Imagine you are Zara who owns a successful bakery in South London. Her Victoria sponges are famous, she has increased the number of customers, and she is making a good profit finally. Then HMRC knocks on the door to ask her some questions regarding her financial reporting. When Sarah suddenly finds that winging it using her books is not the success recipe she thought it was, she also realizes there is no need to use the recipe at all.

Here’s the uncomfortable truth—accounting standard compliance isn’t just bureaucratic box-ticking. It’s the difference between a business that survives scrutiny and one that crumbles under regulatory pressure. Yet most small business owners treat it like dental work: necessary but painful, best avoided until absolutely critical.

Brilliant entrepreneurs stumble. Not because their products suck or customers vanish—but because they never learned the financial rulebook they’re supposed to be playing by.

The Standards Landscape: More Forgiving Than You’d Expect

“Accounting standards.” Those two words make most business owners want to hide under their desk. People picture dusty manuals crammed with legal gibberish that would make a tax lawyer weep. Actually? The UK’s approach to small business accounting is surprisingly human.

FRS 102 governs most small companies, whilst FRS 105 offers even lighter requirements for micro-entities (basically, if your annual turnover is under £632,000, you might qualify). The key isn’t memorising every clause—it’s understanding which standards apply to your specific situation.

Think of accounting standard compliance like cooking. You don’t need to be Gordon Ramsay, but you absolutely need to know the difference between salt and sugar.

The Micro-Entity Advantage

Micro-entities get the accounting equivalent of a fast-pass queue. Under FRS 105, you can file abbreviated accounts that would make a multinational corporation weep with envy for their simplicity. We’re talking about:

- Balance sheet only (no profit and loss statement required for filing)

- Minimal disclosure notes

- Streamlined preparation requirements

But—and there’s always a but—you still need to maintain proper records. The filing might be simpler, but the underlying bookkeeping discipline remains non-negotiable.

Common Pitfalls: The Stuff That Actually Trips People Up

Fifteen years of untangling financial messes has taught me something counterintuitive. The obvious mistakes? Rarely the problem. It’s the subtle stuff that’ll get you.

Revenue Recognition

Sounds boring, right? Tell that to the dozens of businesses I’ve watched stumble over this seemingly simple concept. “Record income when you earn it”—except when do you actually earn it? That six-month project with staggered payments? The annual subscription someone paid upfront? Yeah. It gets messy fast.

Sarah from our bakery example learned this the hard way when she recorded all wedding cake deposits as immediate revenue, rather than recognising it as the work was completed. HMRC wasn’t amused by her creative accounting approach.

The Depreciation Dilemma

That shiny new delivery van doesn’t just magically lose value on paper—it needs to be systematically written down according to accounting standard compliance requirements. Choose the wrong depreciation method, and you’re either overstating or understating your assets.

The Record-Keeping Reality Check

Here’s what proper accounting standard compliance actually looks like in practice:

| Requirement | Small Company (FRS 102) | Micro-Entity (FRS 105) |

| Balance Sheet | Required (detailed) | Required (simplified format) |

| Profit & Loss Statement | Required for filing | Not required for filing |

| Directors’ Report | Usually required | Not required |

| Notes to Accounts | Comprehensive | Minimal disclosure |

| Audit Requirements | May apply (depends on size) | Generally exempt |

Notice how the micro-entity route offers significant relief? But don’t assume it’s a free pass—the underlying transactions still need proper classification and recording.

