Here’s something that’ll make you pause mid-sip of your morning coffee: the average UK business owner loses £3,847 annually to avoidable capital gains tax mistakes. Not through fraud or deliberate evasion—just through the mundane reality of not knowing what they don’t know.

I’ve watched countless entrepreneurs celebrate their “big exit” only to discover weeks later that their celebration was premature. That property sale? The business asset disposal? Even selling company shares to a partner? Each transaction potentially triggers capital gains tax implications that can turn a profitable quarter into a financial headache.

The question isn’t whether you need professional help—it’s whether you can afford not to have a capital gains tax accountant near me in your corner. Distance matters more than you think, and I’ll explain why shortly.

When Capital Gains Tax Becomes Your Business’s Silent Profit-Killer

Capital gains tax doesn’t announce itself with fanfare. It lurks in the shadows of every significant business transaction, waiting to claim its share of your success.

Consider this: you’ve built your consultancy from scratch, worked 60-hour weeks for three years, and finally decide to sell. The buyer offers £200,000—a life-changing sum. But here’s what your excitement might have overlooked: depending on your circumstances, HMRC could claim up to £36,000 of that windfall through capital gains tax.

The transactions that typically catch business owners off-guard include:

- Selling business premises

- Disposing of company shares

- Transferring business assets between entities

- Partnership changes involving asset redistribution

- Intellectual property sales

Each scenario carries different tax implications, relief opportunities, and timing considerations that can dramatically affect your bottom line.

The £36,000 Question: Are You Overpaying?

Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) can reduce your capital gains tax rate to just 10% on qualifying disposals up to £1 million lifetime limit. Sounds straightforward? It’s anything but.

The qualifying conditions read like legal poetry—beautiful in theory, Byzantine in practice. You need to prove you’ve owned at least 5% of ordinary share capital, held voting rights, and been actively involved in the business for at least two years before disposal. Miss one criterion by a day, and you’re facing the standard 20% rate instead.

That’s where the expertise of a capital gains tax accountant becomes invaluable. They don’t just calculate numbers—they architect tax strategies.

Why “Near Me” Isn’t Just About Convenience

“Can’t I just use any accountant?” you might wonder. “Surely tax law is the same everywhere?”

