Last updated: January 2026 | 12-minute read

Here’s something nobody tells you when you register your first business: that euphoric moment when you make your first sale? It’s immediately followed by the cold realisation that someone, somewhere, expects you to account for it.

Not in the vague “I made some money” sense. In the “HMRC wants quarterly digital updates, your bank needs reconciliation, Companies House is watching the clock, and did you remember to save 20% for VAT?” sense.

Which is roughly when most small business owners discover that small business accounting services aren’t a luxury—they’re the difference between a thriving enterprise and a very expensive hobby that occasionally pays you.

I’ve watched brilliant entrepreneurs—people who can pitch investors, develop products, manage teams—get absolutely flattened by bookkeeping. Not because they’re incapable. But because running a business whilst simultaneously learning double-entry bookkeeping, MTD compliance, and CIS tax schemes is like trying to build an aeroplane whilst flying it. Through a thunderstorm. Backwards.

Why 2026 Changes Everything for Small Business Accounting

If you’re reading this in early 2026, congratulations: you’ve picked possibly the most pivotal year for UK small business accounting since… well, since they invented accounting.

Making Tax Digital for Income Tax (that mouthful everyone shortens to MTD ITSA) officially kicks in this April. And unlike previous years where deadlines got pushed back and everyone collectively exhaled, this time HMRC means business.

The MTD Reality Check: From 6 April 2026, if your business earned over £50,000 in gross income from self-employment or property in the 2024/25 tax year, you’re in. No exceptions. Digital records, quarterly submissions, the works.

This isn’t just another compliance checkbox. It fundamentally rewrites how small business accounting services operate in the UK. Your accountant can’t just rock up in January, sort through your year’s worth of receipts (judgementally, I might add), and file your return anymore.

Because here’s the thing: quarterly updates mean your accounting needs to be current. Which means your accountant needs to be involved. Which means that relationship you’ve been treating as transactional? It just became strategic.

What Actually Counts as Small Business Accounting Services?

Right, let’s demolish a common misconception: small business accounting services aren’t one thing. They’re more like… a spectrum? A choose-your-own-adventure where the wrong choices result in HMRC penalties instead of fictional death?

Bookkeeping (The Foundation Nobody Wants to Think About)

This is the daily grind: recording every transaction, categorising expenses, reconciling bank statements, chasing invoices. It’s tedious. Crucial. And the bit most business owners procrastinate on until 11 PM on a Sunday night three months later.

Professional bookkeeping typically runs £100-£300 monthly depending on transaction volume. That design agency processing 40 payments a month? Probably looking at £200. The sole trader with a handful of clients? Could manage with £150.

The interesting thing about modern bookkeeping is it’s moved almost entirely to the cloud. Services like bookkeeping solutions now sync directly with your bank, automatically categorise transactions, and generally do in 20 minutes what used to take three hours with a calculator and a migraine.

Tax Compliance (Because HMRC Doesn’t Accept “I Forgot” as Legal Defence)

Self-assessment returns. Corporation tax. VAT returns. CIS if you’re in construction. Each comes with its own deadlines, forms, and creative opportunities to accidentally commit tax fraud.

A standalone self-assessment typically costs £150-£350. Add VAT returns? Another £50-£150 per quarter. Corporation tax for a limited company? £300-£800 depending on complexity.

But here’s what nobody tells you about tax compliance services: the value isn’t just in filing forms. It’s in someone catching that £4,000 expense you forgot to claim. Or spotting that your salary-dividend split is wildly inefficient. Or noticing you’re about to hit the VAT threshold three months before it happens instead of three months after.

MTD Alert: Starting April 2026, businesses above the £50,000 threshold must submit quarterly digital updates. Miss a deadline? That’s penalty points. Four points equals a £200 fine. Eight points? £400. It accumulates. Fast.

Payroll Management (More Complicated Than It Has Any Right to Be)

Hired your first employee? Brilliant! Now you’re an employer. Which means PAYE, National Insurance calculations, pension auto-enrolment, RTI submissions to HMRC, payslips, P45s, P60s, and a whole alphabet soup of forms.

Payroll services generally charge £5-£10 per employee monthly, plus a setup fee. Five employees? Budget around £50-£75 monthly. Sounds reasonable until you try doing it yourself and discover that calculating statutory sick pay whilst manually filing RTI returns is where joy goes to die.

