Here’s something that trips up most people: hereditary tax doesn’t actually exist – at least not in the way you’d think from the name. What we’re really talking about here is inheritance tax, sometimes called death duties by people who remember when that phrase actually meant something official.

The confusion? Completely understandable. “Hereditary” sounds like something that passes through families, and inheritance tax does affect what you leave behind. But if you walk into HMRC using that term, you’ll get blank stares. The proper name – the one that matters when you’re filling out forms at 2am wondering if you’ve calculated everything correctly – is Inheritance Tax, or IHT for those of us who’ve typed it enough times to need a shortcut.

Right now, with frozen thresholds and rising property values, more families than ever are discovering that hereditary tax (let’s keep calling it that since you searched for it) isn’t just for the wealthy anymore. In 2022/23, over 31,500 estates paid this tax. That’s 4.62% of all deaths in the UK – and the percentage keeps climbing.

The Basics: What Actually Triggers This Tax?

When someone dies in the UK, their “estate” gets valued. That’s everything: the house, savings accounts, investments, that vintage car collection in the garage, even Premium Bonds. Debts come off the total, obviously – you don’t pay tax on what you owed.

The magic number? £325,000. That’s your nil-rate band, frozen since 2009 (yes, really). Anything above this threshold gets hit with a 40% charge. Not 40% of the total estate, mind you. Just the amount over £325,000.

Quick Example: Estate worth £500,000. Subtract the £325,000 threshold. That leaves £175,000. Tax bill: £70,000 (40% of £175,000). The family receives £430,000 after tax.

But here’s where it gets interesting – and by interesting, I mean complicated enough that professional help from specialists like Ask Accountant starts looking rather sensible.

The Residence Nil-Rate Band: Your Home Gets Special Treatment

Someone in Westminster decided that passing your home to your kids shouldn’t be quite so expensive. Enter the residence nil-rate band (RNRB), worth an additional £175,000 – but only if you’re leaving your main residence to direct descendants.

“Direct descendants” means children, grandchildren, stepchildren, adopted or foster children. Not nieces. Not nephews. Definitely not your best mate who you consider family. HMRC doesn’t do sentiment.

This pushes the total tax-free amount to £500,000 per person – though there’s a catch (isn’t there always?). If your estate tops £2 million, this extra allowance starts disappearing. It reduces by £1 for every £2 over that threshold.

