Here’s something nobody tells you at dinner parties: that £50,000 you’re planning to gift your daughter for her house deposit could end up costing your estate £20,000 in tax. Not because you did anything wrong, but because you didn’t know the rules.

I’ve spent years watching families discover—too late—that generosity comes with paperwork. That the money Grandad gave in 2019 is now triggering tax bills in 2026. That wedding gifts have bizarre limits nobody remembers to mention until after the ceremony.

The truth? Inheritance tax gifts aren’t complicated, but they are specific. And in 2025, with HMRC collecting record amounts (£8.2 billion last year), knowing these rules isn’t optional anymore—it’s financial self-defence.

When a Gift Isn’t Actually a Gift (According to HMRC)

HMRC’s definition of a “gift” would make your gran laugh. It’s not just the £20 note in a birthday card. A gift is:

- Money (obviously)

- Property you’ve transferred

- Jewellery, art, antiques

- Shares and investments

- The difference when you sell something below market value

That last one catches people out constantly. Sell your £400,000 house to your son for £250,000? Congratulations, you’ve just made a £150,000 gift. Whether you realised it or not.

The clock starts ticking the moment the gift changes hands. And in the world of inheritance tax gifts rules, timing is everything.

The £3,000 Everyone Forgets to Use

Every tax year—that’s 6 April to 5 April, not January to December, because why would HMRC make anything straightforward?—you can give away £3,000.

No questions asked or no seven-year countdown. No forms.

You can:

- Give it all to one person

- Split it between multiple people

- Combine it with last year’s unused allowance (but only for one year)

Example: Sarah didn’t gift anything in 2023/24. In 2024/25, she can give away £6,000 tax-free by using both years’ allowances. But if she doesn’t use that carried-over £3,000 this year? Gone. It doesn’t roll forward indefinitely.

Most people either forget this allowance exists or assume it’s too small to matter. Wrong on both counts. Over a decade, that’s £30,000 out of your estate—potentially saving £12,000 in inheritance tax at 40%.

The Seven-Year Itch (That Actually Matters)

This is the big one. The rule that turns innocent gifts into potential tax landmines.

The basic principle: If you live for seven years after making a gift, it’s completely free of inheritance tax. Die within seven years? The gift gets pulled back into your estate for tax calculations.

But—and there’s always a but—it’s not a simple yes/no situation.

