Let’s face it – nobody enjoys thinking about death and taxes. Put them together and you’ve got inheritance tax – possibly the least popular dinner table conversation in Britain. Yet here you are, reading about it anyway. Smart move.

I’ve spent years helping families navigate this particularly thorny patch of the tax landscape, and I can tell you something surprising: most people get it wrong. Not just a little wrong – dramatically, expensively wrong. And the taxman rarely calls to tell you you’ve overpaid.

The Basics: When Death and HMRC Collide

Inheritance tax (IHT) hits after you die, taking a chunk of what you leave behind before your loved ones get their share. Currently, the government takes 40% of anything above your tax-free threshold. Yes, forty percent. Nearly half of what you’ve spent your life building could vanish.

But here’s where it gets interesting – the threshold isn’t as straightforward as you might think.

2025 Update: What’s Changed

The spring 2025 budget brought some notable changes to inheritance tax rules that smart planners should know about. The freeze on inheritance tax thresholds has been extended through 2028, meaning inflation will continue eroding their real value.

The government also tightened rules around trusts, particularly for non-UK domiciled individuals. The treatment of certain business assets for Business Property Relief has seen some adjustments as well, with stricter tests for what qualifies as “trading” versus “investment” activities.

For agricultural property, the Agricultural Property Relief criteria now face more scrutiny, especially for “lifestyle farms” where agricultural activity is minimal. Some estate planning strategies involving insurance policies have also come under closer HMRC examination.

These changes make regular review of your inheritance tax planning more important than ever. What worked perfectly last year might be less effective—or even counterproductive—now.

Everyone starts with a basic allowance of £325,000 (the nil-rate band). This hasn’t changed since 2009, despite house prices nearly doubling in many areas. Thanks, inflation.

If you’re leaving your home to direct descendants (children, grandchildren), you get an extra £175,000 (the residence nil-rate band). That potentially gives you £500,000 tax-free.

Married? Civil partnership? Even better – couples can combine these allowances. When one partner dies, any unused allowance transfers to the survivor, potentially creating a £1 million tax-free threshold for the second death.

But wait – there’s a trap. That extra residence allowance starts disappearing once your estate tops £2 million. For every £2 over that limit, you lose £1 of your residence allowance.

