Here’s something nobody tells you when you start a business: the spreadsheets will multiply faster than rabbits. One day you’re tracking expenses in a simple Excel file, the next you’ve got seventeen versions scattered across three different devices, and you’re second-guessing every number you enter.

I’ve watched countless small business owners drown in this exact scenario. But here’s what changed everything for many of them—accounting today looks nothing like it did even five years ago, and that shift isn’t just about fancy software. It’s about fundamentally rethinking how money moves through your business and who’s watching it move.

Why Your Old Accounting System Is Sabotaging Growth

Let’s be blunt. That quarterly catch-up session with your accountant? Where you show up with a carrier bag full of receipts and a sheepish expression? It’s killing your ability to scale.

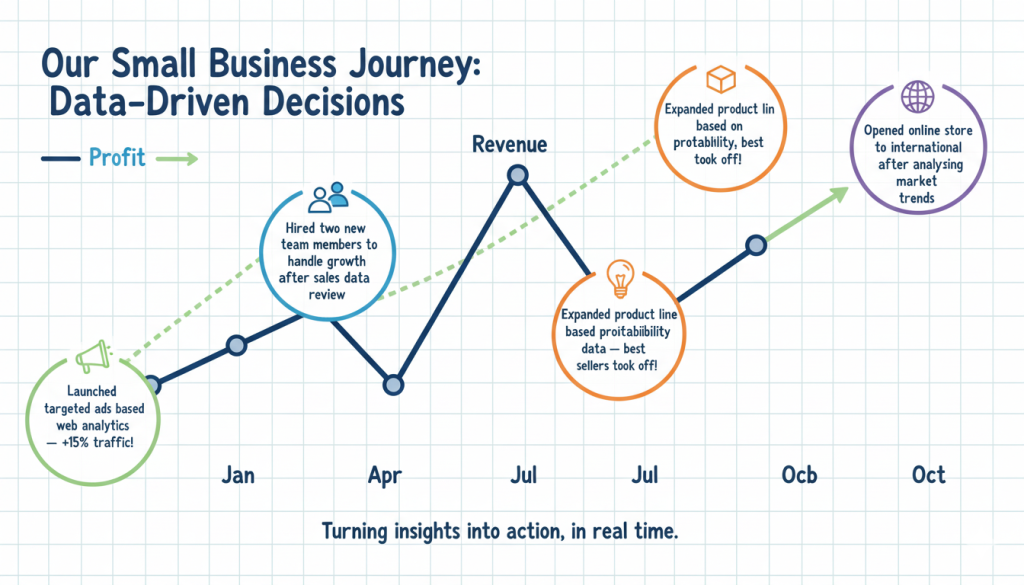

Modern businesses don’t operate in three-month cycles. They need real-time visibility. When you’re making decisions about hiring, inventory, or expansion based on numbers from two months ago, you’re essentially driving whilst looking in the rear-view mirror. And we all know how that ends.

Accounting today demands immediacy. Digital tools have transformed the profession from a backward-looking record-keeping exercise into a forward-focused strategic function. Companies using cloud-based accounting systems make decisions 67% faster than those still wedded to desktop software, according to recent industry research.

The Real Cost of Manual Processes

Manual data entry isn’t just tedious—it’s expensive in ways you probably haven’t calculated. Every invoice typed by hand carries roughly a 1-4% error rate. Multiply that across hundreds of transactions, and suddenly your financial reports contain landmines.

Then there’s time. The average small business owner spends 120 hours annually on basic bookkeeping tasks that could be automated. That’s three full working weeks you could spend actually running your business instead of recording what happened last month.

What Digital Actually Means (And What It Doesn’t)

Here’s where things get interesting, because “going digital” has become one of those phrases that means everything and nothing simultaneously.

It’s not just about buying QuickBooks and calling it a day. True digital transformation in accounting today involves connecting multiple systems so data flows automatically between them.Bank feeds transactions directly into your accounting software. Your invoicing tool talks to your inventory system. Your payroll integrates with your tax calculations.

