Published: January 2026 | Reading time: 12 minutes

Here’s something nobody tells you at dinner parties: inheritance tax rules in the UK are simultaneously straightforward and maddeningly complex. The basic premise? Dead simple. Your estate gets taxed at 40% on everything above £325,000. But then the government added residence nil-rate bands, seven-year rules, taper relief, and a constellation of exemptions that would make a tax barrister’s head spin.

I’ve spent the better part of two decades watching families discover—often too late—that their “simple” estate planning wasn’t quite so simple after all. The inheritance tax rules seem designed to catch people off guard, which is probably why HMRC collected over £7 billion from this tax last year alone.

Let’s cut through the fog, shall we?

The Brutal Basics (Because Someone Has to Start Here)

When you die, everything you own gets added up. Your house, savings, investments, that collection of vintage guitars gathering dust, the lot. This grand total is your “estate.” If it exceeds £325,000, the taxman takes 40% of everything above that threshold. Not 40% of the whole thing—just the excess. Small mercies.

But here’s where it gets interesting (and by interesting, I mean complicated). The inheritance tax rules include something called the residence nil-rate band, which adds another £175,000 to your allowance if you’re leaving your home to direct descendants. Suddenly, a couple could pass on £1 million tax-free if they play their cards right.

The catch? There’s always a catch. If your estate exceeds £2 million, that extra allowance starts disappearing. For every £2 over the limit, you lose £1 of the residence allowance. It’s like watching sand slip through your fingers, except the sand is made of money and HMRC is holding the hourglass.

Gifts, Time, and the Seven-Year Itch

People love giving away their wealth before they die. Smart move, right? Well… depends on when you do it.

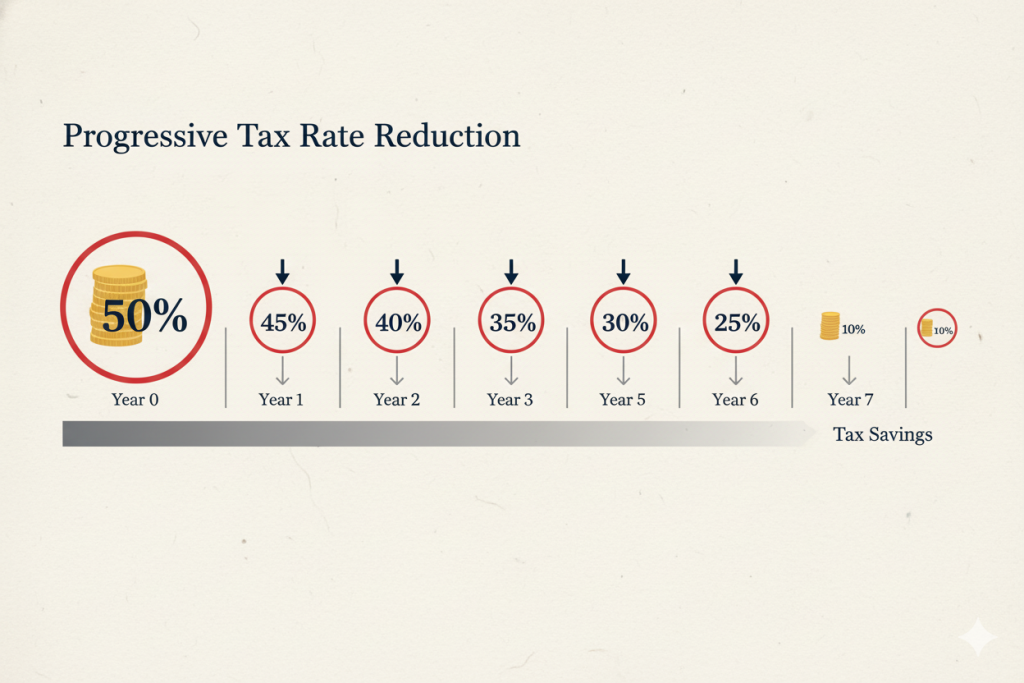

The seven-year rule is the cornerstone of inheritance tax planning. Give away your assets and survive seven years, and those gifts escape inheritance tax entirely. Die within seven years, and they get pulled back into your estate for tax calculations. It’s morbid, I know. But them’s the rules.

