Inheritance Tax Limit Explained 2026

There’s a particular kind of financial shock that tends to arrive at the worst possible moment. You’ve just lost someone. The paperwork is mounting. And then, tucked inside a letter from HMRC, comes a tax bill that nobody anticipated — sometimes for tens of thousands of pounds. All because a threshold quietly existed, and nobody […]

Inheritance Tax: How Much Will You Really Pay?

Here’s something nobody tells you at dinner parties: inheritance tax isn’t just for the wealthy anymore. I’ve watched too many families discover this the hard way—right when they’re grieving, already overwhelmed, and suddenly facing a tax bill that could’ve been avoided (or at least reduced) with a bit of planning. The problem? Most people think […]

Inheritance Tax Gifts Rules Every Family Should Know

Here’s something nobody tells you at dinner parties: that £50,000 you’re planning to gift your daughter for her house deposit could end up costing your estate £20,000 in tax. Not because you did anything wrong, but because you didn’t know the rules. I’ve spent years watching families discover—too late—that generosity comes with paperwork. That the […]

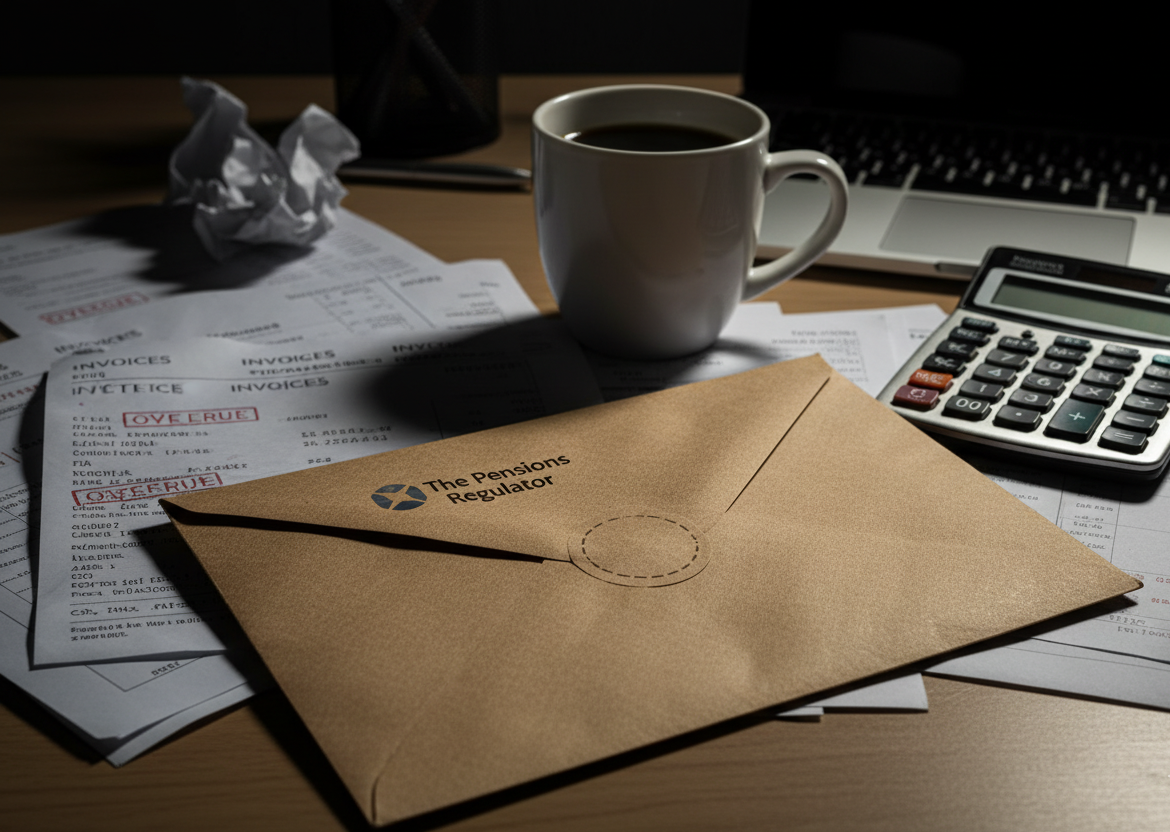

The Auto Enrolment Compliance Trap Nobody Warned You About

Here’s something they don’t tell you at those business networking events: auto enrolment smart pension compliance isn’t just another tick-box exercise. Last year, The Pensions Regulator took enforcement action against 157,142 employers. Read that number again. Most business owners think they’ve sorted their workplace pension once they’ve signed up with a provider. Then – usually at the […]

Corporate Tax Return Deadlines in the UK

There’s a peculiar irony in running a business. You spend months building something brilliant—negotiating contracts, landing clients, perfecting your product—only to discover that missing a single date circled in red on some bureaucrat’s calendar can cost you more than your entire marketing budget. I’m talking about corporate tax return deadlines, of course. And if you’re […]

Why Accounting for Small Companies Is Different

Last thing you want to hear: your accountant treating your three-person startup like it’s Tesco. Here’s why the numbers game changes when you’re small. Right, let’s get something straight from the start. When I tell people that accounting for small companies isn’t just a scaled-down version of big business accounting, I get these blank stares. Like I’ve […]

Auto Enrolment Smart Pension Compliance Guide

Here’s something nobody tells you when you start hiring: that first employee isn’t just about payroll and employment contracts. They’re your trigger for a pension minefield that can rack up £10,000 daily fines if you mess it up. Yes, daily. I’ve watched business owners treat auto enrolment like it’s some optional HR tick-box exercise. Then […]

How Outsource Accounting Works (Step-by-Step)

Last updated: December 2025 Here’s something nobody tells you about running a business: your accounting books are probably messier than you think. I’ve seen it countless times. A business owner thinks everything’s fine — until tax season arrives like an unwelcome relative. Or worse, they miss a crucial VAT deadline because their spreadsheet system (the one […]

Accountant for Self Employed: What an Accountant Can Do for You

Here’s something nobody tells you when you first go self-employed: you’ll spend roughly 14% of your working week thinking about money you don’t have yet, money HMRC wants from you, or receipts you’ve definitely lost. That’s not an official statistic (I made it up), but ask any freelancer and they’ll nod knowingly. The romance of […]