Nobody warns you about the paperwork.

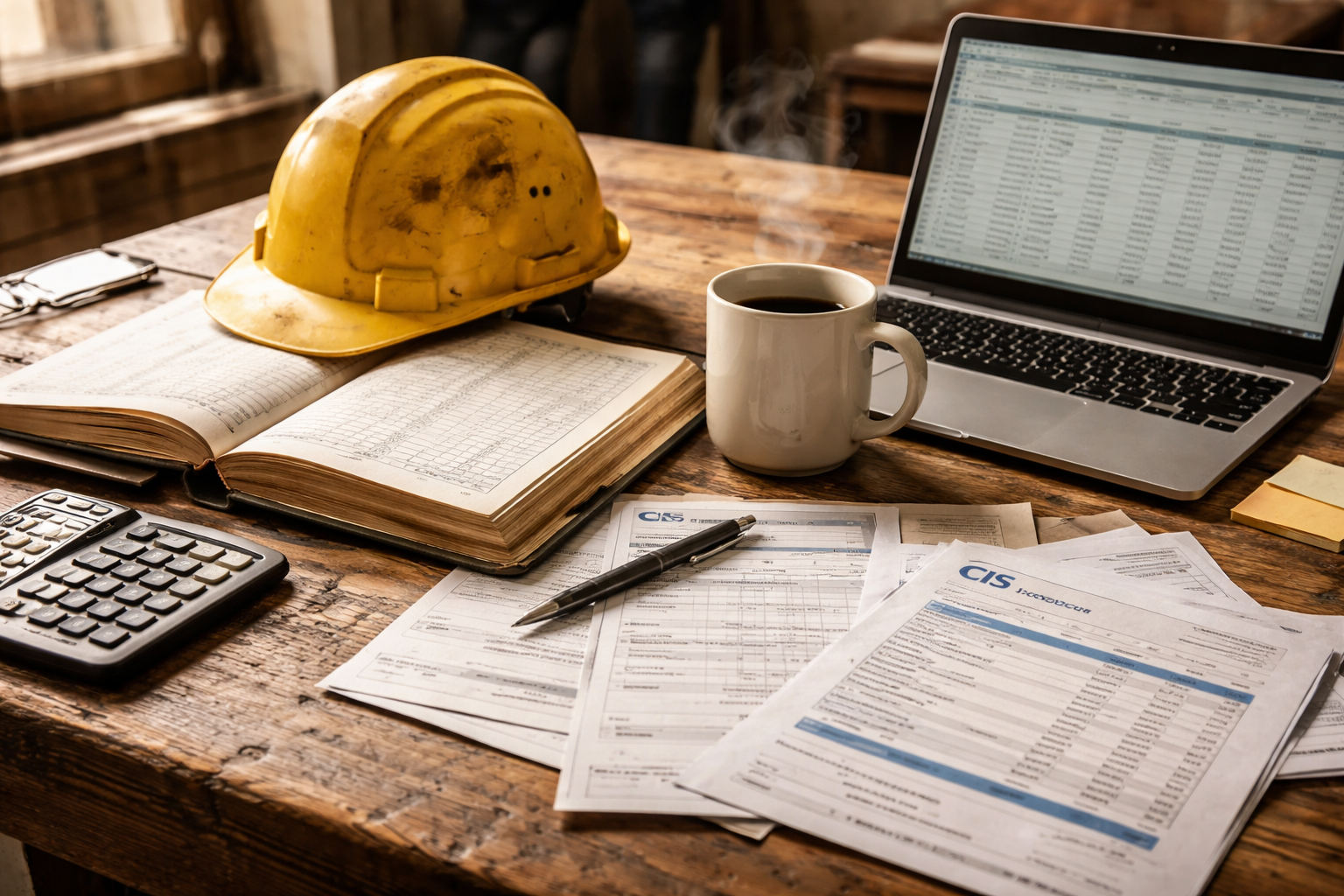

You spent years perfecting your trade — mastering the pour, the fix, the fit-out. Then somebody handed you a contract worth £180,000, spread across eight months, on a site where three other firms are working. Now HMRC wants to know exactly how much of that counts as income this quarter. Welcome to construction accounting. It looks, from the outside, like ordinary bookkeeping with a hard hat slapped on top. It isn’t. Not even close.

