Here’s something they don’t tell you in those neat government guidance notes: submitting an IHT400 form isn’t just paperwork—it’s the bureaucratic equivalent of launching a message in a bottle across the English Channel. You send it off. You wait. Sometimes you wait more. And the question burning in your mind? When on earth will HMRC actually process this thing?

If you’re an executor dealing with someone’s estate right now, you’ve probably discovered that inheritance tax forms come with their own special brand of anxiety. The IHT400 form isn’t a quick Friday afternoon job—it’s comprehensive, demanding, and frankly, more than a little intimidating.

Let me paint you a picture. You’ve just lost someone. You’re grieving. And now HMRC wants you to account for every asset, every debt, every gift made in the last seven years. Oh, and they’d like accurate valuations, please. No pressure.

What Actually Happens When You Submit Your IHT400 Form

So you’ve conquered the beast—completed your IHT400 form, attached all the schedules (IHT405 for the house, IHT403 for those gifts, maybe IHT413 for business assets), paid whatever inheritance tax was due, and sent the whole lot off to HMRC. What now?

The official line goes something like this: HMRC aims to process your IHT400 form within 15 working days. That’s three weeks, roughly. In reality? Well, let’s just say “aims” is doing some heavy lifting in that sentence.

HMRC states they’ll issue the IHT421 within 15 working days of receiving your IHT400 or payment of the tax due, whichever comes later. The IHT421 is basically HMRC’s stamp of approval—the document that says “yes, we’ve seen this, and you can now apply for probate.”

But—and this is a sizeable but—that’s just for straightforward estates. Simple cases where the numbers add up, nothing looks suspicious, and HMRC’s computers don’t decide your submission needs “further review.”

The 20-Day Rule Everyone Forgets

Here’s where it gets interesting. HMRC now recommends waiting 20 working days from when you submit your IHT400 before you even think about applying for probate. Why? Because they changed how the system works, and if you apply too early, your application and their IHT421 won’t match up properly. It’s like arriving at a party before the host—awkward and unproductive.

The process changed in May 2020 when HMRC stopped printing and physically stamping forms. Now they email the IHT421 directly to HM Courts and Tribunals Service (HMCTS). Modern and efficient, right? Except when the matching system goes wonky and your probate application sits in digital limbo because the computers can’t find your IHT421.

| Processing Stage | Official Timeframe | Reality Check |

|---|---|---|

| Initial receipt acknowledgement | 15 working days | Usually reliable if tax paid |

| IHT421 issued to HMCTS | 15 working days | Can be 15-20 days minimum |

| Safe to apply for probate | 20 working days | Don’t rush—seriously, wait |

| Compliance check decision | 12 weeks | Up to 12 weeks if they’re checking |

| Full detailed checks (if required) | Additional 12 weeks | Can extend further |

| Probate grant issued (HMCTS) | Under 7 weeks (target) | 9+ weeks increasingly common |

When Processing Times Stretch Beyond the Forecast

Not all IHT400 forms are created equal. Some sail through. Others? They trigger what HMRC politely calls a “compliance check.”

If you haven’t heard from HMRC within 12 weeks of them issuing your IHT421, you can generally assume they’re not going to question your figures. That’s the good news. The slightly terrifying news? During those 12 weeks, they might decide your estate needs closer scrutiny.

What Triggers Extended Processing for IHT400 Forms?

HMRC doesn’t randomly pick forms to examine. They’re looking for specific red flags:

- Substantial lifetime gifts – Especially those nudging close to or exceeding the nil-rate band

- Complex business assets – Business Property Relief claims get extra attention

- Property valuations that seem… creative – If your £600k London terrace is valued at £400k, expect questions

- Multiple properties, particularly overseas assets

- Trusts (HMRC finds trusts inherently suspicious, bless them)

- Large pension death benefits being claimed

Reality Check: If your IHT400 form includes gifts within seven years of death that total more than the available nil-rate band, recent forum discussions suggest HMRC has been taking longer to issue probate codes. Cases involving lifetime gifts are being referred for review before codes can be issued, which adds weeks to the process.

