Here’s something most online sellers don’t realise until it’s too late: running an ecommerce business means your accounting needs are fundamentally different from a traditional shop on the high street. Not just slightly different. Completely different.

I’ve watched countless sellers make the mistake of treating their Amazon or Shopify business like any other retail operation. They’ll hire a general accountant, upload their bank statements, and expect everything to work out fine. Then reality hits—usually around the first VAT return or when they’re trying to work out why their profit margins look nothing like what the dashboard showed.

The truth? Ecommerce accounts deal with a beast that’s constantly shape-shifting. Your sales come through six different platforms. Payment processors hold your money hostage for weeks. Returns eat into revenue faster than you can track them. And don’t even get me started on the VAT complications when you’re selling a £12 item to someone in Germany whilst your stock sits in a fulfilment centre in Birmingham.

Let me explain why ecommerce accounts deserves its own category—and why getting it wrong costs you more than you think.

Why Your Regular Accountant Might Be Struggling

Picture this: you’ve got sales rolling in from Shopify, Amazon, eBay, Etsy, and maybe TikTok Shop if you’re keeping up with the times. Each platform takes a different cut. Each pays out on different schedules. Amazon might settle every fortnight whilst eBay drops money into your account within days.

Your traditional accountant wants to see gross sales. What they get instead? Net settlements with fees already deducted, refunds processed a week after the original sale, and promotional costs scattered across three different reports that don’t even use the same date format.

This is where ecommerce accountants earn their keep. They know (instinctively, after years of platform-hopping) that you can’t just record what hits your bank account and call it a day. You need the gross transaction data. You need every fee itemised. You need to reconcile marketplace-held reserves that might not show up for another month.

Without this level of detail, your accounts are basically fiction. Pretty fiction, perhaps, but utterly useless for Making Tax Digital or any serious business decisions.

The Multi-Channel Nightmare (And How to Tame It)

Selling across multiple platforms isn’t just twice as much work as one platform—it’s exponentially more complicated.

Each marketplace operates differently:

- Amazon batches your settlements, deducts returns retrospectively, and holds reserves that can vanish into thin air if you’re not watching

- Shopify gives you more control but requires you to track gateway fees, third-party app costs, and subscription charges separately

- eBay has seller fees that vary based on category, promoted listings that cost extra, and international sales that trigger completely different VAT rules

- Etsy charges per listing, takes transaction fees, and adds payment processing on top

Now imagine trying to consolidate all of this into one coherent picture of your business finances. Most business owners I speak with at Ask Accountant in London admit they’re just… guessing. They know they’re making money (they think), but they couldn’t tell you their true profit margin per platform if their business depended on it.

Which, ironically, it does.

The Integration Problem Nobody Talks About

Here’s the bit that really trips people up: your accounting software needs to talk to all these platforms. Not sort of talk to them. Not manually import CSV files every month. Actually integrate properly.

When we’re working with ecommerce clients, we make sure their systems are connected using proper accounting software like Xero or QuickBooks. These tools can pull data automatically from most major platforms, but—and this is crucial—they need to be configured correctly from day one.

Get it wrong initially? You’re looking at hours of manual reconciliation every month. Get it right? Your books basically maintain themselves whilst you focus on actually growing the business.

| Platform | Settlement Schedule | Key Accounting Challenge | Integration Difficulty |

|---|---|---|---|

| Amazon | Every 14 days | FBA fees, reserves, retrospective adjustments | High |

| Shopify | Daily / weekly (varies) | App subscriptions, gateway fees separate from sales | Medium |

VAT: The Silent Profit Killer

If you’re selling online in the UK and think VAT is straightforward, I have some unfortunate news. It’s a minefield, and it’s gotten significantly more complex post-Brexit.

Domestic sales? That’s the easy bit. 20% VAT on most products once you hit £90,000 in turnover. Register, charge VAT, submit returns quarterly. Done.

EU sales? Welcome to the world of OSS (One Stop Shop) and IOSS (Import One Stop Shop). If your EU sales exceed €10,000 annually, you need to register. Different rates apply in different countries. Some items are exempt in certain jurisdictions but not others. The admin alone could drown a small business.

International sales beyond the EU? Generally VAT-free, but you need proof of export. And if you’re using FBA in multiple countries, HMRC wants to know about it.

The bit that catches most sellers out? Making Tax Digital for VAT. Since April 2022, all VAT-registered businesses—regardless of turnover—must keep digital records and file returns using MTD-compatible software. No more manual submissions through the Government Gateway.

