I once watched a brilliant entrepreneur—someone with an amazing product and infectious passion—go from celebrating a seemingly successful year to discovering they were £27,000 in the red. All because of messy bookkeeping. The look on her face still haunts me.

Let’s be honest—nobody daydreams about bookkeeping. You probably didn’t start your business fantasising about reconciling accounts or categorising expenses. Yet here we are, because without someone tracking the financial heartbeat of your company, things fall apart spectacularly fast.

The irony? Good bookkeeping isn’t just about avoiding disasters—it’s actually a secret weapon for growth. When you know exactly where your money’s coming from and going to, you make better decisions. Full stop. And sometimes, proper bookkeeping reveals you’re actually doing better than you thought. Last month, a client discovered an additional £4,300 in recoverable VAT that had been sitting there, unclaimed, for nearly a year.

What Even Is Bookkeeping These Days?

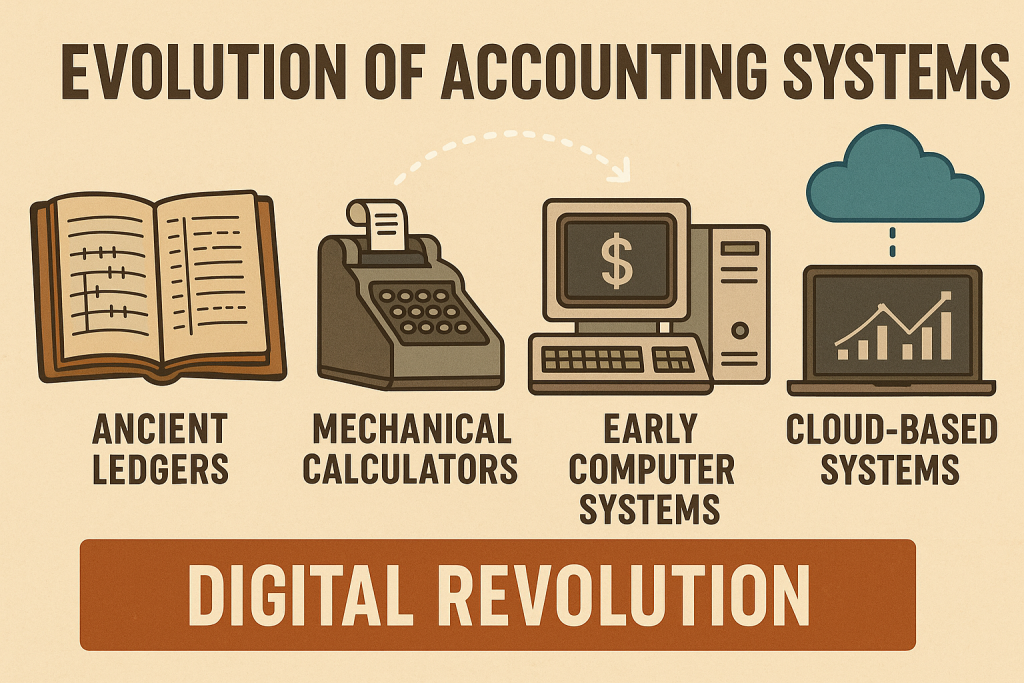

Bookkeeping has come a long way from the green-visor-wearing clerk hunched over ledgers. Today’s bookkeeping blends old-school financial principles with cloud technology and real-time insights.

At its core, bookkeeping means systematically recording all your business transactions—every pound that flows in and out. It’s creating order from the chaos of receipts, invoices, and bank statements. But modern bookkeeping has evolved into something much more powerful than simple record-keeping.

Good bookkeepers don’t just track numbers; they spot patterns. They raise red flags when expenses creep up. They know when your cash flow might hit a tight spot before it happens. They’re the early warning system for your business finances.

A client of mine once called her bookkeeper “the financial smoke detector”—not the most glamorous device in your business, but you’d be mad to operate without one.

