Here’s something nobody tells you when you’re starting out: hiring your first employee transforms you from a business owner into a pension provider overnight. Quite the promotion, isn’t it?

I remember chatting with a café owner in Wimbledon last year—brilliant baker, made these ridiculous cinnamon buns that had queues out the door—who’d just taken on her first part-timer. “I thought I was hiring someone to work the till,” she told me, looking slightly shell-shocked. “Turns out I’m now responsible for their retirement.” Welcome to auto enrolment, where the government decided that Britain’s retirement savings crisis was partly your problem to solve.

But here’s the thing: whilst auto enrolment might feel like bureaucratic overreach (and on Mondays, it definitely does), it’s actually transformed how millions of people save for retirement. Since 2012, workplace pension participation has rocketed from 47% to 88%. That’s 20.4 million people now putting something aside. Not nothing, is it?

Still, if you’re a small employer staring down your duties start date, none of that matters much when you’re trying to figure out whether your Saturday staff need enrolling or what the hell “qualifying earnings” actually means.

What Auto Enrolment Actually Demands From You

Let’s cut through the jargon. Auto enrolment requires every UK employer—yes, even if you’ve only got one employee working six hours a week—to automatically enrol eligible workers into a workplace pension scheme and chip in financially. There’s no minimum company size. If you employ people, you’re in.

The legislation doesn’t particularly care about your profit margins or cash flow concerns, though it does at least give you some breathing room with staged contribution rates. (More on those delightful numbers shortly.)

Who Gets Automatically Enrolled?

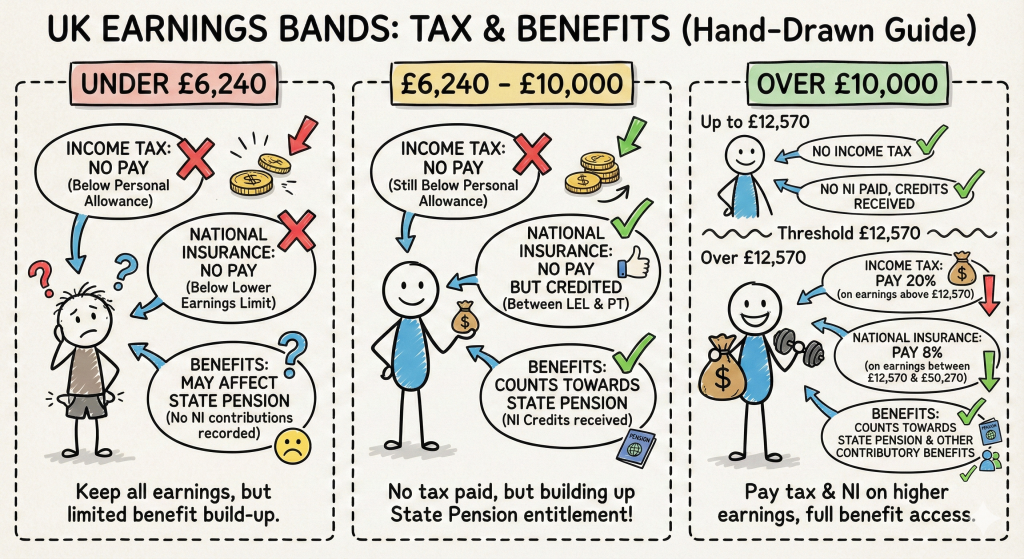

Your “eligible jobholders”—the people you must auto enrol—need to tick three boxes:

- Aged between 22 and State Pension age (currently 66, though that keeps creeping up)

- Earning at least £10,000 per year (or equivalent—works out to about £192 per week)

- Working in the UK (even if they travel abroad for work occasionally)

Here’s where it gets fiddly. Those under 22 or earning between £6,240 and £10,000? They’re “non-eligible jobholders.” They can ask to join, and you must let them—plus contribute on their behalf. People earning under £6,240 are “entitled workers.” They can join too, but you don’t have to contribute.

Reality check: Even your seasonal Christmas staff might be eligible. If they earn over £10,000 annually and meet the age criteria, they’re in—regardless of whether they’re temporary, part-time, or only work three months a year. The law doesn’t distinguish between your finance director and your holiday cover.