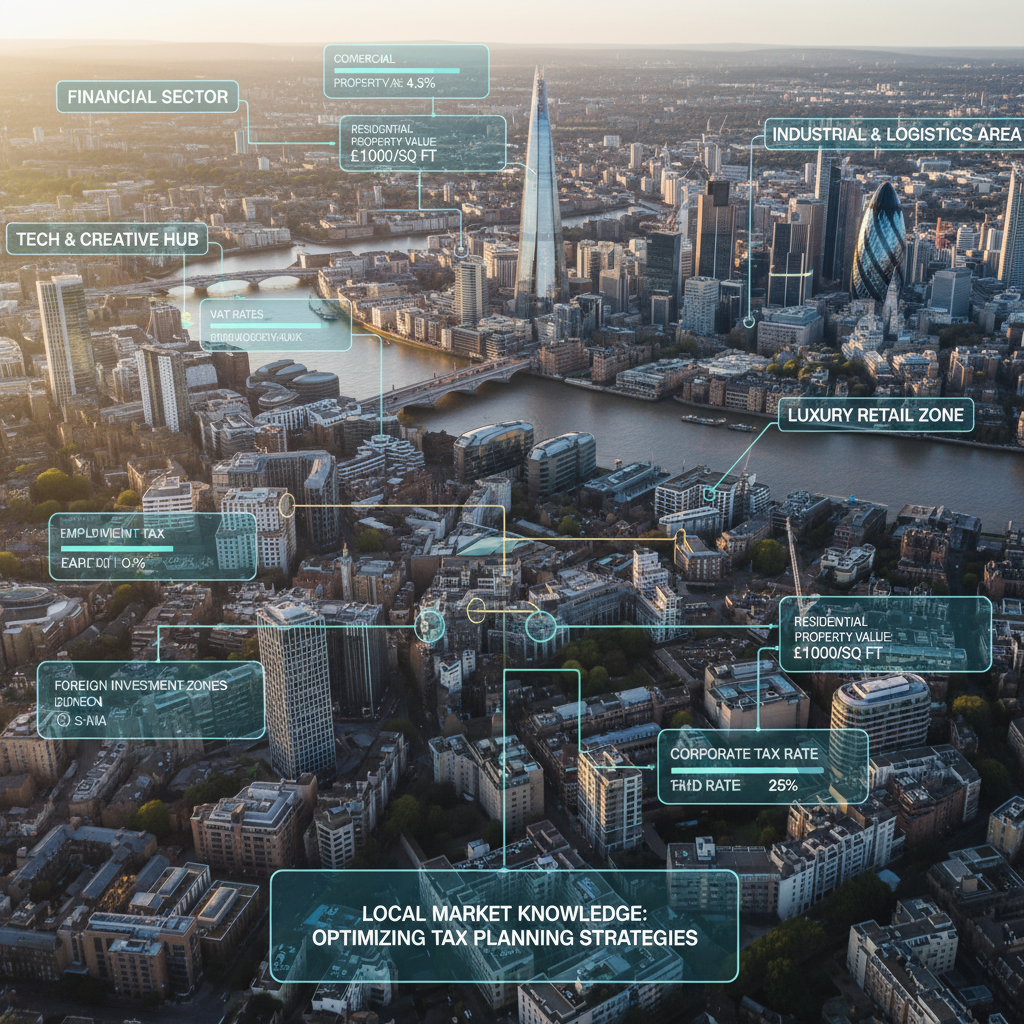

Well, yes and no. While HMRC’s rules apply nationwide, the practical application varies dramatically based on local business ecosystems, property markets, and industry concentrations.

Take London’s fintech sector versus Manchester’s manufacturing base. A capital gains tax accountant near me who understands your local market dynamics can spot opportunities that a distant practitioner might miss entirely.

Local expertise translates into tangible benefits:

- Market-specific valuations: Understanding local property trends affects asset disposal timing

- Industry knowledge: Sector-specific reliefs and considerations

- Network access: Connections with local solicitors, surveyors, and other professionals

- Regulatory awareness: Local authority interactions and compliance requirements

When Ask Accountant works with London-based businesses from their Merton High Street location, they’re not just applying generic tax knowledge—they’re leveraging deep understanding of the capital’s unique business landscape.

The Hidden Costs of DIY Capital Gains Tax Calculations

Here’s a confession: I once tried to calculate my own capital gains tax liability using HMRC’s online guidance. Three hours later, I had a migraine, seven different potential answers, and absolutely no confidence in any of them.

The issue isn’t that the information isn’t available—it’s that it’s scattered across dozens of guidance notes, each with exceptions, exemptions, and edge cases that would make a philosophy professor weep.

Consider these seemingly simple questions that actually require expert interpretation:

- “When exactly did I acquire this asset?”

- Original purchase date?

- Date of substantial improvement?

- Market value at a specific reconstruction event?

- “What’s the correct disposal value?”

- Sale price minus costs?

- Market value if it’s a connected party transaction?

- Deemed disposal value for certain corporate events?

Each answer affects your tax liability, sometimes by thousands of pounds.

The Timing Trap That Catches Everyone

Capital gains tax operates on an annual exemption basis—currently £6,000 for individuals in the 2023-24 tax year. Many business owners assume this means they can spread disposals across tax years to maximize their exemptions.

Sometimes that works brilliantly. Sometimes it backfires spectacularly.

I know a property developer who delayed completing a sale by six weeks to push it into the next tax year, hoping to claim another annual exemption. What she didn’t realize was that the delay meant missing out on Business Asset Disposal Relief because her qualifying period would reset. The “smart” timing strategy cost her £18,000.

A capital gains tax accountant near me would have spotted this trap immediately.

Understanding the Relief Landscape (It’s More Complex Than You Think)