The Backlog Nobody Wants to Discuss

Let’s address the elephant in the room. Processing times for IHT400 forms in 2025 aren’t just about the complexity of your estate—they’re also about HMRC’s capacity.

Despite significant increases in IHT400 submissions, HMRC claims they’re processing over 90% within their 15-day target. That’s actually quite impressive. But that other 10%? Those are the complex estates, the ones with questions, the ones that need human eyes rather than algorithmic approval.

And once HMRC has done their bit, you’re waiting on HMCTS. Press reports suggest half of probate applications now take more than nine weeks to process, though HMCTS maintains the average is under seven weeks. Someone’s maths isn’t mathing here.

The construction sector has been particularly vocal about delays across various HMRC services. Some accountants report clients waiting until August 2025 for PAYE refunds that used to take weeks. While that’s not directly about IHT400 forms, it paints a picture of an organisation stretched thin.

Breaking Down the IHT400 Form Timeline (The Honest Version)

Let me walk you through what really happens after you click “send” or post that hefty envelope:

Week 1-2: Your IHT400 form lands in HMRC’s system. If you’ve paid the tax due, they’ll start processing. If you haven’t paid yet but need to claim an instalment arrangement, this is when you need to submit IHT420 alongside your IHT400 form.

Week 2-3: For straightforward cases—estate under £1 million, no complicated reliefs, valuations look reasonable—HMRC issues the IHT421. This gets emailed directly to HMCTS. You might receive a letter confirming they’ve done this, or you might not. The communication can be… sporadic.

Week 3-4: This is your “safe zone” for applying for probate. Don’t apply before 20 working days have passed. I know you’re keen to get moving. I know beneficiaries are asking questions. Wait anyway.

Week 4-12: If HMRC wants to examine your submission more carefully, they’ll send a letter stating they’re conducting detailed checks. This deadline is usually 12 weeks from when forms were submitted. During this period, they might:

- Ask the Valuation Office Agency to check property values

- Get the Shares and Assets Valuation team to verify investment portfolios

- Request additional documentation about gifts or business assets

- Contact you with specific queries (they’ll phone, usually within 8 weeks of their letter)

Week 12+: If you’ve heard nothing by week 12, breathe easier. Silence after 12 weeks typically means HMRC has no questions about your IHT400 form. You can proceed with distributing the estate, though many executors wait for explicit clearance.

The Clearance Certificate Question

Should you apply for formal clearance using form IHT30? That’s the belts-and-braces approach. HMRC won’t normally issue one until at least a year after death, and only when the tax position is absolutely final. For most estates, the 12-week silence rule is sufficient protection. But if you’re dealing with substantial assets or nervous beneficiaries threatening to sue if anything goes wrong? Get the clearance certificate. It’s worth the wait.

| Estate Complexity | Realistic Total Timeline | Common Delays |

|---|---|---|

| Simple (under £500k, no gifts) | 6-10 weeks total | Probate registry bottlenecks |

| Moderate (£500k-£1m, some gifts) | 10-16 weeks | Valuation queries, gift reviews |

| Complex (over £1m, business assets) | 16-26 weeks | Compliance checks, VOA/SAV involvement |

| Very complex (trusts, overseas assets) | 26+ weeks | Everything—brace yourself |

How to Speed Up Your IHT400 Form Processing

You can’t control HMRC’s workload or their decision to examine your submission. But you absolutely can control how clean your submission is. A well-prepared IHT400 form is your best defence against delays.

Get Your Valuations Bulletproof

This is where amateur hour costs you time. That Edwardian terrace in Wandsworth? Get a proper chartered surveyor’s valuation, not your mate Barry’s estimate. Share portfolios? Download the actual closing prices from the date of death. In 2024, 15% of IHT400 submissions were queried for valuation errors.

For assets over £1,500, professional valuations aren’t just sensible—they’re your shield. For cheaper items, you can estimate, but be reasonable. Don’t value Aunt Mildred’s ancient three-piece suite at £50 if similar items sell online for £400.

