Here’s something nobody tells you about tax returns: the difference between doing them yourself and having a proper tax accountant near me handle them isn’t just convenience. It’s the gap between overpaying HMRC by £2,000 and actually keeping that money in your pocket.

I remember chatting with a mate who’d been filing his own returns for five years. Proud of it, too. Then he finally visited a local accountant—not because he wanted to, but because HMRC sent him one of those delightful brown envelopes requesting “clarification” on his 2023 submission. Turns out he’d been missing legitimate expense claims every single year. The accountant recovered three years’ worth of overpaid tax, which more than covered their fees and bought him a decent holiday.

The moral? Sometimes the money you save doing it yourself is actually money you’re losing.

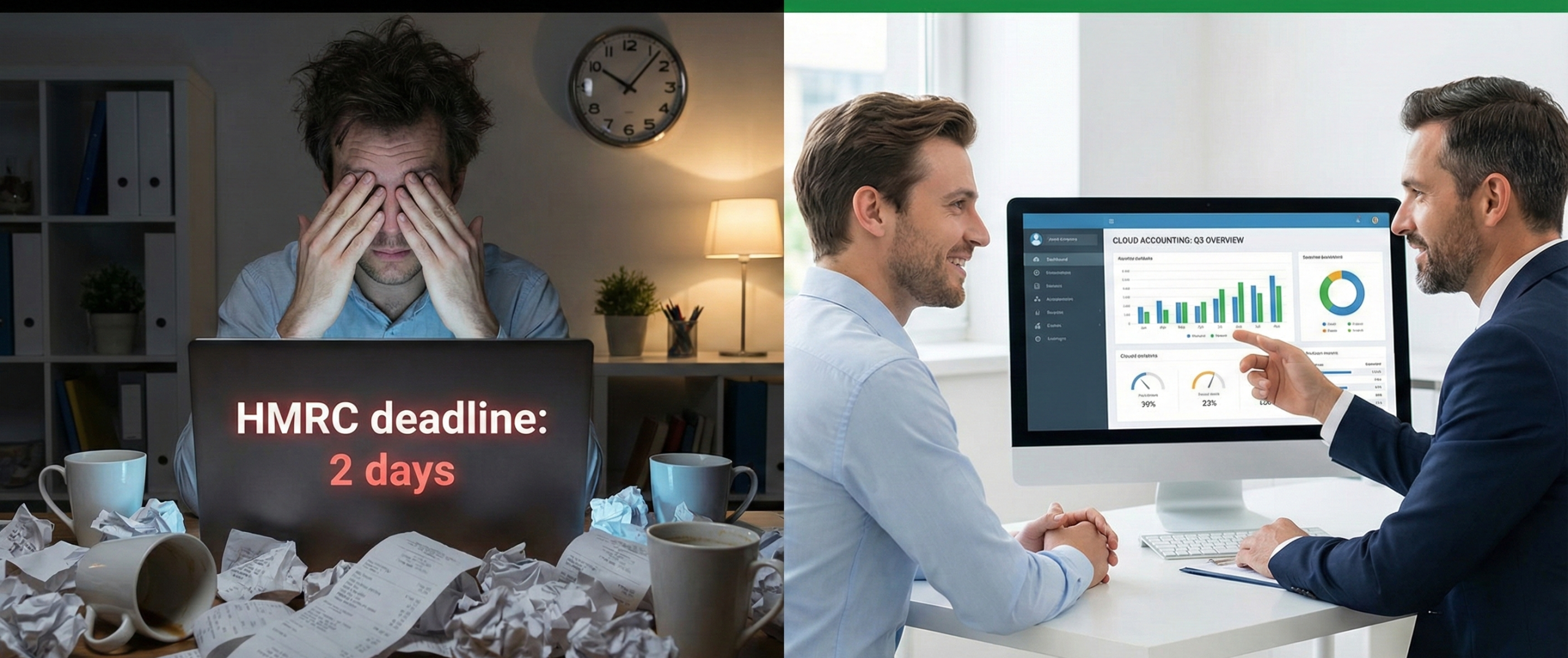

The Real Cost of Going Solo on Tax Returns

Let me be blunt: UK tax law is deliberately complicated. Not in a conspiracy-theory way, but in a “written by committee over decades with amendments upon amendments” way. Self-assessment sounds straightforward until you’re three hours deep on a Sunday evening, searching for the difference between capital allowances and allowable expenses whilst your dinner goes cold.

