Look, I’ve watched enough people choose their accountant the same way they pick a Netflix series: scrolling through options, reading a few reviews, clicking whatever looks decent. And honestly? That approach works fine until HMRC comes knocking, or your business hits a growth spurt, or — God forbid — you’re dealing with inheritance tax whilst grieving.

Here’s the uncomfortable truth: your accountant isn’t just the person who makes your tax return disappear once a year. They’re the difference between sleeping soundly in January and lying awake wondering if you’ve accidentally committed tax fraud. (You probably haven’t, but anxiety doesn’t care about probability.)

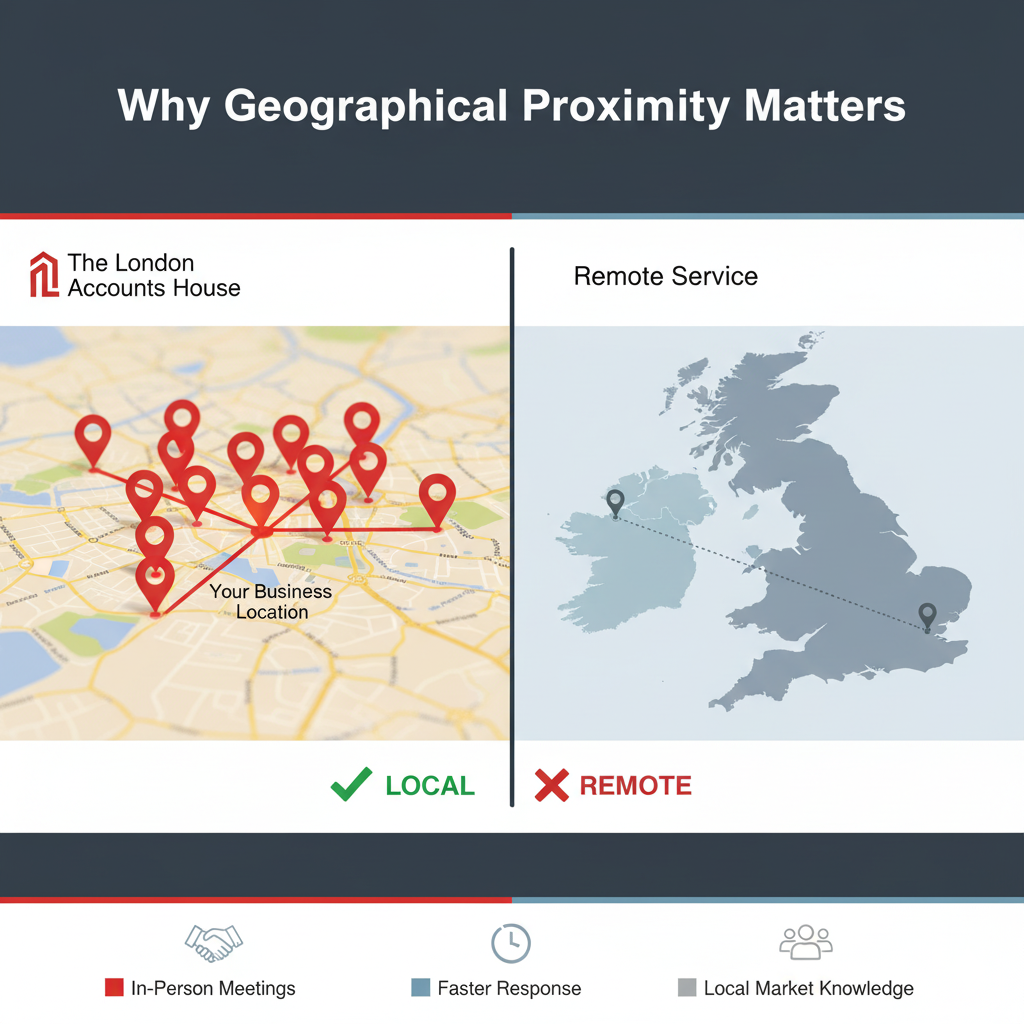

Finding a good accountant near me isn’t about proximity for convenience’s sake. It’s about finding someone who understands that London’s CIS scheme complications are different from Birmingham’s, who knows which local commercial property opportunities actually make financial sense, and who can physically sit across from you when you’re trying to decide whether to expand your business or play it safe.

