Death and taxes—the two unavoidable certainties in life, as the saying goes. But when these two intersect in the form of Inheritance Tax (IHT), things get surprisingly complex. I’ve spent years watching estate owners scratch their heads over IHT calculations, and honestly, who can blame them? The rules seem deliberately designed to confuse.

Let me tell you something that might raise your eyebrows: nearly £6.1 billion flowed into HMRC coffers from IHT in the 2021/22 tax year alone. That’s a staggering 14% increase from the previous year (Source: HMRC IHT Statistics). Frightening? Perhaps. Avoidable? Partially, with careful personal tax planning.

The Basics: When Does IHT Actually Bite?

IHT tax hits estates valued above the nil-rate band threshold—currently frozen at £325,000 until 2028 (thanks, inflation) (See current IHT thresholds on GOV.UK). Anything above this gets taxed at a whopping 40%. Gulp.

But wait—if you’re leaving your home to direct descendants (children, grandchildren), you might qualify for the additional residence nil-rate band (RNRB) of £175,000. Combined, that potentially pushes your tax-free threshold to £500,000.

Married? Even better news. Couples can effectively combine their allowances, potentially sheltering up to £1 million from the taxman’s grasp (Learn about transferring unused thresholds on GOV.UK). Not too shabby, though London property owners might still be sweating.

Surprising Exemptions You Might Have Missed

Most people know about the spouse exemption (transfers between UK-domiciled spouses are exempt – see rules on leaving assets to a spouse on GOV.UK), but there are lesser-known gems hiding in the IHT legislation:

- Business Relief: Own a business? Depending on the type, you might get 50% or even 100% relief (Check eligibility for Business Relief on GOV.UK). This is a key area for corporate tax planning.

- Farm owners, listen up—Agricultural Property Relief offers similar benefits (Understand Agricultural Property Relief on GOV.UK).

- Gifts to charities: Not only completely exempt from IHT, but if you leave at least 10% of your net estate to charity, the IHT rate on the remainder drops from 40% to 36% (Read about gifts to charity and IHT on GOV.UK). Math worth doing!

- Regular gifts from income: If you make regular gifts from surplus income (not capital), these can be immediately outside your estate. No need to survive 7 years. The catch? They must be habitual and not affect your standard of living. Documentation is key here—something many overlook until it’s too late (Guidance on gifts out of income on GOV.UK).

