Last thing you want to hear: your accountant treating your three-person startup like it’s Tesco. Here’s why the numbers game changes when you’re small.

Right, let’s get something straight from the start. When I tell people that accounting for small companies isn’t just a scaled-down version of big business accounting, I get these blank stares. Like I’ve just said pizza tastes different depending on whether you’re eating it in Naples or Nottingham. (Which it does, but that’s another rant entirely.)

The thing is—small company accounting is fundamentally, structurally, annoyingly different from what happens in the glass towers of corporate Britain. And if you don’t get this distinction? You’re setting yourself up for either paying too much, stressing too much, or both.

The Myth of “Just Smaller Numbers”

Someone starts a business, maybe they’re making artisan candles or consulting on cybersecurity (two actual clients of mine, incidentally), and they assume accounting works like a volume dial. Same processes, just… quieter.

Wrong.

When you’re running a small company—let’s say under 50 employees, turnover below £10 million—you’re playing an entirely different sport. Same pitch, different rules. The pressures are distinct. The opportunities are unique. And frankly, the mistakes are far more expensive relative to your size.

Think about it this way: if Barclays miscalculates a tax provision by £50,000, that’s a rounding error in their quarterly report. If your company makes that mistake? That might be your entire growth budget for the year. Or worse—it might be your survival.

Cash Flow: The Thing That’ll Actually Keep You Awake

Large corporations worry about quarterly earnings, investor relations, market positioning. You know what small companies worry about?

Whether the money will be there next Tuesday.

I’m not being dramatic. Cash flow management in small business accounting isn’t just important—it’s existential. You can be profitable on paper and still go bust if your biggest client pays you 60 days late while HMRC wants their VAT on the 7th.

Big companies have credit facilities, treasury departments, and enough financial cushion to weather payment delays. Small companies have… well, they have stress and overdrafts. This is why proper bookkeeping services matter so much—you need real-time visibility into what’s coming and going.

Reality Check:

82% of small business failures come down to cash flow problems. Not bad products. Not bad marketing. Cash flow. Your accountant should be obsessed with this metric, not just filing your annual return and calling it a day.

The Owner-Operator Conundrum

Here’s something that makes accounting for small companies genuinely weird: in most cases, you’re not just the owner. You’re also the operator, the salesperson, the marketing department, and occasionally the person unclogging the toilet. (Glamorous, right?)

This creates accounting challenges that simply don’t exist in larger firms:

Drawing salary vs. taking dividends. Do you even know the tax difference? Because it’s massive. A corporate executive gets a salary package designed by HR and approved by a board. You? You’re making these decisions in between client calls and school pickups, and getting it wrong can cost you thousands in unnecessary tax.

Personal vs. business expenses. When your car is also the company car, and your home office is also your actual home, the lines get blurry. HMRC loves blurry lines. Gives them something to investigate.

Time tracking that actually matters. If you’re billing by the hour or claiming R&D tax credits, your time records aren’t just administrative—they’re revenue. Big companies have systems and processes. You have a half-completed spreadsheet and good intentions.

This is precisely why firms like Ask Accountant exist. We get that you’re wearing seventeen hats, and accounting needs to fit around that reality rather than demanding you transform into a full-time bookkeeper.

Compliance: Same Rules, Different Stakes

Okay, quick question: do you know what your Companies House filing deadline is? Your Corporation Tax deadline? Your VAT return dates? Your PAYE submissions?

If you answered “roughly” or “I think so” or “wait, there are deadlines?”, you’re in good company. About 60% of small business owners I meet are in the same boat.

The frustrating bit? HMRC doesn’t care that you’re small. The penalties are proportionally huge. Miss your Corporation Tax deadline by a day? That’s £100 minimum. Miss it by three months? £200. Miss two years in a row? We’re now talking thousands, plus investigations, plus interest.

| Deadline Missed | Minimum Penalty | Maximum Pain |

|---|---|---|

| Corporation Tax (1 day late) | £100 | Plus interest on tax due |

| VAT Return (late submission) | £400 | Surcharge on tax due (15%) |

| Self Assessment (online, late) | £100 | £1,600+ plus interest |

| PAYE (repeated failures) | Warning first time | Criminal prosecution |

For a company turning over £8 million with a finance team, a £400 penalty is annoying but manageable. For a company turning over £80,000? That’s potentially half your monthly profit gone. See the difference?

Why “DIY” Accounting Usually Ends Badly

Look, I understand the temptation. You’ve got accounting software (Xero, QuickBooks, FreeAgent—doesn’t matter which), and it promises to make everything “simple” and “intuitive.” You figure you’ll save a few grand by doing it yourself.

