The morning commute on the Northern Line. Rain that seems to fall sideways. That moment when your accountant sends over yet another folder of paperwork that needs signing before tomorrow. Some aspects of London business life seem impossibly stuck in the past.

I was having coffee with a small business owner in Merton last week who confessed something that made me laugh: “I’ve got three separate apps to order my lunch, but until last year I was still logging expenses in a spreadsheet my nephew made for me in 2015.” Sounds familiar?

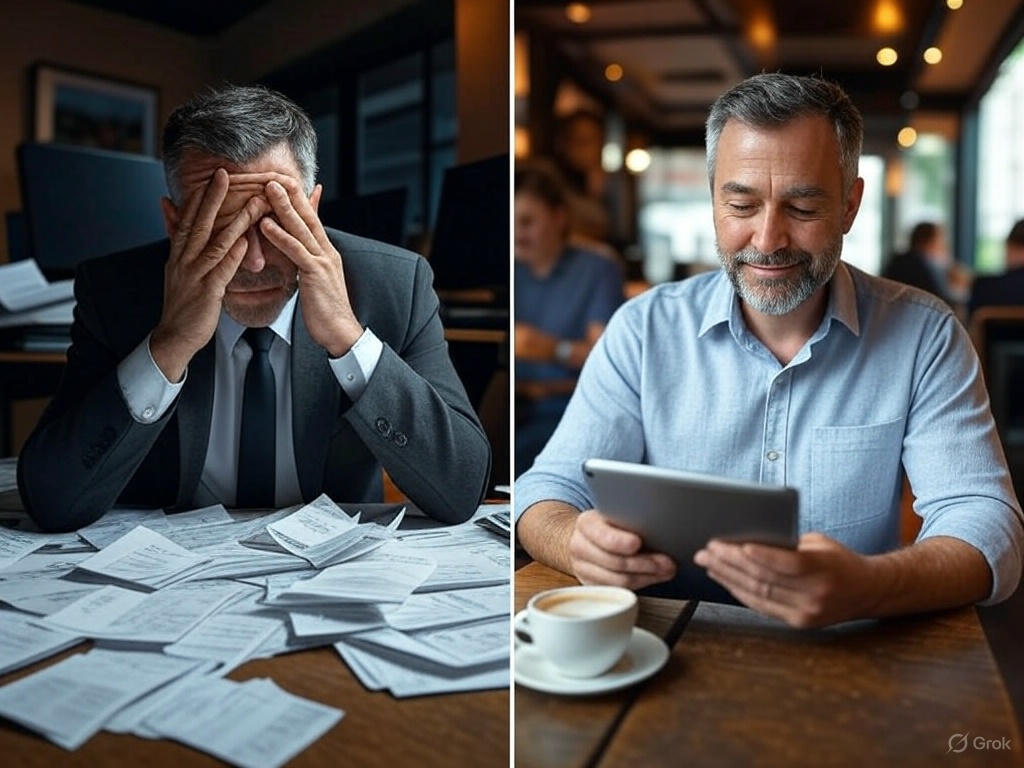

The shift to cloud accounting isn’t just another tech trend—it’s rapidly becoming the dividing line between London businesses that spend their weekends drowning in admin and those that actually have time to, well, have a weekend.

The Fog Lifts: What Cloud Accounting Actually Means

Let’s clear something up straight away—cloud accounting isn’t just “putting your spreadsheets online.” It’s an entirely different approach. For more on its impact, see the impact of cloud-based accounting on small businesses in London.

Traditional accounting often feels like this:

- Frantically sending files back and forth via email

- Your accountant calling about missing receipts (that you’re sure you sent)

- End-of-year panic when numbers don’t add up

- The dreaded “I’ll need this by tomorrow” requests

Cloud accounting flips this model on its head. Instead of having financial data trapped on someone’s laptop or in filing cabinets, everything lives in a secure online environment that updates in real-time.

The team at Ask Accountant explained it perfectly when I was looking into options for my own small consultancy: “Think of it as the difference between writing letters versus having a conversation. Traditional accounting is like posting letters back and forth, while cloud accounting is an ongoing dialogue.”

