Let’s talk about money. Specifically, the money you’re about to spend on someone who’s supposed to help you manage your money better. (Yes, the irony isn’t lost on me either.) I’ve watched countless small business owners delay hiring an accountant because they’re terrified of the bill. They soldier on with spreadsheets held together by hope and expired formulas, convincing themselves they’re “saving money.” Meanwhile, they’re missing tax deductions worth thousands, making costly HMRC mistakes, and—here’s the kicker—probably spending more hours on bookkeeping than they would’ve paid an accountant for anyway. The truth about small business accountant cost in 2025? It’s less scary than you think, but more complicated than a single number. And that’s what we need to unpack.

Why Nobody Tells You The Real Price Upfront

Ring up ten accountants tomorrow morning. Ask them how much they charge. You’ll get ten variations of “it depends.” Frustrating? Absolutely. But they’re not being evasive—accounting fees genuinely vary based on factors most business owners haven’t even considered yet. Your business structure matters. So is your turnover, what industry you in, how well your records are organised (tell the truth) and do you really need an accountant or just someone who will file your self-assessment. To a small business in the UK, the monthly costs can be between £60 and 450, but it is a broad band and can easily fit a lorry in it.

The baseline number, which is that of 60 pounds, normally covers the sole traders that have simple finances and perfect record keeping. At the other end, £450 monthly might include bookkeeping, payroll, quarterly management accounts, and proactive tax planning. Here’s what actually drives the price up or down: Your business structure changes everything. Sole traders generally pay less because their accounting needs are simpler. Limited companies face annual costs between £300 and £2,000, with most businesses paying £500 to £1,200 depending on complexity. That’s annual for basic services—add monthly bookkeeping and you’re looking at additional ongoing fees.

Turnover acts like a multiplier. A business generating £30,000 annually requires different attention than one turning over £300,000. More transactions mean more work, which means higher fees. Some accountants even structure their pricing explicitly around turnover thresholds.

Location matters more than it should. London accountants may charge up to 25% more than the national average, which stings when you’re trying to keep costs down. But you’ve also got more choice in cities, which can work in your favour if you shop around.

The Hourly Rate Trap (And When It Actually Makes Sense)

Hourly billing feels transparent until you realise you have no idea how many hours your tax return actually takes. General accounting work costs between £25 and £100 per hour, whilst specialist services—think complex tax planning or forensic accounting—run from £125 to £250 hourly.

Basic bookkeeping? That’s your £25-£35 range.

Tax advisory work from a chartered accountant? You’re looking at £75-£150+.

The problem with hourly rates is unpredictability. Your accountant might take two hours or twelve to untangle your shoebox of receipts (yes, people still do this). One consultation could solve your problem in forty minutes; another might require three follow-up calls and extensive research. When hourly makes sense:

- One-off projects with defined scope

- Specialist advice sessions

- Crisis management (HMRC investigation, anyone?)

- Businesses with sporadic accounting needs

When it doesn’t:

- Ongoing relationships where you’ll need regular support

- When you’re terrible at organising paperwork (hourly charges escalate fast)

- If you want predictable monthly expenses

Most small business owners benefit more from fixed monthly fees. You know what you’re paying, your accountant knows what they’re expected to deliver, and there’s no awkward dance around “should I ring them about this or is it going to cost me another billable hour?”