Advisory Services (The Bit That Actually Grows Your Business)

This is where small business accounting services transition from “necessary evil” to “competitive advantage.” Business advisory services include cash flow forecasting, growth planning, tax strategy, and that invaluable moment when your accountant says “Have you considered…” and saves you five figures.

Advisory work typically runs £150-£300 hourly, or it’s bundled into comprehensive packages. That tech startup planning to raise funding? They need someone modelling tax scenarios based on scaling revenue. The retail business considering a second location? Cash flow projections aren’t optional, they’re survival.

| Service Type | What It Actually Involves | Typical Cost Range | Why You Need It |

|---|---|---|---|

| Bookkeeping | Daily transaction recording, bank reconciliation, expense tracking | £100-£300/month | Foundation for everything else; required for MTD compliance |

| Tax Returns | Self-assessment, corporation tax, quarterly MTD submissions | £150-£800/year | Legal requirement; penalties for late/incorrect filing |

| VAT Returns | Quarterly VAT calculations and submissions to HMRC | £50-£150/quarter | Mandatory if turnover exceeds £90,000 |

| Payroll | PAYE, NI, pension contributions, RTI filing | £50-£100/month for 5 employees | Legal requirement if you employ staff |

| Year-End Accounts | Statutory accounts, Companies House filing | £500-£1,500/year | Legal requirement for limited companies |

| Advisory | Tax planning, growth strategy, cash flow forecasting | £150-£300/hour or bundled | Saves money long-term; enables growth |

The True Cost Question (And Why the Cheapest Option Usually Isn’t)

Every business owner asks this: “How much should I actually be paying for small business accounting services?”

The answer? Somewhere between “it depends” and “what’s your business worth to you?”

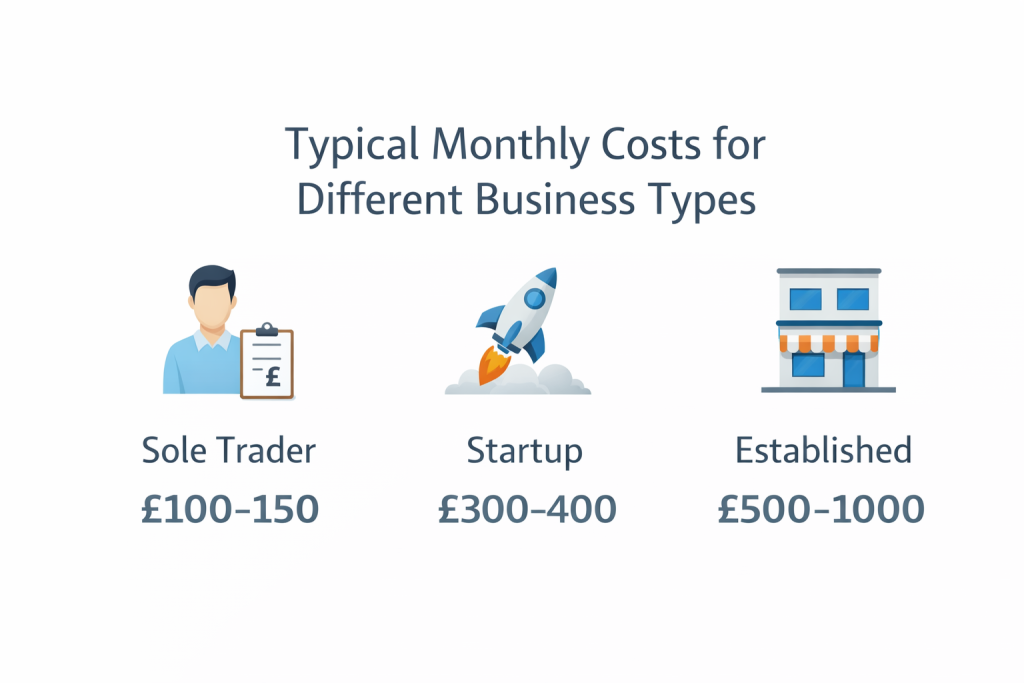

Based on current UK market rates:

- Sole traders with straightforward income: £100-£150 monthly for basic bookkeeping and tax returns

- Start-ups (limited companies, few transactions): £300-£400 monthly plus VAT

- Established businesses with employees and VAT: £500-£1,000 monthly

- Complex operations (multiple revenue streams, international trade, R&D claims): £1,000+ monthly

But here’s what those numbers don’t capture: opportunity cost.