Quick Reality Check: Taper relief kicks in after three years. So if you make it past year three but not year seven, the tax rate on those gifts gradually reduces. It’s still not free, but it’s less painful than the full 40%.

Annual exemptions exist too—£3,000 per year, to be precise. You can give away three grand annually without it counting towards your estate, and if you didn’t use last year’s allowance, you can carry it forward once. Wedding gifts get special treatment: £5,000 to a child, £2,500 to a grandchild, £1,000 to anyone else. The inheritance tax rules are nothing if not specific about weddings.

The Residence Nil-Rate Band Maze

This addition to the inheritance tax rules arrived in 2017, and honestly? It’s caused more confusion than clarity. The idea was noble: help people pass on the family home without triggering massive tax bills. The execution? Byzantine.

You get an extra £175,000 allowance per person, but only if:

- You owned a residence at death (or had owned one you’d downsized from)

- You’re leaving it to direct descendants (children, grandchildren—stepchildren count, siblings don’t)

- Your total estate stays under £2 million

Married couples can combine their allowances, potentially sheltering £1 million from inheritance tax in England. But the taper means high-value estates lose this benefit fast. Own a £2.5 million estate? Your residence nil-rate band just vanished entirely.

| Estate Value | Standard Allowance | Residence Nil-Rate Band | Total Tax-Free (Single) |

|---|---|---|---|

| £500,000 | £325,000 | £175,000 | £500,000 |

| £1,000,000 | £325,000 | £175,000 | £500,000 |

| £2,000,000 | £325,000 | £175,000 | £500,000 |

| £2,200,000 | £325,000 | £75,000 | £400,000 |

| £2,400,000 | £325,000 | £0 | £325,000 |

What Actually Counts Towards Your Estate?

Almost everything. Your house, obviously. Savings accounts, ISAs (yes, even ISAs), shares, business interests, cars, jewellery, art, antiques. That pension you’ve been diligently funding? As of recent changes, pensions are increasingly caught in the inheritance tax net, particularly for deaths after age 75.

Life insurance policies pay out outside your estate—unless you own the policy yourself. Write it in trust, and the payout bypasses your estate entirely. Don’t, and it gets lumped in with everything else. This single mistake costs families tens of thousands every year.

The Property Trap: Joint property doesn’t automatically escape inheritance tax. If you own your home as “joint tenants” with your spouse, the inheritance tax rules treat your share differently than if you’re “tenants in common.” Get this wrong and you waste valuable allowances.

Exemptions That Actually Matter

Some gifts never attract inheritance tax, no matter when you make them or how much they’re worth:

Spouse exemption – Leave everything to your husband or wife, and there’s no inheritance tax. Period. Your unused nil-rate band transfers to them too, doubling their allowance when they eventually pass. This works for civil partners as well, but not unmarried couples. The tax code doesn’t do romance; it does legal status.

Charity exemption – Give to registered charities, and those gifts are completely exempt. Plus, if you leave at least 10% of your net estate to charity, the tax rate on the rest drops from 40% to 36%. It’s one of the few places where the inheritance tax rules reward generosity with tangible savings.

Business Relief – Own a trading business or unlisted shares? You might get 50% or even 100% relief from inheritance tax on those assets. Agricultural property gets similar treatment. This is where business advice becomes crucial—the qualifying conditions are specific and, frankly, easy to trip over.

The Stuff Nobody Mentions Until It’s Too Late

Gifts with reservation of benefit. Sounds obscure, doesn’t it? But it’s a trap that snares people constantly. If you give away your house but continue living in it rent-free, that’s a gift with reservation. HMRC treats it as if you still own it. Same goes for giving away assets while retaining control or benefit from them.

The solution? Either pay market rent to whoever you’ve gifted the property to, or move out entirely. Not exactly convenient, which is why proper inheritance tax planning needs to happen years—sometimes decades—in advance.