Your accountant needs to understand this inside and out. A specialist in ecommerce accounts doesn’t just file your VAT return; they structure your entire system to be MTD-compliant from the start. They know which platforms automatically handle OSS registration. They understand reverse charge mechanisms for digital products. They can tell you whether that software subscription you’re selling is subject to UK VAT or falls under a different regime entirely.

Miss this? HMRC’s penalties start at £100 for late filing and scale up rapidly. Get your VAT calculations wrong? You’re looking at interest charges on underpaid amounts and potential investigations.

Returns and Refunds: The Cash Flow Vampire

Fashion retailers, listen up—return rates in your sector can hit 30%. That’s nearly a third of your sales vanishing back into the void, taking your profit margins with them.

Every return affects three things simultaneously:

- Your revenue (obviously)

- Your inventory (the item’s back in stock… somewhere)

- Your cash flow (the customer got refunded, but you’ve still paid the platform fees)

Traditional accounting treats returns as simple reversals. Ecommerce accounts recognises them as complex events that need tracking across multiple dimensions. When did the sale occur? When was it returned? What condition is the item in? Can you resell it? Did the platform already deduct its commission, and if so, are they refunding their portion?

I’ve seen businesses with £100k in monthly sales operate on less than £15k actual profit after factoring in returns, storage fees, and the cost of processing returns through their 3PL provider. Without accurate bookkeeping services that track these nuances, you’re flying blind.

The Real Cost of Returns Nobody Calculates

UK retailers lose an estimated £20-60 billion annually to return logistics. That’s not just the cost of shipping—it’s warehouse processing, quality checks, repackaging, and the percentage of items that can’t be resold at full price.

Your accounting system needs to capture this. Not just revenue minus refunds, but the full lifecycle cost of every return. Otherwise, your financial reports show false profitability whilst your bank account tells a different story.

Inventory Tracking Across Multiple Locations

Where is your stock right now? If you can’t answer that question within 30 seconds, you’ve got an inventory problem.

Ecommerce sellers often have stock in:

- Their own warehouse or garage (if they’re just starting)

- Amazon FBA centres (possibly multiple locations)

- Third-party logistics providers

- Drop-shipping suppliers who hold stock on their behalf

Each location needs separate tracking. You need to know not just what you have, but where it is, what it cost you to put it there, and how long it’s been sitting there accruing storage fees.

FIFO (first in, first out) or weighted-average costing methods become critical when you’re dealing with products that have seasonal pricing or currency fluctuations affecting your cost base. Get this wrong, and your profit calculations are meaningless.

Specialist ecommerce accounts help you implement inventory management systems that sync with your accounting software. Real-time tracking. Automated reorder points. Cost analysis that actually reflects your true margins instead of some theoretical number plucked from thin air.

Cash Flow: Why Ecommerce Businesses Run Differently

Traditional businesses get paid when they make a sale. Ecommerce businesses… don’t.

