Inheritance Tax: How Much Will You Really Pay?

Here’s something nobody tells you at dinner parties: inheritance tax isn’t just for the wealthy anymore. I’ve watched too many families discover this the hard way—right when they’re grieving, already overwhelmed, and suddenly facing a tax bill that could’ve been avoided (or at least reduced) with a bit of planning. The problem? Most people think […]

How to Maximise Your Inheritance Tax Allowance in 2026

Here’s something nobody tells you at dinner parties (because who discusses tax at dinner parties?): roughly 96% of UK estates won’t pay a penny in inheritance tax. Yet the 4% who do fork out an average of £180,000 to HMRC. That’s not pocket change—that’s someone’s house deposit, a comfortable retirement nest egg, or your kids’ […]

Inheritance Tax Rules Explained Simply 2026

Published: January 2026 | Reading time: 12 minutes Here’s something nobody tells you at dinner parties: inheritance tax rules in the UK are simultaneously straightforward and maddeningly complex. The basic premise? Dead simple. Your estate gets taxed at 40% on everything above £325,000. But then the government added residence nil-rate bands, seven-year rules, taper relief, […]

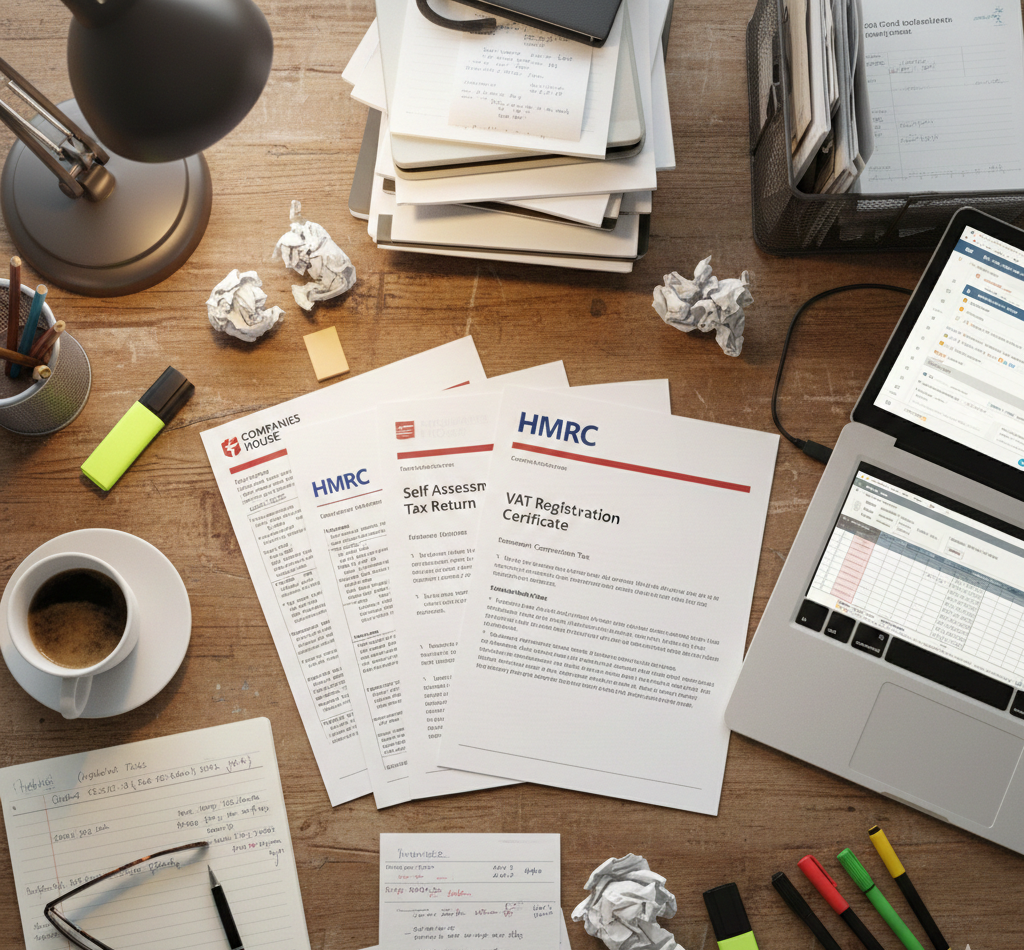

Accounting for Small Companies: The UK Compliance Guide

Last updated: January 2026 | Reading time: 12 minutes Here’s something nobody tells you when you register your first limited company: the paperwork doesn’t end with Companies House. In fact, it’s barely started. I’ve watched countless business owners stumble through their first year of accounting for small companies, only to face penalty notices because they thought […]

Succession Tax Explained: What It Means for Your Estate

Right, let’s address the elephant in the room straightaway: there’s technically no such thing as “succession tax” in the UK. Not officially, anyway. What we’re actually talking about when someone mentions succession tax is Inheritance Tax (IHT) – though you’ll occasionally hear old-timers refer to it as “death duty,” which sounds properly Victorian but hasn’t been the […]