The Real Cost of Non-Compliance

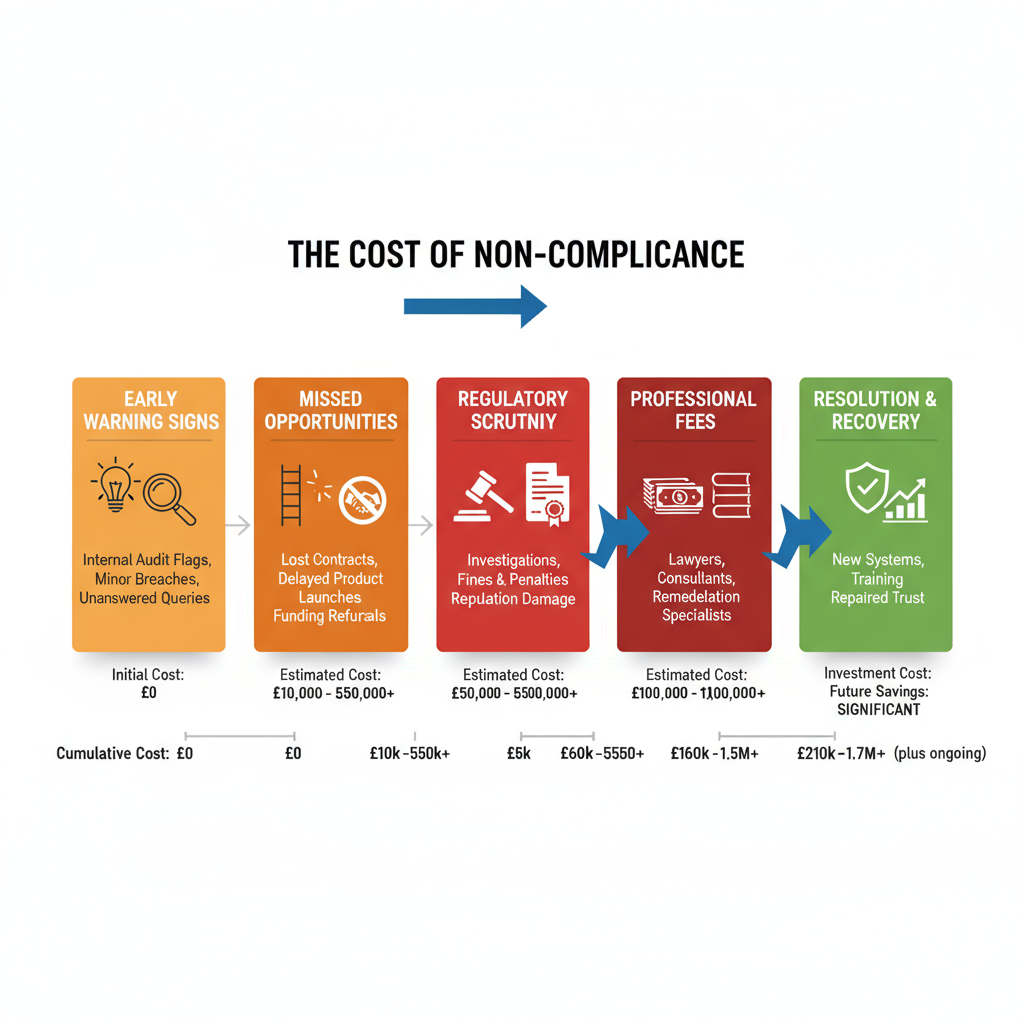

Money talk time. Sure, accounting standard compliance violations can trigger fines—Companies House will happily charge you up to £5,000 for being persistently late with filings. But that’s pocket change compared to the real damage.

The stuff that keeps me up at night? The opportunities that disappear.

Banks scrutinise accounts when you want funding. Investors demand clean, compliant statements. Even potential buyers will ghost you during acquisitions if your books look like they were prepared by a caffeinated teenager.

Case in point: client loses £50,000 equipment finance deal because last year’s accounts violated basic FRS 102 requirements. Bank’s underwriter spots inconsistent depreciation policies, incomplete disclosures, says “thanks but no thanks.”

That’s the real cost. Lost deals. Damaged credibility. The snowball effect of looking unprofessional when it matters most.

Hidden Costs of Poor Compliance

- Higher professional fees to fix compliance issues retrospectively

- Delayed business decisions due to unreliable financial information

- Increased scrutiny from HMRC and other regulatory bodies

- Lost credibility with stakeholders and suppliers

When HMRC Comes Calling

Recent changes have made HMRC increasingly sophisticated in spotting inconsistencies. They cross-reference your filed accounts with VAT returns, PAYE submissions, and even sector benchmarking data.

If your tax compliance is suspect, expect an investigation with questions about:

- Revenue recognition timing

- Expense categorisation

- Asset valuations

- Related party transactions

This process can drag on for months, consuming time and resources that should be focused on growing your business.

Making Compliance Work for You

Here’s where most advice gets it wrong. Accounting standard compliance shouldn’t be a burden you grudgingly bear—it should be a tool that helps you understand and improve your business.

Proper classification of expenses reveals where your money actually goes. Consistent asset valuation helps with insurance and disposal decisions. Regular management accounts (prepared to the same standards as your year-end statements) give you monthly insights into profitability trends.