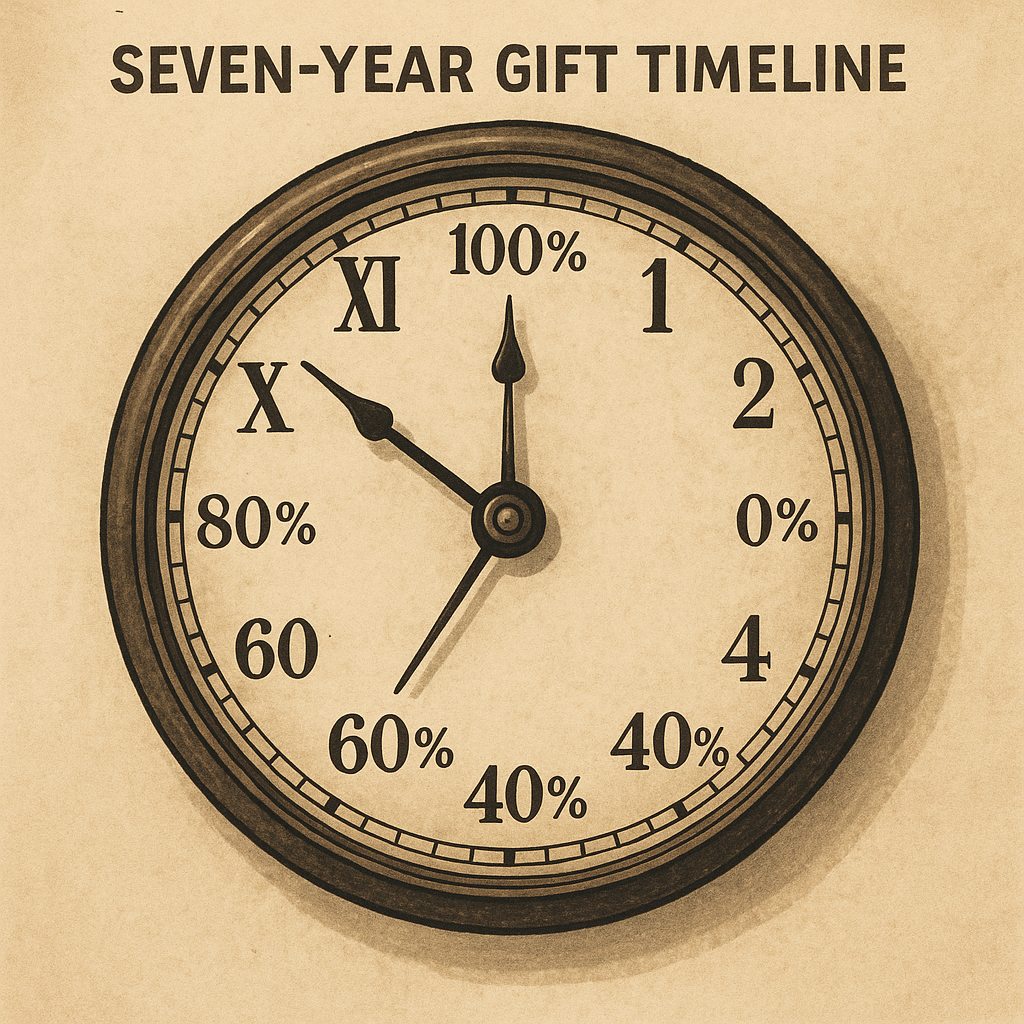

The Seven-Year Itch: Gifts and Timing

One thing we do with clients at Ask Accountant is that people often miss the power of giving while they’re still alive. The system actually encourages this – it’s called potentially exempt transfers (PETs).

Give away assets, then survive seven years, and those gifts become completely IHT-free. Die sooner, and the tax applies on a sliding scale:

| Years between gift and death | Tax rate applied |

|---|---|

| Less than 3 years | 40% |

| 3-4 years | 32% |

| 4-5 years | 24% |

| 5-6 years | 16% |

| 6-7 years | 8% |

| Over 7 years | 0% |

But (isn’t there always a “but”?) – this only works if you give genuinely. Keep benefiting from what you’ve given away, and HMRC calls it a “gift with reservation of benefit.” Translation: still yours, still taxed. That holiday home you “gave” to your kids but keep using every summer? Nice try, but no.

Unexpected Freebies: Tax-Free Giving

Not everything is doom, gloom, and HMRC paperwork. Some gifts never attract inheritance tax, regardless of when you die:

- £3,000 annual gift allowance (and you can carry forward one unused year) – details here

- Small gift exemption – up to £250 per person (as many people as you like) – details here

- Wedding gifts: £5,000 to your child, £2,500 to a grandchild, £1,000 to anyone else – details here

- Regular gifts from surplus income (my favorite underused exemption) – details here

- Gifts to charities and political parties – details here

That last one about “regular gifts from surplus income” deserves special attention. If you can prove the gifts:

- Are made regularly

- Come from income, not capital

- Don’t reduce your standard of living

…then there’s no limit to how much you can give away, tax-free, immediately. No seven-year wait necessary. I’ve seen clients use this to pay grandchildren’s school fees, cover family members’ rent, or fund family holidays – all while reducing their eventual IHT bill.

The Business Relief Bonanza

Own a business? You might be sitting on a goldmine of tax relief. Business Property Relief can provide either 50% or 100% relief from inheritance tax on business assets.

Family businesses typically qualify for 100% relief, making them extraordinarily tax-efficient for passing wealth between generations. I’ve seen family companies worth millions transfer completely tax-free.

But caution – the rules are strict. Investment businesses generally don’t qualify. And HMRC scrutinizes these claims intensely, especially for businesses established shortly before death (they weren’t born yesterday, after all).

Trust us, It’s Complicated

Trusts used to be the go-to solution for inheritance tax planning. Today, they’re more complex but still valuable in the right circumstances.

With a discretionary trust, you can put assets beyond your estate while retaining some control over who benefits and when. The trade-off? Potential upfront tax charges and ongoing administrative requirements.

I’ve seen trusts work wonders for:

- Protecting assets for vulnerable beneficiaries

- Skipping a generation to avoid double taxation

- Providing for complex family situations (second marriages, etc.)

- Keeping business assets intact across generations

One client – let’s call him James – used a trust to ensure his grandchildren’s education would be funded even if his children went through divorce or financial difficulties. The peace of mind was worth every penny of the setup costs.

Life Insurance: The Ultimate Hack?

Sometimes the simplest solutions are the best. Life insurance policies written in trust can provide tax-free cash to cover inheritance tax bills, leaving the estate intact for beneficiaries.

I remember working with a family whose main asset was their London home. Cash-poor but property-rich, they were worried their children would have to sell the family home to pay the tax bill. A joint life insurance policy solved the problem beautifully – and cost much less than they expected.

The key part? It MUST be written in trust. Otherwise, the payout becomes part of your estate and gets taxed too. We’ve seen this mistake more times than we care to admit, and it’s heartbreaking every time.

The Family Home Conundrum

For most families, their home is their biggest asset. It’s also the most emotionally charged part of estate planning. Nobody likes thinking about strangers living in the family home.

Beyond the residence nil-rate band mentioned earlier, consider:

- Downsizing allowance – if you sell to move somewhere smaller, you can still claim the residence relief (details here)

- Equity release – taking value out of your property during your lifetime

- Changing ownership structure – sometimes bringing children into ownership (with all the risks that entails)

We’ve seen creative solutions work wonders, but I’ve also seen families torn apart by poorly planned property arrangements. Tread carefully here – financial efficiency isn’t everything.

Regional Variations: Not All UK is Equal

Inheritance tax is mostly consistent across the UK, but Scotland has different property laws that can affect how assets pass between generations. Northern Ireland has some unique considerations too.

