Let me start with something that might surprise you: the difference between a business that thrives and one that merely survives often comes down to a single decision made in Q4. It’s not about marketing budgets or product launches—it’s about who’s managing your books.

I’ve watched countless small business owners cling to their DIY accounting methods like security blankets, convinced they’re saving money. Meanwhile, they’re bleeding cash through inefficiencies they can’t even see. The irony? The very tool meant to save them money—doing their own bookkeeping—becomes the silent killer of their profit margins.

This financial year, something fundamental has shifted. With Making Tax Digital for Income Tax rolling out in phases from April 2026, the stakes have never been higher. Yet most business owners are still playing financial Russian roulette with their tax compliance.

The Hidden Cost of “Good Enough” Bookkeeping

Here’s what nobody tells you about amateur bookkeeping: it’s not the obvious mistakes that destroy businesses. It’s the subtle ones.

Take Sarah, who runs a boutique consultancy. She meticulously tracked every expense in her carefully crafted Excel sheet. Colour-coded categories, formulas that would make a mathematician weep with joy. She felt brilliant—organised, in control.

Then her accountant discovered she’d been miscategorising client retainers as income rather than liabilities. Three years of incorrect reporting. The correction wiped out what she thought was her most profitable quarter.

A certified bookkeeper would have caught this on day one. They live and breathe these distinctions. They see patterns in your financial data that you’ll miss entirely because you’re too busy running your actual business.

The maths is brutal but honest:

- Average cost of bookkeeping errors: £3,200 per year

- Time spent on DIY bookkeeping: 6-8 hours weekly

- Opportunity cost of that time: Immeasurable

| DIY Bookkeeping Reality Check | Annual Impact |

| Missed tax deductions | £800-2,400 |

| Late filing penalties | £300-1,200 |

| Time opportunity cost | £5,000-12,000 |

| Error corrections | £400-800 |

| Stress-induced decisions | Priceless (and expensive) |

Why This Financial Year Is Different

The regulatory landscape has transformed dramatically. Making Tax Digital for Income Tax will apply to sole traders and landlords with total business and/or property income above £50,000 per year from April 2026, with those earning above £30,000 following in April 2027. This isn’t just a suggestion anymore—it’s law, with teeth. HMRC’s new data-matching capabilities mean discrepancies that once slipped through now trigger immediate attention.

But here’s the twist: certified bookkeepers aren’t just compliance guardians. They’re profit archaeologists, digging up money you didn’t know you had.

Take VAT handling alone. I’ve seen certified bookkeepers identify £4,000 in annual VAT savings within their first month on a client’s books. Not through creative accounting—through proper, legitimate optimisation that the business owner simply didn’t know existed.

