Look, I’ve seen it happen too many times. A business owner sits across from their accountant, eyes glazing over as someone rattles off tax codes and compliance deadlines. The numbers get filed. Boxes get ticked. And absolutely nothing changes about how that business operates.

Here’s the thing nobody tells you when you’re starting out: accounting isn’t really about accounting. Not if you’re doing it right, anyway.

The best accounting company doesn’t just process your numbers—they translate them into decisions. Real ones. The kind that mean you can actually afford to hire that person, or invest in that equipment, or (and this is the dream) take a proper holiday without your phone buzzing every thirty seconds.

And for SMEs? Small and medium enterprises trying to punch above their weight class? That translation service isn’t a luxury. It’s survival.

The Gap Between Recording and Understanding

Most business owners can tell you their turnover. Ask them about their gross profit margin, though, and suddenly it’s all hand-waving and “well, we’re doing alright, I think?”

That gap—between the numbers that exist and the numbers that mean something—is where businesses either plateau or breakthrough.

I watched a client once (small manufacturing outfit, about fifteen employees) who religiously sent us their invoices and receipts. Perfect records. But when we asked why their busiest months were also their least profitable, they looked at us like we’d asked them to explain quantum physics. Turns out they’d been accepting rush orders that required overtime and expedited shipping without adjusting their pricing. For two years.

An accounting company worth its salt spots these patterns. Not in the annual review when it’s too late to fix anything, but in real-time. Well, quarterly at least.

What “Strategic Accounting” Actually Means (Because Everyone Says It)

Right, so every firm claims they’re “strategic” now. The word’s been beaten to death. But there’s a genuine difference between:

- Compliance accounting: Your numbers are correct and the taxman is satisfied

- Strategic accounting: Your numbers tell you what to do next

The first one keeps you legal. The second one keeps you growing.

Strategic means your accountant notices you’re consistently short on cash in March and suggests adjusting your payment terms with suppliers. It means they see your product mix shifting and question whether your pricing structure still makes sense. It means they ask uncomfortable questions like “Do you actually need that office space?” before you’ve even thought about it yourself.

At Ask Accountant, we’ve built our entire practice around this distinction. Not just processing transactions, but turning those transactions into actual business intelligence. Because frankly? If you’re paying someone just to categorise expenses, you might as well use software. (And we’ll set that up for you too, but that’s beside the point.)

The Services That Actually Move Needles

| Service | What Most Firms Do | What Strategic Firms Do |

| Tax Advisory | File your return accurately | Proactively identify allowances and reliefs you didn’t know existed; restructure operations to reduce liability |

| Bookkeeping | Keep records up to date | Track KPIs, flag anomalies, provide monthly insights on cash flow trends |

| Business Advice | Answer questions when asked | Challenge assumptions, model scenarios, act as a sounding board for major decisions |

| Payroll & Auto-enrolment | Process payments correctly | Advise on salary vs dividend strategies, ensure pension contributions work for both business and employees |

Notice how one column is about doing the thing and the other is about thinking about the thing? That’s the whole game.

Why SMEs Need Different Treatment

Large corporations have entire finance departments. They’ve got someone watching cash flow, someone else on forecasting, another person managing tax strategy, and probably a very stressed CFO coordinating it all.

Small businesses? They’ve got Dave. Dave’s also doing sales, operations, and IT support. Dave is tired.

When you’re running an SME, your accounting company needs to be part of your team—not an external service you dread calling. You need someone who understands that your decisions happen quickly, often in response to opportunities that won’t wait for next quarter’s board meeting.

I’m thinking of construction firms navigating CIS claims and refunds while managing cashflow gaps caused by delayed payments. Or family businesses grappling with inheritance tax implications while trying to plan succession. These aren’t theoretical problems you address in five-year strategic plans. They’re right now problems.

