And here is something that will make you very uncomfortable indeed: your business is currently not making as much money as it could be, and in ways that you are totally unaware of. Not by failings and errors but by the thousand subtle lacks which seem inefficiencies of highways and bridges that we never think to maintain.

I have seen genius businessmen create the most unbelievable products and then see their companies fail because they did not understand how to manage their finances. It is disheartening, actually. You wouldn’t perform surgery without a surgeon, yet somehow we convince ourselves that managing complex business finances is something we can figure out on our own.

A certified public accountant isn’t just someone who counts your money—they’re the financial detective who spots what you’re missing, the strategic advisor who sees around corners you didn’t know existed, and sometimes, the person who saves your business from itself.

The Hidden Cost of Going It Alone

When Sarah launched her marketing consultancy three years ago, she was convinced she could handle the books herself. “How hard could it be?” she thought. Spoiler alert: harder than performing a root canal whilst juggling flaming torches.

By year two, she was spending 15 hours a week on financial tasks she barely understood, missing tax deductions worth thousands, and making strategic decisions based on incomplete information. The real kicker? She was paying penalties for filing errors that a certified public accountant would have caught in minutes.

This isn’t unusual. Research suggests that business owners spend an average of 120 hours annually on financial administration—time that could be spent actually growing their business. But here’s where it gets interesting: those same studies show that businesses working with a certified public accountant typically see efficiency improvements of 25-30% within the first year.

The maths are brutal in their simplicity. If you’re billing £100 per hour for your expertise, every hour you spend wrestling with spreadsheets instead of serving clients costs you money. It’s negative arbitrage, and it’s slowly strangling your business.

What Makes a CPA Different from Your Average Bookkeeper

Let me clear up some confusion that costs businesses dearly. A bookkeeper records transactions—they’re the meticulous chronicler of what happened. A certified public accountant, however, is playing an entirely different game.

Certified public accountants undergo years of rigorous education, pass comprehensive examinations, and maintain continuing education requirements. More importantly, they’re trained to think strategically about your financial picture. Where a bookkeeper sees numbers, a certified public accountant sees patterns, opportunities, and potential disasters brewing on the horizon.

| Service Area | Bookkeeper | Certified Public Accountant |

| Transaction Recording | ✓ Daily entries | ✓ Strategic categorisation |

| Tax Planning | Basic preparation | ✓ Proactive strategy & compliance |

| Financial Analysis | Simple reports | ✓ Deep insights & forecasting |

| Business Advisory | Limited scope | ✓ Strategic guidance |

| Regulatory Compliance | Basic understanding | ✓ Expert knowledge & liability protection |

Think of it this way: if your business finances were a car, a bookkeeper would be excellent at recording every mile driven. A certified public accountant would notice that your engine’s running rough, predict when you’ll need major maintenance, and suggest a more efficient route to your destination.

The Efficiency Multiplier Effect

Here’s where things get genuinely exciting. A skilled certified public accountant doesn’t just prevent problems—they create opportunities that compound over time.

Take automated systems implementation. The majority of business owners improvise by creating a hodgepodge of various software tools that cannot interact. Having the proper certified accountant with knowledge in business accounting services on your side can implement the workflow integration that leads to the avoidance of redundant data entry applications, fewer errors, and aspects of having real-time view into financial situation.

I used to have a manufacturing client who was manually reconciling bank statements on a monthly basis, which used to take them a six-hour process in most cases, and was not error free. Their certified public accountant implemented an automated reconciliation system that reduced this to 20 minutes of review time whilst improving accuracy to near-perfect levels.

But the real magic happens in strategic decision-making. When you have accurate, timely financial information, you can spot trends before they become problems, identify profitable opportunities others miss, and make decisions based on data rather than gut feeling. This level of insight transforms how a certified public accountant serves your business beyond traditional bookkeeping functions.

Beyond the Basics: Strategic Financial Architecture

Most people think of accounting as purely reactive—recording what happened after it occurred. But modern practices have evolved into something far more powerful: predictive financial engineering delivered by experienced certified public accountant professionals.

Consider Inheritance Tax Planning

Most business owners only think about inheritance tax planning when it’s too late to implement effective strategies. A proactive approach will model different scenarios years in advance, helping you structure your business in ways that minimise tax liabilities whilst protecting your family’s financial future.

Business Growth Planning

When business growth opportunities arise, they often come with tight deadlines. Having a certified public accountant who understands your financial position means you can evaluate opportunities quickly and accurately, whilst competitors are still gathering their paperwork.

Critical Warning: The biggest mistake I see business owners make is treating their CPA like an expensive bookkeeper. If you’re only using them for tax preparation and basic compliance, you’re wasting 80% of their value. A good certified public accountant should be challenging your assumptions, suggesting improvements, and helping you see possibilities you hadn’t considered.

The Technology Revolution Reshaping Professional Services

Here’s something that might surprise you: the best practices are often more technologically advanced than their clients. They’re using artificial intelligence to detect anomalies, cloud-based systems for real-time collaboration, and predictive analytics to forecast cash flow.