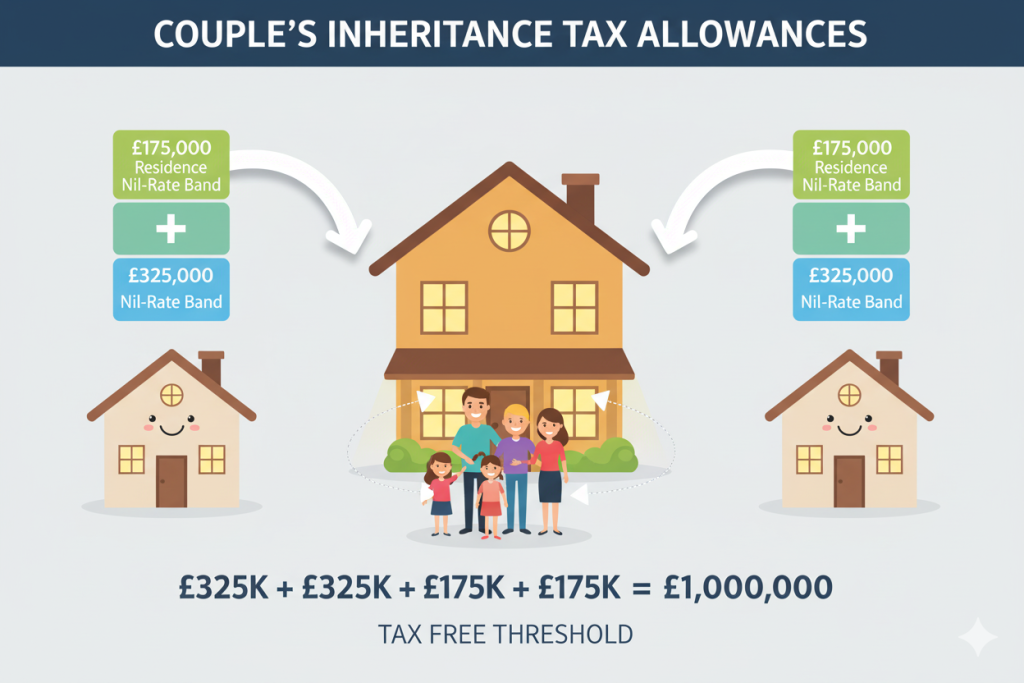

The Married Couple’s Secret Weapon

Spouses and civil partners get a massive advantage. When one partner dies, any unused allowance transfers to the survivor. This means a couple can potentially pass on £1 million tax-free (£325,000 × 2 + £175,000 × 2) if they play their cards right.

The first spouse typically leaves everything to the survivor – no tax there, since spousal transfers are exempt. Then when the second spouse dies, both allowances stack up. It’s one of the few areas where HMRC shows actual generosity.

| Scenario | Nil-Rate Band | RNRB (if applicable) | Total Tax-Free |

|---|---|---|---|

| Single person, no property to descendants | £325,000 | £0 | £325,000 |

| Single person, home to children | £325,000 | £175,000 | £500,000 |

| Married couple, no property to descendants | £650,000 | £0 | £650,000 |

| Married couple, home to children | £650,000 | £350,000 | £1,000,000 |

What Counts as Part of Your Estate?

Practically everything. HMRC casts a wide net:

- Property – your home, buy-to-let properties, that holiday cottage in Cornwall

- Savings and investments – ISAs, stocks, shares, bonds (even though you already paid tax earning that money)

- Business interests – though these might qualify for relief

- Personal possessions – cars, jewellery, art, furniture (yes, even Aunt Edna’s “priceless” vase collection)

- Life insurance policies – unless they’re written in trust

- Gifts made in the last 7 years – the taxman has a long memory

What doesn’t count? Debts, funeral expenses, and anything left to charity. Actually, charitable donations are brilliant for hereditary tax planning – leave 10% or more of your net estate to charity, and the rate on the rest drops from 40% to 36%.

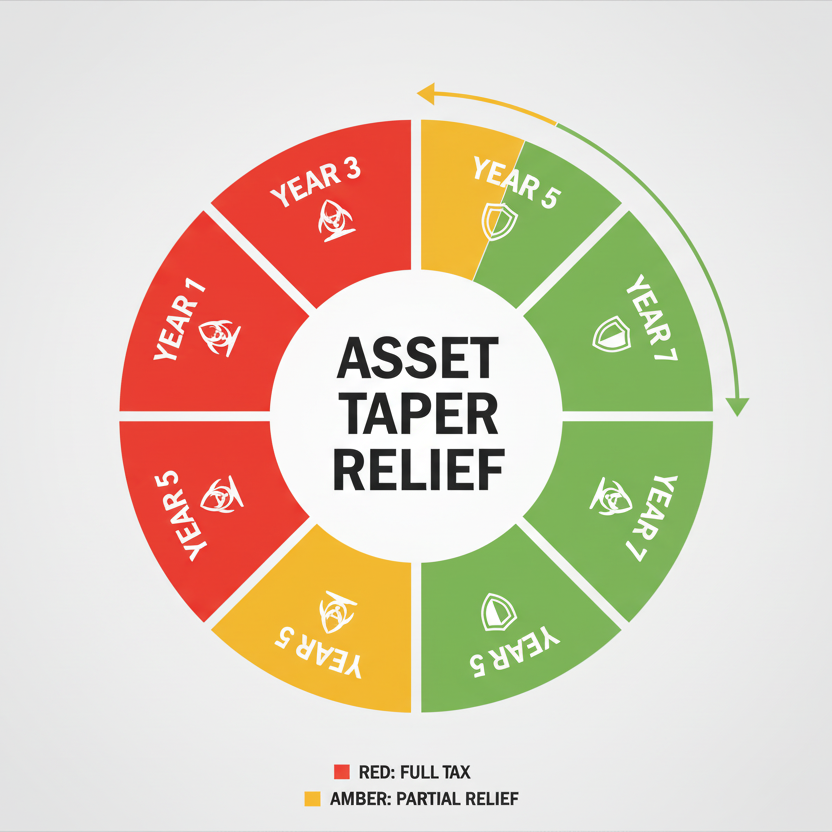

The Seven-Year Rule: Gifting Your Way Around Hereditary Tax

Here’s a strategy people love: give assets away whilst you’re alive. These are “potentially exempt transfers” (PETs). The “potentially” bit is crucial – if you survive seven years after making the gift, it’s completely outside your estate for tax purposes.