The firms that work best with SMEs are the ones who:

- Actually answer their phones (wild concept, I know)

- Speak English instead of accounting jargon

- Understand that your business has seasons, cycles, and occasional chaos

- Don’t make you feel weird for asking basic questions

We’re based at 178 Merton High St, London SW19 1AY, and honestly? About half our new clients come to us because their previous accountant made them feel like an inconvenience. That’s not a high bar to clear, but you’d be surprised how many firms fail at it.

The Numbers That Actually Matter (And They’re Not What You Think)

Everyone obsesses over revenue. It’s the vanity metric of the business world—big numbers that make you feel important at dinner parties but don’t necessarily mean you’re building something sustainable.

Want to know what I look at first when reviewing an SME’s accounts?

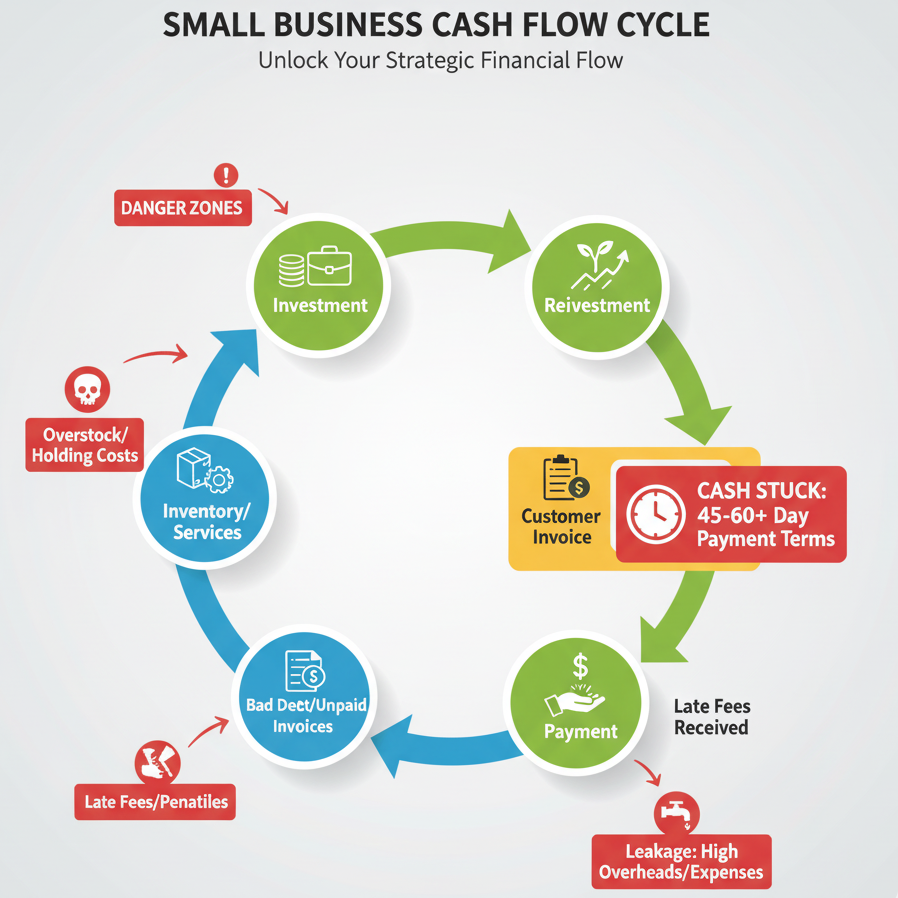

- Cash conversion cycle. How long it takes for your invested cash to come back to you after you’ve paid for goods/services. If this number’s getting longer, you’re growing yourself into trouble.

- Gross profit per employee. Tells you if you’re scaling efficiently or just adding overhead. I’ve seen businesses double their staff and somehow make less money.

- Effective tax rate. Not your marginal rate—what you actually paid as a percentage of profit. If this is higher than 20% for most SMEs, we need to talk about your structure.

- Days sales outstanding. Average time customers take to pay you. Anything over 45 days and you’re essentially providing free financing to your clients.