This technological sophistication translates directly into efficiency gains for your business. When your certified public accountant can automatically categorise transactions, flag unusual patterns, and generate insights from your data, you get better information faster and cheaper than ever before.

But technology alone isn’t the answer. It’s the combination of advanced tools and expert interpretation that creates value. Any software can generate a profit and loss statement. It takes a certified public accountant to explain why your margins dropped in Q3 and what you can do about it.

Modern tax advisory solutions integrate seamlessly with business operations, providing real-time insights that help business owners make informed decisions throughout the year, not just during tax season.

The Hidden Costs of Compliance Failures

Let me share something that keeps me awake at night: the sheer number of businesses that get blindsided by compliance requirements they didn’t know existed.

Take CIS claims and refunds. If you’re in construction or related trades, improper handling of CIS can cost you thousands in unnecessary tax payments or penalties. Yet many business owners don’t fully understand the system until they’re already in trouble.

A competent certified public accountant doesn’t just ensure compliance—they optimise within the rules. They know which expenses qualify for immediate deduction versus capitalisation, how to time transactions for maximum tax efficiency, and when to make elections that can save substantial amounts over time.

| Common Compliance Area | Potential Annual Cost of Errors | CPA Prevention Value |

| VAT Registration Timing | £2,000-£15,000 | Strategic timing advice |

| Corporation Tax Planning | 5-20% of profits | Proactive strategies |

| Auto-enrolment Pensions | £400+ per non-compliant employee | Automated compliance systems |

| IR35 Misclassification | £10,000-£50,000+ | Proper status determination |

The auto-enrolment requirements alone catch many small businesses off guard. A certified public accountant familiar with these regulations can implement systems that ensure compliance whilst minimising administrative burden.

When Small Businesses Need Big Business Thinking

There’s a peculiar irony in small business accounting. The smaller your business, the more you need sophisticated financial thinking—because you have less margin for error.

Large corporations can absorb the occasional inefficiency or missed opportunity. Small businesses can’t. Every pound matters, every decision has amplified consequences, and every advantage compounds more quickly.

This is where specialised small business accounting services become invaluable. A certified public accountant who understands the unique challenges of smaller enterprises can help you think and act with the financial sophistication of much larger companies, whilst maintaining the agility that gives you competitive advantages.

The right professional will understand that small businesses need proactive tax advisory solutions rather than reactive compliance work. They’ll help you plan for growth, manage cash flow effectively, and structure your business for long-term success.