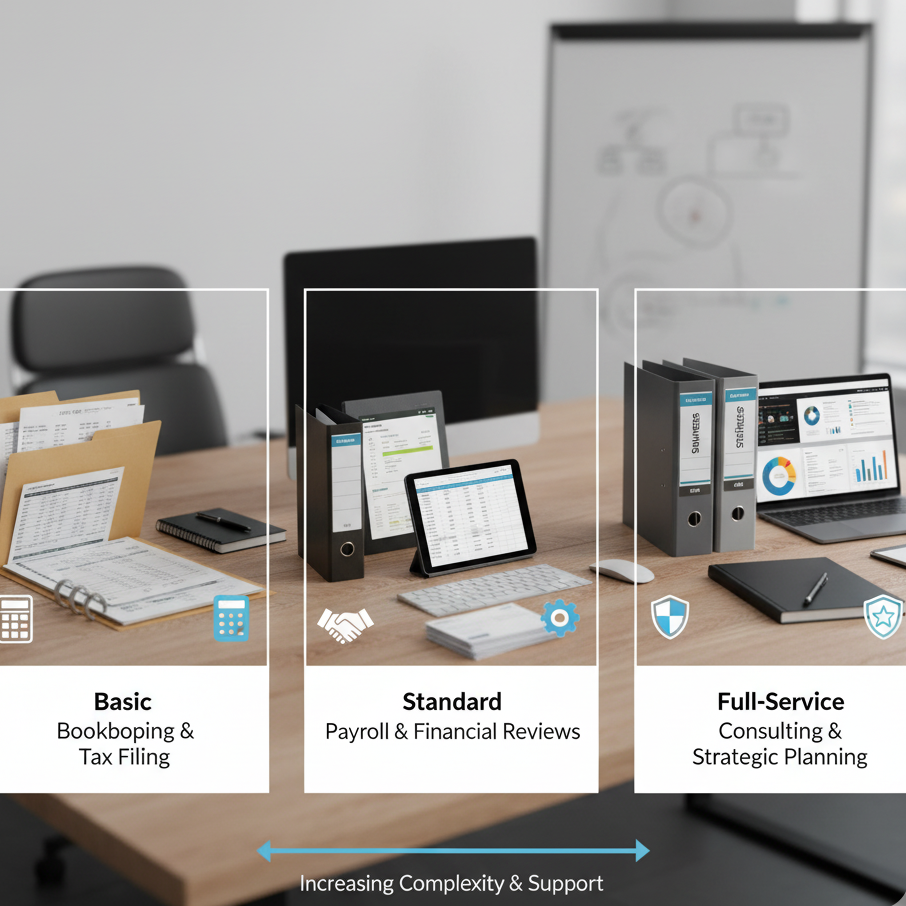

Breaking Down What You Actually Get For Your Money

Let’s get specific, because “accounting services” means different things to different people.

The Bare Minimum Package

Sole traders often pay between £100 and £150 monthly for basic services. This typically includes:

- Annual self-assessment tax return

- Basic tax planning advice

- Year-end accounts preparation

- HMRC correspondence handling

That’s it. No bookkeeping, no monthly check-ins, no proactive planning. Just the essentials to keep you legal and filed on time.

The Actually Useful Middle Ground

For businesses that want more than compliance box-ticking, monthly packages between £200 and £450 might include:

- Monthly bookkeeping and transaction recording

- VAT returns (quarterly or monthly)

- Management accounts

- Payroll processing for small teams

- General business advice

- Tax planning conversations

- Software setup and training (Xero, QuickBooks, etc.)

This is where services like those offered by Ask Accountant become genuinely valuable. Their business accounting services and proactive tax advisory solutions help businesses stay ahead rather than just catching up each year-end.

The Full-Service Approach

Spend £500+ monthly and you’re looking at:

- Everything in the middle tier

- Regular strategic planning sessions

- Cash flow forecasting

- Growth planning support

- Director’s loan account management

- Dividend planning

- Auto-enrolment pension management

- Detailed financial analysis

Honestly? Most small businesses don’t need this immediately. But as you grow past £100k turnover, these services start paying for themselves through better decision-making and tax efficiency.

The Hidden Costs Nobody Warns You About

Right, here’s where things get interesting. That monthly fee? It’s rarely the whole story. Software subscriptions run separately. Xero costs around £35 monthly, QuickBooks varies by package. Some accountants bundle this into their fees; others don’t. Always ask.

One-off projects attract separate charges. Company formation, R&D tax credit claims, restructuring advice—these fall outside standard packages. Expect £300-£1,000+ depending on complexity.

Year-end work might cost extra even with a monthly retainer. Some firms charge additional fees for annual accounts preparation, though decent ones include this in monthly packages.

Penalties for late filing aren’t the accountant’s fault, but they’re costs you’ll incur if things go wrong. HMRC doesn’t care whose fault it was.

Disorganisation costs you money. Every hour your accountant spends deciphering illegible receipts or chasing missing invoices is billable time (or frustration that leads them to increase fees next year). Want lower accounting costs? Keep better records. Boring advice, but transformative in practice.