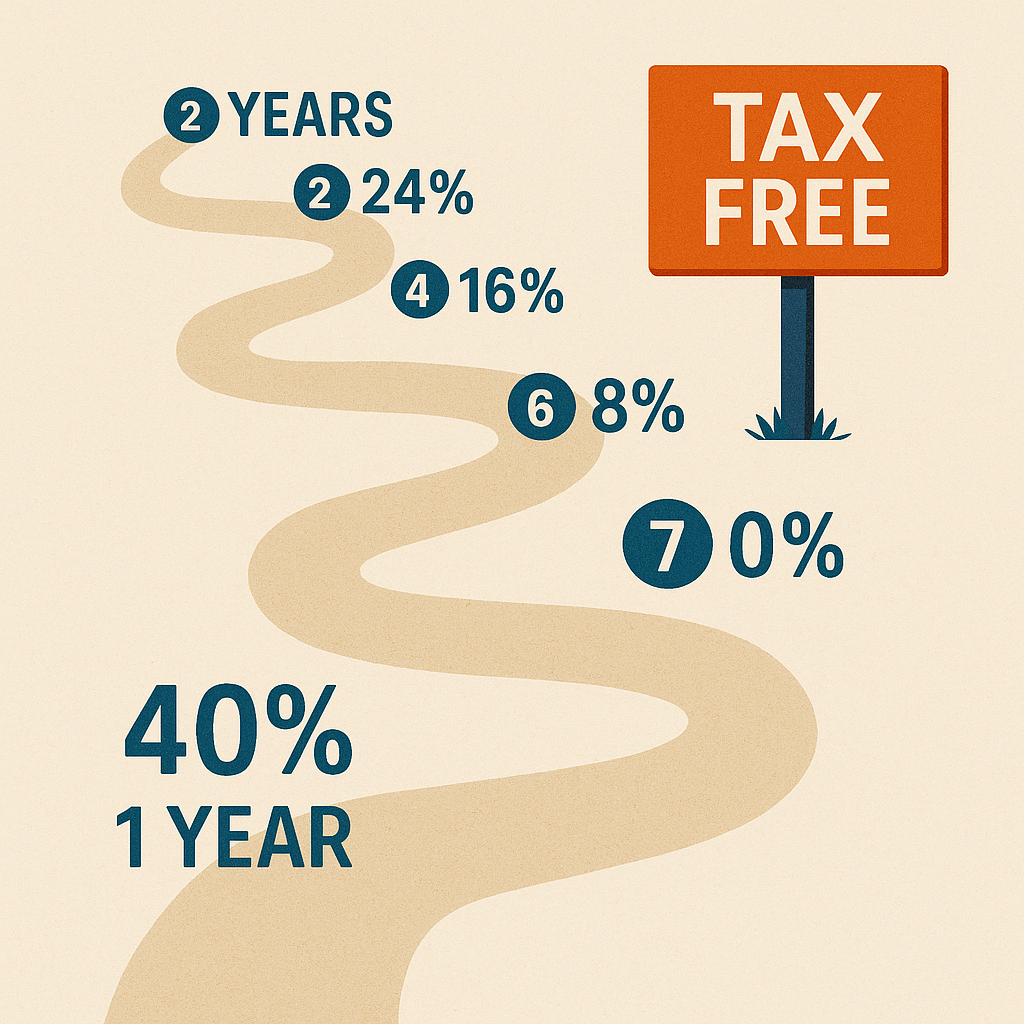

The Seven-Year Itch: Gift Timing Matters

Most people vaguely know about the seven-year rule, but the details trip them up constantly.

Here’s the unvarnished truth: most gifts (technically called ‘potentially exempt transfers’ or PETs) only become fully exempt if you survive 7 years after making them (Understand how gifts affect IHT on GOV.UK). Die earlier, and they may be subject to IHT on a sliding scale:

| Years between gift and death | IHT rate applied |

|---|---|

| Less than 3 years | 40% |

| 3 to 4 years | 32% |

| 4 to 5 years | 24% |

| 5 to 6 years | 16% |

| 6 to 7 years | 8% |

| 7+ years | 0% |

That said, you can give away £3,000 each tax year (your ‘annual exemption‘), plus make small gifts of up to £250 per person to as many people as you like. Wedding gifts also get special treatment: parents can give £5,000, grandparents £2,500, and anyone else £1,000 per wedding, all IHT-free.

I recently had a client who gave away significant assets five years before his unexpected passing. The family saved thousands simply because he’d made those decisions early—though they’d have saved even more had he lasted another two years. Timing really is everything. For more insights, see our 2025 Guide to Inheritance Tax.

Trust Me, Trusts Are Complicated (But Worth Considering)

Trusts used to be the go-to vehicle for IHT planning. While rule changes have made them less attractive than in the golden days, they still have their place in comprehensive estate planning (Learn about Inheritance Tax and trusts on GOV.UK).

Trusts can:

- Provide for vulnerable beneficiaries

- Protect assets from divorce settlements

- Skip a generation (reducing overall family IHT)

- Offer flexibility when circumstances change

But—and it’s a significant but—they come with their own tax regime that can sometimes be more punitive than personal tax rates. The entry charges, periodic charges every ten years, and exit charges make this a complex area where specialist advice pays dividends.

Life Insurance: The Forgotten IHT Solution

Here’s something I’ve noticed over 15+ years in tax advisory: people often overlook the simplest solution of all—life insurance.

A properly written whole-of-life policy, placed in trust, can provide funds to pay the expected IHT bill without increasing the taxable estate. For estates just over the threshold, this can be remarkably cost-effective (Read guidance on life insurance policies and trusts from MoneyHelper).

The key? It must be written in trust from the outset. I’ve seen far too many cases where policies intended to cover IHT ended up increasing the taxable estate because this crucial detail was missed.

Business Owners: Your Golden Ticket (Maybe)

If you own a business, you’re potentially sitting on one of the most valuable IHT reliefs available. Business Property Relief can provide 100% relief from IHT on the value of qualifying business assets. Our business advice services can help explore this.

But beware the pitfalls:

- Investment businesses generally don’t qualify

- Excess cash in the business might not get relief

- The business must be a going concern at death

I remember one business owner who’d built up substantial cash reserves in his company, thinking the entire value would be IHT-free. We had to have a difficult conversation about extracting some of that cash and finding alternative IHT-efficient homes for it. Not a fun day at the office, but better than his family discovering the problem after his death.

The Record-Keeping Nightmare (That Nobody Warns You About)

One aspect of IHT planning that doesn’t get enough attention: the administrative burden it places on your executors.

When someone dies, their executors need to piece together their financial history—potentially going back 14 years if lifetime gifts are involved. Without proper records, this becomes a nightmare.

I strongly recommend:

- Keeping a “gift log” recording dates, amounts, and recipients

- Documenting the reasoning behind regular gifts from income

- Retaining valuation evidence for assets gifted

- Updating your will regularly to reflect lifetime gifts

When Property Complicates Everything

For many UK estate owners, property makes up the lion’s share of their wealth—and creates unique IHT challenges. Specialized property accounts services can be invaluable here.

If you own buy-to-let properties, they won’t qualify for Business Property Relief (despite what some “creative” advisers might suggest). But there are legitimate planning options:

- Insurance to cover the IHT liability

- Equity release to fund lifetime gifts

- Gradual transfer to family members (though beware CGT and income tax implications)

Property portfolios require especially careful planning. A knowledgeable tax advisor can help develop specific approaches for landlords with multiple properties that balance IHT concerns with income needs and capital gains considerations.