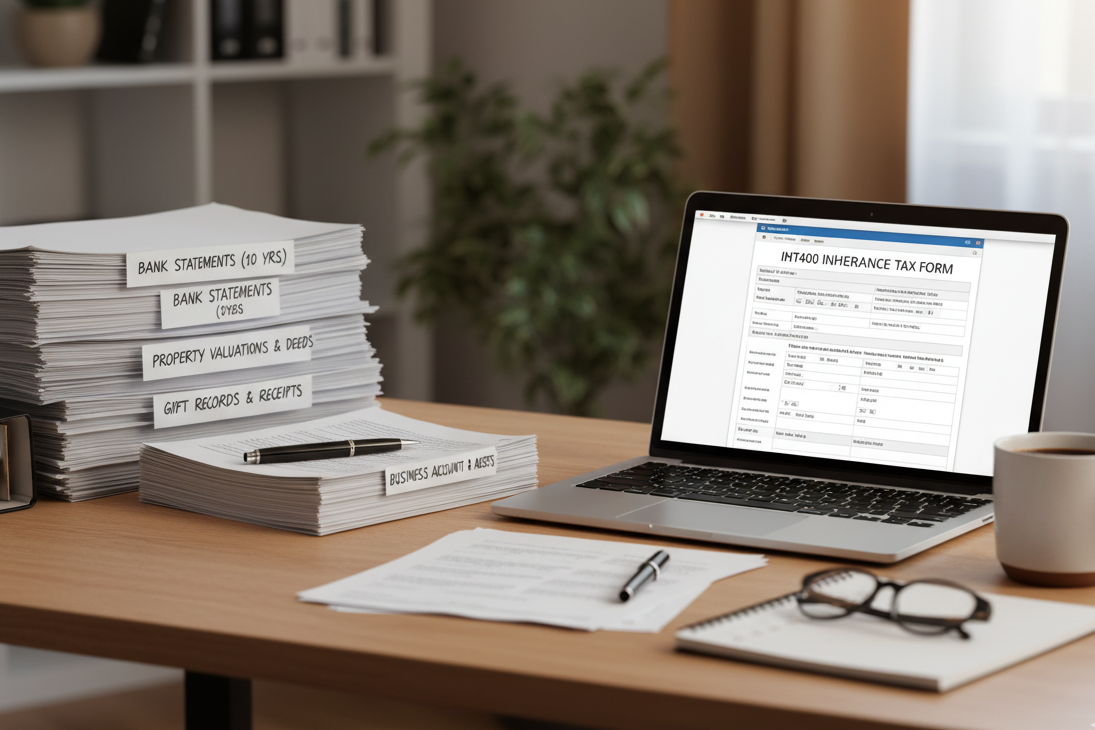

Document Everything Before You Start

The interactive PDF version of the IHT400 form (and yes, you must use Adobe Reader) doesn’t let you save partway through. You need everything gathered beforehand:

- Bank statements for the last 12 months

- Investment portfolio valuations at date of death

- Property valuations (professional ones)

- Details of all gifts made in the seven years before death

- Business accounts if claiming Business Property Relief

- Pension scheme statements

- Life insurance policy documentation

- Mortgage statements and other debts

- Funeral expense receipts

Missing something? You’ll lose all your work when the form times out. Ask me how I know. (I don’t want to talk about it.)

Professional Secret: Use HMRC’s online tax checker before you submit your IHT400 form. The 2025 version now actively prompts you to use this tool. It’s basically a spell-check for tax forms—catches silly errors before HMRC does. Takes ten minutes, saves weeks.

Don’t Drip-Feed Information

Found out three weeks after submission that there was another bank account? Discovered an insurance policy you’d forgotten? HMRC now asks executors to batch up small changes and report them either at the end of the process or after 18 months from the date of death, rather than sending corrections every time something new emerges.

Constant amendments trigger reviews. Submit once, submit completely, submit correctly. If you genuinely discover major new assets later, use form C4 (Corrective Account) to report changes, or forms IHT35 and IHT38 for claims on shares or property sold at a loss.