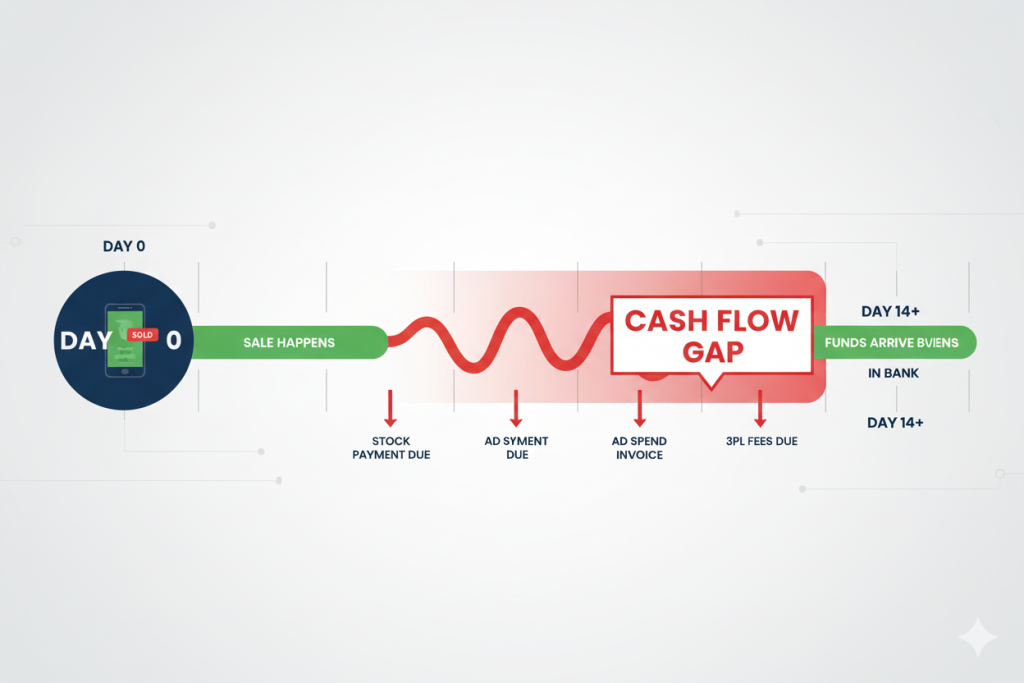

Amazon holds your money for two weeks. Payment processors take 2-3 days to clear. Some platforms hold reserves if they think you’re a risk (and their definition of “risk” can be surprisingly broad).

Meanwhile, you need to pay your suppliers upfront. Stock costs money before you’ve sold a single unit. Advertising spend happens in real-time. Your 3PL charges you whether products are moving or gathering dust.

This creates a cash flow gap that can strangle a profitable business. I’ve seen sellers with £50k in monthly revenue unable to pay a £3k invoice because all their cash was tied up in Amazon’s settlement cycle.

Your accounting needs to forecast this. Not just track what’s happened, but model what’s coming. When will the next payout hit? How much will it be after fees and reserves? Can you afford to restock next week or should you wait until the following settlement?

At Ask Accountant, we work with ecommerce clients to build cash flow projections that account for these platform-specific quirks. It’s not glamorous work, but it’s what keeps businesses solvent during growth phases.

| Cash Flow Challenge | Traditional Retail | Ecommerce |

|---|---|---|

| Payment timing | Immediate (cash/card) | Delayed 2–14 days |

| Reserve holdings | None typically | 5–20% held by platforms |

| Stock investment | Can be gradual | Large upfront for FBA |

| Ad spend | Monthly / quarterly | Daily / immediate |

| Returns impact | Handled in-store, minimal delay | Extended timelines, fees retained |

The International Sales Complication

Selling internationally sounds brilliant until you hit the paperwork.

Different countries. Different tax rules. Different currencies. Exchange rate fluctuations that can turn a profitable sale into a loss between the order date and settlement date.

Currency conversion isn’t just about tracking today’s rate—it’s about understanding when your accounting software should recognise the transaction. At order? At settlement? What rate do you use? The rate when the sale happened or when the money hit your account?

Get this wrong, and your accounts could be off by thousands. HMRC expects you to use their published rates for VAT purposes, but your bank might convert at different rates. Reconciling this requires specialist knowledge.

Then there’s customs documentation, import/export regulations, and varying consumer protection laws. Some countries require specific invoicing formats. Others have mandatory warranty periods that affect your return liabilities.

Ecommerce accounts that specialise in international trade know these nuances. They help structure your business to minimise cross-border complications whilst staying compliant with each jurisdiction’s requirements. This is particularly relevant if you’re using the business advisory services that help with expansion planning.