The Big Decision: Spending vs. Preserving

Let’s take a step back from the technical details and address something more philosophical. There’s often tension between enjoying your wealth during your lifetime and preserving it for the next generation.

Sometimes the best IHT planning is simply to live a little more luxuriously! I’ve had conversations with clients who were living extremely frugally to pass on wealth, not realizing that spending more would actually reduce their IHT bill while improving their quality of life.

On the other hand, I’ve seen families devastated by unexpected IHT bills that forced the sale of cherished family homes or businesses. There’s no universal right answer—it’s intensely personal.

The Foreign Connection: International Assets

Got property abroad? Offshore investments? A potential foreign domicile claim? These international elements add layers of complexity to IHT planning.

The UK has double taxation treaties with some countries regarding inheritance taxes, but not all. In some cases, assets might be subject to both UK IHT and a foreign equivalent.

Foreign domicile status can dramatically alter your IHT position, potentially excluding non-UK assets from the UK IHT net. However, long-term UK residents need careful advice in this area—the “deemed domicile” rules can catch people unaware.

Practical Next Steps: Your IHT Action Plan

If you’ve made it this far (congratulations, by the way—IHT isn’t exactly riveting reading), you’re probably wondering what practical steps you should take next.

- Get a reliable valuation of your estate. You can’t plan properly without knowing where you stand.

- Review (or create) your will. Many IHT planning opportunities are delivered through proper will planning (Find information on making a will on GOV.UK).

- Consider lifetime gifting strategies that fit your circumstances and comfort level.

- Explore business or agricultural reliefs if you qualify.

- Get specialist advice if your estate is over the nil-rate band or has complicating factors.

At Ask Accountant, we frequently see clients who’ve either done no planning (leaving their families with preventable tax bills) or followed generic advice that wasn’t suited to their specific situation. Every estate is unique—what works brilliantly for your neighbor might be completely wrong for you.

Warning: The DIY Danger Zone

While there’s plenty of IHT information available online, attempting complex planning without professional guidance can backfire spectacularly. I’ve seen well-intentioned arrangements fall apart because of missed technical details or changing legislation. The tax savings from proper advice almost always outweigh the cost.

Frequently Asked Questions

Can I just give everything away before I die to avoid IHT? Technically yes, but with significant caveats. Gifts generally take 7 years to become completely IHT-free. Plus, if you continue to benefit from the assets (like giving away your house but continuing to live in it), they’ll remain in your estate under the “gift with reservation of benefit” rules. And don’t forget potential capital gains tax on lifetime gifts!

Do pensions get caught by IHT? Usually not. Most pension funds remain outside your estate for IHT purposes, making them extraordinarily tax-efficient for passing on wealth (See HMRC guidance on pensions and IHT). However, any lump sums already taken or death benefits paid to your estate may be taxable.

How do trusts help with IHT planning? Trusts can remove assets from your estate after 7 years (or immediately in some cases), provide for beneficiaries while maintaining control, and create flexibility for changing circumstances. However, they have their own tax regime that can be complex (Further details on trusts and IHT on GOV.UK). For guidance, see our IHT services.

What happens if I can’t pay the IHT bill? Your executors are generally responsible for paying IHT before they can distribute your estate. In some cases, HMRC allows payment in installments (especially for illiquid assets like property businesses). Planning ahead with life insurance can prevent forced asset sales.

Can my spouse and I each use our nil-rate bands? Yes! Unused nil-rate band can be transferred to a surviving spouse/civil partner, potentially allowing up to £1 million (including residence nil-rate bands) to pass tax-free on the second death (Learn about transferring unused IHT thresholds on GOV.UK).

Final Thoughts: The Ever-Changing IHT Landscape

IHT tax rules never stand still. Almost every Budget brings tweaks and changes—sometimes minor, occasionally seismic. You can find more articles on similar topics on our blog.

What works today might not work tomorrow. That’s why regular reviews of your IHT position are essential—ideally every 2-3 years, or whenever your personal circumstances change significantly.

If you’ve been putting off addressing your IHT situation (you’re not alone—nobody enjoys contemplating their own mortality), take this as your gentle nudge to get started. Your future self—and more importantly, your loved ones—will thank you.

For tailored advice specific to your circumstances, consider consulting with inheritance tax specialists like those at Ask Accountant. With dedicated experts on staff, they can help ensure your legacy passes according to your wishes, not the taxman’s. You can reach them on +44(0)20 8543 1991 to arrange a consultation at their office on 178 Merton High St, London, or contact us online.

Disclaimer: The information provided in this blog post is for general guidance only and does not constitute financial or legal advice. Tax laws are complex and subject to change. It is recommended to seek professional advice tailored to your individual circumstances. Links to external sites are for informational purposes and were last checked on May 21, 2025.

创建Binance账户

January 5, 2026Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?