Die within seven years? The gift gets pulled back into your estate calculation, though with some relief:

| Years Between Gift and Death | Tax Rate on Gift |

|---|---|

| Less than 3 years | 40% |

| 3-4 years | 32% |

| 4-5 years | 24% |

| 5-6 years | 16% |

| 6-7 years | 8% |

| 7+ years | 0% |

Critical Warning: If you give away your house but continue living in it rent-free, HMRC considers this a “gift with reservation of benefit.” Translation: it stays in your estate for tax purposes. You’d need to pay full market rent to make this work, which rather defeats the point.

Annual Exemptions: The Gifts That Don’t Count

You can give away £3,000 each tax year without it counting towards hereditary tax. Miss a year? You can carry forward one year’s unused exemption (but only one).

Other exempt gifts include:

- £250 to as many people as you like (but not to someone who’s also received your £3,000 allowance)

- Wedding gifts: £5,000 to a child, £2,500 to a grandchild, £1,000 to anyone else

- Regular gifts from surplus income – this one’s powerful but requires meticulous record-keeping

Business and Agricultural Property Relief

Own a trading business or farmland? You might qualify for 50% or 100% relief on those assets. This is massive for family businesses – potentially saving hundreds of thousands in hereditary tax.

But – and this is a significant “but” – the Autumn 2024 Budget changed things. From April 2026, these reliefs are capped at £1 million combined. Above that, you get 50% relief, meaning an effective tax rate of 20% instead of 40%. Still better than nothing, but a blow for larger estates.

Agricultural property relief once meant farms could pass between generations without families having to sell up. The new £1 million cap has caused considerable upset in farming communities – understanding how this affects your situation requires specialist knowledge.

The 2025 Residence-Based Rules: A Seismic Shift

Until April 2025, hereditary tax hinged on “domicile” – a fuzzy concept about where you considered your permanent home. From 6th April 2025, the UK switched to a residence-based system.

If you’ve been UK resident for 10 of the last 20 years, you’re now a “Long Term Resident” (LTR). Your worldwide assets become liable for UK inheritance tax. Previously, many expatriates remained caught by domicile rules for years after leaving. Now there’s more certainty – though not necessarily in a good way for everyone.

For those planning to leave the UK, your hereditary tax exposure doesn’t vanish immediately. It phases out based on how long you were resident here. It’s complicated enough that international families really need expert tax advisory solutions.

The Pension Bombshell Coming in 2027

Currently, pensions sit outside your estate for hereditary tax purposes. It’s one reason why leaving money in your pension pot (rather than drawing it all down) has been attractive for those wanting to pass wealth on.

From April 2027, that changes. Unused pension funds will be liable for inheritance tax.

Combined with income tax that beneficiaries already pay on inherited pensions (if you die after 75), the effective tax rate could hit 67%. Yes, you read that correctly. Two-thirds gone.

The Maths: £100,000 pension fund. IHT at 40% = £40,000 tax. Leaves £60,000. Beneficiary pays income tax at 40% on what remains = £24,000. They receive £36,000. Total tax: £64,000 (64%).

This makes pension planning far more urgent for anyone with substantial retirement savings. The old strategies? Many need rethinking entirely.

When and How Do You Actually Pay Hereditary Tax?

Here’s a practical headache: inheritance tax must be paid before you can get probate. And you need probate to access the deceased’s money to pay the tax. Spot the problem?

Executors have six months from the end of the month of death to pay. Miss that deadline? Interest starts accruing. HMRC isn’t lenient about this.

Options for paying include:

- Using your own money temporarily

- Selling assets quickly (often at poor prices)

- Taking out a specialist inheritance tax loan

- Paying in instalments (only available for certain assets like property)

Many families are genuinely caught off-guard by this timing issue. Having professional business advice lined up before you need it saves enormous stress later.

Who Actually Pays This Tax?

The estate pays – specifically, the executor or administrator sorts it out. Beneficiaries don’t usually pay tax on what they inherit (though they might face other taxes, like income tax on rental income from an inherited property).

