Here’s something nobody tells you when you first register for VAT: the rules aren’t actually that complicated. What is complicated is the sheer volume of them, the bizarre exceptions, and—let’s be honest—the fact that HMRC seems to change something every other month.

I’ve watched businesses get slapped with penalties not because they were trying to dodge their obligations, but because they genuinely had no idea a particular rule existed. A £5,000 fine because you didn’t realise daily gross takings needed separate digital recording? That stings. Especially when you’re running a café and already drowning in invoices.

So let’s cut through the noise. This isn’t another generic article telling you that “VAT is important” (thanks, really helpful). This is the practical stuff—the VAT accounting rules that actually matter, the ones that’ll either save you money or cost you a fortune if you get them wrong.

The £90,000 Question (And Why It’s Not As Simple As You Think)

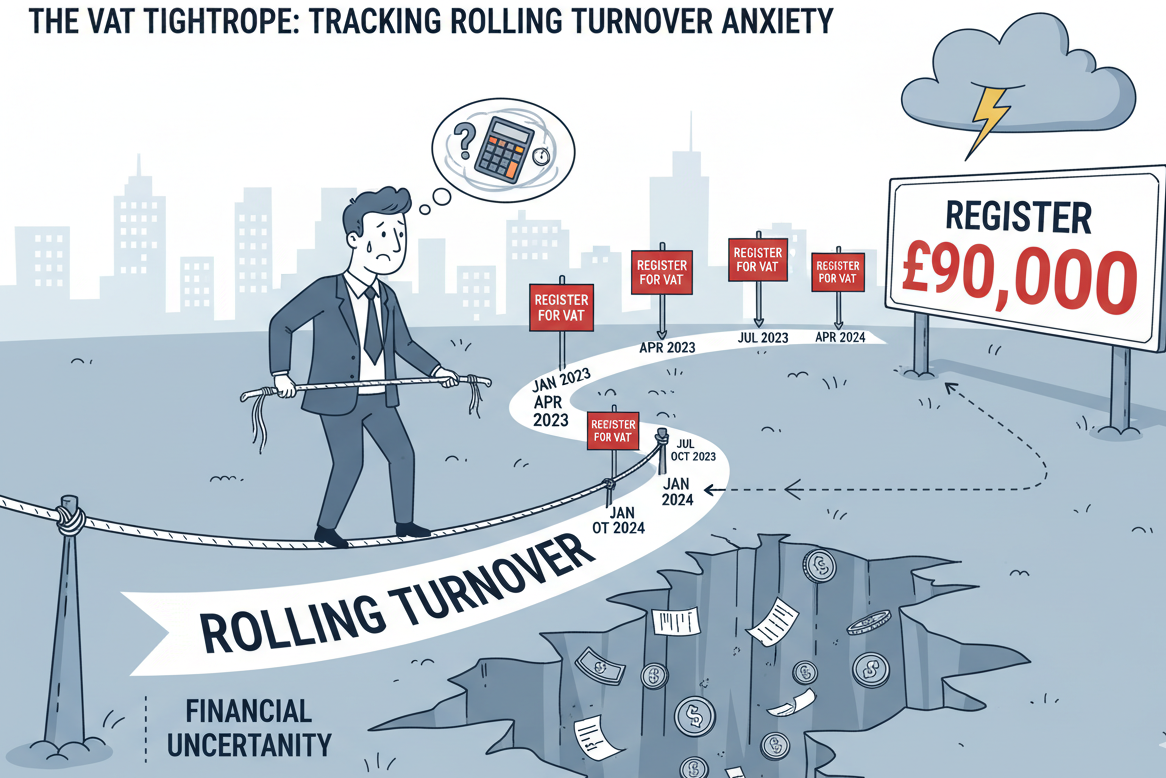

Right, first things first. The VAT registration threshold sits at £90,000 for 2025 and is frozen there until at least March 2026. You’d think this would be straightforward: hit £90k in turnover, register for VAT, done.

Except it’s not your annual turnover that matters—it’s your rolling 12-month turnover. Every single time you make a sale, you’re supposed to add it to your previous 11 months and see if you’ve crossed the line. Miss that calculation? You’ve got 30 days from the end of the month you went over to register. Miss that deadline, and HMRC starts getting twitchy.