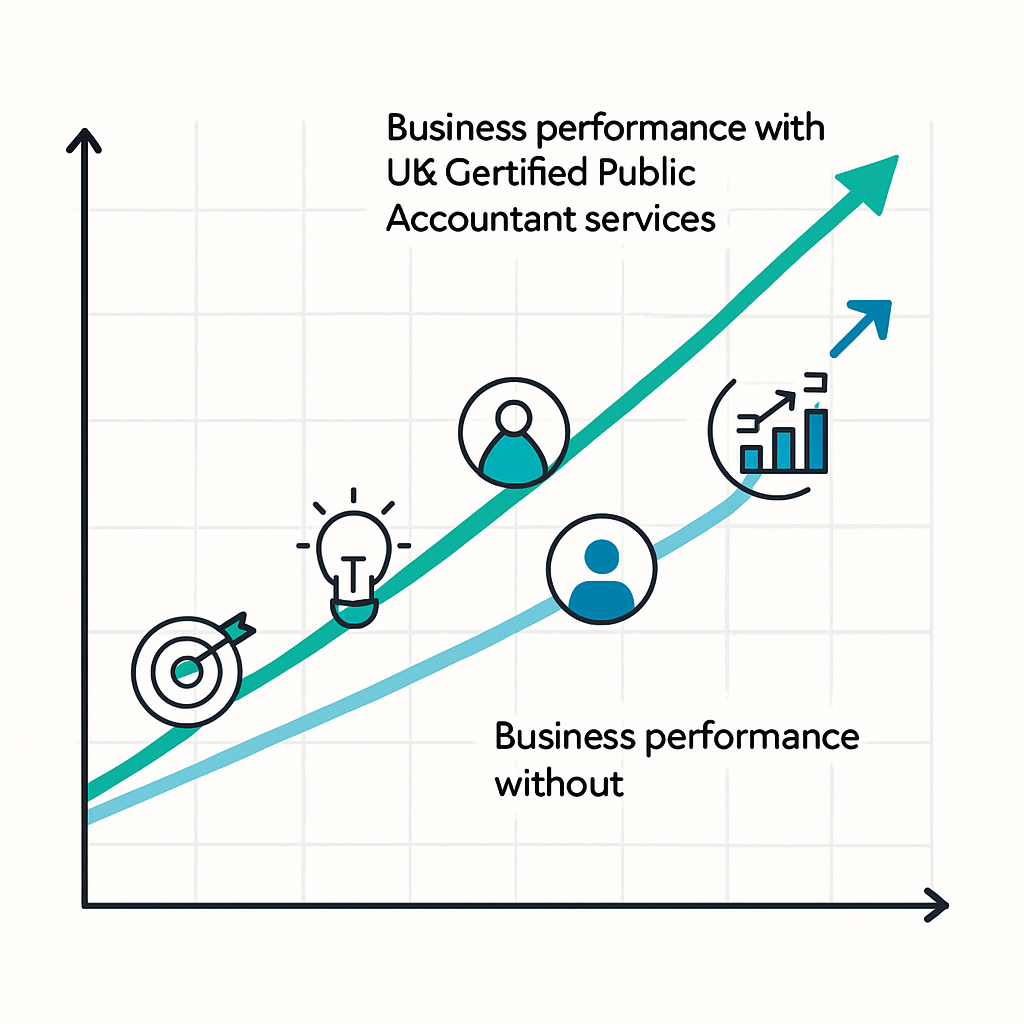

The Real ROI of Professional Financial Management

Let’s talk numbers, because ultimately that’s what matters. In my experience, businesses that engage quality services typically see returns in several categories:

- Time Recovery: 10-15 hours per week returned to core business activities. At £75/hour billing rate, that’s £39,000-£58,500 annually in opportunity value.

- Tax Optimisation: 3-8% reduction in effective tax rate through proper planning and compliance. For a business with £200,000 in profits, that’s £6,000-£16,000 in direct savings.

- Error Prevention: Elimination of penalties and interest charges. Average savings: £2,000-£8,000 annually.

- Strategic Insights: Improved decision-making leading to revenue growth. Conservative estimate: 5-15% improvement in profitability.

The maths become compelling quickly. Even accounting for the cost of professional services, most businesses see net positive returns within months. A skilled certified public accountant pays for themselves through improved efficiency alone.

Finding the Right Professional Partnership

Not all services are created equal. Some are brilliant at compliance but weak on strategy. Others excel at advisory services but struggle with complex technical issues.

What you’re looking for is a practice that combines technical expertise with business acumen. They should ask probing questions about your goals, challenge your assumptions, and offer insights that surprise you.

When evaluating potential partnerships, pay attention to their questions during initial conversations. Are they focused primarily on your tax situation, or are they curious about your business model, growth plans, and operational challenges? The best professionals think like business partners, not just service providers.

A certified public accountant worth their salt will want to understand your industry, your competitive position, and your long-term objectives. They’ll ask about your pain points and suggest solutions you hadn’t considered.

If you’re looking for this level of sophisticated financial partnership, Ask Accountant provides exactly this type of comprehensive approach. Their team combines deep technical expertise in areas like inheritance tax planning and business advisory services with the strategic thinking that transforms good businesses into great ones. Located at 178 Merton High St, London SW19 1AY, they understand that modern businesses need more than just compliance—they need strategic financial partners. You can reach them at +44(0)20 8543 1991 to discuss how their services could reshape your business efficiency.

The Compounding Effect of Financial Excellence

Here’s what I find most compelling about working with an excellent certified public accountant: the benefits compound over time. Better financial systems lead to better decisions. Better decisions create more opportunities. More opportunities generate resources that can be reinvested in further improvements.

It’s a virtuous cycle that accelerates over time. Businesses that establish strong financial foundations early tend to outperform their peers by increasingly wide margins as years pass.

The question isn’t whether you can afford professional services. The question is whether you can afford to continue without them. Your business deserves financial excellence. More importantly, you deserve to focus on what you do best whilst knowing your financial foundation is solid, compliant, and optimised for growth.

Frequently Asked Questions

Q: What is the fair price to be paid to certified public accountant services?

A: Costs are highly dependent on complexity and scope, however, think of this as an investment not an expense. The savings on taxes and efficiency gains are usually more than the costs of the services in the first year to most businesses.

Q: Does a certified public accountant have something to offer of assistance in business growth planning beyond financial compliance?

A: Absolutely. The current services have moved way beyond compliance into strategy and advice, cash flow management, and expansion planning. The outstanding professionals are taken as part of the business family.

What is the difference in using a firm or an individual practitioner?

A: The firms are usually able to provide more experience and back up coverage and the individual practitioner frequently is able to be more personable. When making a choice, consider your complexity and growth path of business.

Q: What is the frequency of my visit to my certified public accountant?

A: Most businesses do best with monthly or quarterly reviews, although they should be in more frequent contact during the very busy times or when making big transitions. Some problems can be avoided by communication as a regular exercise; otherwise small issues can end up costing quite a lot of money.

Q: Is it possible to get my tax burden decreased legally with the aid of a certified public accountant?

A: Yes, by planning, time and make sure you take all your legitimate deductions. Tax advisory services can have a big influence in the effective tax rate paid by you.

Q: How do I select the right accounting service to use on business?

A: Search accounting firms that can provide comprehensive business accounting solutions so that they can offer business accounting services such as bookkeeping, tax planning, and strategic advisory. The top providers will know your business, know how to be more proactive instead of merely reacting to comply.