The Core Tasks That Make Up Modern Bookkeeping

Bookkeeping isn’t one job—it’s a collection of financial tasks that create a complete picture of your business health. These typically include:

- Transaction recording: Documenting every financial move your business makes

- Bank reconciliation: Making sure your records match what your bank says

- Invoice management: Tracking who owes you what (and when)

- Bill payment: Keeping track of what you owe others

- Payroll processing: Ensuring everyone gets paid correctly and on time

- Financial reporting: Creating the documents that tell your business story in numbers

When working with Ask Accountant’s bookkeeping service, I’ve noticed they’re particularly thorough with reconciliations—catching those pesky duplicate entries or missed transactions that plague DIY bookkeepers.

Bookkeeping vs. Accounting: Not Actually the Same Thing

People mix these up constantly, so let’s clear the air. Think of bookkeeping as gathering and organising financial data, while accounting is about interpreting and analysing that data.

Aspect: Bookkeeping

- Focus: Recording financial transactions

- Timeframe: Day-to-day tracking

- Outputs: Transaction records, basic reports

- Qualification requirements: Typically less formal qualifications

- Who does it: Bookkeeper

Aspect: Accounting

- Focus: Interpreting financial information

- Timeframe: Periodic analysis and planning

- Outputs: Financial statements, tax strategy, business advice

- Qualification requirements: Usually requires professional certification

- Who does it: Accountant

Sometimes one person might handle both roles in smaller businesses, but they’re distinct disciplines. It’s a bit like the difference between a photographer who captures all the important moments and the editor who crafts them into a coherent story.

The team at Ask Accountant offers both bookkeeping and full accounting services, which creates some nice continuity when your business needs both.

Why Bother with Professional Bookkeeping?

Small business owners often ask me if professional bookkeeping is worth it. After all, can’t you just use software and do it yourself? Maybe. But consider these scenarios I’ve witnessed firsthand:

- A cafe owner who thought she was turning a profit until a bookkeeper discovered her inventory costs were being calculated incorrectly—she’d actually been losing money for months

- A consultancy that missed £18,000 in claimable expenses in one year because receipts weren’t properly tracked

- A tradesman who faced a hefty HMRC fine because his DIY bookkeeping missed crucial tax deadlines

Beyond avoiding disasters, good bookkeeping delivers surprising benefits:

The Clear Mind Benefit

There’s something psychologically freeing about knowing your finances are in order. No more Sunday night dread wondering if you’re actually making money or guessing at your tax bill.

The Growth Insight Benefit

With proper bookkeeping, you can spot which services are most profitable, which clients cost you money, and where to focus your efforts. One client discovered their smallest service line was actually generating 40% of their profit—information that completely changed their growth strategy.

The Funding Advantage

Try getting a business loan without clean, professional financial records. Banks and investors need to see your financial story clearly told, and bookkeeping provides that narrative.

Cash-Basis vs. Accrual: A Fork in the Bookkeeping Road

One fundamental choice in bookkeeping is whether to use cash-basis or accrual accounting. The difference is simple but impactful:

- Cash-basis accounting records income when you receive payment and expenses when you pay them. It’s straightforward but can misrepresent your actual financial position if you have lots of outstanding invoices or bills.

- Accrual accounting records income when you earn it (even if not paid yet) and expenses when you incur them (even if not paid yet). This gives a more accurate picture of your financial health but requires more sophisticated tracking.

For most small businesses starting out, cash-basis makes sense. But as you grow, accrual often provides better insights for decision-making. I’ve seen businesses hit growth plateaus because their cash-basis bookkeeping masked underlying profitability issues that accrual would have revealed months earlier.

DIY vs. Professional Bookkeeping: A Realistic Assessment

Can you do your own bookkeeping? Sure. Should you? That depends.

When DIY Might Make Sense:

- You’re just starting out with very few transactions

- You have genuine financial expertise and time to spare

- Your business structure is extremely simple

- You actually enjoy financial detail work (some people do!)

When Professional Help Becomes Valuable:

- Your transaction volume exceeds a few dozen per month

- You have employees and run payroll

- You’ve experienced growth and financial complexity has increased

- You’ve had tax troubles or compliance issues in the past

- Your time is better spent on core business activities

The question isn’t really “Can I do this myself?” but rather “Is this the best use of my limited time?”