The Geography of Financial Advice (Or: Why Your Accountant’s Postcode Matters More Than You Think)

Remote work revolutionised everything, right? We can collaborate across continents, hold meetings in our pyjamas, and never actually see the people managing our money.

Except… should we?

I’ve got nothing against virtual accountants. Some are brilliant. But there’s something distinctly reassuring about knowing your accountant understands the local business landscape — not theoretically, but viscerally. They know which banks in your area are actually helpful to small businesses. They’ve worked with your industry peers. They understand regional property values when you’re claiming home office expenses.

Local expertise isn’t romantic nostalgia for face-to-face meetings. It’s practical advantage.

Consider this: tax regulations might be national, but their application often isn’t. A good accountant near me in South West London (someone like Ask Accountant, based at 178 Merton High St, London SW19 1AY) deals daily with clients facing similar challenges. They’ve seen how HMRC interprets certain claims in this jurisdiction. They know the local commercial property market when advising on business premises. They understand regional salary expectations when you’re setting up auto-enrolment.

That knowledge compounds. Year after year. Client after client.

What “Local” Actually Means in Practice

Let me be specific, because “local expertise” sounds like marketing fluff until you break it down:

- Sector clustering: Certain industries concentrate geographically. Tech in East London. Professional services in the City. Retail across various high streets. A local accountant has worked with your competitors (without violating confidentiality, obviously) and understands typical margins, common tax traps, and realistic growth trajectories.

- Property knowledge: Whether you’re claiming home office expenses or considering business premises, local property values and rental markets matter enormously. An accountant who knows your area isn’t guessing.

- Networking value: This one’s huge. Good local accountants know good local solicitors, mortgage brokers, financial advisors, and business mentors. When you need specialist help, they’ve got actual relationships, not just Google results.

- Face-to-face when it counts: Video calls are fine for routine check-ins. But when you’re making a major business decision? When you’re sorting out a complex inheritance tax situation? When your business structure needs complete restructuring? Being able to sit in the same room changes the conversation.

The Qualities That Separate “Accountant” from “Good Accountant”

Right. Let’s talk about what actually makes an accountant good, because passing their exams and hanging out a shingle doesn’t automatically qualify someone to handle your financial life.

Proactive vs. Reactive (The Difference Is Everything)

Most accountants are reactive. You send them your information, they process it, they submit your return. Job done.

Good accountants are proactive. They spot opportunities you’ve missed. Then they flag potential problems before they become expensive. They understand your business well enough to suggest strategies you haven’t considered.

Here’s what that looks like in practice:

| Reactive Accountant | Proactive Accountant |

| “Your return is submitted” | “I noticed your turnover is approaching the VAT threshold — we should discuss registration timing to optimise your position” |

| Files what you give them | Questions figures that seem unusual and catches errors before HMRC does |

| Works to deadline | Contacts you quarterly with tax-planning opportunities |

| Knows tax law | Applies tax law strategically to your specific situation |

| Available during tax season | Available when you need them (within reason — they’re not your therapist) |

That proactive approach? It’s what Ask Accountant built their reputation on. Their tax advisory solutions aren’t just about compliance — they’re about strategy. Business growth planning isn’t an add-on service; it’s integrated into everything they do.

Communication Style (Or: Can You Actually Understand What They’re Saying?)

I once watched an accountant explain capital allowances to a client using so much technical jargon that the client just nodded along, clearly understanding nothing. The accountant seemed pleased with his thorough explanation.

That’s not thorough. That’s useless.

A good accountant near me should be able to explain complex tax concepts in language that doesn’t require a dictionary.

Red flags in communication:

- They consistently use acronyms without explanation

- They seem annoyed by questions

- Their emails read like HMRC guidance documents

- They never check if you’ve actually understood

Green flags:

- They use analogies and examples

- They tailor explanations to your knowledge level

- They encourage questions

- They follow up to ensure understanding

The Search Process (More Art Than Science)

Finding a good accountant near me requires actual effort. Sorry. There’s no Tinder for accountants where you swipe right on someone with good credentials and hope for chemistry.