The Real Value Hidden in Professional Bookkeeping

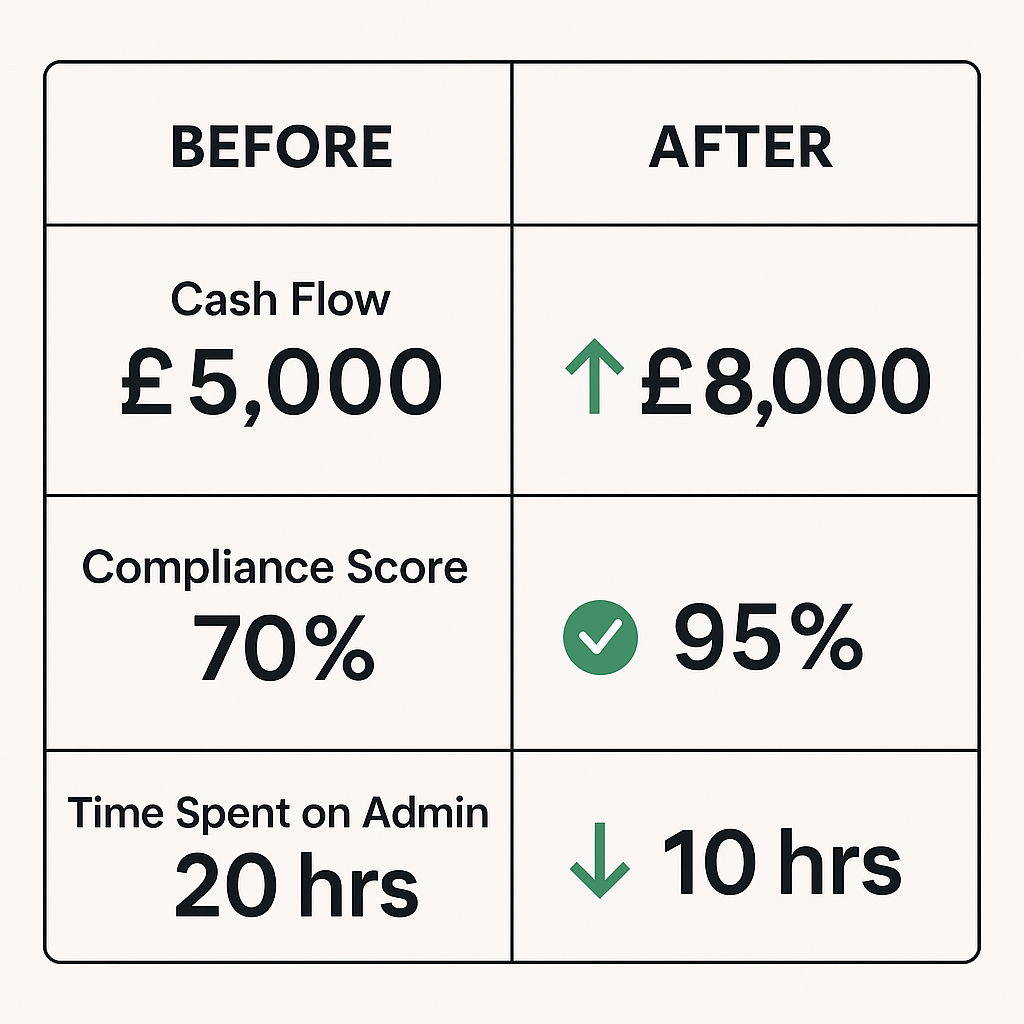

Cash Flow Clairvoyance

Amateur bookkeepers see what happened. Certified bookkeepers see what’s coming. They spot the seasonal patterns in your cash flow six months before you feel the pinch. They notice when your payment terms are slowly creeping from 30 to 45 days, strangling your working capital.

This predictive capability isn’t magic—it’s pattern recognition developed through handling hundreds of similar businesses.

The Expense Audit That Pays for Itself

A good certified bookkeeper doesn’t just record expenses; they question them. Why are office supplies spiking in Q3? Is that software subscription still being used? Are you claiming the home office deduction correctly?

I once watched a bookkeeper save a client £180 monthly by spotting duplicate insurance policies. The client had been paying both for eight months without realising.

Strategic Tax Planning (Not Just Tax Surviving)

Here’s where certified bookkeepers truly earn their keep. They don’t just prepare you for tax season—they help you navigate it strategically.

Should you accelerate equipment purchases before year-end? Is incorporation worth considering? Are you maximising pension contributions for tax efficiency? These aren’t questions for April—they’re decisions for October, November, December.

The Technology Advantage You Didn’t Know You Needed

Modern certified bookkeepers bring more than expertise—they bring integration. Xero, QuickBooks, Sage—these aren’t just accounting software platforms to them. They’re instruments they’ve mastered using cloud accounting.

They set up automated bank feeds correctly (not the half-functional mess most DIYers create) also, they configure tax codes properly. They establish workflows that make month-end close a 30-minute process instead of a weekend nightmare.

| Setup Element | DIY Outcome | Certified Bookkeeper Outcome |

| Bank reconciliation | Weekly struggle | Daily automation |

| Expense categorisation | Frequent errors | Consistent accuracy |

| VAT calculations | Anxiety-inducing | Seamless compliance |

| Financial reporting | Basic spreadsheets | Professional insights |

| MTD compliance | Overwhelming complexity | Streamlined process |

But the real magic happens in the details. They know which expenses can be split between personal and business use (and in what proportions)and also, they understand the nuances of CIS deductions if you’re in construction. They navigate IR35 implications if you’re consulting.

When DIY Becomes Dangerous

Some business owners treat bookkeeping like cooking—something anyone can learn with enough YouTube tutorials. The comparison is apt, actually. Anyone can boil water, but would you want an amateur preparing your wedding cake?

The stakes in bookkeeping are even higher. A ruined cake embarrasses you; ruined books can bankrupt you.

Red flags that scream “Get professional help now”:

- You’re spending entire weekends “catching up” on bookkeeping

- HMRC letters make you physically nauseous

- You’ve ever used the phrase “close enough” when categorising expenses

- Your idea of financial planning is checking your bank balance

- You treat receipts like lottery tickets—some you keep, some you lose

- The thought of Making Tax Digital compliance keeps you awake at night

Understanding Certified Bookkeeper Qualifications

When I mention “certified bookkeeper,” I’m not throwing around marketing jargon. Legitimate qualifications include AAT Level 2 Foundation Certificate in Bookkeeping for beginners and AAT Level 3 Advanced Certificate in Bookkeeping for experienced practitioners (AAT Bookkeepers). The Institute of Certified Bookkeepers (ICB) also offers recognised qualifications and accepts exemptions for those with AAT, ACCA, CIMA, and ICAEW qualifications (Study bookkeeping and pass ICB qualifications).

These aren’t just letters after names. They represent standardised training, ongoing education requirements, and professional accountability. AAT Level 3 Certificate holders can use the letters AATQB after their name and apply for AAT bookkeeping membership (Bookkeeping qualifications | AAT).

The Ask Accountant Difference

This is where I need to be transparent about my own experience. Working with firms like Ask Accountant has shown me how dramatically the right certified bookkeeper can transform a business trajectory.