I remember a web designer who spent eight hours every month doing her own books. When she finally hired Ask Accountant for their bookkeeping services, she used those reclaimed hours to take on two new clients—resulting in more income than the cost of the service. Sometimes DIY is actually more expensive when you factor in opportunity cost.

What Records Do You Need to Keep? (The HMRC Won’t Take “My Dog Ate It” as an Answer)

Bookkeeping requires source documents—the raw evidence of your business transactions. At minimum, you should keep:

- All bank and credit card statements (both paper and electronic)

- Receipts for purchases and expenses (yes, even that £3.50 coffee if it’s business-related)

- Customer invoices and payment records (including those awkward “reminder” emails)

- Payroll records and PAYE documentation

- Previous tax returns and correspondence with HMRC

- Asset purchase documentation and depreciation records

- Contracts and agreements with financial implications

- Mileage logs if claiming vehicle expenses

HMRC requires you to keep most records for at least 6 years in the UK. This isn’t just bureaucratic fussiness—I’ve seen businesses undergo HMRC investigations and those with organized records emerged relatively unscathed, while others faced penalties that could have been avoided.

But beyond compliance, good record management gives you the data to make informed business decisions. When you know exactly what you spent on digital marketing last quarter and the sales it generated, you can make smarter decisions about this quarter’s budget.

One client stored all receipts in a shoebox—literally—and had no idea why his business struggled until proper bookkeeping revealed he was routinely undercharging for projects by about 15%. Good records revealed the truth his gut feeling couldn’t. He’s now tracking properly through a system Ask Accountant helped him set up, and his profit margins have increased dramatically.

Quick Tip: The Making Tax Digital initiative means keeping digital records is no longer optional for VAT-registered businesses. Even if you’re below the threshold now, setting up digital systems early saves painful transitions later.

Common Bookkeeping Mistakes That Kill Businesses

I’ve seen these bookkeeping errors sink otherwise healthy companies:

- Mixing personal and business finances: Creates tax nightmares and makes it impossible to gauge true business performance

- Neglecting reconciliation: Small errors compound into major discrepancies

- Inconsistent categorisation: Makes trend analysis meaningless

- Missing tax deadlines: Results in completely avoidable penalties

- No backup systems: One computer crash away from financial amnesia

- Waiting too long between updates: Quarterly or annual catches-up miss crucial correction opportunities

The most damaging mistake, though? Not using the financial data once it’s compiled. Bookkeeping shouldn’t just be for tax compliance—it should inform your business strategy.

Finding the Right Bookkeeping Rhythm for Your Business

How often should you update your books? It depends on your business volume and needs:

- Daily bookkeeping works for high-transaction businesses like retail

- Weekly bookkeeping suits most small service businesses

- Monthly bookkeeping is the minimum for any serious business

Whatever schedule you choose, consistency matters more than frequency. Set a specific time for bookkeeping and treat it as non-negotiable.

One restaurant I worked with switched from monthly to weekly bookkeeping and immediately identified a pattern of inventory shrinkage that was costing them thousands. The faster you record, the quicker you can correct course.

Software: The Modern Bookkeeper’s Superpower

Choosing the right bookkeeping software can transform a painful process into something almost pleasant. Today’s options make old-school spreadsheets look positively prehistoric.

When selecting software, consider:

- Your business complexity and transaction volume

- Integration needs with other systems (CRM, e-commerce, etc.)

- Reporting requirements

- User-friendliness (will you actually use it?)

- Growth scalability

- Mobile access needs

- Support quality

I’ve seen businesses transform their financial management with the right software. One client reduced their bookkeeping time by 70% just by switching to a platform that automatically imported and categorised bank transactions.

Ask Accountant works with all major bookkeeping platforms but particularly recommends cloud-based solutions that allow for real-time collaboration between business owners and their financial team.

What Makes a Great Bookkeeper?