Start with Your Actual Needs

Be honest about your complexity. If you’ve got straightforward self-employed income and basic expenses, you don’t need (or want to pay for) a firm offering sophisticated business advisory services. But if you’re running a growing business with employees, you need more than someone who just files returns.

Where to Actually Look

- Professional recommendations — Ask other business owners in your industry. Not your mate who claims his accountant is “brilliant” but can’t articulate why. Ask people whose financial situation resembles yours.

- Professional bodies — Search ICAEW, ACCA, or CIMA registers. Qualifications matter. So does ongoing professional development.

- Local searches — Yes, Google “good accountant near me” or “accountant in [your area]”. But don’t stop at the first result. Look at websites, read actual reviews (not just star ratings), check how long they’ve been operating.

- Industry specialists — Some accountants specialise in specific sectors. If you’re in construction, finding someone who truly understands CIS claims and refunds isn’t optional — it’s essential.

The Initial Consultation (Your Audition Opportunity)

Most decent accountants offer a free initial consultation. Use it wisely.

Here’s what to assess:

- Do they ask good questions? A good accountant should interrogate your situation before proposing solutions. If they’re pitching services without understanding your needs, run.

- Can they explain their fees clearly? Fee structures vary wildly. Fixed fees, hourly rates, percentage-based… whatever the model, it should be transparent and comprehensible.

- Do they understand your industry? You shouldn’t have to educate them on basic industry norms. Some learning curve is fine, but they should grasp fundamentals quickly.

- What’s their availability? How quickly do they typically respond to queries? What happens during tax season? Who covers when they’re on holiday?

- What services do they actually offer? If you need bookkeeping, auto-enrolment setup, and business growth planning, confirm they handle all of it. Firms like Ask Accountant offer comprehensive services — inheritance tax, business advice, CIS claims and refunds, bookkeeping, accounting and bookkeeping, small business accounting services — which means fewer relationships to manage.

Here’s a slightly chaotic but useful comparison of what to discuss in first meetings:

| Topic | Why It Matters | Red Flags |

| Fee Structure | You need to budget accurately | Vague answers, reluctance to provide written quotes, unexpected add-ons mentioned casually |

| Experience with Your Industry | Generic advice doesn’t cut it | Can’t name other clients in your sector (even generally), seems unfamiliar with industry-specific tax issues |

| Communication Methods | You need to actually reach them | Unclear response time commitments, no emergency contact process |

| Software/Systems | Integration with your existing tools saves time | Using outdated software, no cloud access, incompatible with your bookkeeping |

| Team Structure | You need to know who actually handles your work | Won’t tell you who’ll work on your account, high staff turnover mentioned |

| Proactive Services | Distinguishes good from mediocre | Only talk about compliance, no mention of planning or strategy |

Red Flags That Scream “Keep Looking”

Some warning signs are subtle. Others are air horns.

- Price appears too good to be true: When their fee is dramatically lower than competitors, there’s a reason. Usually, it’s because they’re cutting corners, taking on too many clients, or you’ll discover hidden fees later.

- They make certain claims: “We will surely give you a refund of £5,000!” Run. No honest accountant will guarantee specific results since tax situations are unique and complicated.

- Pressure tactics: If they are pushing you to sign before you have had time to think, then this is a sales strategy, not professional advice.

- Weak communication at courting stage: If they are slow to respond or unclear in their communication while trying to win your business, imagine what they will be like after they have you locked in.

- No digital infrastructure: It’s 2025. If they are insisting on paper records and physical meetings for routine work, they are behind the curve.

- Resistant to inquiries: Quality professionals welcome knowledgeable customers. If they appear frustrated that you are asking about their method, credentials, or prices, walk away.

The Money Conversation (Because We’re All Thinking About It)

Let’s talk about what accountants actually cost, because the range is… substantial.

- Basic self-assessment return: £150-£400

- Limited company accounts and corporation tax: £800-£2,000+

- Bookkeeping services: £50-£150+ per month

- Payroll processing: £50-£100+ per month

- VAT returns: £100-£300 per quarter

- Comprehensive business advisory: £200-£500+ per month

Those ranges are enormous because pricing depends on complexity, location, firm size, and service level.

Here’s what influences cost:

- Your turnover: Higher turnover usually means higher fees.