The 2025 tax landscape has introduced fresh complications too. Making Tax Digital now applies to self-employed individuals and landlords earning over £50,000 from April 2026, with the threshold dropping to £30,000 by April 2027. If you’re hovering around these figures, getting your ducks in a row now means avoiding penalties later.

Warning: Missing the 31st January deadline triggers an automatic £100 penalty, even if you don’t owe any tax. Filing late? The fines stack up quickly after that initial hit.

But here’s what really gets expensive: the mistakes. Many business owners don’t realise how much they can claim back in allowable expenses, from travel and office costs to software subscriptions and professional fees. Every missed receipt is money left on the table. Every miscategorised expense is a potential audit trigger.

What Actually Makes a Tax Accountant Near Me Worth the Investment?

Right, so you’ve googled “tax accountant near me” and got 47 results. Now what? The thing about finding a tax accountant near me isn’t just about geography—though that helps when you need to pop in with a shoebox full of receipts (we’ve all been there). It’s about finding someone who speaks fluent HMRC and can translate that bureaucratic gibberish into actual savings.

They Know the Loopholes (the Legal Ones)

A qualified tax accountant near me doesn’t just fill in boxes. They know which reliefs you’re entitled to but probably haven’t heard of. R&D tax credits for tech businesses. Capital gains strategies for property investors. CIS refunds for construction workers who’ve had tax deducted at source.

Take Ask Accountant, for instance—a firm based at 178 Merton High St in London. Beyond basic tax returns, they handle everything from inheritance tax planning to CIS claims and business advisory work. The kind of stuff that DIY software won’t even mention because it doesn’t know your specific situation.

They’re Your HMRC Buffer Zone

Ever received correspondence from HMRC? It’s written in a tone that makes you feel guilty even when you’ve done nothing wrong. Having a tax accountant near me means they deal with those letters, not you. They speak the language. They know when HMRC is fishing and when there’s a genuine issue.

Local accountants understand UK tax rules in detail and can point out allowances, reliefs, and deductions that apply to your situation, helping you avoid missed opportunities that could save you money. That’s not marketing fluff—it’s the difference between paying what you actually owe versus what HMRC thinks you might owe.

The “Near Me” Part Actually Matters (Sometimes)

In 2025, we can video call anyone anywhere. So why does proximity matter when searching for a tax accountant near me?

Honestly? It doesn’t always. But here’s when it does:

- Face-to-face rapport building. Some financial conversations feel weird over Zoom. Discussing your business struggles, your inheritance concerns, your messy divorce’s tax implications—these benefit from actual human presence.

- Regional tax knowledge. While all four regions of the UK largely follow the same corporation tax regime, there are some differences when it comes to income tax bands in Scotland, and unique VAT and Import rules in Northern Ireland in light of Brexit.

- Emergency access. The 31st January deadline falls on a Friday this year. If your accountant is local, popping by their office with that missing P60 becomes feasible rather than a courier nightmare.

- Local business networks. A tax accountant near me who’s embedded in the community often has connections to solicitors, mortgage brokers, business advisors—the whole ecosystem you might need.

That said, costs of running a practice in London are substantially higher than in Northern Ireland, largely due to higher commercial rental rates and living expenses, leading to more expensive labour. So if you’re in London searching for a tax accountant near me, expect to pay more than someone in Belfast—even if the expertise is comparable.

How to Actually Choose the Right Tax Accountant Near Me

Here’s the uncomfortable truth: anybody can act as an accountant in the UK, meaning that the tax accountant near you may not actually be qualified with a certification from one of the main regulatory bodies. Terrifying, right?