That graphic designer spending 10 hours monthly on bookkeeping? At £75/hour, that’s £750 in billable time lost. Paying someone £200 to handle it saves £550. Plus the designer’s sanity. Plus they actually invoice clients on time instead of whenever they remember to update their spreadsheet.

Or consider the construction firm that tried DIY CIS returns. Got the calculations wrong. HMRC opened an investigation. Legal fees and accountant remediation? £8,000. Professional CIS management costs £100-£200 monthly. The maths isn’t subtle.

Software vs People (Or: Why Technology Hasn’t Replaced Accountants Yet)

Every few years someone announces that accounting software will eliminate the need for accountants. Then Making Tax Digital launches and suddenly everyone’s scrambling to find an accountant who understands both the technology and the legislation.

Here’s the reality: you need both.

The Software Situation

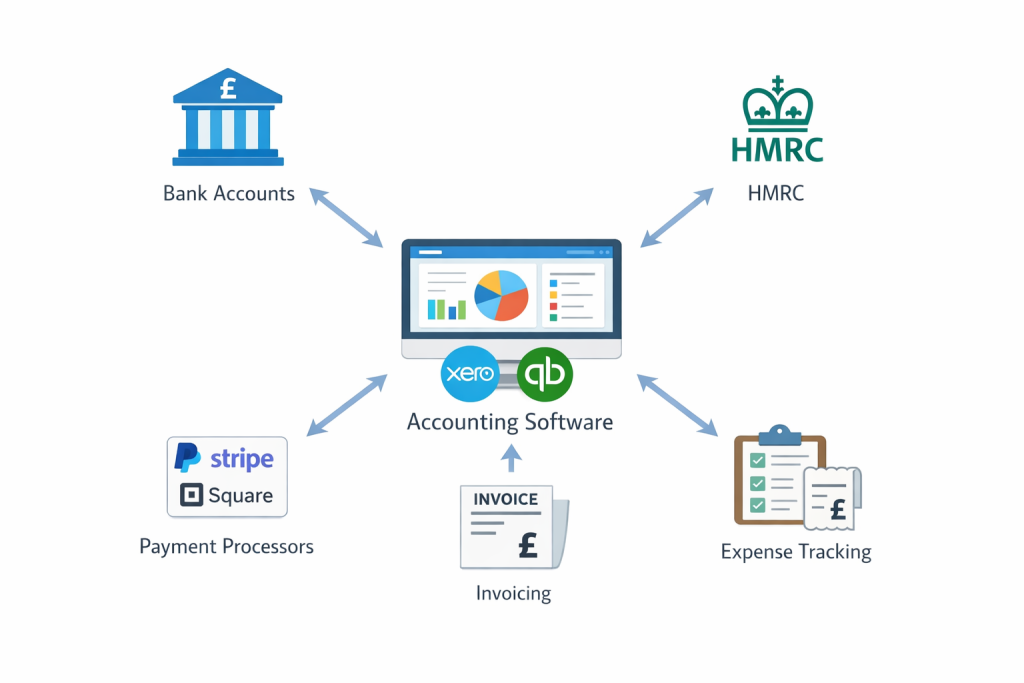

Cloud accounting platforms—Xero, QuickBooks, FreeAgent, Sage—have genuinely revolutionised small business accounting. They sync with your bank. Categorise transactions automatically. Generate reports instantly. Cost £10-£100 monthly depending on features.

QuickBooks dominates the UK market, particularly among businesses with high transaction volumes. Solid for day-to-day practicality, integrates well with accountants, handles MTD submissions.

Xero excels if you need extensive integrations—e-commerce platforms, payment processors, inventory systems. Popular with service businesses and companies working closely with external accountants.

FreeAgent targets freelancers and sole traders. Simpler interface, excellent time-tracking, free with some NatWest business accounts.

But (and this is the crucial bit): software doesn’t understand your business. It can categorise transactions. It cannot determine whether that £3,000 expense should be capitalised or written off immediately. It cannot advise on the tax implications of taking a dividend versus a salary increase. It cannot spot that your pricing strategy is slowly bankrupting you.

Why People Still Matter

Professional small business accounting services provide context. Judgement. Strategic thinking. The software handles the mechanical work; accountants handle the “should we” and “what if” questions.