Exception: gifts. If you receive a gift and the donor dies within seven years, you might be liable for any hereditary tax on that gift.

Strategies to Reduce Hereditary Tax

Let’s be honest – most people don’t relish the idea of 40% of their wealth disappearing to HMRC. Here’s what actually works:

1. Make a Will

Dies intestate (without a will)? Your estate gets divided according to strict rules that might not align with tax-efficient planning. Plus, unmarried partners get nothing under intestacy rules – and you can’t use the spousal exemption.

2. Use Trusts Strategically

Trusts can remove assets from your estate, though the rules are labyrinthine. They come with their own tax charges every 10 years, so they’re not a magic bullet. But for certain situations – protecting vulnerable beneficiaries, for instance – they’re invaluable.

3. Life Insurance in Trust

A life insurance policy written in trust doesn’t form part of your estate. The payout goes directly to beneficiaries, potentially providing liquidity to pay the tax bill without touching other assets.

4. Spend It

Radical thought: enjoy your money. That round-the-world cruise isn’t taxable. Experiences with family? Also not taxable. There’s something to be said for the “die with zero” approach – though it requires confidence you won’t run out.

5. Give to Charity

Charitable donations are exempt, and remember – give 10% or more of your net estate to charity, and the rate drops from 40% to 36% on the rest. Sometimes the maths works out surprisingly well.

6. Regular Gifts from Income

This exemption is underused. If you can prove gifts are regular, come from surplus income (not capital), and don’t affect your standard of living, they’re immediately outside your estate. No seven-year wait.

The catch? Meticulous records. Spreadsheets, bank statements, notes about what counts as “normal” expenditure. HMRC will challenge this if documentation is sloppy.

The Most Common Hereditary Tax Mistakes

Assuming you’re under the threshold. House prices alone have pushed many “ordinary” families over £325,000. Add in savings, pensions (from 2027), and personal possessions, and you might be surprised.

Forgetting about lifetime gifts. That £50,000 you gave your daughter for her house deposit five years ago? Still in your estate if you die within seven years of the gift.

Not reviewing your will regularly. Tax laws change. Family circumstances change. A will from 1995 probably isn’t fit for purpose in 2025.

DIY complex planning. Sure, you can find template wills online. Setting up trusts or navigating agricultural relief? That’s when mistakes get expensive. Really expensive.

Need Expert Help with Inheritance Tax Planning?

Hereditary tax – or inheritance tax, as it’s properly known – affects more families every year as thresholds stay frozen and asset values climb. Whether you’re planning your estate, dealing with a bereavement, or worried about potential tax bills, professional guidance makes a genuine difference.

Ask Accountant specialises in inheritance tax planning, offering practical, tax-efficient strategies tailored to your situation. From business property relief claims to complex estate restructuring, their team handles the technical details whilst you focus on what matters.

Based at 178 Merton High St, London SW19 1AY | Call +44(0)20 8543 1991

Services include comprehensive tax advisory solutions, business accounting, and bookkeeping to keep your financial affairs in order.

Why Is Hereditary Tax So Unpopular?

Polling consistently shows inheritance tax as Britain’s most hated levy. Why? Several reasons resonate with people:

It feels like double taxation. You’ve already paid income tax, national insurance, capital gains tax on these assets. Now another 40% chunk disappears at death?

It hits aspiration. People who worked hard, saved diligently, and lived modestly to leave something for their kids see that ambition thwarted by HMRC.

It’s optional for the wealthy. Those with serious wealth have accountants, lawyers, and complex structures to minimise it. The “moderately comfortable” middle class? They get walloped. This disparity rankles.

The thresholds are frozen. £325,000 since 2009. Inflation has made a mockery of this. If the threshold had risen with inflation, it would be around £500,000 now. The residence nil-rate band is stuck at £175,000 (would be £210,000 with inflation). This is “fiscal drag” in action – a stealth tax increase.

Changes on the Horizon

The thresholds are frozen until at least April 2030. That’s confirmed. Each year of inflation pulls more estates into the tax net – the Office for Budget Responsibility predicts over 6% of deaths will attract inheritance tax by 2028/29, the highest since the 1970s.

Revenue from hereditary tax is projected to hit £7.2 billion in 2023/24. That’s not nothing to the Treasury. Complete abolition – which some politicians periodically suggest – seems unlikely when the government needs every penny.