- Transaction volume: More transactions mean more work and therefore a higher cost.

- Business structure: Limited companies are more expensive than sole traders.

- Add-on services: Every extra service (payroll, VAT, bookkeeping) will be added to the bill.

- Urgency: Need something rushed? Expect a premium.

- Firm prestige: Large, well-known firms charge more (which may or may not be justified by being better).

Value isn’t the same as price. A cheaper accountant who misses tax-saving opportunities or makes errors that trigger HMRC investigations isn’t actually cheaper. A more costly accountant who saves you thousands through strategic planning or avoids costly mistakes justifies the expense.

When you’re assessing cost, ask: “What’s the total value this relationship provides?” Not just “What’s the monthly fee?”

When Local Becomes Essential (Not Just Convenient)

There are situations where having a good accountant near me shifts from “nice to have” to “absolutely necessary.”

- Complex inheritance tax situations: When you’re dealing with estate planning or inheritance tax issues, sitting face-to-face with someone who can explain options, show you calculations, and adjust strategies in real-time is invaluable. This isn’t a video-call conversation.

- Business expansion decisions: Should you open a second location? Hire your first employee? Move from sole trader to limited company? These decisions have massive tax and financial implications. You want someone you can visit, who can review projections with you, who can connect you with other local professionals you’ll need.

- HMRC investigations: If you’re facing an investigation or dispute, you want your accountant nearby. These situations require document reviews, strategy sessions, and potentially representing you at HMRC offices.

- Starting a business: The early stages of business involve countless questions and frequent panic. Having an accountant you can actually meet — someone like the team at Ask Accountant (call them on +44(0)20 8543 1991 if you’re in South West London) — provides reassurance that remote-only relationships can’t quite match.

- Multiple income streams: If you’ve got employment income, rental properties, freelance work, and investment income, your tax situation is complex enough to benefit from regular, in-depth conversations. Email doesn’t cut it.

The Relationship Factor (Yes, It Actually Matters)

You’re going to share sensitive financial information with this person. They’re going to see your income, your debts, your spending patterns, your business struggles, and your ambitious plans.

That requires trust. And some personality compatibility.

I’m not suggesting you need to be best friends with your accountant (though some people are). But you should feel comfortable asking “weird” questions. You should believe they have your best interests at heart. You should feel confident they’re competent.

Chemistry matters. If your accountant makes you feel anxious, inadequate, or annoyed every time you interact, that’s a problem — even if they’re technically skilled.

Some people want an accountant who’s all business. Others prefer someone warmer and more conversational. Some want detailed explanations; others just want the bottom line. None of these preferences are wrong, but they need to match your accountant’s style.

Making the Switch (When Your Current Accountant Isn’t Working)

Let’s say you’ve already got an accountant, but this article has made you realise they’re… not great.

Switching feels awkward. You’ve built a relationship (sort of). They know your situation. Starting over seems exhausting.

Do it anyway.

Signs it’s time to switch:

- They’re consistently unresponsive or miss deadlines

- You don’t understand their advice even after asking for clarification

- They never proactively suggest anything

- You dread contacting them

- Their fees keep increasing without additional value

- They’ve made errors that cost you money or time

- Your business has outgrown their capabilities

- You’ve fundamentally lost trust

How to switch smoothly:

- Find your new accountant first (don’t leave a gap in service)

- Inform your current accountant professionally in writing

- Request your records and files (they’re required to provide them)

- Your new accountant can usually handle the transition details

- Don’t burn bridges — you might need information or clarifications later

Most accountants are used to clients switching. It’s business, not personal. (Though it might feel personal.)

The Technology Question (Cloud vs. Shoebox)

Modern accounting has moved to the cloud. Making Tax Digital has forced even reluctant dinosaurs to update their systems.

When evaluating a good accountant near me, ask about their technology:

- What software do they use? Xero, QuickBooks, Sage, FreeAgent — there are many good options. What matters is whether it integrates with your existing systems.

- Do they offer client portals? Secure document sharing is standard now. If they’re asking you to email sensitive financial documents, that’s concerning.

- Can you access your information 24/7? Cloud systems mean you can view your accounts, reports, and documents anytime.