Plus, frankly, HMRC doesn’t care if your software crashed. When they send an investigation notice, you need someone who can translate “pursuant to Paragraph 1, Schedule 36, Finance Act 2008” into actual English and formulate a response.

The sweet spot? Use software for daily transactions and recordkeeping, but have a professional review it regularly, handle submissions, and provide strategic advice. Like having autopilot on a plane—handles routine flying, but you still want a pilot for takeoff, landing, and turbulence.

How to Actually Choose Small Business Accounting Services (Without Defaulting to “Cheapest Quote”)

Finding the right accounting support isn’t about Google-ing “accountant near me” and picking whoever responds first. Although that’s precisely what most people do, then wonder why they’re dissatisfied.

1. Match Services to Your Actual Needs

Sole trader with £30K turnover? You don’t need a firm specialising in multinational corporations. But a growing e-commerce business absolutely needs someone familiar with e-commerce accounting complexities.

Ask yourself:

- What keeps you awake at night financially? (Cash flow? Tax deadlines? Not understanding your numbers?)

- What do you actually need versus what sounds impressive?

- Are you looking for compliance or strategy? (Honest answer.)

2. Understand the Pricing Model

Fixed monthly fees provide predictability. You know costs upfront, can budget accurately, no surprise invoices when your accountant spends three extra hours sorting your mess.

Hourly rates offer flexibility for one-off projects—tax planning, HMRC dispute resolution, specific advisory work. But they’re dangerous for ongoing support because suddenly every email you send costs money, which creates this weird dynamic where you avoid asking questions to save fees, which defeats the entire purpose of having an accountant.

Most modern practices offer tiered packages: Basic (bookkeeping + returns), Standard (+ VAT + payroll), Premium (+ advisory + unlimited support). Choose based on what your business actually needs, not what sounds prestigious.

3. Verify They Understand MTD (Seriously)

Not all accountants are equally prepared for Making Tax Digital’s income tax rollout. Some are frantically upskilling. Others have been testing systems for months and can walk you through exactly what changes.

Ask specifically:

- Which MTD-compatible software do they use and recommend?

- How will they handle quarterly submissions?

- What’s their process for ensuring accuracy across four updates instead of one annual return?

- What happens if you miss a deadline?

If they get vague or defensive, that’s your answer. Cloud accounting expertise isn’t optional in 2026; it’s foundational.

The Chemistry Test: You’ll be sharing financial information with this person. Probably asking questions that make you feel awkward. Possibly panicking at 10 PM about a looming deadline. Choose someone you can actually talk to. Professional competence matters, but so does not dreading every interaction.

What “Proactive” Actually Means (Hint: Not What Most Firms Claim)

Every accounting firm’s website promises “proactive service.” Most mean “we’ll email you in December reminding you that January deadlines exist.” That’s not proactive. That’s… reactive with slightly better timing.

Genuinely proactive small business accounting services look like:

Spotting issues before they become crises. Noticing your cash flow is trending negative three months out. Flagging that you’re approaching the VAT threshold. Catching an expense pattern that might trigger HMRC interest.

Suggesting opportunities you haven’t considered. Capital allowances on equipment purchases. R&D tax credits (surprisingly accessible for small businesses). Salary-dividend optimization that saves £3,000 in tax. These are the conversations that transform accounting from cost centre to profit driver.

Actually reviewing your numbers regularly. Monthly? Quarterly at minimum. Not just filing returns but examining what the numbers mean. Why did profit margin drop? What’s driving that cash flow crunch? Should you be concerned about these receivables?

At firms like Ask Accountant (178 Merton High St, London SW19 1AY), proactive advisory includes things like helping businesses navigate the MTD transition, identifying tax planning opportunities throughout the year, and providing strategic input on growth decisions—not just filing forms and hoping for the best.

The MTD Compliance Roadmap (What You Actually Need to Do)

Alright, practical brass tacks. If MTD applies to you (or will shortly), here’s the actual process:

Step 1: Determine If You’re In Scope

Gross income from self-employment and/or UK property for 2024/25 tax year:

- Over £50,000? Must comply from 6 April 2026

- Over £30,000? Must comply from 6 April 2027

- Over £20,000? Must comply from 6 April 2028

Note: HMRC will notify you, but it’s your responsibility to check. “I didn’t get a letter” isn’t a valid defence.