See, none of these are complicated. But they tell stories your P&L statement doesn’t. They show you where you’re leaking money, where you’re inefficient, where you’re vulnerable.

A strategic accounting company watches these metrics and asks annoying questions when they drift off course. “Why are you giving 60-day payment terms to customers who historically pay you in 75 days?” “What’s the actual return on that marketing spend?” “Do you know which products are subsidising which other products?”

These questions are uncomfortable. They should be.

The CIS Puzzle (For Those Who Know, You Know)

If you’re in construction, you already know the Construction Industry Scheme is both necessary and deeply irritating. For everyone else: imagine having tax deducted from your payments before you even see the money, then having to claim it back. Now imagine doing that for multiple projects, multiple subcontractors, all with different deduction rates.

Yeah.

CIS claims and refunds are where many construction SMEs leave serious money on the table. Either they don’t claim at all (surprisingly common), or they claim incorrectly and trigger an investigation (worse).

This is one of those areas where having an accounting company that specialises in your industry isn’t optional—it’s financially viable not to. The schemes, allowances, and timing requirements are specific enough that generalist accountants often miss stuff.

We’ve recovered thousands in CIS refunds for clients who didn’t realise they were owed anything. And we’ve prevented several expensive mistakes by catching errors before they were submitted. Neither of those services shows up on the invoice as a line item, but the value is absolutely there.

When Tax Planning Actually Saves You Money

Let me tell you what doesn’t work: calling your accountant in March and asking how to reduce your tax bill for the year that ended in December.

I mean, we’ll try. But you’ve already made all your decisions. The money’s been spent or earned. The structure is what it is.

Tax advisory solutions that actually move the needle happen continuously throughout the year:

- Deciding before you make a major purchase whether to capitalise it or expense it

- Timing income and expenses when you have flexibility

- Choosing the right business structure (sole trader vs limited company vs partnership) before you’re locked in

- Understanding R&D tax credits, capital allowances, and other reliefs you might qualify for

- Planning distributions vs salary to minimise overall tax burden

None of this is rocket science, but it requires someone paying attention before decisions are made, not after.

I had a client recently who was about to purchase £40,000 worth of equipment in April. We moved it to March (end of tax year) and structured it to take advantage of Annual Investment Allowance. Saved them about £7,600 in tax. The whole conversation took fifteen minutes.

That’s what proactive tax advisory solutions look like. Not “let’s see what we can do in hindsight,” but “let’s structure this intelligently from the start.”

