Introduction

Let’s face it – tax isn’t exactly the most thrilling part of running a business. But what if I told you that your company might be sitting on money that rightfully belongs back in your pocket? Yes, you read that correctly, you may be eligible for an HMRC tax refund. Many small and medium-sized businesses (SMEs) across the UK are unknowingly overpaying their taxes each year, leaving thousands of pounds in HMRC’s coffers that could be fueling their own growth instead.

As someone who’s helped countless businesses navigate the often confusing world of tax reclaims, I’ve seen firsthand how transformative these refunds can be for SMEs. Whether it’s funding a new marketing campaign, investing in equipment, or simply improving cash flow during challenging times, recovering overpaid tax can make a significant difference to your bottom line.

In this comprehensive guide, I’ll walk you through everything you need to know about HMRC tax refunds for small businesses – from identifying if you’re eligible to completing your claim and tracking its progress. No complicated jargon or mind-numbing technicalities – just straightforward advice that could put money back where it belongs.

What Exactly Is an HMRC Tax Refund?

Simply put, an HMRC tax refund is money returning to your business when you’ve paid more tax than you actually owe during a tax year. This overpayment can happen for various reasons – perhaps you’ve overpaid through PAYE (Pay As You Earn), had changing circumstances that affected your tax position, or failed to claim allowable expenses and reliefs that you’re entitled to.

For SMEs, these refunds aren’t just loose change. They can represent substantial sums that could be reinvested into your business operations, especially if you discover you’ve been overpaying for several years.

“I always thought tax returns were just about paying what we owe,” a client once told me after receiving a £7,800 refund. “I never considered that HMRC might actually owe us money instead.”

This is a common misconception. While HMRC has sophisticated systems to ensure you pay what you owe, the responsibility for identifying and claiming overpayments often falls on your shoulders. Consider seeking professional tax advice if you’re unsure.

Are You Eligible for a Tax Refund? Signs Your SME Might Be Due Money Back

Before diving into the claiming process, let’s identify whether your business might be sitting on unclaimed refunds. You could be eligible if:

- Your business income has fluctuated significantly during the tax year

- You’ve made payments on account based on previous years’ higher profits

- You’ve invested in qualifying business equipment or research (Capital Allowances)

- You’ve incurred business expenses you haven’t claimed relief for

- Your company has made losses that could be carried back against previous profits (Loss Relief)

- You’ve overpaid Corporation Tax or VAT

- You’ve been operating on estimated tax codes

One small manufacturing company I worked with discovered they were eligible for a refund simply because they hadn’t claimed capital allowances on machinery purchased three years earlier. The oversight had cost them over £12,000 in overpaid tax!

The eligibility criteria differ slightly depending on whether you’re a sole trader, partnership, or limited company, but the principle remains the same: if you’ve paid more than you legally need to, that money should come back to you.

Common Scenarios Where SMEs Overpay Tax

Understanding the typical situations where businesses overpay can help you identify potential refund opportunities:

Unclaimed Capital Allowances

Businesses frequently underestimate or completely overlook capital allowances on equipment, vehicles, and even certain building features. The Annual Investment Allowance (AIA) lets you deduct the full value of qualifying items from your profits before tax, yet many SMEs don’t fully utilize this benefit.

Research and Development Relief

If your company has been developing new products, processes, or services, you might qualify for R&D tax relief. This generous scheme can reduce your corporation tax bill or provide a tax credit—but it’s routinely underused by eligible SMEs who don’t realize their activities qualify as R&D. Our business advice services can help identify eligibility.

Incorrect Tax Codes

For business owners who take a salary through PAYE, incorrect tax codes can lead to significant overpayments. These mistakes can persist for years if not checked regularly via your Personal Tax Account.

Loss Relief Claims

When businesses make a loss, they can often offset this against profits from previous years, generating a tax refund. However, many fail to properly claim these reliefs, particularly during economic downturns when they need cash the most.

VAT Overpayments

Errors in VAT calculations or misunderstandings about what can be reclaimed frequently lead to overpayments. This is especially common in businesses with complex VAT arrangements or those dealing with a mixture of standard-rated and exempt supplies.

How to Claim Your HMRC Tax Refund: A Step-by-Step Guide

Now for the part you’ve been waiting for—actually getting your money back! The process varies slightly depending on your business structure, but here’s a general roadmap:

For Self-Employed Business Owners and Partnerships

- Complete your Self-Assessment tax return: This is the primary mechanism for claiming refunds if you’re self-employed or in a partnership. See our guide on filling in your return.

- Ensure all allowable expenses are included: Review your business costs thoroughly and make sure everything legitimate is claimed.

- Submit your return: Once filed, HMRC will calculate whether you’re due a refund.

- Specify refund preferences: Indicate whether you’d prefer a direct bank transfer (faster) or a cheque (slower).