Why London Businesses Can’t Afford to Wait

London’s business landscape moves at a particularly relentless pace. Commercial rents that make your eyes water. Fierce competition. A workforce with increasingly flexible expectations.

These pressures create a perfect storm where efficiency isn’t a luxury—it’s survival.

Some London-specific reasons cloud accounting makes particular sense:

- The commute tax—Any system that requires less travel time to sign documents or drop off paperwork instantly saves precious hours in a city where the average commute takes significant time. (Note: the 74 min figure may be pre-pandemic, the linked article discusses recent changes).

- Space comes at a premium—Physical storage for accounting documents? In London? At these prices per square foot? Cloud systems eliminate the need for document storage.

- Resource fluidity—London businesses tend to scale up and down quickly, bringing on contractors or temporary staff to meet demand. Cloud systems allow for seamless access management without hardware constraints, reflecting trends in flexible working and the gig economy.

A financial director at a Southwark tech startup told me they switched primarily because “London business happens 24/7—our accounting needed to keep up.” For more on the London business environment, see resources from London business support organizations.

The Numbers That Matter: Cloud vs. Traditional

Let’s look at some figures that might surprise you (data indicative, see industry reports for specifics and benefits and explore our guide to modern bookkeeping):

| Metric | Traditional Accounting | Cloud Accounting |

|---|---|---|

| Time spent on data entry (hrs/month) | 24-32 | 8-10 |

| Average bookkeeping errors | 8-12% of transactions | Under 1% |

| Time to prepare year-end accounts | 3-6 weeks | 1-2 weeks |

| Cost per year (SME) | £2,900-£5,000 | £1,400-£3,500 |

| Visibility of current financial position | Monthly/quarterly reports | Real-time |

But beyond these numbers lies something harder to quantify—peace of mind. I remember the first time I logged into my cloud accounting platform on a Sunday evening before a big Monday meeting and could instantly see exactly where my business stood financially. No panicked texts to my accountant. No guesswork. Just clarity.

The Mental Shift: From “Looking Back” to “Looking Forward”

Here’s where things get interesting. Cloud accounting fundamentally changes what you expect from financial management.

Traditional accounting mainly tells you what happened. Cloud accounting helps you see what’s about to happen.

“The biggest change we see in our clients isn’t technological—it’s psychological,” notes a business advisor at Ask Accountant. “When you’ve got real-time data at your fingertips, you start thinking proactively about your finances rather than reacting to historical information.”

This shift suits London businesses particularly well. In a market where opportunities can appear and disappear in days, having your finger on your financial pulse isn’t just convenient—it’s critical.

But It’s Not All Sunshine and Automated Invoices

I’d be lying if I said the transition to cloud accounting is always smooth sailing. It isn’t.

Some businesses struggle with:

- Staff resistance to new systems (particularly from long-serving team members) – Tips for managing change.

- Initial setup time and data migration headaches

- Subscription costs that can add up across multiple services (e.g., Xero, QuickBooks)

- Occasional internet connectivity issues (though rare in London – see UK connectivity reports from Ofcom)

- The learning curve for teams less comfortable with technology

These growing pains are real, but they’re typically front-loaded. Most businesses report that after the initial adoption phase, these issues fade while the benefits compound.

The Security Question Everyone Asks

“But is it really secure to have all our financial data in the cloud?”

Fair question. And one I obsessed over before making the switch myself.

The short answer: For most small to medium businesses, cloud accounting is significantly more secure than traditional methods.

Why? Professional cloud accounting services invest millions in security infrastructure that most SMEs could never afford for their on-premise systems (learn more from the National Cyber Security Centre’s cloud security guidance). Multi-factor authentication, enterprise-grade encryption, and constant security monitoring come standard.

Compare that to traditional accounting risks:

- Laptops with financial data that can be lost or stolen

- Email attachments with sensitive information

- USB drives passing between staff members

- Paper documents sitting in unlocked drawers

- Backups that rarely get tested until disaster strikes

As the cybersecurity expert who helped us migrate our systems bluntly put it: “Your financial data is probably safer in a properly managed cloud environment than it is on your office computer.”