Business Growth Planning: The Bit Nobody Wants to Think About

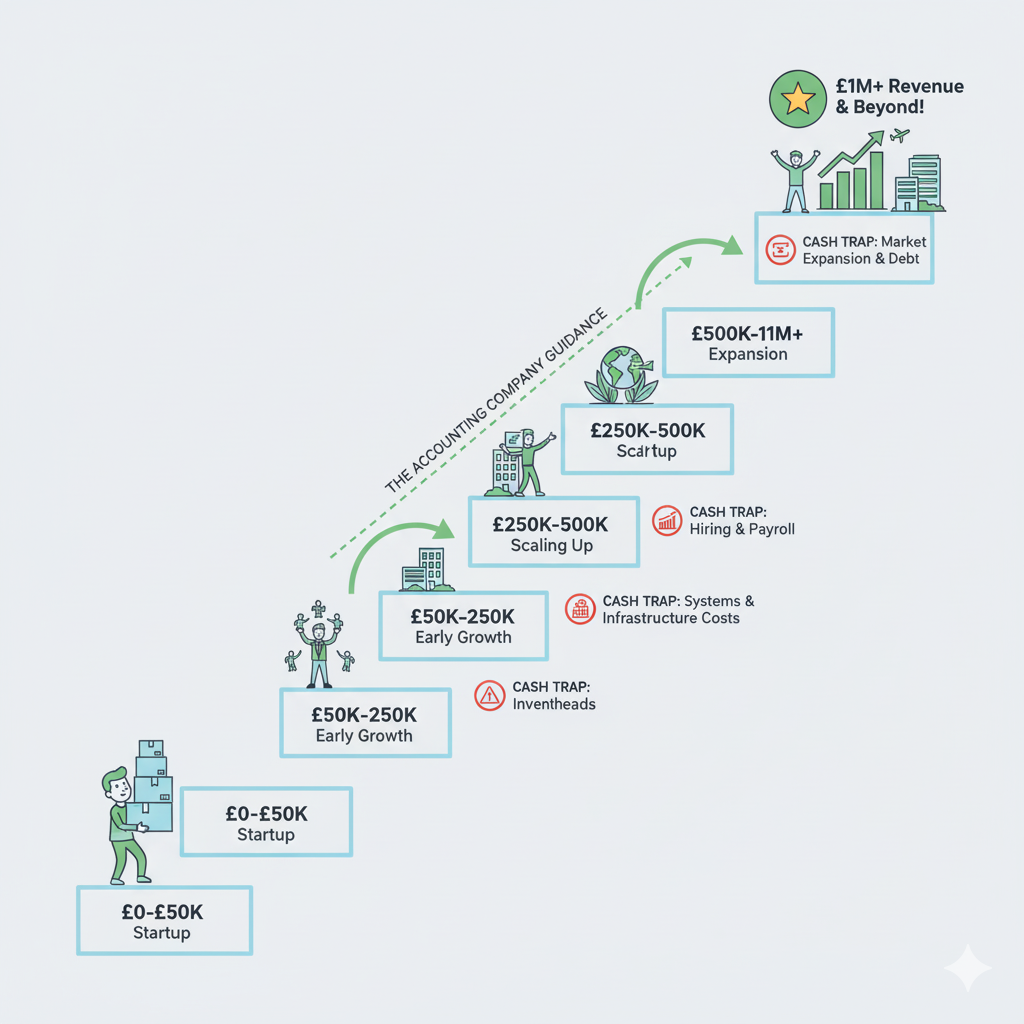

Here’s an uncomfortable truth: most businesses don’t fail because of bad products or insufficient demand. They fail because they run out of money while growing.

Growth eats cash. You need to pay for more inventory, more staff, more space—all before your customers pay you for the increased sales. And if you miscalculate that timing, even successful growth can kill you.

Business growth planning means modelling this out before you commit. What does going from £500k to £1m revenue actually require? How much working capital? What’s the break-even point? When do you need to bring on another person, and what happens to your margins when you do?

| Growth Stage | Common Cash Trap | Warning Sign |

| £0-£250k revenue | Owner working for free, not accounting for actual costs | Profitable on paper but no money to draw |

| £250k-£500k | First employee hire without adjusting pricing | Revenue up, take-home pay down |

| £500k-£1m | Inventory/WIP investment outpacing payments received | Busy but constantly chasing overdraft limit |

| £1m+ | Adding overhead (office, management layer) too early | Fixed costs rising faster than gross profit |

(Yes, that table’s a bit wonky. Real businesses are wonky too.)

The point is: growth without planning is expensive optimism. And your accounting company should be the person telling you the uncomfortable truths about what growth actually requires.

The Inheritance Tax Conversation Everyone Avoids

Switching gears entirely here, but if you’re a family business or you’ve built something valuable, we need to talk about what happens when you’re not around anymore.

Inheritance tax in the UK is brutal. 40% above £325,000 (or £500,000 if you’re passing on your home to direct descendants). For a business worth £1 million, your family could owe £200,000+ in tax within six months of your death.

Got that much lying around in cash? Didn’t think so.

This is where Business Property Relief and proper succession planning become existential rather than theoretical. But here’s the problem: most people don’t want to think about their own mortality. So they don’t plan. And then their family has to sell the business they spent decades building just to pay the tax bill.

