key is choosing tools that integrate properly. A bookkeeping system that doesn’t talk to your invoicing software creates more problems than it solves.

Popular integrations worth investigating:

- Receipt Bank/Dext for receipt capture and processing

- GoCardless for automated direct debit collection

- Stripe for online payment processing

- PayPal integration for e-commerce businesses

- Time-tracking tools for service businesses

- CRM systems for sales pipeline visibility

Building Financial Resilience

The difference between businesses that survive economic turbulence and those that fold often comes down to financial visibility and planning.

Financial resilience fundamentals:

- Accurate, current records. You can’t make informed decisions based on guesswork or outdated information.

- Regular financial review. Monthly management accounts aren’t bureaucracy—they’re your business’s vital signs.

- Scenario planning. What happens if sales drop 30%? What if that major client leaves? How would you fund expansion? Run the numbers before crises hit.

- Professional guidance. An experienced accountant provides perspective beyond compliance—they’re strategic partners in business growth.

- Continuous learning. Financial literacy isn’t optional for business owners. You don’t need to become an accountant, but understanding basics protects you from nasty surprises.

When Good Enough Isn’t Good Enough Anymore

Every business reaches inflection points where existing systems stop working:

- You’re spending more time on admin than client work

- Financial decisions feel like guesswork

- Tax returns trigger existential dread

- You’ve received penalty notices from HMRC

- You’re considering expansion but lack clear financial data

- Investors or lenders are asking questions you can’t answer

These are signals, not failures. They indicate you’ve outgrown your current setup—which is actually progress.

| Business Stage | Accounting Needs | Typical Solutions |

|---|---|---|

| Startup/Sole Trader | Basic income/expense tracking, Self Assessment support | Simple cloud software + annual accountant review |

| Growing SME | Regular bookkeeping, VAT returns, payroll, cash flow management | Outsourced bookkeeping + quarterly accountant consultations |

| Established Business | Full accounting function, management accounts, tax planning, business advisory | Complete outsourced accounting department or in-house finance team |

| Scaling/Exit Planning | Strategic financial planning, due diligence preparation, succession planning | CFO-level advisory + specialist accountants |

The right solution scales with you. Start where you are, but build systems that accommodate where you’re headed.

Making the Shift: Practical First Steps

If your accounting and bookkeeping currently resembles organised chaos (or just chaos), here’s how to begin fixing it:

This week:

- Open separate personal and business bank accounts if you haven’t already

- Sign up for a cloud accounting platform (most offer free trials)

- Connect your business bank account to the software

- Start photographing receipts immediately

This month:

- Catch up on backdated transactions (yes, all of them—rip the plaster off)

- Reconcile your accounts to find discrepancies

- Set up recurring invoices and payment reminders

- Schedule weekly “finance admin” time in your calendar

- Research local bookkeeping services or small business accounting support

This quarter:

- Meet with a qualified accountant to review your setup

- Ensure full compliance with HMRC requirements

- Implement proper record-keeping systems

- Review your business structure for tax efficiency

This year:

- Transition to fully cloud-based systems

- Establish relationship with ongoing accounting support

- Build cash reserves for financial stability

- Develop growth plan with financial projections

The Bottom Line (Pun Intended)

Accounting and bookkeeping will never be the glamorous part of running a business. No one starts a company dreaming about ledgers and VAT returns.

But here’s what proper financial management does give you: clarity, control, and the freedom to focus on what you actually love about your business.

The businesses that thrive aren’t necessarily those with the best products or most charismatic founders. They’re the ones that understand their numbers, plan proactively, and don’t treat financial management as an afterthought.

You don’t need to become an accountant. You just need to care enough about your business to manage its finances properly—whether that’s through self-education and good software, professional support, or (most likely) some combination of both.

Your accounting shouldn’t be the thing that wakes you up at 2 AM anymore. With the right systems, support, and mindset, it becomes just another manageable aspect of business operations.

And that shoebox of receipts? Bin it. We’re living in the twenty-first century.

Frequently Asked Questions

Q: How much should small businesses budget for accounting and bookkeeping services?

A: Costs vary wildly depending on business size and complexity. Basic bookkeeping might run £100-300 monthly, whilst full accounting services including tax planning could be £2,000-5,000 annually. DIY software costs £10-50 monthly, but factor in your time value. Many businesses find outsourcing actually saves money once you account for mistakes prevented and time reclaimed.

Q: When should a small business hire a bookkeeper versus using software alone?

A: If you’re spending over 5-10 hours monthly on bookkeeping, making frequent mistakes, or feeling overwhelmed, it’s time to hire help. Software works brilliantly for straightforward sole traders with few transactions. Once you’ve got VAT, payroll, multiple revenue streams, or employees, professional support becomes cost-effective.

Q: What records does HMRC require me to keep?

A: HMRC requires all business income and expense records for at least 5 years after the Self Assessment filing deadline. This includes invoices, receipts, bank statements, and VAT records. With Making Tax Digital, records must be digital and software-maintained for VAT-registered businesses.

Q: What’s Making Tax Digital and how does it affect me?

A: MTD requires VAT-registered businesses to maintain digital records and submit VAT returns via compatible software. It’s expanding to include income tax for self-employed and landlords. Non-compliance carries penalties. Using MTD-compliant cloud accounting software ensures you meet requirements automatically.

Q: What should I do if I receive an HMRC investigation letter?

A: Don’t panic, but don’t ignore it. Contact a qualified accountant immediately—professional representation dramatically improves outcomes. Gather all relevant records. Respond to deadlines. HMRC investigations often result from anomalies in returns or random selection, not necessarily wrongdoing. Professional support navigates the process and protects your interests.

Need help sorting your business finances? Contact Ask Accountant at 178 Merton High St, London SW19 1AY or call +44(0)20 8543 1991. We specialise in business advisory, tax planning, and taking the accounting headache away so you can focus on running your business.