Inheritance Tax Limit Explained 2026

There’s a particular kind of financial shock that tends to arrive at the worst possible moment. You’ve just lost someone. The paperwork is mounting. And then, tucked inside a letter from HMRC, comes a tax bill that nobody anticipated — sometimes for tens of thousands of pounds. All because a threshold quietly existed, and nobody […]

Inheritance Tax: How Much Will You Really Pay?

Here’s something nobody tells you at dinner parties: inheritance tax isn’t just for the wealthy anymore. I’ve watched too many families discover this the hard way—right when they’re grieving, already overwhelmed, and suddenly facing a tax bill that could’ve been avoided (or at least reduced) with a bit of planning. The problem? Most people think […]

Best Small Business Accounting Services in the UK 2026

Here’s something nobody tells you when you start a business: the accounting bit will keep you up at night more than any dodgy client or failed pitch ever could. I remember chatting with a mate who runs a small construction firm in Manchester. Brilliant at what he does – can build you a gorgeous extension […]

Strategies for reducing inheritance tax on family property in 2026

Last updated: January 2026 | Reading time: 12 minutes Look, I’ll be blunt: the inheritance tax system is designed to catch the unprepared. Frozen thresholds since 2009. Property prices that’ve gone bonkers. A 40% tax rate that bites harder than a Rottweiler with a grudge. And yet… most families stumble into HMRC’s trap because they […]

Small Business Accounting Services Explained 2026

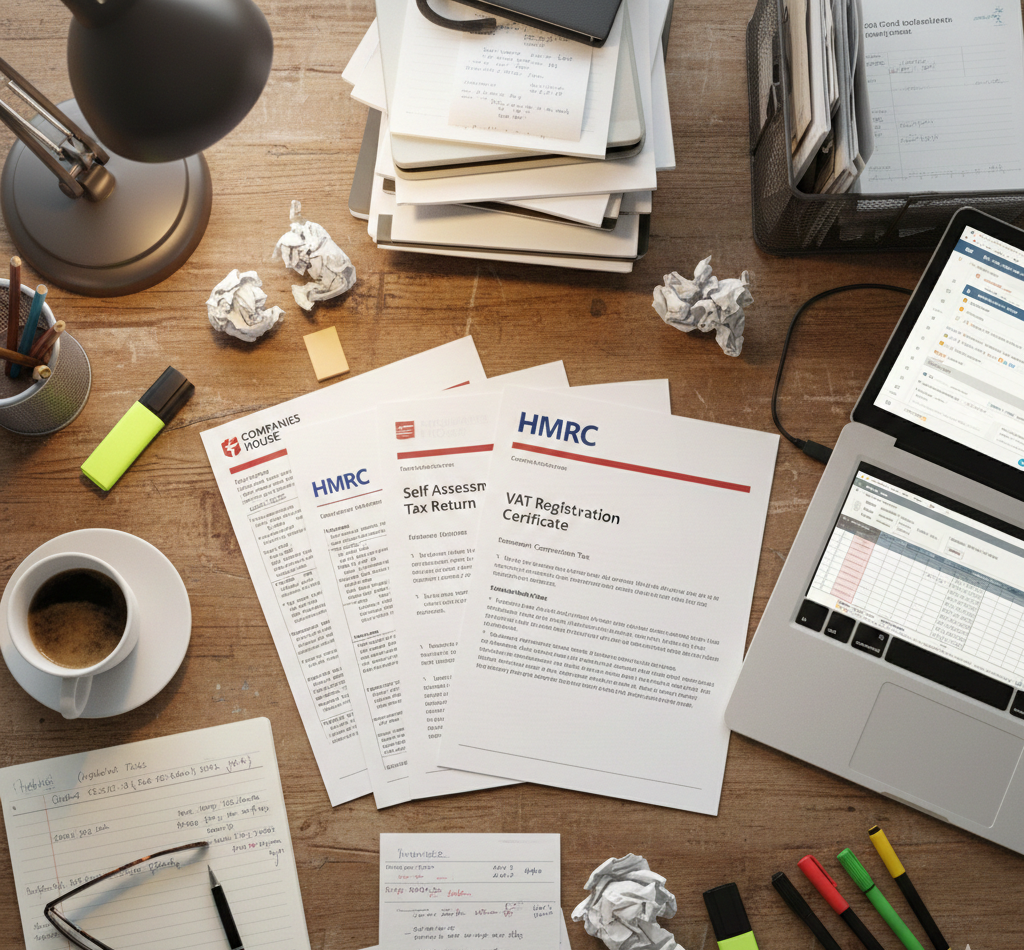

Last updated: January 2026 | 12-minute read Here’s something nobody tells you when you register your first business: that euphoric moment when you make your first sale? It’s immediately followed by the cold realisation that someone, somewhere, expects you to account for it. Not in the vague “I made some money” sense. In the “HMRC wants quarterly […]

VAT Accounting Rules Every Business Must Follow

Here’s something nobody tells you when you first register for VAT: the rules aren’t actually that complicated. What is complicated is the sheer volume of them, the bizarre exceptions, and—let’s be honest—the fact that HMRC seems to change something every other month. I’ve watched businesses get slapped with penalties not because they were trying to dodge their […]

Inheritance Tax Rules Explained Simply 2026

Published: January 2026 | Reading time: 12 minutes Here’s something nobody tells you at dinner parties: inheritance tax rules in the UK are simultaneously straightforward and maddeningly complex. The basic premise? Dead simple. Your estate gets taxed at 40% on everything above £325,000. But then the government added residence nil-rate bands, seven-year rules, taper relief, […]

Inheritance Tax Gifts Rules Every Family Should Know

Here’s something nobody tells you at dinner parties: that £50,000 you’re planning to gift your daughter for her house deposit could end up costing your estate £20,000 in tax. Not because you did anything wrong, but because you didn’t know the rules. I’ve spent years watching families discover—too late—that generosity comes with paperwork. That the […]

Accounting for Small Companies: The UK Compliance Guide

Last updated: January 2026 | Reading time: 12 minutes Here’s something nobody tells you when you register your first limited company: the paperwork doesn’t end with Companies House. In fact, it’s barely started. I’ve watched countless business owners stumble through their first year of accounting for small companies, only to face penalty notices because they thought […]