When vetting potential accountants, ask these questions (and actually wait for proper answers, not evasive waffle):

| Question to Ask | Why It Matters | Red Flags |

|---|---|---|

| What professional qualifications do you hold? | ACCA, CIMA, ICAEW, or ATT credentials mean actual training and standards | Vague responses about “years of experience” without certifications |

| Do you specialise in my type of business/situation? | Freelancers need different expertise than limited companies | “We handle everything for everyone”—jack of all trades, master of none |

| What’s your fee structure? | Fixed fees beat hourly rates for predictable costs | Reluctance to provide clear pricing or written quotes |

| How do you handle HMRC enquiries? | You want representation included, not charged extra | “That would be additional fees” for basic correspondence |

| What software do you use? | Cloud accounting (Xero, QuickBooks) means easier collaboration | Excel spreadsheets and paper files in 2025 |

Pro Tip: Ask if they carry professional indemnity insurance. If they mess up your return, this insurance protects you. No insurance? Walk away.

The Chemistry Test

Look, you’re going to share financial intimacies with this person. Your business fears. Your side hustle income. That Bitcoin you sold. They need to be someone you can actually talk to, not someone who makes you feel awkward for asking questions.

Most decent accountants offer a free initial consultation. Use it. Do they explain things in English or accountant-speak? Do they listen or just push services? Do they seem genuinely interested in helping or just in adding another client to their list?

Common Tax Mistakes Your Local Accountant Will Stop You Making

The beauty of having a proper tax accountant near me is avoiding the expensive errors that seem obvious in hindsight but invisible when you’re wading through forms.

Mixing Personal and Business Expenses

Classic rookie move. Using your business account for groceries or claiming your Netflix subscription as a business expense because you “sometimes watch industry documentaries.” Using business funds for personal purchases or claiming personal expenses as business costs can lead to invalid deductions, increase the chance of an HMRC audit, and create messy financial records.

Separate bank accounts aren’t optional—they’re essential. Your accountant will insist on this if they’re any good.

Missing Legitimate Expense Claims

On the flip side, people leave money on the table by not claiming what they’re actually entitled to. Work-from-home allowances. Mileage for business travel. Professional subscriptions. That laptop you bought specifically for client work.

Many business owners don’t realise how much they can claim back in allowable expenses, from travel and office costs to software subscriptions and professional fees, meaning they pay more tax than necessary.

Getting Employee vs Contractor Classification Wrong

IR35 rules make this particularly thorny. Whether someone should be on PAYE or treated as a contractor isn’t always straightforward, especially with IR35 rules, and getting it wrong can result in fines and backdated tax liabilities.

A knowledgeable tax accountant near me will assess your working arrangements and make sure you’re compliant before HMRC comes knocking.

Ignoring VAT Thresholds

The VAT threshold sits at £85,000 for 2025. Go over it without registering, and you’re looking at backdated VAT bills plus penalties. Stay comfortably under it, and you might voluntarily register anyway to reclaim VAT on purchases. These decisions have consequences either way.

| Tax Mistake | Potential Cost | How Accountant Prevents It |

|---|---|---|

| Late filing | £100+ penalties immediately | Deadline management systems & early prep |

| Missed expense claims | £1,000-£5,000 annually | Comprehensive expense review & categorisation |

| Incorrect VAT treatment | Backdated payments + penalties | Turnover monitoring and timely registration |

| Poor record keeping | Audit triggers & estimated assessments | Cloud software setup and regular bookkeeping |

| Wrong business structure | Thousands in excess tax | Strategic planning based on actual circumstances |

Beyond Tax Returns: What Else Should Your Accountant Offer?

If your tax accountant near me only does tax returns, you’re probably not getting full value. The good ones offer strategic advice that actually moves your financial needle.

Business Growth Planning

Should you incorporate? Hire employees or use contractors? Lease equipment or buy it outright? These decisions have tax implications that ripple forward for years. A proper advisor helps you model different scenarios before you commit.