Step 2: Choose MTD-Compatible Software

Must be HMRC-recognised for digital record-keeping and submissions. Options include full accounting packages (Xero, QuickBooks, etc.) or bridging software that connects spreadsheets to HMRC.

If you already work with an accountant, ask what they recommend. Most have preferred platforms they’re deeply familiar with.

Step 3: Sign Up for MTD

Complete this online registration before your start date. You can sign up early, which honestly? Smart move. Better to test the system when you’re not under deadline pressure.

Step 4: Submit Quarterly Updates

Four times yearly (roughly every three months), submit summaries of business income and expenses. Deadlines are fixed regardless of your accounting year-end:

| Quarter | Period Covered | Submission Deadline |

|---|---|---|

| Q1 | 6 April – 5 July | 5 August |

| Q2 | 6 July – 5 October | 5 November |

| Q3 | 6 October – 5 January | 5 February |

| Q4 | 6 January – 5 April | 5 May |

Step 5: File End of Period Statement and Final Declaration

After the tax year ends, submit:

- End of Period Statement (EOPS): Confirms your quarterly updates were accurate

- Final Declaration: Includes allowances, adjustments, and confirms total tax liability

Deadline: 31 January following the tax year end (same as current self-assessment)

Penalty Warning: MTD introduces a points-based penalty system. Each missed quarterly update = one point. Four points = £200 fine. Eight points = £400. Fifteen points = £1,000. Points reset annually if you stay compliant. This isn’t theoretical—HMRC has already rolled out similar penalties for MTD VAT.

Common Mistakes That Cost Small Businesses Thousands

After watching countless businesses navigate (and occasionally crash into) accounting challenges, patterns emerge. Here are the expensive ones:

Treating Accounting as Annual Event

The “shove everything in a box and deal with it in January” approach is dying. Good riddance. Real-time financial visibility isn’t a luxury; it’s how you avoid discovering in December that you’ve been operating at a loss since March.

MTD enforces this quarterly, but monthly reviews are ideal. Catch problems early, make course corrections, understand your business while you can still influence outcomes.

Mixing Personal and Business Finances

I know separation seems unnecessary when it’s just you. But the moment HMRC queries something, or you need financing, or you’re selling the business, that commingled account becomes a nightmare.

Separate accounts. Always. Professional bookkeeping becomes infinitely simpler when transactions are cleanly separated.

Ignoring Tax Planning Until It’s Too Late

Tax planning isn’t something you do in March. It’s year-round thinking about structure, timing, and opportunities.

That dividend you took in April? Different tax implications than if you’d taken it in March. Equipment purchase in December? Capital allowances. New hire in February? Research R&D credits. These decisions have tax consequences best considered before making them.

Assuming Cheapest Service Equals Best Value

A £50/month bookkeeper who misses deadlines, makes errors, and doesn’t understand your industry costs more than a £200/month service that handles everything correctly. The real cost isn’t the fee; it’s penalties, lost opportunities, and hours you spend fixing mistakes.

Industry-Specific Considerations (Because Not All Businesses Are Created Equal)

Construction and trades: CIS scheme compliance is non-negotiable. Subcontractor deductions, monthly returns, material vs labour distinctions—get this wrong and HMRC gets interested. Fast.

E-commerce: Multi-platform revenue tracking, inventory accounting, international VAT (yes, it’s complicated), payment processing fees. Generic bookkeeping doesn’t cut it.

Professional services: Work-in-progress accounting, fixed vs hourly billing, expense recoverability, potentially partnership structures. Different animals entirely.

Property landlords: Rental income reporting, mortgage interest restrictions, capital gains planning, repair vs improvement distinctions. Plus MTD applies to you too if gross rents exceed thresholds.

Point being: industry-specific expertise matters. An accountant brilliant at retail might be lost on property taxation. Choose accordingly.

The Questions You Should Actually Ask Prospective Accountants

Beyond “how much do you charge?” (though yes, ask that), here’s what separates good from mediocre:

- “How many clients in my industry do you serve?” – You want familiarity with your specific challenges and opportunities.

- “What’s your communication style?” – Email? Phone? Quarterly meetings? Make sure it matches your preferences.

- “How do you handle MTD quarterly submissions?” – Should have a clear process. If they seem uncertain, red flag.