Construction is one of the few industries where a project “in progress” can simultaneously show a profit on paper, burn through your cash reserves, and keep you technically compliant — all at once. The financial mechanics differ genuinely from running a shop or a consultancy. Invoices don’t always follow the work. Costs arrive before revenue. Subcontractors bring their own compliance headaches. And the Construction Industry Scheme (CIS) sits over the whole thing like legislation that will absolutely catch you out if you don’t understand it.

This guide is for UK contractors — sole traders, limited companies, partnerships — who want a proper handle on construction accounting for contractors without wading through 40 pages of HMRC guidance. We’ll cover the core concepts, the practical pitfalls, and the moments where professional support genuinely earns its fee.

A note before we start: this isn’t generic small business accounting advice repurposed for builders. The construction sector has its own accounting standards, its own tax rules, and its own particular ways of going spectacularly wrong. Let’s dig in.

Why Construction Doesn’t Play by the Usual Accounting Rules

Most businesses sell a thing, get paid, record the income. Construction refuses to be that simple. A contractor building a commercial extension might start on-site in March, reach practical completion in November, then raise retention invoices for six months. They only collect the final 5% of the contract value the following spring. What’s the income for the tax year ending April? That depends entirely on which accounting method you use — and the choice matters enormously.

The Two Main Revenue Recognition Methods

The percentage of completion method (also called the stage of completion method) recognises revenue as work progresses. So if you’ve completed 60% of a £200,000 contract, you’d recognise £120,000 as income in that period, even if you’ve only received £80,000. The logic is sound — you’ve earned that revenue — but you need a reliable way to measure completion. Options include: costs incurred versus estimated total costs, surveys of work done, or milestones completed.

The alternative — the completed contract method — defers all revenue and costs until the project finishes. This simplifies things for short contracts. But it creates lumpy, unpredictable income for anyone running multiple overlapping projects. It can also distort your reported profits badly in any given year, which causes problems with banks, lenders, and anyone assessing your business’s financial health.

Under FRS 102 (the accounting standard most UK SMEs follow), the percentage of completion approach is generally required for long-term contracts when you can estimate the outcome reliably. If you can’t estimate reliably, you only recognise revenue to the extent of recoverable costs incurred. This sounds complicated because it is — and it’s one reason why having an accountant who actually knows construction makes a real difference.