What counts towards this magical £90,000?

- Standard-rated sales (obviously)

- Reduced-rate sales at 5%

- Zero-rated sales (yes, even though you’re not charging VAT)

- But not exempt supplies (like residential rent or insurance)

A café owner I know nearly had a breakdown over this. She’d been happily selling sandwiches (zero-rated) and hot drinks (standard-rated) without realising both counted towards the threshold. By the time she twigged, she was six months over and facing backdated VAT liabilities.

Reality Check: Your accountant might tell you to register voluntarily before you hit the threshold. Sometimes that’s smart (especially if you’re buying lots of VAT-able stock and can reclaim it). Sometimes it’s a disaster for your cash flow. There’s no one-size-fits-all answer, which is precisely why VAT accounting drives people mad.

The Three Rates Nobody Can Remember (Until They Get Them Wrong)

UK VAT has three main rates, and the trick isn’t knowing what they are—it’s knowing which one applies to your specific transaction on that specific day.

| Rate | Percentage | Common Examples | The Catch |

|---|---|---|---|

| Standard | 20% | Most goods and services, hot takeaway food, restaurant meals | If in doubt, it’s probably this one |

| Reduced | 5% | Children’s car seats, domestic fuel, mobility aids, some renovation work | Weirdly specific categories—check twice |

| Zero | 0% | Most food (but not hot food), books, children’s clothing, newspapers | You charge 0% but can still reclaim input VAT |

| Note: Exempt supplies (like residential rent, education, most financial services) aren’t included here because you can’t charge VAT on them AND you can’t reclaim VAT on related costs. It’s the worst of both worlds. | |||

The zero-rated versus exempt distinction trips up everyone. Zero-rated is brilliant—you charge your customers nothing extra, but you can claim back VAT on your business purchases. Exempt is rubbish—you can’t charge VAT, and you can’t reclaim it either. If you’re a landlord renting out residential property, you’re stuck in exempt territory and just have to absorb all that VAT on repairs and maintenance.

When Food Stops Being Food

Here’s where VAT accounting gets properly weird. Cold sandwiches? Zero-rated. Heat that same sandwich up? Standard-rated at 20%. A Cornish pasty sold cold from the counter? Zero-rated. The same pasty kept warm under a heat lamp? Standard-rated.

I wish I was joking, but HMRC has genuinely published guidance on the temperature at which a baked good stops being “in the course of manufacture” and starts being “kept hot for consumption.” There was literally a court case about Jaffa Cakes (were they cakes or biscuits?) that determined their VAT treatment.

Making Tax Digital: Because Spreadsheets Weren’t Annoying Enough

If you’re VAT-registered, you’re already in the Making Tax Digital (MTD) system whether you like it or not. Since April 2022, every VAT-registered business—regardless of turnover—must keep digital records and file returns using MTD-compatible software.

What does this actually mean for your VAT accounting day-to-day?

1. Your records must be digital

You can’t just scribble sales in a notebook and add them up at quarter-end anymore. Everything needs to be in software or a spreadsheet that can link to HMRC’s systems.

2. Digital links are mandatory

If you’re using multiple systems (say, one for invoicing and one for expenses), they need to talk to each other digitally. You cannot manually copy figures from one Excel sheet to another. You cannot email a CSV file to yourself and re-enter the data. HMRC is very, very specific about this.

3. You need MTD-compatible software

Xero, QuickBooks, Sage, FreeAgent—pick one. A basic Excel spreadsheet on its own won’t cut it unless you’ve got bridging software to connect it to HMRC’s API.

Unexpected Benefit: Most businesses that complained bitterly about MTD actually find it saves them time once they’re set up properly. Automated bank feeds, digital receipt capture, automatic calculations—it’s 2025, why were we still using paper anyway?

