If you’re reading this, chances are you’ve recently ventured into self-employment, taken on some freelance work, or perhaps you’ve received that rather official-looking brown envelope from HMRC. Whatever brought you here, take a deep breath – completing your Self Assessment tax doesn’t have to be the nightmare you might imagine.

At Ask Accountants UK Ltd, we’ve been guiding individuals through their tax returns for years from our office in South West London. Every January, we see the same worried faces and hear the same concerns. But here’s what we tell everyone who walks through our doors at 178 Merton High Street: with proper preparation and understanding, your Self Assessment

becomes just another administrative task, not a source of anxiety.

Understanding Self Assessment: The Basics

Let’s start with the fundamental question that brings many people to our SW19 office: what exactly is Self Assessment, and why does HMRC require it?

Self Assessment is essentially HMRC’s way of collecting Income Tax and National Insurance from people whose tax isn’t automatically deducted. Most employees never think about it because their employer handles everything through PAYE. But the moment you step outside traditional employment – whether that’s starting your own business, renting out a property, or even just doing some weekend freelancing – you enter Self Assessment tax territory.

The system works on trust. You tell HMRC about your income and expenses, they calculate what you owe, and you pay it. Simple in principle, though the details can get complex, which is why our team at Ask Accountants UK Ltd spends considerable time helping clients navigate the nuances.

Who Actually Needs to File?

This question comes up constantly in our consultations. The general rule is straightforward: if you receive income that hasn’t been taxed at source, you need to complete a Self Assessment. But let’s break down the specific situations we see most often at our London practice:

You definitely need to file if you’re:

- Self-employed or a sole trader earning more than £1,000 per year

- A partner in a business partnership

- A company director (even if it’s your own limited company)

- Earning rental income from property

- Receiving income from investments or savings above certain thresholds

- Claiming Child Benefit and you or your partner earn over £60,000

You might need to file if you:

- Have foreign income

- Need to pay Capital Gains Tax

- Receive income from a trust or settlement

- Have any other untaxed income exceeding £2,500

One situation we encounter frequently at our Merton office involves people doing “a bit on the side” while maintaining regular employment. Perhaps you’re designing websites in the evenings, driving for a ride-sharing service at weekends, or selling crafts online. Many assume these small amounts don’t matter, but HMRC expects you to declare everything. The good news? If your additional income is under £1,000, you might benefit from the trading allowance, meaning you won’t pay tax on it – but you still need to register and declare it.