Three problems with this:

First—accounting software doesn’t make you an accountant any more than owning a stethoscope makes you a doctor. The software records transactions. You still need to know which transactions, how to categorise them, and why it matters. Get this wrong and you’re just creating a very organised mess.

Second—your time isn’t free. Even if you manage to muddle through your bookkeeping, that’s time you’re not spending on actual revenue-generating activities. If you bill at £75/hour and you’re spending six hours a month on accounts, you’re “saving” maybe £300 in accounting fees while losing £450 in billable time. Brilliant maths, that.

Third—mistakes compound. Miss a valid expense deduction? You overpay tax this year, and every year after until you spot it. Miscategorise something? The error carries forward. Forget about a tax-saving structure? You can’t backdate it once you realise.

Professional business advice isn’t about doing what you could do yourself—it’s about doing what you should do, efficiently, and without the mistakes that come from learning on the job.

The Strategic Difference Nobody Talks About

Right, here’s where accounting for small companies gets actually interesting (stick with me).

In large organisations, accounting is primarily backwards-looking. You’re recording what happened, ensuring compliance, producing reports for stakeholders. It’s historical. Necessary, but historical.

In small companies, accounting should be forwards-looking. Or at least, it should be if you’re doing it right.

What do I mean?

When I work with small businesses, we’re not just tallying numbers—we’re using those numbers to make decisions. Should you hire that new person? Can you afford that equipment purchase? Is that new product line actually profitable or just busy?

This requires completely different skills. It’s not enough to know how to file a CT600. You need to understand business modelling, scenario planning, and frankly, how to explain financial concepts to someone who doesn’t think in spreadsheets.

At Ask Accountant, we specialise in this kind of strategic business advisory—not just keeping you compliant, but helping you make smarter decisions with your money.

Quick Example:

Client of mine runs a marketing agency. Wanted to know if she could afford to hire a senior strategist at £55k. Standard accounting answer: “Do the maths on your revenue projections.” Useful accounting answer: “Yes, but only if we restructure your client payment terms first, set up a cashflow buffer, and adjust your dividend strategy to maintain your salary. Here’s the three-month implementation plan.”

See the difference? One answers the question. The other solves the problem.

Tax Planning vs. Tax Compliance (They’re Not the Same Thing)

Let’s talk about everyone’s favourite topic—tax. Specifically, the difference between tax compliance and tax planning in the context of small company accounting.

Tax compliance is what most accountants do by default. File your return, calculate what you owe, submit it on time. Job done. Nothing wrong with this—it’s necessary—but it’s also the bare minimum.

Tax planning is what separates decent accountants from excellent ones. It’s looking at your business structure and asking: is this the most tax-efficient way to operate? Should you be a sole trader or limited company? Are you claiming all available reliefs? Should you be making pension contributions? What about R&D tax credits?

The small company advantage here is flexibility. You can restructure relatively easily. You can make strategic decisions about timing. You can actually implement tax-saving strategies without needing board approval and shareholder votes.

But—and this is crucial—you need someone who’s thinking about this proactively. The corporate tax planning opportunities available to small companies are substantial, but they require planning. The best time to implement a tax strategy is before you need it.

The Technology Trap

Can we talk about how tech companies have convinced everyone that accounting for small companies is “solved” by software? Because it’s getting ridiculous.

Don’t misunderstand—cloud accounting tools are brilliant. They’ve transformed how we work. Real-time data, automated bank feeds, integration with payment systems—all genuinely useful.

But here’s what software can’t do:

- Interpret ambiguous expenses (is that meal with a potential client deductible or not?)

- Understand the context of your business decisions

- Advise on optimal business structure

- Navigate HMRC enquiries (and trust me, “the software said so” isn’t a defence)

- Spot opportunities you didn’t know existed

- Think strategically about your financial future

For small companies, the danger of over-relying on technology is that you optimise for convenience rather than outcomes. Sure, you can automatically categorise transactions, but if you’re categorising them wrongly, you’ve just automated your mistakes.

The sweet spot? Software for efficiency, humans for expertise. Use tech to handle the repetitive stuff, but keep a qualified professional in the loop for decisions and strategy.

What “Good” Small Company Accounting Actually Looks Like

After fifteen years in practice, here’s what I reckon good accounting for small companies should involve (and if your current accountant isn’t doing these things, ask yourself why):

Regular communication. Not just an annual meeting. Monthly or quarterly check-ins where you discuss what’s actually happening in the business. Your accountant should know your challenges, your plans, your worries. How else can they help?