More probable? Tweaks around the edges. Maybe increasing thresholds (at least in line with inflation). Perhaps further restrictions on reliefs. The agricultural and business property changes show the direction of travel: tightening rather than liberalising.

Calculating Your Potential Hereditary Tax Bill

Right, let’s work through a realistic example. The Johnsons – married couple, two adult children, one grandchild.

Assets:

- Family home: £650,000

- Savings and investments: £200,000

- Personal possessions: £50,000

- Total estate: £900,000

First spouse dies, leaves everything to surviving spouse: No tax due (spousal exemption). Unused allowances transfer.

Second spouse dies, leaves estate to children:

- Combined nil-rate bands: £650,000

- Combined residence nil-rate bands: £350,000 (home going to direct descendants)

- Total allowances: £1,000,000

Estate value (£900,000) is below their combined allowances (£1,000,000). No inheritance tax payable.

But change one factor – say the house is worth £1.2 million instead – and suddenly there’s a £80,000 tax bill (40% of £200,000).

Use an inheritance tax calculator to check your own situation. These tools give a ballpark figure, though for accuracy with complex estates, professional valuations matter.

Record-Keeping: The Boring Bit That Matters

When someone dies, the executor needs to value everything. That requires:

- Bank statements

- Investment valuations

- Property valuations (professional ones for houses over £325,000)

- Records of debts

- Details of gifts made in the last seven years

HMRC can request evidence for any figure you declare. Get valuations wrong – particularly if you undervalue – and penalties apply. This isn’t an area for guesswork.

Some people keep a “death file” – morbid name, sensible idea. List of accounts, insurance policies, passwords (stored securely), recent valuations, copies of the will. Makes life vastly easier for whoever has to sort things out.

FAQs About Hereditary Tax

Is hereditary tax the same as inheritance tax?

Yes. “Hereditary tax” isn’t an official term, but it refers to what’s legally called Inheritance Tax (IHT) in the UK. It’s the 40% tax charged on estates above the nil-rate band threshold.

Do you pay inheritance tax on property?

Property forms part of your estate, so yes – unless the total estate is below the threshold. The residence nil-rate band gives an extra £175,000 allowance if you leave your home to children or grandchildren.

Can you avoid inheritance tax legally?

Absolutely. Strategies include making lifetime gifts (surviving 7 years), leaving assets to a spouse, donating to charity, using trusts, and claiming business or agricultural property relief. Tax compliance services ensure you’re using all available legal exemptions.

What happens if you can’t pay the inheritance tax bill?

You have options: paying in instalments for certain assets (like property), taking out a specialist loan, or selling assets. You must pay within six months to avoid interest charges, which makes planning ahead crucial.

Do beneficiaries pay tax on inheritance?

Generally no – the estate pays inheritance tax before distribution. But beneficiaries might face other taxes, like income tax on earnings from inherited assets (rental income, dividend income, etc.).

How often do I need to review inheritance tax planning?

Every few years, or when circumstances change significantly – marriage, divorce, birth of children, big change in asset values, or new tax legislation. The 2025 residence rule changes are a perfect example of why regular reviews matter.

Final Thoughts: Don’t Leave It Too Late

Hereditary tax catches people out because nobody likes thinking about death. It’s uncomfortable. It feels pessimistic. But here’s the thing: proper planning isn’t morbid – it’s a gift to the people you care about.

Every year, families scramble to find £50,000, £100,000, £200,000 to pay tax bills they never saw coming. They sell property quickly at poor prices. They raid their own savings. They take out expensive loans. Sometimes they fight with each other over who’s responsible.

All of this is avoidable.

Whether you call it hereditary tax, death duties, or inheritance tax, the fundamentals are the same: understand your situation, use available exemptions, plan ahead, and get professional help for anything complex. The tax system is intricate enough that expertise genuinely pays for itself.

Start the conversation. Check what your estate is worth. Make a will if you haven’t. Review the one you have if it’s years old. Consider whether your assets are structured tax-efficiently. Talk to your family about expectations.

These aren’t fun conversations. But having them beats leaving your loved ones with a financial mess when you’re gone.

For detailed guidance on your specific circumstances, contact Ask Accountant – their team handles everything from straightforward self-assessment to complex estate restructuring and CIS refund claims.