Best Small Business Accounting Services in the UK 2026

Here’s something nobody tells you when you start a business: the accounting bit will keep you up at night more than any dodgy client or failed pitch ever could. I remember chatting with a mate who runs a small construction firm in Manchester. Brilliant at what he does – can build you a gorgeous extension […]

VAT Accounting Rules Every Business Must Follow

Here’s something nobody tells you when you first register for VAT: the rules aren’t actually that complicated. What is complicated is the sheer volume of them, the bizarre exceptions, and—let’s be honest—the fact that HMRC seems to change something every other month. I’ve watched businesses get slapped with penalties not because they were trying to dodge their […]

How VAT Accounting Works in the UK

Here’s something nobody tells you when you first start thinking about VAT: the £90,000 threshold isn’t a finish line you’re racing toward. It’s more like a trapdoor that opens beneath you when you least expect it. I’ve watched countless business owners celebrate their first £90k in turnover, only to realise – usually around 3am on […]

Making Tax Digital Explained: Simple VAT Solutions for Small Businesses

The taxman’s gone digital, and frankly, it’s about time. But if you’re running a small business and the mere mention of “making tax digital for VAT” makes your head spin faster than a washing machine on its final cycle, you’re not alone. This isn’t just another bureaucratic hoop to jump through – it’s a fundamental […]

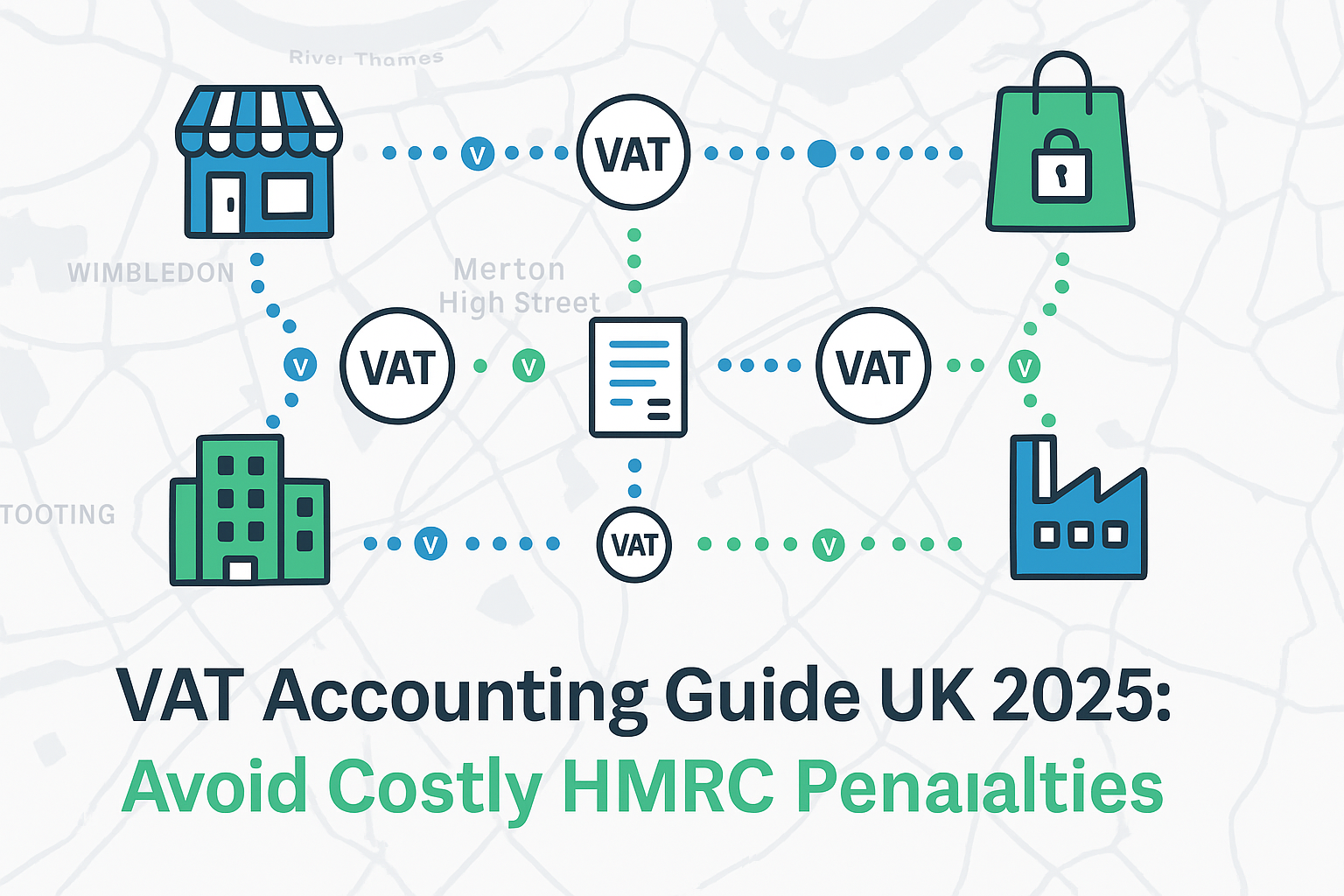

VAT Accounting Guide UK 2025: Avoid Costly HMRC Penalties

Here’s something that’ll make you pause mid-sip of your morning coffee: 78% of UK businesses make at least one VAT-related error each year. And I’m not talking about missing a decimal point—I mean proper, HMRC-will-notice mistakes that can trigger investigations, penalties, and the kind of sleepless nights that no amount of chamomile tea can fix. […]

Local Accountants London: The Smart Choice for Business

Introduction Picture this: you’re a small business owner in London, drowning in receipts, tax forms, and financial projections. Your passion is your product or service – not wading through HMRC guidelines or calculating VAT returns. This is where a local accountant becomes your financial superhero, swooping in with regional expertise and personalised service that large […]