Real London Business Stories: The Switch

Let’s look at a few anonymised examples of London businesses that made the leap:

Camden Fashion Retailer: Reduced accounting costs by 40% within the first year, while gaining the ability to see inventory, sales, and financial position in one dashboard. “We finally understand our seasonal cash flow patterns,” the owner shared.

Hackney Restaurant Group: Cut invoice processing time from 3 days to same-day, dramatically improving supplier relationships. “Our suppliers actually prefer working with us now because they know they’ll get paid promptly,” their operations manager told me.

Fulham Professional Services Firm: Eliminated 15 hours per week of manual data entry, freeing their in-house bookkeeper to focus on financial analysis instead. “She went from data processor to strategic advisor overnight,” the managing partner explained.

What’s striking in these stories isn’t just the efficiency gains—it’s how the businesses redeploy those saved resources in ways that drive growth.

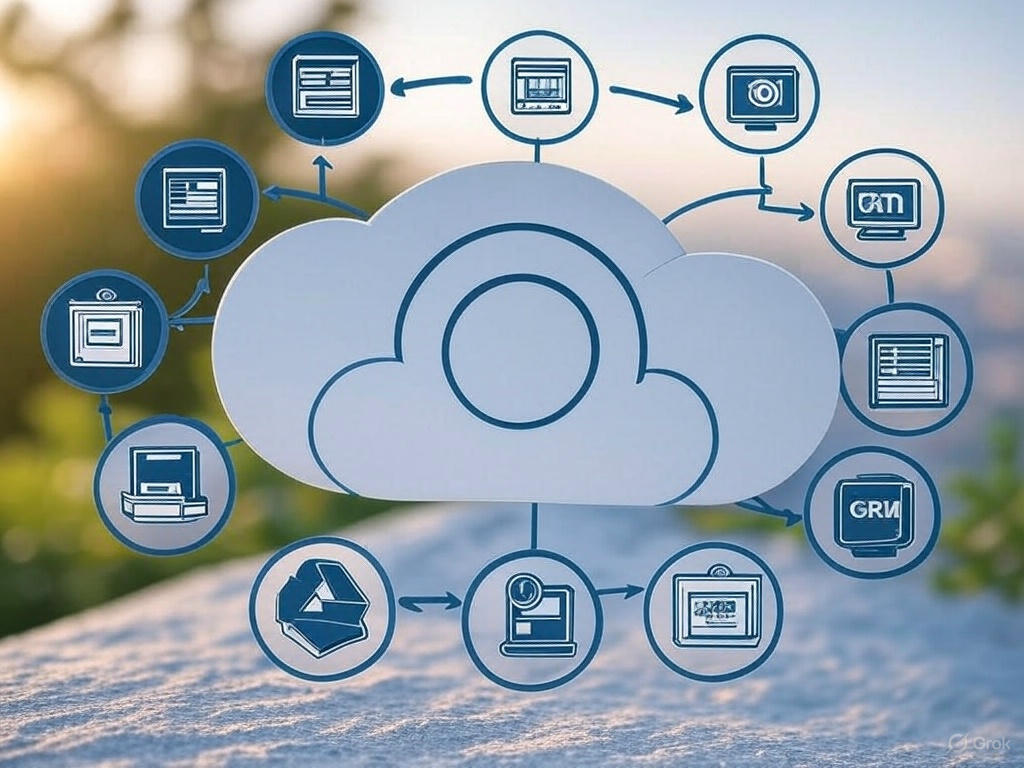

Integration: The Hidden Superpower

Cloud accounting really shines when it talks to your other business systems.

Modern platforms can integrate with:

- Payment processors (e.g., Stripe)

- CRM systems (e.g., HubSpot)

- E-commerce platforms (e.g., Shopify)

- Inventory management

- Project management tools

- Banking feeds (via Open Banking)

This interconnection creates a financial ecosystem that largely maintains itself, dramatically reducing manual input and the errors that come with it.

For London businesses juggling multiple service lines or products, this integration capability often proves transformative. A Shoreditch marketing agency director described it as “like suddenly having an extra account manager who never sleeps.”