The Deed of Variation Loophole

Here’s something I genuinely like about the inheritance tax rules: deeds of variation. Within two years of someone’s death, beneficiaries can redirect their inheritance to someone else, and HMRC treats it as if the deceased had made that arrangement themselves. Useful for skipping a generation or redirecting assets to minimize tax.

Why would you do this? Imagine a widow with her own substantial wealth inheriting everything from her husband. She doesn’t need the money, but her children do. Vary the will, pass assets directly to the kids, and potentially save a fortune in tax when she eventually dies.

| Gift Type | Annual Limit | IHT Treatment | Notes |

|---|---|---|---|

| Annual exemption | £3,000 | Exempt immediately | Can carry forward one year if unused |

| Small gifts | £250 per person | Exempt immediately | Can’t combine with annual exemption for same person |

| Wedding gifts (to child) | £5,000 | Exempt immediately | Must be made in contemplation of marriage |

| Wedding gifts (to grandchild) | £2,500 | Exempt immediately | – |

| Regular gifts from income | No limit | Exempt if from surplus income | Must maintain your standard of living |

| Other lifetime gifts | No limit | Potentially exempt (seven-year rule) | Watch for reservation of benefit |

When Inheritance Tax Rules Collide With Real Life

Theory is lovely. Practice is messy. I’ve seen families argue over whether grandma’s engagement ring counts as part of her jewellery collection or if it was an exempt gift. I’ve watched executors scramble to value a deceased’s share in a family business while grieving siblings disagree about its worth.

Valuation is where theory meets brutal reality. Everything must be valued at market value as of the date of death. Not what you paid for it. Not what you think it’s worth. Market value. For quoted shares, that’s straightforward. For a half-share in a rental property in Hackney with a sitting tenant and rising damp? Less so.

The inheritance tax rules demand you submit form IHT400 if tax is due, along with supporting schedules for different asset types. Miss something, undervalue something, or make an honest mistake, and HMRC can come calling years later with interest charges and penalties.

Trusts: The Nuclear Option

Trusts used to be the go-to for inheritance tax planning. Then the rules changed (because they always do), and trusts became less attractive for many people. But they still have their place.

Put assets into certain types of trusts, survive seven years, and those assets escape your estate. The trust itself might pay some tax (trusts have their own tax rules, naturally), but for large estates, the overall saving can be substantial. Discretionary trusts, bare trusts, interest in possession trusts—each has different inheritance tax rules and different uses.

Do I recommend setting one up yourself? Absolutely not. Trust law makes normal tax law look like children’s reading material. This is where you need proper personal tax planning from someone who actually understands these structures.

What the 2025 Changes Mean (And Don’t Mean)

The nil-rate band has been frozen at £325,000 since 2009. Yes, 2009. House prices have roughly doubled in that time. The residence nil-rate band arrived in 2017, which helped, but it comes with so many conditions that many estates can’t use it fully.

Recent announcements suggest this freeze will continue until at least 2028. Meanwhile, property values climb, investment portfolios grow, and more estates get caught by what was once a tax on the wealthy. Fiscal drag in action—the government raises taxes without technically raising rates.

For context: in 2010, about 3% of estates paid inheritance tax. Now it’s closer to 5-6%, and rising. The inheritance tax rules haven’t become harsher, exactly. They’ve just stayed still while everything around them got more expensive.

Something to Consider: The proposals around bringing pensions fully into the inheritance tax net from April 2027 could fundamentally change retirement planning for many people. Worth watching closely.

Practical Steps That Actually Work

Right, enough theory. What should you actually *do* about all this?

First, understand what you own and what it’s worth. Genuinely worth, not what you paid or what you hope it’s worth. Add it all up. Include everything—joint accounts, insurance policies, that half-share in your sister’s business you’d forgotten about.

Second, make a will. An actual, legally valid will, not some template downloaded at 2am after three glasses of wine. Specify who gets what, appoint executors you trust, and consider tax compliance implications of your choices.

Third, start gifting early if your estate is going to exceed the thresholds. Use your annual exemptions. Make use of wedding gift allowances when relevant. Consider regular gifts from surplus income—these escape the seven-year rule entirely if properly documented.

Fourth, review how you own property with your spouse. Joint tenants or tenants in common? The difference matters enormously for inheritance tax rules and could save your family six figures. We covered this earlier, but seriously—check it.