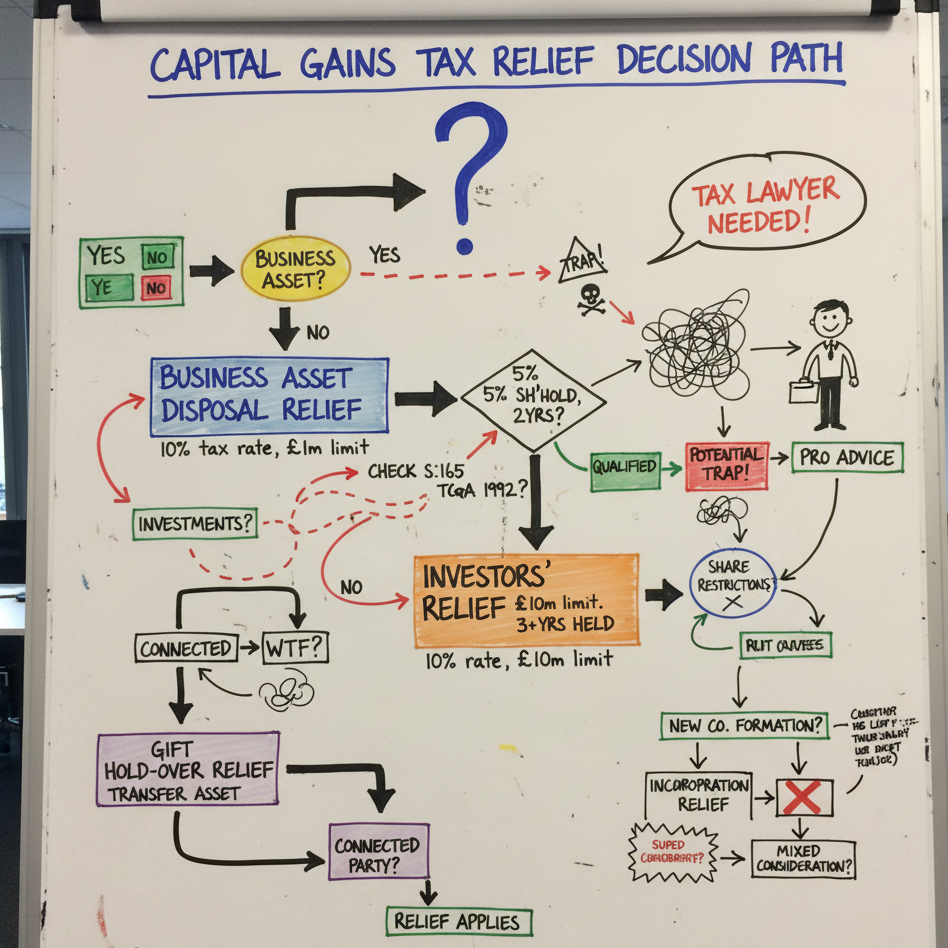

Business Asset Disposal Relief grabs most of the headlines, but it’s just one piece of a much larger puzzle. The relief landscape includes numerous other opportunities that most business owners never discover:

| Relief Type | Maximum Benefit | Key Conditions | Common Pitfalls |

| Business Asset Disposal Relief | 10% tax rate up to £1m lifetime | 5% shareholding, 2-year ownership, active involvement | Timing the qualification period |

| Investors’ Relief | 10% tax rate up to £10m lifetime | New ordinary shares, held 3+ years, qualifying company | Share class restrictions |

| Rollover Relief | Complete deferral of gain | Reinvestment in qualifying business assets within 3 years | Asset qualification rules |

| Gift Hold-Over Relief | Transfer liability to recipient | Gift of business asset or chargeable asset | Connected party implications |

| Incorporation Relief | Defer gains on business transfer to company | Transfer whole business, receive shares | Mixed consideration complications |

The table above barely scratches the surface. Each relief has subcategories, exceptions, and interaction effects that can dramatically change your tax position.

Take Rollover Relief, for example. Most business owners know they can defer capital gains by reinvesting disposal proceeds into new business assets. What they don’t realize is that the timing requirements are stricter than a Swiss train schedule—you generally need to acquire the replacement asset between one year before and three years after the disposal.

But here’s where it gets interesting: partial reinvestment creates partial relief, and the calculations involve more variables than a weather forecast. Get it wrong, and you could find yourself with an unexpected tax bill years later.

The Valuation Minefield: When “Fair Value” Isn’t Fair at All

Asset valuation for capital gains purposes seems straightforward until you encounter your first connected party transaction. Suddenly, “fair value” becomes a philosophical debate with real financial consequences.

Connected party transactions occur more often than you’d expect:

- Selling shares to existing business partners

- Transferring assets between related companies

- Family business restructuring

- Management buyouts involving existing directors

In these situations, HMRC doesn’t care what you actually received—they want to know the asset’s market value. Determining that value often requires professional valuations, market comparisons, and detailed documentation that costs time and money.

But here’s the kicker: getting the valuation wrong doesn’t just affect your current tax bill. It also affects the buyer’s acquisition cost for future capital gains calculations. One mistake can create a cascade of problems for years to come.