Proactive advice. Getting a message that says “You’re approaching the VAT threshold—here’s what you need to consider” before you accidentally trigger registration. That’s value.

Plain English explanations. If your accountant is speaking in acronyms and jargon, they’re either trying to sound clever or they don’t actually understand it well enough to explain simply. Both are problems.

Fixed fees, not surprises. You should know what you’re paying before you start working together. “We bill by the hour” is fine for lawyers, but it creates tension in the client-accountant relationship. You shouldn’t be afraid to call your accountant because you’re worried about the bill.

Understanding your sector. A good accountant for a construction company knows about CIS deductions. One for e-commerce understands VAT on digital services. Someone working with consultants gets IR35. Industry-specific knowledge matters enormously.

| What You’re Paying For | Basic Service | What You Actually Need |

|---|---|---|

| Annual accounts | Filed on time | Filed on time + analysis of trends and concerns |

| Tax returns | Submitted correctly | Optimised for minimum legal liability |

| Bookkeeping | Transactions recorded | Real-time visibility with regular reviews |

| Advice | When you ask | Proactive, before problems arise |

| Communication | Annual | Regular touchpoints |

The Hidden Costs of Cheap Accounting

Right, uncomfortable truth time.

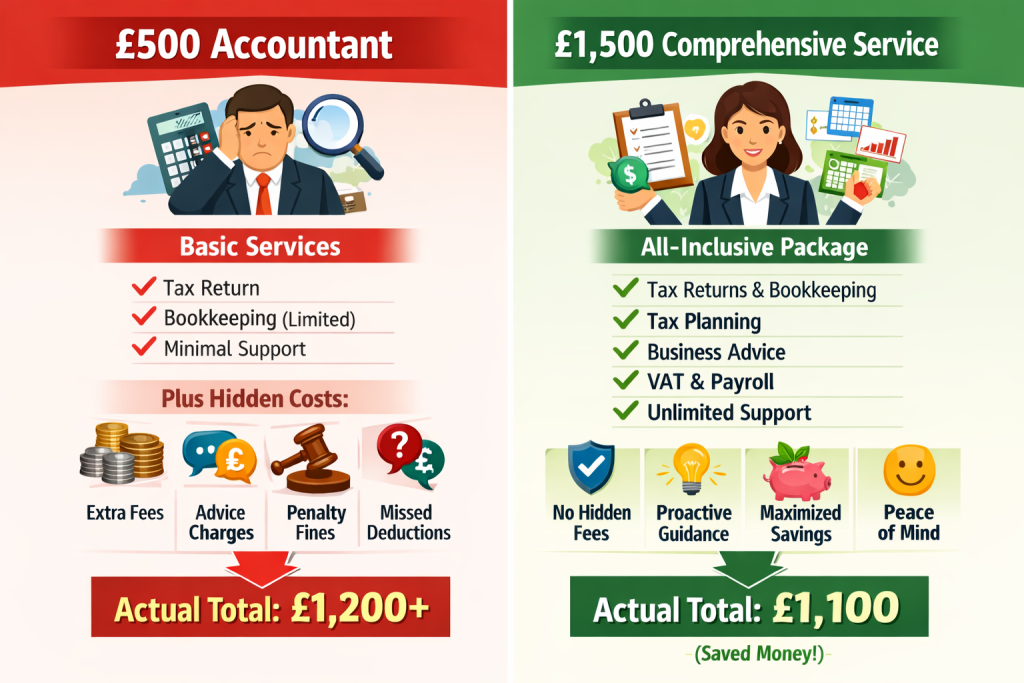

I see this pattern constantly: small business finds an accountant who’ll do their annual accounts for £500. Seems like a bargain compared to firms charging £1,500 or £2,000. They sign up, feeling smug about their negotiation skills.

What actually happens?

The £500 accountant does exactly what they were paid for—files the statutory accounts, submits the tax return, and that’s it. No advice. No planning. No support. You call with a question and there’s an hourly fee. You want help with VAT registration? Extra. Need payroll setup? Also extra.

By year-end, you’ve spent £1,800 in total (but in unpredictable chunks that always seem to hit at the worst times), you’ve made several expensive mistakes, and you’ve missed opportunities that would’ve saved you more than the difference anyway.

Compare that to paying £1,500 upfront for comprehensive small business accounting services that include regular advice, proactive planning, and unlimited reasonable contact.

Which was actually cheaper?