- Do they provide real-time financial information? With proper systems, your accountant can see your current financial position, not just historical data. This enables better, more timely advice.

- What’s their backup system? How do they ensure your data won’t be lost if something goes wrong?

Technology shouldn’t replace personal service — but it should enhance it. The best accountants combine strong tech infrastructure with genuine human expertise and availability.

Industry-Specific Considerations (Because Cookie-Cutter Doesn’t Work)

Different industries have wildly different accounting needs. A good accountant recognises this.

- Construction: You need someone fluent in CIS claims and refunds, who understands subcontractor relationships, who knows how to handle retention payments and long-term contracts.

- Retail: Stock management, margin analysis, VAT complications, cash flow challenges — retail has unique pressures.

- Freelancers/Consultants: Often straightforward until you start scaling. Then you need advice on business structure, VAT registration, pension planning.

- Property investors: Capital gains tax, rental income, mortgage interest restrictions, incorporation decisions — property taxation is byzantine.

- E-commerce: Cross-border VAT, digital services tax, international sales — if you’re selling online, your accountant needs to understand digital commerce.

If your accountant doesn’t understand your industry’s specific challenges and opportunities, they can’t provide good advice. They might file your returns correctly, but they won’t add strategic value.

The Ask Accountant Approach (A Case Study in Local Expertise)

Since we’re talking about finding a good accountant near me, let’s get specific about what good actually looks like in practice.

Ask Accountant, based in Merton (South West London), built their practice around proactive tax advisory solutions rather than just compliance work. That philosophical difference matters.

Their service range — inheritance tax planning, business advice, CIS claims and refunds, tax advisory solutions, business accounting services, bookkeeping, auto-enrolment, small business accounting services, business growth planning — reflects an understanding that clients need comprehensive support, not just annual returns.

What distinguishes their approach:

- Integration: Rather than treating each service as a separate transaction, they view client relationships holistically. Your bookkeeping informs your tax planning. Your tax planning shapes your business growth strategy. Everything connects.

- Accessibility: Being physically located at 178 Merton High St, London SW19 1AY means local clients can drop by for face-to-face conversations when needed. But they’re also reachable by phone (+44(0)20 8543 1991) and modern communication methods for day-to-day queries.

- Industry knowledge: Years of working with London-based businesses means they understand the local commercial landscape, not just theoretically but practically.

This isn’t an advertisement disguised as advice (though I suppose mentioning them this much makes it look that way). It’s an illustration of what “local expertise” actually means: deep knowledge of the geographical and industry context in which your business operates.

Your Accountant as Strategic Partner (Not Just Tax Preparer)

The best accountant relationships transcend transactional service delivery. Your accountant should be a strategic partner in your business growth.

What does that partnership look like?

- Frequent strategic check-ups: Not just “here is your tax bill,” but “here is how your business performed, here is where we see opportunities, and here is what we are worried about.”

- Future planning: Assisting you in modelling various scenarios, understanding the tax implications of business decisions, and organizing transactions in the most optimal way.

- Network introductions: This will help you connect with other professionals you require – lawyers, mortgage brokers, business mentors, potential partners or clients.

- Business problem-solving: Sometimes the best accountants help with challenges that aren’t strictly “accounting” issues. They understand business, not just numbers.

- Challenge and pushback: Good advisors sometimes tell you what you need to hear rather than what you want to hear. If your accountant never questions your decisions or plans, they might be too passive.

The Geographical Advantage in a Digital World

We’ve circled back to where we started: why location matters even in an era of video calls and cloud accounting.

The answer isn’t nostalgia. It’s practical advantage.

A good accountant near me understands context that remote accountants can’t easily access:

- Local economic conditions affecting your business

- Regional property markets relevant to your decisions

- Industry clusters and networking opportunities in your area

- Which local business services (banks, suppliers, services) are actually good

- HMRC’s local interpretation and enforcement patterns

- Community connections that can benefit your business

Plus, there’s something psychologically valuable about knowing you can physically visit your accountant when needed. Even if you rarely do it, knowing you could provides reassurance.

Taking Action (Because Articles Don’t File Tax Returns)

Right. You’ve read this far, which means you either need a new accountant or you’re procrastinating on something else.