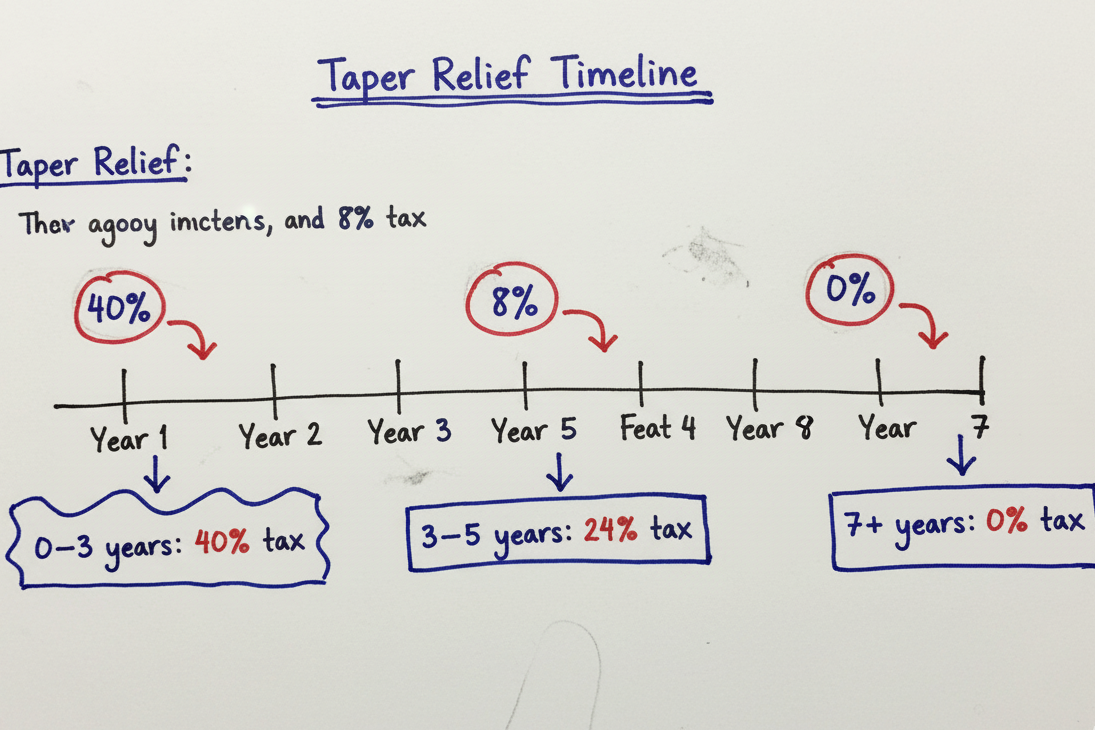

The Taper Relief Scale

| Years Between Gift and Death | Inheritance Tax Rate on Gift | Effective Reduction |

|---|---|---|

| 0–3 years | 40% | No reduction (full rate) |

| 3–4 years | 32% | 20% reduction |

| 4–5 years | 24% | 40% reduction |

| 5–6 years | 16% | 60% reduction |

| 6–7 years | 8% | 80% reduction |

| 7+ years | 0% | Completely exempt |

Taper relief only applies if Inheritance Tax is due — it reduces the tax payable, not the value of the gift.

Critical detail most people miss: Taper relief only applies if the total inheritance tax gifts made in the seven years before death exceed the £325,000 nil-rate band. Below that threshold? No tax regardless of when you die.

The Marco Example

Marco gave £100,000 to each of his four grandchildren in March 2019 (total: £400,000). In March 2023, he gave them another £50,000 each (total: £200,000). He died in April 2026.

- The 2019 gifts: Tax-free (over seven years old)

- The 2023 gifts: Subject to 32% IHT rate (given 3-4 years before death)

If Marco’s estate exceeded £325,000, his grandchildren would owe inheritance tax on that £200,000 at the reduced rate of 32% instead of 40%. That’s still £64,000 in tax—on money they received three years earlier.

Wedding Gifts: The Exception With Fine Print

Getting married or entering a civil partnership unlocks special gifting allowances. But the timing has to be precise.

Tax-free wedding gift limits:

- Parents: £5,000 per parent

- Grandparents: £2,500 per grandparent

- Anyone else: £1,000

You can stack these with your annual £3,000 exemption. So a parent could give:

- £5,000 wedding gift

- £3,000 annual exemption

- = £8,000 tax-free

The catch? The gift must be made before the wedding and the wedding must actually happen. Give it the day after the ceremony? Doesn’t count as a wedding gift—it’s a regular gift subject to the seven-year rule.

Step-parents get the same £5,000 allowance as biological parents. Great-grandparents fall into the £2,500 category with grandparents.

Small Gifts: The £250 Loophole

You can give £250 to as many people as you want. Every year. No limit on the number of recipients.

Your neighbour. Your hairdresser. All fifteen of your nieces and nephews.

The restriction: You can’t combine this with any other allowance for the same person. Give your daughter £3,000 under the annual exemption? You can’t also give her £250 under the small gift rule that same year.

This makes the £250 allowance perfect for:

- Spreading smaller amounts to extended family

- Birthday and Christmas gifts

- Regular payments to multiple grandchildren

Gifts From Income: The Underused Powerhouse

This one’s a hidden gem. You can make unlimited gifts from your regular income, completely free of inheritance tax gifts restrictions. No seven-year rule. No £3,000 cap.