The Money Bit (Because Of Course It’s About Money)

Right, contributions. Since April 2019, the minimum total contribution sits at 8% of qualifying earnings. That’s split as:

- Employer: minimum 3%

- Employee: 5% (though with tax relief, they’re effectively paying 4%)

But what are “qualifying earnings”? Glad you asked. It’s a band of earnings between £6,240 and £50,270 for the 2025/26 tax year. You only calculate pension contributions on earnings within this bracket.

Let’s say someone earns £30,000. Their qualifying earnings are £30,000 minus £6,240, which equals £23,760. The 8% contribution applies to that £23,760—not their full salary.

| Annual Salary | Qualifying Earnings | Total Pension (8%) | Employer (3%) | Employee (5%) |

|---|---|---|---|---|

| £15,000 | £8,760 | £700.80 | £262.80 | £438 |

| £25,000 | £18,760 | £1,500.80 | £562.80 | £938 |

| £35,000 | £28,760 | £2,300.80 | £862.80 | £1,438 |

| £55,000 | £44,030 | £3,522.40 | £1,320.90 | £2,201.50 |

Some employers calculate differently—using “pensionable earnings” (basically the entire salary from £0). That’s fine too, as long as the minimum percentages are met and certain quality tests pass. Your pension provider will guide you here, though it’s worth having your accountant check the numbers if you’re going off-piste.

Choosing Your Poison (Pension Scheme, I Mean)

You’ve got options. Quite a few, actually, which sounds great until you’re comparing provider fees at 11pm on a Tuesday.

NEST (National Employment Savings Trust)

The government-backed scheme, designed specifically for auto enrolment. Free for employers, which is lovely. Employees pay a 1.8% contribution charge each time money goes in, plus a 0.3% annual management charge on the pot value.

NEST’s straightforward and designed for exactly this purpose. Perfect if you’ve got high staff turnover or lots of part-timers. The trade-off? Limited investment choice compared to fancier providers, and that 1.8% contribution charge adds up.

The People’s Pension

Run by B&CE, a not-for-profit with three decades of pension experience (primarily in construction). Around 0.5% annual management charge, with some employers getting rebates depending on their arrangement. Allows transfers in from other pensions—something NEST restricted until recently—and no cap on annual contributions.

More investment flexibility than NEST, including ethical and Sharia funds. Good middle ground between simplicity and choice.

NOW: Pensions

Backed by Danish pension specialists ATP. Monthly employer service charge (varies based on whether you’re direct or through a payroll bureau). Known for decent customer service, though fees can mount up depending on your setup.

Others Worth Considering

Smart Pension, Cushon (by NatWest), and various providers like Aviva or Royal London offer workplace pensions. Some have employee minimums (often five staff), others charge setup fees. Most modern providers integrate with cloud payroll systems—a godsend if you’re already using Xero or QuickBooks.

Choosing advice: If you’re genuinely stumped, NEST exists precisely for this scenario. It’s not glamorous, but it ticks the compliance boxes and won’t bankrupt you. Once you’ve got more headcount or fancy offering enhanced benefits, you can always switch providers.

Your Ongoing Duties (Because It Never Really Ends)

Setting up auto enrolment isn’t a one-off task. Oh no. You’ve got perpetual obligations:

Continuous assessment: You need to regularly check whether employees have become eligible—turned 22, got a pay rise that tips them over £10,000, whatever. When they cross that threshold, you auto enrol them.

Re-enrolment every three years: Even staff who opted out get automatically enrolled again. It’s the government’s way of nudging people who might’ve changed their minds. You must do this within a certain window around your “re-enrolment date” (typically your duties start date plus three years).

Record keeping: Six years minimum. Who was enrolled, when, contribution amounts, opt-out requests—all of it. The Pensions Regulator can audit you, and if your records are pants, the fines escalate quickly.

Declarations of compliance: Within five months of your duties start date, you submit a declaration to the Pensions Regulator confirming you’ve done everything properly. Miss that deadline, and enforcement action starts.

Postponement: Your Secret Weapon

One genuinely useful provision: you can postpone auto enrolment for up to three months. Handy for seasonal workers who might not stick around or new starters who haven’t hit their probation yet.

You must notify them in writing within six weeks. During postponement, if they ask to opt in, you’ve got to enrol them immediately and backdate contributions. But for managing cash flow or avoiding admin for short-term hires, postponement’s a lifesaver.