If you own property across different UK regions (or internationally), getting region-specific advice is crucial. What works in Surrey might not work in Stirling.

International Considerations: The Expat Challenge

If you’ve spent time working abroad, own property overseas, or have family members in different countries, your inheritance tax situation becomes considerably more complex. Many countries have their own version of inheritance tax, creating potential double taxation issues.

The UK’s “domicile” concept is particularly tricky. You might have lived abroad for decades but still be considered UK-domiciled for tax purposes. We had one client who’d lived in Spain for 15 years but was shocked to discover her worldwide assets remained subject to UK inheritance tax.

Key points to consider:

- The UK has inheritance tax treaties with only a handful of countries (list here)

- Some assets may be taxed twice without proper planning

- Different countries have radically different inheritance laws

- Non-UK assets might not pass according to your UK will

For those with international connections, specialist cross-border advice isn’t just helpful – it’s essential.

The Digital Afterlife: Often Forgotten

Here’s something most inheritance guides miss completely: your digital assets. From cryptocurrency to online businesses, valuable domain names to monetized YouTube channels – digital assets can be significant.

Unlike physical assets, digital ones often come with access challenges. We had one client whose son couldn’t access his deceased father’s cryptocurrency wallet containing over £50,000 in Bitcoin. The private keys died with him.

Make sure your digital assets are:

- Documented somewhere secure

- Accessible to executors (without compromising security while you’re alive)

- Valued appropriately for IHT

IHT Myths: What People Get Wrong

After years of advising on inheritance tax, I’ve heard some persistent myths that just won’t die. Let me clear these up:

- “Only the super-rich pay inheritance tax”

The reality? Middle-class families with modest homes in high-value areas often get caught. With property prices and the frozen nil-rate band, you might be “rich” for tax purposes without feeling wealthy. - “My spouse can handle it after I’m gone”

While transfers between spouses are exempt, this just defers the problem. Without proper planning, the second death could trigger a massive tax bill. - “If I give away my house but keep living in it, it’s not mine for tax”

HMRC calls this a “gift with reservation of benefit” and will treat the property as still part of your estate. They’ve seen all the tricks, believe me. - “Setting up a trust avoids all inheritance tax”

Trusts have their uses, but they’re not magic tax shields. Many trigger immediate charges, ongoing periodic charges, and exit charges. They’re tools, not solutions. - “My pension will be taxed when I die”

Actually, pensions can be remarkably tax-efficient for passing wealth. In many cases, they sit outside your estate for inheritance tax purposes (more info here), making them valuable planning tools.

Real Results: A Case Study

Let us show you how this works in practice. The Thompsons (names changed) came to Ask Accountant with an estate valued at £1.8 million. Their potential inheritance tax bill was a whopping £300,000.

Through careful planning over three years, we:

- Used their annual gift allowances systematically

- Set up a regular pattern of gifts from surplus pension income

- Restructured their investment portfolio to maximize Business Property Relief

- Established a life insurance policy in trust to cover remaining liability

The result? Their projected inheritance tax bill dropped to just £75,000 – a saving of £225,000. More importantly, they gained peace of mind knowing their children wouldn’t face a financial crisis while grieving.

Getting Professional Help: Worth Every Penny

DIY inheritance planning is like DIY dentistry – technically possible but rarely advisable.

At Ask Accountant, we’ve seen inheritance tax bills reduced by tens or even hundreds of thousands through proper planning. Yes, professional advice costs money, but it’s usually a fraction of what you’ll save.

Look for advisors who take time to understand your family situation, not just your balance sheet. The best planning balances tax efficiency with family harmony and your personal values.

Next Steps: What To Do Today

Inheritance tax planning isn’t a one-and-done activity. It needs regular review as:

- Tax laws change (and they do, frequently)

- Your assets grow or shrink

- Family circumstances evolve

- Your own priorities shift

Start with these basic steps:

- Calculate your potential inheritance tax liability (HMRC tools can help)

- Review existing wills and trust arrangements

- Consider lifetime giving strategies

- Document all potential exemptions and reliefs

- Discuss your situation with those who’ll be affected

The worst inheritance tax plan is no plan at all. The second worst is one you make and then file away forever.

Simple Assessment: Is IHT Planning Urgent for You?

While every situation is unique, you can quickly gauge your potential inheritance tax exposure by answering these questions:

- Is your estate (including your home, investments, and life insurance not in trust) worth more than £325,000 as a single person or £650,000 as a couple?

- Do you own property that will push your estate over the threshold?

- Have you made any significant gifts in the past seven years?

- Do you have complex family arrangements (second marriages, children from different relationships)?

- Do you own business assets that might qualify for relief?

If you answered “yes” to two or more questions, we recommend arranging a consultation to discuss your specific circumstances. Even rough calculations can reveal significant opportunities for tax savings.

For a no-obligation discussion about your inheritance tax situation, our team at Ask Accountant is always happy to help. With decades of experience in proactive tax advisory solutions and business growth planning, we can guide you through this complex area. Give us a call at +44(0)20 8543 1991 or visit our office at 178 Merton High St, London.