If you’re hiring help, look beyond basic number skills. Great bookkeepers also demonstrate:

- Meticulous attention to detail: They catch the small discrepancies before they become big problems

- Proactive communication: They don’t just record history; they alert you to issues

- Industry knowledge: They understand the specific financial patterns of your business type

- Tech savviness: They use technology to automate the mundane and focus on analysis

- Absolute confidentiality: They handle your sensitive financial data with appropriate care

- Problem-solving orientation: They don’t just identify issues; they suggest solutions

One of my clients described finding a good bookkeeper as “more important than finding a good doctor—at least the doctor doesn’t determine if I can pay my mortgage next month.”

The Cost Question: What Should You Expect to Pay?

“How much?” — it’s often the first question business owners ask, and fair enough. Let me break it down based on what I’ve seen in the market.

Bookkeeping services vary widely in cost based on:

- Business size and complexity

- Transaction volume (a shop with 1,000 monthly transactions needs more work than a consultant with 20)

- Services included (basic recording vs. full financial reporting)

- Location (London prices vs. elsewhere in the UK)

- Experience level of the bookkeeper

As a rough guide for UK businesses in 2025:

- Basic bookkeeping for micro-businesses (fewer than 50 transactions monthly) might start around £150-£250 monthly

- Comprehensive bookkeeping for established small businesses typically ranges from £300-£600 monthly

- Complex businesses with multiple revenue streams or high transaction volumes might pay £700+ monthly

I spoke with the team at Ask Accountant, who mentioned they structure their bookkeeping services to scale with your business needs—starting with essentials and adding services as you grow. Their sweet spot seems to be small to medium businesses looking for both compliance and strategic financial insights.

But here’s the crucial point: good bookkeeping usually pays for itself. I’ve worked with dozens of businesses implementing proper bookkeeping, and virtually all discovered either tax savings or profit opportunities that exceeded the cost. One retailer found £12,000 in overlooked supplier overpayments within the first three months—paying for several years of bookkeeping services in one go.

The Digital Revolution in Bookkeeping

Bookkeeping has gone digital in ways that benefit both businesses and bookkeepers:

- Cloud access means you can check finances from anywhere

- Automation handles repetitive tasks like data entry

- AI-assisted categorisation improves accuracy and speed

- Real-time collaboration between you and your financial team

- Digital receipt capture eliminates paper storage nightmares

This tech evolution doesn’t replace the human element—it enhances it. A good bookkeeper using modern tools can focus less on data entry and more on providing insights that help your business.

How Bookkeeping Feeds Into Your Tax Strategy

Proper bookkeeping isn’t just about tracking money; it’s the foundation of effective tax management. With clean, detailed records, you can:

- Identify all legitimate business deductions

- Provide audit-ready documentation if HMRC has questions

- Make informed decisions about tax-impacting purchases or investments

- Plan for tax payments rather than being surprised by them

I’ve watched clients transform tax time from annual panic to simple process just by implementing consistent bookkeeping practices. The team at Ask Accountant specializes in proactive tax advisory solutions that build upon their bookkeeping services, creating a seamless financial management system.

When Your Business Outgrows Basic Bookkeeping

As businesses evolve, their financial management needs become more sophisticated. Signs you might need to level up from basic bookkeeping include:

- Expanding to multiple locations or revenue streams

- Growing beyond 10 employees

- Seeking external funding or preparing for sale

- Dealing with complex inventory or cost accounting needs

- Managing multiple currencies or international operations

When these complexities arise, you might need to supplement bookkeeping with more advanced accounting services. Ask Accountant offers this natural progression through their comprehensive business advisory and accounting services that build upon their foundational bookkeeping work.

Getting Started: First Steps to Better Bookkeeping

If your bookkeeping needs improvement (and most small businesses’ do), here’s where to begin:

- Assess your current situation honestly—how organized are your finances really?

- Separate personal and business finances completely if you haven’t already

- Choose appropriate software for your business type and size

- Establish a consistent schedule for financial updates

- Consider whether professional help would provide a good return on investment

Taking these steps might not be exciting, but the clarity and confidence they provide certainly is. I’ve seen the relief on clients’ faces when they finally get their financial house in order—it’s like watching someone put down a heavy backpack they’d forgotten they were carrying.