Proactive Tax Planning

This is where the real money gets saved. Instead of looking backward at last year’s income, good tax planning looks forward. Timing income recognition. Maximising pension contributions. Utilising capital allowances strategically.

Firms like Ask Accountant (you can reach them on +44(0)20 8543 1991) provide proactive tax advisory solutions alongside their compliance work. That’s the sweet spot—someone who handles the boring paperwork but also spots opportunities for improvement.

Inheritance Tax Strategies

Nobody wants to think about death, but inheritance tax sits at 40% on estates above the nil-rate band. For many property owners, that’s a massive chunk of wealth that won’t reach your kids. Early planning—trusts, gifting strategies, business property relief—can dramatically reduce this burden.

Getting Your Tax Affairs in Order

Whether you’re self-employed, running a limited company, or managing rental properties, having the right tax accountant near me isn’t an expense—it’s an investment that typically pays for itself several times over.

For comprehensive support including tax compliance, business advice, and bookkeeping services, consider reaching out to established local firms who understand the nuances of UK tax law.

The DIY vs Professional Accountant Cost Reality

Let’s talk numbers, because ultimately that’s what matters. Self-assessment software might cost you £100-£200 annually. Sounds cheap compared to a tax accountant near me charging £300-£600 for the same service, right?

Except it’s not the same service. Not remotely.

Software fills in boxes based on what you tell it. It doesn’t know you could claim simplified expenses instead of actual costs. It won’t suggest adjusting your income timing to reduce your tax bracket. It certainly won’t handle that HMRC enquiry about your 2022 return that just landed in your inbox.

For basic tasks, like self-assessment tax returns, fees can range from £150 to £300 annually, whilst small businesses might pay between £50 and £200 per month for bookkeeping, payroll, and tax preparation. But here’s the thing: good accountants can save you money by making sure you claim all eligible tax deductions, avoid penalties, and manage your finances efficiently.

That monthly fee isn’t just buying you compliance—it’s buying you peace of mind, time back, and often actual tax savings that exceed what you’re paying.

What to Expect from Your First Meeting with a Tax Accountant Near Me

So you’ve found a promising tax accountant near me and booked that initial consultation. What happens next?

Bring everything. Seriously. Last year’s tax return if you filed one. P60s or SA302s. Business bank statements. A rough idea of your income and expenses. That pile of receipts you’ve been meaning to organise for six months.

The accountant will:

- Review your current tax situation and identify immediate concerns

- Explain what services you actually need (versus what they’d like to sell you)

- Provide a clear fee quote—get this in writing

- Outline the process and timeline for getting your affairs in order

- Answer your questions without making you feel weird for asking

Red flag time: if they promise huge refunds before even looking at your figures, that’s not confidence—that’s cowboyism. Genuine professionals are cautious with predictions because they know HMRC doesn’t hand out money without proper justification.

Questions You Should Ask (That Most People Don’t)

Everyone asks about fees. Here’s what you should also be asking your potential tax accountant near me:

“How do you stay current with tax law changes?” The good ones attend continuing professional development courses, subscribe to tax update services, and belong to professional networks.

“What happens if I get audited?” You want to hear that they’ll represent you as part of the service, not treat it as a billable extra.

“Who actually works on my account?” Will it be the qualified person you’re meeting or a junior staff member? Both can be fine, but you should know.

“How quickly do you typically respond to queries?” If they say “within 24 hours” for routine questions, that’s excellent. “Within a week” is acceptable. “Whenever we get to it” is unacceptable.

The Technology Factor: Cloud Accounting and Your Tax Accountant Near Me

Here’s something that’s changed dramatically in recent years: how you interact with your accountant. Gone are the days of boxing up receipts and physically delivering them. Modern accountants work with cloud software like Xero, QuickBooks, or Sage.

This matters because:

- You can see your financial position in real-time, not months after the fact

- Bank feeds automatically import transactions, reducing data entry errors

- Your accountant can access your records remotely, speeding up turnaround times

- Making Tax Digital compliance becomes straightforward rather than terrifying

If your potential tax accountant near me is still working primarily with paper records in 2025, that’s not charming old-school reliability—it’s a warning sign they haven’t kept pace with the industry.