When Things Go Wrong: Penalties That’ll Make You Wince

The Pensions Regulator doesn’t mess about. They’ve used enforcement powers over 500,000 times in the past decade. Here’s what you’re risking:

| Penalty Type | Amount | When It Applies |

|---|---|---|

| Fixed Penalty Notice | £400 | Failure to comply with statutory notice or breach of law |

| Escalating Penalty Notice | £50 to £10,000/day | Continued non-compliance (amount depends on staff numbers) |

| Unpaid Contributions Notice | Varies | When pension provider reports missing payments |

| Prohibited Recruitment Conduct | £1,000 to £5,000 | Offering incentives to opt out or discriminating against joiners |

Criminal offences exist too: Wilfully failing to enrol eligible staff or knowingly providing false information can land you in court. Maximum penalty? Two years in prison or unlimited fines. They’re not joking around.

If you comply late, you must backdate contributions to when the employee first became eligible. That includes your employer contributions and the employee’s—unless you fancy paying theirs too (which, legally, you can do).

Communication: The Bit Most People Botch

Within six weeks of enrolling someone, you must write to them explaining:

- That they’ve been auto enrolled

- Which pension scheme they’re in

- How much you and they are contributing

- How to opt out if they want (and the one-month window to get contributions refunded)

- What happens if they don’t opt out

Most decent pension providers supply template letters. Use them. Don’t try writing your own unless you enjoy compliance headaches.

The Opt-Out Window

Employees have one month from enrolment to opt out and receive a full refund of contributions. After that month, they can still leave, but contributions already made stay in the pension pot.

You cannot—absolutely cannot—encourage opting out. No hints, no nudges, no “well, you could always opt out if money’s tight” comments. That’s prohibited recruitment conduct, and it’ll cost you.

Practical Realities From Someone Who’s Seen This Go Sideways

Theory’s lovely. Practice is messier. A few things I’ve learned from clients navigating auto enrolment:

Payroll integration matters enormously. If your payroll software doesn’t talk to your pension provider, you’re manually uploading contribution files every month. It’s tedious, error-prone, and the kind of task you’ll forget when you’re busy. Cloud-based systems like Xero with built-in pension feeds are worth their weight.

Small margins hurt more. That 3% employer contribution sounds manageable until you’re a hospitality business running on 8% net margins. Suddenly it’s a material cost. Factor it into pricing and wage budgets from day one.

Communication prevents opt-outs. When staff understand what they’re getting—free money from you, tax relief from the government, compounding growth over decades—they’re likelier to stay enrolled. Frame it as a 3% pay rise they can’t touch yet, because that’s essentially what it is.

Re-enrolment sneaks up on you. Three years feels distant until you get an email from the Pensions Regulator reminding you it’s due in a fortnight. Set calendar reminders well in advance.

“I thought auto enrolment was a setup-and-forget thing,” one client told me. “Then I missed my re-enrolment date by three weeks and got slapped with a fixed penalty. Cost me £400 for forgetting one admin task.”

Working With Advisers (Or Going It Alone)

Can you handle auto enrolment yourself? Absolutely. The Pensions Regulator provides step-by-step guidance, and most pension providers offer support.

Should you? Depends on your confidence with payroll admin and your tolerance for regulation. If numbers aren’t your thing or you’ve already got a full plate, getting help makes sense.

At Ask Accountant, we handle auto enrolment setup and ongoing compliance as part of our payroll management services. We’ll assess your staff, choose an appropriate provider, handle declarations, and remind you about re-enrolment dates. It’s the sort of thing that sounds simple until you’re doing it at scale.

The beauty of outsourcing? You’re not suddenly Googling “what’s qualifying earnings” at midnight when your first employee starts Monday. Plus, when legislation changes—and it will—your adviser updates processes without you needing to read Government white papers.

Getting Auto Enrolment Right

If auto enrolment feels overwhelming, you’re not alone. Most small employers find the setup straightforward but the ongoing compliance fiddly. That’s where we help.

Ask Accountant offers full auto enrolment support, from scheme selection to declaration filing. Based in Merton High Street, we work with small businesses across London who need reliable, straightforward auto enrolment services without the corporate fluff.

Call us on +44(0)20 8543 1991 or visit us at 178 Merton High St, London SW19 1AY. We’ll sort out your pension duties so you can focus on actually running your business.