Their approach goes beyond traditional bookkeeping services. When they handle your inheritance tax planning or guide your business growth strategies, they’re seeing your complete financial picture. Your bookkeeping becomes part of a larger narrative about where your business is heading, not just where it’s been.

Located in London but serving businesses across the UK, they’ve built their reputation on turning financial complexity into clarity. Their certified bookkeepers don’t just manage your day-to-day transactions—they integrate with tax advisory solutions and business accounting services to create a seamless financial ecosystem.

The difference is philosophical: they’re not just recording your business story; they’re helping you write a better one.

The Investment That Pays for Itself

Let’s address the elephant: cost. Yes, hiring a certified bookkeeper requires investment. But treating it as pure expense misses the point entirely.

Consider these real-world returns:

Immediate Impact:

- Elimination of late filing penalties

- Recovery of missed tax deductions

- Improved cash flow through better invoicing systems

- Reduced accounting fees at year-end

- Making Tax Digital compliance preparation

Long-term Value:

- Strategic tax planning that compounds annually

- Financial insights that guide better business decisions

- Peace of mind that lets you focus on growth

- Professional financial statements that support lending applications

- Future-proofed compliance as MTD requirements expand

The typical ROI on professional bookkeeping services ranges from 300-500% annually. Not through creative accounting—through competent, strategic financial management.

Making the Switch: Practical Steps

- Start with an honest audit of your current situation. How much time do you spend on bookkeeping? What’s that time worth in terms of business development opportunities? How confident are you in your compliance status?

- Look for certified credentials. ICB membership, AAT qualifications, ACCA, CIMA (Study bookkeeping and pass ICB qualifications)—these aren’t just letters after names. They represent standardised training, ongoing education requirements, and professional accountability.

- Evaluate their technology stack. Modern bookkeeping isn’t about ledger books and calculators. Your certified bookkeeper should be fluent in cloud-based accounting platforms and able to integrate with your existing business systems. They should also be prepared for Making Tax Digital requirements.

- Consider the full service ecosystem. The best certified bookkeepers work within broader financial advisory frameworks. They collaborate with tax specialists, business advisors, and growth planners to ensure your bookkeeping supports your larger business objectives.

The Decision Point

Every successful business owner eventually faces this choice: continue managing their own books or invest in professional expertise. The timing matters more than most realise.

Switching to a certified bookkeeper mid-tax year creates transition complexity. Starting fresh at the beginning of a financial year? That’s strategic timing that sets you up for twelve months of optimised financial management.

This financial year presents the perfect opportunity to make that switch. The regulatory environment demands it. Your growth ambitions deserve it. Your sanity requires it.

The question isn’t whether you can afford a certified bookkeeper—it’s whether you can afford not to have one. In my experience, the businesses that thrive in challenging economic conditions are those that treat financial management as a core competency, not an afterthought.

Your spreadsheet served you well in the early days. But if you’re serious about building something substantial, it’s time to upgrade your financial foundation.

The next time you’re staring at a pile of receipts on a Sunday evening, ask yourself: is this really the best use of my expertise? Or would your time be better spent doing what you do best—running your business?

Ready to explore professional bookkeeping services? Ask Accountant offers comprehensive consultations to help you understand exactly how certified bookkeeping could transform your business operations. You can reach them at +44(0)20 8543 1991 or visit their offices at 178 Merton High St, London SW19 1AY.

FAQ

What’s the Difference Between a Bookkeeper and an Accountant?

Think of bookkeepers as the historians of your business—handling day-to-day transactions, reconciliations, and ensuring your records are accurate and up to date. Accountants, on the other hand, are the strategists—focused on tax planning, compliance, and business growth.

How Much Does a Certified Bookkeeper Cost?

Costs vary by business size and complexity. Expect to pay £200–£800 per month or £15–£40 per hour. Don’t just look at the price—focus on value. A bookkeeper who saves you time, tax, and stress is often worth more than they charge.

Can I Trust Someone with My Financial Data?

Yes. Certified bookkeepers (ICB or AAT qualified) are bound by strict confidentiality and professional standards, often backed by insurance and regulatory bodies.

Will I Lose Control Over My Finances?

No—you’ll gain more control. A good bookkeeper gives you real-time insights, dashboards, and reports, helping you make informed decisions.

Do I Need Support for Making Tax Digital (MTD)?

Absolutely. MTD requires digital records, compatible software, and quarterly submissions. A certified bookkeeper will already be MTD-ready and can handle this transition with ease.

When Will I See Results?

Most businesses feel the benefits within a month—better visibility, reduced stress, and even cost savings. Strategic value often becomes clear within a quarter.

Is My Business Too Small for a Bookkeeper?

No business is too small. Even sole traders benefit, especially with MTD on the horizon. Many bookkeepers offer tailored, affordable services for smaller operations.

What If My Bookkeeper Makes a Mistake?

Certified bookkeepers carry professional indemnity insurance and are accountable to regulatory bodies—unlike DIY bookkeeping, where you bear the full risk.