Reality Check: If you’re still manually downloading bank statements and typing numbers into another programme, you haven’t gone digital—you’ve just changed which screen you’re staring at.

What does digital transformation look like? It’s waking up Monday morning and seeing your weekend sales already categorised and reconciled. Receiving alerts when unusual transactions occur, but not discovering problems during your annual review. It’s having your accountant proactively reach out about tax-saving opportunities because they can see your numbers evolving in real-time.

The Four Pillars Nobody Talks About

Ask most people about digital accounting and they’ll mention cloud software. Maybe automation. But accounting today rests on four interconnected elements that work together—miss one, and the whole structure wobbles.

1. Integration (Not Just Software)

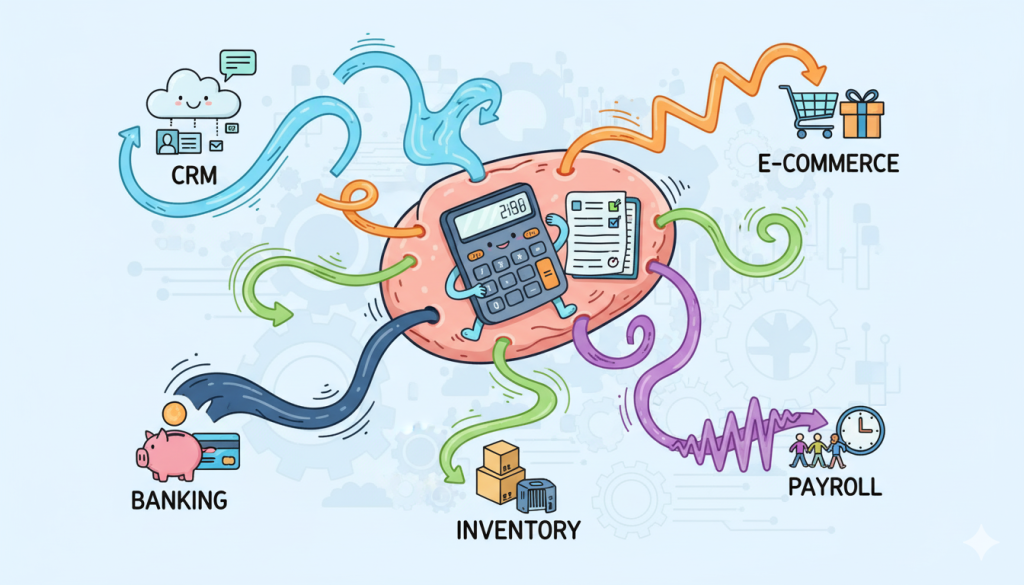

Your accounting system should be the central nervous system of your business, not an isolated organ. When your e-commerce platform, CRM, project management tools, and financial software operate in silos, you’re creating work for yourself.

I worked with a client who’d invested in excellent software but kept each system separate. They employed someone full-time just to move data between programmes. Once we connected everything through APIs, that position became redundant, and more importantly, their financial accuracy jumped from 91% to 99.7%.

2. Real-Time Visibility

This isn’t about obsessively checking your dashboard every five minutes (though some of us do that anyway). It’s about having the ability to answer critical questions immediately: Can we afford that new hire? Is our cash flow healthy enough to take that big order? Which products are actually profitable once we account for all costs?

Traditional accounting systems answer these questions quarterly. Digital accounting today provides answers continuously.

3. Compliance Automation

Tax regulations change. VAT rules shift. Making Tax Digital for Income Tax becomes mandatory from April 2026 for sole traders and landlords earning over £50,000 annually, with the threshold dropping to £30,000 in April 2027. Excel spreadsheets and paper records won’t cut it anymore.

Modern platforms automatically update for regulatory changes. They flag compliance issues before they become HMRC problems. They generate the reports you need without requiring a finance degree to interpret them.

4. Advisory Partnership

This is the bit that surprises people. The best accounting technology doesn’t replace your accountant—it transforms them from a historian into a strategist.