The Payment Timeline (Because That Matters Too)

Here’s a fun paradox: HMRC won’t process your IHT400 form until you’ve paid the tax. But you can’t access estate funds to pay the tax until you’ve got probate. Which you can’t get until HMRC processes your IHT400 form.

Welcome to the wonderful world of inheritance tax administration.

The deadline is firm: inheritance tax must be paid within six months of death to avoid interest charges. Interest currently runs at 7.75% per year on late payments, which adds up frighteningly fast on large estates.

Your options?

- Pay from liquid assets in the estate (if you can access them without probate)

- Pay from your own funds and reclaim from the estate later

- Use the Direct Payment Scheme if there are UK bank or building society accounts

- Arrange instalments for certain assets (property, business assets, unquoted shares) using form IHT420

Don’t forget: you need an Inheritance Tax reference number before you can pay. Apply at least three weeks before you submit your IHT400 form. This is separate from submitting the actual form and catches people out regularly.

When Things Go Wrong (And What to Do About It)

You’ve waited six weeks. Nothing. Eight weeks. Still nothing. Ten weeks and you’re starting to panic because beneficiaries are asking pointed questions about when they’ll actually receive their inheritance.

Wait at least 20 working days before contacting HMRC to check they’ve received your form. Before that point, they’re probably still processing and won’t have useful information.

After 20 working days, ring the Inheritance Tax helpline on 0300 123 1072. Have your IHT reference number ready. Be prepared to wait—phone queues have been running long. One tip from practitioners: call first thing in the morning or right after lunch for shorter wait times.

What If HMRC Questions Your IHT400 Form?

Don’t panic. Questions don’t automatically mean you’ve done something wrong. HMRC might simply need clarification or additional evidence.

When they call (and they will phone before sending formal letters), take detailed notes. Get the name of the person you’re speaking with. Ask for deadlines in writing. If they’re querying valuations, ask specifically which assets and what their concerns are.

Responding promptly is crucial. HMRC usually gives reasonable deadlines, but missing them triggers further delays and potential penalties. If you need more time to gather documentation, ask. They’re generally accommodating if you’re clearly making genuine efforts.

Getting Professional Help with IHT400 Forms

Look, I’ll level with you. The IHT400 form isn’t designed for amateurs. It’s not that you’re incapable—it’s that the stakes are remarkably high and the room for error vanishingly small.

Consider this: the deadline for submitting an IHT400 form is 12 months after death. Miss it? Penalties can reach £3,000, depending on how late you are and how much tax is owed. Submit it with errors? Penalties can go up to 100% of the tax due for failing to report gifts correctly.

This is where firms like Ask Accountant earn their fees. Yes, you’re paying for the service. But you’re buying peace of mind, accuracy, and—crucially—time. Professionals know which schedules to attach, how to claim reliefs properly, and what triggers HMRC scrutiny.

The team at Ask Accountant, based at 178 Merton High St, London, specialise in inheritance tax planning and compliance. They’ve seen every variation of complicated estate, every HMRC query, every unexpected delay. When you’re grieving and overwhelmed, that expertise is invaluable.

Their broader practice includes tax advisory solutions, business accounting services, and even CIS claims and refunds if you’re in construction. The point is: they understand how various tax matters intersect, which matters when estates include business assets or rental properties.

Ring them on +44(0)20 8543 1991 if you’re staring at a blank IHT400 form wondering where on earth to start. Initial consultations typically clarify whether you need full representation or just some guidance to get moving.

When to Definitely Use a Professional:

- Estate value over £500,000

- Any business assets or agricultural property

- Foreign assets or beneficiaries abroad

- Complex gift history

- Trust involvement

- You’re feeling overwhelmed (perfectly valid reason)

Common Mistakes That Extend IHT400 Processing Times

Let me share the greatest hits of IHT400 errors, compiled from years of watching executors stumble:

The “I’ll estimate that” approach: No. Don’t estimate substantial assets. Bank balances vary daily—get the exact figure for the date of death. Share prices fluctuate—look up the actual closing price. Property values matter—get a professional opinion, not Rightmove’s estimate.