Take our bakery owner Sarah. Once she implemented proper accounting standard compliance, she discovered that her afternoon tea catering was far more profitable than retail sales. This insight led to a strategic shift that doubled her margins within eighteen months.

The Technology Advantage

Compliance has been democratised in manners unthinkable just five years ago courtesy of modern cloud accounting software. Many of the grunt work such as depreciation, accrual management, and simple reporting are automatically done by cloud-based systems such as Xero, QuickBooks, and Sage.

However, technology is in the hands of the user. The basic rule of accounting is garbage in, garbage out. You must still know what transactions to record, and how to classify them properly.

| Common Transaction Type | Correct Treatment | Common Mistake |

| Equipment purchase (over £500) | Capitalise as fixed asset, depreciate over useful life | Expense immediately |

| Advance payments from customers | Record as deferred income liability | Recognise as immediate revenue |

| Year-end accruals (utilities, etc.) | Estimate and accrue in correct period | Record only when invoice received |

| Professional subscriptions | Spread over subscription period | Expense when paid |

| Directors’ loan accounts | Track separately from trading | Mix with business expenses |

The DIY vs. Professional Help Dilemma

Every small business owner eventually faces this question. Usually around 2 AM when they’re staring at a spreadsheet that doesn’t balance and questioning their life choices.

DIY works. If you’re comfortable with technology, grasp basic accounting concepts, and deal with straightforward transactions, maintaining accounting standard compliance internally makes sense. Modern software does the heavy lifting—you just need to feed it proper information.

But complexity is a sneaky beast. Multiple revenue streams creep in. Stock levels fluctuate. International customers appear. Suddenly you’re drowning in depreciation schedules and revenue recognition policies that seemed manageable last month.

That’s when smart business owners call professionals. Not to take over completely, but to act as guides. Firms like Ask Accountant don’t just prepare year-end accounts—they help structure transactions correctly from day one. Prevention beats cure every single time in accounting.

The sweet spot is often hybrid: maintain your books monthly using cloud software, but have a professional review quarterly and prepare statutory accounts annually. You get the cost benefits of technology with the peace of mind of expert oversight.

Red Flags That Suggest You Need Professional Help

Some warning signs that your accounting standard compliance might benefit from professional input:

- Cash flow doesn’t match reported profits consistently

- You’re unsure how to classify significant transactions

- HMRC has raised questions about previous filings

- You’re considering major investments or acquisitions

- Your business model has evolved beyond simple trading

Don’t wait for problems to emerge—prevention is invariably cheaper than cure in accounting compliance.

Industry-Specific Considerations

Accounting standard compliance requirements can vary dramatically depending on your sector. Construction companies deal with long-term contracts and retention payments. Restaurants have inventory challenges and tip allocation issues. Professional services navigate work-in-progress and billing complexity.

The principles remain constant, but application requires sector knowledge. What looks like straightforward revenue recognition for a plumber becomes a minefield for a software development agency with annual licences and customisation work.

Focus: Construction and Contracting

FRS 102 requires long-term construction contracts to be recorded on the basis of the percentage of completion whereby outcomes are estimable. This is all scholarly until you are seeking to calculate the percent of a six month construction project which is complete in March.

Stage payments make things even more difficult. The amount of that £10,000 received could be half of a 20,000 project, or a quarter of a 40,000 project and other variations. Misjudging this will impact on profit recognition as well as cash flow forecasting.

Creating Your Compliance Roadmap

No one wants you to become a qualified accountant in a day. But knowing the framework assists you to make improved choices and communicate better with professional advisers.

Step 1: Build the Foundation

Begin with the fundamentals: compliance with the accounting standards starts with standard and timely record-keeping. Set up proper chart of accounts in your software. Establish monthly routines for bank reconciliation and transaction review.

Step 2: Build on Complexity

Then gradually build complexity. Learn about accruals and prepayments. Understand fixed asset procedures. Familiarise yourself with disclosure requirements for your company size. The goal isn’t perfection—it’s competence and confidence. You want to spot issues before they become problems and know when to seek help.

Getting Started: A Rough Timeline for New Businesses

- Months 1-3: Foundation building (aka the “please don’t let me mess this up” phase) Choose accounting software that doesn’t make you want to throw your laptop out the window. Set up your chart of accounts properly—this bit’s crucial, though boring. Get into monthly bookkeeping habits before chaos takes over. Register for whatever schemes apply: VAT, PAYE, the whole administrative circus.