Job Costing — Where Construction Accounting Actually Lives

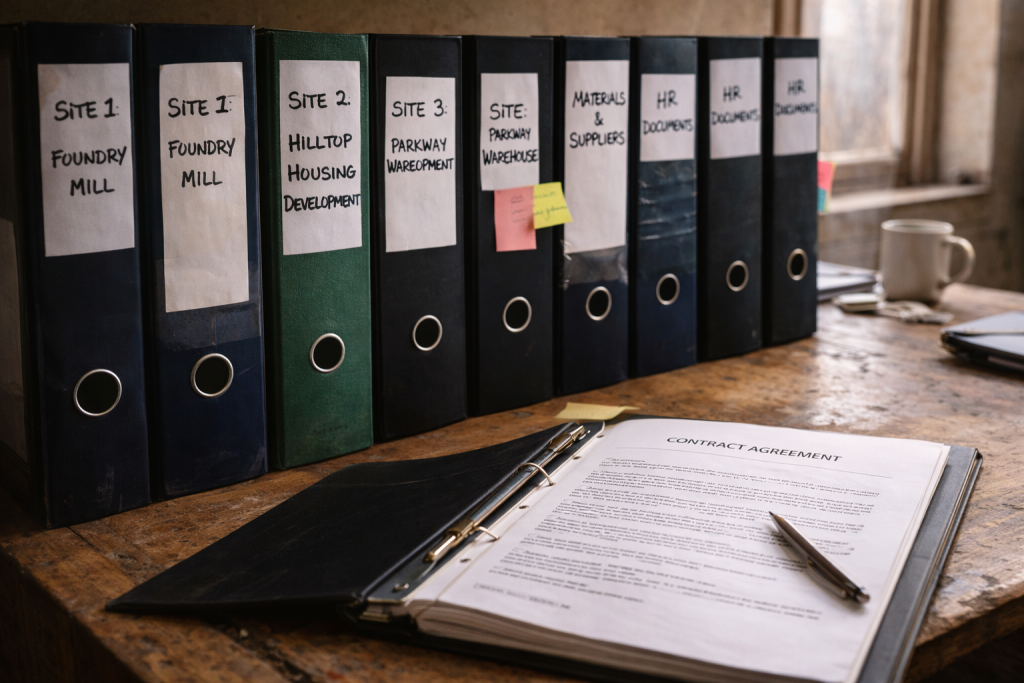

If there’s one concept that separates proper construction accounting from generic business bookkeeping, it’s job costing. The idea is straightforward: every pound you spend goes to a specific contract or project — not thrown into a general expenses bucket. Labour, materials, plant hire, subcontractors, site-specific overheads — all tagged to the job. Every one of them.

Why does this matter so much? Because without job-level cost tracking, you genuinely cannot tell whether a project made money. A contractor turning over £1.2 million might run five jobs simultaneously — three quietly profitable, one breaking even, one haemorrhaging cash without anyone noticing. The P&L looks fine. The bank account looks fine. The underlying reality is rather different.

Good job costing gives you:

- Real-time visibility of project profitability — while you can still do something about it

- Data to write more accurate quotes on future work (most estimating errors trace back to not knowing actual historic costs)

- Evidence for variations claims — when the client changes the spec and you need to show the additional cost, your job cost records are your ammunition

- A defensible basis for work-in-progress valuations on your balance sheet

The Discipline Problem (And How to Solve It)

The real challenge with job costing is discipline. It only works if every expense gets a project code at the point of entry. That means training whoever handles your purchase invoices, having a clear code structure, and using accounting software that makes coding easy. Xero, QuickBooks, and Sage all have job tracking functionality — though some suit construction better than others.

There’s also the question of overhead allocation. Direct costs are easy — the bricks, the scaffolding, the groundworker’s day rate. But how do you apportion the van insurance? The accountancy fees? The boss’s salary when they split their time across multiple sites? You need a consistent method, applied regularly, or your job-level figures will mislead you.

What Goes Into a Construction Job Costing System

| Cost Category | Examples | Direct or Overhead? | Notes |

|---|---|---|---|

| Labour | Employed staff wages, NI, holiday pay | Direct | Timesheets essential for multi-site workers |

| Subcontractors (CIS) | Subbies paid under CIS deduction | Direct | Must verify CIS status before first payment |

| Materials | Timber, concrete, fixings, plumbing fittings | Direct | Watch for materials bought across multiple jobs |

| Plant & Equipment Hire | Scaffold, digger hire, crane time | Direct | Allocate daily/weekly hire to specific project |

| Site Overheads | Site huts, welfare, temporary power/water | Direct | Often underestimated in initial quotes |

| General Overheads | Office rent, insurance, vehicles, management | Overhead (allocated) | Use a consistent allocation method (% of turnover, hours, etc.) |

| Retention | Amounts withheld pending defects period | Balance sheet | Track separately — often forgotten or written off incorrectly |

Table: Common cost categories in construction job costing — direct costs are project-specific; overheads require an allocation policy.

CIS — The Construction Industry Scheme Nobody Reads Until It’s Too Late

Ask any accountant who works with contractors and they’ll say the same thing: the Construction Industry Scheme causes a disproportionate share of client problems. Not because it’s impossibly complex — it isn’t — but because it’s easy to get slightly wrong, and the penalties are genuinely painful.

How CIS Actually Works

Here’s the core mechanic. When a contractor pays a subcontractor for construction work, they must first verify that subcontractor’s status with HMRC. Depending on the result, the contractor either pays in full (gross payment status), deducts 20% and sends it to HMRC (standard verification), or deducts 30% (subcontractor not registered at all). The deducted amounts work as advance tax payments on behalf of the subcontractor. In practice, they create a significant cash flow issue for subcontractors — and a compliance minefield for contractors.

Things that catch people out:

- Failing to verify before the first payment. This isn’t optional. If HMRC decides you should have deducted at 30% (because the subbie wasn’t properly registered), you — the contractor — face liability for the underpayment. Not them. You.

- Misclassifying a subcontractor as self-employed. If HMRC determines someone working under CIS is actually an employee, you face PAYE arrears, NI, and potential penalties. The IR35 rules layer on top of this in a particularly unpleasant way.