Forgetting about jointly-owned assets: If the deceased owned property as joint tenants (not tenants in common), their share passes outside the will but still forms part of the estate for IHT purposes. This confuses people constantly.

Ignoring small gifts: Yes, you need to declare that £100 birthday cheque to the grandson. Gifts totalling over £3,000 in any tax year must be reported. The annual exemption is per tax year, not per recipient.

Missing the Residence Nil-Rate Band: If the main residence passes to direct descendants, you might get an additional £175,000 allowance on top of the standard £325,000. But only if you claim it properly. Many executors leave money on the table here.

Submitting original documents: HMRC has repeatedly said: send copies, not originals. Yet people still send irreplaceable wills and title deeds. Please don’t.

What’s Changed for IHT400 Forms in 2025?

HMRC tinkers with the IHT400 form regularly. Recent updates include:

- Enhanced bank detail requirements for repayments—they need account name, number, and sort code upfront

- Updated death benefits terminology (they’ve stopped calling them “lump sums”)

- Stronger emphasis on the online tax checker before submission

- Revised domicile provisions affecting non-UK domiciled individuals

- Direct digital submission of IHT421s to courts (no more paper trail)

The threshold figures remain stable for 2025: £325,000 nil-rate band, plus potentially £175,000 residence nil-rate band. Together, married couples can shield up to £1 million from inheritance tax if they plan properly. (See our inheritance tax threshold guide for detailed calculations.)

Life After Submitting Your IHT400 Form

Once HMRC processes your form and issues probate clearance, you can finally start distributing the estate. But don’t rush. Seriously.

Even after the grant is issued, HMRC can reopen cases if new information emerges. That’s why many executors wait for either the 12-week silence period or a formal clearance certificate before distributing significant assets.

Keep meticulous records of everything: every bank transfer, every asset sale, every expense paid. Estate accounts should reconcile perfectly. Beneficiaries have years to challenge your actions as executor, and good documentation is your defence.

If asset values change after submission—shares crash, property values fall—you can claim relief. Use form IHT35 for shares sold at a loss within 12 months of death, or IHT38 for property sold at a loss within four years. These claims can save substantial amounts, but timing matters.

Frequently Asked Questions About IHT400 Processing Times

How long does HMRC actually take to process IHT400 forms in 2025?

Officially, 15 working days for straightforward cases. Realistically, allow 20 working days before applying for probate. Complex estates requiring compliance checks can take 12+ weeks. Total timeline from submission to receiving probate grant typically ranges from 6-26 weeks depending on complexity.

Can I check if HMRC has received my IHT400 form?

Yes, but wait at least 20 working days before calling. Contact the Inheritance Tax helpline on 0300 123 1072 with your IHT reference number ready. Calling earlier won’t speed things up—they’ll just tell you to wait.

What happens if I submit my probate application too early?

The courts won’t be able to match your application with HMRC’s IHT421, causing delays. HMRC recommends waiting the full 20 working days after submitting your IHT400 form before applying for probate, even if you’re keen to progress.

How do I know if HMRC is going to examine my IHT400 form more closely?

They’ll send a letter within the first few weeks stating they’re conducting detailed checks, with a deadline (usually 12 weeks) for completion. If you haven’t heard anything 12 weeks after your IHT421 was issued, you can assume no compliance check is happening.

What triggers HMRC compliance checks on IHT400 forms?

Large estates, substantial lifetime gifts, business asset claims, agricultural property relief, trust involvement, overseas assets, property valuations that seem low, and complex financial arrangements all increase scrutiny likelihood. Simple, well-documented estates rarely face checks.

Should I hire a professional to complete my IHT400 form?

For estates over £500,000, with business assets, overseas property, or complex gift histories—absolutely. For simpler estates, you might manage alone, but professional fees often save more than they cost by claiming all available reliefs and avoiding costly errors.

Can I submit my IHT400 form online?

You can complete it using an interactive PDF (download from GOV.UK, open in Adobe Reader), but submission is still by post to HMRC’s Inheritance Tax office. The online tax checker helps spot errors before you print and post.