The requirements:

- The gifts must be regular (not one-off)

- Made from income, not capital/savings

- Don’t affect your standard of living

Examples that work:

- Monthly contributions to a grandchild’s Junior ISA

- Paying a child’s rent every month

- Regular life insurance premiums for a spouse

- Ongoing support for older relatives

What counts as income?

- Salary and wages

- Pension payments

- Dividends from investments

- Rental income

The absolutely critical part: Keep meticulous records. Your executor will need to prove these gifts met all three criteria. Bank statements showing regular payments aren’t enough—you need evidence that your income covered your living costs plus the gifts.

The team at Ask Accountant sees families lose this exemption constantly because they couldn’t produce adequate documentation. A simple spreadsheet tracking income versus expenditure would have saved thousands.

Gifts to Spouses: The Ultimate Free Pass

No limit and no seven-year rule. No forms to fill.

You can give your spouse or civil partner as much as you want, whenever you want, with zero inheritance tax implications.

Two important conditions:

- Your spouse must be UK-domiciled (permanently resident)

- If they’re non-UK domiciled, the limit is £325,000 lifetime

Unmarried partners don’t get this exemption. Living together for 30 years? Doesn’t matter. Not married or in a civil partnership? Every gift follows the normal rules.

The “Gift With Reservation” Trap

This catches people who think they’re being clever.

Scenario: You gift your house to your children to get it out of your estate. But you continue living in it rent-free.

HMRC’s view: Not a real gift. It’s a “gift with reservation of benefit.”

Consequence: The house stays in your estate for inheritance tax purposes. You’ve achieved nothing except creating paperwork.

The fix: If you want to gift property while continuing to live in it, you must pay market rent to whoever now owns it. And you need to live seven years after the gift.

Alternatively, you could:

- Move out completely

- Gift a share and pay proportionate rent

- Use a proper trust structure (get professional advice for this)

Gifts to Charities: Tax Planning’s Best Friend

Give as much as you want to registered UK charities. Completely exempt. No limits. No seven-year rule.

Bonus feature: If you leave at least 10% of your estate to charity, the inheritance tax rate on the rest drops from 40% to 36%.

On a £1 million taxable estate:

- Without charity donation: £400,000 tax

- With 10% to charity: £100,000 to charity + £324,000 tax = £424,000 total

- You’ve given £100,000 to charity and only paid an extra £24,000

Since April 2024, gifts to non-UK charities don’t qualify. If you have a bequest to a foreign charity in an old will, update it.

Birthday and Christmas Presents: Actually Fine

Normal gifts from income for birthdays, Christmas, or other celebrations are exempt. No £3,000 cap on these.

The test: Would a reasonable person consider this a normal, expected gift given your income and relationship?

- £100 to your grandchild for Christmas? Fine.

- £50,000 to your grandchild for Christmas? Not fine (unless you’re extraordinarily wealthy and this is genuinely normal for you).

The gifts must come from income, not savings. And they can’t reduce your standard of living.

Keep receipts and records, especially for larger amounts or if you’re giving to multiple people. Your executor will need to demonstrate these were genuinely regular, income-based gifts.

Capital Gains Tax: The Other Gift Problem

Everyone focuses on inheritance tax gifts, but transferring certain assets triggers capital gains tax (CGT) immediately.

Assets subject to CGT when gifted:

- Property (except your main home)

- Shares and investments

- Valuable items like art or jewellery over £6,000

Assets exempt from CGT:

- Your main residence

- Cars

- Personal possessions under £6,000

- Items with limited useful life

Example: Gift your buy-to-let property to your daughter. HMRC treats this as a disposal at market value. If the property has gained £100,000 in value, you’ll face a CGT bill on that gain—potentially £28,000 at the higher rate.

Your daughter then inherits your acquisition cost. When she eventually sells, she’ll face CGT on gains from when you originally bought it.