What You Must Keep Digital Records Of

HMRC’s quite particular about this. Your digital records need to include:

- Business name and VAT number (obviously)

- Time of supply for each transaction

- Value of each supply

- Rate of VAT charged

- Amount of VAT on each supply

- Total outputs and inputs for each VAT period

If you use the Flat Rate Scheme, you don’t need records of every individual purchase (unless it’s for capital assets over £2,000). If you’re on a Retail Scheme, you must digitally record your daily gross takings. Different schemes, different rules—welcome to VAT accounting in all its glory.

The Reverse Charge Rabbit Hole

Right, this one’s a headache. The reverse charge mechanism flips the normal VAT accounting process on its head. Instead of the supplier charging you VAT, you account for it yourself.

When does this apply?

- Services purchased from overseas – If you’re a UK business buying services from abroad, you account for the VAT on your return (and usually claim it back immediately, so it’s neutral).

- Construction services – The Construction Industry Domestic Reverse Charge applies to most construction services between VAT-registered businesses.

- Specific sectors – Mobile phones and computer chips in bulk, emissions allowances, gas and electricity supplies.

The construction one catches people out constantly. You’re a builder hiring a subcontractor? No VAT on their invoice. But you do need to account for it on your VAT return as both output tax (money you owe HMRC) and input tax (money you’re reclaiming). It’s administratively exhausting but theoretically neutral.

Get it wrong? HMRC will either think you’ve underpaid (penalties incoming) or overpaid (no refund for you, just a correction notice and a headache).

When The Penalties Actually Hurt

HMRC replaced the old Default Surcharge system with a points-based penalty regime that’s both better and worse than what came before.

Late filing penalties: You get penalty points for late submissions. Hit your threshold (varies by how often you file), and you get a £200 fine. Another late return? Another £200. Keep going and those fines stack up fast.

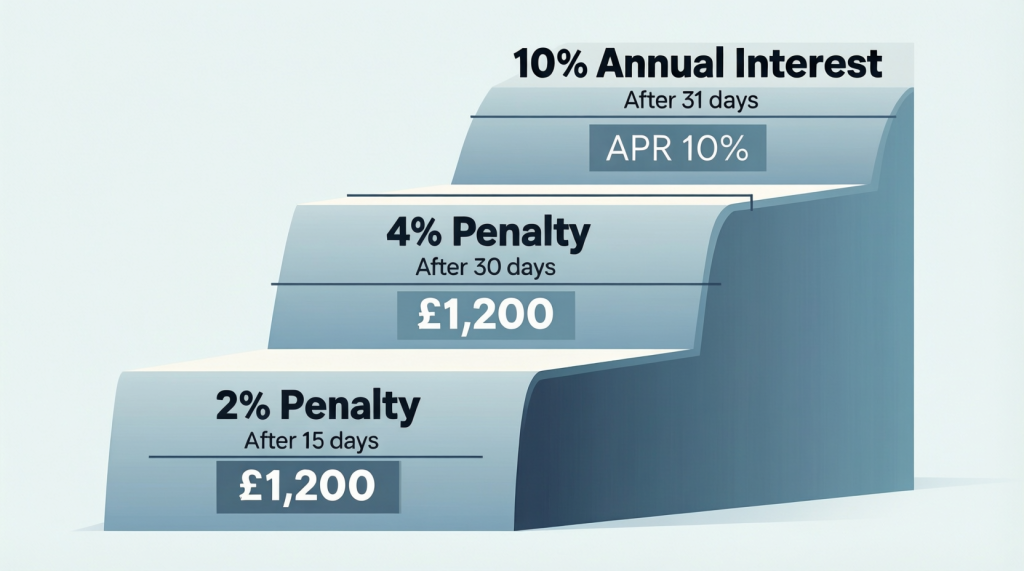

Late payment penalties: If your VAT payment is 15+ days late, you’re charged 2% of what you owe. Still not paid after 30 days? That jumps to 4%. After 31 days, HMRC starts charging 10% per annum interest on the outstanding amount.

| Days Late | Penalty | Additional Interest |

|---|---|---|

| 1-14 days | None (yet) | No |

| 15 days | 2% of VAT due | No |

| 30 days | Additional 2% (4% total) | No |

| 31+ days | 4% standing penalty | Yes – 10% annual rate on outstanding balance |

These aren’t theoretical. A client of mine got hit with a £680 penalty for being six weeks late on a £17,000 VAT payment. Could’ve been avoided entirely with a Direct Debit setup.