The Registration Process: Getting Started

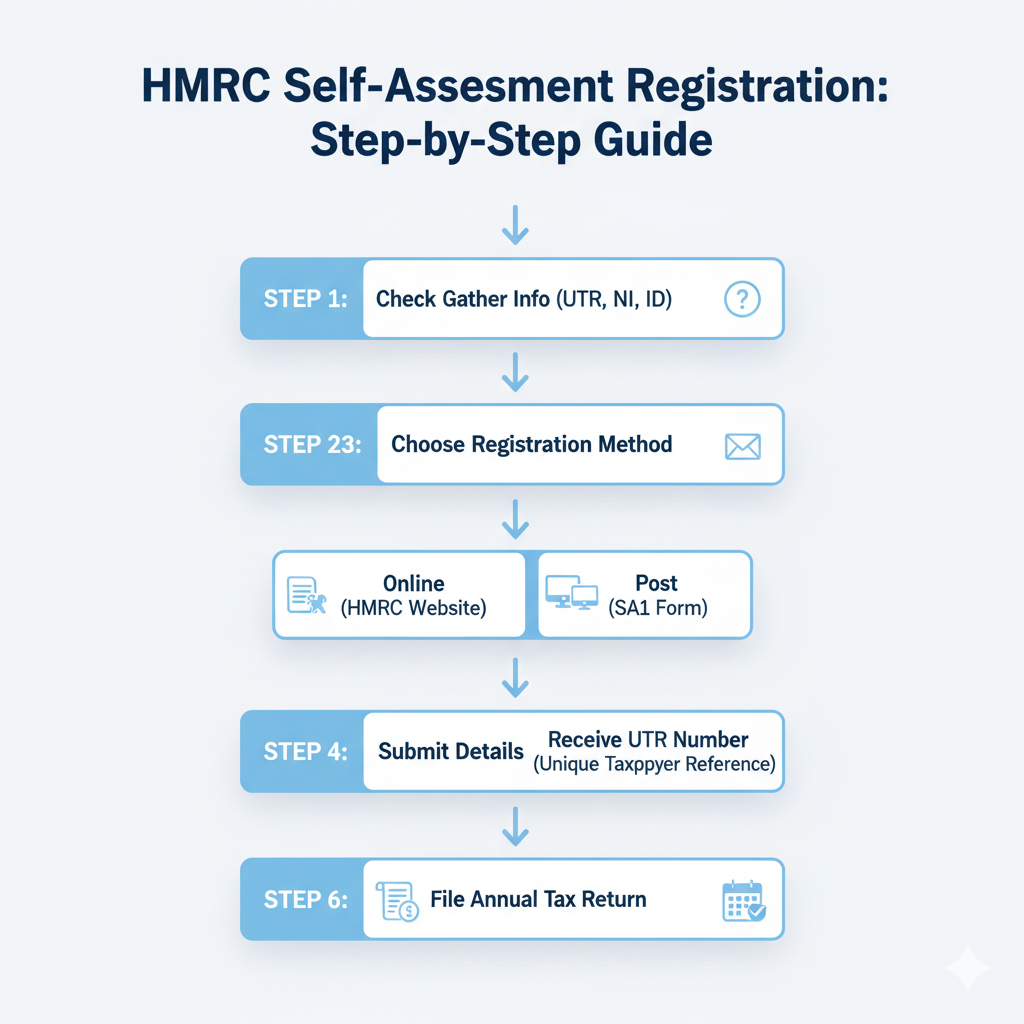

Before you can file your first Self Assessment tax, you need to register with HMRC. This catches many people off guard, particularly when they realise the deadline for registration (5th October) is different from the filing deadline (31st January). Missing the registration deadline can result in penalties, something we help many clients appeal at Ask Accountants UK Ltd.

The registration process itself has become more streamlined over recent years, though it still involves multiple steps:

Step 1: Telling HMRC You Need to File

You can register online through the GOV.UK website, by phone, or by post. We generally recommend online registration – it’s faster and you get immediate confirmation. You’ll need:

- Your National Insurance number

- Your personal details (full name, date of birth, address)

- Business details if you’re self-employed

- The date you became self-employed or started receiving untaxed income

Step 2: Receiving Your Unique Taxpayer Reference (UTR)

After registering, HMRC sends your UTR by post, usually within 10 working days, though we’ve seen it take up to three weeks during busy periods. This 10-digit number becomes your tax identity – guard it carefully. You’ll use it for all future correspondence with HMRC.

Step 3: Setting Up Online Services

Once you have your UTR, you can register for HMRC’s online services. This involves another wait for an activation code by post (yes, more snail mail in our digital age). The code arrives within 7-10 days and remains valid for 28 days. Miss this window, and you’ll need to request another code.

Our advice from years of experience? Start the registration process by early September at the latest. This gives you buffer time for postal delays and ensures you’re set up well before the January deadline.

Record Keeping: The Foundation of Accurate Returns

Walk into our office at Ask Accountants UK Ltd, and one of the first things we’ll discuss is record keeping. Poor records lead to incorrect returns, missed deductions, and potential HMRC investigations. Good records make everything smoother.

The law requires you to keep records for at least five years after the submission deadline. But what exactly should you be keeping?

Employment Income Records

Even if you’re primarily self-employed, any PAYE income needs declaring. Your employer provides a P60 after each tax year ends on 5th April. This document shows your total pay and tax deducted. If you left a job during the year, you’ll have a P45 instead. File these safely – you’ll need the figures for your return.

Some employers also issue P11D forms detailing benefits in kind like company cars or private healthcare. These benefits affect your tax calculation, so don’t overlook them.

Self-Employment Documentation

For your business income, organisation is crucial. We recommend our clients maintain:

Income records:

- All invoices issued

- Bank statements showing payments received

- Cash receipt records

- Details of any goods taken for personal use

Expense records:

- Receipts for all business purchases

- Mileage logs for business travel

- Home office expense calculations

- Professional fee invoices (including accountancy fees – yes, our invoices are tax-deductible!)

Many clients arrive at our Merton High Street office with carrier bags full of crumpled receipts. While we can work with this, digital record-keeping makes everyone’s life easier. Photograph receipts immediately, use accounting software, or even a simple spreadsheet – whatever works for you.

Property Income

Landlords need particularly detailed records. Beyond basic rental income, you should track:

- Mortgage interest payments (though relief rules have changed)

- Maintenance and repair costs

- Insurance premiums

- Letting agent fees

- Wear and tear replacements

The distinction between repairs (allowable) and improvements (capital) often confuses landlords. Our team regularly helps clients understand these differences – it can significantly impact your tax bill.

Investment Income

With interest rates finally offering returns worth having, investment income has become more relevant. You’ll need:

- Interest certificates from banks and building societies

- Dividend vouchers from share holdings

- Details of any foreign income

- Capital gains calculations if you’ve sold assets

Remember, everyone has a Personal Savings Allowance (£1,000 for basic-rate taxpayers, £500 for higher-rate), but you still need to declare the income even if no tax is due.