Gifts to spouses don’t trigger CGT. The asset transfers at your acquisition cost with no immediate tax.

Record-Keeping: The Boring Part That Saves Fortunes

Your executor needs documentation of:

- Every gift over £250

- When it was made

- To whom

- The value

- Which exemption you’re claiming

For regular gifts from income, keep:

- Bank statements

- Evidence of your income

- Records of living expenses

- Proof the gifts were regular

Pro tip: Create a simple spreadsheet with columns for date, recipient, amount, and exemption used. Update it after each gift. Email it to yourself and your solicitor annually.

When Ask Accountant helps families with estate administration, missing gift records are the single biggest cause of delays and overpaid tax. The executor knows Grandad gave money in 2020, but can’t prove it qualified for an exemption. Result? It gets taxed unnecessarily.

The Nil-Rate Band: Your £325,000 Shield

Every individual gets a £325,000 nil-rate band—the amount you can leave (including taxable gifts in the previous seven years) before inheritance tax applies.

Married couples can combine theirs: £650,000 total.

Add the Residence Nil-Rate Band (RNRB): Another £175,000 per person if you’re leaving your home to direct descendants.

Maximum tax-free for a married couple with property going to children: £1 million (£650,000 + £350,000 RNRB).

The sting: The RNRB reduces by £1 for every £2 your estate exceeds £2 million. Own assets worth £2.4 million? Your RNRB disappears entirely.

These bands have been frozen until April 2028. With house prices rising, more estates are getting pulled into the inheritance tax net every year.

| Exemption Type | Amount | Key Restrictions |

|---|---|---|

| Annual exemption | £3,000 | Can be carried forward for 1 tax year only |

| Small gifts | £250 per person | Cannot be combined with other exemptions for the same person |

| Wedding gifts – parents | £5,000 | Gift must be made before the wedding |

| Wedding gifts – grandparents | £2,500 | Gift must be made before the wedding |

| Wedding gifts – others | £1,000 | Gift must be made before the wedding |

| Spouse or civil partner | Unlimited | Unlimited only if UK-domiciled; otherwise £325,000 limit |

| Charities | Unlimited | Must be UK-registered (rules updated April 2024) |

| Regular gifts from income | Unlimited | Must not reduce living standard; detailed records required |

These exemptions apply to Inheritance Tax gifting rules in the UK and must be supported by proper records where required.

Common Mistakes That Cost Thousands

1. Thinking “small” gifts don’t matter Multiple £10,000 gifts to different children add up fast. Track everything.

2. Not using annual exemptions £3,000 per year, every year. Use it or lose it.

3. Assuming oral promises count “Mum said the house was mine” doesn’t help your executor. Document everything.

4. Gifting property but staying rent-free Gift with reservation. Doesn’t work.

5. Ignoring capital gains tax Transferring assets can trigger immediate CGT bills while trying to avoid inheritance tax.

6. Making multiple gifts without professional advice One £100,000 gift needs different planning than ten £10,000 gifts over five years.

What Happens to Gifts Made Just Before Death?

Gifts made in the months before death face extra scrutiny. HMRC will check:

- Was the donor mentally capable of making the gift?

- Did they understand the implications?

- Was there undue influence?

These “deathbed gifts” often become contested, especially if made to:

- One child but not others

- A carer or recent acquaintance

- Someone who benefits from the will

If you’re receiving a substantial gift from older people or unwell, consider:

- Getting independent legal advice for the donor

- Having a doctor assess mental capacity

- Documenting why the gift is being made

When the Rules Might Change

Inheritance tax reform is constantly threatened. Recent speculation includes:

- Extending the seven-year rule to ten years

- Introducing lifetime limits on gifts

- Changes to agricultural and business property relief

The 2024 Budget already included:

- Pensions in estates from April 2027

- Reduced agricultural/business relief from April 2026

With HMRC collecting record amounts and thresholds frozen until 2028, expect more changes. Any estate planning needs to account for potential rule changes.