- “What happens if I miss a deadline or need urgent help?” – Understand availability and emergency procedures upfront.

- “Can you provide references from similar businesses?” – Legitimate firms will happily connect you with satisfied clients.

- “What’s included in your standard fee versus what costs extra?” – Avoid hidden charges and scope creep surprises.

- “How do you stay current with tax law changes?” – Professional development, memberships, training. You want someone committed to continuous learning.

Ready to Sort Your Accounting Before MTD Deadlines Hit?

Whether you need straightforward bookkeeping or comprehensive advisory services, getting the right support now prevents expensive problems later. Ask Accountant offers tailored small business accounting services designed for the MTD era—from quarterly compliance to strategic tax planning.

Call +44(0)20 8543 1991 or visit us at 178 Merton High St, London SW19 1AY

Because accounting shouldn’t be the thing that keeps you awake at night. Running your business should.

Frequently Asked Questions About Small Business Accounting Services

Do I need an accountant if I use accounting software?

Software handles transaction recording brilliantly. But it doesn’t provide strategic advice, catch errors before they become HMRC issues, optimise your tax position, or explain why your profit is up but cash is down. For simple sole trader operations, software alone might suffice. For anything more complex, you want professional oversight.

Can I switch accountants mid-year?

Absolutely. Most switches happen during or just after year-end for simplicity, but you can change whenever. Your new accountant will contact your old one, request files, and handle the transition. Common reasons for switching: better service, better prices, better expertise in your industry, or you actually want someone who returns calls.

How do I know if my accountant is any good?

Good accountants proactively suggest tax-saving opportunities, explain things clearly without jargon, respond promptly to queries, never miss deadlines, and make you feel informed rather than confused. If you’re consistently surprised by your tax bill, unclear on your financial position, or dreading conversations with your accountant, those are warning signs.

What’s the difference between a bookkeeper and an accountant?

Bookkeepers handle daily transactions: recording income/expenses, bank reconciliation, invoice management. Accountants analyse financial data, prepare tax returns, provide strategic advice, handle HMRC communications, and make sense of what the numbers mean for your business. Many small business accounting services offer both, or bookkeepers work under accountant supervision.

What records do I need to keep for MTD?

Digital records of all business income and expenses, stored in MTD-compatible software. This includes sales invoices, purchase receipts, bank statements, and mileage logs if claiming vehicle expenses. Paper records are fine as source documents, but they must be digitally recorded. Spreadsheets can work if connected to HMRC via bridging software, though dedicated accounting platforms are more robust.

How long should I keep business records?

At least six years from the end of the tax year they relate to. HMRC can investigate up to six years back (20 years for deliberate errors). Most businesses keep seven years to be safe. Cloud accounting makes this easier since everything’s automatically stored and backed up.

Is it worth paying for business advisory services?

Depends on your goals. If you’re content maintaining status quo and just need compliance, probably not. If you want to grow, improve profitability, navigate complex decisions, or optimise tax efficiency, absolutely. Good advisory pays for itself—often many times over. A £2,000 advisory fee that identifies £10,000 in tax savings or prevents a £15,000 mistake? That’s not an expense, that’s an investment.

The Bottom Line (Literally and Figuratively)

Small business accounting services aren’t about forms and deadlines, though yes, those matter. They’re about understanding your business financially, making informed decisions, staying compliant without the stress, and—this bit’s crucial—having someone in your corner who cares about your success beyond their fee invoice.

The difference between businesses that thrive and those that merely survive often comes down to financial clarity. Knowing your numbers. Understanding your position. Making decisions based on data rather than guesses.

2026 brings MTD challenges, sure. But it also brings opportunities for businesses that get their accounting properly sorted. Real-time financial visibility. Better cash flow management. Proactive tax planning. Strategic growth support.

Because here’s what I’ve learned watching small businesses for years: the most successful aren’t necessarily the ones with the best products or the flashiest marketing. They’re the ones who understand their numbers and use them intelligently.

Your business deserves small business accounting services that do more than just tick compliance boxes. It deserves support that helps it grow, protects it from expensive mistakes, and gives you the confidence to make bold decisions.

The question isn’t whether you need professional accounting support. It’s whether you’re ready to stop treating it as a necessary evil and start using it as the strategic advantage it should be.

And possibly whether you’re ready to throw away that shoebox of receipts. (You are. Trust me.)