From Chaos to Compliance: File Your Tax Return with Ease

Tax season. Those two words alone can send a shiver down the spine of even the most organised among us. There’s something uniquely British about leaving everything until the last possible moment, isn’t there? We’ll queue politely for hours but somehow convince ourselves that we’ll definitely file our tax return tomorrow. Until suddenly it’s 30th […]

IHT 400: The Executor’s Nightmare That Doesn’t Have to Be

Here’s the truth nobody tells you about becoming an executor: you’ll spend more time wrestling with HMRC forms than grieving properly. The IHT 400 form—all 12 pages of bureaucratic bewilderment—sits there mocking you whilst you’re still figuring out how to access the deceased’s bank account. I’ve watched countless executors stumble through this process, clutching printouts […]

Inheritance Tax Calculator

Thinking about inheritance tax can feel overwhelming, but with our easy-to-use inheritance tax calculator, you get clarity fast. Whether you’re planning your estate or helping a loved one prepare, this tool helps estimate how much tax might be due, giving you peace of mind and control over your finances. Our inheritance tax calculator takes into […]

Business Advisory Accountants: The Secret Weapon for SME Success

Most small business owners treat their accountant like a reluctant dentist appointment – necessary, slightly uncomfortable, and mercifully brief. You hand over a shoebox of receipts in March, get your tax return sorted, and retreat for another year. But here’s the thing that keeps me awake at night: you’re missing the entire point. A business […]