- Getting the materials split wrong. CIS deductions apply to the labour element only — not materials. If you deduct on the full invoice amount including materials, your returns will be wrong.

- Late monthly returns. CIS returns are due by the 19th of each month. Miss this, get a penalty. It starts at £100 for one month and escalates from there.

The Refund Side of CIS

If you’re a subcontractor with CIS deductions throughout the year, you’re likely owed a refund — especially if expenses also reduce your taxable profit. CIS refunds rank among the most under-claimed reliefs in the construction sector. Sole traders and limited companies have different routes to claiming, and the amounts can be substantial. Ask Accountant handles CIS claims and refunds regularly — for many subcontractors, a single annual claim more than covers the cost of accountancy.

⚠️ Watch out for this: If you’re a contractor who is also a subcontractor on other contracts — very common in groundworks and specialist trades — you sit on both sides of CIS simultaneously. Your compliance obligations as a contractor don’t disappear just because you’re also having deductions made from your own payments. Two separate compliance tracks, running in parallel.

VAT in Construction — And Why the Reverse Charge Changed Everything

Until October 2020, VAT in construction was complicated but manageable. You charged VAT on your invoices, reclaimed VAT on your purchases, filed your returns. Standard stuff — with the added complexity of figuring out whether particular works were zero-rated (new residential builds), reduced-rated (certain energy efficiency works), or standard-rated.

Then came the domestic reverse charge for construction services. Everything changed.

How the Reverse Charge Works in Practice

For most B2B construction services between VAT-registered businesses — where the customer will make onward supplies of construction services — the customer, not the supplier, now accounts for the VAT. The subcontractor issues an invoice stating “reverse charge applies” and no VAT changes hands. The main contractor receiving that invoice then accounts for both the output and input VAT on their own return.

Why does this matter for cash flow? Subcontractors who previously received a VAT flow (held temporarily before paying HMRC) no longer get it. If your business model depended on that VAT float — even slightly — the reverse charge hit hard. Get clear on which supplies fall inside the reverse charge and which don’t. Supplies direct to end users (homeowners, non-construction businesses) are generally still standard-rated. The HMRC guidance on the reverse charge is actually more readable than most of their publications.

Zero-Rating: Valuable but Strictly Conditions-Based

Zero-rating deserves a mention. New residential construction carries 0% VAT — you charge nothing on your outputs but still reclaim VAT on your inputs. On a large new-build contract, that input VAT recovery on materials can be significant. But the conditions are strict: proper planning permission, genuinely new construction, not a conversion falling into a different category. The rules around extensions and conversions are eye-wateringly detailed. Charging standard rate when you should have zero-rated — or claiming zero-rating when it doesn’t apply — invites HMRC investigations and penalties.

Work in Progress, Retentions, and the Balance Sheet Nobody Looks At

Two items on a construction contractor’s balance sheet cause more confusion than almost anything else: work in progress (WIP) and retentions. Both are perfectly legitimate accounting concepts. Both get handled badly, far too often.

Work in Progress — Getting the Numbers Right

Work in progress represents costs on contracts that you haven’t yet fully recognised as revenue. Say you’ve spent £30,000 on a job that’s 40% complete on a contract worth £90,000. Under the percentage of completion method, you’d recognise £36,000 in revenue and £30,000 in costs — showing a £6,000 margin. The WIP entry on your balance sheet then captures the relationship between costs incurred, revenue recognised, and amounts billed to date.

Get your WIP calculations wrong and your accounts misstate your profits. Overstate WIP (recognising revenue too early) and you pay tax on money you haven’t earned — money you potentially can’t recover if the contract goes sour. Understate it and you look less profitable than you are, which affects borrowing and investment.

Retentions — Money That’s Yours (But Isn’t Collected Yet)

Retentions are a different kind of problem. Standard practice in UK construction means clients withhold a percentage of contract value — often 5%, sometimes more — during the works and for a defects liability period afterwards. The money is yours in principle. In practice, collecting it takes action, follow-up, and sometimes legal pressure.