The Stuff That’ll Trip You Up If You’re Not Careful

Some VAT accounting rules are obscure enough that you’d never think about them until they become a problem:

Mixed invoices: If you’re selling products at different VAT rates on the same invoice, you need separate digital records for each rate. Can’t just lump it all together. This matters for restaurants (food vs alcohol), retailers (children’s clothes vs adult clothes), and basically anyone with a varied product range.

Deposits and payments in advance: VAT is due when you receive payment, not when you deliver the goods or service. Take a 50% deposit in March but don’t complete the work until June? That deposit’s VAT is owed in your March VAT period.

Bad debt relief: If a customer never pays you, you can claim back the VAT you already paid to HMRC. But only if the debt’s over six months old, under four years old, you’ve already paid the VAT to HMRC, and you’ve written it off in your accounts. Timing matters hugely here.

Partial exemption: If you make both taxable and exempt supplies, you can’t reclaim all your input VAT. You need to work out what percentage of your income is taxable and only claim back that proportion. The calculations are genuinely complex—this is where you ring professional tax advisors rather than guessing.

The Private School Fees Curveball

As of January 2025, private schools now charge 20% VAT on their fees. This is brand new, and it’s causing chaos. Schools that previously enjoyed VAT exemption are scrambling to get their VAT accounting systems up to scratch. If you run an educational institution and you’re reading this thinking “does this apply to me?”—yes, probably. Get proper advice.

Record-Keeping: The Unsexy Bit That Saves You Thousands

HMRC can investigate your VAT records going back four years (or longer if they suspect deliberate errors). You need to keep:

- All sales invoices (including VAT invoices you’ve issued)

- All purchase invoices and receipts

- VAT account records

- Bank statements and payment records

- Import/export documentation (if applicable)

And you need to keep them for six years. Not five. Not “until I’ve moved office twice and can’t find the box.” Six full years, accessible on demand.

Digital record-keeping under MTD has actually made this easier for most businesses. Cloud bookkeeping services automatically back everything up, tag it, categorise it, and make it searchable. You can pull up an invoice from 2019 in about four seconds. Try doing that with a filing cabinet.

Don’t Do This: I’ve seen businesses think they’re being clever by using multiple software systems—one for invoicing, one for expenses, a spreadsheet for adjustments, and a separate tool for MTD submission. This creates a compliance nightmare because you need digital links between ALL of them. Keep it simple. One system that does everything is infinitely better than four systems that kind of work together.

International Trade: Brexit Made Everything Worse

Post-Brexit VAT rules for EU trade are… well, they’re something. The short version is that EU countries are now treated the same as non-EU countries for VAT purposes.

Importing from the EU: You pay import VAT when goods arrive, but UK VAT-registered businesses can use Postponed VAT Accounting. This means you declare and reclaim the import VAT on the same return, so it’s cash-flow neutral. Much better than paying upfront at the border.

Exporting to the EU: Your sales are zero-rated (you charge 0% VAT). But the buyer in the EU might have to pay import VAT and customs duties. Not your problem directly, but it affects your pricing competitiveness.

Services: B2B services to EU businesses? Generally, the place of supply is where the customer is, so no UK VAT. B2C services? Depends on the service type. Digital services have their own bonkers rules involving the One Stop Shop system.

Honestly? If you’re trading internationally, get specialist advice. The rules are too complex, too changeable, and too expensive when you get them wrong. For businesses handling cross-border transactions, speaking to experts at firms like Ask Accountant isn’t just recommended—it’s basically essential unless you enjoy HMRC investigations.

VAT Schemes: Pick Your Poison

Standard VAT accounting isn’t your only option. HMRC offers various schemes that can simplify things (or complicate them differently, depending on your perspective).

Cash Accounting Scheme: Pay VAT when customers pay you, not when you invoice them. Brilliant for cash flow if you have slow payers. Available if your turnover’s under £1.35 million.

Flat Rate Scheme: Apply a fixed percentage to your gross turnover instead of tracking all your input VAT. Percentage varies by industry. Can be simpler but you lose the ability to reclaim VAT on most purchases. Works well for service businesses with few expenses.