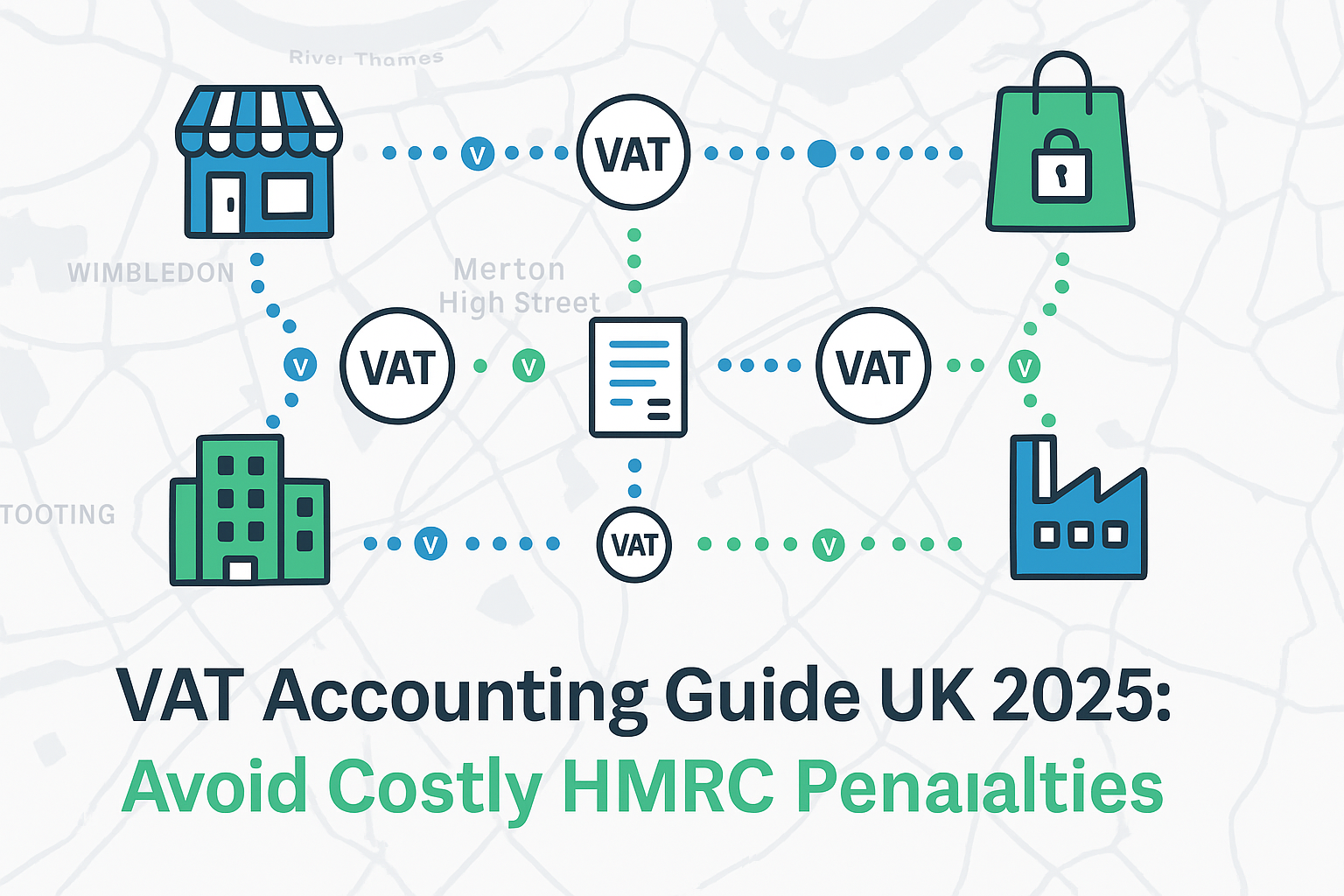

VAT Accounting Guide UK 2025: Avoid Costly HMRC Penalties

Here’s something that’ll make you pause mid-sip of your morning coffee: 78% of UK businesses make at least one VAT-related error each year. And I’m not talking about missing a decimal point—I mean proper, HMRC-will-notice mistakes that can trigger investigations, penalties, and the kind of sleepless nights that no amount of chamomile tea can fix. […]

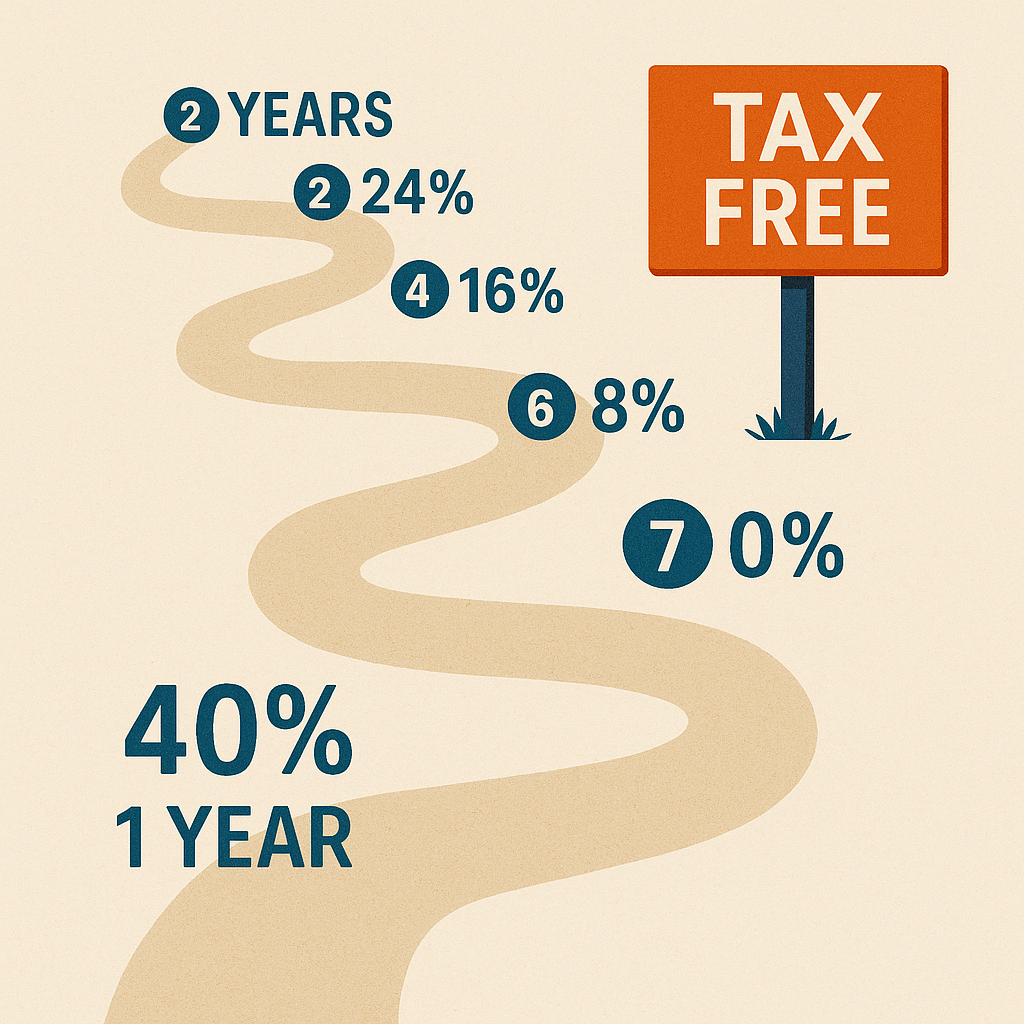

IHT Tax Traps: How to Avoid the 40% IHT Tax Rate in 2025

Death and taxes—the two unavoidable certainties in life, as the saying goes. But when these two intersect in the form of Inheritance Tax (IHT), things get surprisingly complex. I’ve spent years watching estate owners scratch their heads over IHT calculations, and honestly, who can blame them? The rules seem deliberately designed to confuse. Let me […]

