Here’s something they don’t tell you at those business networking events: auto enrolment smart pension compliance isn’t just another tick-box exercise. Last year, The Pensions Regulator took enforcement action against 157,142 employers. Read that number again.

Most business owners think they’ve sorted their workplace pension once they’ve signed up with a provider. Then – usually at the worst possible time, when cash flow’s tight or you’re knee-deep in an HMRC inspection – you discover you’ve been non-compliant for months. The Pensions Regulator doesn’t send friendly reminders. They send £400 fixed penalty notices that escalate daily if you ignore them.

I’ve watched companies crumble under the weight of what they thought would be “simple pension admin”. But here’s the thing: auto enrolment smart pension compliance doesn’t have to be a nightmare if you actually understand what’s required beyond the marketing brochures.

What Even Is This Auto Enrolment Thing? (And Why Should You Care)

Since 2012, every UK employer – yes, even if you’ve only got one employee – must automatically enrol eligible workers into a qualifying workplace pension scheme. The legislation came from the Pensions Act 2008, back when someone in Westminster decided the country was catastrophically under-saving for retirement.

Were they right? Probably. The State Pension sits at £230.25 a week. Try living on that in London. Or anywhere, really.

The auto enrolment smart pension system works like this: if your employees meet certain criteria (more on that shortly), you must enrol them into a pension scheme within three months. Both you and the employee contribute. The employee can opt out, but you can’t encourage them to do so – that’s illegal, and yes, employers have been fined for it.

Reality Check: Even if all your staff opt out, you still have duties. You must complete a declaration of compliance with The Pensions Regulator. Failure to do this? £400 fine. No exceptions, no excuses.

The 2025 Numbers That Actually Matter

Let’s cut through the jargon. For the 2025/26 tax year, here’s what you need to burn into your brain:

| Category | Threshold | What It Means |

|---|---|---|

| Earnings Trigger | £10,000 per year | Anyone earning more than this gets auto-enrolled (if other criteria met) |

| Lower Earnings Limit | £6,240 per year | Contributions calculated on earnings above this amount |

| Upper Earnings Limit | £50,270 per year | Contributions calculated up to this amount |

| Age Range | 22 to State Pension age | Must be within this age bracket for automatic enrolment |

| Minimum Total Contribution | 8% of qualifying earnings | 3% employer minimum, 5% employee (including tax relief) |

These thresholds stayed frozen from 2024/25, which the government justified by saying it helps “ensure everyone who is automatically enrolled would continue to pay contributions on a meaningful proportion of their income.” Translation: they didn’t want to mess with a system that’s finally working.

Who Gets Enrolled? (The Three Categories Nobody Explains Properly)

Eligible Jobholders: Age 22 to State Pension age, earning over £10,000 annually. These people must be auto-enrolled. Non-negotiable.

Non-Eligible Jobholders: Either aged 16-21 or State Pension age to 74, earning over £10,000. Or anyone aged 16-74 earning £6,240-£10,000. They can opt in and you must contribute if they do.

Entitled Workers: Earning under £6,240 per year. Can join voluntarily but you don’t have to contribute.

Here’s where it gets messy: if someone’s earnings fluctuate – bonuses, overtime, statutory pay – their status can change mid-year. Payroll management becomes crucial because you need to reassess eligibility constantly.

Smart Pension vs “Just Any Pension”: Does It Matter?

You might be wondering whether Smart Pension specifically has advantages for auto enrolment smart pension compliance. Smart Pension is one of the UK’s largest master trusts, with over £8.5 billion in assets under management and 1.5 million members as of late 2025.

Their selling point? Technology. Their Keystone platform automates most of the compliance headaches – contribution uploads, member communications, regulatory reporting. They charge 0.30% annually plus £1.75 monthly (waived for accounts under £100).

But here’s what matters more than the provider you choose: whether your auto enrolment smart pension scheme is a qualifying pension scheme. Your scheme must meet minimum quality standards or The Pensions Regulator will have your head on a spike.

Compliance Trap: Some employers think “we’ve got a pension scheme” equals “we’re compliant”. Wrong. Your scheme must be certified as meeting auto-enrolment requirements. You need to renew this certification every 18 months maximum. Miss it? You guessed it – enforcement action.