I’m not being morbid here—I’m being practical. If you’ve built something valuable, protecting it isn’t optional. And unlike most tax planning, inheritance tax planning needs to happen years before it matters because many reliefs require ownership periods.

This is absolutely the kind of thing your accounting company should be bringing up, even though it’s awkward. Especially because it’s awkward. We’ve helped several family businesses structure themselves to take advantage of BPR and other reliefs that dramatically reduce or eliminate IHT liability. But it requires thinking ahead.

What Good Business Advice Actually Sounds Like

“You should grow faster” is not advice. It’s just cheerleading.

“Based on your current margins and fixed costs, you need to reach £750k revenue to comfortably afford another full-time employee, and here’s the cash flow impact of making that hire six months earlier vs six months later” is business advice.

See the difference?

Business advice worth paying for is specific, numbers-based, and helps you make decisions you were going to make anyway—just better informed.

The best business advisors I know (and I work with a few) have this quality: they’re not trying to tell you what to do. They’re trying to show you the actual implications of your options so you can make smarter choices.

Want to open a second location? Let’s model the break-even point and cash requirements.

Thinking about pivoting to a new market? Let’s look at your current customer acquisition costs and margin structure to see if the economics work.

Considering a major investment? Let’s calculate the actual ROI, not the hopeful one.

It’s not sexy. But it’s how sustainable businesses get built.

The Small Business Accounting Services You Actually Need

Let me cut through the marketing jargon every firm uses and tell you what small businesses actually need from their accounting company:

- Someone who answers questions without making you feel speechless. Seriously, this shouldn’t be rare, but it is.

- Monthly or quarterly reviews that don’t require you to prepare for days. If your financial review feels like homework, something’s wrong with the process.

- Proactive tax advisory, not reactive tax filing. There’s a difference between “here’s what you owe” and “here’s how to owe less next time.”

- Bookkeeping that’s current enough to be useful. Year-old numbers help nobody.

- Business advisory that understands your industry specifics, not generic consulting platitudes.

For service businesses, that might mean understanding utilisation rates and pricing structures. For product businesses, inventory management and gross margin analysis. For construction, CIS compliance and contract profitability tracking.

Generic advice is useless. Specific, industry-aware guidance is worth paying for.

At Ask Accountant, we’ve deliberately focused on small business accounting services that address these actual needs rather than the theoretical ones. Our accounting and bookkeeping approach combines regular financial tracking with strategic guidance, whilst our auto-enrolment services ensure your pension compliance doesn’t become a headache. Because what’s the point otherwise?

When to Actually Call Your Accountant (Not Just at Year-End)

Here’s when you should be talking to your accounting company, not just sending them receipts:

- Before making any major purchase or investment

- When considering changing your business structure

- Before hiring employees (especially your first few)

- When pricing new products or services

- If cash flow feels tight despite apparently being profitable

- Prior to entering into any long term contract with abnormal payment terms.

- When strategizing any significant life-related situations (buying a house, having kids, retiring)

Notice these are all before decisions, not after?

Your accountant should be part of your informal board of advisors—the people you run things by before committing. Not the people who tell you after the fact whether you screwed up.

If you’re only hearing from your accountant once a year, you’re not getting your money’s worth. Full stop.

The Reality of Working with an Accounting Company

Let’s be honest about what this relationship actually looks like when it works:

- You’ll have regular check-ins. Monthly for most growing businesses, quarterly if you’re stable and don’t need much guidance. These shouldn’t feel like interrogations—more like catching up with someone who’s actually interested in your business.

- You would get suggestions that sometimes frustrate you since it is conservative or opposes you in your plans. Good. You do not need a yes-person, you need someone to show you the dangers that you are not aware of.

- You will be at times having the feeling that they are demanding something at the worst time possible. They are. Deadlines exist and compliance isn’t optional.