Frequently Asked Questions About Auto Enrolment

Do I need auto enrolment if I’m a sole director with no employees?

No. Limited companies with a single director and no other staff are exempt. The moment you employ someone else—even part-time—auto enrolment duties kick in.

What if my employee earns £9,500 one month then £11,000 the next?

You assess eligibility based on pay reference periods (usually monthly if they’re paid monthly). If they cross the £10,000 annual threshold when annualised, they become eligible. Your payroll system should flag this automatically if it’s set up properly.

Can I use my existing pension scheme for auto enrolment?

Possibly. It needs to be a “qualifying scheme” that meets certain criteria—mainly around minimum contribution levels and governance. Many older schemes don’t qualify, but it’s worth checking with your provider.

What happens if someone opts out, then changes their mind?

They can opt back in, but only once every 12 months. You must facilitate their joining and make contributions from that point. However, they’ll be auto-enrolled again at your three-yearly re-enrolment anyway.

Do I need separate schemes for different types of workers?

No. One scheme can cover everyone—full-time, part-time, temporary staff, the lot. As long as it’s a qualifying scheme, it works for all eligible jobholders.

What if I can’t afford the 3% contribution?

That’s legally tough. The contribution’s mandatory for eligible staff. You might need to rethink wage structures or pricing, but cutting the pension contribution isn’t an option. Some businesses increase prices slightly or factor pension costs into quotes.

Alternatively, consider whether staff are genuinely eligible. If someone’s earning £9,800, they’re not automatically enrolled—though they can still opt in voluntarily, at which point you’d have to contribute.

Can I delay auto enrolment if I’m struggling financially?

You can use postponement (up to three months) when someone first becomes eligible. Beyond that, no. Financial difficulty doesn’t exempt you from pension duties. The Pensions Regulator might offer payment plans for penalties if you fall behind, but that’s addressing non-compliance, not avoiding duties.

The Bigger Picture (And Why This Matters)

Look, auto enrolment’s a faff. No denying it. But step back, and the policy’s actually achieved something remarkable: it’s dragged millions of people into pension saving who’d never have bothered otherwise. Inertia’s powerful, and auto enrolment weaponises it for good.

For small businesses, sure, it’s another cost. But it’s also become table stakes. Try recruiting decent talent whilst offering no pension, and watch them choose your competitor who does. Workplace pensions aren’t perks anymore—they’re baseline expectations.

Plus, there are tax benefits. Employer pension contributions are allowable business expenses, reducing your Corporation Tax. Employees get tax relief on their contributions too. It’s not a pure cost; there’s some offset.

Looking Ahead: Potential Changes

Legislation rarely sits still. There’s ongoing discussion about lowering the auto enrolment age from 22 to 18 and removing the £6,240 lower earnings threshold. Both would expand pension coverage but increase employer costs.

The 2025 Budget included some changes to salary sacrifice arrangements, which can affect how pension contributions are structured. (Salary sacrifice lets employees exchange salary for higher employer pension contributions, saving on National Insurance—both employee and employer.) These details shift periodically, so staying informed helps.

If substantial changes hit, your pension provider and accountant should keep you updated. But the core auto enrolment framework’s unlikely to disappear. It’s too politically embedded now.

Final Thoughts: Just Get It Done

Auto enrolment feels daunting until you’ve done it once. Then it’s just another piece of admin that ticks along in the background—assuming you’ve set it up properly.

The key moves:

- Choose a pension provider early. Don’t leave it until your duties start date.

- Integrate with payroll properly. Manual processes create errors.

- Communicate clearly with staff. Answer questions, explain benefits, don’t hint at opt-outs.

- Keep records meticulously. Six years minimum, everything documented.

- Set re-enrolment reminders. Three years goes quickly.

- Submit declarations on time. Penalties start with missed paperwork.

Most importantly, don’t bury your head in the sand. The Pensions Regulator will find you eventually, and penalties mount frighteningly fast. Better to deal with auto enrolment head-on from the start.

And if you need support—whether that’s initial setup, ongoing compliance, or just someone to explain what “qualifying earnings” means in plain English—we’re here. At Ask Accountant, we’ve guided countless small employers through auto enrolment without the drama. Our business advice and bookkeeping services already help London businesses stay compliant with HMRC. Auto enrolment’s just another part of that picture.

Because honestly? Running a business is complicated enough without pension regulations keeping you up at night.