How to Make the Switch Without Losing Your Mind

Transitioning to cloud accounting doesn’t have to be traumatic. Here’s the approach that seems to work best for most London businesses:

- Start with clear goals—Define what success looks like beyond “moving to the cloud.” Is it time savings? Better reporting? Specific integrations?

- Choose the right timing—Beginning of a financial year is ideal, but not essential. Avoid your busiest periods.

- Get expert help—This isn’t the place to DIY. Professionals like Ask Accountant can manage the transition to cloud accounting with minimal disruption to your operation.

- Train properly—Invest time upfront to ensure your team understands the new systems.

- Run parallel systems briefly—Keeping your old system running alongside the new one for a month provides a safety net.

- Review and optimize—After 3-6 months, review your processes to ensure you’re maximizing the benefits.

Remember that the real benefits of cloud accounting often come from rethinking your processes, not just digitizing existing ones.

Finding the Right Support Partner

The right accountant for traditional accounting isn’t necessarily the right partner for cloud accounting. You need someone who understands both the technology and your business needs.

When evaluating potential accounting partners, ask:

- Which cloud platforms do they specialize in? (Ask Accountant offers specialized cloud accounting services)

- What percentage of their clients are on cloud systems?

- What’s their approach to training and support?

- Can they provide London-specific industry benchmarks? (Check sources like the City of London SME Landscape report for insights)

- How do they handle the transition period?

Good cloud accounting isn’t just about software—it’s about having advisors who can help you interpret and act on the real-time data you’re now receiving.

Common Questions About Cloud Accounting

After helping dozens of London businesses transition to cloud accounting, I’ve noticed these questions pop up consistently:

“How long does the transition typically take?”

For most small to medium London businesses, expect 2-4 weeks from start to finish. Companies with complex inventory or multiple entities might need 6-8 weeks. Ask Accountant typically completes basic transitions in under 3 weeks.

“Will my team need extensive training?”

Most cloud platforms are surprisingly intuitive. The average user needs about 2-3 hours of guided training spread over a week. The accounting team might need more in-depth sessions, but the learning curve isn’t nearly as steep as many fear.

“What happens if I need historical data from years ago?”

Good news—most transitions include importing historical data. How far back depends on your needs. Some businesses bring over 1-2 years, while others import everything. Ask Accountant recommends at minimum importing the current and previous financial year.

“Can I still work with my existing accountant?”

Maybe. Some traditional accountants have embraced cloud systems wholeheartedly. Others resist change. The important question isn’t whether they’ll work with cloud systems, but whether they’ll leverage the cloud’s capabilities to provide better business advice.

“What happens if the internet goes down?”

Mobile apps for most cloud accounting platforms allow access via your phone’s data connection. Many also have offline modes that sync when connectivity returns. In London, with multiple connectivity options, this rarely becomes a serious issue.

Warning: Before choosing a cloud accounting provider, check their backup and data export policies. You should always be able to access and download your financial data even if you decide to switch services later. Learn more about data portability and your rights under UK GDPR from the ICO.

The Bottom Line (Because That’s What This Is All About)

Cloud accounting isn’t perfect. No system is. But for most London businesses, the advantages overwhelmingly outweigh the drawbacks.

When implemented thoughtfully with the right support, cloud accounting doesn’t just change how you track money—it changes your relationship with your business finances entirely.

That shift—from reactive to proactive, from historical to predictive, from confusion to clarity—might be exactly what your London business needs to thrive in increasingly uncertain times.

Take the Next Step

Ready to explore whether cloud accounting makes sense for your London business? Ask Accountant (178 Merton High St, London SW19 1AY) offers no-obligation discovery sessions to assess your specific situation and outline potential benefits.

Call +44 (0)20 8543 1991 to book a 30-minute consultation, or visit their office in Merton to see cloud accounting systems in action. Their team specializes in cloud accounting transitions while providing ongoing business advisory, tax planning services, and information on CIS claims and refunds (see also CIS via GOV.UK) to ensure you get the full benefit of your new systems.

After all, cloud accounting isn’t really about accounting software. It’s about giving London businesses back the one resource they can never get enough of: time