Making the Switch (Or Starting Right)

Whether you’re currently wrestling with DIY accounting, or you’re stuck with an accountant who treats you like a box-ticking exercise, here’s what changing looks like.

First—don’t feel guilty about switching. Seriously. Accountants switch clients when they’re not profitable, and clients should absolutely switch accountants when they’re not getting value. It’s business, not marriage.

Second—the actual transition is less painful than you imagine. Yes, there’s paperwork (Letter of Disengagement from old accountant, Letter of Engagement with new one). Yes, files need transferring. But a competent firm handles this routinely. At Ask Accountant, we manage the whole process—you just need to sign a few forms.

Third—expect a “getting to know you” period. A new accountant needs to understand your business, your history, your goals. Good ones will ask annoying questions about stuff you thought was obvious. That’s them doing their job properly.

Reality Check:

I’ve had clients come to me after years with “family friend” accountants who were lovely people but hadn’t done any tax planning, hadn’t advised on business structure, hadn’t even mentioned R&D credits despite the client clearly qualifying. In the first year alone, we typically save more than our fees. That’s not magic—that’s just doing the job properly.

Common Mistakes Small Companies Make With Accounting

Since we’re being honest, let’s talk about the mistakes I see repeatedly (and which you can now avoid, because you’re reading this):

Waiting until January to think about tax. By then, most tax-saving opportunities have passed. Tax planning happens throughout the year, not in a panic at deadline time.

Mixing personal and business finances. I know it seems easier when you’re starting out. It’s not. It’s a nightmare to untangle, and HMRC really doesn’t like it. Separate bank accounts from day one.

Not keeping receipts. “But it’s on my bank statement!” Doesn’t matter. HMRC can (and does) request receipts. No receipt, no deduction. It’s that simple and that annoying.

Assuming tax codes are correct. HMRC gets them wrong constantly. Check them. Especially if you’re drawing both salary and dividends, or running multiple companies.

Forgetting about auto-enrolment obligations. Hit your trigger point and suddenly you need a pension scheme set up. Not next month. Now. The penalties for non-compliance are eye-watering.

Not planning for tax bills. Corporation tax is due nine months after year-end. That’s fine if you’ve been setting aside money monthly. It’s catastrophic if you’ve spent all the profit and forgot this was coming.

Why Location Still Matters (Even in the Digital Age)

Quick tangent—people always ask if they need a local accountant now that everything’s online. After all, why does it matter if your accountant is in London or Leeds when you’re never actually going to meet them?

Honestly? It partly depends on you.

Some business owners are perfectly happy with a completely remote relationship. Email questions, video calls for year-end reviews, everything handled digitally. If that’s you, location genuinely doesn’t matter.

But I’d say roughly half our clients appreciate having someone they can actually visit. Someone who knows the local business landscape. Someone who can meet for coffee when you’re planning something significant and want to talk it through properly.

There’s also something to be said for an accountant who understands your local market. At our practice on Merton High Street, we know London businesses face different challenges than, say, rural companies. Property costs, wage expectations, competition—it’s all contextual.

Neither approach is wrong. Just know what you prefer before you start looking.

The Growth Inflection Point

Here’s something fascinating about accounting for small companies—there are inflection points where the game changes completely.

At £85k turnover: VAT registration becomes mandatory. Your prices need to either absorb 20% or rise by 20%. Your admin burden increases substantially. If you’re close to this threshold, there are strategies to manage the timing.

Around £100k profit: Dividend tax planning becomes crucial. The difference between efficient and inefficient extraction at this level is thousands annually.

When you hire your first employee: Suddenly you’re an employer. PAYE, NICs, auto-enrolment, employment law. This isn’t a simple step—it’s a different category of business.

At multiple six figures: Business structure questions become more important. Should you have a holding company? Are you outgrowing your current setup?

Each of these inflection points requires proactive planning. They shouldn’t catch you by surprise because a good accountant sees them coming and prepares you.

When You Actually Need to Call Your Accountant

Since I’m apparently doing your accountant’s job of setting expectations, here’s when you should actually be picking up the phone (or sending that email):

Before you make structural changes. Hiring, big purchases, new business lines—check first. The tax implications might change your timing or approach.

When you get anything from HMRC. Don’t panic, but don’t ignore it either. Some letters are routine, some are urgent, and some are “drop everything and respond now.” Your accountant knows which is which.

When you’re planning personal financial moves. Pension contributions, property purchases, dividend timing—these all interact with your business accounting.