The accounting treatment looks simple: retention receivable on your balance sheet, matched by the revenue you’ve recognised. But many contractors either forget to track retention properly, write it off without attempting collection, or leave it out of revenue entirely — creating a systematic understatement of income. There’s also a genuine credit risk. A main contractor going into administration while holding your retention is not a hypothetical. It happens, rather more often than anyone in the industry likes to admit.

💡 Tip worth knowing: Retention money in the UK is currently unsecured — if the party holding it goes bust, you join the queue of unsecured creditors. The Retention Deposit Scheme proposals have been bouncing around Parliament for years. In the meantime, keep a close eye on the financial health of the companies holding your retentions, and factor collection risk into your project profitability assessments.

Your Workforce: When “Subcontractor” Stops Being the Safe Label

Construction has a long tradition of self-employed labour. Always has. The flexibility suits both parties — contractors scale up and down with workload, trades can work across multiple firms. But HMRC has spent the better part of two decades unpicking arrangements it regards as disguised employment, and the construction sector sits firmly in the crosshairs.

The CIS scheme itself was partly designed to capture tax from workers who might otherwise disappear from the system. But the employment status question goes deeper. A subcontractor who works exclusively for you, on your tools, under your direction, at times you dictate — that person looks a lot like an employee. HMRC may well agree. If they do, you face PAYE and National Insurance arrears going back years, plus interest and penalties.

How to Assess Employment Status Risk

The CEST tool (Check Employment Status for Tax) on the HMRC website gives guidance on how HMRC views particular arrangements. It’s imperfect — HMRC only stands behind results if you provide information accurately — but running your subcontractor arrangements through it is a reasonable starting point for spotting risk.

If you do have genuinely employed workers — including working directors — payroll adds another layer. Monthly RTI submissions, auto-enrolment pension contributions, holiday pay accruals, statutory sick and maternity pay. None of it is impossible, but it all needs to work correctly. Payroll management and auto-enrolment are worth delegating if you’re not confident in-house. Errors here become visible to HMRC almost immediately through RTI data.

CIS At a Glance: What Contractors and Subcontractors Need to Know

| Aspect | Contractor Obligations | Subcontractor Position |

|---|---|---|

| Registration | Must register as contractor with HMRC before engaging subbies | Should register — unregistered = 30% deduction rate |

| Verification | Verify every new subcontractor via HMRC online before first payment | Ensure UTR and NI number are correct with HMRC |

| Deduction Rates | 20% (registered), 30% (unverified), 0% (gross payment status) | Apply for gross payment status if turnover > £30k (sole trader) |

| Monthly Returns | File by 19th of each month; nil returns required if no payments | Receive CIS statement from contractor for each payment |

| Penalties | £100 for first month late; escalates to £3,000+ for prolonged non-filing | May have suffered excess deductions — reclaim via self-assessment or corporation tax |

| What’s Covered | Labour element only — not materials (which must be separately identified) | Keep receipts for materials to prove correct split on invoices |

| Refunds | Offset CIS deductions suffered against PAYE/CIS liability owed | Claim refund via self-assessment return or in-year for limited companies |

Note: Gross payment status thresholds differ for sole traders vs partnerships vs companies. The above figures are illustrative — verify current thresholds with HMRC or your accountant, as these can change.

Tax That Doesn’t Have to Cost You More Than It Should

Construction businesses can access some genuinely useful tax reliefs — many of which go under-claimed. The Annual Investment Allowance (AIA), currently at £1 million, lets you deduct 100% of plant and machinery expenditure immediately. For a contractor investing in new plant, equipment, or vehicles, getting the timing and structuring of these purchases right can make a meaningful difference to the year’s tax bill.

Capital Allowances: More to Claim Than Most Contractors Realise

Capital allowances more broadly — first-year allowances, writing down allowances, the structures and buildings allowance for qualifying works — are an area where specialist advice adds real value. The rules around what qualifies are specific. The difference between a purchase treated as capital (spread over many years) versus revenue (deducted in the year) isn’t always obvious. Getting it wrong in either direction creates problems: either you overpay tax now, or you trigger an HMRC query later.

Limited Company vs Sole Trader: Tax Planning Levers

If you operate through a limited company, corporation tax planning opens up options. Salary/dividend optimisation, pension contributions (deductible for the company), timing of director bonuses, and proactive tax planning can all reduce the overall tax burden legitimately. The key word is proactive — you need to make these decisions before the year-end, not after.