The Declaration Nobody Remembers to File

Within five calendar months of your staging date (or your first employee’s start date), you must complete a declaration of compliance via The Pensions Regulator’s online portal. Every. Single. Employer. Even if nobody was enrolled.

Then, every three years, you do it again – the re-declaration of compliance. This coincides with your re-enrolment duties (more on that nightmare in a moment).

The First-tier Tribunal has heard countless appeals from employers who claim they “never received” reminder letters from The Pensions Regulator. The tribunal’s response? There’s a legal presumption that correspondence sent to your registered office was received. You’re liable whether you opened your post or not.

For businesses handling multiple compliance requirements, professional business advice can be the difference between staying compliant and facing escalating penalties.

Re-Enrolment: The Gift That Keeps On Giving

Every three years, you must re-assess all employees who opted out and automatically re-enrol anyone who now meets the eligibility criteria. This is a legal obligation, not a suggestion.

Here’s the cruel twist: even if you have zero employees to re-enrol, you still must complete the re-declaration of compliance. Companies have been fined for failing to do this despite having nobody to re-enrol.

Set calendar reminders. Tattoo the date on your forearm if necessary. This is one of those compliance requirements that feels bureaucratic and pointless until The Pensions Regulator sends you an escalating penalty notice.

When The Pensions Regulator Comes Knocking

The Pensions Regulator isn’t playing anymore. They’ve returned to large-scale in-person spot checks, targeting Greater Manchester, Nottingham, Greater London, and Belfast specifically. Research suggests 74% of spot checks uncover breaches.

| Penalty Type | What Triggers It | Consequence |

|---|---|---|

| Fixed Penalty Notice | Failure to comply with a compliance notice | £400 (immediately) |

| Escalating Penalty | Continued non-compliance after fixed penalty | £50-£10,000 per day |

| Unpaid Contribution Notice | Missing or late pension contributions | Contributions due + RPI + 4.2% interest |

| Criminal Offence | Refusing inspector entry or hindering inspection | £400+ fine, potential prosecution |

One employer appealed a penalty claiming financial difficulties from Covid made pension contributions impossible. The tribunal’s response was brutal: “Pension contributions are not an optional duty that can be ignored during times of financial difficulty.”

Translation: pay your employees’ pensions before you pay yourself. Before you pay suppliers. Before anything.

The Mistakes That Cost Businesses Thousands

Common errors The Pensions Regulator finds repeatedly:

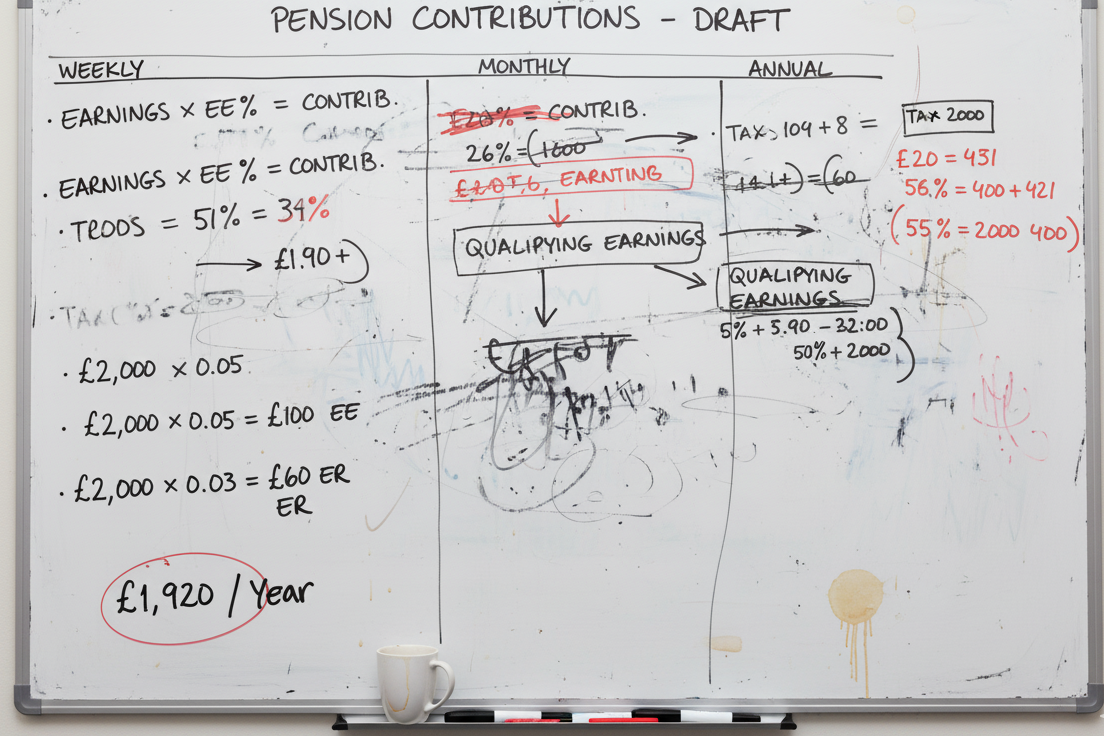

Miscalculating contribution rates. If you’re using qualifying earnings (£6,240 to £50,270), you need different calculations for weekly, monthly, and annual-paid employees. Get this wrong and you’re underpaying – which means backdated payments plus interest.

Not starting contributions on the correct date. Contributions must start from the employee’s auto-enrolment date or postponement date. Miss this by even one pay period and you’ve got unpaid contributions.

Missing employee status changes. Someone turns 22? Their earnings increase over £10,000? They’ve been with you three months now? Each of these triggers reassessment. Professional bookkeeping services track these changes automatically.

Using the wrong contribution basis without certification. Some schemes calculate contributions on total earnings rather than qualifying earnings. Fine – but you need to complete a certification process every 18 months proving your scheme still meets the quality standards.

But here’s the error that absolutely floors me: employers telling employees to opt out. This is explicitly illegal. Some do it anyway, thinking nobody will notice. The Pensions Regulator notices. Employees can bring tribunal claims for detriment or unfair dismissal related to auto-enrolment. You’re risking everything.

Making This Actually Work (Without Losing Your Mind)

First: integrate your payroll and pension systems. Manual uploads of contribution data are where mistakes happen. Most modern payroll software connects directly to auto enrolment smart pension providers.

Second: conduct quarterly compliance audits. Check that contributions actually reached the pension scheme. Verify employees’ categories haven’t changed. Confirm your certification is current. At Ask Accountant, we’ve seen businesses avoid thousands in penalties simply by implementing quarterly checks.

Third: understand the payment deadlines. Contributions must reach the pension scheme by the 22nd of the month following deduction (19th if paying by cheque – though honestly, if you’re still using cheques for this in 2026, we need to talk). Miss this deadline and you’re looking at unpaid contribution notices plus interest.

Fourth: keep immaculate records. The Pensions Regulator can request evidence of compliance going back years. Document everything – enrolment dates, opt-out requests, contribution calculations, communications sent to employees.

Pro Tip: Set up three-year recurring calendar alerts for re-enrolment and re-declaration. Not annual reminders – three-year ones timed precisely to your staging date. This single action prevents more penalties than anything else.

What About Salary Sacrifice? (The Smart Pension Angle)

SMART pensions – that’s Salary-sacrifice, Management, and Risk-free Tax-efficient (not to be confused with Smart Pension the provider) – allow employees to exchange salary for employer pension contributions. Both parties save on National Insurance.

At current rates (15% employer NIC, 8% employee NIC below £50,270), the savings are substantial. An employee earning £25,000 contributing the minimum 5% saves roughly £100 annually in NIC. The employer saves about £187.50.

But here’s the catch: the 2025 Budget restricted salary sacrifice benefits. From April 2029, pension contributions via salary sacrifice above £2,000 will be liable for NIC. Still worth doing for most employees, but the calculations get more complex.

Also watch out for National Minimum Wage implications. If salary sacrifice reduces someone’s pay below NMW, you’re non-compliant. This is a surprisingly common error with lower-paid employees.

The Provider Question Everyone Asks

Should you use Smart Pension specifically for your auto enrolment smart pension scheme? Here’s the honest answer: it depends on your business size and complexity.

Smart Pension works well for:

- Businesses wanting minimal administrative burden – their automation is genuinely good

- Companies with fluctuating workforce sizes – the technology handles scaling

- Employers who value sustainable investing – their 15% allocation to private markets including green energy is distinctive

- Organisations needing extensive payroll integrations – they connect with major providers seamlessly

Potential limitations:

- The £1.75 monthly charge adds up across large workforces (though it’s waived for small accounts)

- Investment choice is limited compared to some competitors – 18 funds sounds like a lot until you compare it to platforms offering hundreds

- Transfer-out processes can take 12+ weeks, which frustrates employees leaving the company

NEST (National Employment Savings Trust) remains the government-backed default option. Lower charges (0.3% + 1.8% on contributions), but some employers find the platform less intuitive.