- Months 4-6: Fine-tuning (when you realise what you got wrong initially) Review those account classifications—bet you got a few wrong first time round. Sort out proper expense management so receipts stop living in your car’s glove compartment. Figure out filing obligations and deadlines. Start thinking about your first statutory accounts preparation (scary but necessary).

- Months 7-12: Strategic thinking (you’re basically a proper business now) Use management accounts for actual decision-making rather than just compliance box-ticking. Plan for growth and changing requirements—what works at £50k turnover won’t cut it at £500k. Build relationships with professional advisers before you desperately need them at midnight on a Sunday. Survive your first statutory filing experience with dignity intact.

Future-Proofing Your Approach

Accounting standard compliance isn’t static. Standards evolve, technology advances, and business models change. What works for a £100,000 turnover business might be inadequate at £1 million.

Brexit has introduced additional complications for businesses with EU connections. New sustainability reporting requirements are emerging for medium-sized companies. MTD (Making Tax Digital) continues expanding its scope.

The trick is to get elasticity into your systems at the outset. Select software that is scalable. Establish contacts with professional advisers when you do not really need them. Keep good records that can be changed according to requirements.

The Digital Revolution’s Impact

Small business compliance capabilities have been changed by cloud accounting, which has also introduced new expectations. Live reporting, automatic bank feeds, and in-built payroll solutions are turning into a norm and not a luxury.

But new dangers are also posed by technology. The quality of compliance is influenced by data security, system integration and user competence. These are more powerful tools, however they need more advanced knowledge to be effective.

Wrapping Up: Your Next Steps

Meeting the requirements of accounting standards does not necessarily need to be the business version of root canal treatment. When done right, it can be an indispensable management tool that helps in making better decisions and sustainable growth.

Review your current setup honestly. Are you maintaining adequate records? Do you understand which standards apply to your business? Can you explain your accounting policies to a bank manager or HMRC inspector?

If you’re feeling overwhelmed, you’re not alone. Most small business owners didn’t start their ventures to become accounting experts. The trick is finding the right balance between personal understanding and professional support.

For businesses in the London area, Ask Accountant offers comprehensive support ranging from basic bookkeeping to strategic tax advisory solutions. They are based at 178 Merton High St, London, SW19 1AY and they assist small businesses in overcoming compliance requirements and still have a focus on achieving growth goals. You can contact them at +44(0)20 8543 1991 to get an initial consultation.

It is important to remember that compliance with accounting standards is not only a regulatory issue but also an investment in the future of your business. Get it right and it will pay in credibility, efficiency and peace of mind.

Frequently Asked Questions

Q: What do I need to know to determine that my business is a micro-entity under FRS 105? A: You must choose at least two of the following: annual turnover of at least 632,000 or less, total assets at least 316,000 or less or 10 or fewer employees. The majority of small businesses qualify without much difficulty but here is the snag, you have to fulfil the requirements in two years in a row and thereafter file as a micro-entity.

Q: What will become of me should I fail to file my accounts on time? A: Companies House has automatic fines, £150 for less than one month late (painful but manageable), £375 for 1-3 months late, £750 for 3-6 months late, and £1,500 for over six months late. Keep being late persistently? They can disqualify you as a director. Not fun.

Q: Can I change my accounting policies whenever I want? A: Accounting standard compliance demands consistency. You can change policies, but only if the new approach gives more reliable information. Plus you’ll need to explain the change and its impact in your accounts notes. It’s paperwork-heavy, basically.

Q: Do I need an audit as a small company? A: Probably not. Most small companies dodge audit requirements if they stay under the size thresholds (typically £10.2 million turnover, £5.1 million assets). But watch out—shareholders with 10% or more can still demand an audit if they’re feeling awkward.

Q: How long should I keep accounting records? A: Six years from the accounting period end. For companies, that’s law. VAT records also need six years in most cases, though some situations need longer. My advice? When in doubt, keep it longer rather than binning stuff early.

Q: Cash accounting vs accruals—what’s the difference for small businesses? A: Companies generally must use accruals accounting under accounting standard compliance rules (record when transactions happen, not when money moves). Some tiny businesses can elect cash accounting for tax purposes, but that doesn’t change your statutory accounting requirements. Two different games, two different rulebooks.