Should You Be Giving Money Away?

Here’s the uncomfortable truth: gifting to reduce inheritance tax only makes sense if you can genuinely afford to give the money away.

Don’t gift if:

- You might need the money for care costs

- It would affect your lifestyle

- You’d stress about not having it

- Your financial situation is precarious

The “seven-year rule” assumes you’ll live that long. What if you need the money back in year five? You can’t just un-gift it.

Consider:

- Keeping enough for 10+ years of living expenses

- Emergency funds

- Potential care costs (£50,000+ per year for residential care)

- Your own quality of life

Dying with a bigger estate and happy memories beats dying broke with regrets about that gift you made to save tax.

Getting Professional Help

For simple gifts within exemptions, you probably don’t need advice. But consult a specialist if:

- You’re gifting more than £50,000

- Property or business assets are involved

- You have complex family situations

- You’re trying to maximise multiple exemptions

- International elements exist

What to expect in terms of cost:

- Basic advice: £200-500

- Comprehensive gift planning: £1,000-3,000

- Trust structures: £3,000+

The right advice easily pays for itself by avoiding mistakes.

Firms like Ask Accountant in London specialise in inheritance tax planning and can create a gifting strategy tailored to your situation. They’re at 178 Merton High St, London SW19 1AY, or call +44(0)20 8543 1991.

Their tax advisory solutions cover everything from simple gift planning to complex estate structures. Sometimes talking through your options with someone who deals with inheritance tax gifts daily prevents expensive mistakes.

The Bottom Line

Inheritance tax gifts rules are generous if you know them and plan ahead. Used properly, exemptions let you transfer substantial wealth tax-free.

The key principles:

- Use your £3,000 annual exemption religiously

- Understand the seven-year rule and its taper relief

- Keep impeccable records of every gift

- Don’t gift what you might need

- Get advice before transferring property or large amounts

Start early. The seven-year clock doesn’t begin until you make the gift. Waiting until you’re 85 to start planning limits your options.

Your family doesn’t need to pay thousands in unnecessary inheritance tax. But saving that tax requires planning while you’re healthy, understanding the rules, and documenting everything properly.

The worst inheritance tax strategy? Having no strategy at all.

Frequently Asked Questions

Can I gift my house to my children and still live in it? Not rent-free. If you gift your house but continue living there without paying market rent, it remains in your estate as a “gift with reservation.” To remove it from your estate, either move out or pay market rent and survive seven years.

Do I need to tell HMRC when I make a gift? Usually no. Most gifts don’t need to be reported when made. The recipient doesn’t pay tax on receiving gifts. It’s only when you die that your executor needs to account for gifts made in the previous seven years.

What if I can’t remember all the gifts I’ve made? Your executor will need to reconstruct them from bank statements, which is time-consuming and may miss gifts. Start documenting now. Create a simple log of all gifts over £250 with dates and amounts.

Can I change my mind after making a gift? Generally no. Once you’ve given something away, it’s gone. This is why it’s crucial not to gift money you might need. “Gifts” with strings attached may not count as gifts for tax purposes.

Does inheritance tax apply to gifts I receive from overseas? If you’re UK-based, receiving a gift isn’t taxable for you. However, if the overseas donor dies and their country has estate/gift taxes, their estate might face tax. UK inheritance tax focuses on the donor’s domicile and estate, not the recipient’s.

What happens if I make too many gifts? There’s no penalty for making gifts. The consequence is that if you die within seven years, those gifts get added back to your estate for calculating inheritance tax. This could push your estate over the nil-rate band, creating a tax bill.

Are gifts to my grandchildren treated differently than gifts to children? No, they follow the same rules. The £3,000 annual exemption, seven-year rule, and small gift allowance apply equally. The only difference is wedding gifts (£2,500 for grandparents vs £5,000 for parents).