When your accountant has access to live data through cloud systems, conversations shift from “what happened?” to “what should we do next?” Firms like Ask Accountant, who’ve embraced this model, spend less time on data entry and more time providing business advice and proactive tax advisory solutions that actually move the needle for their clients.

| Traditional Accounting | Digital Accounting Today | Impact on Small Business |

| Quarterly updates | Real-time dashboards | Make decisions based on current reality, not ancient history |

| Manual data entry | Automated bank feeds & integrations | Reduce errors from 3-4% to under 0.5% |

| Reactive tax planning | Proactive tax optimization | Average savings of £3,500-£8,000 annually for small businesses |

| Location-dependent access | Cloud-based anywhere access | Work from home, office, or that café with the excellent coffee |

| Compliance as afterthought | Built-in regulatory updates | Avoid penalties, sleep better at night |

| Historical reporting | Predictive analytics | Spot problems before they become disasters |

Making The Switch Without Losing Your Mind

Right, so you’re convinced that digital accounting is the way forward. Brilliant. Now comes the tricky bit—actually doing it without disrupting your entire business or spending six months in transition hell.

First thing: don’t try to change everything simultaneously. I’ve seen businesses attempt a complete overnight transformation, and it usually ends with someone crying in the stationery cupboard. (Sometimes that someone is the owner.)

Start with your bank feeds. Connect your business bank account to your accounting software. This one move does get rid of about 40 percent of manual data entry and at that very step, accuracy is enhanced. After that is going well after a month, switch to the next integration.

The Data Migration Minefield.

Once historical data gets transferred into a new system, then it becomes appropriately complicated. There are years of transactions, records of customers, suppliers, and inventory that must transfer correctly.

Here is what will work: move a single financial year at a time; beginning with the latest. Check the migrations before proceeding to the next one. And, whilst I beg leave to entreat you, my dear, do not delete backups of your old system until you are fully assured that nothing has been moved improperly.

During the migration some businesses find out that their past records were even more sloppy than they had imagined. Categories that made sense five years ago no longer apply. Supplier names spelled three different ways. It’s tedious to clean up, but you’ll thank yourself later.

The Skills Gap Everyone Ignores

Installing software is easy. Getting your team to use it effectively? That’s where most digital transformations stumble.

Your staff might be Excel wizards but completely lost in cloud-based systems. Or perhaps they’re digital natives who can’t understand why proper bookkeeping classifications matter. Accounting today requires a blend of traditional financial knowledge and modern technological fluency that’s surprisingly rare.

Unpopular Opinion: Sometimes it is not the person that has always done the books that should lead your digital transformation. They are invested in the old way since it is working to its advantage although it is dragging your business behind.

Once a transition phase is to be considered, bringing in outside expertise. Those providing business accounting services and bookkeeping can also train and implement it so that your staff is actually embracing the new system instead of struggling with it.

Security: The Elephant Sitting On Your Cloud.

How about the issue that is making business owners sleep deprived: Is it not risky to leave my financial information in the cloud?

Short answer? It’s far safer than that filing cabinet in your office or the laptop that three employees share the password to.

Cloud accounting platforms use bank-level encryption, multi-factor authentication, and automated backups. They employ security teams whose entire job is protecting your data—something you probably can’t replicate with an on-premise server.

That said, security isn’t just about the software. It’s about access management, password policies, and staff training. The biggest security vulnerability in most systems isn’t the technology—it’s the human who clicks on that dodgy email or writes their password on a sticky note.

What Decent Security Actually Requires

- Role-based access – Your warehouse staff don’t need to see payroll figures. Your sales team shouldn’t access supplier payment details.

- Regular access audits – That employee who left eight months ago probably shouldn’t still have login credentials.

- Two-factor authentication everywhere – Yes, it’s slightly annoying. So is having your business bank account drained.

- Encrypted backups – Automated, tested regularly, stored separately from your primary system.

Beyond the Basics: What’s Next for Digital Accounting

If you think accounting today is revolutionary, wait until you see what’s rolling out next.