Completing Your Return: The Practical Steps

Come January, our office buzzes with activity. But clients who’ve prepared properly find the actual completion surprisingly straightforward. Here’s how we guide people through the process:

Understanding the Sections

The online Self Assessment tax form adapts based on your circumstances. Answer the initial questions honestly – trying to skip sections will only cause problems later. The main sections include:

- Personal details (usually pre-populated)

- Income from employment

- Self-employment income and expenses

- Property income

- Other income (dividends, interest, foreign income)

- Reliefs and deductions

- Student loan repayments

Calculating Self-Employment Profit

This often causes the most confusion. Your taxable profit isn’t simply your income minus expenses. You need to consider:

- Allowable vs non-allowable expenses

- Capital allowances for equipment

- Basis period rules (especially important with recent changes)

- Simplified expenses if applicable

We frequently see mistakes here. Common errors include claiming for entertaining, regular clothing (even if bought specifically for work), or the full cost of mixed-use expenses. When in doubt, seek professional advice – the cost of getting it wrong exceeds our reasonable fees.

The Basis Period Reform

A significant change affecting many self-employed individuals is the basis period reform, implemented from the 2024-25 tax year. If your accounting year doesn’t align with the tax year (ending 5th April), you might face transitional adjustments. This can create unexpectedly high tax bills in the transition year, though spreading provisions exist.

At Ask Accountants UK Ltd, we’ve helped numerous clients navigate these changes. If your year-end is, say, 31st December, you’ll need to apportion profits across tax years. It’s complex enough that even HMRC’s guidance runs to dozens of pages.

Payment Deadlines and Methods

Understanding when and how to pay prevents costly penalties. The key dates are etched in every accountant’s memory:

31st January: Deadline for:

- Filing your online return

- Paying any tax owed for the previous tax year

- First payment on account for the current tax year

31st July: Second payment on account due

Payments on Account Explained

This system confuses many first-time filers who visit our London office. Essentially, HMRC wants tax paid as you earn, not in arrears. So alongside settling last year’s bill, you make advance payments towards the current year’s liability.

Example: In January 2026, you’ll pay:

- Any balance for 2024-25 tax year

- First payment on account for 2025-26 (usually 50% of previous year’s bill)

Then in July 2026, you pay the second 50%. It means your first Self Assessment tax often feels expensive – you’re paying backwards and forwards simultaneously.

Good news: if your bill is under £3,000 and you file by 31st December, you can request collection through PAYE instead, spreading the cost over the following tax year.

Payment Methods

HMRC accepts various payment methods:

- Direct Debit (our recommended option – set it and forget it)

- Bank transfer (faster payments usually clear same day)

- CHAPS (for last-minute large payments)

- Cheque (allow 3 working days)

Note: You cannot pay personal tax with a personal credit card anymore. Business credit cards remain acceptable, but check the terms – some treat tax payments as cash advances.

Common Mistakes and How to Avoid Them

After years of preparing returns at our SW19 office, we’ve seen every possible mistake. Here are the most common, and how to avoid them:

Missing the Deadline

The £100 automatic penalty for late filing is completely avoidable. File in December, not January 31st at 11:45 pm. Our office sees a surge in panicked calls every January 30th – don’t be part of that statistics.

Forgetting Payments on Account

Many people budget for their tax bill but forget the payment on account. Suddenly, a £3,000 bill becomes £4,500. We help clients plan for this, setting aside funds monthly to avoid January shock.

Incorrect Expense Claims

HMRC increasingly uses sophisticated data analysis to spot unusual claims. Claiming £5,000 for ‘sundry expenses’ raises red flags. Be specific, be honest, and keep receipts. Our rule at Ask Accountants UK Ltd: if you wouldn’t confidently explain it to an HMRC inspector, don’t claim it.

Mixing Business and Personal

Using one bank account for everything makes accurate returns nearly impossible. Open a dedicated business account – most banks offer free business banking initially. It simplifies record-keeping immeasurably.

Ignoring Benefits in Kind

That company car, health insurance, or gym membership from your employer? They’re taxable benefits. Your P11D form details these, but people often misplace it or forget to include the figures. The result? HMRC adjustments and potential penalties.

Mathematical Errors

The online system calculates automatically, but you still input the figures. Transposition errors (writing £15,000 instead of £51,000) happen more than you’d think. Double-check everything. Better yet, have someone else review it – fresh eyes spot mistakes.

When Professional Help Makes Sense

We’re not saying this because we’re accountants, but there are genuine situations where professional help saves money and stress. Consider getting support if:

Your situation is complex:

- Multiple income sources

- Foreign income

- Capital gains calculations

- Basis period transitions

- Trust income

You’re time-poor: Your hourly rate probably exceeds our fee. Why spend weekends wrestling with tax returns when you could be earning money or enjoying life?

You’re risk-averse: Mistakes can trigger investigations. Even innocent errors create stress and cost time to resolve. Professional preparation reduces this risk significantly.