Sole traders and partnerships should think about their self-assessment returns in the context of their actual trading pattern. Construction income can be lumpy — a bumper year followed by a slow one. Legal mechanisms exist for smoothing that out: overlap relief, loss carry-back. They’re completely legitimate. They simply require you or your accountant to pay attention.

Cash Flow in Construction: Profitable on Paper, Broke in Reality

Here’s a scenario that plays out in the construction sector every single year. A contractor is busy. Turnover is good. Their accountant is happy with the profit margin. Then — in a bad month, when a big client pays late, when materials prices spike, when a plant breakdown delays an application — they can’t make payroll. They’re “profitable.” They’re also, temporarily, unable to pay their bills.

This is the cash flow paradox of construction, and it’s structural. You pay costs (labour, materials) before or as the work happens. You bill the client at agreed intervals — monthly valuations, milestone invoices, whatever the contract specifies. The client certifies your application, then takes their contractual payment period. They might dispute part of it. They treat the 30-day payment term as a floor rather than a ceiling. Meanwhile you’re already starting the next month’s labour costs.

The One Tool That Actually Prevents Cash Crises

A robust cash flow forecast — updated weekly, not monthly — ranks among the most valuable financial tools a contractor can own. It doesn’t prevent late payments. But it means you see the gap coming three weeks out rather than the day before payroll. That three-week window is the difference between arranging an overdraft extension and having a genuine crisis.

The Housing Grants, Construction and Regeneration Act 1996 (as amended by the Local Democracy Act 2009) gives contractors statutory payment rights — but exercising those rights requires knowing they exist and having the paperwork in order. Many contractors accept late payment simply because they don’t know they have legal options.

Finding an Accountant Who Actually Understands the Sector

Not all accountants are the same. A perfectly competent general practice handling 200 clients — restaurants, e-commerce, buy-to-let landlords — may lack the depth of construction accounting experience you actually need. CIS, VAT reverse charge, WIP accounting under FRS 102, capital allowances on plant — these specifics require genuine familiarity, not just the willingness to look things up.

What should you expect from a good construction accountant? They should ask questions about your contracts and your workforce. They should understand the difference between how you bill and how you pay tax. They should flag CIS compliance issues without you having to raise them. And they should be proactive — reaching out before deadlines, not after.

Beyond Compliance: Advisory That Actually Moves the Needle

Firms offering business advisory services alongside pure compliance work deserve serious consideration. There’s a real difference between an accountant who files your returns accurately and one who helps you structure your business for growth, monitors your job-level profitability, and thinks ahead about your tax position. Both provide value. One provides considerably more of it.

Ask Accountant, based in South West London at 178 Merton High St, London SW19 1AY, works with contractors and construction businesses across a range of services — from bookkeeping and CIS refunds through to corporate tax planning and business growth planning. If you’re a contractor wrestling with any of the issues in this article, it’s worth a conversation. Call them on +44(0)20 8543 1991.

Software: What’s Actually Useful and What Creates More Admin

Cloud accounting has transformed small business finance, and construction is no exception. Making Tax Digital requirements have pushed most VAT-registered businesses onto cloud platforms already. But the question of which software suits a contractor isn’t settled just by being MTD-compliant.

Choosing the Right Platform for Construction

For construction-specific features, dedicated platforms exist — Xero with its Projects module, QuickBooks with job costing functionality, and construction-specific tools like Causeway or Coins for larger businesses. General cloud platforms work well for contractors whose main need is clean bookkeeping and CIS return management. If you need detailed project cost reporting with WIP analysis, you may need either a specialist platform or a well-configured general one.

The honest answer: software is only as useful as the data you put in. A sophisticated construction accounting system with inconsistent cost coding is worth less than a simpler tool used meticulously. The discipline of job costing depends on whoever handles purchases coding them correctly — every time. Software won’t create that discipline. Process, training, and accountability will.

Why Site Access to Your Accounts Matters More Than You Think

One practical advantage of cloud platforms for construction contractors: you can access them from site, not just the office. Purchase invoices photographed and uploaded on-site, rather than accumulating in a folder in someone’s van. Bank feeds keep the ledger current rather than requiring manual updates. These aren’t trivial improvements — they’re the difference between having reliable financial data in real time and scrambling to reconstruct the picture at month-end.