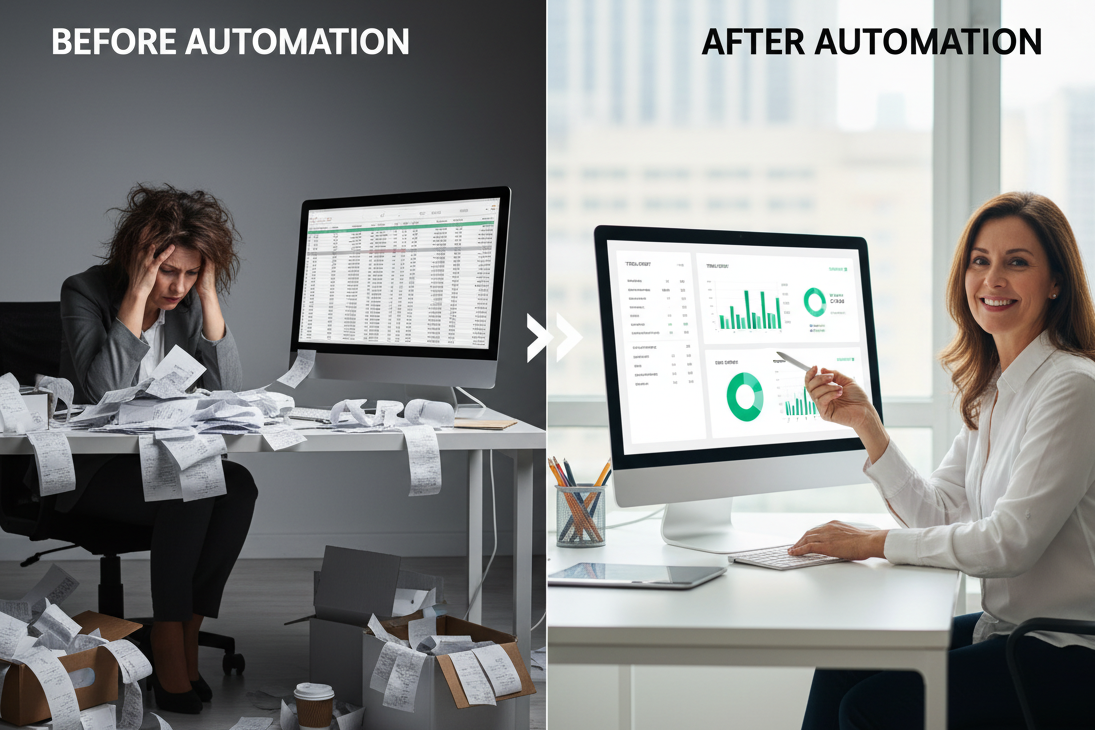

Automation: Not Optional Anymore

Manual bookkeeping for an ecommerce business is like trying to empty the ocean with a teaspoon. Technically possible. Completely impractical.

You need automation at every level:

- Sales data automatically pulled from platforms into your accounting software

- Bank feeds matching transactions to invoices without human intervention

- VAT calculations handled by MTD-compliant systems that submit directly to HMRC

- Inventory updates syncing across platforms to prevent overselling

- Financial reports generated in real-time so you can make decisions based on current data, not last month’s numbers

Modern accounting software like Xero, QuickBooks, or Sage can do all of this—if configured properly. The setup is complex enough that most business owners need professional help getting it right.

Once it’s working? You save 6+ hours monthly on admin. Your data is accurate. Your tax obligations are met automatically. You can actually see your real profit margins instead of rough estimates.

This is where having an accountant who understands cloud accounting becomes invaluable. They don’t just set it up—they maintain it, troubleshoot integration issues, and update systems as platforms change their APIs (which happens more often than you’d think).

Tax Planning for Growth

Here’s something most ecommerce sellers overlook: proactive tax planning.

When you’re operating across multiple platforms and potentially multiple countries, there are genuine opportunities to structure things efficiently. Should you be VAT registered even if you’re below the threshold? Would incorporating save you tax compared to operating as a sole trader? Are you claiming all available reliefs and allowances?

Small business accounting services for ecommerce need to be forward-looking, not just reactive. It’s not enough to file accurate returns—you need someone who can model different scenarios and show you the tax implications of scaling up, expanding internationally, or changing your business structure.

At Ask Accountant (call us on +44(0)20 8543 1991 if you want to discuss your specific situation), we work with clients to build tax advisory solutions that minimise liability whilst keeping everything above board. This includes strategies around timing of expenses, optimal structure for partnerships, and claiming R&D relief if you’re developing proprietary systems.

The difference between a £5k tax bill and a £15k tax bill often comes down to planning. Not tax avoidance—just smart structuring and timing of decisions.

The Cost of Getting It Wrong

Let me be blunt: bad ecommerce accounts doesn’t just mean messy books. It means:

- HMRC penalties for incorrect VAT returns or late submissions (easily £1,000+ per mistake)

- Cash flow crises because you didn’t see them coming

- Lost growth opportunities because you couldn’t confidently assess profitability

- Platform suspensions if your financial documentation doesn’t hold up during audits (yes, Amazon and others do these)

- Wasted money on stock that isn’t actually profitable once you factor in all the fees

- Stress that prevents you from focusing on growing the business

I’ve met sellers who spent £30k on inventory they couldn’t shift because they didn’t realise their margins were paper-thin after platform fees. Others who faced £5k HMRC penalties for VAT errors that could’ve been avoided with proper systems. Some who missed out on business loans because their accounts were such a mess that banks couldn’t assess the risk.

The cost of specialist ecommerce accounts seems expensive until you compare it to the cost of not having them. We’re talking about professionals who might charge £200-400 monthly for ongoing support, versus potential five-figure losses from avoidable mistakes.

What to Look For in an Ecommerce Accountant

Not all accountants understand ecommerce. Some will tell you they do, then treat your Amazon business like a corner shop that happens to have a website.

Look for:

- Platform expertise – They should know Amazon, Shopify, eBay inside and out

- MTD compliance – Non-negotiable for VAT-registered businesses

- Integration experience – Can they connect your platforms to accounting software properly?