Fifth, write your life insurance in trust. Takes ten minutes, costs nothing, saves your beneficiaries potentially 40% of the payout in tax. The easiest win in all of inheritance tax planning.

When You Need Professional Help (Hint: Probably Now)

Look, I’m not going to pretend this is simple stuff you can handle alone. Some estates are straightforward—single person, modest assets, everything to charity. File the forms, pay the bill (if any), done. Most aren’t that neat.

If your estate might exceed £500,000 (single) or £1 million (married), you need advice. If you own business assets, overseas property, or have a blended family situation, you need advice. If you’re unsure about any of the inheritance tax rules we’ve covered, you definitely need advice.

The teams at Ask Accountant see these situations daily. We’re based at 178 Merton High St, London SW19 1AY, and you can reach us on +44(0)20 8543 1991. Whether you need a simple estate review or complex planning involving trusts and business relief, we’ve handled it before. Multiple times. In multiple interesting permutations.

Our approach to tax advisory solutions isn’t about finding loopholes or aggressive schemes. It’s about understanding the rules thoroughly and structuring your affairs to work within them efficiently. Sometimes that means trusts. Sometimes it’s simpler—just better documentation and timing of gifts.

The Uncomfortable Truth About Planning

Nobody wants to think about their own mortality. Inheritance tax planning requires you to confront it head-on. How much time have you got? (Unknown.) What will your assets be worth when you die? (Unknowable.) Will the tax rates and thresholds be the same then? (Almost certainly not.)

You’re planning for an uncertain future using rules that will definitely change, probably multiple times before they matter to you. It’s inherently imperfect. But doing nothing—that’s a guaranteed plan to pay maximum tax.

The inheritance tax rules reward early action. They reward good record-keeping. They reward people who think about these things when there’s time to do something, not when the solicitor is reading the will and everyone realizes the tax bill is going to wipe out half the estate.

Common Questions (Because Everyone Asks These)

Can I avoid inheritance tax entirely?

Legally? If you’re willing to give everything away and survive seven years, or leave it all to your spouse/charity, sure. Practically? Most people want to maintain their lifestyle and leave something to their children, which limits options. You can minimize it substantially with proper planning, though.

What if I move abroad?

UK domicile rules are complex and sticky. Being “domiciled” in the UK for inheritance tax purposes is different from being resident. You can live abroad for decades and still be deemed UK-domiciled. These rules changed in 2017 and will change again in 2025. Get specialist advice before assuming foreign residence solves anything.

Do my children pay tax on their inheritance?

No. The estate pays inheritance tax before distribution. What they receive is tax-free to them (though they might have ongoing tax obligations on income from inherited assets). The 40% bite happens at the estate level.

Can executors be held personally liable?

Yes. If they distribute the estate before paying the inheritance tax bill, or if they underpay tax due to poor valuations, HMRC can pursue the executors personally. This is why executor insurance exists and why many people appoint professional executors for complex estates.

Final Thoughts (Not Really Final, Obviously)

The inheritance tax rules aren’t going to simplify themselves. If anything, they’ll likely get more complex as governments tinker with thresholds, exemptions, and rates to raise revenue without the political cost of actually increasing rates.

What you can control: understanding your situation, making informed decisions about gifts and asset ownership, structuring things efficiently, and keeping good records. What you can’t control: exactly when you’ll die, what assets will be worth then, or what the rules will be at that point.

So plan for what you know, build in flexibility for what you don’t, and review things regularly as your circumstances change. The inheritance tax threshold might be frozen, but your life isn’t. People marry, divorce, have children, start businesses, inherit money themselves. Each change potentially affects your inheritance tax position.

And if you’re reading this thinking “I should probably sort this out”—you’re right. You should. The best time was ten years ago. The second-best time is now. Give Ask Accountant a call, or if you’re the DIY type, at least make a start on understanding what you own and what your estate might look like. Future-you (and more importantly, your beneficiaries) will be grateful you bothered.

Because the only thing worse than paying inheritance tax is your family paying more than they needed to because you never got around to planning.