But in exchange? You’ll make better decisions. You’ll keep more of what you earn. You’ll avoid expensive mistakes. And you’ll have someone who actually knows what’s happening in your business to call when something unexpected comes up.

That’s the deal. And for SMEs trying to build something sustainable, it’s a pretty good one.

Making the Switch (If Your Current Accountant Isn’t Cutting It)

Changing accountants feels like a massive hassle, so people delay it even when they’re clearly unhappy. But here’s the secret: it’s not that complicated.

Most of the work is on the new firm’s end. They’ll request information from your old accountant, handle the transfer of records, and get everything set up. Your main job is to sign some forms and answer questions about what wasn’t working before.

Red flags that it’s time to move:

- Your calls or emails go unanswered for days

- You don’t understand your own financial reports

- Advice is generic or feels copy-pasted

- You’re constantly surprised by tax bills

- They don’t seem to know your industry

- You dread interacting with them

Look, accounting is a professional service. If you’re not getting value, find someone who’ll deliver it. We’re at Ask Accountant, located at 178 Merton High St, London SW19 1AY. Ring us at +44(0)20 8543 1991 if you want to have a conversation about whether we’d be a good fit. No pressure, no hard sell—just a chat about what you need and whether we can deliver it with our business accounting services.

The Bottom Line (Pun Intended)

Numbers without context are just data. Data without decisions is just trivia. And trivia doesn’t help you build a business.

The right accounting company turns your financial information into strategy. They demonstrate what you are strong in, where you are weak, and what opportunities you have, but you do not see them yet. They are not only documenting what has already happened, they are also assisting you in making decisions about what is to come.

For SMEs especially, this difference matters. You don’t have the luxury of a finance department or the buffer of corporate resources. You need every advantage, and that includes having someone who’s genuinely invested in making your numbers work for you.

So yes, find an accounting company that handles your compliance. That’s table stakes. But don’t settle for just compliance. Find one that actually helps you build something.

Because your business deserves more than someone who just files forms and sends invoices. It deserves a partner who sees the strategy hiding in your spreadsheets.

Frequently Asked Questions

But What is the difference between bookkeeping and accounting of small businesses?

The day-to-day recording of transactions, the invoices that are sent, the bills paid, etc. Accounting takes that information and transforms it into information that makes sense: financial statements, calculations of tax, and analysis to aid in making decisions. Consider bookkeeping as note taking and accounting as writing the essay. Both required, varying skills.

What should an SME pay as an accounting service?

Wildly, depends upon what you need.Simple compliance (tax return, annual accounts) could cost a small firm between £1,000 and UK3,000 every year. Add regular bookkeeping, payroll, and advisory services, and you’re looking at £200-£500+ monthly. But here’s the thing: good accounting pays for itself through tax savings and better decisions. If you’re just comparing prices, you’re missing the point.

Do I really need an accountant if I’m using accounting software?

Software is brilliant at recording and organising data. It’s terrible at interpreting that data, planning strategy, or understanding tax law. You might not need an accountant to do your bookkeeping anymore, but you absolutely need one to use that information effectively. Unless you enjoy reading HMRC guidance documents for fun?

When should a small business move from a sole trader to a limited company?

Typically when you’re making £50k+ profit annually, though it depends on your specific situation. Limited companies offer tax advantages at higher profit levels and provide liability protection, but they also mean more compliance and administration. Your accountant should model both scenarios for your actual numbers rather than giving you a generic answer.

How can an accounting company help with business growth?

By showing you what growth actually costs before you commit to it. They model cash flow requirements, identify which products/services are actually profitable, help you price new offerings correctly, and flag potential problems before they become crises. Financial planning is the only way to manage a growth that is not planned.

What am I supposed to carry when I meet my new accountant?

Financial statements (within recent ones, as long as you have them), tax returns of the past two years, information about your business structure and what you do, and honesty as to what is not working with your current set-up. But mostly? Bring your questions. A good first meeting is more about them understanding your business than you providing perfect documentation.