Frequently Asked Questions About Construction Accounting

Do I have to register for CIS if I’m a sole trader contractor?

Yes — if you pay subcontractors to carry out construction work, you must register as a contractor under CIS. This applies regardless of your business structure. Even if you’re a sole trader who occasionally hires subbies, the obligation stands. Failing to register and operate CIS correctly can result in penalties — and HMRC can hold you liable for unpaid deductions.

What’s the difference between an application for payment and a tax invoice in construction?

An application for payment (sometimes called a “valuation” or “interim application”) is a request for payment based on work done to date. It’s not technically a VAT invoice until it’s certified or paid. In construction accounting, understanding when a transaction becomes a VATable supply — and when you should raise a proper VAT invoice — matters for both compliance and cash flow. The basic tax point rules apply (earliest of invoice date, payment date, or supply date), but construction contracts often contain specific payment and certification mechanisms that affect this.

Can I claim back CIS deductions that have been taken from my payments?

Yes. If you’re a sole trader subcontractor, CIS deductions suffered are credited against your income tax and National Insurance liability on your self-assessment return. Overpayments generate a refund. For limited company subcontractors, you can offset CIS deductions against the company’s PAYE/CIS liabilities. If the company is a pure subcontractor with no employees, this generates a refund claim you submit directly to HMRC. CIS refund claims are a significant practical benefit that many contractors don’t pursue proactively.

What counts as “construction operations” for CIS purposes?

The definition is broad. It includes: site preparation, demolition, building, installation of systems (electrical, plumbing, heating, ventilation), finishing works (plastering, joinery, flooring), and associated external works. Some activities fall outside it — professional work (architects, surveyors, consulting engineers), drilling for oil/gas, installation of certain equipment, and work on property not intended as part of a permanent structure. The HMRC CIS 340 guide has a detailed breakdown.

Should a small construction company operate as a sole trader or limited company?

This genuinely depends on your specific circumstances — turnover, profit levels, growth plans, personal financial situation, risk appetite. As a rough guide: at lower profit levels, the tax savings from limited company status are modest. The additional compliance costs (corporation tax, Companies House filings, director duties) may outweigh them. As profitability grows, the ability to pay a tax-efficient combination of salary and dividends becomes more valuable. Get proper business advice on structure before you commit. Changing structure after the fact carries its own costs and complications.

What is work in progress (WIP) and why does it matter for my accounts?

WIP in construction represents the value of work done on a contract that you haven’t yet fully invoiced or settled. It appears on your balance sheet as an asset (costs incurred plus profit recognised, less amounts already billed). Accurate WIP is essential for presenting honest accounts, paying the correct tax, and giving banks or investors a true picture of your financial position. Under FRS 102, long-term contracts generally require the percentage of completion method — which means regular WIP assessments at each reporting date.

How is construction accounting different from regular business accounting?

Construction accounting differs in several meaningful ways. Revenue recognition follows contract progress rather than simple invoicing. Job costing tracks profitability at the project level. The CIS scheme creates specific payroll and subcontractor compliance obligations. VAT includes the domestic reverse charge mechanism. Long-term contracts require WIP accounting. And retention receivables need separate balance sheet tracking. Generic small business accounting approaches often produce misleading results for construction companies — which is why sector-specific expertise matters.

The Bottom Line

Construction accounting for contractors is more than keeping receipts and filing returns on time. It’s about understanding how money moves through your business — contract by contract, month by month — and having systems that give you reliable information rather than a retrospective story.

The contractors who stay financially healthy over the long term tend to share certain characteristics. They know whether each project is making money, not just the business overall. They stay CIS-compliant without panic. They manage cash flow with some kind of forward visibility. And they have an accountant genuinely in their corner — not just someone processing data once a year.

None of this requires a finance department. It requires good processes, appropriate tools, and professional support matched to the actual complexity of your work. If your current accounting setup isn’t giving you the visibility and confidence you need, address it before the next crunch — not during it.

For contractors in and around London looking for specialist construction accounting support, Ask Accountant offers everything from day-to-day bookkeeping and CIS refund claims through to tax advisory and business growth planning. Get in touch at 178 Merton High St, London SW19 1AY or call +44(0)20 8543 1991.