The Documentation Dilemma

I learned this lesson the expensive way. When restructuring a partnership several years ago, we thought we’d been thorough in documenting our asset transfers. We had agreements, we had calculations, we even had a nice folder with everything organized alphabetically.

What we didn’t have was the specific documentation HMRC wanted to see. During a later enquiry, they questioned our valuation methodology, our timing assumptions, and our interpretation of certain contractual terms. Three months of back-and-forth correspondence later, we ended up paying additional tax plus interest and penalties.

A capital gains tax accountant near me would have known exactly what documentation HMRC expects and ensured we had it from day one.

Planning Strategies That Actually Work (And Some That Don’t)

Tax planning advice often sounds clever in theory but falls apart under scrutiny. I’ve seen business owners implement elaborate schemes that looked brilliant on paper but crumbled when tested against real-world complications.

Effective strategies focus on fundamentals:

- Timing optimization: Spreading disposals across tax years while maintaining relief eligibility

- Relief stacking: Combining multiple reliefs where legislation permits

- Loss harvesting: Realizing allowable losses to offset gains

- Spousal transfers: Utilizing both partners’ annual exemptions and rate bands

The devil, as always, lives in the details.

Consider loss harvesting—the practice of realizing capital losses to offset gains. Sounds simple: sell underperforming assets, crystallize the loss, reduce your overall tax bill. But the 30-day rule means you can’t repurchase the same asset within 30 days, or the loss becomes disallowed. And “same asset” has a broader definition than you might expect.

When Smart Planning Becomes Tax Avoidance

There’s a fine line between legitimate tax planning and arrangements that HMRC might challenge as artificial avoidance. The General Anti-Abuse Rule (GAAR) gives HMRC broad powers to counteract transactions that lack commercial substance.

Professional guidance from a capital gains tax accountant near me becomes essential when exploring the boundaries of acceptable planning. They understand not just what’s technically possible, but what’s likely to survive HMRC scrutiny.

The Corporate Complexity Layer

Business capital gains become exponentially more complex when companies are involved. Corporate disposals trigger corporation tax rather than capital gains tax, but the calculation principles overlap in confusing ways.

Corporate-specific complications include:

- Substantial shareholding exemption (SSE) applications

- Degrouping charges on intra-group transfers

- Rollover relief interactions with corporation tax

- Connected company rules affecting valuations

The substantial shareholding exemption deserves special mention because it’s frequently misunderstood. When a company disposes of shares in another company, the gain might be completely exempt from corporation tax if specific conditions are met.

The conditions seem reasonable: 10% shareholding held for at least 12 months, with both companies being trading companies. But the definition of “trading company” has generated more HMRC guidance notes than a bestselling novelist has chapters.

Common Mistakes That Cost Thousands

After years of working with businesses on capital gains issues, I’ve noticed the same mistakes recurring with depressing frequency. Most are avoidable with proper planning, but they continue catching entrepreneurs off-guard.

The biggest culprits:

- Mistake #1: Assuming all business assets qualify for relief Not every business asset qualifies for Business Asset Disposal Relief. Investment properties held by trading companies often don’t qualify, even if they’re used in the business. The distinction between trading and investment activities becomes crucial.

- Mistake #2: Ignoring the two-year qualification period Business Asset Disposal Relief requires two years of qualifying ownership and involvement. Restructuring transactions, changes in shareholding, or periods of reduced involvement can restart this clock without warning.

- Mistake #3: Misunderstanding connected party rules Family members, business partners, and related companies are “connected parties” for capital gains purposes. Transactions between connected parties use market value, not actual consideration, creating unexpected tax charges.

- Mistake #4: Poor loss utilization Capital losses can only offset capital gains, not other income. But they can be carried forward indefinitely and back one year. Strategic timing of loss realization can significantly reduce overall tax bills.

- Mistake #5: Inadequate record-keeping HMRC can enquire into capital gains calculations for up to six years (longer in cases of negligence). Without proper records, even legitimate positions become difficult to defend.

When to Involve a Capital Gains Tax Accountant Near Me

The decision often comes down to risk versus reward. Simple disposals with clear-cut circumstances might not justify professional fees. Complex situations with substantial financial implications almost always do.