You want to minimise tax legally: We know allowances and reliefs you might miss. The fee often pays for itself through tax savings. Last month, we identified overlooked pension contributions saving a client £2,000 – far exceeding our modest fee.

The Ask Accountants UK Ltd Difference

From our convenient location at 178 Merton High Street, we serve clients across London and beyond. But what sets us apart isn’t just our SW19 postcode – it’s our approach to making tax manageable for real people.

We don’t just fill in forms. We explain the process, help you understand your tax position, and plan for future years. Our clients leave not just with completed returns but with knowledge and confidence.

Our Self Assessment tax service includes:

- Full return preparation and submission

- Year-round record keeping advice

- Tax planning consultations

- HMRC correspondence handling

- Payment on account calculations

- Penalty appeal assistance where appropriate

The investment? Far less than the potential cost of mistakes, penalties, or missed tax-saving opportunities. Plus, our fees are tax-deductible – they reduce next year’s bill.

Planning for Next Year

Once this year’s return is submitted, start preparing for next year. Our most organised clients maintain systems that make January stress-free:

Monthly disciplines:

- Reconcile bank statements

- File receipts digitally

- Update income and expense spreadsheets

- Set aside tax provisions

Quarterly reviews:

- Calculate profit to date

- Estimate tax liability

- Adjust provisions if needed

- Identify tax planning opportunities

Year-end preparation:

- Gather all necessary documents by April

- Book your accountancy appointment early

- Review tax-saving opportunities before year-end

Digital Tools and Resources

Technology has transformed tax preparation. While nothing replaces professional advice for complex situations, several tools help with organisation:

HMRC’s App: Check your tax position, make payments, and receive reminders. It’s surprisingly useful and improving constantly.

Cloud Accounting Software: Packages like QuickBooks, Xero, or FreeAgent automate much record-keeping. They integrate with banks, categorise expenses, and generate reports. We can recommend suitable options based on your business.

Receipt Scanning Apps: Tools like Dext or AutoEntry photograph and categorise receipts. No more shoe boxes full of fading paper.

Mileage Trackers: Apps like MileIQ automatically log business journeys. HMRC accepts digital logs, making the 45p per mile claim easier to justify.

Special Considerations for 2025-26

Several factors make this year’s Self Assessment particularly important:

Basis Period Reform Continues: If you’re affected by the transitional rules, this might be your second year of adjustments. Understanding the spreading elections and overlap relief remains crucial.

Making Tax Digital Expansion: While not yet mandatory for Self Assessment, HMRC’s digital push continues. Preparing now avoids future rush.

Post-Pandemic Adjustments: Many businesses still have pandemic-related grants or loans affecting their tax position. Bounce Back Loan forgiveness, for instance, might create taxable income.

Energy Support Schemes: Various business energy support schemes may impact your tax calculation. Keep detailed records of any support received.

Getting Started Today

Procrastination is the enemy of stress-free tax returns. Whether you’re handling it yourself or seeking professional help, start now. Here’s your action plan:

- Check if you need to register: If you’re unsure, call us on 020 8543 1991 for a quick consultation

- Gather your documents: Start collecting P60s, P11Ds, invoices, and receipts

- Set up systems: Open that business bank account, start that spreadsheet, download that app

- Consider professional help: A conversation with Ask Accountants UK Ltd could save you time, money, and stress

Conclusion: Making Self Assessment Manageable

Self Assessment doesn’t have to be the annual ordeal many people fear. With proper preparation, good records, and either careful attention or professional help, it becomes simply another business task.

At Ask Accountants UK Ltd, we’ve guided thousands through their tax returns. Some arrive stressed and leave relieved. Others come organised and leave even better prepared for next year. All leave knowing their tax affairs are properly handled.

Whether you’re a freelancer in Wimbledon, a landlord in Morden, or running a business anywhere in London, we’re here to help. Our Merton High Street office is easily accessible, our team is approachable, and our fees are reasonable.

Don’t let Self Assessment tax stress define your January. Take control now. Book a consultation, get organised, and make this year the one where tax returns became manageable.

Ready to simplify your Self Assessment tax?

Contact Ask Accountants UK Ltd today:

- Visit us: 178 Merton High St, London SW19 1AY

- Call: +44(0)20 8543 1991

- Email: info@askaccountantsukltd.co.uk

Let’s make your tax affairs as straightforward as they should be. Because at Ask Accountants UK Ltd, we believe everyone deserves stress-free tax returns.

Disclaimer: Tax legislation changes regularly and individual circumstances vary. This guide provides general information current as of October 2025. For personalised advice specific to your situation, please contact Ask Accountants UK Ltd for a professional consultation. We’re authorised and regulated by the relevant professional bodies to provide tax and accounting services.