Before you sign long-term commitments. Leases, contracts, financing agreements. Have your accountant review the numbers, especially the cashflow implications.

When you’re confused or worried. Honestly, this should be reason enough. Stewing about something for weeks is pointless when a five-minute conversation would answer it. If you’re paying for unlimited advice, use it.

What Ask Accountant Actually Does Differently

Right, so I’ve spent 3,000 words explaining why accounting for small companies requires a different approach. Let me be specific about how we implement that at Ask Accountant (since you’re probably wondering).

We don’t just file your returns and send you an invoice. That’s not accounting—that’s admin.

Our approach involves regular touchpoints throughout the year. We look at your numbers monthly, flag issues before they become problems, and suggest opportunities as they arise. When you call or email with questions, you get answers from people who know your business, not a random person reading your file for the first time.

We specialise in proactive tax advisory solutions rather than reactive compliance. That means we’re thinking about your next tax return now, not when the deadline’s looming.

And we work with you to build proper financial infrastructure—not fancy for the sake of it, but robust enough to support growth without becoming a burden. Cloud accounting, integrated systems, streamlined processes. The kind of setup that scales as you do.

If that sounds like what you need (or at least what you want to discuss), call us on +44(0)20 8543 1991 or visit us at 178 Merton High St, London SW19 1AY. Or just email—we’re pretty responsive.

The Bottom Line (Pun Intended)

So why is accounting for small companies different?

Because you can’t afford mistakes. Because your time is limited. Because opportunities pass quickly. Because cash flow is existential rather than theoretical. Because you need advice, not just compliance. Because you’re trying to build something, not just maintain it.

Accounting for Small Companies, done right, is part bookkeeping, part tax planning, part business advice, and part therapy. (Seriously, you’d be surprised how often clients just need to talk through their worries with someone who understands the numbers.)

It’s not about making the simple stuff complicated—it’s about making the complicated stuff manageable. There’s a massive difference.

The accountants who get this? They’re genuinely helpful partners in your business journey. The ones who don’t? They’re just glorified bookkeepers, and you can probably find cheaper glorified bookkeepers if that’s all you want.

Choose wisely. Your business deserves better than the bare minimum.

Frequently Asked Questions

Do small companies really need professional accountants?

Technically? No. Legally, you can file your own accounts. Practically? Almost certainly yes. The cost of mistakes—missed tax reliefs, compliance penalties, poor cash flow management—typically exceeds professional fees within the first year. Plus, your time has value, and it’s usually better spent growing your business.

What’s the difference between a bookkeeper and an accountant for small companies?

Bookkeepers record transactions and maintain financial records. Accountants analyse those records, provide tax advice, file statutory returns, and offer strategic guidance. Many small companies need both—either from separate providers or from an accounting firm that offers comprehensive services.

How much should accounting for Small Companies cost?

For a basic limited company with straightforward affairs, expect £800-£2,000 annually. This should include year-end accounts, Corporation Tax return, and basic advice. More complex operations—multiple revenue streams, employees, VAT—will cost more, typically £2,000-£5,000. Monthly bookkeeping adds £100-£300 monthly depending on transaction volume.

Should I be a sole trader or limited company?

Depends entirely on your circumstances. Generally, if you’re earning over £30,000-£40,000 profit annually, a limited company becomes more tax-efficient. Below that, sole trader simplicity might win. But there are other factors—liability protection, credibility with clients, ability to retain profits. It’s not a one-size-fits-all decision.

Can I change accountants mid-year?

Absolutely. There might be some overlap in fees (paying your old accountant for work to date), but you’re never trapped. Professional bodies have clear handover procedures. Most good accountants will manage the transition for you—it’s more common than you’d think.

What records should I keep for accounting purposes?

All invoices (sales and purchases), bank statements, receipts for expenses, payroll records if you have employees, VAT records if registered, and asset purchase documentation. Keep them for at least six years—HMRC can go back this far in investigations. Digital copies are fine, but make sure they’re backed up.

Is cloud accounting necessary for small companies?

Not technically mandatory (yet), but increasingly becoming the standard. Making Tax Digital requirements are expanding, and cloud systems make real-time bookkeeping dramatically easier. They also enable better collaboration with your accountant. The monthly cost (£10-£30 typically) is usually worth it for the time saving alone.

How often should I speak to my accountant?

At minimum, quarterly check-ins plus your year-end meeting. But honestly, whenever you need advice on financial decisions. A good accountant should encourage contact rather than charging by the minute for every question. If you’re afraid to call your accountant, that’s a problem with the relationship, not with how often you should communicate.