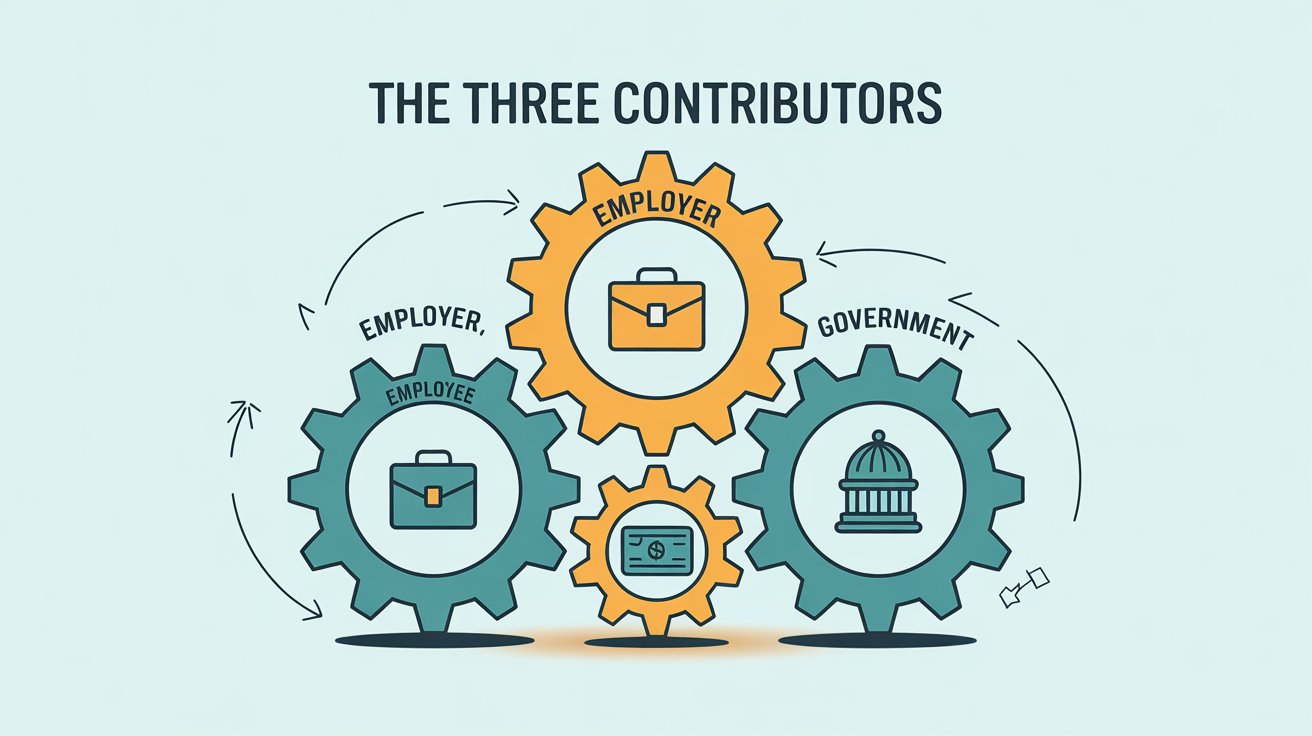

The Ultimate Guide to Auto-Enrolment: Navigating Workplace Pensions in 2025

Ever been trapped in the corner at a dinner party when someone brings up pensions, and you feel that familiar urge to fake a phone call or sprint for the nearest exit? I’ve been there—nodding politely while mentally calculating how many prawn vol-au-vents I could stuff in my pockets before making my escape. But here’s […]

The Ultimate Guide to Modern Bookkeeping for UK Businesses

I once watched a brilliant entrepreneur—someone with an amazing product and infectious passion—go from celebrating a seemingly successful year to discovering they were £27,000 in the red. All because of messy bookkeeping. The look on her face still haunts me. Let’s be honest—nobody daydreams about bookkeeping. You probably didn’t start your business fantasising about reconciling […]

Tackling Your Self Assessment Return: A No-Nonsense Guide

Let’s face it – self assessment return don’t exactly spark joy. They lurk in the back of your mind for months, then suddenly it’s January and you’re frantically hunting for receipts you swore you kept somewhere. I’ve been there, done that, and finally learned how to make the process less painful. Self assessment returns aren’t […]