For Limited Companies

- File your Company Tax Return: Complete form CT600 accurately, including all allowable expenses and capital allowances.

- Calculate your corporation tax correctly: Use HMRC’s online tools or accounting software to ensure accuracy.

- Submit amended returns if necessary: If you discover past overpayments, you can submit amended returns for previous accounting periods.

- Request a repayment: Specify that you want overpaid tax refunded rather than held on account for future liabilities.

I remember helping a small IT consultancy that had been calculating their corporation tax manually for years. When we reviewed their returns, we found they’d consistently overpaid due to not claiming travel expenses properly. Their refund came to over £9,000 across three years!

Documents You’ll Need to Support Your Claim

Having the right documentation ready not only speeds up your claim but also reduces the risk of HMRC queries or investigations. Key documents include:

- Your company’s Unique Taxpayer Reference (UTR)

- Your business’s corporation tax reference (if applicable)

- National Insurance numbers (for self-employed claims)

- Complete business accounting records

- Evidence of expenses and capital purchases

- Bank details for receiving the refund

Organization is key here. One interior design business I advised had all their receipts and invoices in shoeboxes—literally! We spent a full weekend sorting through them, but the effort paid off with a substantial refund. Don’t let poor record-keeping cost you money that’s rightfully yours.

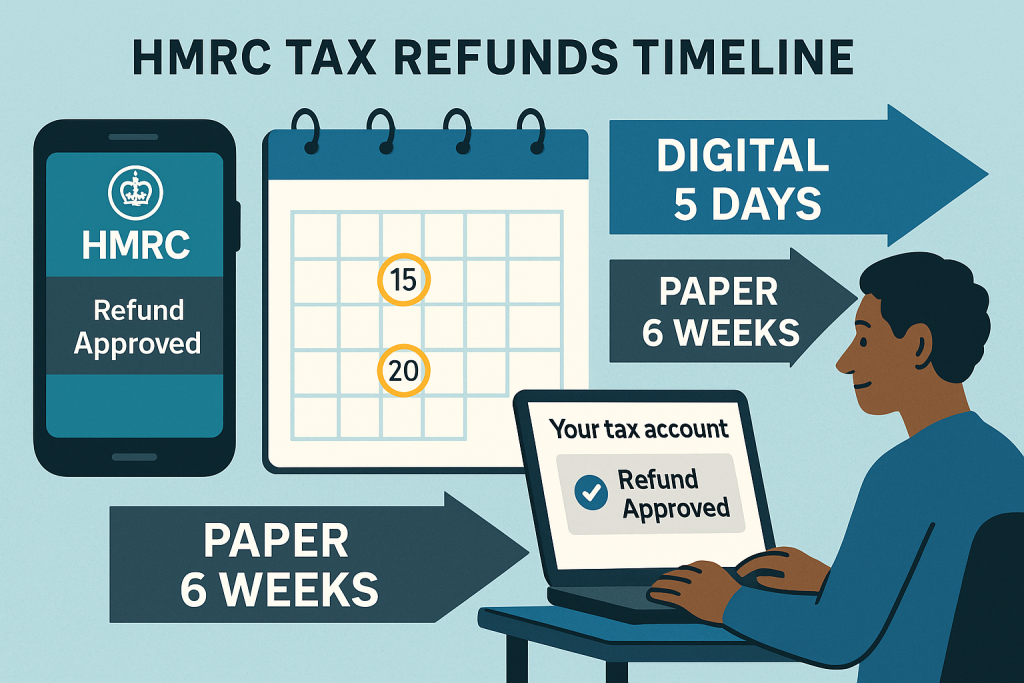

Timeline: How Long Does an HMRC Tax Refund Take?

“When will I get my money?” This is probably the question I hear most often when discussing tax refunds with clients. While exact timelines vary, here’s what you can generally expect:

- Online refunds: typically arrive within 5 working days after approval

- Cheque refunds: can take up to 6 weeks to process and deliver

- Complex claims: involving multiple years or significant amounts may take longer due to additional checks

The process tends to be quicker for straightforward claims submitted online through your Government Gateway account or the HMRC app. Paper-based claims almost always take longer, so digital submission is recommended whenever possible.

One important point about timing: HMRC doesn’t automatically process refunds. While they might send a P800 tax calculation showing you’re due money back, you’ll still need to actively claim it. Don’t fall into the trap of waiting for HMRC to send you money without taking action!

Claiming Refunds for Previous Years: It’s Not Too Late

Here’s a nugget of information that surprises many business owners: you can claim tax refunds for up to four years after the end of the tax year in which you overpaid. That means if it’s currently the 2025/26 tax year, you could potentially claim refunds as far back as the 2021/22 tax year.