Clear indicators you need professional help:

- Disposal proceeds exceeding £50,000

- Multiple asset disposals in the same tax year

- Connected party transactions

- International elements (non-UK assets or non-resident status)

- Previous HMRC enquiries or compliance issues

- Uncertain asset acquisition dates or costs

- Corporate restructuring or business sales

The cost of professional advice typically represents a fraction of potential tax savings. More importantly, it provides certainty in an area where mistakes carry significant penalties.

What to expect from professional engagement:

A capital gains tax accountant near me should provide comprehensive analysis covering all applicable reliefs, optimization strategies, and compliance requirements. Ask Accountant, for instance, offers specialized tax advisory solutions that go beyond basic compliance to identify genuine tax planning opportunities.

Services typically include:

- Detailed liability calculations with alternative scenarios

- Relief eligibility assessments and optimization strategies

- Valuation guidance and professional referrals

- Documentation requirements and record-keeping advice

- HMRC correspondence handling

- Integration with broader business tax planning

The Technology Factor: Modern Tools for Ancient Problems

Capital gains tax calculations have become increasingly sophisticated, but the technology supporting them varies dramatically between providers. Specialized software, which is now available to the best capital gains tax accountants near me, can model a complex situation and optimize the outcomes of numerous variables.

Technology is good though, and the skill behind that technology. Simple disposals may be automated, however edge cases, relief interactions, and strategizing opportunities present problems to automated calculators.

Human factor is incomparable to interpretation, judgment and strategic thinking. Computerized calculations; planners are accountants.

The Future: What Is in store?

Regulations on capital gains tax keep on changing, and the changes have more often been in directions which tend to make it more complex than simplified. Last few years have been characterized by numerous modifications in relief eligibility, rate structures and requirement of report.

Recent and proposed changes include:

- Reduction in annual exemption amounts

- Shorter payment deadlines for certain disposals

- Enhanced reporting requirements

- Restrictions on relief availability

Staying current with regulatory changes requires continuous professional development that most business owners simply don’t have time for. A capital gains tax accountant near me makes this ongoing compliance their daily focus.

The Bottom Line: Investment or Necessity?

Professional capital gains tax advice isn’t an expense—it’s an investment in financial efficiency. The question isn’t whether you can afford professional help, but whether you can afford to make expensive mistakes.

Consider the mathematics: professional fees might range from £500 to £5,000 depending on complexity. Mistakes in capital gains tax calculations can easily cost ten times that amount, plus interest and penalties for late payment.

But there is more than calculating the money there is peace of mind. Having your tax position known to be optimal and compliant will enable you to concentrate on what you are best at- running your business.

You should not sail in these waters alone in case you have to pay capital gains tax on business disposals. The combination of local expertise, specialized knowledge, and strategic thinking that a capital gains tax accountant near me provides can transform a potentially costly obligation into an optimized outcome.

For businesses in London and the surrounding areas, Ask Accountant offers comprehensive capital gains tax planning alongside their broader range of business accounting services, inheritance tax planning, and proactive tax advisory solutions. Their contact details are +44(0)20 8543 1991 or they can be found at their offices at 178 Merton High St, London SW19 1AY.

Making the decision to seek professional assistance may sound intimidating but the other option, figuring out your mistakes when it is too late to make things right, is even worse.

Frequently Asked Questions

Q: What will a capital gains tax accountant near me charge?

A: Costs depend on the level of complexity, although a specialist might charge between 150 and 400 an hour, or a set cost to make simple disposals of between 500 and 2,000.

Q: Am I allowed to realize capital gains tax relief on the sale of any business asset?

A: Not automatically. There are certain requirements of Business Asset Disposal Relief that involve minimum percentages in holding shares, period of ownership and active requirements.

Q: How is the capital gains tax and corporation tax on asset disposal different?

A: Capital gains tax is paid by individuals (at 10% or 20% depending on the circumstances) and by companies capital gains tax (at 25% (large companies) at present) is paid, but with a number of reliefs in place.

Q: Do you require a capital gains tax accountant in my locality to do small disposals?

A: In cases where there are simple situations, and the disposal is less than 10,000 pounds, you may go it alone. Nonetheless, professional review can be used even in smaller disposals, especially when you have several transactions to conclude or your ownership is complicated.

Q: When should I approach a capital gains tax accountant in my area?

A: Preferably, seek professional counsel prior to disposing to anything. Opportunities to conduct strategic planning are reduced enormously after the transactions are made and therefore early consultations tend to provide the best results.