What Business Structure Actually Costs

The gap between sole trader and limited company accounting fees isn’t small—it’s a canyon.

| Business Structure | Annual Cost Range | What’s Included |

| Sole Trader (Basic) | £200 – £600 | Self-assessment, basic tax advice |

| Sole Trader (With Bookkeeping) | £1,200 – £2,400 | Monthly bookkeeping, self-assessment, ongoing advice |

| Limited Company (Basic) | £500 – £1,200 | Annual accounts, Corporation Tax, confirmation statement |

| Limited Company (Full Service) | £2,400 – £6,000+ | Bookkeeping, payroll, management accounts, tax planning, strategic advice |

Table 1: What Business Structure Actually Costs

London vs. The Rest of Britain

Geography shouldn’t matter this much, but it does. Central London accountants charging £150+ hourly aren’t uncommon. Venture out to Yorkshire or Wales and suddenly £60 hourly feels perfectly reasonable for similar qualifications. The difference? Rent, salaries, operating costs—all the usual urban overheads. Ask Accountant, based at 178 Merton High St, London SW19 1AY, manages to bridge this gap by offering competitive rates despite their London location. Their approach focuses on value over premium pricing, which matters when you’re comparing quotes for small business accountant cost.

When Cheap Actually Costs More

I’ve seen businesses switch accountants three times in two years, each time chasing lower fees. Know what they ended up with? Inconsistent advice, repeated setup costs, and financial records that looked like they’d survived a blender accident.

The Services That Actually Save You Money

Here’s where accountant costs stop being expenses and start being investments. Tax planning – Not illegal avoidance schemes, but legitimate structuring. Self-assessment tax returns alone cost £150-£350, but proper tax planning throughout the year can save multiples of that figure.

CIS claims and refunds for construction industry businesses often go unclaimed because owners don’t realise they’re due money back.

Business advisory services help you avoid expensive mistakes. Should you hire or outsource? Lease or buy equipment? Expand now or wait? Bad decisions cost far more than accounting fees.

The DIY vs. Professional Calculation

Let’s be realistic about DIY accounting. It works for maybe 10% of small businesses—those with:

- Minimal transactions (under 50 monthly)

- No employees

- No VAT registration

- Straightforward income sources

- Good organisational habits

- Willingness to learn tax rules

Everyone else? You’re probably costing yourself money trying to save on accounting fees.

The Bottom Line on Small Business Accountant Cost

After all this, what should you actually pay?

- Sole traders with straightforward affairs: £100-£200 monthly gets you solid support without overpaying.

- Small business accountant cost (under £100k turnover): Budget £200-£350 monthly for proper service.

- Growing businesses (£100k-£500k turnover): £350-£500 monthly provides comprehensive support.

- Larger small businesses (£500k+ turnover): £500-£1,000+ monthly, potentially more for complex operations.

Frequently Asked Questions

What is small business accountant cost UK? The average cost of accounting to most small businesses in UK is between 60 and 450 per month. Sole proprietors will tend to spend between £100-150 per month, whereas limited companies will require a higher amount of money, often between 200-400 per month, based on the complexity. The precise price would be determined by your turnover and the business type and the level of compliance or full bookkeeping services that you require.

Should you pay as a small business a help with an accountant? Yes, for most businesses. Effective accounting, properly done, is usually more efficient in terms of taxes, penalty avoidance and improved decision making. It may make an exception of extremely simple sole proprietors with few transactions who can afford to study DIY accounting. Professional accounting support is self-rewarding to all other people, particularly, those that are limited companies.

What is the cost to hire accountants per hour in UK? The small business accountant cost in the UK range between 25 and 150 per hour. Simple bookkeeping is at the bottom (£25-35), and more specialist services such as complicated tax planning are priced at £125-250 per hour. Nonetheless, hourly payments are a declining trend with the majority of accountants opting to maintain packages of fixed monthly payments to guarantee certainty.

Is it allowable to deduct accountant charges against tax? Yes. Both a sole trader and limited company may allow accounts fees as a cost of conducting business. The amount of taxable profits is deductible to the extent of the entire cost of accounting services, bookkeeping, tax advice and audit fees (without incurring taxable interest and penalty). This is equivalent to discounting the actual cost of accounting by your marginal tax rate.

What are some of the services under basic accounting? Basic facilities are traditionally annual accounts preparation, filing tax returns and basic advice on tax planning. They do not typically involve bookkeeping, payroll, VAT returns, or management accounts all of which are more expensive. Never accept what basic accounting entails without asking what is actually involved since basic accounting is subjective to various companies.

Is it necessary to hire a local accountant or an online accountant? The two are effective to various businesses. Local accountants provide physical meetings and local assistance but may be expensive in the locality. Internet accountants are cheaper and convenient, but deprived of personal communication. Take into account your level of technological comfort, the difficulty of your finances, and the importance of face-to-face meetings. It does not have a universally correct answer.