Artificial intelligence is moving beyond simple categorisation into predictive analytics. AI investment in accounting is projected to grow at a 42.5% compound annual rate through 2027. Systems now forecast cash flow with scary accuracy, suggest optimal payment timing for suppliers, and identify tax deduction opportunities you’d never spot manually. Even financial reports can be generated using generative AI and complex queries may also be addressed using AI when previously it needed human specialists.

The implementation of blockchains is slowly making its way into the accounting software mainstream, which is likely to ensure audit trail immutability as well as immediate verification. Its possible uses and practical uses are yet to be seen, but the possibility of cutting down fraud cases and simplifying auditing is enormous.

And then there is the Internet of Things supplying financial systems. It can be imagined that your delivery trucks would automatically take the mileage claims, your office equipment would automatically claim depreciation, your shelves of inventory would automatically compute reorder. It is a science fiction but pioneers are already testing these systems.

| Feature | What It Does | Who Benefits Most | Availability |

| AI-powered forecasting | Predicts cash flow & trends | Seasonal businesses, rapid growth companies | Available now in premium platforms |

| Blockchain verification | Creates tamper-proof transaction records | Businesses requiring high audit compliance | Early adoption phase |

| IoT integration | Automatic data capture from devices | Manufacturing, logistics, retail | Testing/pilot programmes |

| Automated tax filing | Submits returns without human intervention | Every business (let’s be honest) | Widely available |

| Real-time collaboration | Multi-user access with instant updates | Businesses with remote teams | Standard feature now |

The Cost Conversation We Need To Have

Let’s talk money, because that’s probably your main concern.

Digital accounting systems range from £10 monthly for basic packages to several hundred pounds for enterprise solutions. The temptation is to start cheap and upgrade later, but that often means migrating systems twice—doubling your transition headache.

Instead, think about what you’re replacing. If you’re currently paying someone £15/hour for 10 hours weekly of bookkeeping work that automation could reduce to 3 hours, the software pays for itself immediately. If avoiding a single late payment penalty of £400 because you had real-time cash flow visibility, your system covered its annual cost.

And here’s something most people don’t consider: the opportunity cost of bad financial information. How many growth opportunities have you missed because you weren’t sure about cash flow? How many unprofitable products have you continued selling because you lacked proper costing data? Those invisible costs dwarf subscription fees.

ROI Beyond the Spreadsheet

The return on investing in proper digital accounting today shows up in unexpected places:

- Better credit terms from suppliers who see you as organized and reliable

- Faster access to funding because you can produce clean financials immediately

- Reduced stress and improved mental health (seriously—not underestimating this)

- More time for strategic work instead of administrative drudgery

- Improved relationships with advisors who can finally give you useful guidance

Finding the Right Partner For Your Journey

Software alone won’t transform your accounting. You need expert guidance through the process, ongoing support when things get confusing, and strategic advice that connects financial data to business decisions.

Look for accounting partners who’ve fully embraced digital themselves. If they’re still running their own practice on desktop software, they’re not equipped to guide your transformation. You want advisors who live in the cloud, who understand integration possibilities, who can explain complex platforms in plain English.

Thinking of switching to online accounting? It is a journey worth undertaking, but you do not always have to do it by yourself. Ask Accountant provides business with full support in terms of transitioning to this system, choosing the right platforms, and the implementation and training aspects. Their business team is based in 178 Merton High St, London SW19 1AY and they focus on enabling small businesses to take advantage of technology without the frustration.

It is true that whether you require assistance in the area of auto-enrolment, CIS claims and refunds, or overall business growth planning, the difference between having experts who are familiar with both conventional accounting concepts and new digital solutions. Call them at +44(0)20 8543 1991 to talk to them about how digital transformation would serve your unique case.

Common Pitfalls (And How To Dodge Them)

Before we wrap up, let’s discuss the mistakes that derail digital accounting implementations. Learn from others’ expensive errors.

- Pitfall #1: Choosing software based on price alone. That £10/month platform might be fine for a sole trader with twenty transactions monthly, but if you’re doing serious volume or need specific integrations, you’ll outgrow it within months. Then you’re migrating again, which costs far more in time and frustration than paying proper money initially.