This extended timeframe is extremely valuable for businesses that:

- Have recently discovered they’ve been incorrectly calculating tax

- Have found receipts or evidence of unclaimed allowances from previous years

- Have been too busy managing day-to-day operations to review their tax position regularly

I worked with a small construction company that had completely overlooked plant and machinery allowances for three consecutive years. When we finally reviewed their position, they received a refund of over £15,000. The business owner was astonished—that money funded a new vehicle they desperately needed but couldn’t previously afford. Check our CIS claims service if you’re in construction.

Common Mistakes to Avoid When Claiming Your Refund

Even when you’re entitled to a refund, simple errors can delay or reduce your payment. Here are the pitfalls I most frequently see businesses falling into:

Incomplete Records

HMRC needs evidence to support your claim. Incomplete or disorganized records make it difficult to verify your entitlement and may lead to your claim being rejected or reduced. Consider Cloud Accounting solutions.

Missing Deadlines

Remember that four-year window I mentioned? It’s strict. If you miss it, your overpaid tax stays with HMRC permanently. Keep an eye on the Tax Calendar.

Incorrect Bank Details

A surprising number of refunds get delayed because businesses provide outdated or incorrect bank information. Double-check these details before submitting.

Failing to Respond to HMRC Queries

If HMRC has questions about your claim, responding promptly is crucial. Ignoring their inquiries will stall your refund indefinitely. Our team can help manage HMRC investigations.

Over-Claiming

While you should claim everything you’re entitled to, trying to push the boundaries with questionable expenses can trigger investigations that delay legitimate refunds and potentially lead to penalties.

How to Track the Status of Your Tax Refund

The waiting game can be frustrating, but HMRC does provide ways to monitor your claim’s progress:

- Personal Tax Account or Business Tax Account: This online dashboard shows the status of your claim and any actions needed.

- HMRC App: Offers similar tracking capabilities on your mobile device.

- Phone: If online tracking doesn’t provide enough detail, you can call HMRC directly, though be prepared for potential wait times.

- Accountant Access: If you work with an accountant, they can often check status updates through their agent services account.

A word of patience: during peak periods like the end of the tax year or self-assessment deadlines, processing times often increase. Planning your claim for quieter periods can sometimes result in faster turnarounds.

Special Considerations for Different Business Types

The refund process has some important variations depending on your business structure:

Sole Traders

You’ll typically claim through self-assessment. If you’re due a refund after filing your return, you can usually receive it directly to your bank account within a few days of your assessment being processed.

Limited Companies

Corporation tax refunds work differently than income tax. Your company must submit a CT600 form, and any adjustments might require amended returns for specific accounting periods. Company secretarial support can be useful here.

Partnerships

These can be more complex as both the partnership and individual partners may have tax positions affected. Refunds might be split between partners according to profit-sharing ratios.

VAT-Registered Businesses

VAT refunds operate on a completely separate system from income or corporation tax. Claims typically happen through your regular VAT returns, with adjustments for past periods made via specific correction procedures.

Working with Professionals vs. Doing It Yourself

Should you handle your tax refund claim personally or bring in professional help? There are valid arguments for both approaches:

DIY Approach

Pros:

- No professional fees

- Direct control over the process

- Learning opportunity for simple claims

Cons:

- Time-consuming

- Risk of missing eligible claims

- Less expertise in maximizing legitimate refunds

Professional Assistance (like Ask Accountants UK)

Pros:

- Expert knowledge of available reliefs and allowances (Accounts and Tax services)

- Time savings for you and your team

- Often identifies refund opportunities you might miss

- Greater confidence in claim accuracy

Cons:

- Professional fees (though these are typically offset by higher refund amounts)

- Need to share financial information

I’ve seen businesses attempt DIY claims and recover some money, only to discover they could have claimed significantly more with professional guidance. One retail client initially received a £3,200 refund on their own but later recovered an additional £8,700 with specialized help for the same period.

Conclusion: Taking Action on Your Potential Refund

If there’s one thing I hope you take away from this guide, it’s that recovering overpaid tax isn’t just for large corporations with teams of accountants. Small and medium businesses across the UK are successfully reclaiming money they’ve overpaid, often with transformative effects on their financial health.

The key is taking that first step—reviewing your tax position to identify potential overpayments, gathering the necessary documentation, and submitting your claim through the appropriate channels. Whether you choose to manage this process yourself or work with a tax professional, the potential returns make it well worth the effort.

Remember, this isn’t about aggressive tax avoidance or finding loopholes—it’s simply about ensuring you don’t pay more than you legally need to. HMRC’s own guidance acknowledges that taxpayers are entitled to reclaim overpaid tax, and the systems are in place to facilitate this.

So take a look at your business tax history. Those old tax returns gathering dust might just contain the key to a financial boost your business could really use right now.

Need professional assistance with your tax refund claim? Contact our team of SME tax specialists today for a free initial consultation. We’ve helped hundreds of businesses just like yours recover overpaid tax, with an average refund of £7,400 per client.