Annual Accounting Scheme: File one VAT return a year instead of four quarterly ones. You make advance payments based on your previous year’s liability. Good for businesses with stable, predictable income. Turnover limit: £1.35 million.

Each scheme has pros and cons. The Flat Rate Scheme saves admin but can cost you money if you buy lots of VATable stock. The Annual Accounting Scheme means less paperwork but potentially worse cash flow if your advance payments are based on a bumper year.

When To Actually Get Help (And When You’re Fine On Your Own)

Look, I’m not going to pretend every business needs a full-time accountant for VAT. Plenty of small businesses manage perfectly well with good software and a basic understanding of the rules.

But there are scenarios where DIY VAT accounting is genuinely risky:

- You’re approaching the £90k threshold and need to decide whether to register early

- You make both taxable and exempt supplies (partial exemption is genuinely complex)

- You’re importing or exporting regularly

- You’re in construction and dealing with the reverse charge

- You’re recovering from a HMRC investigation or penalty

- Your turnover’s growing fast and VAT schemes that worked last year are now costing you money

The business advisory and tax compliance teams at Ask Accountant (based at 178 Merton High St, London SW19 1AY) work with businesses across London dealing with precisely these situations. Sometimes a one-hour consultation saves you five figures in penalties. Sometimes you genuinely don’t need help and can crack on yourself.

The trick is knowing which situation you’re in.

The Bottom Line (Finally)

VAT accounting isn’t going anywhere. The rules will keep changing—HMRC seems contractually obligated to tweak something every Budget—but the fundamentals stay the same. Keep accurate digital records, file on time, pay what you owe, and understand which rate applies to what you’re selling.

Most penalties aren’t because businesses are trying to cheat the system. They’re because someone didn’t know about the daily gross takings rule, or missed the rolling 12-month calculation, or thought exempt and zero-rated were the same thing.

Get the basics right, use decent software, and don’t be afraid to ask for help when things get properly complicated. Your future self (and your bank balance) will thank you.

Need specific advice on your VAT situation? The team at Ask Accountant can help with everything from registration decisions to HMRC investigations. Give them a call on +44(0)20 8543 1991, or swing by their office at 178 Merton High St if you’re in the area. Sometimes the money you spend on getting it right first time is the best investment you’ll make all year.

Frequently Asked Questions About VAT Accounting

Do I need to register for VAT if my turnover is under £90,000?

Not mandatory, but you can register voluntarily. This makes sense if you’re buying lots of VAT-able stock or services and want to reclaim the input VAT. But it also means more admin and you’ll need to add VAT to your prices, which could affect competitiveness. Run the numbers before deciding.

What’s the difference between zero-rated and exempt supplies?

Zero-rated supplies are taxable at 0%, meaning you charge no VAT but can reclaim VAT on related purchases. Exempt supplies mean you can’t charge VAT and you can’t reclaim VAT on associated costs. Zero-rated is much better for your business.

Can I still use Excel spreadsheets for VAT under Making Tax Digital?

Technically yes, but you’ll need bridging software to connect your spreadsheet to HMRC’s systems. Most businesses find it easier to just use MTD-compatible accounting software like Xero or QuickBooks, which handles everything in one place.

What happens if I miss the VAT registration deadline?

You’ll face penalties and potentially have to pay backdated VAT on all sales since you should have registered. HMRC can go back up to four years. You’ve got 30 days from the end of the month you exceeded the threshold—don’t miss it.

How do I know which VAT rate to charge on different products?

When in doubt, it’s probably standard rate (20%). The main exceptions are children’s clothing, most food (but not hot food or restaurant meals), books, and newspapers (zero-rated), plus children’s car seats, domestic fuel, and some renovation work (reduced rate at 5%). If you’re genuinely unsure, check HMRC’s guidance or ask an accountant.

Can I reclaim VAT on all business expenses?

Not quite. You can reclaim VAT on most genuine business purchases, but there are restrictions on things like business entertainment (can’t reclaim), employee meals (usually can’t reclaim), and vehicles (depends on the type). You also need valid VAT invoices as proof.