If you’re seriously looking for a good accountant near me, here’s your action plan:

- Define your actual needs (be specific about services, complexity, and communication preferences).

- Create a shortlist (3-5 accountants worth investigating further).

- Schedule consultations (most are free; take advantage).

- Prepare questions (use questions from this article and add your personal concerns).

- Check references (request client testimonials or professional references).

- Compare offerings (draw a simple comparison table of the services, prices, and approach).

- Trust your gut (if something does not feel right, it is likely not right).

- Make a decision (don’t let perfect be the enemy of good).

If you are in South West London, it is reasonable to begin your search with Ask Accountant. They provide the variety of services most companies require, they are established and reputable, and their services are modeled on active support as opposed to responsive compliance.

Nevertheless, no matter where you are geographically, the rules are the same: find a person who is qualified, experienced in your line of business, proactive in their work, clear in their communication, and fits your personality and business requirements.

The Bottom Line (Literally)

No professional relationship has as much influence on your financial success as your accountant. They determine how much you will pay in taxes, how your business will develop, whether you will spot opportunities or fail to notice them, and whether you will sleep well or worry constantly about HMRC.

Choosing a good accountant near me isn’t about convenience (although that’s a plus). It is a matter of identifying a person with the local knowledge, industrial expertise, and personal approach that suits your needs.

Distance might not matter for routine bookkeeping or simple returns. But for strategic advice, complex tax planning, business growth decisions, and situations where you need genuine counsel rather than just form-filling — local expertise matters enormously.

Take the search seriously. Ask difficult questions. Don’t settle for “fine” when you could have “excellent.”

Your future self — the one who’s successfully navigated business growth, minimised tax bills, and built wealth — will thank you for investing time in finding the right accountant now.

Frequently Asked Questions

What is the approximate cost of a good accountant?

Prices vary enormously depending on the complexity of your situation. Simple self-assessment could cost between £150-£400 per annum. Small limited companies typically pay £1,000-£2,500 for accounts and corporation tax. Add bookkeeping, payroll, VAT returns, and advisory services, and monthly costs can easily run up to £300-£500+.

What qualifications should my accountant have?

Look for qualified accountants registered with recognised professional bodies: ICAEW (Institute of Chartered Accountants in England and Wales), ACCA (Association of Chartered Certified Accountants), or CIMA (Chartered Institute of Management Accountants). These qualifications ensure that they have met educational standards and are adhering to professional ethics.

Can I use an online-only accountant or do I need someone local?

Online accountants are efficient in simple cases. However, for complicated tax planning, business growth decisions, inheritance tax issues, or when you simply prefer face-to-face meetings, local accountants are beneficial. They know your local market, provide easier access for crucial discussions, and can establish connections with other local professionals you may require.

How often should I communicate with my accountant?

At a minimum, you should communicate annually for tax return preparation. However, better relationships include quarterly check-ins, monthly bookkeeping check-ins, and instant communication when you have to make important business decisions or have tax questions. Proactive accountants frequently initiate these conversations, rather than just answering your questions.

What is the difference between a bookkeeper and an accountant?

Bookkeepers record day-to-day financial transactions (sales, purchases, and payments). Accountants prepare financial statements, manage tax compliance, and provide strategic advice. Many accounting firms offer both services, creating effective integration. Some small businesses only require bookkeeping, while others need full accounting and advisory services.

When is it time to change accountants?

Switch your current accountant when they continuously miss deadlines, are unresponsive to inquiries, make errors, are not proactive with their advice, or you have simply lost faith in them. Also consider switching when your business becomes too complex for them to handle or when you find someone who can deliver much more value.

What should I bring to the first meeting with my accountant?

Bring recent tax returns, up-to-date financial statements (if you have them), information about your income sources, details about your business structure, and a list of your specific questions or concerns. There is no need to worry about having everything perfectly organised; part of their job is to assist you in developing better systems.

Do I need an accountant if I’m just self-employed with simple income?

Strictly speaking, no – you may submit self-assessment returns yourself. However, even simple cases can benefit from a professional review. Accountants can frequently identify overlooked deductions, ensure you are claiming all legitimately allowable deductions, and help avoid mistakes that lead to HMRC investigations. The expense typically pays for itself in time saved and the extra deductions claimed.