Related Reading: Understanding cloud accounting can transform how you manage business finances. It’s not just about convenience; it’s about real-time visibility into your tax position.

When Should You Actually Start Looking for a Tax Accountant Near Me?

The worst time to search for a tax accountant near me? Mid-January when the 31st deadline is looming and you’re panicking. That’s when accountants are slammed, taking on emergency clients who’ll pay premium fees for rushed work.

The best time? Right now. April through December. When accountants have capacity to take on new clients properly, spend time understanding your situation, and set up systems that prevent future chaos.

Even if your tax return isn’t due until next January, getting your affairs organised now means:

- Time to implement tax-saving strategies for the current year

- Proper bookkeeping systems established before they’re desperately needed

- Relationship built with your accountant so they understand your goals

- No last-minute panic when January rolls around

Special Circumstances: When You Absolutely Need a Tax Accountant Near Me

Some situations scream “get professional help immediately.” These include:

You’ve Received an HMRC Investigation Letter

Don’t pass go. Don’t attempt to handle this yourself. Get to a tax accountant near me who has experience with HMRC enquiries. The wrong response can escalate a routine check into a full investigation.

You’re Starting a Business

The business structure decisions you make at the start have tax implications for years. Sole trader, partnership, or limited company? Each has different tax treatments. Get this right from day one.

You’ve Inherited Property or Investments

Inheritance tax, capital gains tax, income tax on rental profits—inheriting wealth brings tax complexity. Professional advice here isn’t optional; it’s essential. For detailed help with this, services like inheritance tax planning can save substantial amounts.

You’re in Construction and Dealing with CIS

The Construction Industry Scheme means tax is deducted from your payments at source. Getting CIS refund claims right requires understanding gross payment status, proper records, and how to actually reclaim what you’re owed.

Your Turnover Has Just Crossed £85,000

VAT registration becomes mandatory. The paperwork multiplies. The penalties for errors get steeper. This is not a DIY moment.

The “Near Me” Alternative: Virtual Accountants

I’ll be honest: searching for a tax accountant near me and actually choosing a local one aren’t synonymous anymore. Many successful client-accountant relationships happen entirely remotely.

Virtual accountants can offer:

- Lower overheads, sometimes translating to lower fees

- Access to specialists who might not exist in your immediate area

- Flexible communication times outside traditional office hours

- Modern, tech-forward approaches because that’s their entire business model

The trade-off? You lose that face-to-face option for complex discussions. Video calls are excellent, but they’re not quite the same as sitting across a desk from someone when you’re explaining why your business lost money last year and you’re worried about the future.

Ultimately, whether your tax accountant is physically near you or virtually accessible depends on your preferences and circumstances. Both can work brilliantly. Both can be disasters if you choose poorly.

Final Thoughts: The Tax Accountant Near Me Investment

Here’s what I’ve learned after years of watching friends, family, and clients navigate UK tax: the people who treat their accountant as an expense are the ones who see minimal value. The people who treat their accountant as an investment—someone who actively contributes to their financial wellbeing—are the ones who rave about how much they’ve saved.

Finding the right tax accountant near me isn’t about Google rankings or who’s cheapest. It’s about finding someone competent, communicative, and actually interested in your success. Someone who proactively suggests improvements rather than passively filing whatever you send them.

Your tax affairs are too important—and potentially too expensive—to wing it. Whether you’re self-employed, running a growing business, managing investments, or facing complex situations like self-assessment requirements, getting professional help isn’t admitting defeat. It’s being smart.

And if you’re in London looking for comprehensive support beyond just annual returns—things like payroll management, VAT services, or auto-enrolment—reaching out to an established firm like Ask Accountant might just be one of the better financial decisions you make this year.

Because here’s the truth: HMRC doesn’t care whether you understood the rules. They only care whether you followed them. Having a proper tax accountant near me is how you make sure you do—whilst paying the absolute minimum required by law.