- Pitfall #2: Neglecting training. Buying software without ensuring your team knows how to use it properly is like buying a sports car for someone who’s never driven. Expensive and potentially dangerous. Budget for training as part of implementation costs.

- Pitfall #3: Ignoring your accountant’s input. They’re going to be working with whatever system you choose. Get their opinion before committing. Better yet, work with an accountant who can recommend solutions based on experience with multiple clients in your industry.

- Pitfall #4: Trying to maintain two systems during transition. I know it feels safer, but running old and new systems simultaneously is exhausting and defeats the purpose. Set a hard cutover date, prepare thoroughly, then commit.

Your Next Steps

Right. You’ve made it this far, which suggests you’re serious about modernising your approach to accounting today. Here’s what actually happens next.

Start by auditing your current situation. What’s working? What’s driving you bonkers? Where do errors keep appearing? Which questions can’t you answer quickly? This assessment guides your priorities.

Then research platforms suited to your industry and size. Don’t just read marketing materials—find actual users and ask about problems. Every system has limitations; you want to know what they are before you’re stuck with them.

Obtain the quotes of a few providers, yet more consider the quality of their onboarding process and the quality of its support rather than the cost per month. A moderately priced platform with superior customer care will cost you less money in the long-run than a low-priced platform which leaves you hanging at the altar when an eventuality strikes.

Last but not the least, develop a realistic timeline. A decent transition process (data migration, testing, employee training) requires most of 2-3 months to make the business transition properly. Anyone who says that they can have you running within a week is either a liar or he is sending you to the graveyard.

The Bottom Line

Digital accounting is not coming it is here. The companies that are currently doing well are not always the ones that sell the best product and use the most brilliant marketing strategies. They are the ones that can be clearly seen financially, whose processes are efficient and able to make quick-informed decisions.

This is the transition already being made by your competitors. Some have finished it. The gap between businesses with modern financial systems and those still fighting with spreadsheets grows wider every quarter.

But the point is here–it is not too late. In fact, small businesses are in a better position to undergo this change compared to large corporations which are burdened with old systems and bureaucratic systems of approvals. You are able to make fast decisions, make changes, and allow changes to take place overnight, and experience the fruits of your labor.

The possibilities that exist in accounting today, were nonexistent five years ago. It’s not whether you should take up the digital transformation or not, it is how you will be the first one to take the transformation or you will be left to run after other competitors.

The decision, so to say, is in your hands. But choose quickly. The carrier bag of receipts is not becoming any lighter.

Frequently Asked Questions

What is the time required to switch to digital accounting?

A typical transition of most small business requires 2-3 months, which encompasses data transfer, testing, and training of staff. Hurrying up the process is normally giving more issues than solutions.

What becomes of my past records of financial information?

The use of reputable accounting software enables you to migrate past data, which in most cases is several years early. It will be complicated depending on the existing system and quality of data.

Will my current accountant still be able to work with me?

Absolutely. Actually, the connection with your accountant is improved by using the modern cloud accounting as it provides your accountant with immediate access to your data. They do not waste much time when it comes to data entry but rather give strategic advice.

Am I confident in the cloud of my financial information?

Cloud accounting servers normally employ bank-tier encryption, multi-factor authentication, and automatic backups security systems, which are well beyond most small businesses to install in house. It is not the cloud infrastructure that is likely to pose a greater risk, but rather poor passwords practices or lack of proper access controls.

What is the actual cost of digital accounting?

The cost of software subscriptions start at £10-300+ monthly based on features and size of business. But the cost of fewer bookkeeping hours, fewer errors, superior tax planning, and penalties avoided should all be added up.

Will digital accounting assist in the Making Tax Digital compliance?

Necessary, in fact, indispensable. After April 2026, when an individual taxpayer or a landlord with annual income above 50,000 requires MTD compatible software, paper records and Excel will not qualify as / comply with HMRC regulations. Online accounting systems have an inbuilt compatibility with MTD, which automatically formats and sends data in the necessary format. This is decreased to less than £30,000 as of April 2027 and thus, even smaller businesses have to start preparing.