The right choice? Whichever provider your auto-enrolment specialist recommends after assessing your specific workforce demographics and payroll setup. This isn’t a decision to make based on a comparison website.

When Things Go Wrong (And How to Fix Them)

Received a compliance notice from The Pensions Regulator? Don’t panic. Don’t ignore it either.

You typically have 28 days to respond. Within that period:

- Conduct an immediate audit of your auto enrolment smart pension compliance – contribution records, enrolment dates, scheme certification status

- Identify exactly what’s wrong (often it’s not what The Pensions Regulator thinks it is)

- Fix the compliance breach immediately

- Document everything you’ve done to remedy the situation

- Respond formally within the deadline with evidence of corrective action

Many compliance notices get resolved without penalties if you act fast and comprehensively. The Pensions Regulator’s stated aim is maximising compliance, not collecting fines. They actually want you to sort it out.

But if you’ve received an unpaid contribution notice or escalating penalty notice? Get professional advice immediately. These have strict appeal deadlines and complex legal requirements. Appealing to the First-tier Tribunal isn’t a DIY project.

The Re-Enrolment Date Crisis

This deserves its own section because it catches everyone eventually. Your re-enrolment date is exactly three years from your staging date. Not approximately. Exactly.

If your staging date was 1 April 2022, your re-enrolment date is 1 April 2025. You have a six-month window starting from that date to complete re-enrolment. But the re-declaration of compliance? That’s due within five months of your re-enrolment date.

Most employers miss this timing. They complete re-enrolment at month five, then scramble to file the re-declaration before month five ends. Better approach: handle re-enrolment in month one or two, file the re-declaration immediately, then relax.

Here’s what’s genuinely helpful: The Pensions Regulator allows you to choose any date within that six-month window as your re-enrolment date. Pick a date that suits your payroll cycle. Document it. Use it consistently every three years.

What The Future Holds (Spoiler: More Complexity)

The Pensions (Extension of Automatic Enrolment) Act 2023 gave the government powers to lower the auto-enrolment age from 22 to 18 and remove the lower earnings limit entirely. These changes haven’t been implemented yet – the Labour government is “considering if and when to make changes”, balancing improved pension outcomes against effects on low earners.

If implemented, this will dramatically increase the number of workers you must enrol and the contribution calculations you must perform. More complexity, more compliance burden, more potential for errors.

Additionally, there’s growing pressure to increase minimum contribution rates beyond 8%. The Institute for Fiscal Studies argues current levels are inadequate for retirement security. If that happens, expect employee resistance to opt-in rates and potentially higher opt-out percentages.

For employers already stretched thin managing tax compliance requirements, this feels like another burden. But early preparation – building robust systems now, ensuring payroll integration works flawlessly, maintaining meticulous records – will make future changes manageable rather than catastrophic.

The Bottom Line: Compliance Isn’t Optional

Let me be brutally honest with you. Auto enrolment smart pension compliance isn’t sexy. It doesn’t generate revenue. It won’t appear in your company’s achievements list.

But it’s the difference between a business that survives regulatory scrutiny and one that faces escalating penalties, potential tribunal claims, and catastrophic reputational damage when The Pensions Regulator publishes your enforcement action.

The employers who treat this seriously – who invest in proper systems, who conduct regular audits, who don’t view compliance as an afterthought – save thousands in penalties and countless hours in crisis management.

If you’re in London SW19 and you need someone to actually explain your auto-enrolment obligations without the jargon? Call Ask Accountant at +44(0)20 8543 1991. We’re located at 178 Merton High St, and we specialise in making compliance manageable for businesses that would rather focus on, you know, actually running their business.

Because here’s what I’ve learned after years of untangling these situations: the businesses that delegate compliance to specialists aren’t the ones getting penalty notices. They’re the ones sleeping soundly, knowing their auto enrolment smart pension obligations are handled professionally, comprehensively, and correctly.

And honestly? That peace of mind is worth substantially more than £400.