- International knowledge – Essential if you sell cross-border

- Proactive communication – You want advice, not just annual filings

- Real-time reporting – They should give you dashboard access to current figures

- Growth planning – Can they model what happens when you scale?

Ask potential accountants specific questions: “How do you handle FBA fee reconciliation?” “What’s your process for OSS VAT registration?” “How do you track inventory across multiple locations?”

Vague answers are a red flag. You want someone who lights up talking about these details because they’ve solved these problems hundreds of times before.

Building Systems That Scale

The biggest difference between businesses that grow and those that plateau? Scalable systems.

When you’re doing £10k monthly revenue, you can probably muddle through with basic bookkeeping. At £50k, you need proper systems. At £100k+, you need professional ecommerce accounts managing everything because the complexity scales faster than your time to handle it.

Good accounting systems should make growth easier, not harder. When you add a new platform, it should integrate smoothly. When you expand to a new country, your VAT handling should adapt without wholesale restructuring. When you hit the next revenue milestone, your cash flow forecasting should already account for it.

This is why business growth planning is so tightly connected to accounting. You can’t plan growth without understanding your current financial position. You can’t execute growth without systems that can handle increased volume.

Making the Switch to Specialist Support

If you’re currently using a general accountant and wondering whether specialist in ecommerce accounts is worth it, ask yourself:

- Do you actually understand your true profit margins per platform?

- Could you confidently explain your VAT position to HMRC right now?

- Do you spend more than 5 hours monthly on bookkeeping admin?

- Have you faced unexpected tax bills or cash shortfalls?

- Are you making business decisions based on accurate financial data or educated guesses?

If any of these hit close to home, it’s time to upgrade.

The transition doesn’t have to be painful. A decent ecommerce accountant will audit your current setup, identify gaps, and implement solutions gradually. Within 2-3 months, you should have automated systems that give you real-time visibility into your finances with minimal ongoing effort from your side.

The peace of mind alone is worth it. Knowing your VAT is handled. Knowing your cash flow is being monitored. Knowing you can make decisions based on actual data instead of hopeful estimates.

Your Next Steps

Ecommerce accounts isn’t something you can afford to get wrong. The stakes are too high, the regulations too complex, and the margins often too thin to absorb costly mistakes.

Whether you’re just starting out on Shopify or you’re running a multi-million-pound operation across six platforms, you need accounting systems designed specifically for the way ecommerce businesses actually work. Not adapted from traditional retail. Not kludged together from generic templates. Purpose-built for the unique challenges of online selling.

If you’re in London and need help getting your ecommerce accounts in order, we’re at 178 Merton High St, London SW19 1AY. We’ve been helping online sellers since before “ecommerce accounting” was even a recognised specialism. We understand the platforms, the regulations, and—most importantly—the pressure you’re under to keep everything running whilst trying to grow.

Sometimes the smartest business decision isn’t about marketing spend or product selection. It’s about getting the boring stuff right so you can focus on everything else. That’s what proper ecommerce accounts gives you: freedom to build your business instead of drowning in spreadsheets.

Get it sorted. Your future self will thank you.

Frequently Asked Questions

Do I need an ecommerce accounts if I’m only selling on one platform?

Even single-platform sellers face complications traditional accountants might miss—things like FBA fee structures, marketplace reserves, and MTD compliance. If your turnover is approaching £90k annually, specialist knowledge becomes essential for VAT handling alone.

How much does specialist ecommerce accounts cost?

Monthly fees typically range from £150-400 for small to medium sellers, depending on turnover and complexity. Annual accounts might add another £500-1,000. Compare this to the cost of HMRC penalties (£100+ per late filing) or poor decision-making based on inaccurate data (potentially thousands in lost profit).

Can I use regular accounting software for my ecommerce business?

Software like Xero and QuickBooks work fine—if configured correctly with proper integrations. The software isn’t the issue; it’s the setup and ongoing management. Most ecommerce sellers need professional help getting integrations working properly and maintaining them as platforms update their APIs.

What’s the difference between bookkeeping and accounting for ecommerce?

Bookkeeping is the day-to-day recording of transactions—ideally automated through platform integrations. Accounting is the strategic work: tax planning, financial forecasting, business advisory, and compliance. You need both, but for ecommerce, specialist knowledge makes an enormous difference in quality and accuracy.

How do I know if my current accountant understands ecommerce?

Ask them specific questions about platform fee reconciliation, OSS/IOSS registration, or handling multi-currency transactions. If they can’t give detailed answers or seem to be treating your online business like a traditional shop, it’s time to look for someone with ecommerce expertise.